Electrophoresis Reagents Market Outlook:

Electrophoresis Reagents Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 2.6 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of electrophoresis reagents is evaluated at USD 1.6 billion.

The increasing demand for advanced molecular diagnostics, proteomics, and genetic research applications is the key factor behind the intense growth of the market. It also serves a large patient pool affected by genetic disorders. This can be evidenced from the NIH report, which was published in January 2022, which revealed that approximately 2.8 million children aged 0 to 17 years in the U.S. have a reported genetic condition, which marks 3.9% of the population in this age group, denoting the huge necessity for electrophoresis reagents.

Furthermore, payers, including government and private insurers, are progressively recognizing the value of electrophoresis-based diagnostic tests, leading to proper pricing and reimbursements. For example, in India the Testing Fee Reimbursement Scheme by the Ministry of Micro, Small and Medium Enterprises (MSME), is enabling financial support to Scheduled Caste (SC) and Scheduled Tribe (ST) owned micro and small enterprises (MSEs) by reimbursing up to 80% or ₹1,00,000 (USD 1,250) (whichever is lower) of testing fees paid to NABL or BIS accredited laboratories, government labs, or PSUs.

Key Electrophoresis Reagents Market Insights Summary:

Regional Highlights:

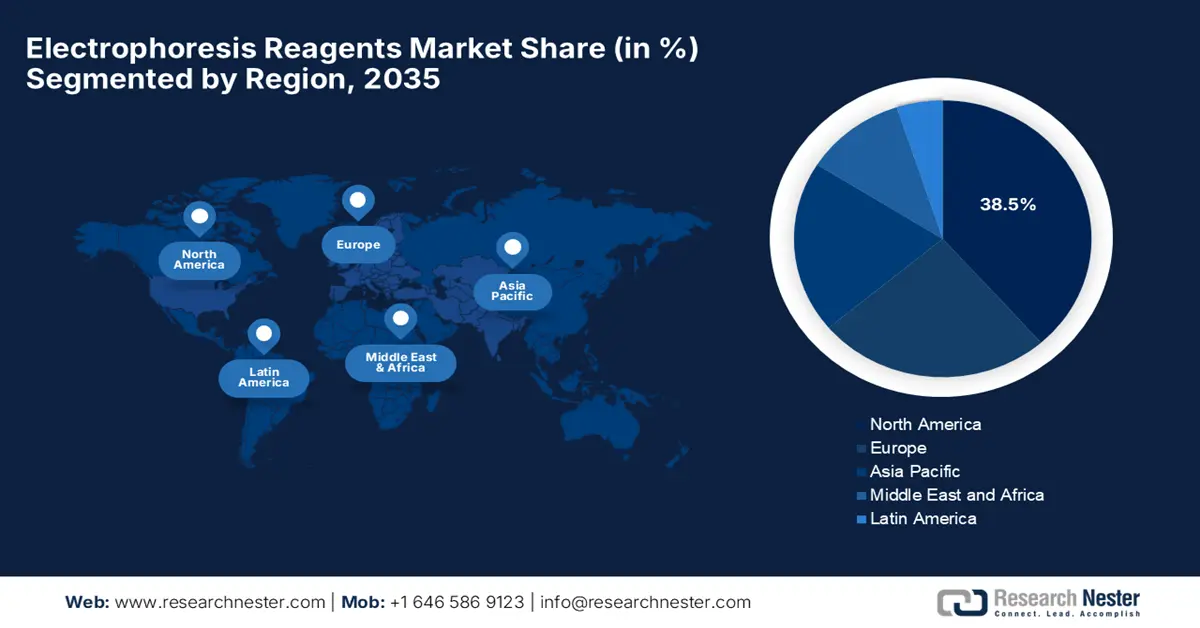

- North America is anticipated to secure the largest 38.5% revenue share in the electrophoresis reagents market by 2035, sustained by a robust research ecosystem and the strong presence of biotechnology firms and academic institutions.

- The Asia-Pacific region is projected to emerge as the fastest-growing market during 2026-2035, owing to increasing electrophoresis adoption in research institutions and rising technological advancements across emerging economies.

Segment Insights:

- The trade merchant segment is projected to hold a dominant 55.6% revenue share in the electrophoresis reagents market by 2035, propelled by increasing adoption by high-end laboratories to enhance workflow efficiency and ensure regulatory compliance.

- The biotechnology segment is anticipated to account for 35.4% revenue share by 2035, driven by expanding genomic and proteomic research emphasizing precise molecular separation for personalized medicine.

Key Growth Trends:

- Amplifying discoveries in electrophoresis techniques

- Expansion of clinical applications

Major Challenges:

- High cost of quality reagents

- Technical complexions

Key Players: Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Agilent Technologies, Inc., Danaher Corporation, QIAGEN N.V., Lonza Group Ltd., PerkinElmer, Inc. (Revvity), GE HealthCare Technologies Inc., Hoefer, Inc., Promega Corporation, Sigma-Aldrich Corporation, Cytiva, Sebia Group, Eppendorf AG, Analytik Jena AG, SERVA Electrophoresis GmbH, New England Biolabs, Inc., Takara Bio Inc., Shimadzu Corporation.

Global Electrophoresis Reagents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.6 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Singapore

Last updated on : 1 October, 2025

Electrophoresis Reagents Market - Growth Drivers and Challenges

Growth Drivers

- Amplifying discoveries in electrophoresis techniques: This is a pivotal driving factor for the market since the innovations in capillary electrophoresis and automated systems have enhanced the efficiency and resolution of the processes. For instance, in March 2025, CMP Scientific reported that it had expanded collaborations with biopharmaceutical companies to utilize their Capillary Electrophoresis - Mass Spectrometry (CE-MS) technologies for advanced biotherapeutic characterization.

- Expansion of clinical applications: The ever-increasing occurrence of chronic diseases such as cancer, diabetes, and genetic disorders has expanded the use of electrophoresis in clinical diagnostics, thereby constantly driving business in this field. In March 2023, the report from TrAC Trends in Analytical Chemistry revealed that capillary electrophoresis is widely used in biopharmaceutical process monitoring to analyze protein concentration, quality attributes, and impurities throughout upstream and downstream production.

- Increase in research funding: The escalating investments in biotechnology and pharmaceutical research are propelling the demand for electrophoresis reagents, encouraging more players to operate in this sector. Therefore, in May 2025, the data from IBEF reported that in July 2023, 15 firms signed MoUs which were valued at Rs. 2,000 crore (USD 239.99 million), in a day, for investments in the biotechnology field, hence suitable for standard market growth.

Key Statistics on Rare Genetic Disorders in India (22-Year Study)

|

Category |

Statistic |

|

Total patients studied |

3,294 |

|

Number of rare diseases identified |

305 |

|

Neuromuscular & Neurodevelopmental diseases (NMND) |

149 (48.9%) |

|

Inborn Errors of Metabolism (IEM) diseases |

47 (15.4%) |

|

Patients diagnosed with IEM |

1,992 (61%) |

|

Gaucher disease cases |

224 (11.2% of IEM patients) |

|

Duchenne muscular dystrophy cases |

291 (32.9% of NMND patients) |

|

Trinucleotide repeat expansion disorders |

242 (27.3% of NMND patients) |

|

Spinal muscular atrophy cases |

141 (15.9% of NMND patients) |

|

β-thalassemia cases |

120 (80.5% of haematological group) |

|

Cystic fibrosis cases |

74 (98.7% of pulmonary group) |

|

Estimated rare disease burden in India |

~70 million people affected |

|

Spinal muscular atrophy incidence |

1 in 10,000 newborns |

|

Cystic fibrosis incidence |

1 in 40,000 to 1 in 100,000 |

|

β-thalassemia trait prevalence |

1.4% to 3.4% (central India) |

|

Haemophilia A prevalence |

0.9 per 100,000 people |

Source: NIH

Revenue Opportunities for Electrophoresis Reagents Manufacturers

|

Year |

Company |

Revenue Opportunity |

Description |

|

2025 |

Thermo Fisher |

USD 2 billion investment in US manufacturing and R&D |

Expanding manufacturing capacity and innovation to support life sciences and diagnostics |

|

2025 |

QIAGEN |

Launch of 3 automated sample prep instruments |

New instruments (QIAsymphony Connect, QIAsprint, QIAmini) targeting high-throughput and low-throughput labs |

|

2024 |

Sebia |

FDA clearance for CAPILLARYS 3 DBS device |

Automated capillary electrophoresis device for newborn hemoglobin disorder screening, enhancing lab efficiency |

Source: Company Official Press Releases

Challenges

-

High cost of quality reagents: One of the primary challenges associated with the market is the huge cost associated with these premium range reagents and kits. Also, most of the advanced reagents require specialized manufacturing and strict quality controls, which is further driving up prices, making them less accessible for smaller research labs and educational institutions, hence causing a hindrance to the market expansion.

- Technical complexions: The aspect of technological complexions and the need for a skilled workforce have skewed the upliftment of the market. The sector often necessitates skilled technicians and researchers to correctly prepare, handle, and interpret results using reagents, which is a notable hurdle in developing nations. Therefore, the lack of adequately trained personnel can lead to experimental errors, poor reproducibility, and unreliable data, widening the adoption of electrophoresis methods.

Electrophoresis Reagents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.6 billion |

|

Regional Scope |

|

Electrophoresis Reagents Market Segmentation:

Trade Segment Analysis

Based on trade merchant segment is expected to garner the largest revenue share of 55.6% in the electrophoresis reagents market during the discussed timeframe. The segment’s dominance is attributable to the increased preference from the high-end laboratories to streamline their workflow. Also, most of the lab owners are sourcing reagents from specialized suppliers rather than producing them in-house, with a key emphasis on quality control and regulatory compliance, hence denoting a wider segment scope.

Application Segment Analysis

In terms of application, the biotechnology segment is predicted to gain a revenue share of 35.4% in the electrophoresis reagents market by the end of 2035. The growth in the segment originates from extensive research, especially in genomics and proteomics, since precise molecular separation is highly essential for personalized medicine. In December 2023, Amgen announced the launch of a new Foundations of Biotech extension titled Gel Electrophoresis Troubleshooting to help students investigate inconsistent DNA band migration using GelGreen stain.

Type Segment Analysis

Based on the type, the agarose gel segment is expected to attain a share of 32.7% in the electrophoresis reagents market during the discussed timeframe. The subtype remains most widely used owing to its efficiency in DNA, RNA, and protein separation. As per the May 2023 NIH article, agarose is widely used in biomedical applications due to its reversible temperature-sensitive gelling, biocompatibility, and mechanical strength. The report also emphasized its versatility, which enables its use in gel electrophoresis, drug delivery, tissue engineering, and wound dressings.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Trade |

|

|

Application |

|

|

Type |

|

|

Product Form |

|

|

End user |

|

|

Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrophoresis Reagents Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 38.5% in the market by the end of 2035. The region’s upliftment in this field is readily propelled by the robust research atmosphere and presence of biotechnology firms and academic institutions. Testifying to this, NIH stated that its funding made a huge impact by generating nearly USD 93 billion in 2023, supporting more than 300,000 researchers via over 60,000 grants. For every USD 1 of investment, approximately USD 2.46 in economic activity is produced, and every USD 100 million in funding leads to about 76 patents, resulting in USD 600 million in R&D opportunities.

The U.S. is augmenting its dominance in the regional market on account of a strong infrastructure supporting biomedical research and clinical diagnostics. The country’s focus on genomic studies fosters a continuous need for advanced electrophoresis solutions. This can be evidenced from NVIDIA’s January 2025 announcement stating that it has collaborated with IQVIA, Illumina, Mayo Clinic, and Arc Institute to advance genomics, drug discovery, and healthcare, hence suitable for standard market growth.

Canada has a huge potential in the market owing to the increased investments in biotechnology and healthcare research. In this context, Aescap reported that the Aescap Genetics Fund was launched in January 2022, which invests exclusively in biotech companies focused on RNA, gene, and cell therapies that target diseases at their root cause. It also stated that the fund diversifies across diseases, development stages, and regions, prioritizing firms with existing products and pipelines while supporting the development of treatments for conditions such as Alzheimer’s, cancer, and Parkinson’s.

Prevalence and Annual Incidence of Genetic and Related Birth Defects in the U.S. - 2024

|

Genetic Disorder / Birth Defect |

Occurrence Rate |

Babies Affected Annually |

|

Chromosome (Gene) Malformations |

||

|

Trisomy 13 (Patau Syndrome) |

1 in 6,967 births |

527 |

|

Trisomy 18 (Edwards Syndrome) |

1 in 3,336 births |

1,101 |

|

Mouth/Face Defects |

||

|

Cleft lip with and without cleft palate |

1 in 1,032 births |

3,560 |

|

Cleft lip with cleft palate |

1 in 1,583 births |

2,320 |

|

Cleft palate alone |

1 in 1,583 births |

2,321 |

Source: CDC

APAC Market Insights

The Asia-Pacific market is identified as the fastest-growing landscape owing to the growing use of electrophoresis in research institutions across diverse countries beyond China and India, such as Japan, South Korea, and Australia. Besides, the emerging markets in the region are increasingly adopting advanced technologies with a collective goal of improving diagnostics and biotechnology applications, hence positively contributing to market expansion.

China is showcasing robust growth in the market owing to its huge emphasis on precision medicine and government-backed biotech initiatives. In May 2023, Beijing Liuyi Biotechnology reported that it showcased its electrophoresis products at the 20th China International Scientific Instruments and Laboratory Equipment Exhibition, at the Beijing National Convention Center, and it also stated that it is seeking OEM and distributor partners in order to unlock the complete potential in this field.

India has become the targeted landscape for major investors involved in the electrophoresis reagents market due to its focus on cost-effective production and expanding pharmaceutical R&D. In February 2023, Advanced Electrophoresis Solutions Ltd., a pioneer in high-performance capillary isoelectric focusing (iCIEF) systems and reagents, announced a partnership with Medispec. Medispec, which will serve as the exclusive distributor of AES products in India, will provide sales, service, and application support. This collaboration is predicted to accelerate development by bringing AES’s advanced electrophoresis technologies to India.

Key Growth Drivers for the Market in India's Biotechnology Sector

|

Category |

Details |

|

Policy Support |

BioE3 Policy (2024) promotes high-performance biomanufacturing, R&D, and innovation - boosts reagent use |

|

Startup Ecosystem |

~6,000 biotech startups as of 2023 |

|

Infrastructure |

73 BIRAC-supported bio-incubators and biotech parks |

|

Investment |

Major investments by Serum Institute, Biocon, Bharat Biotech |

|

Regulatory Strength |

665 FDA-approved plants, 1,400+ WHO-compliant facilities |

|

Research Expansion |

MoUs with international universities, bilateral research, and increased reagent consumption |

Source: IBEF

Europe Market Insights

Europe is likely to maintain a prominent position in the global market over the analyzed timeframe. The region benefits from substantial biotechnology advancements, pharmaceutical development, and constant efforts from national and international players. In July 2022, Bioevopeak Co., Ltd. reported that it obtained the CE certification for its electrophoresis and imaging products, which marks a significant milestone in product quality. Besides, this certification serves as a strong endorsement of the company's technological capabilities and supports its expansion into worldwide markets.

Germany is maintaining a strong position in the regional electrophoresis reagents market due to its robust pharmaceutical and biotech industries, supported by substantial government funding and well-established research infrastructure. Besides, the country has a huge focus on quality control, regulatory compliance, and innovation in terms of molecular biology techniques, which contributes to steady growth. Furthermore, Germany’s active participation in global research collaborations further enhances the adoption of electrophoresis reagents in various life sciences applications, thereby creating an encouraging opportunity for domestic and foreign firms.

The U.K.’s growth trajectory in the electrophoresis reagents market is primarily shaped by continuous advancements in electrophoresis technology and increasing use in disease biomarker identification, which are key factors. In May 2025, the University of Edinburgh reported that its engineers had developed GelGenie, which is an AI-powered open-source tool that automates and enhances gel electrophoresis image analysis, overcoming limitations of traditional manual methods.

Key Electrophoresis Reagents Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Danaher Corporation

- QIAGEN N.V.

- Lonza Group Ltd.

- PerkinElmer, Inc. (Revvity)

- GE HealthCare Technologies Inc.

- Hoefer, Inc.

- Promega Corporation

- Sigma-Aldrich Corporation

- Cytiva

- Sebia Group

- Eppendorf AG

- Analytik Jena AG

- SERVA Electrophoresis GmbH

- New England Biolabs, Inc.

- Takara Bio Inc.

- Shimadzu Corporation

The international electrophoresis reagents market is extremely competitive with the presence of both established and emerging firms from diverse regions. The market represents a consolidated structure wherein the top 5 players have captured the maximum revenue share. Besides, the landscape is also marked by continuous innovation, strategic acquisitions, and expansion into emerging markets. Also, the companies are focusing on developing automated systems, sustainable reagent formulations, and eco-friendly alternatives to traditional chemicals to maintain their competitive edge.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, LICORbio reported that it acquired SERVA Electrophoresis, which is best known for its high-quality electrophoresis reagents, consumables, and workflow instrumentation, and this move will broaden LICORbio’s electrophoresis product portfolio.

- In January 2024, Agilent Technologies notified that it had launched the ProteoAnalyzer, an automated parallel capillary electrophoresis system for protein analysis, unveiled at the 23rd Annual PepTalk Conference.

- In June 2025, Shimadzu reported that its MultiNA II MCE-301 microchip electrophoresis system won the Red Dot Design Award 2025 for its innovative product design, usability, and reliability, and the system automates the entire electrophoresis process.

- In February 2024, Sysmex Corporation and Hitachi High-Tech Corporation entered into a strategic alliance in developing new genetic testing systems using capillary electrophoresis sequencers.

- Report ID: 8151

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrophoresis Reagents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.