Mobile BI Market Outlook:

Mobile BI Market size was USD 20.1 billion in 2025 and is estimated to reach USD 158 billion by the end of 2035, expanding at a CAGR of 22.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile BI is assessed at USD 24.7 billion.

The mobile business intelligence (BI) market depends on the worldwide semiconductor industry supply chain, especially for displays and chips. The key reliance is on various Asian countries such as Taiwan and South Korea. Countries are strengthening local manufacturing and diversifying suppliers, aiming to mitigate the supply chain for the market. The Semiconductor Industry Association (SIA) reported that global semiconductor sales reached USD 62.1 billion in July 2025. This is a 20.6% increase compared to July 2024. The robust semiconductor trade is reflecting a positive influence on the sales of mobile BI solutions.

For instance, in India, the electronics sector is flourishing, and the country has made various policies for achieving a trade balance. The sector is aided by investment in the semiconductor sector and is pushing for domestic tech production. The Press Information Bureau (PIB) reveals that in just four years since the India Semiconductor Mission (ISM) started in 2021, the country has made great progress in expanding its semiconductor industry. The government launched a USD 9.16 billion incentive program to support this, with nearly USD 7.83 billion already allocated, and to make India a global leader in semiconductor innovation and production, the Prime Minister opened the SEMICON India 2025 event in New Delhi on September 2.

Moreover, the country’s focus on domestic electronics manufacturing is expected to create opportunities for U.S. technology investment in semiconductors and various cloud-based BI solutions. Similar to the U.S. Chips Act, India is also pushing for domestic production of semiconductors and further reducing reliance on China. This indicates that developing countries are expected to act as major revenue boosters in the mobile BI market in the years ahead.

Key Mobile BI Market Insights Summary:

Regional Highlights:

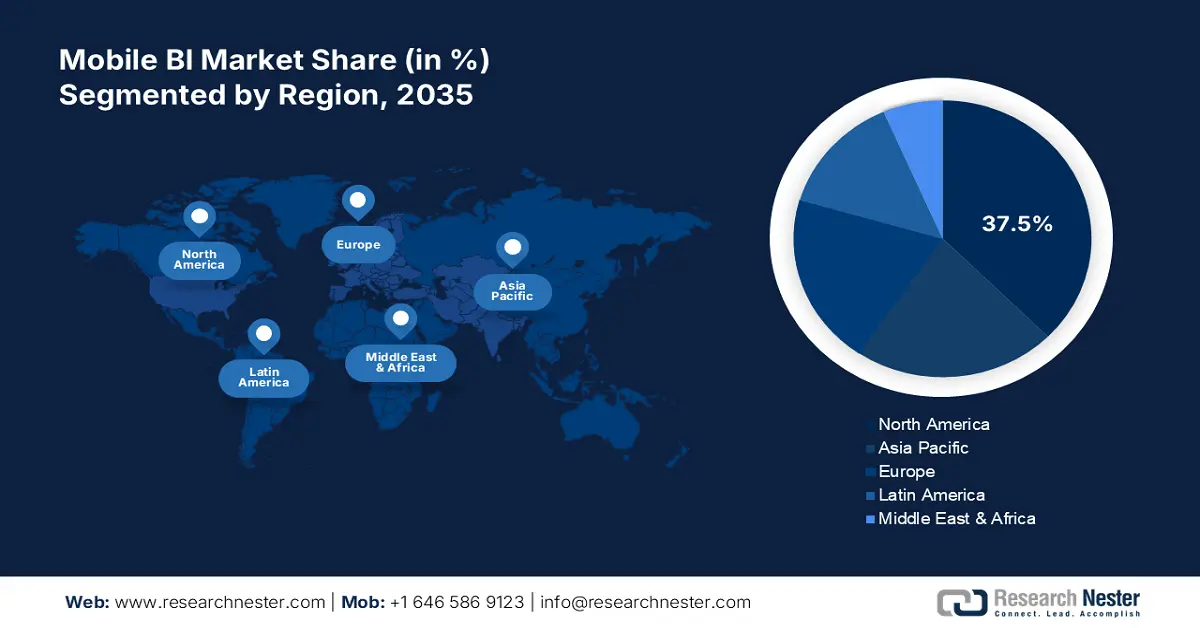

- North America is anticipated to hold 37.5% of the mobile BI market share by 2035, impelled by early 5G adoption and high smartphone penetration.

- APAC is expected to secure the second-largest share of the market by 2035, catalyzed by rapid digital transformation and widespread smartphone penetration.

Segment Insights:

- The software segment is projected to hold 66.9% of the Mobile BI Market share by 2035, driven by real-time data access and decision-making capabilities.

- The IT & telecommunications segment is expected to capture 27.1% share by 2035, fueled by the sector’s digital-first orientation and robust Internet penetration.

Key Growth Trends:

- Surge in emphasis on real-time data analytics

- Rising adoption of BYOD and mobile workforces

Major Challenges:

- Data protection regulations

- Lack of infrastructure in emerging economies

Key Players: SAP SE, IBM Corporation, Oracle Corporation, Tableau Software (Salesforce), SAS Institute Inc., QlikTech International AB, Zoho Corporation, TIBCO Software Inc. (Cloud Software Group), Domo, Inc., Yellowfin BI, Hitachi Vantara, Samsung SDS, Fusionex Group, MicroStrategy Incorporated.

Global Mobile BI Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 3 October, 2025

Mobile BI Market - Growth Drivers and Challenges

Growth Drivers

- Surge in emphasis on real-time data analytics: The burgeoning requirement for quick access to business metrics is bolstering the demand for mobile BI. Businesses utilizing real-time dashboards have seen enhanced decision-making capability. Enterprises are adopting real-time analytics to incorporate versatile KPIs and operational agility, particularly in fast-paced sectors such as retail and logistics. Also, various executives and field teams depend upon the mobile BI for garnering a good understanding.

- Rising adoption of BYOD and mobile workforces: North America is pioneering in mobile BI incorporation due to rising enterprise mobility maturity, while Asia Pacific is witnessing high growth through various government-run digitization programs. Companies are investing in robust mobile BI platforms that align with the devices of employees and ensure adherence to locally made laws for protection. The National Institute of Standards and Technology (NIST) states that over 95% of organizations allowed employees to use their personal devices for work even before the pandemic began. Additionally, there has been a surge in the usage of AR dashboards in manufacturing as well as the retail sectors for excellent data visualization, further bolstering the market growth.

- Technological trends: The integration of AI and ML is transforming the mobile BI market by automating decision-making ability. The inclusion of these technologies’ upgrades real-time interpretation of data on mobile platforms, enabling the companies to act promptly and precisely. As mobile BI steers toward predictive analytics, AI acts as the underlying engine, fostering contextual suggestions and anomaly detection across sectors. In November 2024, Microsoft launched Copilot for Power BI Mobile apps. This AI feature makes it easy for users to explore data on their phones, improving the mobile experience with a quick and simple way to access information. This indicates that continuous technological innovations are set to boost the profits of key players in the coming years.

Challenges

- Data protection regulations: The stringent data privacy laws obstruct the cross-border flow of data. The General Data Protection Regulation of the EU and the Personal Data Protection Act of India are some of the key hindering regulatory factors hampering the sales of mobile BI solutions. The lack of universal regulations thus limits the adoption of mobile BI technologies.

- Lack of infrastructure in emerging economies: The low penetration of 4G/5G and inefficient cloud infrastructure hinders the process of mobile BI deployment. The price-sensitive markets lack advanced infrastructure due to limited budgets. The internal political pressure and high tariffs are also the main hindering factors for infrastructure and new technology trade growth.

Mobile BI Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.9% |

|

Base Year Market Size (2025) |

USD 20.1 billion |

|

Forecast Year Market Size (2035) |

USD 158 billion |

|

Regional Scope |

|

Mobile BI Market Segmentation:

Solution Segment Analysis

The software segment is projected to hold 66.9% of the mobile BI market share by 2035. The core functionality that enables real-time data access and decision-making is mainly fueling the mobile BI software solutions. The dashboards and reporting capabilities are also key factors influencing the sales of mobile BI software platforms. The rise of subscription-based SaaS models is strengthening software adoption across several end use industries. Furthermore, the integration of digital technologies is poised to fuel the development of advanced mobile BI software solutions.

End user Segment Analysis

The IT & telecommunications segment is projected to capture 27.1% of the global market share through 2035. The reliance on real-time data and complex network operations is propelling the application of mobile BI solutions. The sector’s digital-first orientation is further fueling the sales of mobile BI technologies. The International Telecommunication Union (ITU) estimates that about 5.5 billion people, or 68% of the world’s population, were using the Internet in 2024. The robust Internet penetration represents high earning opportunities for key players.

Organization Size Segment Analysis

The large enterprises are estimated to account for 76.5% of the global market share due to their high daily operation rates. Complex operations spanning from finance to customer service necessitate large enterprises to invest in mobile business intelligence solutions. The cloud shift and modernization of IT infrastructure through incorporating AI and ML is set to double the profits of key players in the years ahead. Furthermore, the expansion of operational units is likely to drive large companies to invest in advanced business intelligence solutions.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Trade |

|

|

Application |

|

|

Solution |

|

|

Organization Size |

|

|

Deployment Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile BI Market - Regional Analysis

North America Market Insights

The North America mobile BI market is anticipated to garner 37.5% of the market share through 2035. The growth of the market in the region is driven by the early adoption of 5G and the high penetration of smartphones. Prominent companies, Tableau and Microsoft, localized their dashboard deployment for the public sector in the region. Also, there has been an increase in regulatory push for data transparency in various public companies, catalyzing the market growth in the region.

The U.S. is set to lead the sales of mobile BI solutions owing to the strong presence of an enterprise base and robust digital infrastructure. BFSI, retail, healthcare, and technology sectors are at the forefront of fueling the demand for mobile BI technologies. The cloud-first strategies adopted by both the public and private sectors are accelerating the trade of mobile business intelligence technologies. The hybrid work models are also another factor propelling the overall market growth.

The Canada market is estimated to be driven by the nationwide digital transformation movement. The growth of cloud adoption and the increasing demand for data-driven decision-making solutions are also contributing to the market growth. According to the Statistics Canada 2025 report, AI use differed across industries. Over the past year, 12.2% of businesses used AI for producing goods or services, with the highest use in information and cultural industries (35.6%), professional, scientific, and technical services (31.7%), and finance and insurance (30.6%). The strategic public-private strategies are set to fuel the sales of mobile BI technologies in the years ahead.

APAC Market Insights

The APAC market is expected to hold the second-largest revenue share throughout the anticipated timeframe. The rapid digital transformation and widespread smartphone penetration are accelerating the application of mobile business intelligence software platforms. The shift of several industries to data-driven decision-making solutions is also propelling the adoption of mobile BI technologies. China, South Korea, India, and Japan are the most profitable marketplaces across the region.

The China market is estimated to be driven by the government-backed digitalization strategies and the maturity of its mobile ecosystem. The report by the China Power Project reveals that about 70-80% of people in big cities use the internet, while around 50% of people across the country are online. The country’s high mobile penetration and leading position in 5G infrastructure deployment are set to double the profits of mobile BI companies in the years ahead.

The India market is foreseen to increase at a robust pace, owing to the booming digital economy and affordable mobile internet. The digitalization of the majority of industries is projected to fuel the trade of mobile business intelligence technologies. According to the India Brand Equity Foundation (IBEF) report, the Union Budget for 2025-26 has allocated USD 232 million to boost AI use and improve related infrastructure. Thus, supportive government policies and funding are set to accelerate the overall market growth in the years ahead.

Europe Market Insights

The Europe market is expected to increase at the fastest pace between 2026 and 2035. The region’s strong digital infrastructure and regulatory push for data-driven governance are projected to fuel the demand for mobile BI solutions. The rapid enterprise adoption of advanced analytics is reported due to the high mobile penetration and mature 5G networks. Sectors including BFSI, healthcare, manufacturing, retail, and public services are the primary end users of mobile BI technologies in the region.

Germany leads the mobile business intelligence sales owing to its strong manufacturing and industrial base. The Industry 4.0. trends and rapid digitalization are also contributing to the increasing demand for mobile BI solutions. The automotive, manufacturing, and logistics industries are among the most active adopters of mobile dashboards. Further, continuous technological advancements are set to drive the market growth in the years ahead.

The U.K. mobile BI market is estimated to be driven by its strong financial services sector and advanced retail ecosystem. The public and probate sector’s shift toward cloud technologies is opening lucrative doors for mobile business intelligence solutions. The International Trade Administration (ITA) disclosed that public cloud services, which form the biggest part of the cloud computing market in the U.K., earned about USD 12 billion in 2020. This revenue is also expected to grow quickly in the coming years due to the government’s digital economy initiatives.

Key Mobile BI Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- IBM Corporation

- Oracle Corporation

- Tableau Software (Salesforce)

- SAS Institute Inc.

- QlikTech International AB

- Zoho Corporation

- TIBCO Software Inc. (Cloud Software Group)

- Domo, Inc.

- Yellowfin BI

- Hitachi Vantara

- Samsung SDS

- Fusionex Group

- MicroStrategy Incorporated

The competitive landscape of the market is rapidly evolving as established key players, IT giants, and new entrants are investing in novel technologies. Key players in the market are focused on developing products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position. Here are some key players operating in the market:

Recent Developments

- In March 2025, SAP launched SAP BusinessObjects BI 2025 with new features to improve business intelligence. These updates make the tool easier to use, more efficient, and ready for future needs.

- In September 2024, Qlik introduced new improvements to its AutoML tools. These updates help analytics teams easily create and use powerful machine learning models, with built-in features to explain predictions in real time.

- Report ID: 3361

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile BI Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.