Suction Catheters Market Outlook:

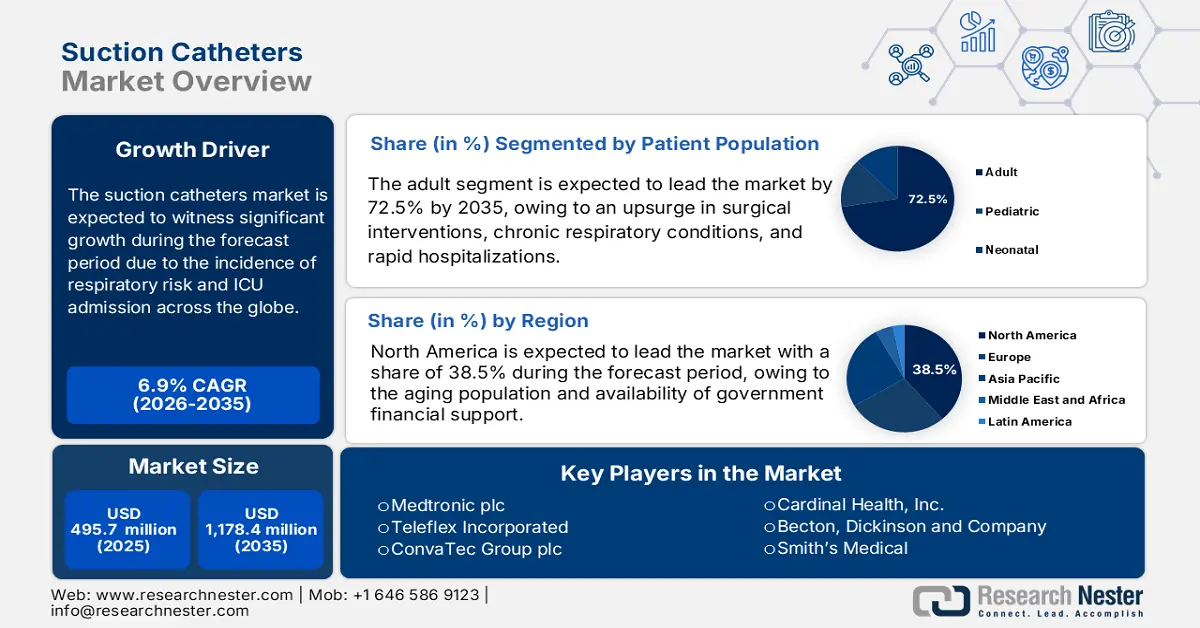

Suction Catheters Market size was USD 495.7 million in 2025 and is anticipated to reach USD 1,178.4 million by the end of 2035, increasing at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of suction catheters is assessed at USD 545.7 million.

The demand for the market is continuously increasing, owing to a surge in the number of respiratory disorders an effective requirement for severe care. According to an article published by the World Health Organization in November 2024, every year, more than 3 million people lose their lives due to chronic obstructive pulmonary disease (COPD). Besides the prevalence, the accessibility to cost-effective care is restricted, particularly across low- and middle-income nations, wherein 85% of COPD deaths take place. Therefore, owing to the disease incidence and shortage of care services, there is a huge growth opportunity for the market.

Moreover, the international demographic modification, along with an upsurge in the aging population, are also responsible for uplifting the market. In addition, technological innovation has brought different advancements, such as closed system suction catheters that have achieved high patient outcomes, along with an escalation in the market demand. As stated in an article published by the PRB Organization in January 2024, the elderly population in America over 65 years of age will increase to 82 million by 2050 from 58 million as of 2022, denoting a rise from 17% to 23%. Therefore, this indicates the majority of the older population affected with respiratory diseases, thus denoting the market’s huge demand globally.

Key Suction Catheters Market Insights Summary:

Regional Highlights:

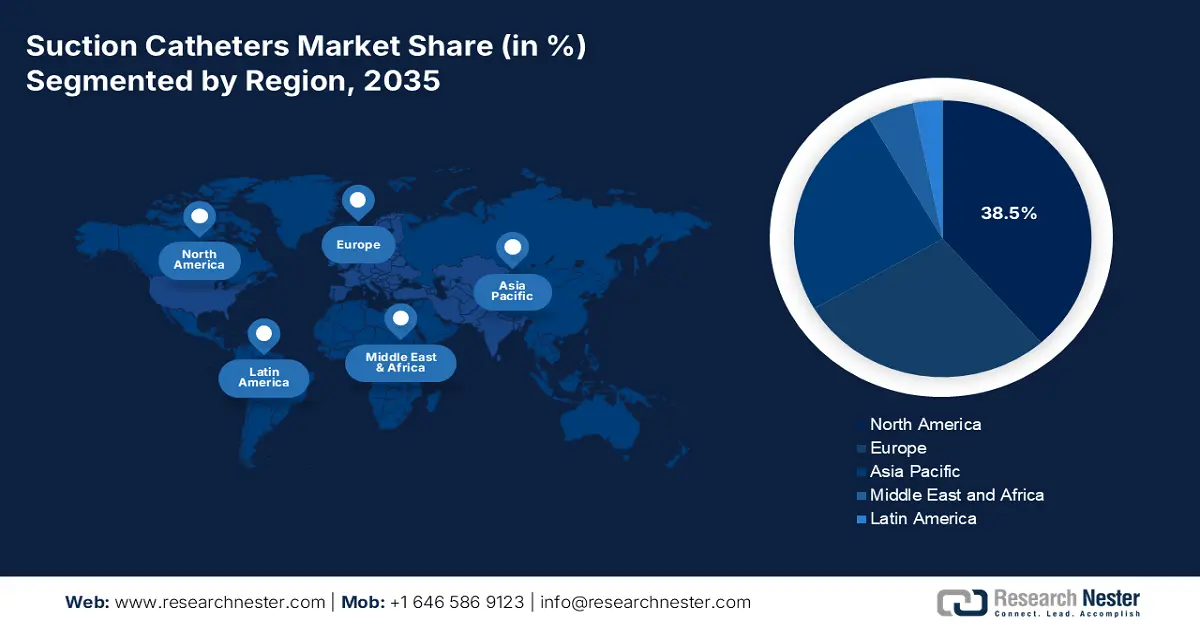

- The North America suction catheters market is projected to secure the largest share of 38.5% by 2035, supported by demographic transitions and increased governmental and corporate R&D funding allocations.

- Asia Pacific is anticipated to witness the fastest expansion through 2026-2035, stimulated by heightened government healthcare investments, growing ICU admissions, and surging medical tourism.

Segment Insights:

- The adult segment of the suction catheters market is anticipated to hold a dominant 72.5% share by 2035, propelled by the high prevalence of surgical interventions and chronic respiratory diseases among adult populations.

- The airway management segment is expected to capture the second-largest share by 2035, supported by its critical role in secretion clearance, optimal ventilation maintenance, and prevention of postoperative pulmonary complications.

Key Growth Trends:

- A rise in disease incidences

- Sudden shift in trade dynamics

Major Challenges:

- Obstacle in the delay and price cap for approval

- Clinical adoption and training gaps

Key Players: Medtronic plc (U.S), Teleflex Incorporated (U.S.), ConvaTec Group plc (UK), Cardinal Health, Inc. (U.S.), Becton, Dickinson and Company (U.S.), Smith’s Medical (U.S.), Fresenius Medical Care AG (Germany), Terumo Corporation (Japan), Olympus Corporation (Japan), B. Braun Melsungen AG (Germany), AngioDynamics, Inc. (U.S.), Cook Medical LLC (U.S.), Merit Medical Systems, Inc. (U.S.), Nipro Medical Corporation (Japan), Asahi Kasei Corporation (Japan), Poly Medicure Limited (India), HLL Lifecare Limited (India), Bluesail Medical Co., Ltd. (China), Medline Industries, Inc. (U.S.), Medikon Australia Pty Ltd (Australia).

Global Suction Catheters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 495.7 million

- 2026 Market Size: USD 545.7 million

- Projected Market Size: USD 1,178.4 million by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 30 September, 2025

Suction Catheters Market - Growth Drivers and Challenges

Growth Drivers

- A rise in disease incidences: The aspect of low metabolism, aging factor, and pollution with the global population has increased the respiratory risk, which is readily driving the market internationally. According to an article published by the WHO in June 2025, chronic respiratory disease affects over 80 million people, particularly in Europe. Despite this prevalence, almost 6.8 million are newly diagnosed every year. Besides, asthma and COPD cater to the majority of CRD cases in the region, readily responsible for 80% of CRD-based deaths, thereby making them suitable for boosting the market.

- Sudden shift in trade dynamics: The component of cost-optimized as well as sustainable manufacturing is the ultimate notable business strategy to derive a wide-ranging edge that results in trade shifts in the market. In addition, the pandemic has developed a massive strain on the healthcare system and directed the overall market to readily focus on extended manufacturing ability. As stated in the May 2025 AAMC Organization article, leaders in the industry are extremely concerned about trade with China, wherein the latest 145% tariff has been effectively levied, to which the country responded with a 125% tax on goods from the U.S., thereby creating a positive impact on the market.

- Innovations in material science: This is essential for the market since it can enable scientists and engineers to establish a relationship between a material’s properties and structure, thus permitting the design and development of the latest materials with suitable characteristics. According to an article published by the U.S. Bureau of Labor Statistics in May 2023, the employment rate of material scientists has been recorded to be 8,810, with an hourly wage of USD 54.0 and a yearly wage amounting to USD 112,440, thereby denoting an optimistic outlook for the overall market.

Aging Population Driving the Suction Catheters Market Demand

|

Years/Number of People |

Average Ratio |

Minimum Ratio |

Maximum Ratio |

|

2022 |

31.3 |

14.2 |

55.4 |

|

2023 |

31.9 |

14.6 |

55.7 |

|

2024 |

32.7 |

15 |

56 |

|

2025 |

33.6 |

15.4 |

56.3 |

Source: OECD

Acrylic Polymers 2023 Export and Import Uplifting the Suction Catheters Market

|

Countries |

Export |

Import |

|

Germany |

USD 2.6 billion |

USD 1.1 billion |

|

China |

USD 1.9 billion |

USD 2.1 billion |

|

U.S. |

USD 1.9 billion |

USD 1.1 billion |

Source: OEC

Challenges

- Obstacle in the delay and price cap for approval: The accumulation of investment and capitalization in the research and development for the product efficacy has been controlled by the barrier of the price cap, which has caused a hindrance in the market. The aspect of government intervention is extremely suitable to fix the price cap for the medical product, which results in a gap for the manufacturer to successfully earn their respective profit margin and face challenges to sustain in the present market. For instance, the government in Europe has limited the profitability rate by imposing a compulsory discount on medical devices, lowering the overall profit rate.

- Clinical adoption and training gaps: The aspect of market entry does not guarantee any kind of clinical utilization, and combating this entrenched clinical practice is a huge hurdle in the market internationally. Healthcare providers might be resistant to incorporating the latest devices, owing to familiarity with current products, or even concerns pertaining to additional complexity. For instance, shifting a hospital from open to a closed-system catheter demands an extended in-service training on the newest protocols. Besides, manufacturers need to readily invest in evidence-generation programs and clinical specialist teams to effectively demonstrate superior results.

Suction Catheters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 495.7 million |

|

Forecast Year Market Size (2035) |

USD 1,178.4 million |

|

Regional Scope |

|

Suction Catheters Market Segmentation:

Patient Population Segment Analysis

The adult segment in the market is anticipated to constitute the largest share of 72.5% by the end of 2035. The segment’s growth is highly attributed to an effective high prevalence of surgical interventions and chronic respiratory conditions among demographic adults. Besides, adults are disproportionately impacted by disorders, including COPD, which is one of the leading causes of rapid hospitalization internationally. Meanwhile, the majority of emergency and elective surgeries, from trauma care to cardiovascular procedures, are readily conducted on adults, which has effectively necessitated routine airway management and suctioning in ICUs and operating rooms.

Application Segment Analysis

The airway management segment in the market is projected to account for the second-largest share during the predicted duration. The segment’s growth is highly fueled by its importance in clearing obstructive secretions, ensuring suitable ventilation and oxygenation, and reducing complication risks, such as atelectasis and pneumonia. According to an article published by the Journal of Oral and Maxillofacial Surgery in August 2025, a clinical study was conducted on 52 subjects to evaluate the suction catheter utilization, wherein 50% to 53.8% of bleeding took place, but eventually it was self-limited, thereby not severely affecting the nasal passage, thereby suitable for the segment’s upliftment.

Material Segment Analysis

The PVC segment in the market is expected to cater to the third-largest share by the end of the projected timeline. The segment’s development is highly driven by its importance originating from flexibility, chemical ability, clarity, and biocompatibility for medical utilization in reliable, effective, and safe devices for moving airway secretions. As stated in an article published by the JACC Journal in March 2023, a clinical study was conducted on 1,113 patients and the complication, along with adverse event rates accounted for 0% to 5.6% for catheter ablation, as well as 9.5% to 21% for antiarrhythmic drug therapy, particularly for PVC recurrence. Therefore, this denotes a prolific opportunity for the segment to readily flourish in the market globally.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Patient Population |

|

|

Application |

|

|

Material |

|

|

End user |

|

|

Product |

|

|

Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Suction Catheters Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the largest share of 38.5% by the end of 2035. The market’s growth in the region is highly attributed to the aspect of demographic switch, along with funding allocation by the government and corporate firms, leading to an increase in research and development to uplift the market efficiency. According to an article published by the Office of Inspector General in August 2022, Medicare permitted USD 121 407 million for intermittent urinary catheters, while suppliers initiated a payment of USD 121 million to acquire them successfully.

The suction catheters market in the U.S. is growing significantly, driven by a surge in revenue and an increase in the aging population, which is leveraging the need for catheter and ventilation utilization. Besides, as per an article published by NLM in July 2024, 50% of children and 62% of adults in the country suffer from asthma. In addition, there are intense and frequent episodes of symptoms, mainly affecting children aged 0 to 4 years, which are 59.1% and 62.9% of Black people. Therefore, with such prevalence of respiratory diseases, there is a huge demand for the market in the country.

The suction catheters market in Canada is also growing due to the existence of the publicly funded health and medical system, value-based and cost-effective procurement, a sudden shift towards advanced products, the aspect of provincial budgets, and guidelines for infection control and prevention. For instance, as of July 2024, the Government of Canada, along with its partners, initiated an investment of USD 19.3 million for 9 research projects to successfully address the future threats to lung health. Besides, the University of British Columbia granted USD 1,999,990 for lungs on fire research and USD 1,799,331 by the University of Alberta for interventions to cater to health outcomes, thus suitable for the market’s upliftment.

Asthma Incidence in North America (2025)

|

Components |

Rate |

|

Overall population affected |

7.7% |

|

Adults |

24.9 million (8.0%) |

|

Children |

4.6 million (6.5%) |

|

Females |

9.7% |

|

Males |

6.2% |

|

Inpatient hospitalization |

94,000 |

|

Emergency department |

900,000 |

|

Approximate economic expenses |

USD 50 billion |

|

Death caused |

Over 3,500 |

|

Asthma attack in adults |

39.6% |

|

Asthma attack in children |

38.7% |

Source: ACAAI Organization

APAC Market Insights

Asia Pacific in the suction catheters market is expected to emerge as the fastest-growing region during the projected timeline. The market’s exposure in the region is highly attributed to the aspect of government spending for developing healthcare, which has resulted in an increased number of ICU admissions. According to the data report published by the World Bank Organization in 2025, the present health expenditure of the region amounts to 6.5% of the gross domestic product (GDP). Besides, a rise in medical tourism, huge private and public healthcare facility development, and a surge in the aging population are also boosting the market’s exposure.

The suction catheters market in China is gaining increased traction, owing to the presence of the NMPA mandate for healthcare services to readily prioritize the expansion of single-use catheter devices. As per an article published by the World Economic Forum in March 2023, the country’s National Health Commission expected that the cohort of people aged more than 60 years would increase from 280 million to over 400 million by the end of 2035. Besides, the July 2022 NLM article denotes that 264.0 million, which is 18.7% of the overall population, is aged over 60 years, thereby denoting a huge opportunity for the market in the overall country.

The suction catheters market in India is also developing due to the presence of the Ayushman Bharat scheme and the government’s increased spending on suitable medical supplies, such as catheters, and the existence of the public health insurance program. As indicated in a data report published by Invest India in September 2025, the valuation of the medical devices industry is projected to increase to USD 50 billion by the end of 2030, along with a 16.4% growth rate. Additionally, the medical devices export valuation was USD 3.3 billion as of 2023, in comparison to USD 2.9 billion in 2022, thereby creating an optimistic outlook for the overall market.

Needles, Catheters, Cannulae 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

China |

USD 1.9 billion |

USD 2.1 billion |

|

Japan |

USD 1.3 billion |

USD 1.7 billion |

|

Malaysia |

USD 1.1 billion |

USD 297 million |

|

Thailand |

USD 560 million |

USD 210 million |

|

Singapore |

USD 464 million |

USD 314 million |

|

India |

USD 388 million |

USD 297 million |

Source: OEC

Europe Market Insights

Europe market is projected to grow steadily by the end of the forecast duration. The market’s exposure in the region is highly driven by the demographic switch leading to an upsurge in aging demographics, along with a rise in the incidence of respiratory health risk. Besides, there is an effective demand for suction catheters in Germany, resulting in an increased adoption of minimally invasive surgeries. According to an article published in April 2024 by Europe Commission, the EHDS is predicted to save almost €11 billion over ten years, of which €5.5 billion is expected to be saved for health data exchange and better accessibility.

The suction catheters market in Germany is gaining increased importance, owing to growth in ICU admissions, provision of a suitable budget for hospitalization, and the rigid establishment of innovative suction systems. According to an article published by NLM in December 2024, earlier only 10% of the population comprised health insurance, and currently, the rate accounts for 100%, which is suitable for the market’s development in the country. Besides, adults need to make a payment of 10 euros per day as a fixed amount for rehabilitation treatment. Therefore, with all such benefits, there is a huge opportunity for the market to flourish in the country.

The suction catheters market in France is also developing, owing to the aspect of medical devices for reimbursement under the French National Authority for Health, the existence of a standard health insurance system, and priority for hospital funding. According to an article published by the ITA in August 2024, the overall market size of medical devices was USD 37,476, along with USD 33,738 for overall localized production, USD 9,562 for total exports, and USD 13,300 for total imports, thereby denoting a positive impact on the market in the country.

Key Suction Catheters Market Players:

- Medtronic plc (U.S)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teleflex Incorporated (U.S.)

- ConvaTec Group plc (UK)

- Cardinal Health, Inc. (U.S.)

- Becton, Dickinson and Company (U.S.)

- Smith’s Medical (U.S.)

- Fresenius Medical Care AG (Germany)

- Terumo Corporation (Japan)

- Olympus Corporation (Japan)

- B. Braun Melsungen AG (Germany)

- AngioDynamics, Inc. (U.S.)

- Cook Medical LLC (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Nipro Medical Corporation (Japan)

- Asahi Kasei Corporation (Japan)

- Poly Medicure Limited (India)

- HLL Lifecare Limited (India)

- Bluesail Medical Co., Ltd. (China)

- Medline Industries, Inc. (U.S.)

- Medikon Australia Pty Ltd (Australia)

The international market is experiencing a competitive environment, and notable players, such as Teleflex and Medtronic, are constituting the majority of the market share. The competitive approach, which is followed by business, includes market expansion, product innovation, and different other factors. For instance, Teleflex and Medtronic are deliberately addressed as noble brands with increased innovation cleared by the FDA in suction catheter manufacturing. In addition, Smiths Medical, along with Becton, Dickinson and Company, have readily invested in research and development, particularly within the single-use technology to provide high patient outcomes and escalate the market performance.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2024, MicroVention, a subsidiary of Terumo Corporation, declared the publication of the SOFIA to evaluate the SOFIA Flow Plus Aspiration Catheter for aiding acute ischemic stroke.

- In February 2024, MIVI Neuroscience approached the U.S. FDA to seek clearance for its Q Revascularization System, which is considered suitable for treating stroke catheter, with the intention of gaining a 93.9% revascularization success rate.

- In June 2023, BIOTRONIK announced the launch of its Oscar multifunctional peripheral catheter and smart promotional activities, which is commercially available across selected factories in the U.S.

- Report ID: 4033

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Suction Catheters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.