Medical Cyclotron Market Outlook:

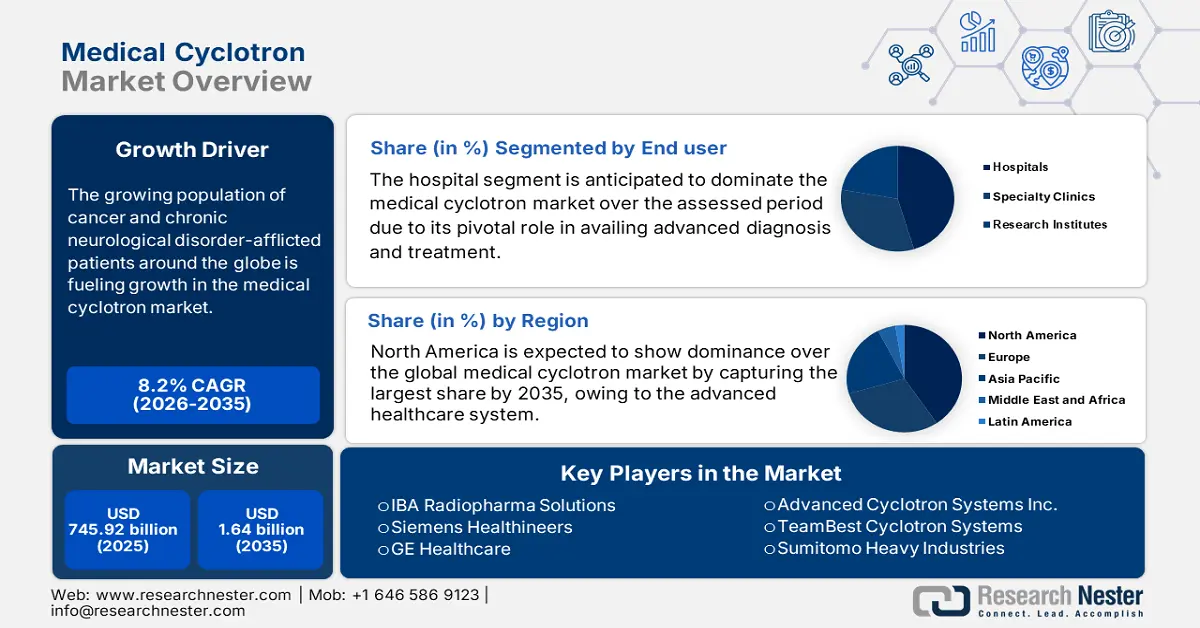

Medical Cyclotron Market size was valued at USD 745.92 million in 2025 and is expected to reach USD 1.64 billion by 2035, expanding at around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical cyclotron is evaluated at USD 800.97 million.

The growing population of cancer-afflicted patients around the globe is pushing dedicated organizations to innovate more effective diagnostic and therapeutic radiopharmaceuticals, which ultimately fuels growth in the market. As per the WHO prediction, the number of occurrences of this life-threatening ailment is poised to grow by 60.3% over the next 2 decades. The demographic impact of the increasing demand in this sector can also be testified by the 2025 report from the Robert Koch Institute, which calculated the volume of residents in Germany requiring cyclotron-based therapies to surpass 850,012. This also highlighted a 42.3% rise in the patient pool from 2018. Furthermore, the rising incidence of cancer in the U.S. and Japan imposes a collective potential to generate USD 1.9 billion in revenue by 2030.

Continuous inflation in the cost of production, raw materials, compliance, and maintenance has a significant effect on payers' pricing in the market. The disruptions in the supply chain and delays in regulatory approval often stimulate this upward trajectory of financial pressure present in this sector. For instance, the rising expenses of precision manufacturing and stringent regulations raised the producer price index (PPI) for this merchandise by an annual growth rate of 4.3% in 2024 from 2020. Subsequently, the other key economic indicator, the consumer price index (CPI), for nuclear medicine procedures also peaked at a 5.9% year-over-year (YoY) rise during the same tenure. Thus, the worldwide focus is concentrated on bringing more cost-effective solutions to improve accessibility in this field.

Key Medical Cyclotron Market Insights Summary:

Regional Highlights:

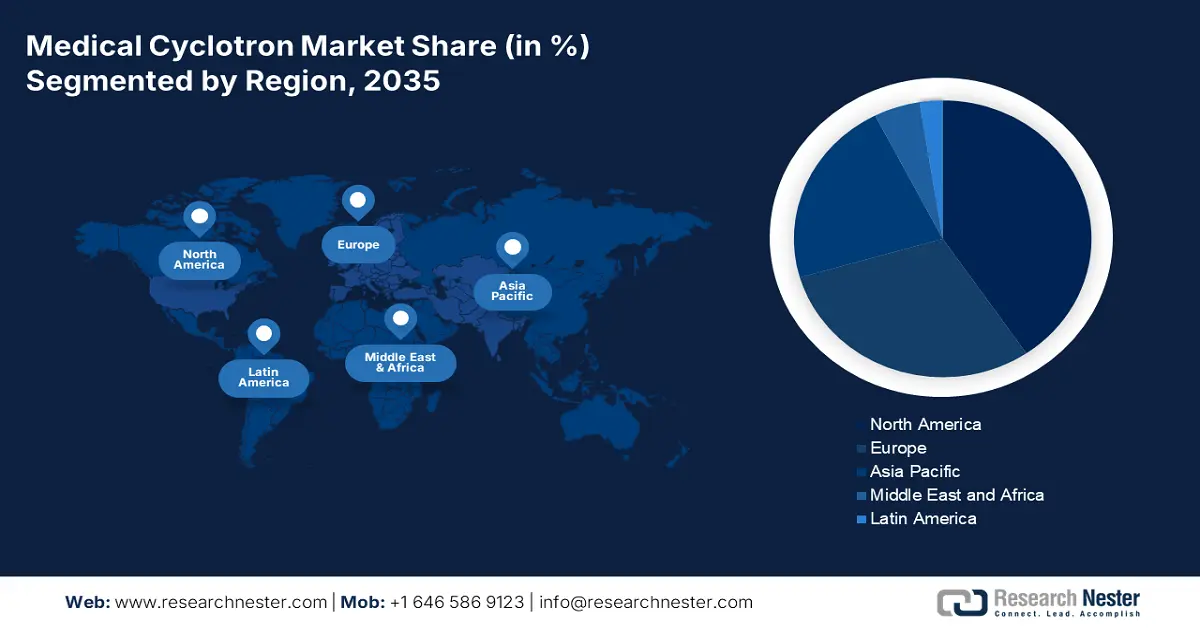

- North America medical cyclotron market will hold around 40.50% share by 2035, driven by the enlarging patient pool, advanced healthcare system, and technological innovations.

- Asia Pacific market will exhibit the highest CAGR during 2026-2035, driven by increasing cancer mortality, rapid infrastructural modernization, and government initiatives.

Segment Insights:

- The hospital segment in the medical cyclotron market is projected to hold a 45.30% share by 2035, driven by its pivotal role in advanced diagnosis and treatment with government-backed infrastructure investments.

Key Growth Trends:

- Contribution to the quality improvement of medical care

- Tech-based elevation in production

Major Challenges:

- Unavoidable delays and budget overflow

Key Players: GE Healthcare, Siemens Healthineers, IBA Worldwide, Sumitomo Heavy Industries, Ltd., Advanced Cyclotron Systems, Inc., Nueclear Healthcare Limited, TeamBest, Best Cyclotron Systems, Inc. (BCSI).

Global Medical Cyclotron Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 745.92 million

- 2026 Market Size: USD 800.97 million

- Projected Market Size: USD 1.64 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Medical Cyclotron Market Growth Drivers and Challenges:

Growth Drivers

-

Contribution to the quality improvement of medical care: The presence of multiple clinical evidence, establishing the effectiveness and cost reduction in healthcare, is dragging the focus of organizations on investing in the medical cyclotron market. For instance, in 2022, the AHRQ study proved that the use of cyclotron-produced F-18 FDG in early-stage PET imaging can eliminate the need for unintended hospital admissions by 23.4%. It also mentioned that this approach has the potential to save more than USD 1.5 billion from U.S. spending on healthcare. The validation of cyclotron-based theranostics further escalated with the positive outcomes from the IQWiG evaluation in Germany, which recorded a 31.2% improvement in the survival rates of patients with prostate cancer.

- Tech-based elevation in production: As the trend of modernization gains traction in critical industries, such as healthcare, authorized investors are magnifying their efforts to integrate technologically advanced solutions from the market. For instance, in 2023, the U.S. Department of Energy drafted a USD 100.3 million outlay for their initiative to develop non-uranium-based Molybdenum-99 (Mo-99) production, which further elevated the resilience in the isotope supply chain. Simultaneously, the Oak Ridge National Lab concluded a 50.3% cost reduction in Gallium-68 production on utilization of solid-target cyclotrons in 2024. Such government findings and financial support are promoting and streamlining this sector's progress.

Historical Patient Growth Analysis: Shaping the Market Landscape

The surge in nuclear medicine procedures during the timeline from 2010 to 2020 reflected the transformative expansion rate of the patient pool in the market. The global crisis in cancer survival amid the selected tenure highlighted the urgent need for advanced diagnostic and therapeutic solutions, such as PET/CT scans, which eventually fostered a sustainable consumer base for this sector. This can also be testified by the 230.4% hike in the net volume of these assessments performed across the U.S., creating a substantial demand for cyclotron-produced isotopes such as F-18, Ga-68, and Lu-177. Furthermore, the growing population of highly prone and afflicted residents in emerging economies pushed their governments to shift toward bulk procurement and deployment of cyclotrons.

Medical Cyclotron Users (2010 vs. 2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

Growth (%) |

Key Driver |

|

U.S. |

1.8 |

4.1 |

217.4% |

Medicare PET coverage |

|

Germany |

0.9 |

2.2 |

216.2% |

Universal healthcare |

|

France |

0.7 |

1.6 |

225.1% |

Gov. nuclear medicine grants |

|

Spain |

0.6 |

1.3 |

233.3% |

Private oncology investments |

|

Australia |

0.5 |

1.0 |

250.2% |

Radiopharmaceutical exports |

|

Japan |

1.1 |

2.8 |

212.1% |

Aging population |

|

India |

0.08 |

0.9 |

1100.2% |

New cyclotron installations |

|

China |

0.4 |

1.7 |

1300.4% |

National cancer screening |

Feasible Expansion Models Shaping the Medical Cyclotron Market

The current dynamics of the market are shifting toward technological advancements and cost-optimized production. These approaches of expansion have proven their efficacy through the commercial successes of key players adopting them. For instance, between 2022 and 2024, the suppliers in India earned a 12.3% revenue boost from cyclotron-based diagnostics by applying the pathway of forming alliances with government hospitals. Such events are crafting a guideline for new entrants on conducting market operations in a cost-effective and beneficial way through strategic moves while ensuring gradual and sustainable growth in this sector.

Revenue Feasibility Models (2020-2024)

|

Model |

Region |

Revenue Impact |

Key Driver |

|

Govt.-Private JVs |

India |

+12.1% (2022-2024) |

DAE subsidies |

|

Bulk Procurement |

China |

-20.4% unit cost |

NMPA tenders |

|

Lease-to-Own |

Brazil |

+8.2% adoption |

ANVISA waivers |

|

AI-Driven Maintenance |

U.S. |

+15.3% uptime |

NIH grants |

Challenge

-

Unavoidable delays and budget overflow: The lengthy process of attaining clearance from individual stringent regulations implemented in different regions imposes a major hurdle in the medical cyclotron market. Alongside the progressing pipelines, the authorization criteria are tightened to ensure complete safety and security of patients. As a result, it often causes delays in new launches due to prolonged evaluation, raising the overall budget for commercialization and levels of pricing standards. For instance, a 30.4% delay in projected timelines for approval from the Atomic Energy Regulatory Board (AERB) is present in India with an 18-month requirement. However, pioneers in this field are proactively combating this issue with pre-submitted documentation.

Medical Cyclotron Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 745.92 million |

|

Forecast Year Market Size (2035) |

USD 1.64 billion |

|

Regional Scope |

|

Medical Cyclotron Market Segmentation:

End user Segment Analysis

In terms of end users, the hospital segment is anticipated to dominate the medical cyclotron market with a share of 45.3% over the assessed period. This proprietorship majorly stems from its pivotal role in availing advanced diagnosis and treatment under one roof as a centralized system for healthcare delivery. Additionally, the continuous government investments in infrastructural development in the medical industry incorporate the reinforcement and accommodation of PET/CT scans and radiopharmaceutical therapies. Thus, the steady capital influx secures a major position for hospitals in revenue generation in this sector. Moreover, its captivity over a higher volume of cyclotron installations and isotope consumption is also fueling its dominance.

Type Segment Analysis

Based on type, the high-energy cyclotrons segment is expected to garner a significant share of 42.4% in the medical cyclotron market throughout the forecasted timeframe. The increasing worldwide utilization of proton therapy for cancer treatment is the primary driver behind its accelerated augmentation toward leadership. In this regard, the International Atomic Energy Agency (IAEA) predicted the number of proton therapy centers, operating across the globe, to surpass 61 by the end of 2035. Furthermore, continuous funding from dedicated healthcare authorities is acting as a financial cushion for this segment, fostering a greater scope of innovation. Testifying this, the National Cancer Institute estimated a net of USD 2.9 billion worth of fundraising for proton cyclotrons by 2030.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Cyclotron Market Regional Analysis:

North America Market Insights

North America is expected to show dominance over the global medical cyclotron market by capturing the largest share of 40.5% during the selected tenure. The region's strong emphasis on several driving factors, such as the enlarging patient pool, advanced healthcare system, and technological innovations, is evidence of this leadership. In this regard, the National Institute of Health (NIH) recorded over 2.2 million new incidences of malignancies in North America in 2024. It also mentioned that 65.5% of these residents required PET imaging technology to detect, treat, and monitor the root cause, health impact, and progression of the disease. This highlights the existence of a sustainable demand across this landscape.

The U.S. is propagating the medical cyclotron market with a strong and expanding reimbursement structure. As evidence, the Centers for Disease Control and Prevention (CDC) presented a forecast of USD 3.6 billion to be the value of nationwide Medicare coverage for PET scans by 2030. This outlay is projected to enlist assessments in more than 41 operational centers within the U.S. territory. Simultaneously, the supportive gesture of government investors toward deploying and availing the maximum number of advanced clinical facilities and services for patients is inspiring both domestic and foreign companies to participate in this field. For instance, the NIH invested a total of USD 2.2 billion to advance cyclotron-based theranostics in 2024.

APAC Market Insights

Asia Pacific is projected to become the fastest-growing landscape of the medical cyclotron market by 2035, exhibiting the highest CAGR. Increasing cancer mortality, rapid infrastructural modernization, and government initiatives are accumulatively stimulating the region's progress in this sector. Particularly, emerging economies, such as China, India, and Malaysia, are presenting greater business opportunities for global pioneers. In addition, technologically developed countries, including Japan and South Korea, are accelerating the pace of discoveries and deployment of next-generation diagnostic and therapeutic technologies. This reflects the characteristics of a progressive and lucrative environment for this sector.

China is emerging as a regional powerhouse of manufacturing and revenue generation in the market. With a predominant control of the raw material supply chain, the country embarks on its significance as a lucrative consumer base and a dominating radiopharmaceutical producer. Additionally, China is witnessing a revolutionary shift toward digitalization, underscoring the efficiency of AI-enhanced cyclotron systems in elevating the quality and scalability of cancer care. Furthermore, the nation's propagation is also fueled by the ambitious goals of the governing bodies to make China a global healthcare giant. In this regard, the NMPA reported that the government investment in this category increased by 15.1% in the past 5 years, which supported diagnosis for more than 1.6 million patients in 2023.

Medical Cyclotron Market Players:

- IBA Radiopharma Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare

- Siemens Healthineers

- Sumitomo Heavy Industries

- Advanced Cyclotron Systems Inc.

- TeamBest Cyclotron Systems

- Philips Healthcare

- Olympus Medical

- Skanray Technologies

- Samsung Healthcare

- Canon Medical Systems

- Veolia Environmental

- Clean Harbors Inc.

- Hitachi High-Tech Corporation

- ResMed Ltd.

- Mindray Bio-Medical Electronics

- United Surgical Industries

- Malaysia Healthcare Innovations

- Toshiba Medical Systems

- Elekta AB

The medical cyclotron market is progressing with a highly competitive atmosphere, backed by key players prioritizing AI-driven automation, precision diagnostics, and sustainable solutions. For instance, IBA Radiopharma and GE Healthcare focused on developing next-generation high-energy cyclotron systems to solidify their leadership in this sector. Simultaneously, Siemens Healthineers and Samsung Healthcare are integrating AI in their clinical imaging portfolio, enhancing precision in nuclear medicine. These strategic technology advancements and commercial moves are reshaping the industry and expanding the field of application & range of options for oncology and nuclear medicine.

Top 20 key players of this cohort of innovators are:

Recent Developments

- In May 2024, NorthStar Medical revolutionized Mo-99 production by launching its uranium-free Ruby-FILL Generator System, solving critical global supply chain gaps. The cyclotron-compatible technology already secured USD 50.3 million from U.S. hospital contracts, poised to capture 25.2% of the diagnostic isotope market by 2025.

- In March 2024, Siemens Healthineers launched its upgraded Eclipse RT Pro Cyclotron, featuring AI-driven isotope yield optimization to enhance PET radiopharmaceutical production efficiency. The system drove a 15.1% increase in Q2 2024 orders, particularly from cancer centers in Europe and North America.

- Report ID: 1112

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Cyclotron Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.