Medical Coatings Market Outlook:

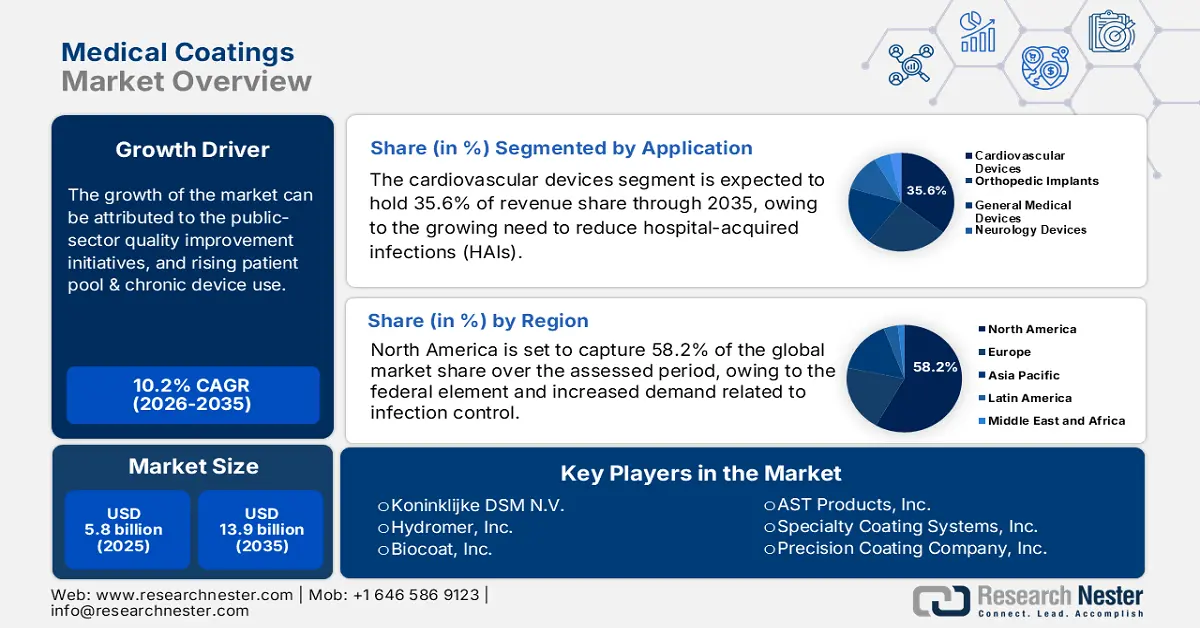

Medical Coatings Market size was valued at USD 5.8 billion in 2025 and is projected to reach USD 13.9 billion by the end of 2035, rising at a CAGR of 10.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of medical coatings is evaluated at USD 6.3 billion.

The increasing occurrence rate of chronic illness and the growing focus on healthcare-associated infection (HAI) control are collectively fueling demand in the medical coatings market. As diabetes, cardiovascular disease (CVD), and respiratory ailments often require the use of implantable devices, stents, and diagnostic tools, the amplification in these demographics translates to greater adoption in this sector. Providing an overview of this enlarging epidemiology, a 2024 study from the National Library of Medicine (NLM) unveiled that more than 1.0 million cardiac surgeries are performed each year worldwide.

The overall supply chain of the market consists of regulated chemical imports, GMP-compliant APIs, and finished components; hence, increases in production cost contribute to a higher payers’ pricing for end users. However, adequate investment and participation in the development of next-generation formulations lead to a well-balanced B2B-serviced value chain in this sector. On the other hand, in the medical device industry, payers are increasingly linking reimbursement levels to infection‑control and patient safety metrics, which strengthens the case for premium medical coatings.

Key Medical Coatings Market Insights Summary:

Regional Highlights:

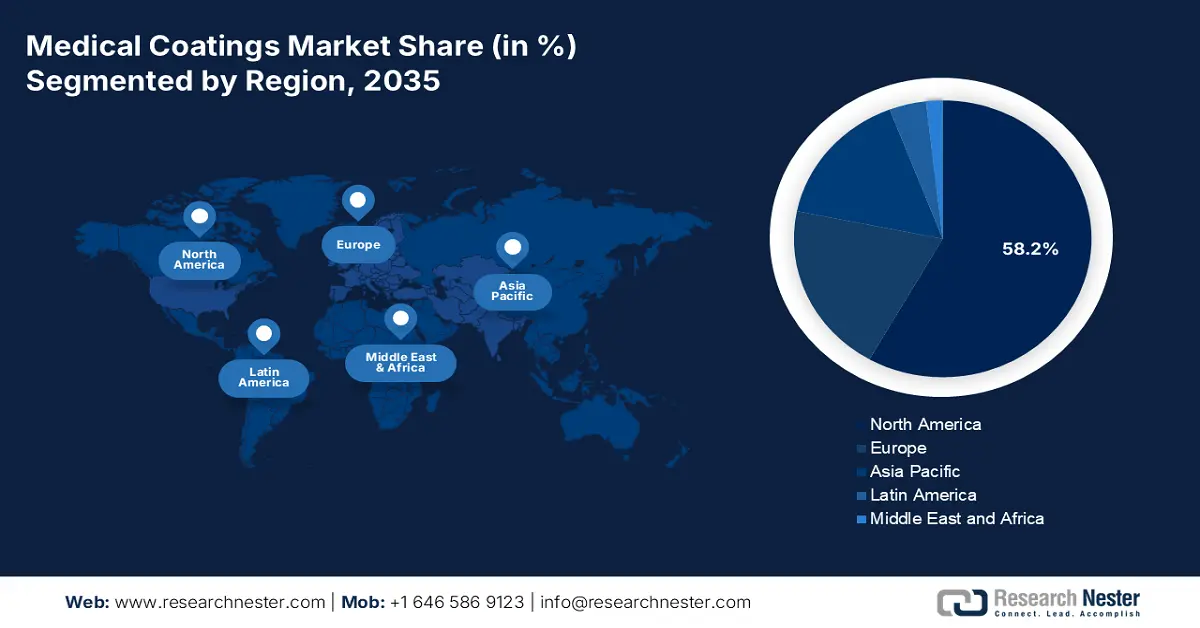

- By 2035, North America is projected to command a 58.2% share in the Medical Coatings Market, underpinned by federal infection-control regulations.

- Asia Pacific is set to grow at the fastest pace by 2035, supported by its position as a hub for international medical device production and innovation.

Segment Insights:

- By 2035, cardiovascular devices are expected to secure a 35.6% share in the Medical Coatings Market, propelled by the rising global incidence of CVD events requiring surgical intervention.

- Hydrophilic coatings are estimated to achieve a 28.8% share by 2035, supported by their essential role in improving the performance of instruments used in cardiac surgeries.

Key Growth Trends:

- Rising demand for minimally invasive surgeries (MIS)

- Growing worldwide concerns about HAIs

Major Challenges:

- High product pricing & affordability

- Supply chain integrity & counterfeits

Key Players: Royal DSM, PPG Industries, Inc., SurModics, Inc., Medtronic plc, Abbott Laboratories, W. L. Gore & Associates, Inc., Hydromer, Inc., Specialty Coating Systems, Inc., Biocoat, Inc., Covalon Technologies Ltd., Thermo Fisher Scientific, Mitsubishi Chemical Group, Precision Coating Company, Inc., Kurt J. Lesker Company, AST Products, Inc., Medicoat AG, Harland Medical Systems, Inc., Aculon, Inc., AdvanSource Biomaterials Corp., Sono-Tek Corporation, BioInteractions Ltd.

Global Medical Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.8 billion

- 2026 Market Size: USD 6.3 billion

- Projected Market Size: USD 13.9 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (58.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Mexico

Last updated on : 30 September, 2025

Medical Coatings Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for minimally invasive surgeries (MIS): Less blood loss and shorter recovery times gained from MIS procedures are increasingly becoming popular around the globe, establishing a substantial demand base for the medical coatings market. Specifically, the involvement of precision instruments such as catheters, guidewires, and endoscopes requires protective layers to improve overall performance and biocompatibility of the device. This can also be evidenced by the explosive growth of the endoscopes industry, which is one of the largest fields of application for this sector.

- Growing worldwide concerns about HAIs: In modern healthcare, HAIs are becoming a global issue, where catheters, implants, and surgical instruments are common vectors for infection. Testifying to this demography, a 2022 NLM report revealed that the occurrence rate of catheter-associated urinary tract infections (CAUTI) among ICU patients stood at 7.7 per 1000 catheter days. Another WHO finding underscored that more than 52.3% of HAI sepsis-afflicted individuals treated in the ICU die every year. This epidemiology concludes the urgent necessity of incorporating options from the market in regular healthcare practices.

- Advancements in coating technologies: Ongoing innovations in nanotechnology, polymer science, and surface chemistry are securing continuous development in the market. Newer products launched in this sector now offer combined benefits such as antimicrobial resistance, improved lubricity, and drug delivery capabilities. For instance, in June 2024, Hydromer launched a next-generation version of its thromboresistant medical device coating, F200t. HydroThrombX can reduce platelet adhesion and cell mitosis while preventing the risk of restenosis. Such advances help manufacturers maintain both compliance and market relevance.

Trends in Key Demographics in the Medical Coatings Market

Global Cardiac Surgical Volume and Targets by Country Income Group

(2024)

|

Category |

Total (Per 100,000 Population Per Year) |

|

Actual Volume in High-Income Countries |

123.2 |

|

Unadjusted Targets for LMICs |

61.6 |

|

Adjusted Target - Upper-Middle-Income |

86.1 |

|

Adjusted Target - Lower-Middle-Income |

55.1 |

|

Adjusted Target - Low-Income |

40.2 |

Source: NLM

Challenges

- High product pricing & affordability: The high prices related to coated instruments and equipment used in healthcare often drive the use of poor-quality products within low-income areas of the world. Thus, this limits the rate of acceptability and adoption in the medical coatings market. On the other hand, pressure from affordability thresholds makes it difficult for manufacturers to maintain quality and profitability at the same time. This ultimately imposes a shortfall of financial backing and commercial engagement in this sector.

- Supply chain integrity & counterfeits: The worldwide concern about counterfeit healthcare-related products also harms brand reputation in the market. It not only damages the consumer trust in branded products but also creates financial erosion in this sector. Particularly in low- and middle-income countries (LMICs), the economic barriers are increasing the occurrence of counterfeits, underscoring the urgent need for the development of affordable, region-specific pipelines.

Medical Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 13.9 billion |

|

Regional Scope |

|

Medical Coatings Market Segmentation:

Application Segment Analysis

Cardiovascular devices are predicted to capture the highest share of 35.6% in the market by the end of 2035. This dominance is consolidated by the high worldwide occurrence of CVD events requiring surgical intervention to prevent death. In this regard, the 2023 NLM study unveiled that over 18 million people lose their lives due to CVD every year worldwide, with approximately 1 million children born with congenital heart defects in LMICs each year. This epidemic is further adopting MIS procedures, which rely heavily on coated devices, including stents and catheters.

Type Segment Analysis

Hydrophilic coatings are estimated to become the dominant subtype in the medical coatings market by acquiring a share of 28.8% throughout the assessed timeline. The segment’s leadership in this sector is directly linked to its critical role in enhancing the performance of instruments used in cardiac surgeries. This portfolio features easier insertion, better maneuverability, and reduced vessel trauma that translates to shorter procedure times and improved patient safety. Evidencing the same, in October 2023, Surmodics introduced its most advanced hydrophilic medical device coating technology, Preside, which is highly suitable for a wide range of complex medical device application, including mechanical heart valves by enabling greater lubricity and durability.

End user Segment Analysis

Hospitals are poised to remain the leading end users in the market over the discussed timeframe. These facilities are globally established and preferred as the central hub for complex medical procedures, which redirects to the maximum use of coated devices. Besides, the large volumes of surgical intervention across a wide range of medical departments, including cardiovascular, orthopedic, and neurological, broaden the scope of greater utilization of medical coatings. Moreover, the comprehensive 24/7 emergency services, intensive care units, and large patient capacity in hospitals create sustained, high-volume demand for single-use and reusable coated devices.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Substrate Material |

|

|

Material Type |

|

|

Application |

|

|

Application Method |

|

|

Device Class |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Coatings Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 58.2% in the market during the analyzed tenure. The region’s dominance in this sector is highly attributable to federal infection-control provinces and regulations. In addition, the clinically proven outcomes of reduced HAI risks enable more robust reimbursement coverage from Medicare and Medicaid for coated catheters and stents. Moreover, the regulatory push towards MedTech manufacturers to align with protocols related to hygiene of medical devices to gain commercial and payer priorities is securing a sustainable cash inflow in this landscape.

The U.S. is one of the largest and most progressive consumer bases in the North America market. This can be exemplified by the 2022 report from the NLM, unveiling the annual number of CAUTI cases in the country surpassing 1.0 million, where associated costs of preventable incidences ranged between USD 115 million and USD 1.8 billion. This demography underscores a large-scale utilization of coated medical and surgical instruments, establishing a strong demand base for the merchandise. Evidencing the same, the import and export values of medical dressings, etc., having an adhesive layer, in the U.S. stood at USD 824 million and USD 676 million in 2023, according to the OEC data.

The Canada market is positively growing with the continuous influx of capital from national healthcare authorities to comply with the international infection control standards. Particularly, in long-term and acute care facilities, organizations are actively promoting the adoption of such protective layers to prevent deaths among the geriatric population. Besides, the nation holds a prominent position among the world’s top medical device manufacturers and suppliers, accounting for an industry value of USD 10.0 billion in 2024, which creates a favorable business environment for this sector.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the market by the end of 2035. Being home to international hubs of medical device production and innovation appears to be the strongest accelerator of progress in the APAC landscape. Besides, the growing focus on enhancing healthcare infrastructure and services by enacting strict infection-control regulatory reforms enables greater consumption in this category. On the other hand, government-led R&D budget allocations to med-tech and surgical instruments further facilitates a lucrative cash inflow in this sector.

In China, regulatory reforms by the National Medical Products Administration (NMPA) are increasing participation and investment in the market by mandating hygiene-compliance standards in the national medical system. Testifying to the same, the OEC reported that the robust export value of medical dressings, etc., having an adhesive layer, in China, which surpassed USD 940 million in 2024 alone. This also prompts innovation in the existing pipeline in this sector to align with the region-specific commercialization criteria.

The Japan medical coatings market is benefiting from the government incentive systems for antimicrobial agents and the annual price review system that recognizes the potential of high-cost medical device technologies in delivering better outcomes. Moreover, with one of the highest proportions of elderly citizens globally, there is growing demand for biocompatible and antimicrobial coatings for catheters, implants, and diagnostic tools in Japan. Additionally, the ongoing investments in R&D further strengthen its presence in this field.

Statistical Trends in Cardiac Surgery Demographics

|

Country |

Statistical Overview |

Timeline |

|

China |

A total of 69,000 congenital heart disease surgeries were performed in 728 hospitals nationwide |

2023 |

|

Japan |

Approximately 63,427 cardiovascular surgeries were performed, showcasing a 3.0% increase |

2022-2023 |

|

Australia |

132,000 coronary angiography procedures reported for patients admitted to hospital |

2021-2022 |

|

India |

Annually, 300,000 cardiac procedures were being performed across 420 cardiac centres in the country |

2023 |

|

South Korea |

The number of heart-related procedures is predicted to increase by 947,811 cases annually |

2023-2042 |

Source: NCCD, NLM, and AIHW

Europe Market Insights

The Europe market is estimated to garner a notable industry value from over the timeline between 2026 and 2035. The persistent growth of the region in this sector is primarily backed by regulatory convergence through EU MDR, public health agendas concerning HAIs, and rising R&D funding for novel technologies from the Horizon Europe Platform. Besides, the European Centre for Disease Prevention and Control (ECDC) estimated that HAIs occur in 4.3 million hospitalized patients per annum across Europe. In addition, it has been reported by the NLM in 2025 that HAIs cause 16 million additional days of hospitals stays every year in the region, with associated costs exceeding USD 8.2 billion, leading to a heightened interest in antimicrobial devices.

National reimbursement policies across the UK are favoring the revenue of supplier companies in the medical coatings market. The country is established as a sophisticated landscape, having an explicit focus on infection prevention, regulatory alignment, and cross-border research cohorts. The nation’s emphasis on this sector is also solidified through its stability in public offers, accomplished by ongoing NHS reform and partnerships with ABPI associations. Moreover, regulatory backing and new opportunities from payer-funded budget allocations continue to support the significance of UK in this field.

In Germany, continuous funding for coated devices from BMG-backed procurement programs fosters a well-established industrial strength and supply chain base for the market. On the other hand, the regulated environment of the MDR is assisting the country to speed up the uptake and participation in this sector. Inspired by such a favorable business atmosphere, in June 2024, Freudenberg Medical shared its plans to expand its drug device combination products portfolio by dedicating more than USD 50 million to constructing a new 130,000 sq. ft. Hemoteq AG production facility for drug and hydrophilic coatings for medical devices and components in the Aachen, Germany.

Country-wise Export-Import Data for Medical Dressings, etc.

(Having an Adhesive Layer) (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Germany |

582 million |

491 million |

|

Netherlands |

199 million |

386 million |

|

Ireland |

38.6 million |

34.6 million |

Source: OEC

Key Medical Coatings Market Players:

- Royal DSM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- SurModics, Inc.

- Medtronic plc

- Abbott Laboratories

- W. L. Gore & Associates, Inc.

- Hydromer, Inc.

- Specialty Coating Systems, Inc.

- Biocoat, Inc.

- Covalon Technologies Ltd.

- Thermo Fisher Scientific

- Mitsubishi Chemical Group

- Precision Coating Company, Inc.

- Kurt J. Lesker Company

- AST Products, Inc.

- Medicoat AG

- Harland Medical Systems, Inc.

- Aculon, Inc.

- AdvanSource Biomaterials Corp.

- Sono-Tek Corporation

- BioInteractions Ltd.

At the global level in 2025, the medical coatings market is characterized by U.S. and European leaders such as DSM, Surmodics, and Hydromer. Major initiatives in the market include cross-border partnerships, expansion into the Asia-Pacific region, and acquisitions of leading regional coating companies. Emerging players in India, Japan, and Malaysia are gaining ground in the global market with low-cost, high-quality coatings that meet local healthcare needs. Key innovation areas are being explored to boost the performance and safety of the newer generation medical devices worldwide.

Below is the list of some prominent players operating in the market:

Recent Developments

- In September 2025, BioInteractions launched a new category of high-performance, zero-leaching coating solutions, Surface-Active Systems, which is designed to improve implant performance, enhance patient safety, and evolve therapeutic outcomes. It assists in infection prevention, thrombosis control, and device longevity.

- In January 2025, Hydromer introduced PFAS-free hydrophilic coatings for medical devices to provide manufacturers with a seamless transition. These advanced coatings offer exceptional lubricity, durability, and biocompatibility, ensuring devices perform optimally while adhering to evolving environmental standards.

- Report ID: 3897

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.