Medical Adhesives Tape Market Outlook:

Medical Adhesives Tape Market size was over USD 10.55 billion in 2025 and is projected to reach USD 19.25 billion by 2035, growing at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical adhesives tape is evaluated at USD 11.14 billion.

The rising incidences of trauma injuries and chronic conditions requiring surgical intervention are primarily driving the market growth. According to an NLM report, the annual death cases of trauma around the world was around 6.0 million in 2021. Simultaneously, the counts of people with permanent and temporary injuries from these events were 40.0 million and 100.0 million per year, respectively. On the other hand, the population of patients with chronic wounds, caused by diseases such as type 2 diabetes, cardiovascular affections, leprosy, and other tropical ailments, surpassed 40.0 million in 2023 (ScienceDirect). These figures indicate increasing demand in this sector, as medical adhesive tapes (MAT) are widely used to close the surgical incision, lacerations, and other wounds.

Moreover, the products available in the market have a utility in sensitive areas, where traditional closure methods may deteriorate the condition. Currently, there is a growing emphasis on effective solutions with affordable payers’ pricing for wound care management. In addition, recently introduced adhesive tapes can offer economic advantages by reducing operative time, minimizing the need for additional care for removal, and potentially shortening hospital stays. On this note, NLM published results from a comparative single-blind clinical trial on ThermoTape, Tegaderm, and Kind Removal Tape in October 2023. It showcased 58.0% and 45.0% reduction in pain and skin redness during removal of ThermoTape with warming than the other two.

Key Medical Adhesives Tape Market Insights Summary:

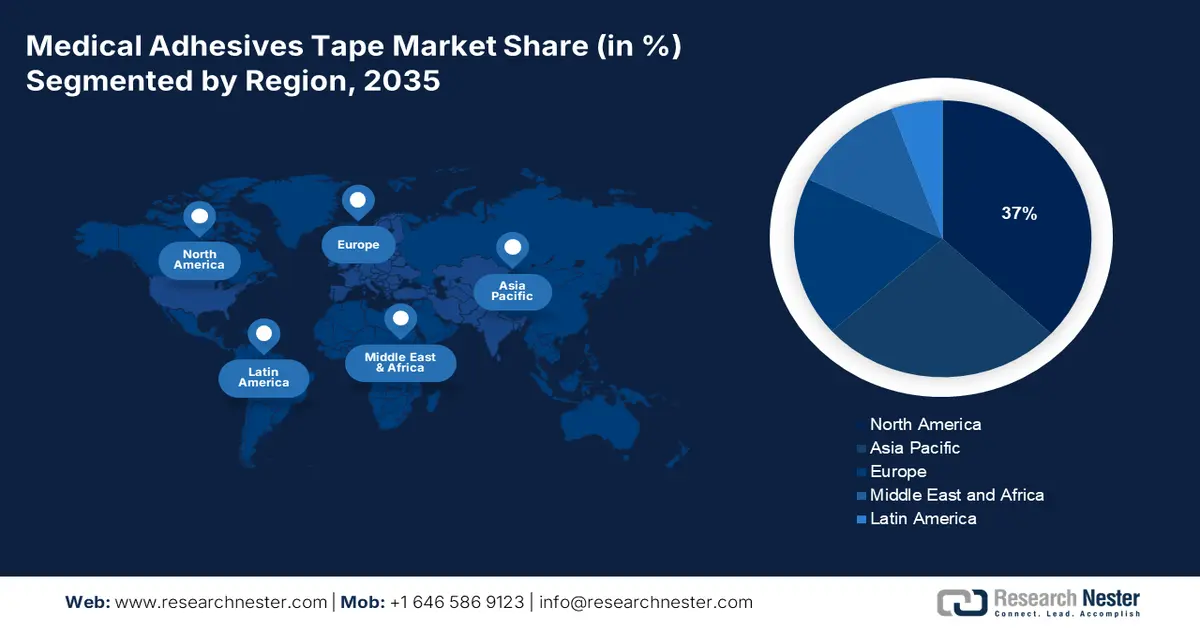

Regional Highlights:

- North America medical adhesives tape market will secure around 37% share by 2035, driven by rising surgical procedures, road accidents, and demand from cosmetic and reconstructive surgeries.

- Asia Pacific market will achieve remarkable growth during the forecast timeline, driven by a rapidly aging population, rising chronic disease prevalence, and increasing disposable incomes.

Segment Insights:

- The fabric segment in the medical adhesives tape market will hold a 40% share, attributed to the higher flexibility, elasticity, and durability of fabric as a backing material over the forecast period 2026-2035.

Key Growth Trends:

- Extensive use in cosmetic and emergency procedures

- Advancements and investments in wound care management

Major Challenges:

- Adverse reactions and resistive consumer base

Key Players: Smith & Nephew plc, Company OverviewBusiness StrategyKey Product OfferingsFinancial PerformanceKey Performance IndicatorsRisk AnalysisRecent DevelopmentRegional PresenceSWOT Analysis3M, Medline Industries Inc., Paul Hartmann AG, Cardinal Health, Baxter International, Inc., Johnson & Johnson Services, Inc., Nitto Denko Corporation, Lohmann GmbH & Co. KG, Meridian Adhesives Group.

Global Medical Adhesives Tape Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.55 billion

- 2026 Market Size: USD 11.14 billion

- Projected Market Size: USD 19.25 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 11 September, 2025

Medical Adhesives Tape Market Growth Drivers and Challenges:

Growth Drivers

-

Extensive use in cosmetic and emergency procedures: The worldwide emergence of ambulatory surgical centers (ASCs) and cosmetic restorations are driving demand in the medical adhesives tape market. Both the disciplines prioritize patient satisfaction and convenience, which pushes associated organizations to cultivate the most efficient method for wound closure. MATs are specifically crafted to deliver seamless operation and better post-operative experience by eliminating the discomfort and delay in recovery, usually associated with suture removal. In addition, an NLM review from March 2024 concluded that 5 out of 8 selected studies showed statistically significant improvement in scars from closures on using paper adhesive tapes.

- Advancements and investments in wound care management: Heightening investments in wound care is securing a stable capital influx in the market. This also fueling innovation in this sector, such as hypoallergenic materials, antimicrobial coatings, and silicone-based adhesives. Moreover, these discoveries are making these tissue adhesion techniques more efficient and durable for a wide range of healthcare disciplines. For instance, in February 2022, engineers at the Massachusetts Institute of Technology developed a sticky patch, named surgical duct tape, repairing gut leaks and tears in minimal time and with biocompatibility. The expanding advanced wound care industry is also evidence to this sector’s growth.

Challenges

- Adverse reactions and resistive consumer base: Some people may have allergic reactions or sensitivities to certain adhesive materials, which may limit their usage. Despite ongoing research, developing adhesives that are universally biocompatible and hypoallergenic is still a challenge for companies, particularly on a commercial perspective. Thus, economic and strategic hurdle in product development may hamper progress in the market. However, the government support and external fundings are cultivating a profitable atmosphere for global pioneers in this field, attracting more companies to participate.

Medical Adhesives Tape Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 10.55 billion |

|

Forecast Year Market Size (2035) |

USD 19.25 billion |

|

Regional Scope |

|

Medical Adhesives Tape Market Segmentation:

Backing Material Segment Analysis

The fabric segment is estimated to gain the largest share of 40% in the medical adhesives tape market throughout the analyzed timeframe. The segment’s leadership is majorly attributed to the higher flexibility, elasticity, and availability of fabric as a backing material. Moreover, having greater strength than paper and plastic makes it the most durable and desired component for various applications, such as sport burns, healing fractures, ligament tears, and other intricate surgeries. For instance, in August 2024, KT launched KT Turf Tape, made of a premium synthetic fabric, to offer burn protection, pain relief, and muscle support for football players. Furthermore, the affordability of this type of tapes are also a significant factor in making this segment the highest revenue generating asset for this field.

Application Segment Analysis

The medical adhesives tape market from surgeries segment is expected to garner a significant revenue by the end of 2035. During surgical interventions, MATs are helps secure both surfaces of tissues together and aid in wound healing until rejuvenated tissue retains enough strength to function properly. Thus, the heightening number of surgeries is propelling this segment’s captivation. In 2021, 234.0 million major surgeries were performed worldwide (NLM), whereas, in 2023, the annual count of surgeries taking place around the globe reached 313.0 million (NLM). Additionally, with the rising integration of medical robotics and laparoscopy, the demand for non-invasive tissue or skin adhesion is increasing.

Our in-depth analysis of the global medical adhesives tape market includes the following segments:

|

Type |

|

|

Backing Material |

|

|

Adhesion |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Adhesives Tape Market Regional Analysis:

North America Market Insights

North America industry is predicted to hold largest revenue share of 37% in the medical adhesives tape market over the assessed period. The region’s leadership is attributed to the rising cases of surgical procedures and road accidents. In this regard, a 2024 NLM study concluded that each 1 in 9 people living in the households of the U.S. had at least 1 surgery in the previous year. Additionally, the average number of emergency department visits for traffic crash injuries in the U.S. was 3.8 million between 2019 and 2020 (NLM). In both scenarios, healthcare professionals deal with sustained lacerations, abrasions, or deep cuts, where MATs are used as the first line wound care commodity.

The U.S. is augmenting the market with the surging demand for cosmetic procedures and the aging population. According to the American Society of Plastic Surgeons, approximately 1.6 million, 25.4 million, and 1.0 million cosmetic surgical, minimally invasive, and reconstructive procedures were performed in the U.S. in 2023, respectively. In addition, every 1 in 5 citizens, aged 65 and over, in this country undergone minimum 1 surgery in the past year, as per 2024 NLM report. This demography testifies to the nation’s significance in generating notable revenue for the regional landscape, attracting global pioneers to participate.

APAC Market Insights

The Asia Pacific medical adhesives tape market is estimated to be the second largest shareholder, registering 25% by 2035 with a remarkable CAGR. The region has a rapidly aging population, leading to a higher prevalence of age-related health conditions and chronic diseases. According to the United Nations report, 58.5% of the world’s older citizens were living in Asia in 2022. Surgical interventions are often required to address these conditions resulting in a greater need for MATs to support tissue repair, hernia fixation, wound closure, and others. Moreover, increasing disposable income in the region is increasing the focus on patient satisfaction. These trends are expected to increase the demand in this sector.

Japan presents a large consumer base for the market, owing to the large patient pool. In 2023, the number of habitats aged 65 and over across the nation was 36.2 million, accounting for 33.3% of the total population, as per the World Economic Forum. Thus, the country is pushing the capabilities and territory of clinical discoveries to cope with the growing demand and expand the field of application in this sector. On this note, in February 2024, researchers at Kyushu University, in collaboration with Nitto Denko, created a new adhesive tape that can easily stick 2D materials from various surfaces. This innovation showed potential of utilization in anti-cancer drug delivery and medical imaging.

Medical Adhesives Tape Market Players:

- Smith & Nephew plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Medline Industries Inc.

- Paul Hartmann AG

- Cardinal Health

- Baxter International, Inc.

- Johnson & Johnson Services, Inc.

- Nitto Denko Corporation

- Lohmann GmbH & Co. KG

- Meridian Adhesives Group

- Nautic Partners, LLC

- Solventum Corporation

Key players in the market are continuously evolving the components and features of their products to solidify their position. They are utilizing advanced materials to incur less damaging and long-acting impact. In this regard, in October 2023, DuPont launched Liveo MG 7-9960 Soft Skin Adhesive, offering higher adhesion while enabling long wear time and gentle removal. This low-cyclics silicone soft skin adhesive is formulated to support advanced wound care dressing. Simultaneously, many other global leaders are engaging their resources in rigorous R&D to offer more sustainable and effective options for a wide range of applications. This cohort of key players includes:

Recent Developments

- In February 2025, Nautic Partners completed the acquisition of the Specialty Tapes business from Berry Global Group, in transaction of USD 540.0 million. With this purchase, the company launched a newly branded company, Vybond, offering pressure-sensitive adhesive tapes worldwide.

- In October 2024, Solventum introduced a double-coated medical tape, built with 2487 Hi-Tack Silicone and Acrylate Adhesives on Liner. This wound care solution is designed to address the unmet needs of patients with sensitive skin, causing minimal trauma during removal and enabling comfortable application.

- Report ID: 5005

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Adhesives Tape Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.