Marketing Calendar Software Market Outlook:

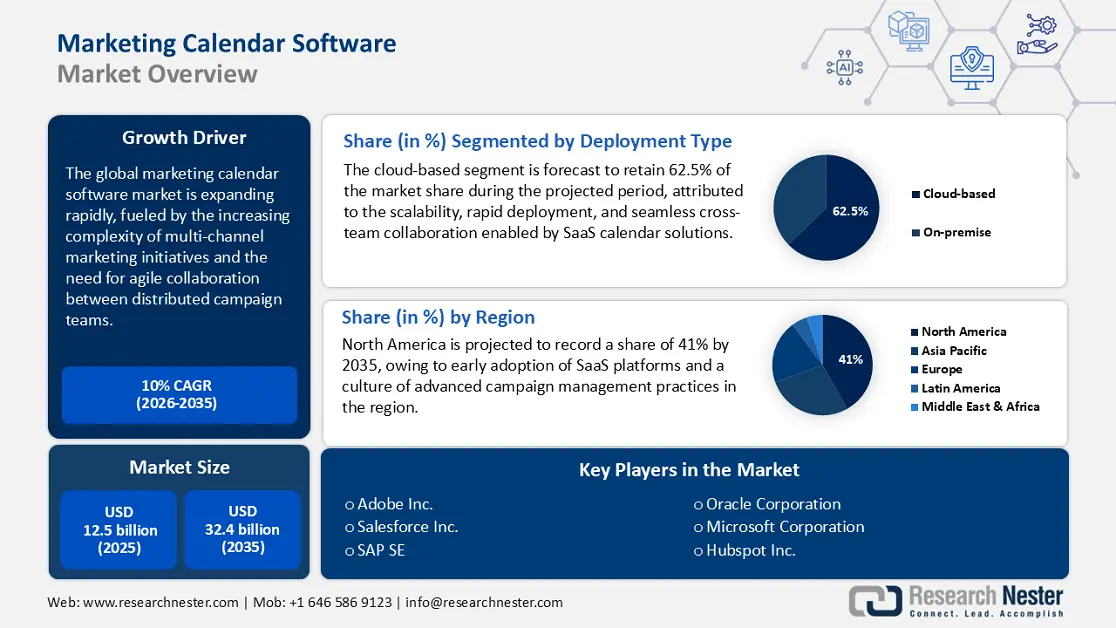

Marketing Calendar Software Market size is valued at USD 12.5 billion in 2025 and is projected to reach a valuation of USD 32.4 billion by the end of 2035, rising at a CAGR of 10% during the forecast period, i.e., 2026-2035. In 2026, the industry size of marketing calendar software is assessed at USD 13.7 billion.

The marketing calendar software market is making the transition from independent scheduling software to seamless, AI-based planning centers that manage the complete campaign journey. A key growth driver is the necessity for an integrated command center to link strategy, content creation, activation, and measurement in one view that can be shared and collaborated on. In September 2024, Adobe unveiled generative AI innovations in Adobe Experience Cloud, including enhancements to Adobe Workfront that utilize AI to create creative briefs and project plans orchestrated in integrated marketing calendars. This represents the industry trend toward putting planning tools inside larger platforms to enhance operational efficiency and give a single source of truth to marketing teams.

This market's expansion is also being influenced by emerging regulatory demands that bake compliance into campaign processes. Central to this is government regulation on data privacy, which is forcing marketing teams to include consent management and data governance processes in their planning calendars. In January 2025, the U.S. government finalized a regulation to block the movement of Americans' sensitive personal data to countries of concern, affecting how data is sourced and utilized for global campaigns by marketers. This means that any campaign booked in a marketing calendar has to factor in data residency and data transfer limitations now, making planning both a governance and scheduling function.

Key Marketing Calendar Software Market Insights Summary:

Regional Insights:

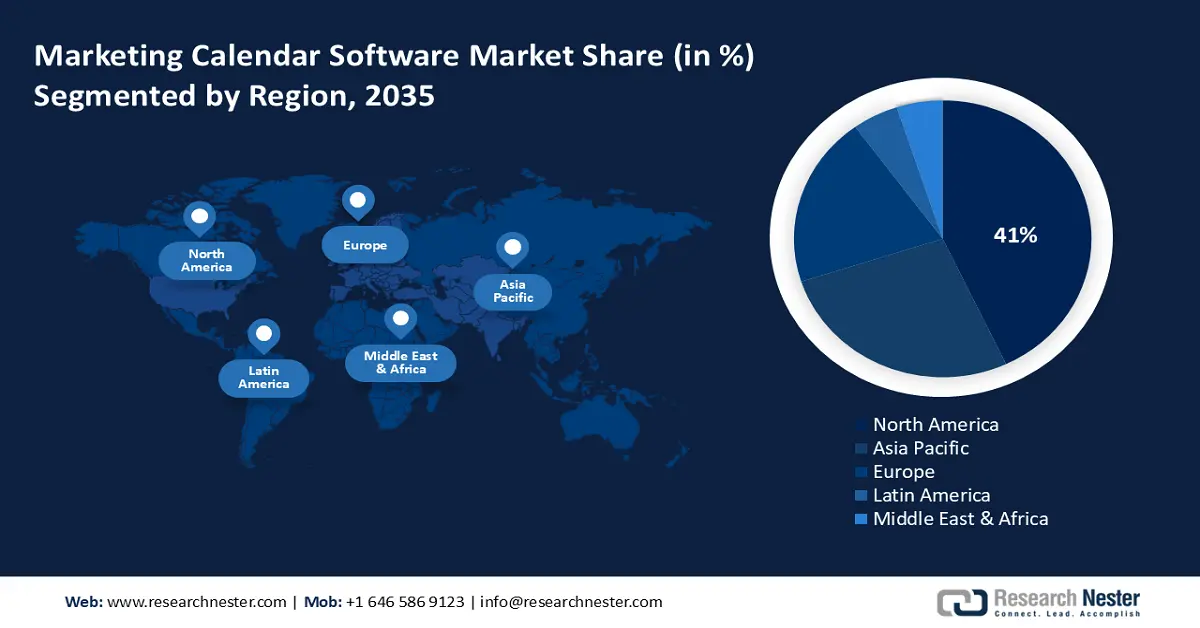

- By 2035, North America is expected to command a 41% share of the Marketing Calendar Software Market, spurred by an established martech ecosystem and a strong focus on data-driven decision-making.

- Asia Pacific is projected to record a 9.8% CAGR from 2026–2035, propelled by rapid digitalization, a growing middle class, and heightened use of mobile devices and social media.

Segment Insights:

- The cloud-based segment of the Marketing Calendar Software Market is projected to secure 62.5% share by 2035, sustained by the rising demand for easy-to-use, scalable, and collaborative planning tools that complement other martech solutions easily.

- The small and medium enterprises (SMEs) segment is anticipated to hold a 55% share by 2035, bolstered by the demand for easy-to-use tools combining planning, delivery, and analytics.

Key Growth Trends:

- Unification of planning and execution

- AI-facilitated campaign support

Major Challenges:

- Changing data privacy and consent laws

- Increased oversight of online advertising tactics

Key Players: CoSchedule, LLC,Monday.com Ltd.,Asana, Inc.,ClickUp, LLC,Smartsheet Inc.,HubSpot, Inc.,Planable, Inc.,Wrike, Inc.,Webex,Sprout Social, Inc.,Nifty Technologies, Inc.,Hootsuite Inc.,Nulab Inc. (Backlog, Cacoo),Cybozu, Inc. (Kintone),Rakuten Group, Inc. (Marketing tech suite)

Global Marketing Calendar Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.5 billion

- 2026 Market Size: USD 13.7 billion

- Projected Market Size: USD 32.4 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, United Kingdom, Japan

- Emerging Countries: – India, Brazil, South Korea, Indonesia, Australia

Last updated on : 25 September, 2025

Marketing Calendar Software Market - Growth Drivers and Challenges

Growth Drivers

- Unification of planning and execution: Marketing teams are abandoning stand-alone planning and execution tools in favor of integrated platforms that link strategy to activation within one workflow. One driving force is that a common calendar view, with real-time visibility across all campaign activities and dependencies, is necessary. In September 2024, HubSpot unveiled significant enhancements to its Marketing Hub at INBOUND, such as a new "Campaigns" object for controlling cross-channel efforts in a single calendar, powered by AI assistants to automate content creation. This tying together automates manual handoffs and speeds up the entire go-to-market process, making the calendar an operational hub.

- AI-facilitated campaign support: Generative AI integration is revolutionizing marketing calendars from being static scheduling tools to smart helpers that actively aid campaign development. This is fueled by the need for platforms that can speed up the development of content, from brief-writing to asset creation, within the planning interface itself. Salesforce launched Einstein Copilot for Marketers in May 2024 at its "Connections" event, an AI assistant built into Marketing Cloud that assists teams in creating campaign briefs, content, and customer segments. These AI-enabled capabilities decrease administrative burden and allow marketers to dedicate more time to strategic efforts and creative tuning.

- Predictive and automated timeline management: Today's marketing calendars are changing to incorporate predictive analytics and automation that assist teams in forecasting bottlenecks and streamlining resource utilization. One major growth propeller is the necessity for faster responses in competitive situations where adjustments must be made in real-time in order to achieve campaign success. In June 2024, Monday.com rolled out new AI-driven features, such as predictive timeline modifications that update project calendars in real-time based on current progress automatically, enabling marketing teams operating in industries like e-commerce and technology to anticipate delays and keep ahead. This move towards smart automation makes marketing planning more adaptive and responsive.

Generative AI Startup Funding by Sector (2019-H1 2023)

Rapid growth in generative AI funding - climbing from under $1 billion in 2019 to $14.1 billion in H1 2023 - is transforming marketing calendar software. Advanced engines now automate campaign copy, social posts, and email drafts, syncing them with calendar timelines for effortless scheduling. This reduces repetitive planning, shortens content cycles, and supports continuous coordination across channels.

|

Year |

Generative AI Infrastructure (USD billion) |

Content Generation Tools (USD billion) |

|

2019 |

0.5 |

0.4 |

|

2020 |

0.8 |

0.7 |

|

2021 |

2.2 |

1.9 |

|

2022 |

2.6 |

2.3 |

|

2023 (H1) |

14.1 |

14.1 |

Source: World Bank

Competition Interventions by Government in Digital Markets (2020-2024)

Globally, governments are accelerating efforts to regulate digital giants and foster fair competition. Since the EU launched its Digital Markets Act in 2022, at least 19 countries have advanced similar laws, while Australia, India, Japan, and South Africa unveiled new or revised measures to curb market dominance. These steps focus on transparency, accountability, and fair access across areas such as mobile ecosystems and food delivery. Reflecting this momentum, worldwide interventions have soared from just 14 in 2020 to 153 in 2024.

Source: UNCTAD

Challenges

- Changing data privacy and consent laws: The rising matrix of international data protection laws presents enormous barriers to marketing planning because each campaign now has to comply with stringent consent and data treatment regulations. One specific challenge is the necessity of incorporating compliance checks into the schedule for each activity touching personal data. Certain laws mandate companies to apply stringent procedures for collecting and handling user consent, drastically changing campaign planning processes by introducing obligatory, auditable steps. This regulatory resistance decelerates campaign deployment and introduces a degree of legal complexity into marketing processes.

- Increased oversight of online advertising tactics: Government efforts to regulate online marketing are layering new compliance and verification responsibilities onto campaign workflows, impacting media planning calendars and creative approvals. One of the specific challenges is the necessity to track compliance with new principles of ad transparency and consumer protection. In November 2024, the UK's Online Advertising Taskforce issued a report on its pilot of new principles for advertising intermediaries, aimed at minimizing online harms and enhancing ad compliance, which coerces marketers into incorporating new verification steps into campaign calendars. These steps increase the pre-launch workload and necessitate more coordination among legal and marketing teams.

Marketing Calendar Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 12.5 billion |

|

Forecast Year Market Size (2035) |

USD 32.4 billion |

|

Regional Scope |

|

Marketing Calendar Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment is forecast to retain 62.5% of the marketing calendar software market share during the forecasting period, supported by the demand for easy-to-use, scalable, and collaborative planning tools that also complement other martech solutions easily. One of the enablers is the capability of distributed teams to collaborate from a single, always current calendar. One of the supporting developments is the enrichment of combined platforms with improved cross-channel collaboration. In August 2024, as part of its 19.8 "Summer" release, Sprinklr announced significant enhancements to its marketing calendar, specifically to its Editorial Calendar. These updates provided enhanced cross-channel collaboration, greater control over campaign management, and improved analytics for marketing teams. This cloud-native collaboration ensures that all parties concerned have real-time insight into campaign advancement, anywhere in the world.

Organization Size Segment Analysis

The small and medium enterprises (SMEs) sector is likely to record a 55% marketing calendar software market share by 2035, given that affordable, one-stop platforms have democratized advanced marketing planning. A key stimulus is the demand for easy-to-use tools combining planning, delivery, and analytics that do not need an entire team of experts. The companion trend is the development of cheap, integrated marketing and sales platforms. In June 2024, Zoho released its "all-new" Marketing Automation 2.0 as part of Zoho Marketing Plus. This major update was accompanied by enhancements across the platform, including a Unified Marketing Calendar for better campaign planning and collaboration. This gives SMEs the capabilities to execute more strategic, data-driven campaigns that drive growth and competitiveness in the market.

End user Segment Analysis

The marketing and advertising agencies segment is predicted to hold a share of 31% through 2035, fueled by the demand to handle numerous client campaigns with open visibility and streamlined workflows. Effective social media management and client collaboration platforms now offer a central dashboard for streamlined collaboration, approvals, and reporting across multiple accounts. This represents a significant advancement in the field. In February 2024, Loomly launched its Next Generation Post Builder, which included major enhancements to the platform's workflow, collaboration, and previewing capabilities. These updates were intended to assist marketing agencies in planning, previewing, and approving social media content more effectively for several brands. These agency-centric tools are critical to ensuring quality and efficiency in scaling client services.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Organization Size |

|

|

End user |

|

|

Functionality |

|

|

Pricing Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marketing Calendar Software Market - Regional Analysis

North America Market Insights

North America marketing calendar software market is expected to hold a 41% market share through the forecast period, spurred by an established marketing technology ecosystem and a high focus on data-driven decision-making. The overall growth driver is constant innovation from top software vendors, who are integrating sophisticated AI and automation features into their solutions. North American businesses are thus early adopters of new marketing planning technologies and try to differentiate themselves through this.

The U.S. marketing calendar software market is anticipated to remain a significant market in North America, with a market that compels businesses to optimize their marketing efforts. A strong impetus is the necessity for effective campaign management to squeeze out ROI in a competitive digital marketplace. One of the key policy changes that shapes the market is regulating marketing in certain industries. In 2025, the U.S. Centers for Medicare & Medicaid Services (CMS) released its yearly MARx calendar, which mandates non-negotiable marketing, enrollment, and reporting deadlines for Medicare Advantage plans, compelling healthcare marketers to organize their internal calendars around government-mandated schedules. This indicates the manner in which regulatory systems in critical industries instill a foundational requirement for accurate and compliant marketing planning tools.

Canada market is stable and growing, backed by an innovative technology industry and an emphasis on data protection and privacy. One of the market drivers is the demand for marketing solutions that are regulation-compliant, which is influencing buying behavior. One such policy development is the progress of broad privacy legislation. In 2024, Canada further progressed in its Digital Charter Implementation Act (Bill C-27), which features the Consumer Privacy Protection Act (CPPA) that would oblige businesses to update their data processing routines and include privacy impact assessments in their annual marketing calendars to remain compliant. This regulatory climate fuels the demand for marketing calendar software with strong governance and compliance capabilities, which becomes a differentiator in Canada.

APAC Market Insights

Asia Pacific marketing calendar software market is anticipated to register a CAGR of 9.8% from 2026 to 2035, driven by fast digitalization, an expanding middle class, and an increased use of mobile devices and social media. A prominent trend among rapidly expanding organizations is the adoption of all-in-one marketing platforms, enabling them to scale operations both quickly and efficiently. This presents a key opportunity for software vendors that are able to provide integrated, user-friendly solutions that meet the varying needs of the region.

The marketing calendar software market in China features a distinctive digital ecosystem and firm regulatory regime that necessitates a localized marketing strategy. A critical aspect is to have tools that can manage the country's robust data privacy regulations while reaching consumers on popular local platforms. One of the most crucial policies is the enforcement of data protection regulations that control cross-border data transfers. In 2024, China persisted with the stringent enforcement of the Personal Information Protection Law (PIPL), affecting how international businesses can advertise to Chinese consumers, frequently requiring separate marketing calendars and compliant processes to avoid illicit data transfers. Such regulatory nuance is fueling demand for specialized software and local know-how.

India market is expanding, led by a thriving digital economy and a huge, youthful, and technologically advanced population. One of the key drivers is the demand for scalable and cost-effective marketing options that can get businesses in front of large and varied numbers of people. A pertinent policy initiative is the establishment of a new data protection regime. In February 2025, India released the draft Digital Personal Data Protection (DPDP) Rules, which obligate companies to have rigorous processes for collecting and handling user consent, changing campaign planning processes by inserting a required, compliant consent-collecting step into each marketing calendar item involving personal information. This is driving the deployment of marketing technology that can manage compliant, scalable campaigns.

Europe Market Insights

Europe marketing calendar software market is expected to garner steady growth from 2026 to 2035, influenced by a high emphasis on data protection and consumer privacy. One of the drivers is the requirement for software able to assist marketers with the intricate regulatory environment, specifically the General Data Protection Regulation (GDPR). Subsequently, software with in-built compliance and governance capabilities is in tremendous demand throughout the region.

Germany market is recording growth owing to its high level of B2B business, which is efficiency- and data security-driven. A crucial element is the demand for marketing solutions capable of managing complex, multi-step campaigns while adhering to stringent data protection regulations. A pertinent government initiative in this area is the promotion of secure cloud computing. In 2024, Germany's Federal Office for Information Security (BSI) championed its C5 (Cloud Computing Compliance Controls Catalogue), a publicly backed standard that offers a definitive benchmark for businesses to choose secure SaaS applications for their marketing planning and data handling. This is making buying decisions and inducing the adoption of compliant and secure marketing calendar tools, particularly in the "Mittelstand."

The UK market is competitive and dynamic, with high visibility given to digital marketing and an established technology ecosystem. Key factors include the growing need for flexible, collaborative planning tools that can adapt to rapid marketing campaigns. Additionally, significant policy changes are emerging, particularly new regulations aimed at digital markets and consumer protection. In November 2024, the UK's Digital Markets, Competition and Consumers (DMCC) Act was enacted, adding strict anti-subscription trap rules and fake review prohibition rules, requiring marketers to plan a quarterly compliance review of their checkout and review collection processes into their yearly marketing plans. This is driving the need for agile and compliant marketing planning software that can keep pace with the changing regulatory landscape.

Key Marketing Calendar Software Market Players:

- CoSchedule, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Monday.com Ltd.

- Asana, Inc.

- ClickUp, LLC

- Smartsheet Inc.

- HubSpot, Inc.

- Planable, Inc.

- Wrike, Inc.

- Webex

- Sprout Social, Inc.

- Nifty Technologies, Inc.

- Hootsuite Inc.

- Nulab Inc. (Backlog, Cacoo)

- Cybozu, Inc. (Kintone)

- Rakuten Group, Inc. (Marketing tech suite)

The competitive landscape for marketing calendar software includes both specialized, standalone tools and integrated features within broader marketing suites. Some dominant players are CoSchedule, LLC, Monday.com Ltd., Asana, Inc., ClickUp, LLC, Smartsheet Inc., HubSpot, Inc., Planable, Inc., Wrike, Inc., Airtable, Sprout Social, Inc., Nifty Technologies, Inc., Hootsuite Inc., Nulab Inc., Cybozu, Inc., and Rakuten Group, Inc. The market is characterized by a competition to provide the most advanced and consumer-oriented planning experience, with increased focus being placed on AI-based aid, integrations to the deepest levels, and enterprise-scale collaboration capabilities. The greater concentration of the martech market is also a principal driver, compelling individual vendors to innovate and niche to compete against the big platform players.

A major trend that is impacting the competitive landscape is the acquisition of niche tools by large platform players to build more extensive, end-to-end solutions. This consolidation is prompted by the need for integrated workflows that minimize the use of multiple, standalone tools. An example of this is the acquisition of influencer marketing platforms by social media management suites. In August 2023, Sprout Social bought Tagger Media, a leading influencer marketing platform, enabling Sprout to bring influencer campaign management natively into its social media suite and integrated content calendar. This action is indicative of the larger industry movement of developing consolidated platforms that give marketers one source of truth for all marketing functions, from planning through execution and measurement.

Here are some leading companies in the marketing calendar software market:

Recent Developments

- In September 2025, Microsoft announced several new updates and enhancements to its Power BI platform, coinciding with the FabCon Vienna event. These updates included improvements to Copilot and other AI capabilities, such as a default-on Copilot experience and key changes to default visuals.

- In April 2025, Webex released a software version update, RoomOS 11.27.1.7, that included several new features. Among the enhancements were the introduction of an "Auto catch-me-up" feature powered by an AI Assistant, new whiteboarding capabilities, and extended support for USB cameras.

- In January 2025, Salesforce rolled out new AI-powered features for marketers, including an enhanced marketing calendar. The enhancements allowed for improved cross-channel visibility and streamlined workflows. Specific new features included AI-assisted campaign brief generation and the Agentforce Campaign Designer, which centralized editing and refinement of multichannel campaigns.

- Report ID: 3494

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marketing Calendar Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.