Maritime Satellite Communication Market Outlook:

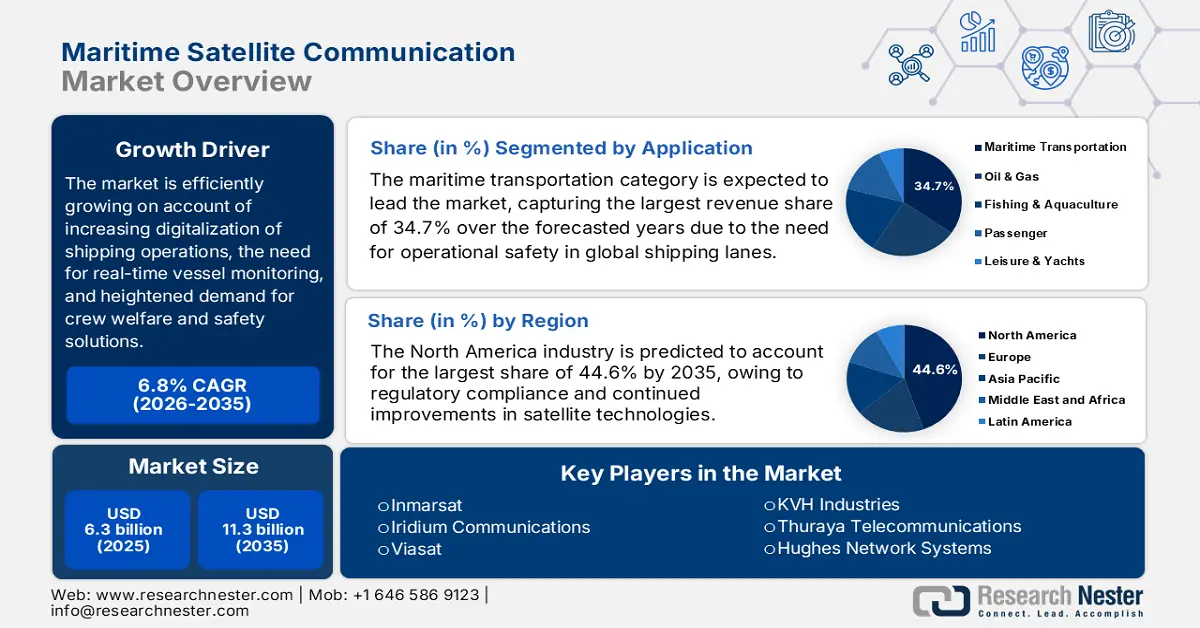

Maritime Satellite Communication Market size was valued at USD 6.3 billion in 2025 and is projected to reach USD 11.3 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of maritime satellite communication is assessed at USD 6.7 billion.

The maritime satellite communication market is efficiently growing on account of increasing digitalization of shipping operations, the need for real-time vessel monitoring, and heightened demand for crew welfare and safety solutions. In this context, Intelsat in April 2025 announced that it has secured a U.S. Space Force contract to provide commercial satellite communications, which includes global maritime coverage, under the proliferated LEO (pLEO) program. Besides, the contract underscores the pivotal role of satellite connectivity in government maritime operations and highlights extensive investments in LEO and GEO networks with a prime focus on enhancing operational efficiency and resilience. Hence, such development reflects the expanding demand for secure, always-on maritime satellite communication services in both defense and commercial sectors, contributing to a wider market expansion.

Furthermore, governments across the world are constantly putting efforts into increasing the adoption of advanced technologies, such as bonded multi-network services, high-throughput satellites, and low Earth orbit constellations, benefiting the market. In August 2025, the Ministry of Ports, Shipping, and Waterways of India announced its plans to explore a satellite or acquire a transponder for the maritime sector in the country. It also mentioned that the initiative aims to strengthen coastal and port management infrastructure by enabling real-time vessel tracking, enhanced navigational safety, congestion monitoring, and improved disaster and pollution response across India’s coastline and inland waterways. In addition, the system would integrate with national maritime databases and reduce dependence on foreign navigation systems, supporting the Atmanirbhar Bharat vision, hence indicating a positive market outlook.

Key Maritime Satellite Communication Market Insights Summary:

Regional Insights:

- North America is forecast to secure a dominant 44.6% revenue share by 2035 in the maritime satellite communication market, underpinned by strong regulatory compliance requirements and continuous advancements in next-generation satellite communication technologies.

- Asia Pacific is projected to witness the fastest expansion through 2035, recording accelerated adoption as rising maritime trade volumes and large-scale investments in advanced satellite-enabled maritime infrastructure stimulate demand.

Segment Insights:

- The maritime transportation segment is anticipated to account for a leading 34.7% revenue share by 2035 in the maritime satellite communication market, supported by the essential requirement for real-time navigation, logistics coordination, and operational safety across global shipping routes.

- The commercial vessels sub-segment is expected to achieve a significant revenue share by 2035, reinforced by increasing global trade volumes and stricter environmental, emission, and safety compliance mandates.

Key Growth Trends:

- Smart shipping & IoT integration

- Rising demand for reliable connectivity at sea

Major Challenges:

- Coverage limitations and signal reliability

- Regulatory and spectrum management issues

Key Players: Iridium Communications (U.S.), Viasat (U.S.), KVH Industries (U.S.), Thuraya Telecommunications (U.A.E.), Hughes Network Systems (U.S.), Marlink (France), Speedcast (U.S.), Intelsat (U.S.), SES Satellite (Luxembourg), Cobham SATCOM (Denmark), NSSLGlobal (U.K.), Orbit Communication Systems (Israel), ST Engineering (Singapore), Network Innovations (Canada).

Global Maritime Satellite Communication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size: USD 6.7 billion

- Projected Market Size: USD 11.3 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, Singapore, Brazil

Last updated on : 24 December, 2025

Maritime Satellite Communication Market - Growth Drivers and Challenges

Growth Drivers

- Smart shipping & IoT integration: Most of the modern vessels rely on sensors and connected systems for continuous monitoring and autonomous operations, thereby providing encouraging opportunities for pioneers in the maritime satellite communication market. In this regard, Maersk in May 2025 announced that it had begun rolling out its next-generation IoT connectivity platform across 450 vessels, which also includes owned and time-chartered ships, to enable smarter cargo tracking and real-time data transmission. The firm also notes that this platform supports thousands of IoT devices and upgrades onboard infrastructure from 2G to 4G, allowing higher data granularity for improved supply chain visibility and operational efficiency. In addition, the platform is especially designed for proper interoperability and scalability, and it integrates multiple wireless technologies and advanced components from partners such as Nokia and Onomondo.

- Rising demand for reliable connectivity at sea: Maritime operators require high-speed, always-on communication for navigation, crew welfare, cargo tracking, and operational efficiency, which in turn drives consistent growth in the market. For instance, in September 2023, Hapag-Lloyd announced that it is rolling out Starlink satellite internet across its fleet, with a prime focus on enhancing connectivity at sea, and is following successful trials on four pilot vessels. It also stated that the high-speed service, which offers up to 250 Mbps, enables video calls, streaming, and supports remote maintenance and vessel inspections, improving both crew welfare and fleet management. Furthermore, full installation and activation were planned, which marks a significant step forward in maritime communication, hence making it suitable for overall market growth.

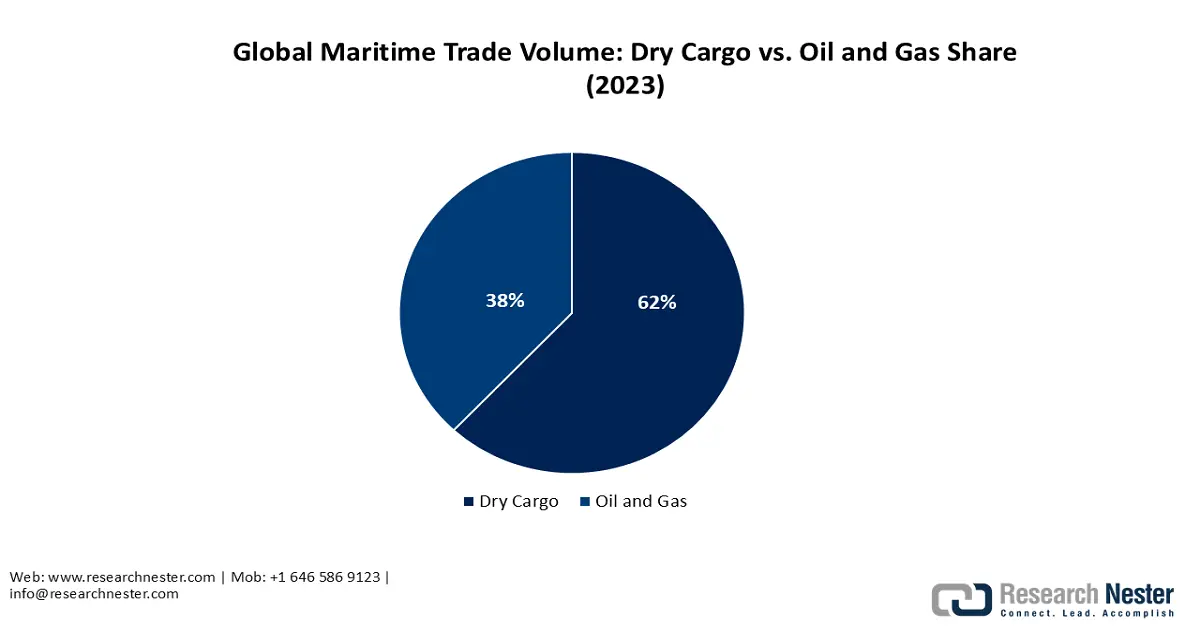

- Growth in maritime traffic and trade: Expansion in terms of international shipping routes, rising imports & exports, and more vessels operating longer voyages boost the need for satellite links, increasing demand in the maritime satellite communication market. The article published by UNCTAD in April 2025 states that it released new country-level seaborne trade data, which showcases that maritime transport moves more than 80% of goods traded worldwide, thereby highlighting its most significant role in global supply chains. Besides, the dataset also provides detailed data on trade flows, helping governments monitor performance, plan port and transport infrastructure, and guide investment and policy decisions. In addition, the data also shows a shift toward dry cargo and increasing participation of developing economies, reflecting the evolving dynamics of global maritime trade, hence attracting more players to make investments in this field.

Maritime Trade by Country Group (2023)

|

Country Group |

Percentage Share (%) |

|

Developing economies |

53.2 |

|

Developed economies |

46.1 |

|

Small island developing states |

2.1 |

|

Least developed countries |

1.9 |

Source: UNCTAD

Maritime Trade by Region (2023)

|

Region |

Percentage Share (%) |

|

Asia |

47.1 |

|

Europe |

24.0 |

|

Americas |

16.9 |

|

Oceania |

7.3 |

|

Africa |

4.7 |

Source: UNCTAD

Challenges

- Coverage limitations and signal reliability: Despite the global reach, the maritime satellite communication market is facing huge challenges in terms of coverage and reliability. The geostationary satellites can witness limited coverage in polar regions and signal degradation owing to the weather conditions, such as heavy rain or storms. Besides, latency is another issue, especially for GEO systems, which readily affects applications such as video conferencing, remote monitoring, and autonomous vessel operations. Meanwhile, the LEO constellations reduce latency and improve coverage, which necessitate complex satellite handovers and dense infrastructure. Furthermore, maintaining consistency and quality connectivity across vast and remote ocean areas is highly difficult, especially for vessels operating in extreme or isolated maritime environments.

- Regulatory and spectrum management issues: This is yet another challenge that has skewed up upliftment of the market. Operators must comply with international maritime regulations, national licensing requirements, and frequency allocation rules, which vary by country and region. Therefore, coordinating spectrum use among multiple satellite operators increases the risk of interference, especially as new LEO and HTS systems debut into the market. Also, any delays in regulatory approvals can slow network expansion and technology deployment. In addition, vessels traveling across multiple jurisdictions must ensure compliance with different communication laws, increasing administrative burden and operational complexity for ship owners and service providers as well.

Maritime Satellite Communication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 11.3 billion |

|

Regional Scope |

|

Maritime Satellite Communication Market Segmentation:

Application Segment Analysis

The maritime transportation category is expected to lead the entire maritime satellite communication market, capturing the largest revenue share of 34.7% over the forecasted years. The dominance of the segment is due to the critical need for real-time navigation, logistics, and operational safety across global shipping lanes. Simultaneously, the heavy investments in IoT, predictive maintenance, and crew connectivity are also supporting its market leadership across the globe. In June 2025, Maersk partnered with Inmarsat Maritime to upgrade satellite communications across its 340-container ship fleet by enhancing bandwidth and enabling vessels to function as floating offices. Besides, Inmarsat also states that this initiative combines Ka-band and resilient L-band networks, by ensuring always-on, secure connectivity for operational efficiency & improved crew welfare. This dominance further aligns with the growing share of dry cargo in global maritime trade in 2023, as higher vessel activity and operational complexity directly increase the demand for high-capacity satellite communication across commercial shipping fleets.

End Use Segment Analysis

By the end of 2035, the commercial vessels sub-segment is anticipated to command a lucrative revenue share in the market. The growth of the segment is highly subject to the high trade of global goods by volume. Simultaneously, the increasing regulatory requirements for environmental monitoring, emission reporting, and safety compliance are pushing vessel operators to opt for more reliable satellite communication systems. Also, strategic collaborations between fleet operators and satellite service providers are accelerating the deployment of next-generation connectivity solutions, including Ka-band and hybrid GEO-LEO networks. In addition, enhanced crew welfare programs, such as high-speed internet for remote work, education, and entertainment, are becoming standard, further solidifying the segment’s growth and market share in the maritime satellite communication industry.

Service Type Segment Analysis

In the service type segment, data services will capture a significant share in the maritime satellite communication market owing to the heightened demand for internet connectivity, cloud-based fleet management, IoT, and real-time monitoring at sea. On the other hand, operators rely on data-driven solutions for navigation, predictive maintenance, and crew welfare. In June 2023, Mitsui O.S.K. Lines (MOL) reported that it had conducted a successful sea trial of Starlink satellite communication on an ocean-going vessel, which achieved up to 50 times faster connectivity when compared to conventional systems. It also notes that this high-speed, low-latency data service enables real-time ship-to-shore system sharing, supports digital fleet operations, and enhances crew welfare by allowing video calls and internet access during off-duty hours. Furthermore, this trial highlights the growing adoption of advanced data services in maritime satellite communication to improve operational efficiency and seafarer well-being, hence denoting a positive market outlook.

Our in-depth analysis of the maritime satellite communication market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End use |

|

|

Service Type |

|

|

Type |

|

|

Connectivity Type |

|

|

Offering |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Maritime Satellite Communication Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 44.6% in the market by the conclusion of 2035. The region’s leadership in this field is attributable to the heightened demand for communication in maritime operations, regulatory compliance, and continued improvements in satellite technologies. In December 2024, Iridium Communications Inc. announced that it had launched Iridium Certus GMDSS, which is a next-generation maritime satellite communication service providing global distress alert, safety voice, and maritime safety information. Also, the system integrates regulated services such as LRIT and SSAS with broadband capabilities, thereby allowing vessels to streamline equipment, reduce costs, and ensure safety even in remote oceans. In addition, SOLAS-class ships can instantly alert rescue coordination centers in emergencies, enhancing crew safety and operational efficiency, hence making it suitable for standard market growth.

The U.S. is showcasing unprecedented progress in the maritime satellite communication market owing to the presence of key market players and their strategic initiatives. These pioneers are putting constant efforts into continued innovations and cross-border collaborations for exceptional service delivery. In this context, the Jet Propulsion Laboratory in December 2025 reported that Sentinel-6B, which is a joint U.S.-European mission led by NASA and partners, has started sending its first ocean height measurements since its November launch, covering 90% of the world’s oceans. The satellite utilizes radar altimetry and tracks sea-level changes with ultra-precision to support marine forecasting, navigation, national security, and coastal planning. In addition, once it is fully calibrated, Sentinel-6B will enhance understanding of ocean dynamics and support maritime and environmental monitoring.

The market in Canada has gained huge exposure owing to the presence of an extensive coastline, a proactive shipping industry, and a focus on Arctic and remote maritime operations. Simultaneously, the increasing demand for ship-to-shore connectivity and enhanced crew welfare is readily encouraging the adoption of satellite communication solutions. In November 2025, MDA Space announced that it had made a USD 10 million equity investment in maritime launch services, thereby becoming both an equity owner and partner to advance Canada’s sovereign space capabilities. The firm notes that this partnership will support the development and operations of Spaceport Nova Scotia, Canada’s first-ever commercial orbital launch complex, enhancing domestic launch capacity for commercial, civil, government, and defense clients. Furthermore, this collaboration aims to strengthen the space value chain, drive economic growth in Canada, and provide a reliable, responsive option for global launch services.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the maritime satellite communication market due to increasing maritime trade activities and the huge necessity of advanced communication systems. Countries across this region are making stronger investments in maritime infrastructure, whereas government initiatives are enhancing both safety and efficiency. In October 2025, IHI Corporation, Inovor Technologies, and Meisei Electric announced that they had launched a joint research initiative to develop and demonstrate small satellite technology, which is aimed at enhancing maritime surveillance capabilities between Japan and Australia. The collaboration will focus on building a versatile satellite constellation, which includes Optical, SAR, VDES, RF, IR, and hyperspectral sensors, to support target detection and tracking for land and sea operations. In addition, this partnership strengthens bilateral defense and space cooperation, leveraging expertise from Japan, Australia, and international collaborators such as ICEYE, Surrey Satellite Technology, and Satellite Vu.

China is the leading country in the regional market, propelled by the expansion of its commercial shipping and naval operations, supported by robust domestic satellite infrastructure, and the government's focus on advanced communication systems. The country’s market also benefits from a huge emphasis on satellite broadband services to enhance connectivity for vessels operating in the South China Sea and beyond, reflecting the strategic importance of reliable ship-to-shore communication for trade and security across major sea routes. In September 2023, ZTE and SpaceIoT reported that they had completed the industry’s first 5G NTN deployment in a marine scenario in Zhoushan, Zhejiang, by integrating Tiantong mobile satellites with 5G NTN base stations and terminals. The firm also notes that this system enables real-time maritime monitoring, which includes water quality, temperature, humidity, and emergency rescue services, demonstrating seamless satellite-ground connectivity for vessels and remote islands, hence denoting a positive market outlook.

In India, the maritime satellite communication market is readily blistering growth owing to the expanding maritime trade, naval modernization, and increased demand for reliable connectivity at sea. The country’s government and private sector are proactively developing satellite capabilities to enhance naval reach, reflecting a strategic push to support secure communication links across the ocean region. In December 2025, the Indian Space Research Organization (ISRO) is set to launch the BlueBird Block-2 communication satellite, which marks the latest in AST SpaceMobile’s next-generation constellation. It is designed to provide space-based cellular broadband directly to standard mobile smartphones, and will be the largest commercial communications satellite to reach Low Earth Orbit via ISRO’s LVM3-M6 launch vehicle. In addition, ISRO has previously supported high-profile missions such as Chandrayaan-2, Chandrayaan-3, and OneWeb satellite deployments, hence underscoring India’s growing role in commercial satellite communications and space-based connectivity solutions.

Europe Market Insights

Europe has a stronger potential to capitalize on the global maritime satellite communication market. The region’s prominence in this field is primarily fueled by the presence of strict regulatory bodies, which proactively promote safety and efficiency in maritime operations. The region’s market also benefits from rising vessel numbers and the heightened demand for real-time data. In November 2025, Vodafone and AST SpaceMobile together announced the creation of a new EU satellite constellation, with Germany chosen as the location for their European Sovereign Satellite Operations Centre. Besides, the constellation, managed by their joint venture SatCo, aims to provide space-based mobile broadband directly to everyday smartphones across Europe, supporting both commercial use and emergency services. In addition, this initiative enhances digital sovereignty, offering secure, resilient connectivity in Europe by complementing terrestrial networks and enabling pan-regional coverage with advanced command and security features.

Germany is the key growth contributor for the regional maritime satellite communication market progression. The country’s market is highly propelled by ongoing partnerships between satellite operators and maritime service providers, who focus on the enhancement of connectivity and service quality. In December 2025, ICEYE and Rheinmetall announced that they secured a €1.7 billion (approximately USD 1.86 billion) contract with the country’s Armed Forces to provide space-based reconnaissance through a synthetic aperture radar (SAR) satellite constellation. The joint venture, Rheinmetall ICEYE Space Solutions, will manage satellite operations, ground stations, and AI-driven image analysis to deliver high-frequency, all-weather intelligence supporting NATO’s eastern flank. Hence, such instances reflect the presence of heightened demand in the country, encouraging both national and international players to operate in Germany.

In the U.K., the maritime satellite communication market is expanding rapidly, efficiently driven by regulatory standards such as SOLAS and the UK Maritime Coastguard Agency’s requirements, prompting vessels to adopt integrated communication systems. The country’s government in October 2024 reported that Horizon Technologies’ Amber-2 Maritime Domain Awareness (MDA) satellite, supported by a £1.2 million (approximately USD 1.5 million) UK space agency investment, is on track to detect dark vessels that are involved in illegal activities such as smuggling, illegal fishing, and sanctions evasion. Using radio frequency (RF) detection, the satellite can track vessels even when AIS systems are turned off, complementing shore-based systems for coverage within national waters and open oceans. Furthermore, the Amber Programme, which also includes follow-on Amber-3, strengthens the UK’s leadership in space-based maritime security, thereby fostering innovation and global intelligence capabilities.

Key Maritime Satellite Communication Market Players:

- Inmarsat (U.K.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Iridium Communications (U.S.)

- Viasat (U.S.)

- KVH Industries (U.S.)

- Thuraya Telecommunications (U.A.E.)

- Hughes Network Systems (U.S.)

- Marlink (France)

- Speedcast (U.S.)

- Intelsat (U.S.)

- SES Satellite (Luxembourg)

- Cobham SATCOM (Denmark)

- NSSLGlobal (U.K.)

- Orbit Communication Systems (Israel)

- ST Engineering (Singapore)

- Network Innovations (Canada)

- Inmarsat is the worldwide leader in maritime satellite communication, offering a wide range of connectivity solutions through its geostationary satellite fleet and high-throughput services such as Fleet Xpress and Fleet Broadband. It also supports vessel operations, crew welfare, and safety compliance by combining L-band and Ka-band broadband services for data, navigation, and voice communications. Expanding hybrid satellite networks, enhancing polar coverage, and partnering with maritime stakeholders to integrate IoT and managed connectivity services are a few strategies opted for by Inmarsat.

- Iridium Communications operates a unique low-earth-orbit satellite constellation that delivers exceptional global coverage, which also includes polar regions underserved by traditional GEO systems, making it crucial for remote maritime operations. Its Iridium Certus platform provides low-latency voice and data services that are suitable for safety, tracking, and remote fleet monitoring. Further, Iridium is focused on innovation and expanding broadband capabilities, which has strengthened its position across commercial and government maritime segments

- KVH Industries is best known for its specialized maritime satellite hardware, especially the TracPhone antenna systems and its mini-VSAT broadband network. The company serves multiple vessel types, from commercial ships to luxury yachts, and emphasizes crew welfare services along with connectivity. Simultaneously, KVH’s strategic direction includes developing hybrid connectivity solutions, integrating content delivery, and enhancing cybersecurity features in its extensive product portfolio.

- Thuraya Telecommunications is a part of the broader satellite telecom landscape that offers maritime and mobile satellite services across the international sea routes. The firm’s products emphasize reliable voice and data communication, particularly for vessels that are operating outside traditional terrestrial coverage. Region-focused expansion, collaborations with fishing and coastal fleets for safety systems deployment, and enhancing emergency communication capabilities are a few strategic activities opted for by Thuraya to secure its market position in this field.

- Viasat is yet another dominant force in this field, which is providing high-throughput maritime communication services using GEO satellites and advanced broadband technologies. The firm’s prime focus is to strengthen its capacity offerings and service flexibility for maritime customers, from commercial logistics to leisure vessels. Furthermore, Viasat’s focus on innovation, scale, and broader satellite service integration positions it as a predominant leader in this market.

Below is the list of some prominent players operating in the global market:

The maritime satellite communication market is hosting a mix of established GEO/MEO/LEO satellite operators and specialized equipment manufacturers. Key pioneers such as Inmarsat, Iridium Communications, and Viasat compete in terms of global coverage, bandwidth capacity, and reliability, whereas the other players, KVH Industries and Cobham SATCOM, are focused on advanced antenna hardware and integrated VSAT terminals. In December 2025, Inmarsat Maritime announced that Krey Schiffahrt selected its NexusWave bonded connectivity service for four newbuild heavy lift project cargo carriers. Besides, this solution will provide always-on, high-speed, unlimited connectivity to support efficient vessel operations, performance, and energy monitoring, and enhanced crew welfare. Hence, such milestones underscore the increasing adoption of advanced managed satellite communication services in modern, environmentally efficient commercial vessels.

Corporate Landscape of the Market:

Recent Developments

- In December 2025, Inmarsat Maritime, a Viasat company, introduced the next phase of its NexusWave bonded connectivity service, leveraging the upcoming ViaSat-3 satellites and a new VS60 maritime terminal to deliver higher bandwidth and improved network performance.

- In December 2025, Cobham Satcom and Gatehouse Satcom merged to form a subsidiary focused on delivering integrated 5G NTN network solutions, combining Cobham’s radio access and ground infrastructure expertise with Gatehouse’s advanced 5G NTN software capabilities while maintaining Cobham’s core maritime and enterprise product offerings.

- In June 2025, Alén Space reported that it had successfully placed its SATMAR satellite into orbit aboard a SpaceX Falcon 9 rocket from Vandenberg Space Force Base, California. The satellite aims to advance maritime digitalization by validating the new VDES (VHF Data Exchange System) standard, enabling bidirectional satellite communications in the VHF band.

- Report ID: 634

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.