Manufacturing Execution Systems Market Outlook:

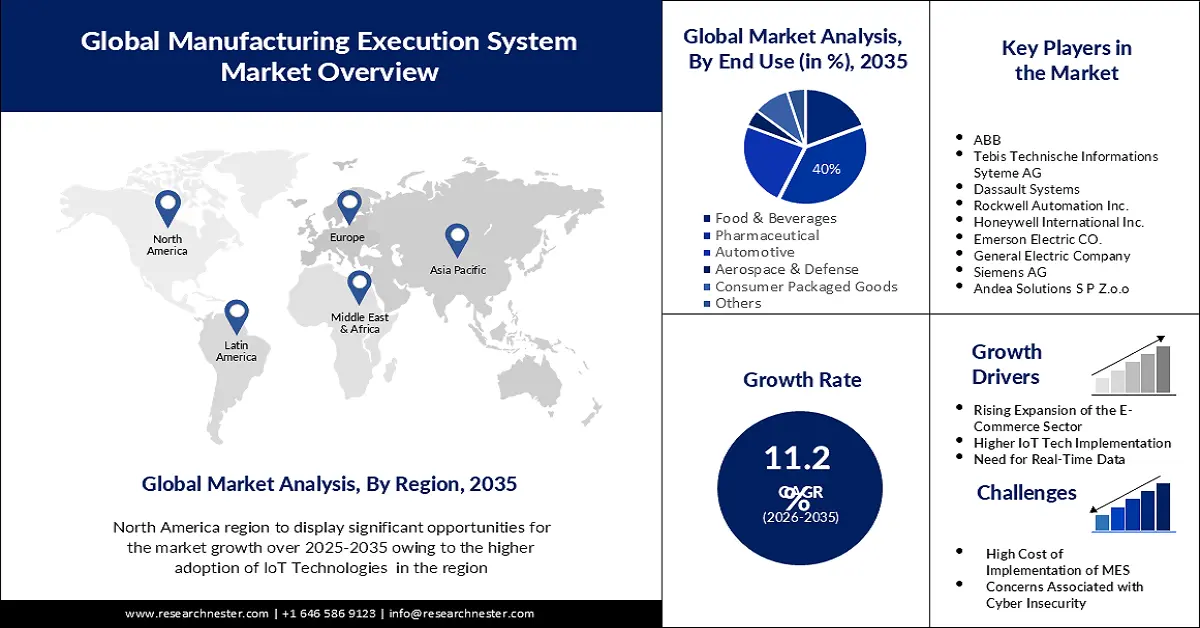

Manufacturing Execution Systems Market size was valued at USD 16.67 billion in 2025 and is likely to cross USD 48.19 billion by 2035, expanding at more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of manufacturing execution systems is assessed at USD 18.35 billion.

The growth in the market is primarily driven by the increasing popularity of automation in process and discrete production. According to a study published by ScienceDirect in June 2024, the adoption rate of Industry 4.0 technologies among global value chains (GVCs) worldwide ranged between 10.8% and 40.5%. This signifies the magnifying shift toward smart manufacturing and digital transformations to attain improved visibility and integrate real-time decision-making. Moreover, companies are deliberately seeking operational efficiency to reduce waste, escalate production yield, and ensure compliance by streamlining the whole procedure.

The enlarging pharmaceutical industry is also fueling adoption in the market. According to a report from the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), published in February 2025, the cost of constructing a new vaccine production site is calculated to be up to USD 2.0 billion. In addition, managing complex supply chains, ensuring sufficient production capacity, maintaining quality standards, and securing regulatory approvals for these plants require a significant investment. On the other hand, these advanced solutions replace paper-based procedures, which are too slow and prone to errors, assisting pharma producers with decreased downtime and risks, and allowing them to perform better and offer competitive payers’ pricing for their products.

Key Manufacturing Execution Systems Market Insights Summary:

Regional Highlights:

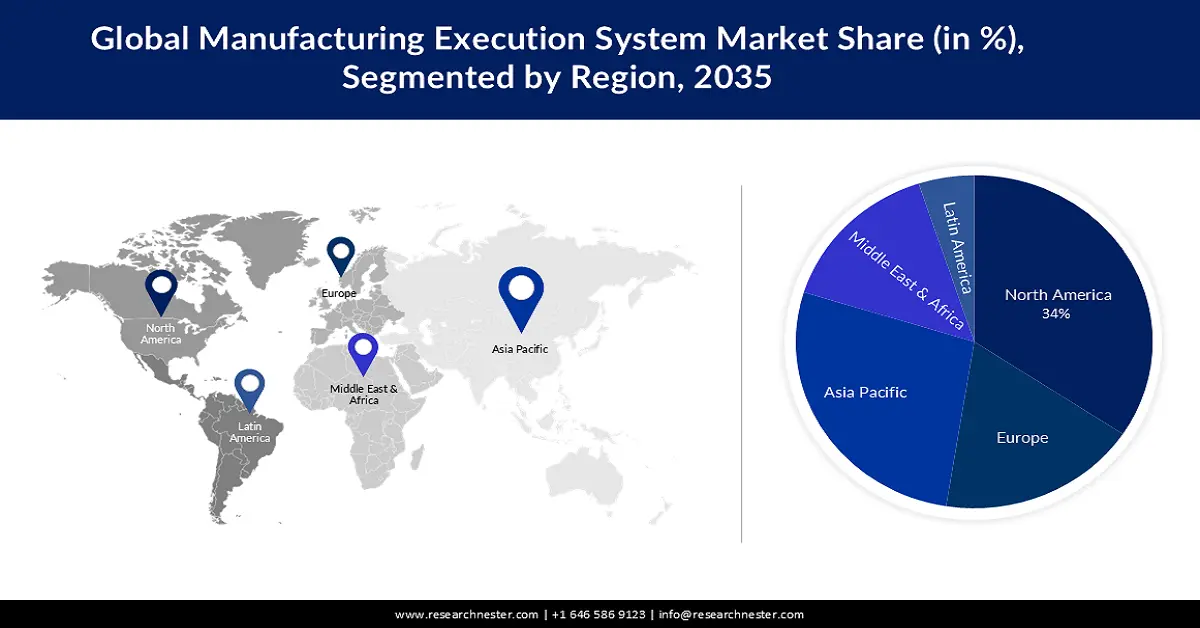

- North America manufacturing execution systems market is projected to capture a 33% share by 2035, driven by presence of major MES providers and increasing R&D investment in advanced manufacturing solutions.

- Asia Pacific market is expected to experience notable CAGR during 2026-2035, driven by rising industrialization, manufacturing capacity expansion, and strong demand from China and India.

Segment Insights:

- The hybrid deployment segment in the manufacturing execution systems market is expected to secure a 43% share by 2035, driven by rising demand for real-time analytics in oil & gas through digitalization.

- The pharmaceutical segment in the manufacturing execution systems market is expected to hold a notable revenue share by 2035, driven by improved regulatory compliance and data integration for patient care.

Key Growth Trends:

- Growing demand for medicines worldwide

- Rapid integration of tech-based and AI-powered solutions

Major Challenges:

- Hurdles in upgradation and maintenance

Key Players: Epicor Software Corporation (U.S.), Siemens AG (Germany), Rockwell Automation, Inc. (U.S.), SAP SE (Germany), ABB Ltd (Switzerland), Dassault Systèmes S.A. (France), AVEVA Group Plc (U.K.), Applied Materials Inc. (U.S.), Oracle Corporation (U.S.), General Electric Company (U.S.), Emerson Electric Co. (U.S.).

Global Manufacturing Execution Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.67 billion

- 2026 Market Size: USD 18.35 billion

- Projected Market Size: USD 48.19 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, South Korea, Mexico, Brazil

Last updated on : 11 September, 2025

Manufacturing Execution Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for medicines worldwide: As more public and private organizations invest in rigorous R&D, the need for efficient production management is rising. Particularly, the significant surge in biologics in medical emergencies, such as COVID-19, is pushing biopharma producers to adopt technologically advanced devices from the manufacturing execution systems market. For instance, till 2021, during the COVID-19 pandemic, 32 vaccines gained emergency use authorizations, which were further produced in a total of 11.0 billion doses (IFPMA). Additionally, the contribution of government bodies in improving public access to required medication is also propelling demand in this sector.

-

Rapid integration of tech-based and AI-powered solutions: The growing need for connected and automated factory operations has remarkably inspired leaders in the market to introduce artificial intelligence (AI) and cloud-based infrastructure. For instance, in April 2024, SAP SE launched new AI-powered features, such as AI-driven insights, AI copilot Joule, AI-based asset operator, and real-time traffic data & machine-learning-trained models, in its existing pipeline of supply chain solutions. This addition helps companies transform their productivity with enhanced efficiency and precision. Such innovations and their effectiveness are inspiring manufacturers to invest more in this field.

Challenges

-

Hurdles in upgradation and maintenance: Despite the aim to reduce production expenses, the high initial cost of implementing these commodities may slow down wide adoption in the market. Associated devices and tools require frequent customization and supportive infrastructure, which often causes budget overflow, particularly for small-sized enterprises (SMEs). Besides, the setup and maintenance expenditures are also high and time-consuming as they involve complex technology and need skilled employees. This, as a result, makes it difficult for SMEs to adopt manufacturing execution systems (MES) as they grow hesitation from financial exhaustion.

Manufacturing Execution Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 16.67 billion |

|

Forecast Year Market Size (2035) |

USD 48.19 billion |

|

Regional Scope |

|

Manufacturing Execution Systems Market Segmentation:

Deployment Mode Segment Analysis

The hybrid segment in the manufacturing execution systems market is estimated to gain a robust revenue share of 43.0% over the assessed timeline. The segment’s growth is attributed to the expanding oil & gas industry, having a necessity for real-time and big data analytics and management in challenging environments. For instance, till 2022, it was estimated (World Economic Forum) that digital transformation has the potential to generate USD 1.6 trillion value from this industry. Among this amount, USD 1.0 trillion originated solely from digitalization and USD 640.0 billion from societal benefits. It also predicted USD 170.0 billion, USD 10.0 billion, USD 30.0 billion, and USD 430.0 billion to be garnered by customer savings, productivity improvements, water usage reduction, and lower emissions.

End user Segment Analysis

The manufacturing execution systems market from the pharmaceutical segment is set to garner a notable share by the end of 2035. Besides the considerable cost reductions and improved regulatory compliance, MES enables this industry with the functionality to link patient-related data with the production environment inside the facility. In addition, these systems can enhance business procedures in the supply chain and uplift product quality, adding value to the trade and inspiring pharmaceutical leaders to invest more in this sector. To justify this fact, in December 2020, the International Society of Pharmaceutical Engineering calculated the annual net present value (NPV) to be USD 3634.0 in return for an initial investment of USD 50,000 in new MES applications.

Our in-depth analysis of the global manufacturing execution systems market includes the following segments:

|

Offering |

|

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Manufacturing Execution Systems Market Regional Analysis:

North American Market Insights

The manufacturing execution systems market in North America is poised to account for the largest share of 33.0% throughout the analyzed timeframe. The region is impelled by the existence of major pioneers and service providers in this field. In addition, the growing investment in extensive research & development to create more advanced MES solutions, addressing the unmet needs of different entities, is bringing innovation to this landscape. For instance, in August 2024, Nanotronics introduced a next-generation AI-driven manufacturing process control platform, nSpec Copilot, to drive production excellence. Therefore, several large and small enterprises are increasingly adopting this new range of flexible and scalable MES.

The U.S. is augmenting the market with the magnifying production and economic output from its industrial territory. As per the Federal Reserve System, the nationwide industrial production (IP) grew at an annual rate of 5.5% in the first quarter of 2025. Particularly, the contribution of this country in cultivating innovation for the pharma, MedTech, and biotech industries is glorifying its significance in regional growth. On this note, in February 2023, GE Digital enabled new MES enhancements in its Proficy Smart Factory portfolio and presented customer-driven results at the 27th Annual ARC Industry Forum. The company mentioned that its MES software helped a paper company make an annual savings of USD 4.0 million and an automotive manufacturer reduce inspection costs by 40.0%.

APAC Market Insights

The Asia Pacific manufacturing execution systems market is estimated to be the second largest shareholder and to exhibit a notable CAGR by 2035. The region’s fast propagation is led by rising industrialization and manufacturing capacities. On this note, the United Nations predicted the manufacturing value added (MVA) per capita in the upper middle-income countries (UMICs) in Asia Pacific to surpass USD 4344.0 by 2030. Developing nations, such as China and India, are increasingly becoming the primary source of growing demand for comprehensive software programs that maximize the effectiveness of manufacturing processes and gather data about overall plant activities.

China is an internationally recognized hub of manufacturing and industrialization in the world, making it a lucrative business opportunity for global pioneers. According to a report from the Center for Strategic & International Studies, the country’s MVA accounted for USD 4.6 trillion in 2023, representing 29.0% of the total global MVA. It also mentioned that the trade balance of manufactured goods in China reached USD 1.8 trillion in the same year, where 24.0% of the exported goods in 2020 were electronics. Thus, the enlarging consumer base, distributed across various industries such as pharmaceutical and electronics, in this country is fostering a progressive atmosphere for the market.

Manufacturing Execution Systems Market Players:

- Epicor Software Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Rockwell Automation, Inc.

- SAP SE

- ABB Ltd.

- Dassault Systèmes S.A.

- AVEVA Group Plc

- Applied Materials Inc.

- Oracle Corporation

- General Electric Company

- Emerson Electric Co.

- Cybake

- Sanmina Corporation

The market is evolving with the continuous involvement of key players in extensive R&D and new discoveries. These leaders are focusing on developing multi-functional commodities to attract a wider consumer base. On this note, in April 2024, AVEVA expanded its world-leading industrial intelligence platform, CONNECT, by launching data and visualization services for hybrid MES solutions. This new addition is capable of managing production data efficiently in the cloud to offer full-fledged visualization and optimization across multi-site operations. Such innovations, coupled with government-organized MES training initiatives, are inspiring more companies to invest in this field. This cohort of innovators includes:

Recent Developments

- In March 2025, Cybake launched a new lot tracking, traceability, and manufacturing execution module as an addition to its ERP-type bakery management software system. This is a user-friendly, affordable, and comprehensive solution, which enables fast product recalls and audits.

- In October 2024, Sanmina introduced 42Q Connected Manufacturing to offer real-time visibility to distributed production lines. This innovative solution features a unified data ecosystem, real-time analytics, and enhanced quality monitoring to fasten the processes across sites while making the workflow more effective.

- Report ID: 5132

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.