Lysosomal Treatment Market Outlook:

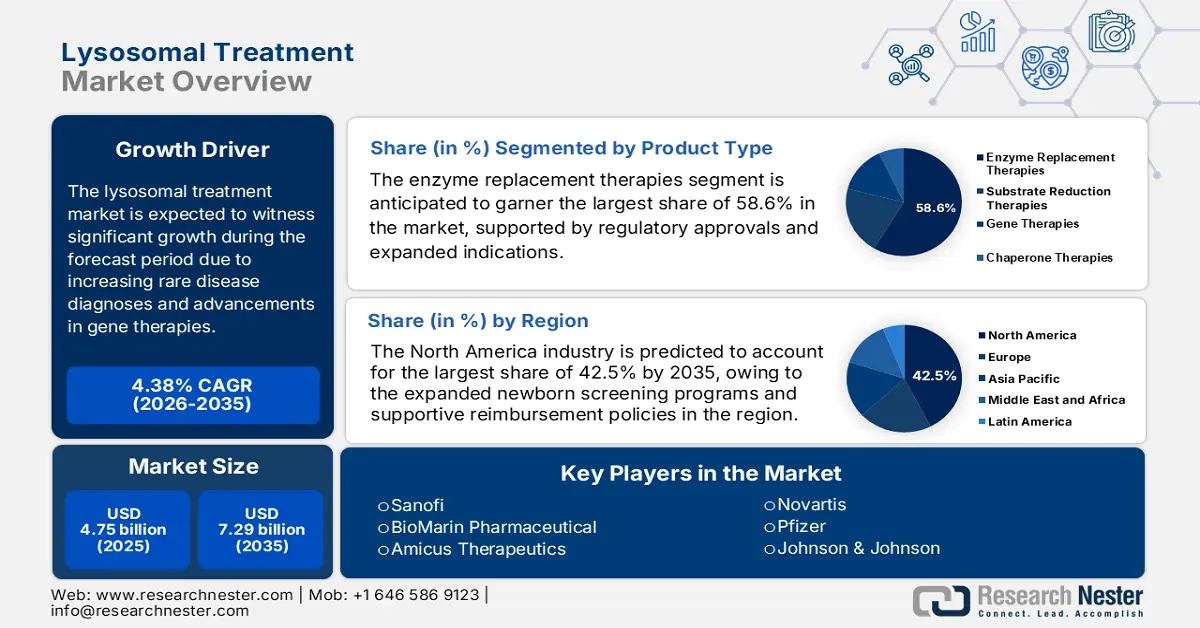

Lysosomal Treatment Market size was valued at USD 4.75 billion in 2025 and is projected to reach USD 7.29 billion by the end of 2035, rising at a CAGR of 4.38% during the forecast period, i.e., 2026-2035. In 2026, the industry size of lysosomal treatment is estimated at USD 4.96 billion.

The worldwide patient pool in the market is continuing to expand, highly attributed to the ailments such as Gaucher, Fabry, and Pompe, necessitating enzyme replacement therapies (ERTs), gene therapies, and substrate reduction therapies. In this regard, the report from the National Gaucher Foundation (NGF) in 2025 noted that lysosomal storage disorders affect roughly 1 in 7,700 births, making them a relatively common health problem. Besides, the supply chain for these therapies involves specialized active pharmaceutical ingredients, biologics manufacturing, and cold-chain logistics owing to the temperature-sensitive nature of these therapies. Testifying to the same, the FDA data in 2024 revealed that production is highly dominated by the U.S. and Europe.

Moreover, the global lysosomal storage disease (LSD) treatment market is witnessing tremendous growth spurts because of the with opportunities to find therapies, more frequent diagnoses of LSDs, and improved government funding available for LSDs. Stem cell therapies and gene therapies are becoming available, and may offer permanent (or long-term) cures. The evolving treatment options reflect progress towards a better diversity of treatment options available for LSDs. Additionally, the introduction of digital health technologies provides more capacity for patient monitoring and adherence to treatment regimens. In terms of regions, North America is the market with the greatest maturity because of their strong health systems and innovations in research intensity.

Key Lysosomal Treatment Market Insights Summary:

Regional Insights:

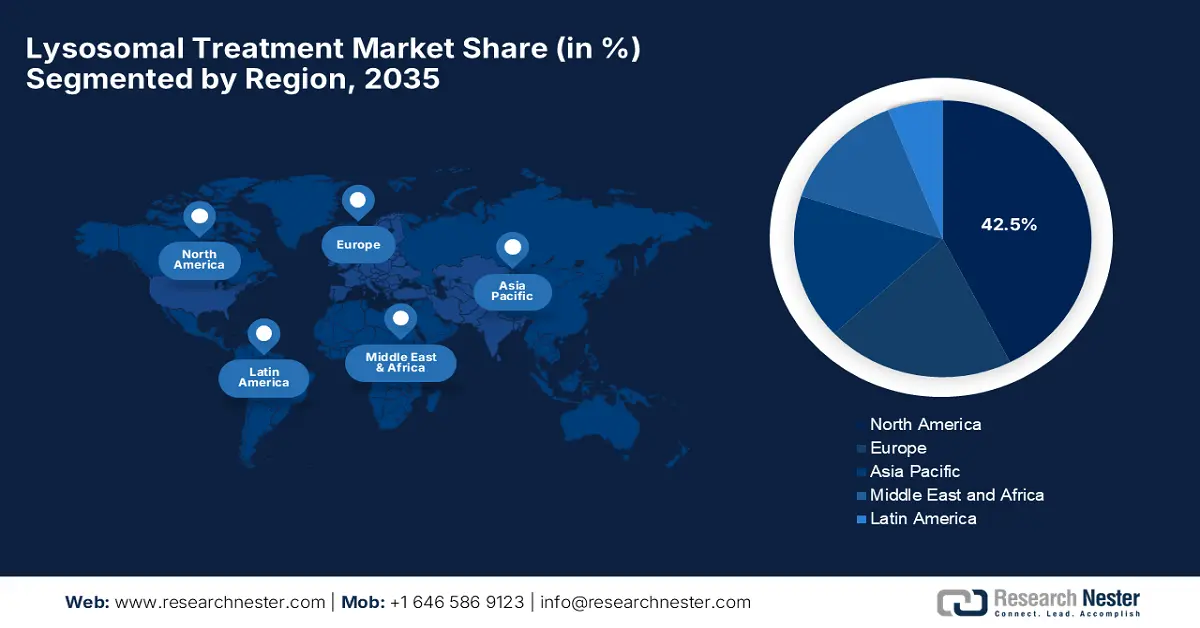

- North America in the Lysosomal Treatment Market is forecasted to capture the largest 42.5% share by 2035, fueled by supportive reimbursement frameworks and widespread newborn screening initiatives.

- Asia Pacific is set to register the fastest growth during 2025–2034, owing to advancing diagnostic capabilities and government-led rare disease programs.

Segment Insights:

- The enzyme replacement therapies segment in the Lysosomal Treatment Market is anticipated to command a 58.6% share by 2035, propelled by regulatory approvals and expanded treatment indications.

- The Gaucher disease segment is estimated to account for 32.6% of the market by 2035, owing to newborn screening mandates and therapeutic advancements.

Key Growth Trends:

- Enhanced healthcare quality

- Strategic sector collaborations

Major Challenges:

- Administrative price controls and reimbursement barriers

- Limited insurance coverage and exacerbated treatment costs

Key Players: Sanofi (France), BioMarin Pharmaceutical (U.S.), Amicus Therapeutics (U.S.), Novartis (Switzerland), Pfizer (U.S.), Johnson & Johnson (U.S.), Chiesi Farmaceutici (Italy), CSL Behring (Australia), Protalix BioTherapeutics (Israel), Ultragenyx Pharmaceutical (U.S.), Sarepta Therapeutics (U.S.), Green Cross Corp (South Korea), Biocon (India), Hansa Biopharma (Sweden), LG Chem Life Sciences (South Korea).

Global Lysosomal Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.75 billion

- 2026 Market Size: USD 4.96 billion

- Projected Market Size: USD 7.29 billion by 2035

- Growth Forecasts: 4.38% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Malaysia

Last updated on : 12 September, 2025

Lysosomal Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Enhanced healthcare quality: The institutional and regulatory efforts are positively influencing the market to expand at a rapid pace. On the other hand, the CDC 2023 data states that newborn screening for Pompe and Gaucher diseases has improved outcomes. Moreover, better healthcare quality typically comes with greater insurance coverage and better payment structures, which would create affordability for costly treatments like enzyme replacement therapy (ERT) and gene therapy. Better-trained healthcare professionals and support in developing multidisciplinary care teams resulted in improved patient management, adherence, and long-term outcomes.

- Strategic sector collaborations: The aspect of partnerships between healthcare organizations and leading pharmaceutical firms is escalating progress in the market. For instance, in August 2023, a biotechnology research organization in the Boston area and an Italian pharmaceutical company established a collaboration to develop a new blood-brain barrier-crossing platform technology for people with lysosomal storage diseases. Besides, in August 2021, Eli Lilly and Company and Lycia Therapeutics, Inc. announced a multi-year research partnership and licensing agreement centered on the discovery, development, and commercialization of novel targeted therapeutics.

- Supportive regulatory environment and orphan drug incentives: Regulatory authorities across the globe are offering incentives to stimulate the development and approval of therapies for rare diseases, such as LSDs. Orphan drug designation may be associated with several benefits, including market exclusivity, reduced fees, and tax credits to stimulate pharmaceutical companies to invest in research and development. In addition to orphan drug incentives, pharmaceutical companies may also receive expedited review of new therapies through a business model including streamlined applications or priority reviews.

Challenges

- Administrative price controls and reimbursement barriers: The extreme price ceilings and low reimbursement is an important gap in the market. Furthermore, the delay or denial of reimbursement from public and private insurers restricts access to these approved therapies for patients, particularly and disproportionately in middle and low-income countries. These financial and bureaucratic realities will continue to restrict the uptake of treatment, which restricts both market size and in turn, innovation and global activity in the LSD (lysosomal storage disorders) therapeutic market.

- Limited insurance coverage and exacerbated treatment costs: The lack of adequate reimbursements and surging treatment costs have been hindering market expansion in almost all nations. Without insurance coverage, health provider recommendations for expensive treatments can feel somewhat less reliable and trustworthy when patients can't afford them. Ultimately, limited coverage and a higher cost of treatment restrict the available pool of patients to target, but they also disincentivize growth in the LSD treatment market.

Lysosomal Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.38% |

|

Base Year Market Size (2025) |

USD 4.75 billion |

|

Forecast Year Market Size (2035) |

USD 7.29 billion |

|

Regional Scope |

|

Lysosomal Treatment Market Segmentation:

Product Type Segment Analysis

Based on product type, the enzyme replacement therapies segment is anticipated to garner the largest share of 58.6% in the market during the assessed timeframe. Regulatory approvals and expanded indications are the key factors propelling the dominance of this segment. Enzyme replacement therapies ERT intervene with the root causes of enzyme deficiency, which are behind many LSDs and have proven strengths in managing symptoms and the functioning of organs. ERT is one of the first and most widely approved treatments from the major regulatory agencies. As a result, there is broad access for physicians and patients. ERT has been used across many subtypes under LSDs, able to treat patients across age and demographics with a long history of safety and effectiveness.

Disease Type Segment Analysis

In terms of disease type, the Gaucher disease segment is projected to grow at a considerable rate, with a share of 32.6% in the market by the end of 2035. The growth in the segment originates from the newborn screening mandates and therapeutic innovations in this field. Gaucher disease has also shown higher incidence rates relative to other LSDs, which has benefited the therapeutic development pathway and led to earlier and greater development than any of the other LSDs. The availability of effective long-term therapies has allowed for the management of Gaucher disease to become more commonplace, allowing for greater uptake of treatment.

End User Segment Analysis

The hospital sub-segment is predicted to hold the highest market share by the end of 2035. There is greater availability for early and accurate diagnosis and access to trials for new therapies in hospitals. Availability of reimbursement, advanced monitoring, and emergency services support prioritizes hospitals as the primary institution for LSD treatment. It is expected that hospitals will continue to be the principal facility for providing these lifesaving therapies as the number of diagnosed patients grows and treatment protocols become more complex.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Disease Type |

|

|

Route of Administration |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lysosomal Treatment Market - Regional Analysis

North America Market Insights

North America in the lysosomal treatment market is predicted to account for the largest share of 42.5% during the assessed timeframe. The leadership of the region is propelled by the expanded newborn screening programs and supportive reimbursement policies. The region is teaming with leading biopharmaceutical companies and major research institutions that are at the forefront of developing, testing, and commercializing innovative LSD treatments. The presence of regulatory agencies willing to help accelerate the available treatment for rare diseases through orphan drug designation, rapid approval processes, and tax incentives has helped foster a climate of availability. In addition, the many factors leading to high awareness, solid insurance coverage, and accessibility for specialized centers enable timely diagnosis and treatment-supported management of LSDs in North America.

The U.S. is augmenting its dominant position in North America’s market, led by the Medicare and Medicaid coverage expansions. The U.S. Food and Drug Administration (FDA) offers substantial regulatory support for LSD treatments through orphan drug designation, fast-track approval, and priority review that serves to encourage companies to develop and ultimately launch therapies. The U.S. also has one of the highest rates of newborn screening programs, which allow for earlier diagnosis and earlier treatment initiation. On top of that, there is broad insurance coverage (public and private), high per capita spending on health care, and readily available treatment at academic centers to support long-term care for LSDs.

Canada is displaying consistent growth in the lysosomal treatment market, evident by strong fiscal support through provincial healthcare investments. A well-structured public health system in Canada provides patient access to treatments or interventions regardless of a condition's rarity, and the important commerce of Canada’s healthcare system encourages centralized referral pathways and clinical centers of excellence in metabolic disorders, promoting coordinated multispecialty care for patients. Canada's involvement in global clinical trials and early uptake of novel treatments only complements the strength of this market further.

APAC Market Insights

Asia Pacific in the lysosomal treatment market is emerging as the fastest-growing region from 2025 to 2034. This accelerated progress is a result of improving diagnostics and government-led rare disease initiatives. The landscape is readily dominated by Japan, allocating significant amounts to the lysosomal therapies, which is followed by China and India. The prominent countries, South Korea and Malaysia, are emerging nations, further creating a prolific opportunity for both domestic and international players to operate in this field.

China is consistently solidifying its status of a dominant contributor in the lysosomal treatment market, thanks largely to immense government support and rapid patient identification. The improvements in newborn screening programs that are now nationwide and expanded access to genetic diagnostics are significantly increasing the identification of LSD patients at infancy while also improving treatment outcomes. The Chinese biotech industry is quickly ramping up its investment into the R&D of LSD therapies. These efforts are accelerating the localization of LSD therapies.

India’s lysosomal treatment market is gaining increased traction, supported by substantial funding grants and domestic manufacturing initiatives. Efforts to increase genetic testing and the availability of newborn screening programs are improving the ability to diagnose LSDs, which have been underdiagnosed for far too long. The Indian government has begun to adopt policies and system initiatives to better manage rare diseases, which includes pulling together plans to improve access and insurance for expensive treatments. According to the Observer Research Foundation, in October 2024, the Delhi High Court ordered the Union government to establish a National Fund for Rare Diseases (NFRD).

Europe Market Insights

Europe’s market for lysosomal treatment is rapidly growing on account of centralized rare disease policies and enzyme replacement therapy reimbursement reforms. The region has a robust healthcare infrastructure and regulatory support in place that enables innovative therapies to be developed and adopted. European countries have established extensive newborn screening programs and genetic testing programs that help to diagnose LSDs more accurately. In addition, the European Medicines Agency (EMA) provides incentives for drug developers that permit these drugs to be accessed faster for these rare diseases.

The advantages of Germany's very robust healthcare system, which includes full insurance coverage for rare disease treatments, are compelling for LSDs. The German government has also strongly endorsed healthcare facilities for LSDs. Germany has developed a network of specialized metabolism and genetic centers that can facilitate early diagnosis, and they incorporate a multidisciplinary approach in the management of LSDs. Germany has very good reimbursement policies that limit patient out-of-pocket costs for more expensive treatments like ERTs and the many potential gene therapies entering the marketplace.

France is consolidating their high position in the LSD treatment market thanks to a well-developed and well-supported rare disease treatment system. Like Germany, France's healthcare system can deliver universal care at a very low out-of-pocket expenditure by patients, combined with a strong reimbursement system. The French government took rare disease treatment plans quite seriously with their national plan for rare diseases, and LSDs have always benefited. This, in turn, paid off by way of developing specialized reference centers that were capable of providing expert diagnosis, treatment, and robust long-term care for those patients with LSDs.

Key Lysosomal Treatment Market Players:

- Sanofi (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioMarin Pharmaceutical (U.S.)

- Amicus Therapeutics (U.S.)

- Novartis (Switzerland)

- Pfizer (U.S.)

- Johnson & Johnson (U.S.)

- Chiesi Farmaceutici (Italy)

- CSL Behring (Australia)

- Protalix BioTherapeutics (Israel)

- Ultragenyx Pharmaceutical (U.S.)

- Sarepta Therapeutics (U.S.)

- Green Cross Corp (South Korea)

- Biocon (India)

- Hansa Biopharma (Sweden)

- LG Chem Life Sciences (South Korea)

The international lysosomal treatment market represents an extremely consolidated landscape with the top five companies gaining control over the maximum revenue share. The U.S. and Europe-based pioneers dominate in terms of innovation, where there are 75.5% of products are in the pipeline. Besides, the emerging nations such as India and South Korea lead in terms of cost-effective biosimilars. Strategic shifts are yet another asset of this landscape, with 80.5% of leading firms currently leveraging gene therapy programs. Furthermore, the market observed 45.6% expanded vertical integration over the last five years, whereas the average R&D spending increased to 22.6% of revenue.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2025, Azafaros, a clinical-stage company, declared the completion of a €132 million Series B investment to further Phase 3 clinical trials of novel treatments for lysosomal storage diseases.

- In August 2025, GC Biopharma, a leading global pharmaceutical company declared that Hunterase (idursulfase beta), a recombinant enzyme replacement treatment for Hunter syndrome (MPS II), has been delivered. The International Journal of Biological Macromolecules, a distinguished journal with SCIE index, has published the research findings, which describe the function of N-glycosylation in lysosomal targeting.

- Report ID: 7925

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lysosomal Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.