Luxury Goods Market Outlook:

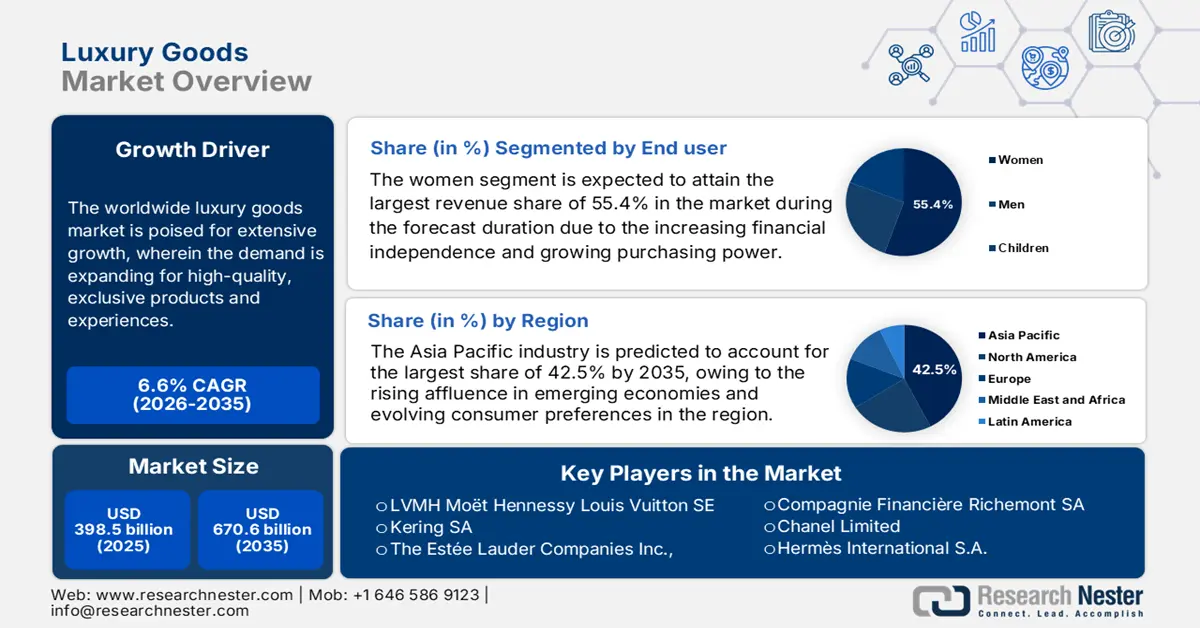

Luxury Goods Market size was valued at USD 398.5 billion in 2025 and is projected to reach USD 670.6 billion by the end of 2035, rising at a CAGR of 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of luxury goods is estimated at USD 402.6 billion.

The worldwide market is poised for extensive growth, wherein the demand is expanding for high-quality, exclusive products and experiences. Also, the increasing globalization, evolving consumer lifestyles, and the influence of digital platforms are providing an encouraging opportunity for pioneers in this field. According to GJEPC reports published in February 2025, in 2024, India’s overall gold demand rose by 5% to 802.8 tonnes, wherein the total value surged 31% to ₹5,15,390 crore (USD 5.8 billion). Jewelry demand grew 22% in value to ₹3,61,690 crore (USD 4.1 billion), reflecting resilient consumer interest despite price fluctuations.

Furthermore, the report also underscored that investments in terms of gold demand also witnessed significant growth, reaching 239.4 tonnes with a 61% rise in value, supported by digital gold, ETFs, and corrections in gold prices. Meanwhile, in 2025, the demand is expected to be between 700 to 800 tonnes, with jewelry purchases likely to recover. Therefore, this demand for resilient jewelry and strong growth in gold investments highlight sustained consumer gains the investor interest, hence making it suitable for overall market growth.

Key Luxury Goods Market Insights Summary:

Regional Highlights:

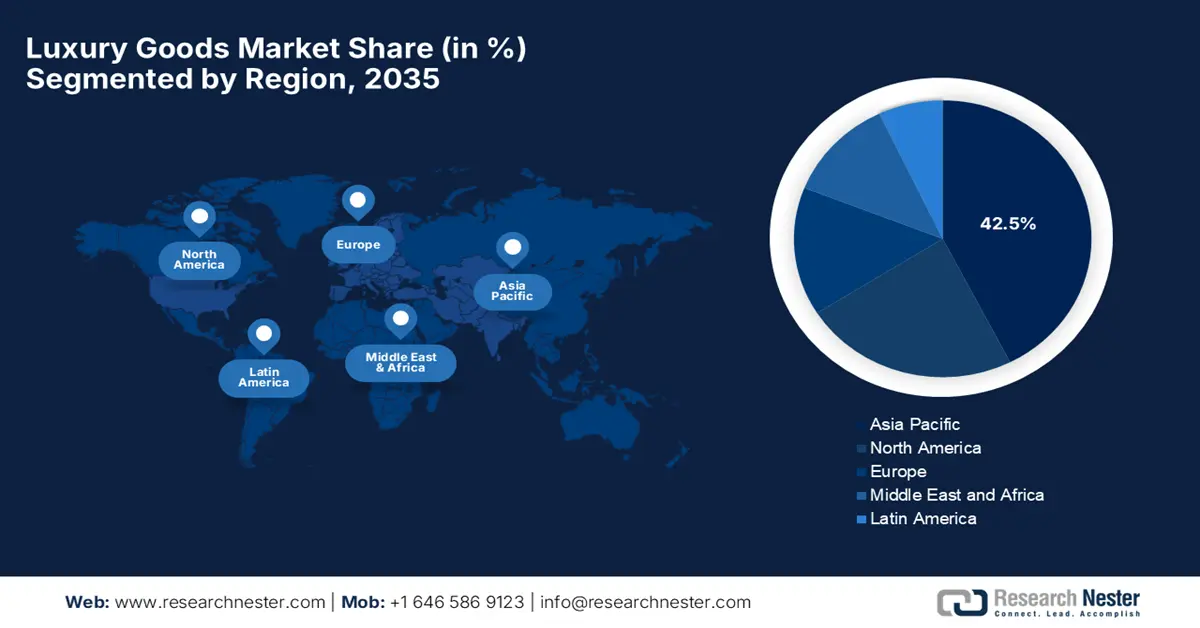

- Asia Pacific is expected to command a 42.5% share by 2035 in the luxury goods market, owing to rising affluence in emerging economies and evolving preferences for gold jewelry, sustainability, and digital convenience.

- North America is projected to secure a considerable share by 2035, attributable to experiential luxury, premium travel, and lifestyle-focused offerings.

Segment Insights:

- The women segment is projected to attain a 55.4% share by 2035 in the luxury goods market, reinforced by increasing financial independence and rising purchasing power among women.

- The online/e-commerce segment is expected to capture a 35.4% share by 2035, bolstered by the post-pandemic shift in consumer behavior and advanced brand digitalization.

Key Growth Trends:

- Rising global affluence

- E-commerce expansion & digital transformation

Major Challenges:

- Economic uncertainty

- Changing consumer preferences

Key Players:

Global Luxury Goods Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 398.5 billion

- 2026 Market Size: USD 670.6 billion

- Projected Market Size: USD 16.43 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, United Arab Emirates

Last updated on : 4 November, 2025

Luxury Goods Market - Growth Drivers and Challenges

Growth Drivers

- Rising global affluence: The wealth accumulation in emerging markets is the primary driver for the market since it increases the affordability. Also, this rise in disposable income enables a larger segment of the population to afford premium and luxury products that were accessible only to the global elite. The Bureau of Economic Analysis in September 2025 stated that DPI (Disposable Personal Income) rose by 0.1% in August, 0.2% in July, whereas it remained stable in June. Therefore, these changes reflect variations and inflationary pressures that influence consumer behavior, positively impacting market growth.

- E-commerce expansion & digital transformation: The luxury sector is witnessing a profound shift in how it reaches consumers, wherein the digital touch points are playing a major role, enabling them to engage younger, tech-savvy audiences. In this regard International Trade Administration revealed that the industry of B2B eCommerce is projected to grow at a 14.5% compound annual growth rate. Meanwhile, on the B2C side, the worldwide eCommerce revenue is forecasted to reach USD 5.5 trillion by the end of 2027. Therefore, this rapid growth of B2B and B2C eCommerce will create an optimistic opportunity market by expanding both digital accessibility and global reach.

- Sustainability & ethical sourcing: The market is extremely benefited from the consumers who are expecting brands to operate on a sustainable & ethical basis. Besides, the heightened demand for eco-friendly materials is also contributing to the upliftment of the international luxury sector. In November 2024, MIAR introduced its collection of sustainable luxury bags crafted in Italy, which is a combination of craftsmanship with sustainability, using ethically sourced materials such as vegetable-tanned leather and recycled fabrics.

Major Luxury Brand Initiatives and Expansions (2023-2024)

|

Year |

Company |

Details |

Description |

|

2024 |

Miu Miu |

Upcycled Collection Launch |

Launched a limited-edition collection using upcycled denim and leather remnants, with Aura Blockchain verification. |

|

2023 |

Ralph Lauren |

Canada Expansion |

Launched a dedicated e-commerce site and opened its first luxury brand store in Toronto as part of a wider North American expansion. |

|

2023 |

Kering Beauté |

Acquisition of Creed |

Acquired the high-end luxury fragrance house Creed to establish a strategic platform for growth in the beauty segment. |

Source: Company Official Press Releases

Challenges

- Economic uncertainty: This is a major obstacle for the market to capture the desired capital since it is highly sensitive to the economic cycles. Also, during recessions, inflationary periods, or geopolitical tensions, consumer spending on these luxurious goods often declines, which leads to lower sales. Furthermore, in affluent segments, the uncertainty about future income or investment returns can reduce demand, thereby making these revenue streams volatile.

- Changing consumer preferences: The younger generations, such as Millennials and Gen Z, are shifting priorities from luxury items to experiences, sustainability, and digital engagement. Therefore, the traditional luxury brands that are rooted in heritage must adapt to these changing choices by incorporating eco-friendly materials and immersive digital experiences to capture the interest of younger audiences.

Luxury Goods Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 398.5 billion |

|

Forecast Year Market Size (2035) |

USD 670.6 billion |

|

Regional Scope |

|

Luxury Goods Market Segmentation:

End user Segment Analysis

Based on end user women segment is expected to attain the largest revenue share of 55.4% during the forecast duration. The increasing financial independence and growing purchasing power of women across all nations is the primary driver behind this leadership. As per an article published by UNDP in July 2024, Women’s economic empowerment enables high access to resources, markets, and decision-making, wherein 40% of women lack formal financial services, women earn on average 77% of men’s income, and labor participation is 63% versus men’s 94% hence denoting a wider segment scope.

Distribution Channel Segment Analysis

In terms of distribution channel, online/e-commerce segment is anticipated to garner a significant revenue share of 35.4% by the end of 2035. The growth in the segment is highly subject to a shift in consumer behavior post-pandemic. Also, the advanced digitalization by brands such as AR try-ons, virtual showrooms, is also propelling continued demand in this landscape. Furthermore, the massive acceleration in the e-commerce sector is one of the major trends that luxury brands have completely leveraged to reach a wider audience group.

Product Type Segment Analysis

Based on product type, the luxury watches & jewelry segment is expected to gain a lucrative share of 28.7% during the analyzed timeframe. Their role as stable investment assets and stores of value, especially during economic uncertainty, is the key factor driving upliftment of this subtype. In 2025, Titan Company Limited reported that it acquired a 67% stake in Damas Jewelry for AED 1,038 million, also aiming to acquire the remaining 33% by the end of 2029, marking a major step in expanding its presence across the six GCC countries.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Distribution Channel |

|

|

Product Type |

|

|

Category |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Luxury Goods Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to garner the largest revenue share of 42.5% in the worldwide luxury goods market during the forecast timeline. The dominance of the region is effectively attributable to the rising affluence in emerging economies and evolving consumer preferences for gold jewelry, sustainability, and digital convenience. Marriott International’s Luxury Group in July 2025 launched the Luxury Wellbeing Series 2025 across the region by offering wellness experiences at properties in Bali, the Maldives, and Goa. Moreover, the program integrates sleep, nutrition, and physical & mental well-being, making it suitable for affluent travelers seeking holistic enrichment, hence suitable for standard market growth.

China is augmenting its leadership in the luxury goods market owing to the presence of its vast consumer base and its interest in both international and emerging domestic brands. The country also benefits from e-commerce platforms and digital marketing, which significantly influence purchasing behavior. In May 2024, LVMH declared that it had extended its partnership with Alibaba to redefine the luxury retail experience in the country by leveraging Alibaba’s cloud and AI technologies, including generative AI and machine learning platforms, to enhance omnichannel operations. The prime focus of this collaboration is to deliver personalized, tech-driven luxury experiences across LVMH’s Maisons, optimize supply chains, and deepen customer engagement on platforms such as Tmall.

India has become the target landscape for investors in luxury goods owing to strong economic growth, a rising middle class, export values, and increasing awareness of global fashion and lifestyle trends. On the other hand, the growing influence of travel and digital media has heightened the exposure of international luxury brands among consumers in the country. In November 2023, SMCP announced that it had entered the country’s market through an exclusive partnership with Reliance Brands Limited, which will distribute Sandro and Maje, the French fashion brands in India, hence suitable for standard market growth.

India’s Luxury Goods Exports (April 2024 - March 2025)

|

Commodity |

Total Exports (April '2024 - March 2025, USD Million) |

March '25 Exports (USD Million) |

February '2025 Exports (USD Million) |

MoM % Growth |

% Share of Total Exports |

|

Gems And Jewelry |

29,802.06 |

2,896.21 |

2,537.22 |

14.15% |

6.87% |

|

Leather And Leather Manufacturers |

4,363.25 |

353.93 |

328.47 |

7.75% |

1.01% |

|

Handicrafts Excl. Handmade Carpet |

1,765.32 |

130.59 |

155.38 |

-15.96% |

0.41% |

|

Carpet |

1,540.49 |

137.12 |

118.83 |

15.40% |

0.36% |

|

Ready-made garments of all textiles |

15,974.61 |

1,529.58 |

1,534.76 |

-0.34% |

3.68% |

Source: NIRYAT

North America Market Insights

North America is predicted to hold a considerable share in the global luxury goods market throughout the discussed tenure. The leadership is primarily driven by experiential luxury, premium travel, and lifestyle-oriented offerings. Consumers in the region are increasingly demanding omnichannel access, personalized services, and curated luxury experiences, which is catalyzing pioneers' enthusiasm to craft more of such luxurious and accessible products. Furthermore, the emerging trends such as sustainable luxury, tech-enabled personalization, and limited-edition products are shaping the growth dynamics in the market, attracting affluent Millennials and Gen Z buyers.

The U.S. holds a strong position in the regional luxury goods market, efficiently backed by the high disposable incomes and the preference for both heritage luxury brands and innovative designer labels, with growing emphasis on sustainability and digital engagement. Fossil Group, Inc., in February 2025, announced the extension of its partnership with Michael Kors, continuing to design and deliver Michael Kors watches and jewelry. The collaboration will allow Michael Kors to offer a wide range of accessories, ready-to-wear, and fragrances through global stores and digital channels, allowing a steady business growth in the country.

Canada in the luxury goods market is showcasing a positive growth trajectory on the global landscape, owing to the presence of cross-border shopping choices and digital channels, boosting the domestic retail sector, wherein the demand for experiential luxury is also surging. Canada Goose in July 2023 announced the launch of its recommerce platform, Canada Goose Generations, which allows customers to trade in and purchase pre-loved outerwear. Further, the initiative extends product lifecycles, mitigates warranty waste, and highlights the firm’s commitment to sustainability, hence attracting environmentally aware consumers.

Europe Market Insights

Europe in the luxury goods market is positively influenced by a combination of factors such as heritage, craftsmanship, and brand legacy across fashion, leather goods, watches, and jewelry. In October 2025, Kering and L’Oréal declared a strategic alliance in luxury beauty and wellness, which includes L’Oréal’s acquisition of the House of Creed and exclusive fragrance and beauty licenses for Gucci, Bottega Veneta, and Balenciaga. The agreement was valued at €4 billion (USD 4.6 billion) and aims to accelerate growth for Kering’s iconic brands while leveraging L’Oréal’s expertise in luxury beauty, hence positioning them at the forefront of high-potential luxury markets.

Germany is representing strong growth in the regional luxury goods market, owing to the heightened demand for unique luxurious goods. In April 2025, Mytheresa reported that it received clearance from the European Commission to acquire YOOX NET-A-PORTER from Richemont, which marks creating a major step in leading the international digital luxury group. Besides, the combined entity, named LuxExperience B.V., is expected to bring together Mytheresa, NET-A-PORTER, MR PORTER, YOOX, and THE OUTNET, thereby offering curated luxury selections while maintaining each brand’s distinct identity.

France, in the luxury goods market, has gained immense exposure, which is a vibrant mix of both international luxury brands and domestic designer labels, shaped by London’s status as a luxury capital and gateway for affluent domestic and international buyers. Besides, LVMH remains the pivotal contributor for upliftment in the country’s luxury sector, which is currently operating 119 production sites. In 2024, the firm readily based an investment of €1.7 billion (USD 1.84 billion) in facilities and stores in the country, while supporting more than 910 nonprofits, hence highlighting its economic and social impact in France.

LVMH Business Group Revenue 2024

|

Business Group |

2024 (€ million) |

2024 (USD million) |

|

Wines & Spirits |

5,862 |

6,345 |

|

Fashion & Leather Goods |

41,060 |

44,463 |

|

Perfumes & Cosmetics |

8,418 |

9,106 |

|

Watches & Jewelry |

10,577 |

11,448 |

|

Selective Retailing |

18,262 |

19,753 |

|

Other activities & eliminations |

504 |

546 |

|

Total LVMH Moët Hennessy Louis Vuitton |

84,683 |

91,661 |

Source: LVMH

Key Luxury Goods Market Players:

- LVMH Moët Hennessy Louis Vuitton SE (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kering SA (France)

- The Estée Lauder Companies Inc. (U.S.)

- Compagnie Financière Richemont SA (Switzerland)

- Chanel Limited (France)

- Hermès International S.A. (France)

- PVH Corp. (U.S.)

- L'Oréal Luxe (France)

- Rolex SA (Switzerland)

- Tapestry, Inc. (U.S.)

- Capri Holdings Limited (U.S.)

- Prada S.p.A. (Italy)

- Ralph Lauren Corporation (U.S.)

- Burberry Group plc (U.K.)

- Swatch Group Ltd (Switzerland)

- Titan Company Limited (India)

- Shiseido Company Limited (Japan)

- Lotte Duty Free (South Korea)

- Samsung C&T Corporation (South Korea)

- Valiram Group (Malaysia)

- LVMH Moët Hennessy Louis Vuitton SE is emerging as the undisputed leader in the luxury industry wherein it’s built on a strategic model of diversification and acquisition. The company’s strength lies in its vast portfolio, which consists of wines & spirits, fashion & leather goods, perfumes & cosmetics, and selective retailing. Also, LVMH’s strategy revolves around the mega brands such as Louis Vuitton and Dior, maintaining an aura of exclusivity while achieving immense scale.

- Kering SA, originating from France, the company has strategically positioned itself as a curator of a powerful stable of different and modern luxury houses, where Gucci is its central pillar. Also, the company is extremely focused on fashion, leather goods, and jewelry. The firm also specializes in empowering creative directors to drive a bold, provocative vision that strongly resonates with younger, fashion-forward consumers.

- Compagnie Financière Richemont SA is dominating the industry with its high-end watch and jewelry portfolios. The company also leverages some of the world's most prestigious watchmakers, such as Cartier, IWC, Jaeger-LeCoultre, and luxury jewelers called Van Cleef & Arpels, Buccellati. Therefore, this focus on hard luxury, particularly jewelry, provides resilience due to the category's high value and investment nature.

- The Estée Lauder Companies Inc., headquartered in the U.S. the firm is a predominant leader in prestige beauty, wherein its multi-channel approach captures diverse consumer demographics and beauty categories. Besides, its portfolio is a masterclass in brand management, encompassing skincare powerhouses, makeup icons, and designer fragrances such as Tom Ford and Jo Malone.

- Hermès International S.A. is recognized as one of the central players in the luxury goods industry that deliberately prioritizes quality and long-term value over rapid growth. The company’s strategy lies in the antithesis of the acquisition-led conglomerate model. Besides, the company also maintains an iron grip on its production, vertically integrating its manufacturing to ensure uncompromised quality.

Below is the list of some prominent players operating in the global market:

The global luxury goods market represents an oligopolistic nature, which is dominated by Europe-based pioneers such as LVMH, Kering, and Richemont, leveraging vast portfolios of heritage brands. Mergers & acquisitions are the key strategies opted for by the players to expand their product portfolios and capture consumer interest. For instance, in November 2022, The Estée Lauder Companies Inc. announced that its USD 2.8 billion acquisition of the TOM FORD brand marked a revolutionary move to make ELC the sole owner of all TOM FORD intellectual property. Besides, the deal, funded through cash, debt, and deferred payments, secures long-term control of the fast-growing TOM FORD BEAUTY line.

Corporate Landscape of the Luxury Goods Market:

Recent Developments

- In March 2025, Louis Vuitton introduced its women’s fall-winter 2025 collection in Paris, wherein the show celebrated the Maison’s travel heritage with a combination of past and present through bold silhouettes, rich textures, and motifs that reimagined modern elegance.

- In November 2024, Diageo announced the creation of the Diageo Luxury Group, which is a new global division combining its premium spirits, luxury brand homes, and experiences under a single portfolio. The division will also manage brands such as Brora, Port Ellen, Johnnie Walker Princes Street, and Justerini & Brooks, focusing on products retailing above USD 100.

- Report ID: 8212

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Luxury Goods Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.