Pre-school Games and Toys Market Outlook:

Pre-school Games and Toys Market size was valued at USD 15.4 billion in 2025 and is projected to reach USD 31.3 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pre-school games and toys is assessed at USD 16.5 billion.

The global pre-school games and toys market is expanding within the broader consumer goods industry. The market is defined by a steady demand driven by the fundamental demographic and economic factors. The primary consumer base is defined by the population of children aged 0 to 5 years, with the global birth rates and household expenditure patterns serving as key indicators. The Our World in Data report in 2024 depicts that the overall population of children under 5 years was nearly 654.03 million in 2023. This data represents a stable foundational consumer cohort. The economic drivers include the household disposable income, with organizations such as the OECD tracking family spending patterns in many member countries, household expenditure on recreation and culture, which includes toys, and accounts for a significant portion of the average budget.

From the supply chain and regulatory perspective, the industry operates within a robust global framework. Manufacturing and distribution are highly influenced by international trade policies, material costs, and complex safety regulations. Agencies such as the U.S. Consumer Product Safety Commission enforce rigorous standards for physical and chemical safety, with the commission reporting involvement in toy-related recalls in recent years, highlighting the vital importance of compliance. Further, the shift in retail channels is increasing the sales of the segment. According to the Toy Association report in 2025, the global toy sales reached USD 111.8 billion in 2024, which is an up 3% over 2023. Environmental, Social, and Governance (ESG) considerations are also evolving from voluntary initiatives to potential regulatory frameworks, affecting material sourcing and production lifecycle assessments.

Global Toy Sales

|

Year |

Sales (USD billion) |

|

2019 |

92.9 |

|

2020 |

98.9 |

|

2021 |

109.5 |

|

2022 |

111.0 |

|

2023 |

109.0 |

|

2024 |

111.8 |

Source: The Toy Association 2025

Key Pre-school Games and Toys Market Insights Summary:

Regional Insights:

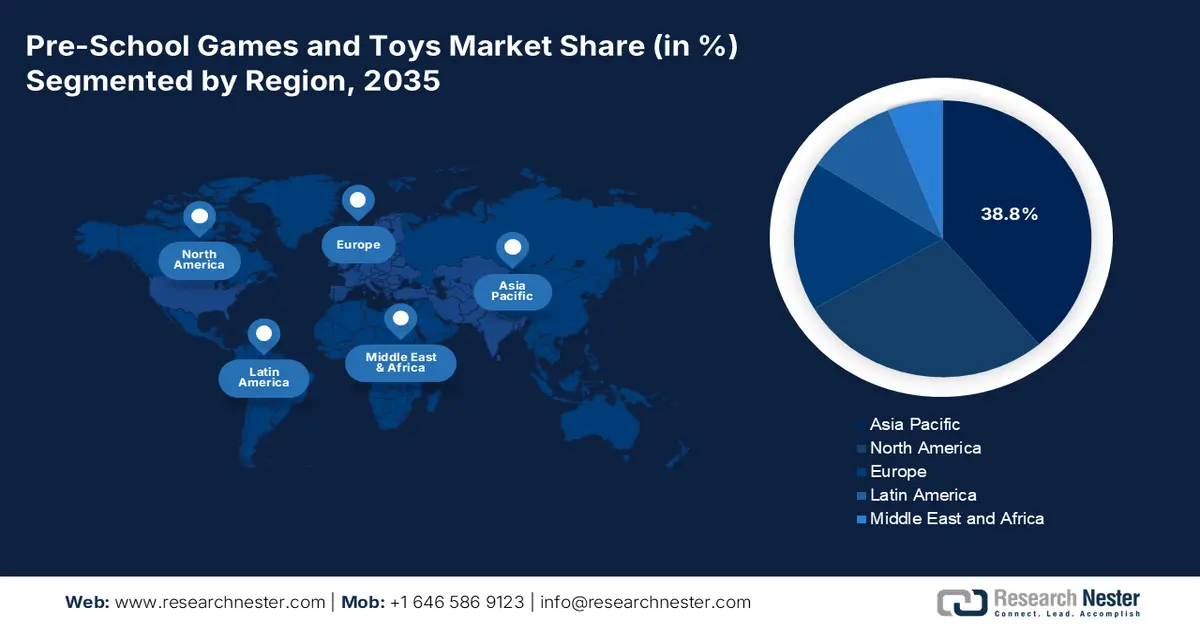

- The Asia Pacific region is projected to secure a 38.8% share by 2035 in the pre-school games and toys market, supported by demographic expansion, rising incomes, and national emphasis on foundational learning and play-based pedagogy.

- North America is anticipated to grow at a 3.9% CAGR through 2035, reinforced by strong per-child spending and substantial federal and state investment in public pre-K programs.

Segment Insights:

- The plastic segment is expected to command a 55.7% share by 2035 in the pre-school games and toys market, sustained by its durable, moldable, safe, and cost-efficient material advantages.

- The online distribution channel is set to capture the largest share by 2035, propelled by consumer preference for convenience, extensive assortments, transparent pricing, and the accelerating influence of digital content.

Key Growth Trends:

- Safety regulations and compliance enforcement

- Strong demographic base of children aged 3 to 5 years

Major Challenges:

- Intense competition and brand dominance

- Rapidly changing play trends and short lifecycles

Key Players: Mattel (U.S.), LEGO Group (Denmark), Bandai Namco Holdings (Japan), Melissa & Doug (U.S.), Ravensburger (Germany), Simba Dickie Group (Germany), TOMY Company (Japan), Playmobil (Geobra Brandstätter GmbH, Germany), VTech Holdings (Hong Kong), Kids II (U.S.), Moose Toys (Australia), Goliath Games (Belgium/Netherlands), Funskool (India), Sonokong Co. (South Korea), Young Toys (South Korea), Fisher-Price (U.S.), My-Toys Manufacturing Sdn Bhd (Malaysia), Hamleys (India), Spin Master (Canada).

Global Pre-school Games and Toys Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.4 billion

- 2026 Market Size: USD 16.5 billion

- Projected Market Size: USD 31.3 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 9 December, 2025

Pre-school Games and Toys Market - Growth Drivers and Challenges

Growth Drivers

- Safety regulations and compliance enforcement: Safety enforcement is significantly shaping the product design, material selection, and procurement patterns. The U.S. Consumer Product Safety Commission data in November 2023 recorded that 38% of the children sustained toy-related injuries under age 5 in 2022, heightening the regulatory scrutiny and increasing the demand for compliant materials and certified toys. The report also stated that toy recalls are removing the unsafe units from circulation, reinforcing the need for third-party safety testing. In Europe, strict EN-71 rules under the EU Toy Safety Directive continue to influence the manufacturing specifications. This regulatory environment drives the institutions to favor the safety-certified toys, increasing the demand for the premium, compliant, and sustainably sourced products. In 2025, compliance investment is expected to push suppliers toward safer, regulation-first designs globally.

- Strong demographic base of children aged 3 to 5 years: The size of the preschool population directly affects the institutional procurement volumes. The World Bank released a report in April 2025 has stating that in low- and middle-income countries across the globe, nearly 250 million children under 5 years are forming a stable domestic end user base with consistent purchasing cycles for early learning materials and demanding the market. The European population in the same age group remains more stable due to immigration and strong public childcare systems supported by the national budgets. As the countries enhance access to early education, public and private schools continue to expand the inventory of developmental toys and structured play tools. In 2025, the demographic stability in North America and rapid population growth in South Asia are expected to reinforce the global demand for preschool educational toys.

- Public investment in early childhood education: The government funding for the pre-primary programs directly increases the institutional procurement of educational toys and resources. For example, the Ministry of External Affairs data in December 2022 indicated that the government has planned to launch an INR 3,500 crore PLI scheme for toys to boost the domestic manufacturing of toys. Similarly, the European Union’s Erasmus+ program allocates a significant amount annually to support the early childhood education projects that include equipping the learning environments. This creates a stable B2B channel for suppliers of accredited curriculum-aligned educational toys and manipulatives, driving the demand for products that meet the pedagogical standards over the pure environment.

Challenges

- Intense competition and brand dominance: The pre-school games and toys market is highly saturated and dominated by the giant players such as Mattel and LEGO. These companies possess vast marketing budgets and shelf monopolies. This makes the new entrants struggle for retail visibility and consumer trust. Moose Toys succeeded by innovating with collectibles such as Shopkins, carving a niche via viral marketing rather than direct competition, showcasing the need for disruptive ideas in the crowded field. In fact, an industry report noted that Mattel and Hasbro alone held the largest share in the total U.S. toy market, illustrating the immense scale new entrants must contend with.

- Rapidly changing play trends and short lifecycles: Toy trends can be fleeting and are driven by viral social media or hit shows. Companies risk massive inventory write-offs if they misjudge demand. Spin Master excels here via its innovation engine, rapidly prototyping and marketing hits such as PAW Patrol to capitalize on trends before they fade. This challenge is quantified by the NPD Group, which reported that the lifecycles for fad toys have compressed from years to often a single holiday season, pushing the manufacturers into a high-stakes guessing game.

Pre-school Games and Toys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 15.4 billion |

|

Forecast Year Market Size (2035) |

USD 31.3 billion |

|

Regional Scope |

|

Pre-school Games and Toys Market Segmentation:

Material Segment Analysis

Under the material segment, plastic is projected to maintain its leading material share and is estimated to hold the share value by 55.7% by 2035. The segment is driven by the functional superiority, such as plastic being durable, easily molded into a safe, round shape, washable, and cost-effective for mass producing vibrant, intricate toys. These features make it ideal for meeting the robust safety standards. For example, the U.S. Consumer Product Safety Commission actively regulates toy safety, and plastic manufacturing consistency is key for compliance. The OEC 2023 report depicts that Vietnam has exported toys worth USD 2.78 billion globally, underscoring the massive ongoing scale of plastic in the supply chain. While the bioplastics and recycled content are growing, their market penetration remains limited by higher costs and scalability issues, ensuring plastics revenue leadership.

Distribution Type Segment Analysis

The online distribution channel is poised to capture the largest share by 2035 in the pre-school games and toys market. The segment is shaped by the consumer demand for convenience, vast selection, price transparency, and the powerful influence of digital marketing and unboxing content. The channel’s growth was permanently stimulated by the pandemic, creating a sustained preference for e-commerce. A critical supporting statistic comes from the U.S. Census Bureau data in August 2025, indicating the retail e-commerce sales for Q2 of 2025 were USD 304.2 billion, which is an increase of 1.4% from Q1 of 2025. This reflects a significant and steady climb and a rapid expansion. Brands are investing heavily in direct-to-consumer (DTC) websites and subscription models, bypassing traditional retail to gain valuable customer data and build loyalty, solidifying online as the primary retail frontier.

Age Group Segment Analysis

By 2035, the 2 to 4-year age group is projected to dominate the segment. The dominance of the segment is based on the critical window of rapid cognitive, linguistic, and motor skill development, where play is essential for learning. Demand is fueled by the parental and caregiver investment in toys that promote the school readiness, problem-solving solving and imaginative play. The government data underscores the economic scale of this demographic focus. As the child enters the 2 to 4 year range, the expenditures in toys, games, and other equipment rise intensively in categories like construction sets, advanced puzzles, and pretend-play toys. This consistent household spending, targeted at developmental milestones, secures this age group's commercial dominance in the market.

Our in-depth analysis of the pre-school games and toys market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Distribution Channel |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pre-school Games and Toys Market - Regional Analysis

APAC Market Insights

Asia Pacific is the dominant player in the pre-school games and toys market and is poised to hold the share of 38.8% by 2035. The market is driven by the massive demographic growth, rising household incomes, and significant investment in early childhood education. India and China form a dual core, with China driving with the educational tech integration, and India is fueled by the vast young population and the expanding middle class. The key regional driver is the national policy emphasizing the foundational learning and play-based pedagogy, structurally boosting the demand. On the other hand, South Korea and Japan are the high-value markets focused on innovative STEM/STEAM and licensed character toys. The widespread adoption of e-commerce and super apps for shopping, supported by the government's digital infrastructure, pushes and defines the primary distribution channel. The sustainability concerns are rising the demand and remain secondary to price and functionality in volume-driven segments.

India’s market is one of the world’s most dynamically expanding markets and is driven by its vast and young population and a rapidly growing aspirational middle class. The formalization of early education via the National Education Policy 2020 is a critical pathway. A key government statistic underscoring the scale of opportunity is demographic, as per the Ministry of Education data in 2022, the estimated population in the 3 to 5 year age group was over 85,753,425, representing an immense core consumer base. The urbanization and the growing nuclear families further amplify per-child spending. While the price sensitivity is high in mass markets, there is a simultaneous growth in branded, educational, and organized retail segments.

Population Projections by Gender in Age Group 3 to 5

|

State |

Boys |

Girls |

Total |

|

Andhra Pradesh |

1403600 |

1294400 |

2698000 |

|

Bihar |

5422577 |

4588405 |

10008613 |

|

Gujarat |

2396321 |

2061356 |

4458326 |

|

Haryana |

1032800 |

881200 |

1915000 |

|

Madhya Pradesh |

3304620 |

2840166 |

6144740 |

|

Maharashtra |

3279267 |

2870533 |

6149800 |

|

Tamil Nadu |

1935800 |

1780000 |

3716000 |

Source: Ministry of Education 2022

The China market is defined by the premiumization and a strong alignment with the national educational policy, even amidst a declining birth rate. The demand is concentrated on high-quality cognitively developmental toys as parents invest more per child. Government initiatives are pivotal; the National Health Commission’s guidelines and the 14th Five-Year Plan explicitly support the development of the infant and child care industry. This creates a structured B2B channel for educational resources. A key statistical indicator is investment. According to China’s Ministry of Education, in 2022, the national spending on education reached RMB 6.132,914 trillion, marking a rise of 5.97% on the previous year. This investment highlights the commercial premiumization trend, enabling manufacturers to focus on higher-margin innovation products.

North America Market Insights

North America is expanding rapidly in the pre-school games and toys market and is expected to grow at a CAGR of 3.9% by 2035. The high per-child spending and robust regulation drive the market. The key drivers include substantial federal and state investment in public pre-K programs, which institutionalize demand for educational toys. The U.S. and Canada are driving the market. The U.S. Department of Education budgets a billion annually for Early Learning grants. A primary trend is the integration of STEM/STEAM principles into play, driven by national educational initiatives. Concurrently, robust e-commerce penetration with the U.S. Census Bureau indicates that annual e-commerce penetration is high and provides the distribution. Demand is increasingly bifurcated between mass-market licensed products and premium, sustainable, or open-ended toys catering to parental values around development and safety.

The U.S. pre-school games and toys market is defined by the high consumer spending power and a strong policy focus on early childhood education. A primary trend is the direct link between the federal funding and institutional demand. The First Five Year Fund report in March 2021 indicates that the U.S. Department of Education’s annual budgets allocate significant funds, such as the USD 1 billion for the Head Start program, allocated based on agency enrollment towards openings or expanding classroom capacity, upgrading materials in existing facilities, and purchasing new developmental play tools and age-appropriate toys. The programs also support the increase in institutional purchasing of educational toys and play materials across thousands of federally funded preschool centers. Further, the parental demand is increasingly segmented with the growth in the STEM-focused toys supported by the national education goals and in sustainable products reflecting broader environmental consumer trends.

The market in Canada is shaped by a strong provincial governance in education and a pronounced demographic focus on immigration. A key driver is the substantial government investment in universal early learning and child care, a federal-provincial initiative aiming to minimize the fees and create new spaces, thereby increasing the structured play environments. The Employment and Social Development Canada administers billion in ELCC funding, directly influencing the institutional procurement. Trends include a growing demand for bilingual and multicultural toys that reflect Canada’s diverse population, a priority in national multiculturalism policy. Canada has imported over USD 1.66 billion of toys in 2023, as per the OEC report. Further, the consumer preference aligns with high safety and environmental standards, often exceeding federal regulations. The market is also defined by the preference for outdoor and active toys, supported by various campaigns from organizations such as the Canadian Pediatric Society, promoting physical activity that influences seasonal and category demand.

Europe Market Insights

The Europe market is characterized by high regulatory standards and a strong emphasis on safety and sustainability in educational value. The demand is stable and is driven by the established consumer spending power and robust public investment in early childhood education and care systems. A regional driver is the European Union’s policy framework, including the European Pillar of Social Rights, which advocates for universal access to quality early childhood education, thereby institutionalizing the demand for educational resources. A significant childhood education statistic is the EU’s commitment under the European Child Guarantee, which aims to lift children out of poverty and includes access to early education, indirectly supporting the market. Further, digital-physical hybrid toys that support STEM learning are gaining traction, though stringent data privacy laws (GDPR) govern their development.

Germany is set to be the highest revenue shareholder in Europe's pre-school games and toys market by 2035. The primary growth driver is its strong economic base and comprehensive publicly funded childcare infrastructure. The legal entitlement to a childcare place for children over one year old, established by the Kita expansion law, ensures a consistent high volume institutional demand for educational toys. Furthermore, Germany’s robust product safety act and alignment with EU ecological directives drive the demand for high-quality sustainable products supporting premium segments. The data from the European Commission in April 2025 depicts that in 2024, the financing statistics state that the public sector accounted for Euro 46.5 billion for early childhood education and care, underpinning this ecosystem.

UK will retain a leading share in the market due to its large market size and significant investment in early years, despite economic uncertainties. The expansion of the free childcare hours to include younger children is a key policy driver. The Department for Education’s investment in training and resources for the early years workforce directly influences the procurement standards. A major trend is the growing demand for technology-enhanced physical toys that support early digital literacy within frameworks like the UK’s Early Years Foundation Stage curriculum. Supportive data comes from the Office for National Statistics (ONS), which tracks household spending on recreation and culture, a category including toys, demonstrating resilience in family expenditure in this area.

Key Pre-school Games and Toys Market Players:

- Hasbro (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mattel (U.S.)

- LEGO Group (Denmark)

- Bandai Namco Holdings (Japan)

- Melissa & Doug (U.S.)

- Ravensburger (Germany)

- Simba Dickie Group (Germany)

- TOMY Company (Japan)

- Playmobil (Geobra Brandstätter GmbH, Germany)

- VTech Holdings (Hong Kong)

- Kids II (U.S.)

- Moose Toys (Australia)

- Goliath Games (Belgium/Netherlands)

- Funskool (India)

- Sonokong Co. (South Korea)

- Young Toys (South Korea)

- Fisher-Price (U.S.)

- My-Toys Manufacturing Sdn Bhd (Malaysia)

- Hamleys (India)

- Spin Master (Canada)

- Hasbro in the market utilizes its powerhouse entertainment brands, such as Play-Doh and franchise licenses to drive growth. Strategically, it focuses on the digital physical play integration via app-connected toys and direct-to-consumer e-commerce platforms to enhance engagement and data-driven product development. In 2024, the company generated USD 847 million in operating cash flow, a YoY improvement of USD 122 million.

- Mattel is a dominant player in the market with iconic brands such as Fisher-Price and Thomas & Friends. Its key initiatives include a strong sustainability push towards recycled materials, expanding the digital gaming content via its IP, and using direct retail channels to gather consumer insights and build brand loyalty. Mattel163's mobile gaming joint venture with NetEase continued to grow and exceeded USD 200 million in revenue.

- LEGO Group maintains leadership in the market with its DUPLO system. Its strategy centers on sustainable material innovation for its bricks, creating immersive digital experiences that complement physical sets and strategic expansions into educational play via partnerships and its LEGO Foundation initiatives.

- Bandai Namco Holdings competes in the market with lines such as Tomica and licensed character toys. Its core strategy exploits synergies between its toy division and vast video game/anime IP portfolio, focusing on cross-media storytelling, interactive toy development, and capturing the high-growth Asian markets.

- Melissa & Doug has carved a significant niche in the market by championing wooden, screen-free, open-ended play. Its strategic initiatives focus exclusively on this ethos, emphasizing quality craftsmanship, educational value, and tapping into parental demand for alternatives to digital and plastic-based toys.

Here is a list of key players operating in the global pre-school games and toys market:

The global pre-school games and toys industry is intensely competitive and is dominated by the giant players such as LEGO, Mattel, and Hasbro, alongside strong specialty players such as Melissa & Doug. The key strategies include aggressive digital physical integration using augmented reality and app-connected toys to enhance the play. There is also a major shift toward sustainability with initiatives for recycled materials and eco-friendly packaging. Further, strategic licensing of the popular children’s media franchises is vital for brand visibility, while direct-to-customer channels and expansion into high-growth markets in Asia are prioritized for growth and resilience against retail disruptions. Moreover, companies are expanding their geographic location via mergers and acquisitions. For example, in January 2024, Spin Master completed the acquisition of Melissa & Doug, a trusted brand in early childhood play.

Corporate Landscape of the Market:

Recent Developments

- In May 2025, Funskool India Limited has launched an exciting new line-up of toys and games designed to keep children engaged and creatively inspired throughout the summer.

- In May 2024, the UK toy brand WOW Toys (NAD Developments Limited) has been acquired by SMART TOYS AND GAMES (Smart Industries NV). SMART is headquartered in Belgium with subsidiaries in the UK and the U.S.

- Report ID: 8294

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pre-school Games and Toys Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.