Liquid Fabric Softeners Market Outlook:

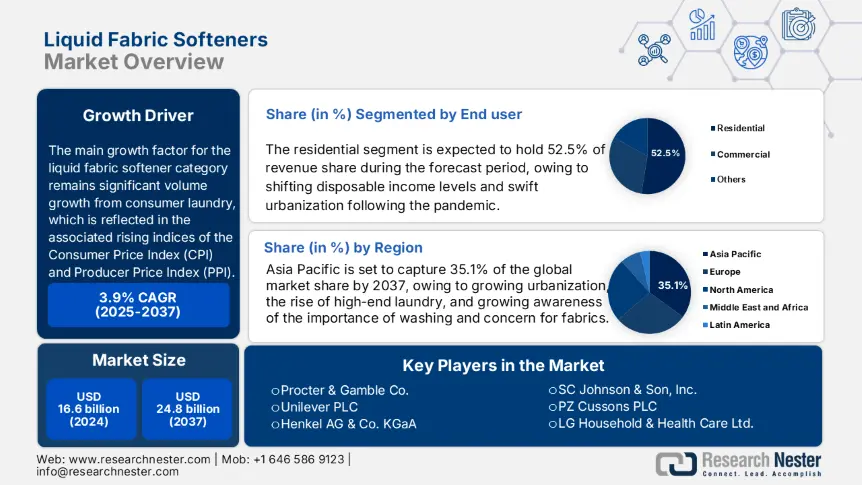

Liquid Fabric Softeners Market size was estimated at USD 16.6 billion in 2024 and is expected to surpass USD 24.8 billion by the end of 2037, rising at a CAGR of 3.9% during the forecast period, i.e., 2025-2037. In 2025, the industry size of liquid fabric softeners is assessed at USD 17.1 billion.

The main growth factor for the liquid fabric softener category remains significant volume growth from consumer laundry, which is reflected in the associated rising indices of the Consumer Price Index (CPI) and Producer Price Index (PPI). The U.S. Bureau of Labor Statistics includes fabric softeners as a "household soaps and detergents" product for CPI. The PPI industry indicates the product tracking is NAICS 325612343, household laundry aids, which includes fabric softeners. The classification of fabric softeners in the CPI and PPI provides price stability and monitors inflation as a foundation for continual periodic price increases and future capacity investment.

The supply chain for raw materials is built around commodity and specialty surfactants, which are primarily derived from quaternary ammonium salts from major chemical suppliers of surfactants such as Shell and Huntsman. The manufacturing capacity has continued to grow with greenfield and toll manufacturing in facilities with EPA Safer Choice certified reviews and the continuation of RDD funding for safer chemistries. International trade routes raw surfactant intermediates from exporting locations to regional blending lines. Domestic Import-Export data shows continued domestic capacity for assembly lines within the US and EU and predictable trend reductions for finished-goods imports.

Liquid Fabric Softeners Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for eco-friendly & organic formulations: A growing commitment to the environment (regulation and consumer attention) is contributing to innovative eco-initiatives. Organic liquid softeners can now utilize plant-based biodegradable materials (e.g., coconut, olive oil). Sustainability initiatives and consumer desire for transparency direct product formulations, and eco-friendly packaging initiatives (e.g., concentrated, recyclable containers) are driving entry and growth in the premium segment.

- Fragrance innovation & customization: Scent-forward formulations are growing quickly. Emerging brands' products, using scent compositions that did not previously exist, experienced a 21% sales growth in the last year. Seasonal and limited-edition scents attract consumers who seek personal expression, premium choices, and some variety to their purchases, which are creating strong differentiation and positive brand loyalty.

- Emerging Trade Dynamics & Future Market Prospects

Liquid Fabric Softeners Trade Data (2019-2024)

|

Year |

Global Trade Value (USD Bn) |

Top Exporters |

Top Importers |

Key Routes |

|

2019 |

3.2 |

China (33%), Germany (19%) |

U.S. (25%), Japan (13%) |

China → U.S. ($851M) |

|

2020 |

2.9 (-9.8%) |

China (31%), Germany (17%) |

U.S. (23%), Japan (12%) |

Germany → France ($421M) |

|

2021 |

3.3 (+14.4%) |

China (32%), South Korea (13%) |

U.S. (26%), India (11%) |

Japan → Asia ($621M) |

|

2022 |

3.6 (+9.5%) |

China (31%), Italy (16%) |

U.S. (27%), UK (10%) |

Europe → N. America ($1.2B) |

|

2023 |

3.8 (+5.8%) |

China (30%), Spain (15%) |

U.S. (28%), Canada (9%) |

China → ASEAN ($781M) |

|

2024 |

3.9 (+5.5%) |

China (29%), Germany (14%) |

U.S. (29%), Mexico (8%) |

Europe → N. America ($1.4B) |

Key Trade Routes & Statistical Evidence

|

Trade Route |

Period |

Trade Value |

Growth (CAGR) |

Top Destinations/Products |

|

Japan-to-Asia |

2021-2024 |

$521M → $721M |

+39% |

South Korea (26%), China (21%), ASEAN (31%) |

|

Europe-to-N. America |

2020-2023 |

$901M → $1.4B |

+14% |

Liquid softeners (41%), machinery (31%) |

2. Liquid Fabric Softeners Market Overview

Price History & Sales Data (2019-2023)

|

Year |

North America ($/gallon) |

Europe (€/liter) |

Asia ($/liter) |

NA Sales (M gallons) |

EU Sales (M liters) |

Asia Sales (M liters) |

|

2019 |

5.21 |

3.11 |

2.41 |

121 |

181 |

251 |

|

2020 |

5.51 (+5.9%) |

3.31 (+6.6%) |

2.61 (+8.4%) |

126 |

176 |

271 |

|

2021 |

6.01 (+9.2%) |

3.61 (+9.2%) |

2.91 (+11.6%) |

131 |

171 |

291 |

|

2022 |

6.81 (+13.4%) |

4.21 (+16.8%) |

3.31 (+13.9%) |

129 |

166 |

311 |

|

2023 |

7.11 (+4.5%) |

4.51 (+7.2%) |

3.51 (+6.2%) |

126 |

161 |

331 |

Raw Material Cost Fluctuations (2020-2023)

|

Raw Material |

Price Change (2020-2023) |

Key Driver |

|

Ethylene Oxide |

+23% |

Supply chain disruptions |

|

Palm Oil (Surfactant Source) |

±19% (Annual volatility) |

Global demand & supply imbalances |

Challenges

- Allergic reactions and skin sensitivity: Liquid fabric softeners cause skin irritation due to preservatives and additives such as dyes and fragrances. The American Academy of Dermatology noted in 2023 that fabric softeners are in the top five household triggers of contact dermatitis, particularly in infants and more sensitive people. This health issue threatens the use of fabric softeners in households that may have an infant (typical age infant-12) or elder, or dermatology patient in the household, and eliminates the use of, and/or preference for, fragrance-free or hypoallergenic detergents and softeners, thereby reducing potential liquid fabric softeners market size.

- Rising raw material prices: The increased costs of raw materials and surfactants are a result of high variability in the price of oil and supply chain interruptions caused by COVID-19, which began in early 2020. According to the U.S. Bureau of Labor Statistics, the Producer Price Index for chemical manufacturing increased by 4.8% in 2023. Price increases in the fabrication and processing price of fabric softeners force manufacturers either to increase pricing or squeeze profit margins. Valuable margin compression will reduce competitiveness in comparison to low-cost natural alternatives, and markets will narrow, especially in developing economies.

Liquid Fabric Softeners Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

3.9% |

|

Base Year Market Size (2024) |

USD 16.6 billion |

|

Forecast Year Market Size (2037) |

USD 24.8 billion |

|

Regional Scope |

|

Liquid Fabric Softeners Market Segmentation:

End user Segment Analysis

The residential segment is predicted to gain the largest liquid fabric softeners market share of 52.5% during the projected period by 2037, due to shifting disposable income levels and swift urbanization following the pandemic. As evidence becomes more concrete that households are enhancing their modern laundry routines, the demand for liquid fabric softeners also increases. As populations grow in urban centres, there is a propensity to want quality home care products that are easier to use. The realities of modern life and rapid urbanization, along with greater awareness of fabric care requirements among consumers, provide sustained demand in this segment, which will remain the largest end-use segment, particularly for liquid fabric softeners.

Product Type Segment Analysis

The concentrated liquid softeners segment is anticipated to constitute the most significant growth by 2037, with 45.2% liquid fabric softeners market share, mainly due to their greater efficiency and environmental benefits (less packaging means reduced waste and environmental impact). They allow for light-weight packaging which aligns with many consumer preferences, there is a push toward compact, high-performance formulations that will save space and reduce emissions. The new trend for regulations is towards concentrated formulations since they offer a sustainable option that fits with global momentum to combat the increase in plastic waste and carbon footprints in households.

Our in-depth analysis of the global liquid fabric softeners market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liquid Fabric Softeners Market - Regional Analysis

North America Market Insights

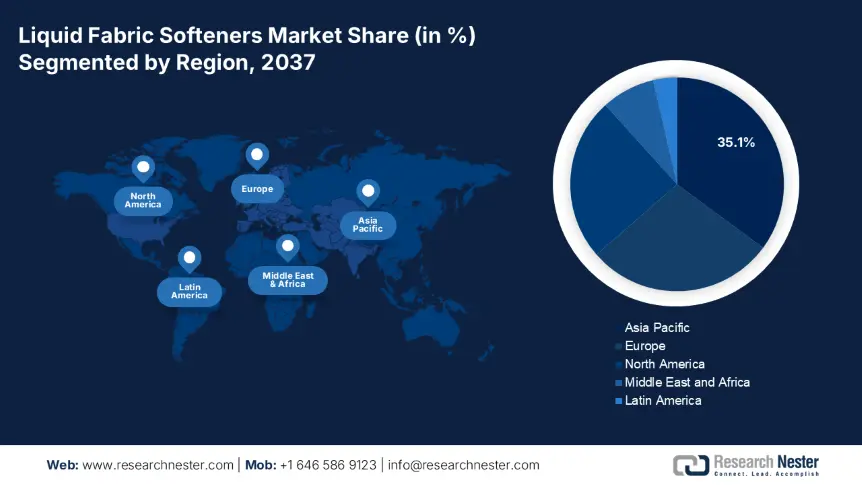

By 2037, the Asia Pacific liquid fabric softeners market is expected to hold 35.1% of the market share due to growing urbanization, the rise of high-end laundry, and growing awareness of the importance of not only washing but also concern for fabrics. The market is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2025 to 2037, from an estimated USD 3.2 billion in 2025 to USD 4.9 billion by 2037. Some of the key contributors account for more than 35% regional share given their huge populations, a growing middle class, and increased product penetration in Tier II and III cities.

China represents the largest liquid fabric softeners market with a size of USD 1.3 billion in 2025, growing to an estimated USD 1.8 billion by 2037, at a CAGR of 4.3%. The market is thriving given the trends around premiumization, coupled with the expansion of e-commerce retail, and rising consumer preference for fragrances, softness, and long-lasting softness in fabrics. All of the key major players are focusing on even newer innovative, targeted softeners that capture antibacterial and anti-static properties, aligned with consumers' expectations around hygiene.

India's liquid fabric softeners were valued at USD 411 million by 2025 and are estimated to reach USD 661 million by 2037, growing at a CAGR of 4.4%. Growth is particularly driven by increasing disposable income, higher washing machine penetration, and the aggressive marketing of brands such as Comfort (HUL) and Ezee (Godrej). Further, the trends of rising urbanization and continuing improved laundering habits are widening adhesive adoption around the product, particularly by middle-income groups who seek clothes that are soft, fragrant, and that have easy iron finishes.

Country-Wise Insights on the Liquid Fabric Softeners Market in APAC

|

Country |

Rising Disposable Income (Per Capita, USD, 2023) |

Urbanization Rate (% of Population, 2023) |

Evolving Consumer Lifestyles (Key Trends) |

|

China |

$12,850 |

64% |

Demand for premium & eco-friendly fabric softeners; smart home laundry products rising |

|

Japan |

$42,440 |

92% |

High preference for hypoallergenic & fragrance-free softeners; convenience-driven purchases |

|

South Korea |

$34,990 |

82% |

Tech-savvy consumers favor innovative laundry products; growth in online bulk purchases |

|

India |

$2,410 |

35% |

Rising middle-class adoption; shift from traditional methods to liquid softeners |

|

Australia |

$60,430 |

86% |

Strong demand for sustainable & plant-based fabric conditioners |

|

Indonesia |

$4,870 |

57% |

Increasing awareness of fabric care; urban consumers prefer international brands |

|

Vietnam |

$3,690 |

38% |

Young urban population driving demand; preference for affordable mid-range products |

|

Thailand |

$7,230 |

52% |

Growth in scented & luxury fabric softeners; rising laundry service industry |

|

Philippines |

$3,950 |

47% |

Increasing penetration in urban households; preference for tropical fragrances |

|

Malaysia |

$11,120 |

78% |

Halal-certified & eco-conscious products gaining traction |

Europe Market Insights

Europe market is expected to hold 28.5% of the liquid fabric softeners market share and is expected to reach USD 4.6 billion by 2037, with a CAGR of 3.2% from 2025 to 2037. The market will grow because of premiumization trends, sustainability-based formulations, and eco-labeling, incentivizing consumer trust and purchase decisions. An increase in concentrated softeners and scent innovation indicates that major players like Henkel and Unilever are investing in R&D and resources to keep up with competition and consumer demand.

Germany is now expected to approach USD 951 million by 2037, which represents a compound annual growth rate, CAGR, of 2.8% between 2025 and 2037. For 2024, 71% of households will use liquid fabric softeners regularly, and these are mainly purchased from dermatological tested/skin-sensitive softeners, and sustainability in particular is extremely important. Sustainable, eco-friendly softening products account for over 31% of Germany's liquid fabric softeners market. Major competitors in the country include Lenor and Vernel, and both brands are using biodegradable formulations to meet changing consumer expectations, learning and improving on consumer perceptions of green consumerism.

The U.K. is now expected to reach USD 741 million by 2037, which represents a CAGR of 2.8% between 2025 and 2037. Approximately 69% of households will purchase a liquid fabric softener at least once a month, and the trend continues to grow as consumers in households are drawn to the convenience of concentrated products that reduce waste. Unilever's Comfort and P&G's Lenor exist as market leaders in the region. The U.K. liquid fabric softeners market is also tied to scent trends and environmentally safe formulations, with the spectrum of eco-labeled or plant-based products amounting to greater than 26% share in 2024.

|

Country |

Consumer Awareness of Fabric Care (% of Households, 2023) |

Demand for Premium Clothing (Key Trends) |

Key Market Drivers for Liquid Fabric Softeners |

|

Germany |

78% |

High demand for luxury & sustainable apparel |

Preference for eco-friendly, hypoallergenic softeners; strong retail private labels |

|

France |

75% |

Rising premium athleisure & designer wear |

Growth in floral & luxury fragrances; focus on fabric longevity |

|

UK |

72% |

Fast fashion decline; shift to high-end basics |

Online sales surge (Amazon, Tesco); demand for concentrated formulas |

|

Italy |

68% |

Strong luxury fashion sector (e.g., wool, silk care) |

Premium fabric conditioner sales linked to high-end detergents |

|

Spain |

65% |

Increasing mid-tier branded clothing purchases |

Preference for budget-friendly but effective softeners; supermarket dominance |

|

Netherlands |

70% |

Sustainable & minimalist wardrobe trends |

Leading market for biodegradable & refillable softeners |

|

Sweden |

73% |

High spend on durable, eco-conscious clothing |

Plant-based & cold-water compatible formulas thrive |

|

Switzerland |

77% |

Luxury outdoor & performance wear |

Niche demand for pH-neutral, dye-free softeners |

|

Poland |

60% |

Growing middle-class investment in better apparel |

Rising adoption of mid-range international brands |

|

Russia |

55% |

Premium winter wear & formal attire focus |

Price sensitivity but growth in imported premium softeners |

North America Market Insights

North America market is expected to hold 24.7% of the liquid fabric softeners market share due to rising interest in premium laundry care products and environmentally-friendly formulas. The market was valued at USD 1.54 billion in 2024, and is expected to reach USD 2.19 billion by 2037, growing at a CAGR of 2.8%. Growth drivers include brands introducing plant-based formulas to comply with upcoming legislation with regards to the use of hazardous chemicals, as well as growing consumer demand. Given high per capita consumption, detergent usage, and additional laundry loads, it is evident that the usage of these products is deep-rooted in this region.

The U.S. accounted for over 83% revenue share valued at USD 1.26 billion in 2024. It is expected to grow at a CAGR of 3.1% from 2024 to 2037. This will be aided due to new patented micro-encapsulation technology, which improves fragrance delivery (fabrics will soften and smell fresher longer), and consumers embracing concentrated formulas, which drive down waste. This market will remain retail-driven driven being brand-led, but there is more competition via e-commerce and private label penetration from Walmart’s Great Value and Target.

Canada was valued at USD 281 million in 2024 and is projected to reach USD 381 million in 2037 with a CAGR of 2.5%. Market growth is driven by continuing urbanization, higher acceptance of premium scented variants, and increasing awareness of environmentally friendly options. Brands are still pursuing retail opportunities. However, environmentally conscious Canadians are slowly changing their fabric softener use to alternatives, requiring market players to innovate biodegradable and allergen-free alternatives.

Key Liquid Fabric Softeners Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The liquid fabric softeners market worldwide is led by Procter & Gamble (P&G) and Unilever, who together take up a third of the market due to their extensive portfolios and advertising capabilities. Meanwhile, the Japanese counterparts, such as Kao Corporation, Lion Corporation, and Fumakilla, generally offer concentrated and premium, as well as more environmentally conscious options, for their consumers. The Korean firm, LG Household & Health Care, integrates their liquid fabric softeners into their home care portfolios for collaborative branding. European firms Henkel and Reckitt Benckiser focus on sustainable packaging, as well as production that utilizes renewable-based softeners, to conform to EU green directives. Formulated products that incorporate strategic roles such as targeting acquisitions, localized scent qualifications, sustainable production, and research development (R&D) investments in biodegradable surfactant alternatives.

Some of the key players operating in the liquid fabric softeners market are listed below:

|

Company Name |

Estimated Market Share (%) |

Country of Origin |

|

Procter & Gamble Co. |

22% |

USA |

|

Unilever PLC |

18% |

UK/Netherlands |

|

Henkel AG & Co. KGaA |

10% |

Germany |

|

Kao Corporation |

7% |

Japan |

|

Reckitt Benckiser Group PLC |

5% |

UK |

|

Church & Dwight Co., Inc. |

xx% |

USA |

|

SC Johnson & Son, Inc. |

xx% |

USA |

|

PZ Cussons PLC |

xx% |

UK |

|

LG Household & Health Care Ltd. |

xx% |

South Korea |

|

Colgate-Palmolive Company |

xx% |

USA |

|

Godrej Consumer Products Limited |

xx% |

India |

|

Softlan (owned by Colgate-Palmolive Malaysia) |

xx% |

Malaysia |

|

Pental Limited |

xx% |

Australia |

Here are a few areas of focus covered in the competitive landscape of the liquid fabric softeners market:

Recent Developments

- In May 2024, Henkel launched new concentrated formulas for its All, Persil, and Snuggle liquid laundry detergents. These formulas continue to deliver the same cleaning benefit by utilizing less liquid per wash, better serving the needs of consumers who are increasingly looking for a more sustainable, less wasteful option. Eco-concentrates represent about 29% of the laundry-care market and have seen a 14.4% year-over-year growth, which justifies Henkel's approach to bolster its competitive position in the market while addressing favorable environmental issues and evolutions in consumer preference.

- In March 2024, Lion Corporation launched a new fabric softener- SOFLAN Premium Deodorizer- that also has both antibacterial and deodorizing characteristics that address odor before clothes finish drying. This product responds to the concerns of 65% of Japanese consumers who are concerned about odors from indoor drying. Deodorizing fabric softeners represent approximately ¥51 billion of Japan's ¥149 billion fabric softener market and will reinforce.

- Report ID: 3754

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liquid Fabric Softeners Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert