Glamping Tents Fabric Market Outlook:

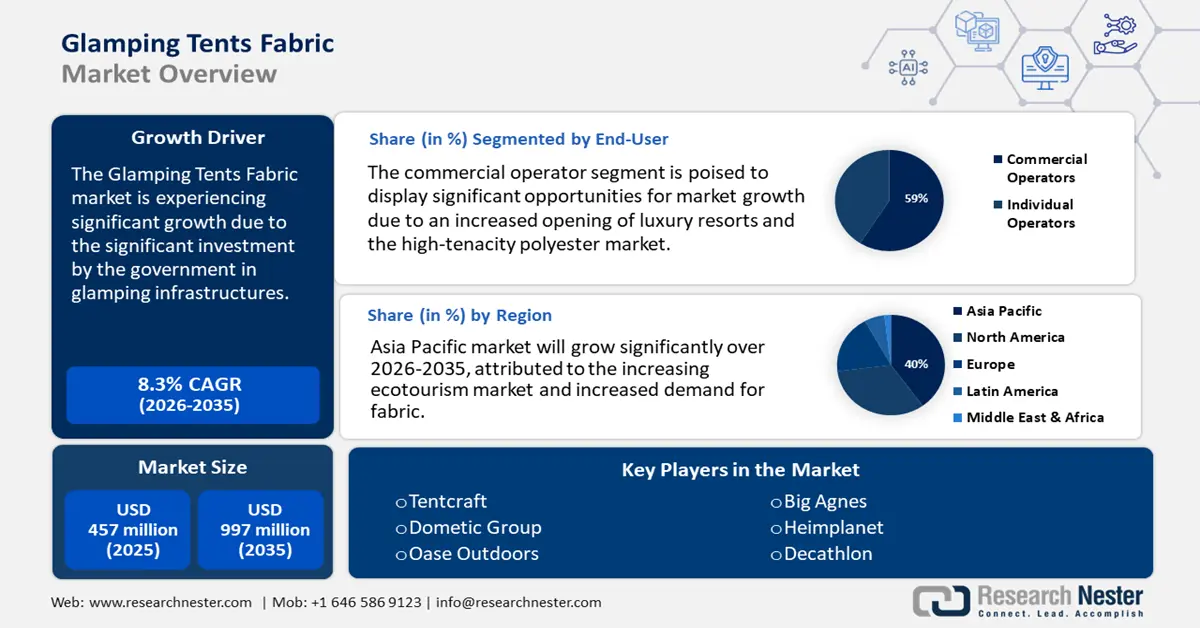

Glamping Tents Fabric Market size was valued at USD 457 million in 2025 and is projected to reach USD 997 million by the end of 2035, rising at a CAGR of 8.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of glamping tents fabric is estimated at USD 494 million.

The glamping tents fabric market is projected to grow primarily due to significant investments by the government in glamping infrastructure. Tourism, a global high-growth industry with over 700 million arrivals and receipts exceeding US$500 billion, significantly boosts income, jobs, and foreign exchange. Despite India’s modest 0.4% share of international arrivals, strong domestic religious tourism enables the sector to contribute 5.6% to GDP and directly employ 20 million people. Furthermore, the growth of ecotourism surges demand and propels market expansion. For instance, nature-based tourism accounts for roughly 20% of global tourism, drawing substantial interest worldwide. Protected Areas host an estimated 8 billion visits each year, creating an economic impact of about USD 600 billion, underscoring the sector’s importance to both international travel and the global economy. Additionally, global textile fiber output rose from 58 million tons in 2000 to 116 million tons in 2022 and is projected to reach about 147 million tons by 2030. Growing fabric orders for polyester with recycled content experienced a rise of 14% annually, according to a report by the European Environment Agency.

Polyester remains the dominant fiber in global supply chains, with production rising from 63 million tons in 2022 to 71 million tons in 2023, representing 57% of total fiber output. Recycled polyester also showed growth, increasing from approximately 8.6 million tons in 2022 to about 8.9 million tons in 2023. According to the FRED, the Producer Price Index (PPI) for textile products and apparel, polyester-manufactured fibers was 126.694 in May 2022. Glamping tents typically use durable, weather-resistant fabrics such as canvas, poly-cotton blends, and treated polyester for strength, breathability, and UV/water protection. Rising eco-tourism, experiential travel, and luxury outdoor stays are driving strong global demand. Market growth is supported by expanding adventure tourism, sustainable materials innovation, and increasing investments in high-end camping infrastructure worldwide.

Key Glamping Tents Fabric Market Insights Summary:

Regional Insights:

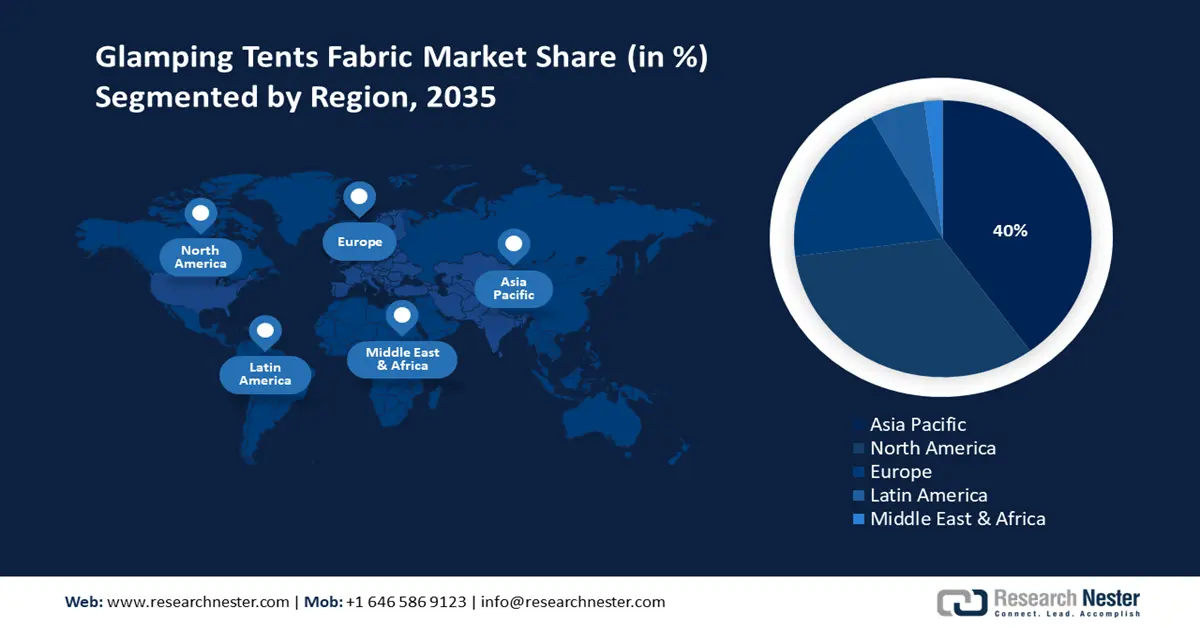

- The Asia Pacific glamping tents fabric market is projected to hold a 40% revenue share by 2035, supported by the surge in eco-tourism and wellness travel across emerging economies.

- North America is anticipated to secure a 32% revenue share by 2035, attributed to the rapid expansion of polyester-based sustainable fabrics and increased participation in luxury camping.

Segment Insights:

- The commercial operators segment is expected to command a 59% share of the Glamping Tents Fabric Market by 2035, propelled by large-scale investments from luxury resorts and eco-retreats in high-performance, weather-resistant fabrics.

- The polyester segment is projected to capture a 49% share by 2035, owing to the growing adoption of recycled polyester materials under European Union sustainability mandates.

Key Growth Trends:

- Consumer demand for durability

- Government support for rural and eco-friendly infrastructure

Major Challenges:

- Fire safety regulations

- Supply chain disruptions

Key Players: Tentcraft, Dometic Group, Oase Outdoors, Big Agnes, Heimplanet, Decathlon, Coleman, Kathmandu, Reliance Industries, Hyke & Byke, Blackpine Sports, Tentipi, Poler Outdoor Stuff, Toray Industries, Teijin Limited, Toyobo Co., Ltd, Seiren Co., Ltd.

Global Glamping Tents Fabric Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 457 million

- 2026 Market Size: USD 494 million

- Projected Market Size: USD 997 million by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Australia, Indonesia, Thailand, South Korea

Last updated on : 25 September, 2025

Glamping Tents Fabric Market - Growth Drivers and Challenges

Growth Drivers

- Consumer demand for durability: Durability has become a defining factor in shaping the glamping tent fabric market. With glamping blending outdoor adventure and luxury, tents must endure diverse climates, heavy usage, and prolonged outdoor placement while maintaining comfort and style. This need has increased the preference for fabrics like treated canvas, ripstop nylon, and high-denier polyester, which offer strength and resilience. Manufacturers are also advancing fabric technologies with UV protection, waterproofing, and abrasion resistance to meet these expectations. As durability becomes linked to safety, reliability, and long-term value, premium-grade fabrics are securing a stronger position in the glamping tents fabric This trend highlights how durability is driving innovation and competitiveness in glamping tent materials.

- Government support for rural and eco-friendly infrastructure: Multiple governments support and promote rural tourism and responsible lodgings through grants, tax incentives, and programs aimed at infrastructure. In many regions, government policies that foster sustainable construction standards lead to an increase in the use of high-quality, eco-certified fabrics for glamping tents. Compliance with fire codes and environmental regulations often leads manufacturers toward becoming compliant, sustainable suppliers. It takes time to go through certification processes to be compliant with environmental regulations, as suppliers have to develop low-VOC textiles that meet certification requirements, enabling market growth while giving compliant, sustainable suppliers a competitive advantage.

- Trade policy shifts: Concerns about geopolitics are causing supply chains to be restructured, with the EU Carbon Border Tax increasing the cost of imported traditional fabrics. In 2022/23, England’s holiday park and campsite sector generated £9.2 billion in visitor spending, supporting 170,429 full-time jobs and contributing £5.45 billion in GVA. Additionally, maintenance spending by tourers and holiday caravan owners added about £964.4 million to the UK economy, highlighting the sector’s substantial economic impact.

Emerging Trade Dynamics

Awnings, Tents, and Sails Trade in 2023

|

Exporting Country |

Trade Value (USD) |

Importing Country |

Trade Value (USD) |

|

China |

$2.9 B |

United States |

$912 M |

|

Germany |

$305 M |

Germany |

$508 M |

|

Bangladesh |

$286 M |

France |

$395 M |

Sources: OEC

Challenges

- Fire safety regulations: Countries around the world enforce stringent flammability regulations on outdoor accommodations. To be compliant means flame-retardant treatments that can alter fabric texture, breathability, and environmental profile. The rapid pace of changes to building and safety codes leads to ongoing testing requirements. Frankly, accommodating user comfort, fire retardancy, and new environmental certifications raises costs, risks, and limits design options for high-end glamping tents.

- Supply chain disruptions: Glamping suppliers across the world rely on fabric suppliers and chemical finishers that are specialized to deliver fabrics suitable for glamping. Geopolitical instability, shipping delays, and raw material pricing volatility (especially for artificial base fibers) can impact availability or cause both time and delivery uncertainty. Limited manufacturing capabilities locally compound the risk of shortages, forcing tent makers to carry more inventory or pay separations to secure local delivery of quality fabrics scheduled to arrive on time.

Glamping Tents Fabric Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 457 million |

|

Forecast Year Market Size (2035) |

USD 997 million |

|

Regional Scope |

|

Glamping Tents Fabric Market Segmentation:

End user Segment Analysis

The commercial operators' segment is expected to grow at a profitable rate by 2035, with the largest glamping tents fabric market share of 59%. The commercial operators’ segment is expanding as resorts, luxury campsites, and eco-retreats increasingly invest in durable, weather-resistant fabrics to meet rising glamping demand. The latest UN Tourism World Tourism Barometer reports about 790 million international tourists from January to July 2024, reflecting an 11% rise over 2023 and just 4% below 2019’s pre-pandemic levels, signaling a strong global travel rebound. These businesses prioritize premium materials with superior UV protection, fire retardancy, and aesthetic appeal to enhance guest comfort and safety. Continuous upgrades and large-scale purchases by hospitality chains drive consistent volume, making commercial operators a key growth engine for the glamping tent fabric market globally.

Material Type Segment Analysis

The polyester segment is expected to grow at a glamping tents fabric market share of 49% by 2035, owing to the increased adoption of recycled polyester due to the European Union’s mandatory obligation on operators to use recycled content. Global recycled polyester fiber production rose from about 8.6 million tons in 2022 to roughly 8.9 million tons in 2023, reflecting steady year-over-year growth in sustainable textile manufacturing. Polyester fabrics are lightweight, quick-drying, and cost-effective, making them ideal for diverse climates and frequent use. Their ability to hold color, resist mold, and support waterproof coatings attracts manufacturers and operators seeking long-lasting, aesthetically appealing tents, driving consistent adoption across luxury outdoor accommodations and eco-friendly glamping developments worldwide.

Fabric Treatment Segment Analysis

The waterproof segment is anticipated to grow with an upward trend by 2035, with the glamping tents fabric market share of 41%, driven by the increasing popularity of sustainable waterproofing to meet the mandates imposed by the Environmental Protection Agency. Travelers expect luxury camping experiences free from leaks and moisture, driving demand for advanced water-repellent coatings and laminated textiles. Innovations in eco-friendly waterproofing and breathable membranes enhance durability and sustainability, enabling tents to withstand heavy rain while maintaining ventilation, which boosts adoption among premium glamping resorts and eco-tourism destinations worldwide.

Our in-depth analysis of the glamping tents fabric market includes the following segments:

|

Segment |

Subsegments |

|

Material Type |

|

|

Application |

|

|

Fabric Treatment |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glamping Tents Fabric Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific market is projected to grow significantly over the forecast period by 2035, with a revenue share of 40%. The Asia Pacific glamping tents fabric market is rapidly developing due to increasing eco-tourism, wellness travel, and outdoor leisure activities. Rising incomes for the growing middle class, a preference for sustainable accommodations, and government efforts to stimulate nature-based tourism in various countries are boosting the market. Manufacturers are focusing on developing lightweight, UV-resistant, and waterproof fabrics that will operate in different climatic environments. Partnerships with excursion operators and adventure travel companies are increasing representation in the market. Growing awareness of low-impact travel and environmental certifications is encouraging the use of recyclable and eco-friendly textiles across the region.

The glamping tents fabric market in China is prospering due to the growing domestic tourism, urban residents on a quest to discover premium outdoor experiences, and the rural policy initiative of revitalization. Local provincial governments are promoting eco-tourism zones that encourage expanding luxury camping sites and promoting the toppling of the tent maker revolution. This policy direction does support developing high-performance fabrics able to stand the litmus test of diverse climates. Tremendous investment continues to be made in modern weaving machines by an increasing number of Chinese fabric suppliers, advancing sustainable textiles and professional certifications. Evidently, China is likely a major supplier and emerging consumer of glamping tents fabric.

As eco-tourism grows and experiential travel becomes increasingly possible across wildlife sanctuaries, hill stations, and desert locations, there is traction in India’s glamping tents fabric market. Government-led programs, like Incredible India and State eco-tourism programs, are boosting luxury camping projects, and so the demand for durable and weatherproof fabrics. In India, domestic textile companies are responding to the demand for UV-protected and water-repellent fabrics to suit monsoon and tropical weather with an increasing variety. India holds rich eco-tourism assets, encompassing 70% of the Himalayas, a 7,000 km coastline, both hot and cold deserts, the world’s 10th-largest forest area, and the 6th-highest count of recognized UNESCO Natural Heritage sites, showcasing exceptional geographical diversity. Increased interest in sustainable travel and stay culturally engaging experiences means the adoption of eco-friendly and recycled tent fabrics continues to steadily rise across India's premium outdoor hospitality industry.

North America Market Insights

The North American glamping tents fabric market is expected to grow at a substantial rate, with a revenue share of 32% by 2035, owing to the rapid expansion of polyester in the region. Demand emphasizes durable, weather-friendly, and sustainable materials that elevate both comfort and aesthetics. The combined forces of growing participation in luxury camping, along with government support for outdoor recreation infrastructure, enhance the market outlook. Lightweight, UV-resistant, and eco-friendly textile innovations for resorts, campgrounds, and private operators are advantages to advertise their premium and durable tent solutions in a variety of climates and seasonal uses.

The U.S. Glamping tents fabric market is becoming more advantageous, considering the increased footprint of luxury camping destinations and increased spending on outdoor recreation. Federal grant funding opportunities through the National Park Service and the Outdoor Recreation Legacy Partnership are creating opportunities for campsite upgrades using eco-friendly textiles. Eco-friendly fabrics are becoming preferred fabrics due to their water repellent coatings, UV protection, and superior insulating properties. Increasing interest in adventure tourism products and eco-friendly materials will continue to propel demand for innovative, low-maintenance weatherproof tent fabrics across the US.

Canada's glamping tents fabric market is strengthened by its vast number of natural landscapes and strong adventure tourism industry. Global trade of Awnings, Tents, and Sails totaled $5.75 billion in 2023, down 21.2% from $7.29 billion in 2022. Despite this decline, the category recorded a 5.64% annualized growth rate over five years. Ranking 496th among 1,217 traded products, it represented 0.025% of world trade. With a Product Complexity Index of –0.61, it was the 751st most complex product among 1,044 globally. Operators favor textiles that are breathable, fire-retardant, and weather-resistant to withstand the diverse climates that range from coastal regions to Northern territorial climates. The shift for luxury wilderness experience, and the new facilities in national and provincial parks, will continue to bring opportunities to high-quality fabric suppliers of glamping tents.

Europe Market Insights

The European glamping tents fabric market is expected to grow at a substantial rate, with a revenue share of 19% by 2035, due to the increase of eco-tourism across different landscapes and climate regions has allowed Europe’s glamping tents fabric market to flourish. This demand for sustainable and luxurious outdoor stays in the outdoors is bringing more and more demand for durable and weather-resistant fabrics. With increased investment into nature and based accommodation and tight environmental guidelines bringing forward advantages for innovative textile processes and advancements in sustainable outdoor textiles, favorable policies and regulations for low-impact tourism present new market opportunities for cutting-edge recyclable materials appropriate for the array of locations where glamping exists within Europe.

Growing consumer demand for luxury outdoor experiences in breathtaking countryside and coastal locations is driving the growth of the glamping tents fabric market in the U.K. Due to the glamping nature and in alignment with the national green tourism objectives, increased focus on weatherproof, breathable fabrics that are sourced and made as sustainably as possible is intended. Camping surged in popularity post-COVID, with 50% of leisure travelers rating camping as the safest option during the pandemic. In 2022, 7.2 million households camped for the first time globally, reflecting a major influx of new campers. Younger demographics are leading this growth. 45% of Millennials and 44% of Gen Z report a high interest in trying camping. Meanwhile, UK spending on camping and caravanning jumped significantly in 2021, showing a large demand for outdoor travel among domestic travelers.

Key Glamping Tents Fabric Market Players:

- Tentcraft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dometic Group

- Oase Outdoors

- Big Agnes

- Heimplanet

- Decathlon

- Coleman

- Kathmandu

- Reliance Industries

- Hyke & Byke

- Blackpine Sports

- Tentipi

- Poler Outdoor Stuff

- Toray Industries

- Teijin Limited

- Toyobo Co., Ltd

- Seiren Co., Ltd

The global glamping tents fabric market is highly fragmented, with Tentcraft (USA) and Dometic (Sweden) setting the standard for sustainability and personalization. While European companies such as Oase Outdoors stand out by using recycled polyester for 36% of their output, Japanese companies like Toray and Teijin focus on high-performance nylon. Among the main strategies are Reliance Industries' internal polyester production cost reduction, Dometic's €51 million investment in PFAS-free waterproofing to meet ECHA standards, and Kathmandu's introduction of UV-resistant textiles into the Asian market. To avoid U.S.-China tariffs, Big Agnes has shifted its production to Vietnam.

Some of the key players operating in the glamping tents fabric market are listed below:

Recent Developments

- In June 2024, Polycore launched the innovative EcoShield PRO fabric line, featuring PFAS-free waterproofing to comply with EU regulations. This fabric line is designed specifically for luxury glamping tents. When compared to typical PVC-coated textiles, the innovative fabric's greater UPF 50+ UV protection, with 30% less weight, makes it an exceptional choice for high-end outdoor accommodations. High-end brands like Under Canvas (USA) and Hapimag (Europe) are early adopters that emphasize their appeal for eco-conscious glamping operators.

- In May 2024, Tentcraft unveid its SolarThread fabric, reforming off-grid camping and featuring built-in photovoltaic technology that generates 1kW of power per 10m² of tent surface. The fabric is aligned with Patagonia Provisions and is already being used by eco-resorts across California. The new material combines enduring, weather-resistant properties with solar energy collection, allowing resorts to function sustainably without relying on external power sources. The company’s aim to satisfy the rising demand for energy-independent outdoor lodging is fulfilled by this launch.

- Report ID: 8128

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glamping Tents Fabric Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.