Light Engine Market Outlook:

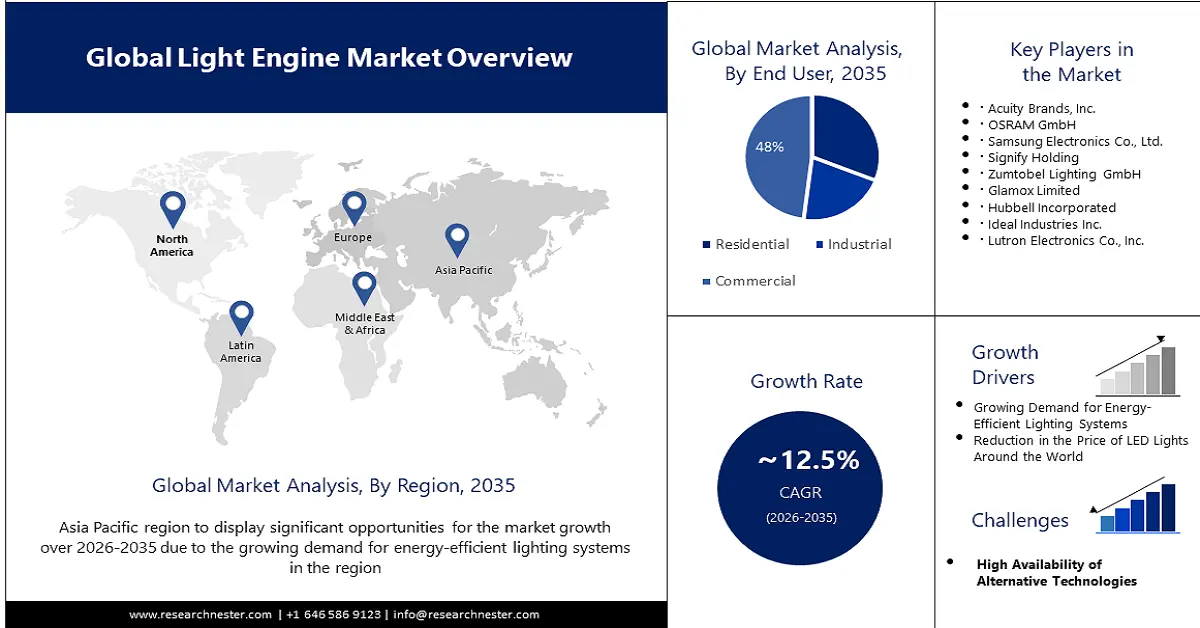

Light Engine Market size was valued at USD 35.2 billion in 2025 and is expected to reach USD 114.31 billion by 2035, registering around 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of light engine is evaluated at USD 39.16 billion.

The growth of the market can be attributed to the several government mandates enforced on energy conservation and LED adoption. Thus, people are opting for LED lighting due to the regulations enforced by the government related to energy conservation. As per the India Brand Equity Foundation, the Indian government distributed LED bulbs at a price of USD 0.12 in rural areas to households.

The residential sector is expected to grow revenue by the end of the estimated time frame, owing to increased industrialization and the number of smart cities initiatives around the world. As a result, the rising adoption of LED lighting in residential buildings is a driving reason behind the strong customer demand.

Key Light Engine Market Insights Summary:

Regional Highlights:

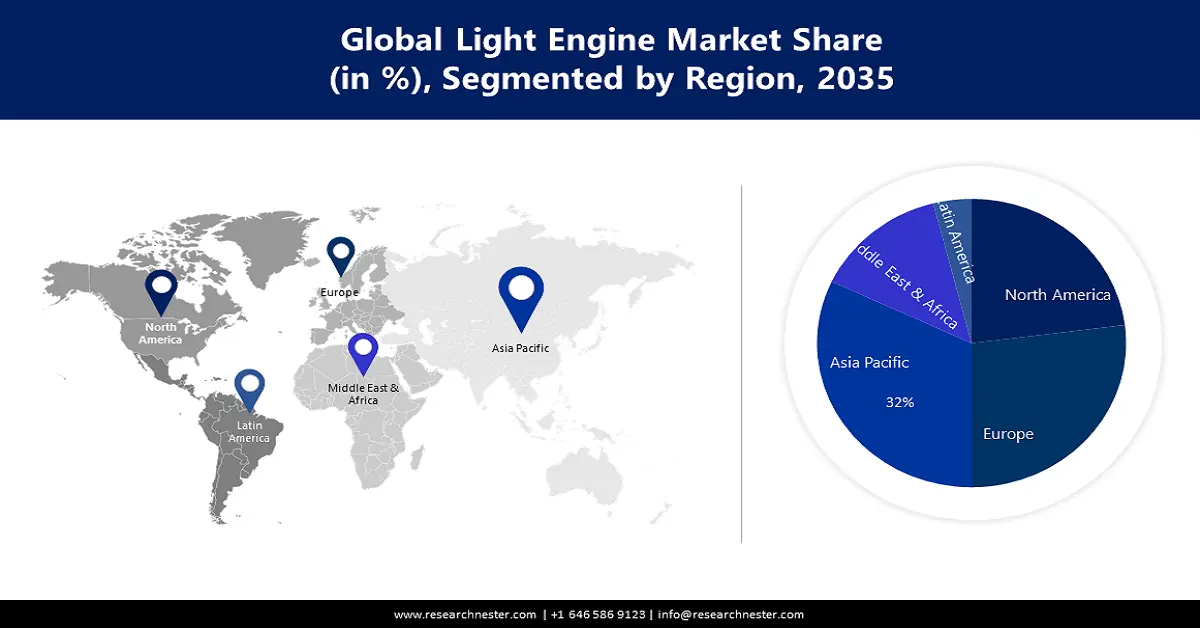

- Asia Pacific light engine market is poised to capture 32% share by 2035, driven by surging adoption of light engine lights and rapid rise in population.

- Europe market will secure the second largest share by 2035, driven by a thriving construction sector with increasing investments and new infrastructure development.

Segment Insights:

- The luminaires segment in the light engine market is projected to secure a 54% share by 2035, influenced by increased installations of lighting in infrastructure development projects.

- The commercial segment in the light engine market is expected to capture a 48% share by 2035, fueled by rising demand for advanced lighting in commercial spaces like offices and exhibitions.

Key Growth Trends:

- Growing Demand for Energy-Efficient Lighting Systems

- Reduction in the Price of LED Lights Around the World

Major Challenges:

- Growing Demand for Energy-Efficient Lighting Systems

- Reduction in the Price of LED Lights Around the World

Key Players: General Electric Company, Acuity Brands, Inc., OSRAM GmbH, Samsung Electronics Co., Ltd., Signify Holding, Zumtobel Lighting GmbH, Glamox Limited, Hubbell Incorporated, Ideal Industries Inc., Lutron Electronics Co., Inc.

Global Light Engine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.2 billion

- 2026 Market Size: USD 39.16 billion

- Projected Market Size: USD 114.31 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 9 September, 2025

Light Engine Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Energy-Efficient Lighting Systems- The increasing use of energy-efficient lighting in the vehicle business players has upped their attempts in recent years to create consciousness about energy efficiency.

-

Reduction in the Price of LED Lights Around the World- According to the latest Energy.Gov data, lighting constitutes around 15% of a typical home's electrical consumption, and utilizing LED lighting lowers the average household approximately USD $225 in energy bills per year globally.

- Rising Urbanization Globally- Growing urbanization has culminated in technological innovation, which provides cutting-edge technology and goods to consumers and enterprises. LEDs mounted on a board are analogous to light engines. Between 2010 and 2021, the pace of urbanization in the United States accelerated by around 20%.

- Increasing Adoption of Advanced Technologies- The never-ending growth in internet accessibility around the world along with numerous technological advancements comprising 5G, blockchain, cloud services, Internet of Things (IoT), and Artificial intelligence (AI), amongst other things, has considerably boosted the economy during the previous two decades. As of April 2021, there had been over 4.5 billion active internet users worldwide.

Challenges

-

·High Availability of Alternative Technologies

-

·High Cost of the Light Engine

Since the previous few years, light-emitting diode devices have grown in popularity. The initial cost of one of the units of these type of diode system, however, is substantially higher than the present CFL lighting system.

- Lack of Awareness Related to the Installation Costs

Light Engine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 35.2 billion |

|

Forecast Year Market Size (2035) |

USD 114.31 billion |

|

Regional Scope |

|

Light Engine Market Segmentation:

End User Segment Analysis

The commercial end-use sector held the largest revenue share of more than 48%. The desire for advanced lighting among event, museum, and exhibition operators to enhance lighting solutions is one of the primary factors behind the swift development of the commercial construction industry worldwide. The requirement for high-luminance light engine lights is increasing primarily due to the need for office lighting to comply with government rules and standards, which is driving market growth.

Product Type Segment Analysis

The luminaires segment will account for 54% share of the global light engine market. Light engine lights are all luminaires utilized in track illumination, high bays, troffers, and lighting on roads. The setting up of additional track lights and light posts as a result of the growing creation of projects related to the development of the country.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Installation Type

|

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Light Engine Market Regional Analysis:

APAC Market Insights

The light engine market in the Asia Pacific industry is expected to dominate majority revenue share of 32% by 2035. The rapid rise in population and surging adoption of light engine lights are also assessed to accelerate the region’s market growth in the coming years. According to the most current data, Asia spans 29.4% of the surface of the earth and has an estimated population of over 4.75 billion people (as of 2022), making up roughly 60% of the global population. As of 2022, the total population of China and India was expected to exceed 2.8 billion people.

European Market Insights

Europe is projected to account for the market's second-largest revenue share in the year 2035. The expansion of this field can be attributed to the IT industry's thriving construction sector, which is benefiting from increasing investments and new infrastructure development efforts. The construction industry is vital to the European Union's economy. The sector employs 18 million people directly and accounts for around 9% of the EU's GDP. Moreover, the architectural consultancy is expected to be driven throughout the projection period by the eventual resumption of the construction of multiple data center structures that had been briefly halted owing to the COVID-19 pandemic. Furthermore, Germany is expected to have the highest CAGR during the estimated time frame owing to the country's huge production units of smart home devices.

Light Engine Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acuity Brands, Inc.

- OSRAM GmbH

- Samsung Electronics Co., Ltd.

- Signify Holding

- Zumtobel Lighting GmbH

- Glamox Limited

- Hubbell Incorporated

- Ideal Industries Inc.

- Lutron Electronics Co., Inc.

Recent Developments

- June 2021- Acuity Brands, Inc. agreed to acquire the North American operations of ams Osram’s digital systems business, which includes manufacture of LED drivers, LED light engines, and components for internet connectivity.

- June 2022- DEDO lights, a manufacturer of LED lighting and solutions, and its partner firm Prolycht announced the new RGBLAC LED lighting system. This LED produces a spot light beam with a 6:1 variation.

- Report ID: 3648

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Light Engine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.