LiDAR Market TOC

- An Introduction to the Research Study

- Preface

- Market Taxonomy

- Definition of the Market and the Segment

- Acronyms and Assumptions

- The Research Procedure

- Sources of Data

- Secondary

- Primary

- Manufacturer Front

- End User Front

- Supplier/Distributor Front

- Calculation and Derivation of Market Size

- Top-down Approach

- Bottom-up Approach

- Sources of Data

- Recommendation by Analyst for C-Level Executives

- An Abstract of the Report

- Evaluation of Market Fluctuations and Outlook

- Market Growth drivers

- Market Growth Deflation

- Market Trends

- End User Based

- Product/Service Based

- Fundamental Market Prospects

- Strategic competitive opportunities

- Geographic opportunities

- Application centric opportunities

- Pricing Analysis

- Regional Demand Analysis

- Analysis on Recent Development/Market Trends in Japan

- Analysis on Market Trends

- Global LiDAR Market Outlook & Projections, Opportunities Assessment, 2022 to 2035

- Market Summary

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Increment $ Opportunity Assessment, 2023-2036

- Year on Year Growth Forecast (%)

- By Product

- Airborne LiDAR Market Value (USD Million0 Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million0 Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unnamed Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Geography

- North America Market Value (USD Million) Current and Future Projections, 2023-2036

- Latin America Market Value (USD Million) Current and Future Projections, 2023-2036

- Europe Market Value (USD Million) Current and Future Projections, 2023-2036

- Asia Pacific Excluding Japan (APEJ) Market Value (USD Million) Current and Future Projections, 2023-2036

- Japan Market Value (USD Million) Current and Future Projections, 2023-2036

- Middle East & Africa Market Value (USD Million) Current and Future Projections, 2023-2036

- North America Lidar Market Valuation, Business Viewpoint, and Forecast by region, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the Market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- BY Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unmanned Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Country

- US Market Value (USD Million) Current and Future Projections, 2023-2036

- Canada Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- Latin America LiDAR Market Valuation, Business Viewpoint, and Forecast by Region, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Country

- Brazil, Market Value (USD Million) Current and Future Projections, 2023-2036

- Mexico, Market Value (USD Million) Current and Future Projections, 2023-2036

- Argentina, Market Value (USD Million) Current and Future Projections, 2023-2036

- Rest of Latin America, Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- Europe LiDAR Market Valuation, Business Viewpoint, and Forecast by Region, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unmanned Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Country

- Germany Market Value (USD Million) Current and Future Projections, 2023-2036

- UK Market Value (USD Million) Current and Future Projections, 2023-2036

- Italy Market Value (USD Million) Current and Future Projections, 2023-2036

- France Market Value (USD Million) Current and Future Projections, 2023-2036

- Spain Market Value (USD Million) Current and Future Projections, 2023-2036

- BENELUX Market Value (USD Million) Current and Future Projections, 2023-2036

- Russia Market Value (USD Million) Current and Future Projections, 2023-2036

- Poland Market Value (USD Million) Current and Future Projections, 2023-2036

- Rest of Europe Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- Asia Pacific Excluding Japan (APEJ) LiDAR Market Valuation, Business Viewpoint and Forecast by Region, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unmanned Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Country

- China, Market Value (USD Million) Current and Future Projections, 2023-2036

- India, Market Value (USD Million) Current and Future Projections, 2023-2036

- Indonesia, Market Value (USD Million) Current and Future Projections, 2023-2036

- South Korea, Market Value (USD Million) Current and Future Projections, 2023-2036

- Australia, Market Value (USD Million) Current and Future Projections, 2023-2036

- Singapore, Market Value (USD Million) Current and Future Projections, 2023-2036

- Malaysia, Market Value (USD Million) Current and Future Projections, 2023-2036

- New Zealand, Market Value (USD Million) Current and Future Projections, 2023-2036

- Rest of Asia Pacific Excluding Japan (APEJ), Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- Japan LiDAR Market Valuation, Business Viewpoint and Forecast, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unmanned Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

- Middle East & Africa LiDAR Market Valuation, Business Viewpoint and Forecast by Region, 2023-2036

- Outline of the Segment

- Detailed Overview

- Trends in the market

- By Product

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Terrain Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Bathymetric Air LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Mobile Ground-Based LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Still Image Ground LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- UAV LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Solid State LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- Airborne LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Technology

- 2D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 3D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- 4D LiDAR Market Value (USD Million) Current and Future Projections, 2023-2036

- By Application

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- Roads Market Value (USD Million) Current and Future Projections, 2023-2036

- Rails Market Value (USD Million) Current and Future Projections, 2023-2036

- Pipelines Market Value (USD Million) Current and Future Projections, 2023-2036

- Engineering Market Value (USD Million) Current and Future Projections, 2023-2036

- Environment Market Value (USD Million) Current and Future Projections, 2023-2036

- Forest Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Coastline Management Market Value (USD Million) Current and Future Projections, 2023-2036

- Pollution Models Chemicals Market Value (USD Million) Current and Future Projections, 2023-2036

- Agriculture Market Value (USD Million) Current and Future Projections, 2023-2036

- Wind Farm Market Value (USD Million) Current and Future Projections, 2023-2036

- Precision Forestry Market Value (USD Million) Current and Future Projections, 2023-2036

- ADA and Unmanned Vehicles Market Value (USD Million) Current and Future Projections, 2023-2036

- Exploration Market Value (USD Million) Current and Future Projections, 2023-2036

- Oil and Gas Market Value (USD Million) Current and Future Projections, 2023-2036

- Mining Market Value (USD Million) Current and Future Projections, 2023-2036

- Urban Planning Market Value (USD Million) Current and Future Projections, 2023-2036

- Maps Production Market Value (USD Million) Current and Future Projections, 2023-2036

- Meteorology Market Value (USD Million) Current and Future Projections, 2023-2036

- Military & Defense Market Value (USD Million) Current and Future Projections, 2023-2036

- Corridor Mapping Market Value (USD Million) Current and Future Projections, 2023-2036

- By Country

- Combined Gulf Countries Market Value (USD Million) Current and Future Projections, 2023-2036

- Israel Market Value (USD Million) Current and Future Projections, 2023-2036

- South Africa Market Value (USD Million) Current and Future Projections, 2023-2036

- Rest of Middle East & Africa Market Value (USD Million) Current and Future Projections, 2023-2036

- By Product

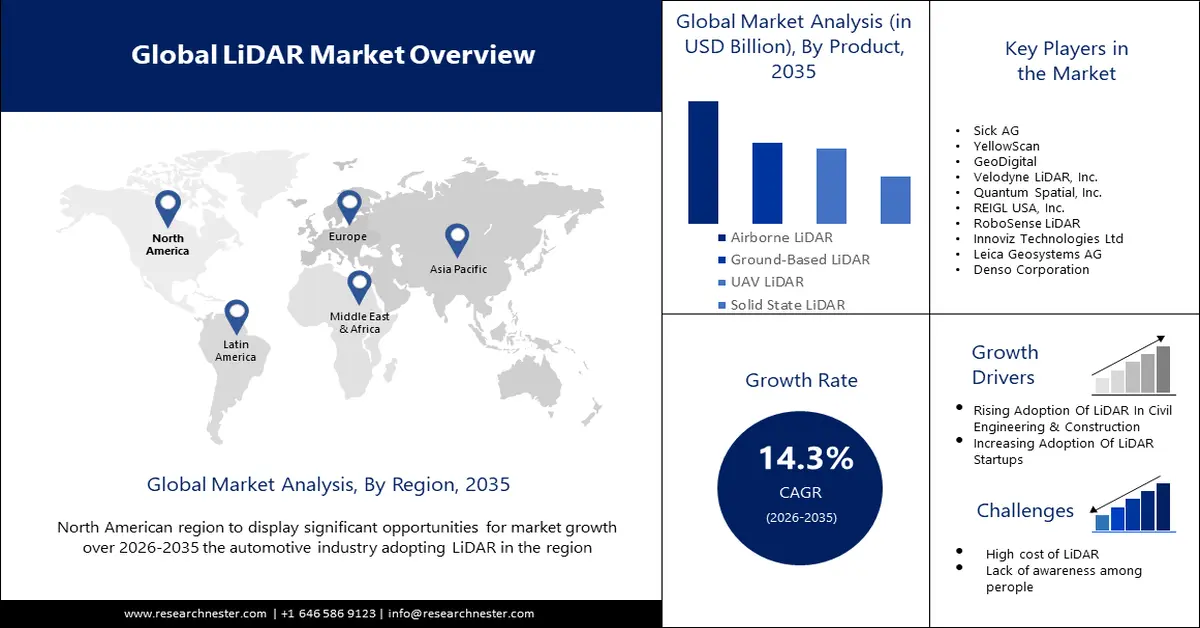

LiDAR Market Outlook:

LiDAR Market size was valued at USD 2.56 billion in 2025 and is likely to cross USD 9.74 billion by 2035, expanding at more than 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of LiDAR is assessed at USD 2.89 billion.

The growth is set to be encouraged by the technological advancement in LiDAR. Quantum-Systems and YellowScan jointly announced the launch of a geomatics grade LiDAR scanner integrated into the payload chamber of the drone, with accompanying software. Hence, this rising development of LiDAR has increased the scope for the product thus boosting the market growth.

In addition to these, factors that are believed to fuel the LiDAR market expansion is the increasing development of smart cities. LiDAR technology generates precise, superior-resolution 3D mapping data, which is useful for building utility infrastructure and metropolitan environments.

For instance, Siemensstadt has initiated a project for smart city development, and provided the largest ever fund of USD 600 million for transforming industrial areas into urban and modern districts.

Key LiDAR Market Insights Summary:

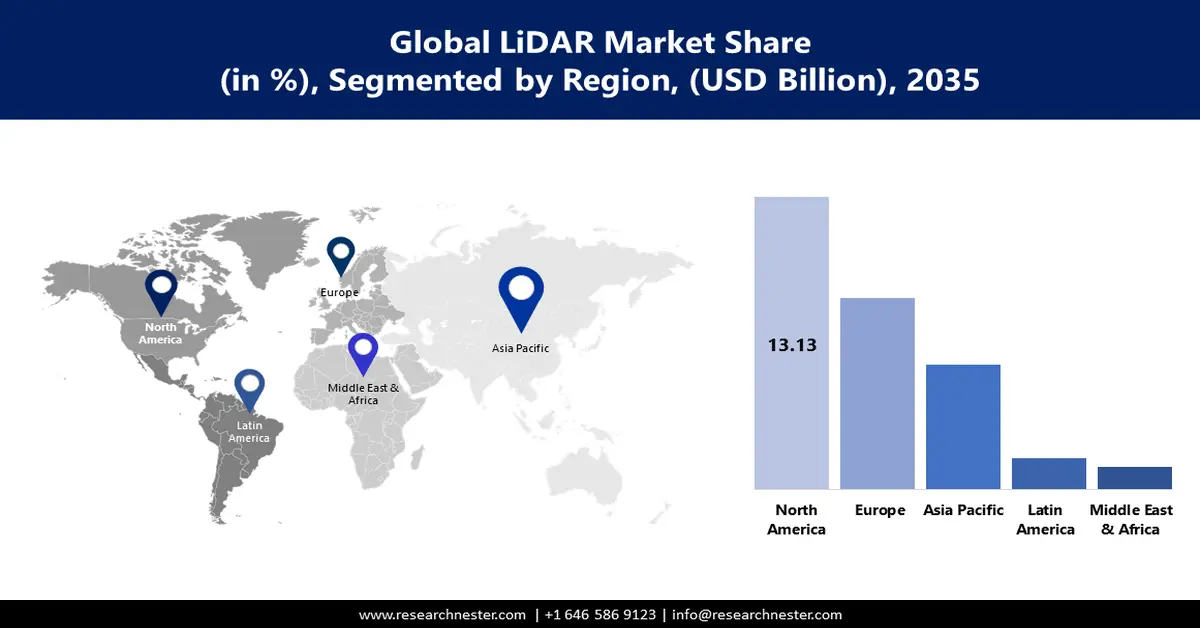

Regional Highlights:

- North America LiDAR market is projected to capture a 43% share by 2035, driven by rising demand for platoon operations and automated vehicle adoption.

- Europe market is expected to experience significant CAGR during 2026-2035, driven by government LiDAR usage for historic landscape studies.

Segment Insights:

- The airborne lidar segment in the lidar market is expected to hold a significant share by 2035, attributed to rising natural calamities and increasing use in urban planning and infrastructure monitoring.

Key Growth Trends:

- Growing investment by companies in digitization

- Rising development in GPS

Major Challenges:

- High cost of LiDAR services

- Accident threats associated with UAV

Key Players: Faro Technologies, Inc., Leica Geosystem Holdings AG, Teledyne Optech Incorporated (A part of Teledyne Technologies), Trimble Navigation Limited, RIEGL USA, Inc., Quantum Spatial, Inc., Velodyne LiDAR, Inc., Sick AG, YellowScan, GeoDigital.

Global LiDAR Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.56 billion

- 2026 Market Size: USD 2.89 billion

- Projected Market Size: USD 9.74 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

LiDAR Market Growth Drivers and Challenges:

Growth Drivers

- Growing investment by companies in digitization - Since the pandemic the acceleration in adoption of digitization has grown significantly. Around 91% of organizations have some sort of digital program in place, and in 2023, up to 60% of organizations want to boost their investments in digital transformation. Furthermore, this digital adoption is poised to bring in maximum ROI further by increasing efficiency. However, digitization frequently required accurate and elaborative 3D spatial data, which increased the use of LiDAR for capturing 3D point images. Hence, Lidar technology can develop a digital model to spot irregularities before work starts, along with monitoring changes to show progress.

- Rising development in GPS - GPS has now become an integral part of individuals' lives owing to its feature of navigating seamlessly. In addition, its use for various security purposes such as protecting the property or detecting the criminal has also risen notably. Various end-user industries including automobiles and smartphones have boosted the deployment of GPS in their system. This is because GPS is often combined with LiDAR to provide precise land surveying mapping and accurate positioning and location data. Additionally, a number of developments have been surging which is forecasted to boost the market growth. For instance, the introduction of the GPS III system which was developed by the United States Space Force. Users can expect GPS signal accuracy and availability to improve with the deployment of GPS III satellites.

- Higher investment in LiDAR startups - The merging of new companies is foreseen to bring newly developed and cost-effective LiDAR technologies. NUview, a startup that maps the whole surface of the earth every year with the help of ranging LiDAR technology and light detection has locked the funding of USD 15 million.

Challenges

- High cost of LiDAR services -Various factors determine the cost of LiDAR, therefore fixing the cost of LiDAR is a challenge itself. The LiDAR service is formed by the integration of sensors, data processing, and analysis which increases the demand for overall service. With the growing development of LiDAR, the LiDAR services are becoming expensive thus hampering the growth of the market.

- Accident threats associated with UAV - UAV LiDAR have gained huge importance with advancements in technology in the world. It has proven its great efficiency in areas covered with plants and shrubs. However, the prevalence of accidents is also projected to rise, and the elements to influence these incidents could be operator errors, malfunctioning of the equipment, and environmental conditions. Additionally, human-UAV collision incidents are also estimated to surge which has further created huge concern.

- Risk of data theft captured by LiDARs

LiDAR Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 2.56 billion |

|

Forecast Year Market Size (2035) |

USD 9.74 billion |

|

Regional Scope |

|

LiDAR Market Segmentation:

Product Segment Analysis

The airborne LiDAR market is expected to account for a significant revenue share by 2035. The growth of the segment can be attributed to the rising occurrence of unexpected natural calamities, such as earthquakes, floods, landslides, and others. Airborne LiDAR is crucial for creating precise floodplain maps, that enable better planning for the emergency response. In 2021, over 432 catastrophic occurrences were documented, which is significantly more than the typical number of 357 yearly catastrophic events from 2001 to 2020.

Apart from this, the use of airborne LiDAR is also growing for urban planning, as airborne LIDAR may offer important information for urban planning, including land use, and zoning. Their use is also surging for evaluating the effect of infrastructure development on natural resources and ecosystems, detecting leaks in underground utilities, and more

Application Segment Analysis

The corridor mapping segment in the LiDAR market is expected to witness significant growth during the forecast period. LiDAR enables the monitoring of structural integrity, and vegetation clearances of utility infrastructures, including telecommunication cables, power lines, gas pipelines, and others.

The growth of the segment is predicted to be encouraged by the rise in the installation of new pipelines for oil and gas transmission and its rapid development. In the world, currently, many projects are in development or being proposed for the expansion of oil and gas pipelines, the combined length of pipelines is around 131,760 miles.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

LiDAR Market Regional Analysis:

North American Market Insights

The LiDAR market in North America is poised to dominate 43% revenue share by 2035. The growth of the market can be dominated majorly by the rising demand for platoon operations in the region.

Based on US Department of Transportation data, the total states that have permitted commercial truck platooning account for 51% of freight miles within the country. The rising demand for automated vehicles, with features, such as ADAS radar systems and AEB is also expected to augment the market growth in the region.

European Market Insights

The Europe LiDAR market is expected to witness significant growth during the forecast period. This can be attributed majorly to the rising usage of LiDAR by the government to enable the study and analysis of historic landscapes. The government of the United Kingdom has been collecting LiDAR data for over 17 years and making it accessible to the public. According to a government official, the data will be leveraged by archaeologists who are interested in investigating historic infrastructures.

LiDAR Market Players:

- Faro Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leica Geosystem Holdings AG

- Teledyne Optech Incorporated (A part of Teledyne Technologies)

- Trimble Navigation Limited

- RIEGL USA, Inc.

- Quantum Spatial, Inc.

- Velodyne LiDAR, Inc.

- Sick AG

- YellowScan

- GeoDigital

Recent Developments

- Velodyne LiDAR, Inc. established a multi-year cooperation with GreenValley International to provide LiDAR sensors for carried-around, portable, and unmanned aerial vehicles (UAV). Velodyne is presently supplying sensors to GreenValley as part of this agreement.

- Leica Geosystems Holdings AG a subsdiary of Hexagon announced the launch of Leica CountryMapper. It is a combination of camera and sensor that delivers the most efficient technique for large-area scanning and LiDAR mapping.

- Report ID: 5264

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

LiDAR Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.