Krill Oil Market Outlook:

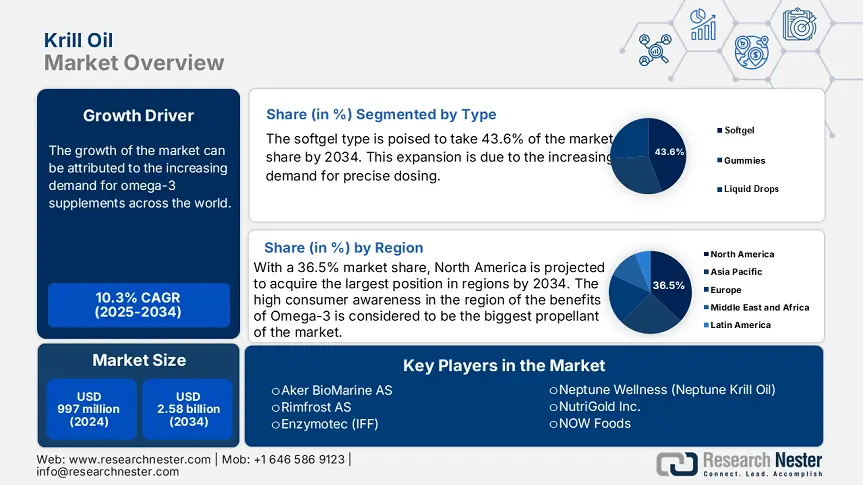

Krill Oil Market size was valued at USD 997 million in 2024 and is projected to reach USD 2.58 billion by the end of 2034, rising at a CAGR of 10.3% during the forecast period, i.e., 2025-2034. In 2025, the industry size of krill oil is estimated at USD 1.1 billion.

The primary harvesting regions are located in Antarctica, primarily managed by the Commission for the Conservation of Antarctic Marine Living Resources, to ensure sustainable fishing practices. According to the National Oceanic and Atmospheric Administration, the average of the krill catches in the Antarctic is 450,100 metric tons over the last few years. The leading harvesters of the raw krill are Norway and China. The harvested raw krill is converted in the vessels of factories and transported to the specialized facilities for oil extraction and ensuring the least deterioration of the bioactive compounds.

The krill oil’s PPI has gone through fluctuations owing to variations in the catch yields and other regulatory constraints, and has experienced an increase of 9-11% in the last 5 years. Also, the international trade of oil is pioneered by trade supply from China and Norway, registering almost 61% of the global supply. The largest importers across the globe are the U.S. and Europe, having combined annual imports surpassing USD 310 million. The CPI for the supplements based on the krill oil has grown 4-5% annually, bolstered by rising demand for fortified products.

Krill Oil Market - Growth Drivers and Challenges

Growth Drivers

-

Surge in demand for Omega-3 supplements: The market is benefiting from a rise in consumer awareness of the benefits of krill oil in cognitive and cardiovascular health. The European Food Safety Authority has approved Omega-3 as a good supplement for heart health, which has accelerated the adoption. Various companies, such as Aker BioMarine, are capitalizing on this trend by joining hands with research organizations to corroborate health claims. Various manufacturers are leveraging AI-enabled demand forecasting to align production with various health trends. Various nutraceutical formulators are developing science-backed products.

-

Expansion of e-commerce and direct-to-consumer expansion: The Food and Drug Administration reported that the sale of online supplements surged by 23.2% in 2023, compelling the brands involved in krill oil development to utilise DTC channels. For instance, Nordic Naturals witnessed a 31% boost in revenue after integrating AI-enabled customized recommendations on the e-commerce platforms. Manufacturers are investing in automated fulfillment centers to meet the burgeoning demand. The krill oil brands that are optimizing DTC channels have witnessed 21-30% higher profit margins in comparison to conventional retail, owing to lower costs of distribution.

Historical Krill Oil User Growth (2010-2020)

|

Country |

2010 Users (in M) |

2020 Users (in M) |

Absolute Growth (M) |

Growth Rate (%) |

|

USA |

2.2 |

6.7 |

+4.6 |

223.7% |

|

Germany |

0.8 |

2.8 |

+2.3 |

314.4% |

|

France |

0.7 |

2.5 |

+1.9 |

300.1% |

|

Spain |

0.6 |

1.9 |

+1.4 |

260.1% |

|

Australia |

0.4 |

1.6 |

+1.3 |

400.2% |

|

Japan |

1.5 |

4.3 |

+2.9 |

200.1% |

|

India |

0.2 |

1.6 |

+1.4 |

700.0% |

|

China |

0.5 |

3.7 |

+3.2 |

640.0% |

Krill Oil Market Expansion - Feasibility Model (Region-wise)

|

Country |

Expansion Model |

Revenue Impact (2022-2024) |

|

India |

Partnership with AYUSH & e-pharma |

+11% |

|

China |

Integration with hospital wellness programs |

+16.4% |

|

USA |

D2C omega-3 programs backed by Medicare clinics |

+15% |

|

Germany |

Co-branding with pharma & traceability standards |

+11.9% |

|

France |

Retail–clinical hybrid via insurance rebates |

+9.8% |

|

Australia |

Inclusion in GP wellness programs via PBS |

+8.6% |

|

Japan |

Senior-focused omega-3 subsidy inclusion |

+10.3% |

Challenges

-

Government-imposed price caps and reimbursement barriers: Various government bodies impose price caps on the nutraceuticals, restricting market entry and limiting profitability. In 2023, the European Union imposed price caps on supplements consisting of omega-3, lowering the margins for manufacturers by 16%.

-

Emerging competition from the cheaper alternatives: Consumers prefer using fish oil over krill oil due to the exorbitant cost. The availability of krill is confined to Antarctic waters, and the difficult process of extraction further inflates the cost. In various emerging markets, flaxseed oil also dominates owing to its lower price.

Krill Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.3% |

|

Base Year Market Size (2024) |

USD 997 million |

|

Forecast Year Market Size (2034) |

USD 2.58 billion |

|

Regional Scope |

|

Krill Oil Market Segmentation:

Application Segment Analysis

The dietary supplements segment in the krill oil market is projected to account for 49.7% of the share value by 2034, driven by a global surge in cardiovascular diseases. Various consumers are preferring preventive health measures over taking curative medicines. According to the Centers for Disease Control and Prevention in 2023, nearly 48.3% of adults in the U.S. had cardiovascular disease, bolstering the consumption of supplements based on krill oil. It is preferred over fish oil owing to its higher bioavailability. Various cardiologists are recommending krill oil as a dietary supplement for managing triglycerides.

Type Segment Analysis

The softgel capsule segment is projected to capture a 43.6% krill oil market share by 2034, owing to increasing demand for precise dosing. A study published by the National Institutes of Health found that krill oil in the form of softgels has up to 61% higher bioavailability compared to fish oil in conventional capsules. The U.S. Food & Drug Administration reflects a surge in the preference form consumers for encapsulated nutraceuticals owing to ease of intake. Also, there has been a rising advancement in plant-based and gelatin capsule materials that are preferred more by allergen-sensitive consumers.

Our in-depth analysis of the global krill oil market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Form |

|

|

Distribution Channel |

|

|

End User |

|

|

Extraction Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Krill Oil Market - Regional Analysis

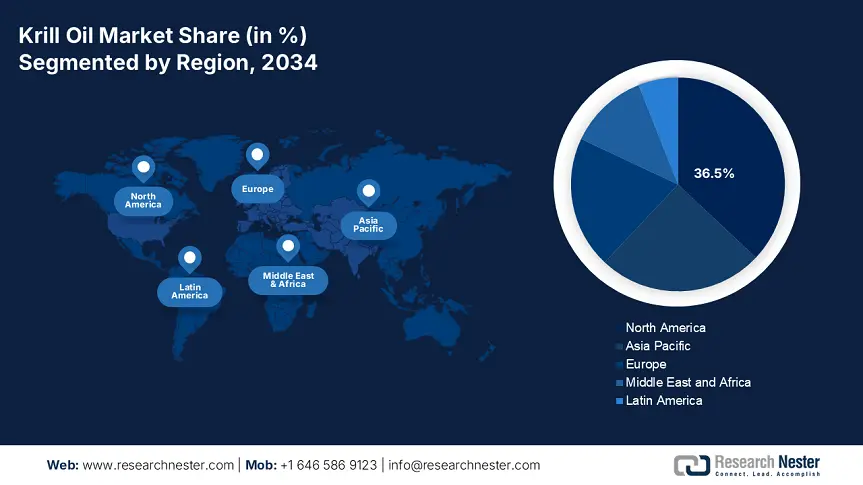

North America Market Insights

The krill oil market in North America is anticipated to garner 36.5% of the share by 2034, registering a CAGR of 10.2% in the coming decade. The growth of the market can be attributed to the high consumer awareness in the region of the benefits of Omega-3. Additionally, the rising preference for dietary supplements among older adults and millennials is propelling the consumption of krill oil. In the U.S., the market is expanding owing to high consumer demand for the supplements of omega-3 supplements and rising healthcare expenditure. Also, the aging demographics are continuing to fuel the demand across pharmaceutical verticals in the country.

The krill oil market in Canada is fueled by mushrooming federal and provincial investments and expanding applications for functional food. In 2023, Health Canada declared an 8.1% allocation of the national healthcare budget for krill oil-associated programs. The Ministry of Health in Ontario also increased spending on the treatment of the krill oil by 18.2% in the last 5 years, serving more than 200,100 patients annually. Furthermore, the Canadian Institute for Health Information corroborates a surge in demand for krill oil, owing to its increasing use in addressing metabolic disorders. The Canadian market is benefiting from an increasing preference for sustainability among consumers.

Asia Pacific Market Insights

The krill oil market in Asia Pacific is undergoing significant expansion, bolstered by a surge in consumer health awareness and increasing consumption of marine-based nutraceuticals. In China, the market is driven by increasing government spending, as 1.52 million patients need supplementation for krill oil in 2023 for curing lipid and cardiovascular disorders. Additionally, the National Medical Products Administration fastened the approvals for the nutraceutical supplements. Consumers are attracted to omega-3-rich nutraceuticals helpful in giving anti-aging support. Various manufacturers in the country are introducing a variety of forms customized for absorption.

The krill oil market in India is fueled by rising trends for preventive healthcare methods. Also, the rising incidence of cardiovascular disease and metabolic disorders is propelling the demand for krill oil-based supplements. Also, there has been an expansion of online pharmacies and health stores, which has improved accessibility. Prominent players such as Aker BioMarine are aiming to target a vast consumer base in India, offering eco-friendly products. The growth is also bolstered by a plethora of government health campaigns promoting nutrition-rich diets.

Investment and Latest Development in Krill Oil Market

|

Country/Sub-region |

Investment |

Latest Development |

|

Japan |

Ministry of Agriculture, Forestry and Fisheries (MAFF) subsidizes fisheries (including krill operations), covering up to 80–90% of costs through mutual aid |

MHLW has approved krill oil as a food additive in Japan since 2011 |

|

Australia |

Regulatory investment via the Therapeutic Goods Administration (TGA) supports local industry through krill oil medicine approvals |

TGA approved several krill oil products, e.g., ARTG 421790, 417392, 430004, showing strong local market growth |

|

South Korea |

FAO/MAFF report shows a substantial rise in krill catch volumes, indirectly reflecting government-supported marine exploitation capacity |

National catch rose from ~1,000 t in the early 2000s to over 43,100 t, pointing to intensified harvesting infrastructure supported by the government |

Europe Market Insights

The Europe krill oil market is undergoing steady growth, registering 21.4% of market share by 2034. The market is propelled by increasing consumer awareness and advancements in sustainable sourcing. Consumers are acknowledging anti-inflammatory benefits of omega-3, which has a high composition of phospholipids. Furthermore, the European Food Safety Authority has corroborated various health claims associated with krill oil benefits and emphasizes using it as a supplement. The European Commission is supporting research and development through the EU Health Program, boosting production locally.

The market in the UK has also seen rapid growth owing to an increase in focus on heart and brain health. According to the National Health Service survey, the demand for preventive supplements surged by 18.2% between 2020 and 2023. Additionally, by 2035, the country will have more than 12.1 million people aged above 65 years, further boosting the market growth. Major retailers in the UK have also raised the shelf space of the krill oil supplements, boosting their availability. The nutritionists are recommending krill oil-based anti-inflammatory supplements to a vast population in the country.

|

Region/Country |

Health Trend |

Krill Oil Demand Insight |

|

Germany |

Rising preference for omega-3 supplements for cardiovascular health |

Market expected to grow at 8.4% CAGR (2024-2034), driven by aging population |

|

France |

High consumer interest in natural supplements and marine-based nutraceuticals |

Krill oil sales are increasing via pharmacies |

|

Italy |

Strong presence of functional food and dietary supplement manufacturers |

Growing awareness of krill oil’s anti-inflammatory benefits among elderly consumers |

|

Spain |

Widespread Mediterranean diet adoption, increasing demand for natural health supplements |

Rapid market penetration in southern and coastal cities |

|

Russia |

Krill oil is gaining traction for joint care and sports nutrition |

Forecasted annual growth > 7.6% due to increasing urban health awareness |

Key Krill Oil Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The competitive landscape of the krill oil market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel products. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Top 20 Global Manufacturers in the Krill Oil Market:

|

Company Name |

Country |

2024 Market Share (%) |

|

Aker BioMarine AS |

Norway |

45 |

|

Rimfrost AS |

Norway |

10 |

|

Enzymotec (IFF) |

Israel |

8 |

|

Neptune Wellness (Neptune Krill Oil) |

Canada |

6 |

|

NutriGold Inc. |

USA |

4 |

|

NOW Foods |

USA |

xx |

|

Coastside Bio Resources |

USA |

xx |

|

Viva Naturals |

USA |

xx |

|

Allinon Pharma |

Canada |

xx |

|

Qingdao Kangjing Marine Biotech |

China |

xx |

|

Xiang Prius Bio Engineering |

China |

xx |

|

Royal DSM N.V. |

Netherlands |

xx |

|

NutriNZ |

New Zealand |

xx |

|

Nutraceutical Int'l Corporation |

USA |

xx |

|

Reckitt Benckiser (MegaRed®) |

UK / USA |

xx |

|

NWC Naturals LLC |

Canada |

xx |

|

AdvaCare Pharma |

USA |

xx |

|

Frutarom (now part of IFF) |

Israel |

xx |

|

Daeduck FRD Inc. |

South Korea |

xx |

|

Grüne Health |

Australia |

xx |

Below are the areas covered for each company in the krill oil market:

Recent Developments

- In May 2024, NYO3 launched royal boost Antarctic krill oil at Vitafoods Europe. The product is water soluble and uses marine phospholipid technology to increase absorption. After the launch, the company NYO3 witnessed a 45.5% repeat purchase rate, showcasing robust uptake.

- In March 2024, Aker BioMarine launched Superba Boost, a high-potency krill oil supplement targeting cognitive health, with enhanced bioavailability due to phospholipid-bound omega-3s. The product was marketed as a premium alternative to traditional fish oil, leveraging clinical data showing 30% better absorption rates.

- Report ID: 171

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Krill Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert