Gas Chromatography Market Outlook:

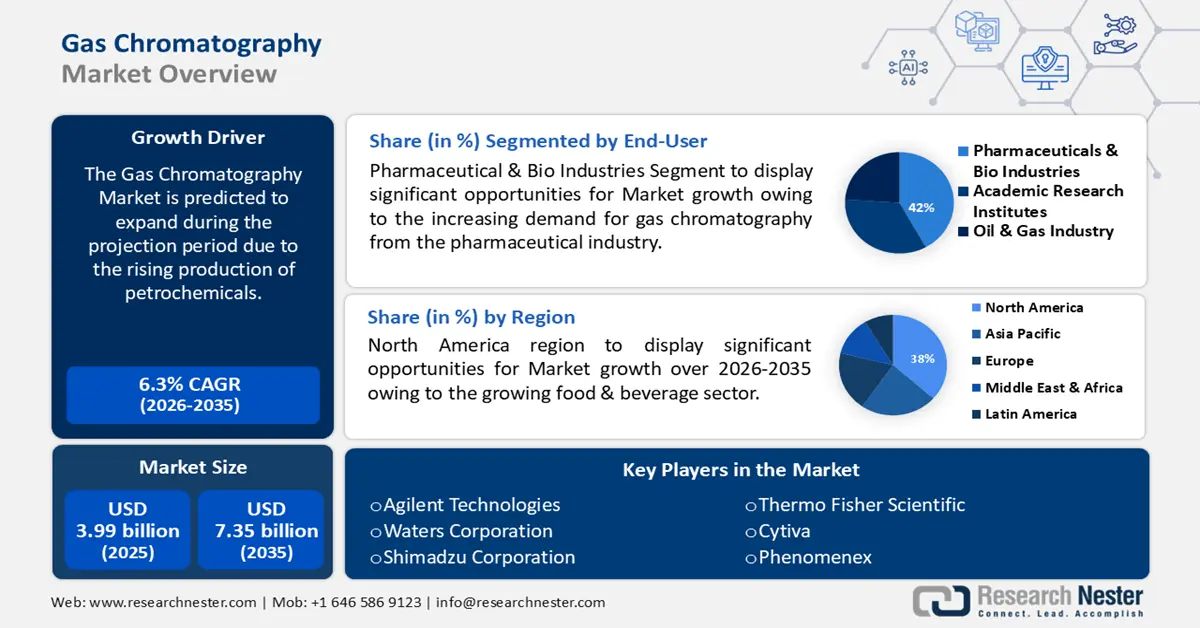

Gas Chromatography Market size was over USD 3.99 billion in 2025 and is anticipated to cross USD 7.35 billion by 2035, growing at more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas chromatography is assessed at USD 4.22 billion.

The rising production of petrochemicals and advanced medicines impels the growth in the market. According to the International Energy Agency, the oil and gas consumption in the worldwide petroleum industry is expected to increase by 10 million barrels per day and 850.0 billion cubic meters by 2030, respectively. Gas chromatography (GC) plays a crucial role in separating method and identifying & measuring the primary chemical elements present in fuel samples to ensure quality in this merchandise. In addition, it helps the pharmaceutical industry to attain quality control and regulatory compliance during drug development. Thus, these factors conjugately inflates demand in this sector.

In this regard, a 2023 NLM study discussed the cost-efficiency of 2D GC in drug discovery and analysis, where the average cost of the complete process of launching a single drug ranged between USD 1.0 billion and 2.0 billion. It further mentioned this method’s potential in offering several financial advantages for producing personalized medicines by providing precise and accurate mass measurement and molecule detection. Further, rigorous exploration is required to bring more affordability in the market, helping companies present a competitive payers’ pricing for their products. In November 2021, the American Chemical Society released a publication on the development of a low-cost and versatile GC system, which is built with materials worth less than USD 100.0, for teaching analytical chemistry.

Key Gas Chromatography Market Insights Summary:

Regional Highlights:

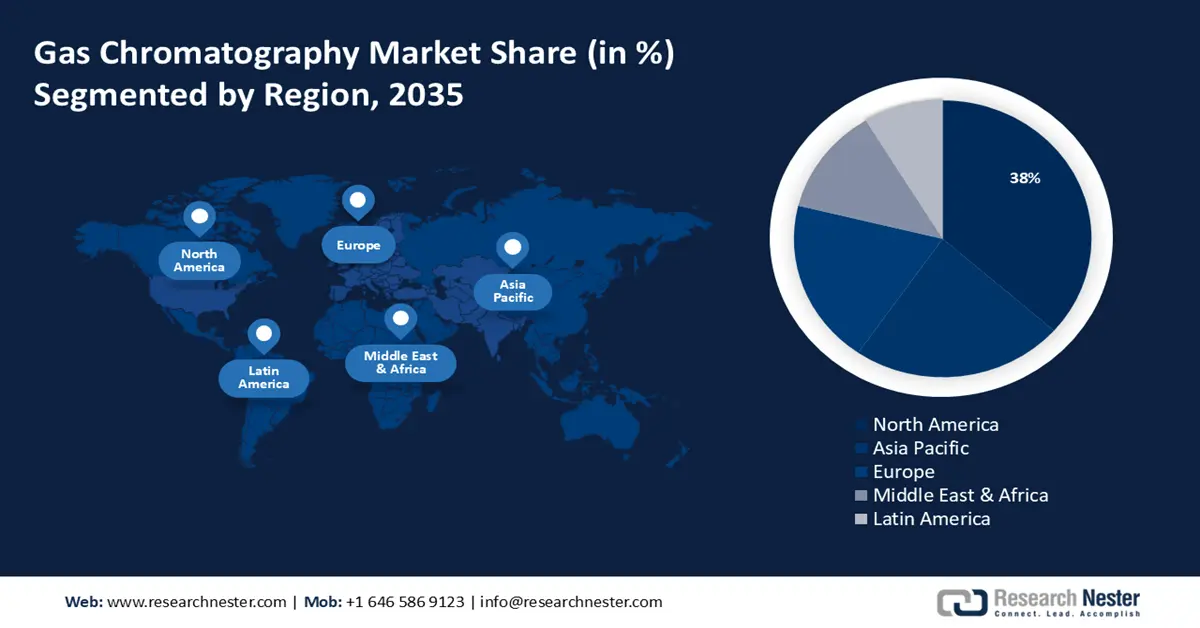

- The North America gas chromatography market is projected to capture a 38% share by 2035, attributed to rising demand for advanced analytical systems in the food & beverage industry and strong presence of global market leaders.

- The Asia Pacific market is expected to secure a 24% share by 2035, fueled by growing environmental awareness, heavy investments, and rising pharmacology R&D activities.

Segment Insights:

- The pharmaceuticals & bio segment in the gas chromatography market is projected to secure a 42% share by 2035, attributed to broad applications of gas chromatography in drug discovery and clinical toxicology.

- The accessories & consumables segment in the gas chromatography market is poised for substantial growth during 2026-2035, driven by high replacement demand and innovations in chromatography components.

Key Growth Trends:

- Rising awareness about industrial sustainability

- Tech-based advancements in the process

Major Challenges:

- Hurdles in competency and hiring workforce

Key Players: Agilent Technologies, Waters Corporation, Shimadzu Corporation, Thermo Fisher Scientific, PerkinElmer, Merck KGaA, Phenomenex, Bio-Rad Laboratories, Cytiva.

Global Gas Chromatography Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.99 billion

- 2026 Market Size: USD 4.22 billion

- Projected Market Size: USD 7.35 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Gas Chromatography Market Growth Drivers and Challenges:

Growth Drivers

- Rising awareness about industrial sustainability: As global greenhouse gas (GHG) emissions increase, industries become more aware of adopting eco-friendly solutions. For instance, till 2023, the chemical industry was emitting approximately 2.0 billion metric tons of CO2 annually, accounting for 5.0% of the global GHG emissions (ScienceDirect). Another IEA estimation revealed that this amount is poised to register 20.0% and 30.0% increments by 2030 and 2050, respectively. Thus, it has become essential to take proper action against this to combat global warming. With the help of GC detectors, the source of emissions in gas samples from chambers can be measured and controlled, propelling adoption in the gas chromatography market.

- Tech-based advancements in the process: Integration of advanced technology in the market is revolutionizing the efficacy of its existing product pipelines. On this note, in June 2022, PerkinElmer introduced an automated platform, GC 2400, enabling simplified operations, precise outcomes, and flexible monitoring in laboratories. This next-generation solution is designed to cater several customers from pharmaceutical, food, environmental, and industrial organizations with streamlined workflow and enhanced productivity. Such innovations are now being widely utilized to reduce the overall cost of production while maintaining compliance, attracting more organizations to invest in this sector.

Challenges

- Hurdles in competency and hiring workforce: The traditional devices available in the market are usually retailed at high pricing, which may impact their general accessibility. Particularly, the premium instruments with advanced features and functionalities are may become expensive for small-sized enterprises (SMEs). This further limit adoption in this field. Moreover, finding trained operators is becoming harder for these organizations, as it becomes an additional economic burden for them. Thus, continuous development and introduction of cost-effective commodities is highly required to maintain the market’s competency in all aspects.

Gas Chromatography Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 3.99 billion |

|

Forecast Year Market Size (2035) |

USD 7.35 billion |

|

Regional Scope |

|

Gas Chromatography Market Segmentation:

End user Segment Analysis

The pharmaceuticals & bio industries segment in the gas chromatography market is estimated to gain a robust revenue share of 42% in the throughout the forecast years. The segment’s notable captivation is majorly attributed to the increasing demand for these systems in drug discoveries and broad applications. GC is frequently utilized in the pharmaceutical and biotechnology R&D for quality control objectives and to find contaminants in active pharmaceutical ingredients (APIs). Besides, this is also used in the bio-analysis of blood and urine samples for detecting barbiturates, alcohols, narcotics, residual solvents, drugs such as anesthetics, and antihistamines. Furthermore, GC systems are highly desired to identify toxins and venoms, making them an essential tool in the clinical toxicology industry.

Product Segment Analysis

The accessories & consumables segment is set to garner a notable share in the gas chromatography market by 2035. The steady surge for these companion commodities is fueled by their limited durability. Accessories, such as columns, fittings, pipes, and others are accumulatively generating significant revenue, solidifying this segment’s leadership. Moreover, innovations in this segment are anticipated to create numerous opportunities global leaders. For instance, in April 2024, Waters Corporation launched GTxResolve Premier Size Exclusion Chromatography 1000Å 3-micron Columns, escalating the pace of gene-based therapeutics production.

Our in-depth analysis of the global gas chromatography market includes the following segments:

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Chromatography Market Regional Analysis:

North American Market Insights

The North America gas chromatography market is poised to account for the largest revenue share of 38% by the end of 2035. This proprietorship is owned by the growing demand for advanced analytical systems in the enlarging food and beverage industry across the region. There is a notable use of GC devices in vaporization and a gas carrier to analyze and detect nutrients or contaminants in the production samples. As per the Department of Commerce, the number of establishments associated with this industry in the U.S. was 42,708 in 2022. It also mentioned that 16.8% and 15.4% of sales and employees of the total U.S.-based manufacturing establishments belonged to this merchandise. This testifies to the region’s significance in revenue generation from this sector.

The U.S. is home to several global leaders in the market such as Waters Corporation, Agilent Technologies, Thermo Fisher Scientific, and others. This indicates a remarkable commercial engagement and revenue generation in this landscape. For instance, in 2022, Waters secured an 8.0% constant currency growth in net sales of its analytical products, including GC systems and columns in America, in comparison to the previous year. The country’s predominant contribution in the global biopharma production and economy is also a driver in this field. In this regard, the International Trade Administration stated that the total biopharmaceutical R&D expenditure by the U.S.-based companies accounted for USD 96.0 billion in 2023.

APAC Market Insights

The Asia Pacific gas chromatography market is estimated to hold the second largest share of 24% and a greater pace of growth over the analysed timeframe. The increasing public awareness about the environmental impact of rapid industrialization is boosting this sector. Thus, both domestic and international pioneers are investing heavily in this region. For instance, in September 2023, Shimadzu launched Brevis GC-2050 gas chromatograph, offering enhanced productivity and space saving. Furthermore, the growing R&D activities in pharmacology, particularly in precision medicine, is propelling need for GC-related products. This can further be testified by the expected dominance of APAC in the pharmaceutical contract manufacturing services industry, with the largest share of 42.9% by 2035.

India is strengthening its position in the regional market by escalating domestic manufacturing capabilities for various industries, including pharmaceuticals and chemicals. For instance, in 2025, this country was ranked as the 4th largest producer of agrochemicals in the world, acquiring up to 18.0% of the global dyestuffs and dye intermediates production. Additionally, India became the largest vaccine manufacturer worldwide, accounting for over 50.0% of the global supply. On the other hand, the nationwide demand for chemicals and petrochemicals is projected to surpass USD 1.0 trillion by 2040 (IBEF). These figures indicate the country strong emphasis on this field, as it present lucrative business opportunities and a wider consumer base.

Gas Chromatography Market Players:

- Agilent Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Waters Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific

- PerkinElmer

- Merck KGaA

- Phenomenex

- Bio-Rad Laboratories

- Cytiva

The market is continuously evolving with the upgrades in product pipeline by key players from around the globe. They are currently focusing on captivating maximum consumers by escalating their products’ capabilities in laboratory operations and performance. On this note, in March 2022, Thermo Fisher Scientific released a new range of GC and GC-mass spectrometry instruments, with significant hardware and software updates. This portfolio includes: TRACE 1600 Series Gas Chromatograph, AI/AS 1610 Liquid Autosampler, ISQ 7610 Single Quadrupole GC-MS, and TSQ 9610 Triple Quadrupole GC-MS/MS, enhancing usability, uptime, and efficacy. Such key players are:

Recent Developments

- In January 2025, Shimadzu Corporation launched seven new Brevis GC-2050 Systems for the Green Transformation (GX) merchandise. The additional pipeline is equipped with various pretreatment devices and detectors: Automatic Gas Analysis, Jetanizer/Polyarc Microreactor, Customized GC, Multi-Detector GC, Thermal Desorption, Pyrolysis Analysis, and Headspace Sampler systems.

- In August 2024, Agilent Technologies introduced new J&W 5Q GC/MS Columns for superior gas chromatograph performance. This innovative portfolio consists of ultra-inert performance and ultra-low-bleed technology to offer cutting-edge performance and durability for active analytes, enabling high sensitivity, maintaining accuracy, mass spectral fidelity, and accurate quantitation.

- Report ID: 4930

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Chromatography Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.