Bioremediation Market Outlook:

Bioremediation Market size was valued at USD 16.4 billion in 2024 and is projected to reach a valuation of USD 52.7 billion by the end of 2037, rising at a CAGR of 9.1% during the forecast period, i.e., 2025-2037. In 2025, the industry size of bioremediation is estimated at USD 18.4 billion.

The bioremediation industry is anticipated to garner stable growth owing to rising environmental concerns coupled with tighter regulations. The World Bank approximates that the global waste generation is likely to hit 3.40 billion tonnes by 2050, with much of that being inappropriately managed, leading to increased environmental pollution. The scenario represents the stark necessity for effective remediation. Ancient Organics Bioscience launched PaleoPower in May 2023, an advanced bioremediation product using beneficial bacteria that decompose glyphosate pollution in soils. These types of steps demonstrate the market's ability to solve complex pollution issues in an environmentally friendly way.

Governments in various countries are directing funds toward bioremediation technology in pursuit of their environmental goals. The combination of favorable policies and technological advancements is creating an important role for bioremediation in global environmental programs. The proactive role of both the private sector and government agencies highlights the increasing acknowledgment of the role of bioremediation in reducing environmental degradation and encouraging sustainable measures for an environment made clean for the future.

Bioremediation Market - Growth Drivers and Challenges

Growth Drivers

- Increasing industrial pollution: Industrial activities play an important role in contributing to environmental degradation. In the U.S., about 1.2 trillion gallons of untreated industrial waste are dumped into water bodies every year. This staggering figure highlights the importance of efficient remediation methods. One such solution is offered through bioremediation, whereby microorganisms are used in order to degrade the contaminants. In January 2023, Aquapolo Ambiental treated as much as 1,000 liters of domestic wastewater per second for reuse in the petrochemical plant, demonstrating the applicability of bioremediation in an industrial environment. Such activities play an important role in reducing the negative impacts of industrial pollution.

- Advances in biotechnology research: The use of biotechnology for environmental remediation has unlocked new pathways for pollution management. Scientists at MIT have already genetically engineered yeast for heavy-metal extraction from polluted water. This revolution proves the capability of bioengineered organisms for solving intricate issues of contamination. This showcases the immense potential of synthetic biology in addressing environmental challenges. Such advancements highlight a future where tailored biological solutions play a crucial role in restoring ecosystems.

- Government initiatives and financing: Governments increasingly acknowledge the role of bioremediation in attaining environmental targets. The U.S. Environmental Protection Agency (EPA) issued its first national drinking water standard for PFAS in April 2024, designed to safeguard 100 million individuals. The agency also pledged USD 1 billion for PFAS testing in public drinking water systems. These heavy investments are proof of increasing reliance on the use of bioremediation methods for maintaining public health as well as environmental safety. These efforts are set to drive the market for bioremediation.

Challenges

- Delays in remediation: One of the primary challenges with bioremediation is the time it takes in order to produce desired outcomes. The rate of microbial breakdown varies with environmental conditions, which can make remediation take longer. Furthermore, the complexity of microbial ecosystems is responsible for the slow rate of bioremediation. This constraint makes it necessary for the development of measures to speed up microbial activity as well as increase efficiency.

- Regulatory and public acceptance: Regulatory obstacles and public distrust can impede the use of bioremediation technology. Although such efforts receive government backing, public acceptance and overcoming complicated regulations continue as challenges for large-scale implementation. Although awareness has increased, as well as demonstrated effectiveness, the public can be wary of safety concerns and long-term implications of bringing in microorganisms or natural mechanisms in polluted environments. Clarity of purpose through open communication and strong scientific proof is key in order to alleviate such concerns and build public acceptance of the use of bioremediation.

Bioremediation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

9.1% |

|

Base Year Market Size (2024) |

USD 16.4 billion |

|

Forecast Year Market Size (2037) |

USD 52.7 billion |

|

Regional Scope |

|

Bioremediation Market Segmentation:

Type Segment Analysis

In situ bioremediation is estimated to capture 68.1% market share during the forecast period, owing to its low cost and low environmental impact, cleaning contamination directly from the source. Bioventing and biosparging have shown effectiveness in several contaminated sites. The efficiency of in situ bioremediation, as well as its low environmental footprint, is why in situ is such an important tool in environmental remediation. To carry out in situ remediation, no movement of contaminated material is involved, which adds to its attractiveness.

Technology Segment Analysis

Phytoremediation, which involves the use of plants for cleaning contaminated environments, is estimated to capture a 30.4% market share by 2037. The cost-effective and eco-friendly green technology is rapidly gaining traction. The dominant market size of the phytoremediation segment indicates its critical position in the business of bioremediation. Popular phytoremediation methods such as phytoextraction and phytostabilization tackle both groundwater as well as terrestrial pollution with ease. The increasing focus on sustainable as well as green remediation methods is also estimated to contribute to the robust phytoremediation market.

Our in-depth analysis of the bioremediation market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

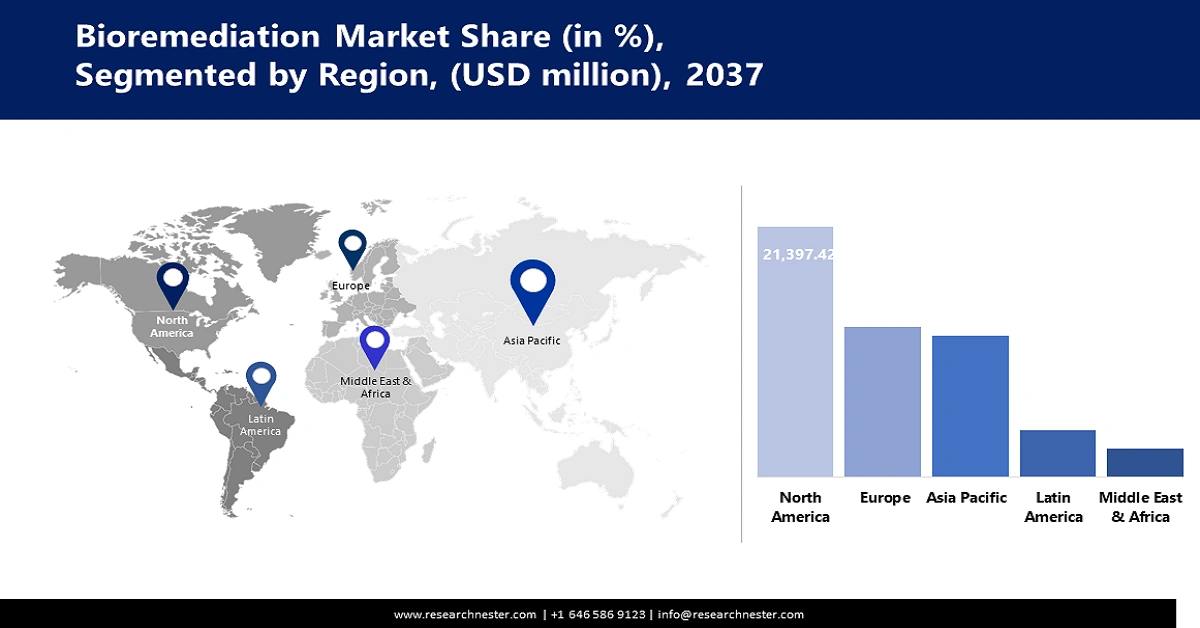

Bioremediation Market - Regional Analysis

North America Market Insights

North America market is projected to capture a 40.5% market share over the forecast period, supported by rigorous environmental policies as well as technological advancements. The activities of the Environmental Protection Agency of the U.S., including the Superfund Program, demonstrate the importance of environmental remediation in the region. Additionally, the presence of major market players as well as the conduct of frequent research activities in the region pushes growth in North America bioremediation sector.

The U.S. bioremediation market is distinguished by strong government support and heavy investments in research and development. In April 2024, the EPA launched its first national drinking water standard for PFAS in an effort to safeguard 100 million individuals from serious health conditions. The agency also pledged USD 1 billion for public water system PFAS testing. These efforts demonstrate the country's proactive stance toward environmental remediation through the use of bioremediation.

Canada's environmental sustainability commitment, as well as stricter laws, are supporting its bioremediation market. The country’s emphasis on pollution control strategies as well as clean technologies is promoting the adoption of bioremediation methods. Intersectoral collaboration between private entities as well as government agencies is supporting innovation. The country's focus on research and development is projected to propel its bioremediation market growth during the forecast period.

APAC Market Insights

Asia Pacific bioremediation market is estimated to expand at a CAGR of 9.7% from 2025-2037. The industrialization and urbanization in nations such as India and China have triggered heightened environmental pollution, driving the need for efficient remediation services. The governments of Asia Pacific are creating policies for sustainable practices, thus driving the market for bioremediation. The use of advanced technologies, as well as heightened awareness regarding environmental preservation, are major drivers of the market in Asia Pacific.

China's market for bioremediation is rapidly increasing as the government makes efforts towards pollution control as well as environmental rehabilitation. The government enforced strict measures through the Ministry of Ecology and Environment in order to tackle pollution of the soil as well as the water. The waste generation in Beijing rose in 2023 from 1.714 million tons in 2022 to 1.825 million tons, which highlights the importance of efficient waste management systems. The emphasis of the nation on sustainable development is anticipated to drive the demand for bioremediation.

India bioremediation market is increasing at a stable pace, spurred on by the country's attempt to combat environmental pollution. Urbanization has caused serious water pollution, driven by an estimated 70% of surface water being non-potable. The Central Pollution Control Board is encouraging the use of bioremediation methods in order to overcome such situations. Increased public awareness and government policies will drive the India bioremediation market. This push towards cleaner technologies is also attracting significant investments in research and development within the nation.

Key Bioremediation Market Players:

- Allonnia

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carus

- Drylet, Inc.

- Evoqua Water Technologies LLC (Xylem)

- Geovation Engineering, P.C.

- JRW Bioremediation, L.L.C

- Regenesis Corporation

- RNAS Remediation Products

- Terra Systems

- Veolia

The bioremediation market is marked with the presence of a few major players with focus areas of innovation, as well as strategic partnerships. Some prominent players in the market are Allonnia, Carus, Drylet, Inc., Evoqua Water Technologies LLC (Xylem), Geovation Engineering, P.C., JRW Bioremediation, L.L.C., Regenesis Corporation, RNAS Remediation Products, Terra Systems, and Veolia. These players are making investments in the development of their products as well as increasing their market presence.

Allonnia launched 1,4 D-Stroy in May 2023, an innovative bioremediation system for degrading 99% of 1,4-dioxane in contaminated groundwater, a leading source of chronic pollution with serious health implications. The launch is an indicator of an industry-wide move toward precise microbial solutions. With public fund backing and infrastructure programs, the industry is gaining momentum. Furthermore, technological innovation and cross-industry collaborations are imperative for market dominance. The competitive environment is changing dramatically with sustainability as its foundation.

Here are some leading companies in the bioremediation market:

Recent Developments

- In January 2025, CSIR-National Institute of Oceanography (NIO) partnered with Organica Biotech Pvt Ltd and other industry leaders to develop sustainable bioremediation solutions using marine microorganisms for eco-friendly pollution control and wastewater treatment. This collaboration aims to harness the unique capabilities of marine life to address environmental contamination.

- In September 2024, Allonnia partnered with Mining3 to promote sustainable mining. This collaboration focuses on bio-solubilization for enhanced ore quality, bio-cementation for waste stabilization, and bio-extraction for recovering valuable elements like rare earth metals. These biological technologies signify a considerable advancement in eco-friendly and effective mining practices.

- In May 2024, Myconaut joined the NVIDIA Inception Accelerator Program to enhance its fungal bioremediation solutions using AI. This strategic move leverages artificial intelligence to improve the efficiency and effectiveness of their mycoremediation technologies for pollutant degradation.

- Report ID: 7683

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioremediation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert