Iron Chelates Market Outlook:

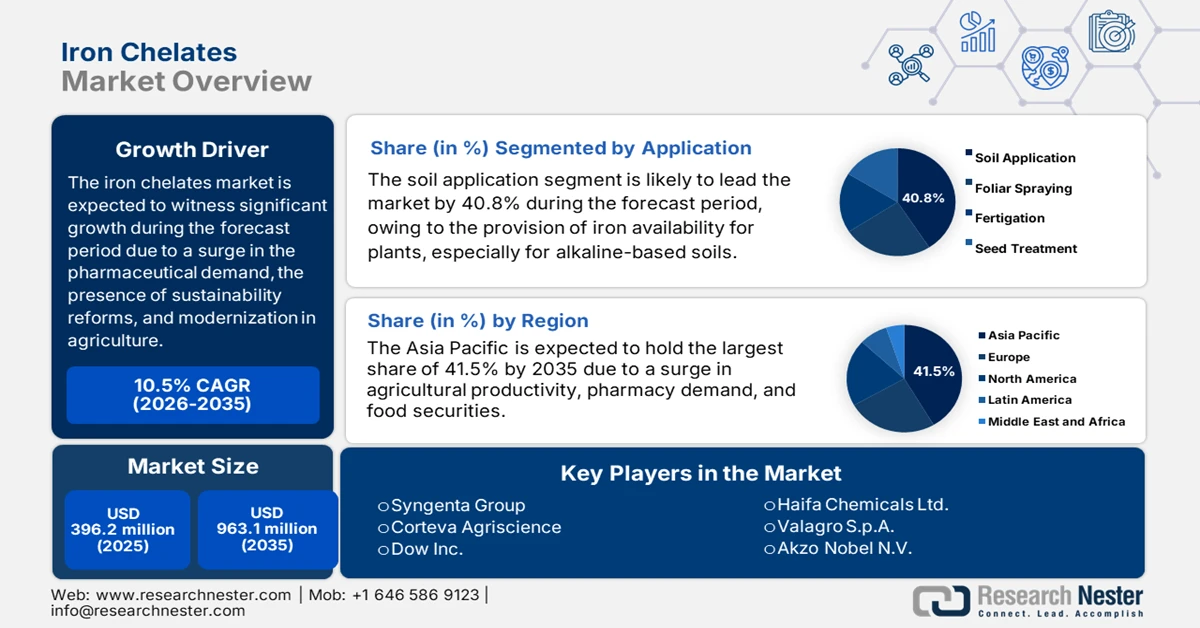

Iron Chelates Market size was over USD 396.2 million in 2025 and is estimated to reach USD 973.1 million by the end of 2035, expanding at a CAGR of 10.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of iron chelates is estimated at USD 437.8 million.

The worldwide iron chelates market is witnessing steady growth, highly fueled by pharmaceutical demand for iron chelation therapies, the presence of sustainability mandates, and agricultural modernization. According to official statistics published by the Global Agricultural Productivity Organization in May 2025, precision agriculture has emerged as one of the critical pathways to gain sustainable productivity growth that is required to meet the 2% yearly growth rate and agricultural demand by the end of 2050. In addition, over 50% of farms in the Midwest states use precision agriculture practices, which is directly fueling the market’s demand internationally. Besides, the almost USD 200 million in federal funding for this particular agricultural mode has been significant, given its increased focus on food security. Therefore, based on the continuous development of precision agriculture, there is a huge growth opportunity for the iron chelates market.

Furthermore, eco-friendly chelates, pharmaceutical expansion, regional growth, and digital integration are other factors driving the global iron chelates market. As per an article published by OECD in November 2025, there has been a surge in the average number of practicing pharmacists per capita by 10%, accounting for 86 pharmacists per 100,000 population. Additionally, 77% of practicing pharmacists operated in community pharmacies as of 2023, and meanwhile, 23% operated in hospitals and other healthcare infrastructures. This denotes the continuous expansion of the pharmaceutical industry, which is readily bolstering the market’s demand across different nations. Moreover, the ongoing iron chlorides supply as a material or source of iron is also skyrocketing the market’s exposure internationally.

2023 Iron Chlorides Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

China Taipei |

84,200 |

- |

|

U.S. |

70,700 |

- |

|

China |

52,400 |

- |

|

Philippines |

- |

235,000 |

|

Japan |

- |

37,300 |

|

Global Trade Share |

0.005% |

|

|

Export Growth |

100% |

|

Source: OEC

Key Iron Chelates Market Insights Summary:

Regional Insights:

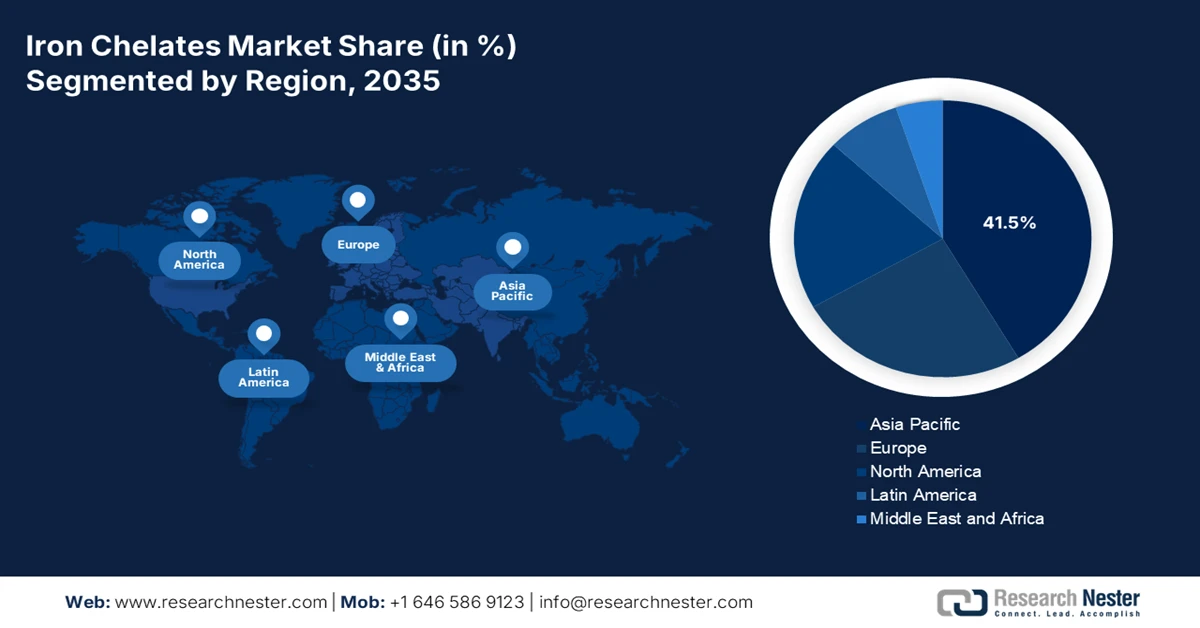

- Asia Pacific is expected to command a dominant 41.5% share by 2035 in the iron chelates market, underscoring its expanding agricultural and pharmaceutical footprint across major economies, supported by rapid farm-scale expansion and policy-led agri-chemical development.

- North America is projected to register the fastest growth during the forecast period, reflecting accelerating uptake across advanced farming systems and life-science applications, reinforced by agricultural modernization and government-supported sustainable chelation initiatives.

Segment Insights:

- Soil Application sub-segment within the application segment is projected to account for a leading 40.8% share by 2035 in the iron chelates market, reflecting its critical role in ensuring plant-available iron in alkaline soils where chelation sustains solubility and uptake, spurred by its effectiveness in mitigating chlorosis in high-pH agricultural conditions.

- EDDHA sub-segment under the type segment is expected to secure the second-largest share by 2035, underpinned by its superior stability in alkaline and calcareous soils that ensures consistent iron availability to crops, reinforced by rising adoption of precision agriculture and sustainability-driven farming practices.

Key Growth Trends:

- Increase in healthcare demand

- Focus on technological advancement

Major Challenges:

- Increase in production expenses

- Regulatory compliance and environmental standards

Key Players: BASF SE (Germany), Nouryon (Netherlands), Syngenta Group (Switzerland), Corteva Agriscience (U.S.), Dow Inc. (U.S.), Yara International ASA (Norway), Haifa Chemicals Ltd. (Israel), Valagro S.p.A. (Italy), Akzo Nobel N.V. (Netherlands), Hebei Monband Water Soluble Fertilizer Co., Ltd. (China), Shandong Luba Chemical Co., Ltd. (China), Nufarm Limited (Australia), Sumitomo Chemical Co., Ltd. (Japan), Mitsubishi Chemical Group Corporation (Japan), LG Chem Ltd. (South Korea), Hanwha Corporation (South Korea), Indian Farmers Fertiliser Cooperative Limited (India), Coromandel International Limited (India), Petronas Chemicals Group Berhad (Malaysia), Sime Darby Plantation Berhad (Malaysia)

Global Iron Chelates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 396.2 million

- 2026 Market Size: USD 437.8 million

- Projected Market Size: USD 973.1 million by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.5% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: India, Brazil, Mexico, Vietnam, Indonesia

Last updated on : 21 January, 2026

Iron Chelates Market - Growth Drivers and Challenges

Growth Drivers

- Increase in healthcare demand: An increase in the prevalence of iron overload diseases, owing to blood transfusions, has bolstered the pharmaceutical demand, which is positively impacting the iron chelates market growth internationally. According to official statistics published by the World Health Organization in May 2025, 54% of blood transfusions are provided to children under the age of 5 years. Meanwhile, across high-income nations, the most prevalent transfused group is more than 60 years of age, accounting for almost 76% of total transfusions. Besides, as per an article published by NCBI in June 2023, nearly 15 million units of red blood cells are transfused every year in the U.S., while almost 85 million are transfused globally, thereby denoting an optimistic outlook for the market’s growth and development.

- Focus on technological advancement: The aspect of research and development investments in innovative formulations tends to optimize stability in various soil conditions, which is also uplifting the iron chelates market globally. As stated in an article published by NLM in March 2025, offsetting the climate-based productivity slowdown by the end of 2050 is poised to increase research and development spending from 5.2% to 7.8% every year. This results in a fixed spending upliftment scenario by an additional USD 2.2 billion to USD 3.8 billion under the supplement spending situation. In addition, this further amounts to an additional USD 208 billion to USD 434 billion or USD 65 billion to USD 113 billion by 2050. Therefore, based on this increased spending, there is a huge growth opportunity for the market to enhance its exposure internationally.

- Surge in agricultural productivity: Iron chelates have become necessary for correcting iron deficiencies, especially in alkaline soils, which are readily widespread in South Europe and the Asia Pacific. According to an article published by the NIH in September 2025, an estimated half of the 1.6 billion anemia cases globally are due to iron deficiency. Besides, the Food and Nutrition Board at the National Academies of Sciences, Engineering, and Medicine has established required dietary allowances for iron intake, including 8 mg to 27 mg for adults, along with 0.27 mg to 27 mg for adolescents, children, and infants, depending on life stage, gender, and age. Moreover, the presence of government-backed food security programs is also responsible for expanding the iron chelates market internationally.

Challenges

- Increase in production expenses: One of the most pressing challenges in the iron chelates market is the high cost of production, particularly for advanced chelates such as EDDHA and DTPA. These compounds require complex synthesis processes and specialized raw materials, which significantly increase manufacturing expenses compared to traditional fertilizers. As a result, iron chelates are often priced higher than conventional micronutrient solutions, limiting their accessibility to smallholder farmers in developing economies. The cost barrier is further amplified by fluctuations in raw material prices, energy costs, and supply chain disruptions. For instance, the global chemical industry has faced rising input costs due to energy market volatility, which directly impacts chelate production.

- Regulatory compliance and environmental standards: Another significant challenge for the iron chelates market is stringent regulatory compliance, especially in Europe and North America. Iron chelates, being chemical compounds, fall under strict environmental and safety regulations. Agencies such as the Europe Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) mandate rigorous testing, registration, and compliance with sustainability standards before products can be marketed. These regulations increase the time-to-market and add substantial costs for manufacturers. For example, Europe’s REACH regulation requires extensive documentation and safety assessments, which can delay product launches and discourage smaller firms from entering the iron chelates market.

Iron Chelates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 396.2 million |

|

Forecast Year Market Size (2035) |

USD 973.1 million |

|

Regional Scope |

|

Iron Chelates Market Segmentation:

Application Segment Analysis

The soil application sub-segment, which is part of the application segment, is anticipated to garner the largest share of 40.8% in the iron chelates market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance for iron readily available to plants, particularly in high-pH or alkaline soils. In this case, iron usually gets locked up, combating plant uptake and causing chlorosis, while chelates protect the iron, thereby keeping it soluble and permitting roots to absorb it effectively. According to official statistics published by NLM in May 2025, almost 57% of croplands witnessed a reduction in yearly soil exposure as of 2022, of which 23% of these reductions were significant. Besides, India, with 92% of its stabilized cropland locations currently undergoing soil exposure duration, thereby proliferating the sub-segment’s exposure within the market.

Type Segment Analysis

The EDDHA sub-segment, as part of the type segment, is projected to hold the second-largest share in the iron chelates market during the forecast period. The sub-segment’s growth is highly fueled by its exceptional stability in alkaline and calcareous soils. Unlike other chelates such as EDTA or DTPA, EDDHA maintains iron solubility even at high pH levels, making it indispensable for regions with alkaline soil conditions, particularly in Southern Europe, the Middle East, and parts of the Asia Pacific. This stability ensures consistent iron availability to crops, preventing chlorosis and boosting yields in cereals, fruits, and vegetables. The sub-segment’s growth is driven by increasing adoption of precision agriculture and sustainability mandates. Farmers prefer EDDHA because it diminishes nutrient losses, improves efficiency, and aligns with eco-friendly farming practices.

End use Segment Analysis

By the end of the stipulated timeline, the fertilizers segment under end use is expected to account for the third-largest share in the iron chelates market. The segment’s development is highly propelled by the aspect of iron chelates that are widely incorporated into soil treatments, foliar sprays, and fertigation systems to address iron deficiencies that limit crop productivity. Their role is particularly critical in regions with alkaline soils, where traditional iron salts are ineffective. Growth in this segment is driven by global food security concerns and government-backed agricultural modernization programs. For instance, India’s National Mission on Sustainable Agriculture and China’s Five-Year Plan for Green Agriculture emphasize micronutrient fertilizers, including iron chelates, to enhance yields and reduce environmental degradation.

Our in-depth analysis of the iron chelates market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

End use |

|

|

Crop Type |

|

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Iron Chelates Market - Regional Analysis

APAC Market Insights

The Asia Pacific iron chelates market is anticipated to garner the largest share of 41.5% by the end of 2035. The market’s upliftment in the region is highly driven by rapid agricultural growth, food security strategies, and pharmaceutical demand. In addition, Japan, India, and China are dominating the regional growth, owing to government-backed chemical advancement and large-scale farming. According to official statistics published by the Green FDC Organization in March 2024, the clean coal re-lending program in China constitutes a remaining quota, amounting to RMB 25.2 billion (USD 3.5 billion) from its overall allocation of RMB 300 billion (USD 42.4 billion). Besides, the green loan balance has reached RMB 30.0 trillion (USD 4.2 billion) as of 2023, denoting a 36.5% year-on-year (YoY) increase and further accounting for 12.7% of the overall loan balance.

The iron chelates market in China is growing significantly due to the government expenditure on chemical technologies, along with administrative bodies prioritizing sustainable agriculture. As stated in an article published by NLM in March 2024, there has been a surge in the number of chemicals to 204 million in the country, and is continued to grow at a rate of millions to more than 10 million yearly in current years. Besides, the country has emerged as the sole and largest producer of chlorinated paraffins and polyfluoroalkyl substances, accounting for an estimated 37% and 40% of the international utilization and production. Moreover, the country’s focus on its Five-Year Plan has emphasized green chemistry and circular economy approaches, thus ensuring to long-lasting demand. Therefore, based on all these factors, there is a huge growth opportunity for the market in the country.

The iron chelates market in India is also growing, owing to an upsurge in fund allocation by the Ministry of Chemicals and Fertilizers for sustainable chemical technologies, along with the Department of Science & Technology (DST) readily supporting research and development in eco-friendly fertilizers. According to official statistics published by the ChemIndia Government in 2024, the value added in the chemicals industry has increased by USD 29.7 billion as of 2024, with an expected 3.2% growth rate by the end of 2029. Besides, in this particular industry, 100% FDI in the country is permitted under the automatic route. Meanwhile, the domestic chemical sector spends on research and development to the extent of 2% to 3% of the overall turnover, in comparison to against 9% to 10% by the multi-national organizations across overseas nations, thereby making it suitable for bolstering the market.

North America Market Insights

North America iron chelates market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by agricultural modernization, pharmaceutical applications, and the presence of government programs for escalating the adoption of sustainable chelation processes. As per an article published by the CSIS Organization in April 2025, the elimination of agriculture-based trade gaps in the region has readily quadrupled, and the U.S. exported USD 174.9 billion of agriculture-based products as of 2023, with USD 32 billion to Canada and USD 28.6 billion to Mexico. Besides, agriculture, food, and associated industries significantly employ 10 million people in Mexico, Canada, and the U.S., and this represents 6%, 7%, and 5.5% of each of the country’s gross domestic product (GDP), thereby bolstering the market’s demand.

The iron chelates market in the U.S. is gaining increased traction due to governmental sustainability programs, the aspect of federal funding for clean energy chemicals, safety regulations, and advanced manufacturing. As per an article published by the U.S. Department of War in October 2022, manufacturers in the overall region contribute over USD 2.3 trillion to the country’s economy, with every dollar spent in manufacturing leading to an additional USD 2.7 added to the economy. Besides, at present, the manufacturing industry in the U.S. displays only 11% of the country’s GDP, accounting for 35% of the overall regional productivity growth, along with 60% of the total exports. Moreover, the aspect of manufacturing readily employs more than 12.5 million people and offers wage-based employment opportunities. Therefore, with extreme exposure to manufacturing, the market is gaining more importance in the country.

The iron chelates market in Canada is also developing, owing to federal investment in sustainable chemicals, agricultural modernization programs, along with safety and environmental standards. Based on government estimates published by the Government of Canada in November 2023, the Minister of Emergency Preparedness and Minister is significantly responsible for the Pacific Economic Development Agency of Canada (PacifiCan) and declared funding of more than USD 1.1 million to Burnaby-based Greenlight Innovation Corporation. This has been suitable for manufacturing and developing hydrogen fuel cells, energy storage devices, and electrolysers, which are boosting the chemical sector in the country. Besides, as per the Hydrogen Strategy for Canada, the international hydrogen sector is projected to reach USD 300 billion by the end of 2030, which is also proliferating the market’s growth.

Europe Market Insights

Europe iron chelates market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by pharmaceutical demand, sustainability mandates, and agricultural modernization. As per official statistics published by EFPIA in 2024, the research-specific pharmaceutical sector in the region initiated an investment of €50,000 million and directly employs 900,000 people, while generating almost 3 times more employment indirectly. Besides, the expense of researching and developing the latest biological or chemical entity is estimated to be €3,130 million (USD 3,296 million). Moreover, the UK, Spain, Italy, Germany, and France jointly account for 15.8% new medicines cover for active ingredients. Additionally, the aspect of parallel imports in pharmacy is also bolstering the market in the overall region.

Country-Wise Parallel Imports Share for the Pharmacy Market in Europe (2022)

|

Countries |

Imports Share (%) |

|

Austria |

4.3 |

|

Belgium |

3.7 |

|

Denmark |

29.4 |

|

Finland |

2.5 |

|

Germany |

7.0 |

|

Ireland |

5.4 |

|

Netherlands |

5.4 |

|

Norway |

2.6 |

|

Poland |

1.7 |

|

Sweden |

11.2 |

|

UK |

9.9 |

Source: EFPIA

The iron chelates market in Germany is gaining increased exposure due to advanced research and development facilities, stringent government support, and precision in agriculture adoption. According to an article published by the ITA in August 2025, food prices in the country increased by nearly 2.2% as of 2024, in comparison to previous years. Besides, as per the 2026 FABLE Consortium article, the agriculture industry in the country is significantly responsible for approximately 9% of the domestic emissions, which readily accounted for 62.4 million tons of carbon dioxide equivalents. Furthermore, the country has effectively set an economy-based emissions reduction target of almost 65% by the end of 2030, along with 88% by the end of 2040, which is also creating a huge growth opportunity, along with an increase in demand for the market in the country.

The iron chelates market in the UK is also developing due to an increased focus on DEFRA’s agricultural modernization programs, readily emphasizing micronutrient fertilizers for food security. According to a data report published by the UK Government in October 2025, the country is focused on reducing greenhouse gas emissions by almost 80% by the end of 2050. In addition, this particular target reduction within the Climate Change Act was successfully amended to nearly 100% reduction. Besides, in terms of clean energy transition, the country comprises the largest market share of electric vehicles amongst the majority of regional automotive markets. This is highly driven by the public support for decarbonization, with savings amounting to £1,500 every year. Therefore, this increased focus on the environmental aspect reflects robust governmental assistance for sustainable chemical advancement, which is bolstering the market’s exposure.

Key Iron Chelates Market Players:

- BASF SE (Germany)

- Nouryon (Netherlands)

- Syngenta Group (Switzerland)

- Corteva Agriscience (U.S.)

- Dow Inc. (U.S.)

- Yara International ASA (Norway)

- Haifa Chemicals Ltd. (Israel)

- Valagro S.p.A. (Italy)

- Akzo Nobel N.V. (Netherlands)

- Hebei Monband Water Soluble Fertilizer Co., Ltd. (China)

- Shandong Luba Chemical Co., Ltd. (China)

- Nufarm Limited (Australia)

- Sumitomo Chemical Co., Ltd. (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- LG Chem Ltd. (South Korea)

- Hanwha Corporation (South Korea)

- Indian Farmers Fertiliser Cooperative Limited (India)

- Coromandel International Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Sime Darby Plantation Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- BASF SE is one of the largest global suppliers of agricultural micronutrients, including iron chelates, with strong research and development capabilities in sustainable fertilizer solutions. The company focuses on eco-friendly formulations aligned with Europe Green Deal regulations, ensuring long-term stability in alkaline soils and supporting precision agriculture.

- Nouryon is a leading producer of specialty chemicals, including chelated micronutrients like iron chelates, widely used in agriculture. The company emphasizes innovation in water-soluble fertilizers and sustainable chemistry, strengthening its presence in Europe and the Asia Pacific markets.

- Syngenta Group integrates crop protection and nutrition solutions, with iron chelates forming part of its micronutrient portfolio. Its strategy focuses on improving crop yields in iron-deficient soils, supported by precision farming technologies and partnerships with agritech firms.

- Corteva Agriscience offers a broad range of crop protection and nutrient solutions, including iron chelates for soil and foliar applications. The company invests heavily in sustainability initiatives, aligning with U.S. agricultural modernization programs to enhance micronutrient efficiency.

- Dow Inc. contributes to the iron chelates market through advanced chemical formulations used in fertilizers and soil treatments. Its focus is on supply chain integration and innovation in chelation chemistry, supporting U.S. agricultural productivity and sustainable farming practices.

Here is a list of key players operating in the global iron chelates market:

The international iron chelates market is highly competitive, with multinational corporations and regional leaders vying for market share through innovation, sustainability, and geographic expansion. Europe-based firms, such as BASF and Nouryon, dominate with advanced research and development capabilities, while U.S. players such as Corteva and Dow leverage integrated supply chains. Asia-specific companies, including Sumitomo Chemical and LG Chem, focus on eco-friendly formulations and precision agriculture solutions. Strategic initiatives include mergers, acquisitions, and partnerships to strengthen distribution networks, alongside investments in bio-based chelates. Besides, in October 2025, Nouryan introduced HBED, which is the world’s strongest iron chelate, with unmatched performance, efficiency, and stability. This HBED has readily redefined iron availability in high pH soils, thereby ensuring plants get the required nutrition, thus bolstering the iron chelates industry’s growth globally.

Corporate Landscape of the Iron Chelates Market:

Recent Developments

- In December 2025, Cyvex Nutrition announced its tactical sales partnership with SloIron Inc. to significantly distribute SloIron, which is the first-ever plant-based ferritin iron ingredient readily designed to optimize customer compliance and diminish formulation risks.

- In April 2025, BASF Care Chemicals has declared the introduction of Trilon G chelating agent, which readily uses glutamic acid diacetate (GLDA) chemistry. This has complemented the current range of chelating agents of the organization, including methylglycinediacetic acid (MGDA) and tetrasodium ethylenediaminetetraacetate (EDTA).

- In February 2024, Pharmacosmos Group notified the acquisition of AbFero Pharmaceuticals, Inc. under the share purchase deal for an overall consideration of almost USD 225 million by combining upfront expenses, royalties, commercial milestones, and regulations.

- Report ID: 8357

- Published Date: Jan 21, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Iron Chelates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.