Direct Reduced Iron Market Outlook:

Direct Reduced Iron Market size was over USD 64.61 billion in 2025 and is projected to reach USD 146.08 billion by 2035, witnessing around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of direct reduced iron is evaluated at USD 69.55 billion.

Globally steel industry is the biggest contributor to greenhouse gas emissions in the atmosphere. Generally, iron is produced with the help of a blast furnace route which is one reason behind high carbon emissions. However, the directly reduced iron does not produce a high amount of greenhouse gases, particularly carbon dioxide. It enables more environment-friendly approaches to be adopted by steel producers, which reduces their carbon footprint and mitigates climate change. The growing demand for direct reduced iron as a primary raw material for steel production due to its low carbon emissions compared with traditional Iron Production Process is an important factor driving the development of the direct reduced iron market driven by increasing focus on energy efficiency and reducing greenhouse gas emissions in the steel industry. Thus, growing steel production is predicted to drive the growth of the market in the forecast period. According to the World Steel Association, global crude steel production stood at 1,950.5 million tons in 2021 and is expected to grow by 3.7% compared with 1,880.4 million tons in 2020.

Steel is a principal raw material for products and projects in many sectors, including construction, the automobile sector as well as industry. The growth of infrastructure, urbanization, automotive manufacturing and industrial production is having a positive impact on steel demand. In view of continued increases in steel consumption, there is a corresponding need for iron production, which constitutes an essential part of the manufacture of steel.

Key Direct Reduced Iron Market Insights Summary:

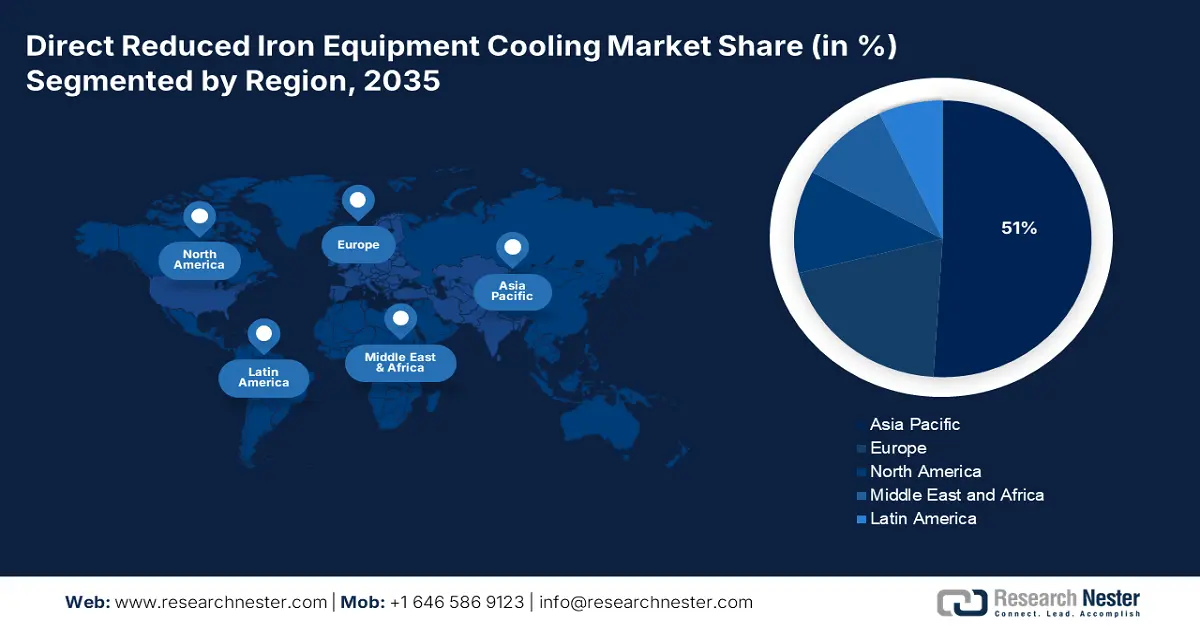

Regional Highlights:

- The Asia Pacific direct reduced iron market will dominate over 51% share by 2035, driven by high steel production, increasing demand from construction and automotive sectors, and rapid infrastructure development.

- The Europe market will achieve substantial CAGR from 2026 to 2035, fueled by adoption of advanced DRI technologies, improved energy efficiency, and reduced operational costs.

Segment Insights:

- The gas based segment in the direct reduced iron market is anticipated to capture a 53% share by 2035, fueled by the efficiency and environmental benefits of gas-based iron production.

- The pellets segment in the direct reduced iron market is forecasted to secure a 47% share by 2035, driven by the high iron content and consistent feedstock benefits of iron ore pellets in DRI processes.

Key Growth Trends:

- Growing Integration of Gas Based Direct Reduction Technologies Instead of Coal Based Methods

- Integration of Industry 4.0 Technologies

Major Challenges:

- Growing Integration of Gas Based Direct Reduction Technologies Instead of Coal Based Methods

- Integration of Industry 4.0 Technologies

Key Players: Suez Steel Co., Qatar Steel, JFE Steel Corporation, Tata Steel, JSW Group, ArcelorMittal, SABIC, Welspun Group.

Global Direct Reduced Iron Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 64.61 billion

- 2026 Market Size: USD 69.55 billion

- Projected Market Size: USD 146.08 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: India, Iran, Saudi Arabia, Russia, Mexico

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Direct Reduced Iron Market Growth Drivers and Challenges:

Growth Drivers

- Growing Integration of Gas Based Direct Reduction Technologies Instead of Coal Based Methods - The gas-based technologies aid in reducing carbon footprints in steel-making procedures. These methods reduce or eliminate reliance on coal and coke, both of which are major carbon emitters, through the use of natural gas or hydrogen as a reducing agent. The adoption of gas-fueled direct reaction technologies is an effective means for reducing carbon emissions and promoting sustainability in the steel sector, given that firms are seeking to achieve carbon neutrality as well as comply with more stringent environmental regulations. Direct reduction using natural gas is a proven method that has been in use for many years. In 2019, its production rate was close to 82 million tons.

- Integration of Industry 4.0 Technologies - Efficiency enhancement and advanced process optimization are enabled with the integration of Industry 4.0 in DRI production. Automation and robotics have the potential to replace significant procedures such as mixing, material handling, feeding, and discharge operations. Operational efficiency can be substantially improved through the automation of redundant tasks and reductions in human intervention. In order to determine trends, patterns, and anomalies that optimize the parameters in the production process, reduce waste as well and improve total productivity, AI-powered algorithms may also analyze manufacturing data from an instant point of view.

Challenges

- High Initial Status and Operational Costs - Significant capital investment is required for the establishment of a DRI plant. Complicated engineering, procurement, and construction processes including the installation of technology like Direct Reduced Reactors, Gas Reforming Systems, or Gas Turbines are required to build a DRI plant. There may be considerable costs associated with building and commissioning a power station, as well as the necessary infrastructure. Apart from the capital investments, there may also be substantial operational costs associated with DRI production. These are predicted to hamper the direct reduced iron market expansion in the projected period.

- Fluctuation in Raw Material Prices Especially in Natural Gas - There are generally long-term planning and development phases in DRI projects. Anyhow, the possibility of these projects depends on their price assumptions and current market conditions. Such calculations are subject to uncertainty as a result of volatility in gas prices. It can lead to unfavorable financial results that render the DRI project economically unviable if prices are higher than projections made at the initial evaluation stage. This could harm the growth of the globally distributed renewable energy market, by making potential investors and companies hesitate to invest in such power plants.

- Impact of the COVID-19 pandemic is set to hamper the market growth in the estimated period.

Direct Reduced Iron Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 64.61 billion |

|

Forecast Year Market Size (2035) |

USD 146.08 billion |

|

Regional Scope |

|

Direct Reduced Iron Market Segmentation:

Forms Segment Analysis

In terms of form segmentation, the pellets segment in the direct reduced iron market is predicted to hold the largest revenue share of 47% by 2035. The direct reduced iron pellets are made up of run-of-mine iron ores. In addition, iron ore pellets can provide several advantages, such as the common size and composition of iron ore pallets that help to ensure that there will be consistent feedstocks in the DRI process. With the consistency of these iron balls, it is thus easier to achieve a safe and controlled reduction process. The iron ore pellets have a high iron content of around 70%, which allows them to be more efficient in reducing and results in increased dried mineralization yields.

Production Process Segment Analysis

Direct reduced iron market share from the gas based segment is expected to surpass 53% by the end of 2035. Gas-based production is essentially a reverse current process in which hot and highly reducing gases are used to make lump iron ore or pellets into metallic iron. Compared to other processes, gas-based production is relatively efficient in terms of benefits provided by the Gas Production Process. The way this is done makes it possible to control the reduction process as precisely as other iron-making processes, resulting in lower energy consumption. Furthermore, owing high adoption of natural gas and considering environmental concerns the growth of this segment is predicted to grow in the projected period. The world's consumption of natural gas amounted to approximately 3,84 trillion cubic meters in 2022.

Our in-depth analysis of the global market includes the following segments:

|

Forms |

|

|

Production Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Direct Reduced Iron Market Regional Analysis:

APAC Market Insights

The Asia Pacific direct reduced iron market is predicted to hold the largest revenue share of 51% by 2035. The Asia-Pacific region is a major hub for steel production, with countries such as China, India, and Japan leading the way. As steel demand continues to increase in sectors such as construction, automotive, and infrastructure development, a stable and cost-effective supply of steel is required. DRI provides a reliable and efficient alternative to traditional steelmaking methods. Its use in steel production will help meet the growing demand for steel in the region, thereby driving the growth of the DRI market. Rapid infrastructure development, growing investment in development, and urbanization in countries such as China and India are driving demand for steel in the Asia-Pacific region. Welspun announced plans to invest about USD 5 billion in Telangana over the next five years, across segments such as IT and ITES clusters and logistic parks, in September 2023. Welspun World Chairman B.K. Goenka said that it would create around 50,000 jobs, including 20,000 direct and 30,000 indirect ones.

European Market Insights

The direct reduced iron market in the Europe region is expected to grow substantially by the end of 2035. In the production process, operational efficiency and energy consumption have been greatly improved due to the development of advanced DRI technologies in the region. The modern generation of distributed renewable energy plants offers enhanced energy recovery systems and optimized process parameters that lead to a reduced power requirement for each tonne of DRI produced. Given the increased energy costs and environmental concerns, energy efficiency is an essential factor for Europe's steel producers.

Direct Reduced Iron Market Players:

- Gallantt Group of Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nucor Corporation

- Jindal Shadeed Iron & Steel

- Tosyali Algerie

- Suez Steel Co.

- Qatar Steel

- JFE Steel Corporation

- Tata Steel

- JSW Group

- ArcelorMittal

- SABIC

- Welspun Group

Recent Developments

- IBM and JFE Steel have entered into a partnership in September 2023 with the aim of providing JAVA's mAIster and fault recovery systems, supported by IBM Watson AL. It was initially designed for the application of JFE steel itself in domestic and international markets but has now been extended to include such applications.

- By buying the majority of Voestalpine's shares in Texas, ArcelorMittal made a deal to acquire Voestalpine in 2022. Acquiring the HBI facilities is an essential component of this acquisition. It's the kind of iron that is directly reduced.

- Report ID: 4416

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Direct Reduced Iron Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.