Self-service Kiosk Market Outlook:

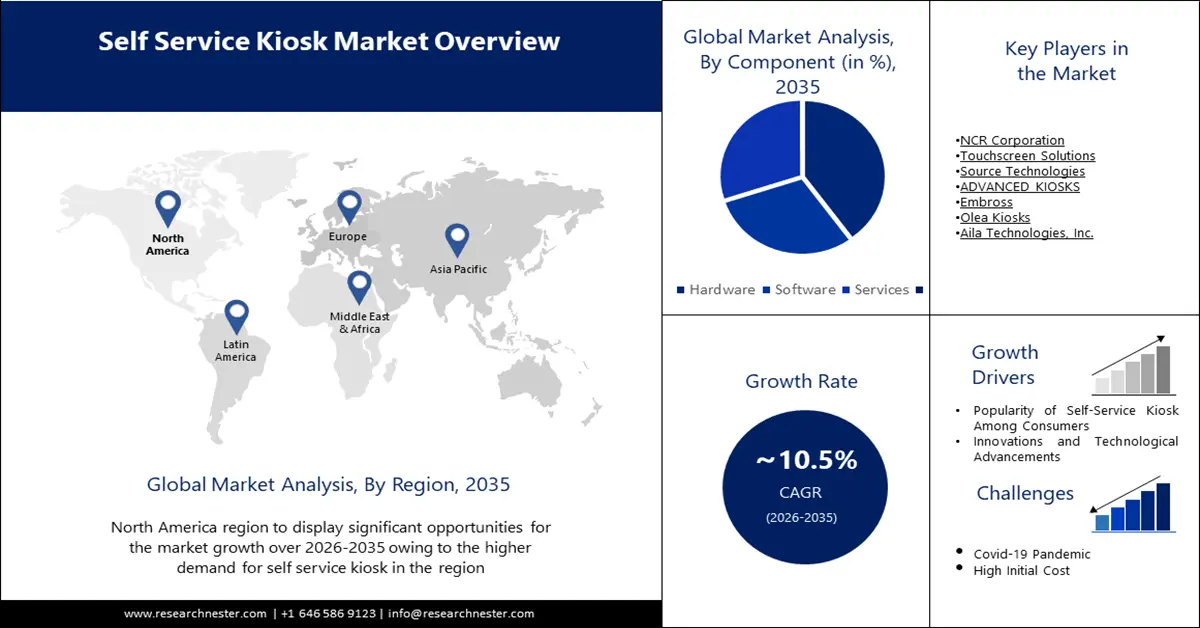

Self-service Kiosk Market size was over USD 14.63 billion in 2025 and is anticipated to cross USD 39.71 billion by 2035, growing at more than 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of self-service kiosk is estimated at USD 16.01 billion.

The self-service kiosk market is experiencing significant growth as kiosks become prevalent across various sectors globally. Integration of features such as touchless interfaces and advanced payment processing technologies are further propelling the market expanison. For instance, in August 2023, SITA upgraded Air France-KLM Group’s existing line-up of 400 self-service kiosks in Paris’ Charles de Gaulle Airport, and Amsterdam’s Schiphol Airport, intending to deliver new functionalities for passengers such as contactless payments.

The retail industry is a major consumer with applications such as self-checkout, product information, and order and payment processing. Self-service kiosks are also widely used in the hospitality industry, especially in fast-food restaurants, cafes, and hotels, which is inviting more investments in the region’s market. For instance, in October 2024, Irish-headquartered Ordú invested USD 1.54 million with Lazenby Group which is a global kiosk manufacturer. The collaboration is forecasted to generate USD 9.2 million in additional revenues for Ordú in the next 3 years.

In addition, technological advancement and innovations have allowed the invention of self-service technologies and innovation, these technologies include ticketing machines, ATMs, mobile scanning, barcode reader, and others. Self-service kiosk-wide utilization can be seen in shopping malls, supermarkets, banks, private sectors, hospitals, amusement parks, etc. In the self-service kiosk industry, improving customer comfort has been the only focus point, therefore, multiple technologies and innovations have been introduced for the ease of people.

Key Self Service Kiosk Market Insights Summary:

Regional Highlights:

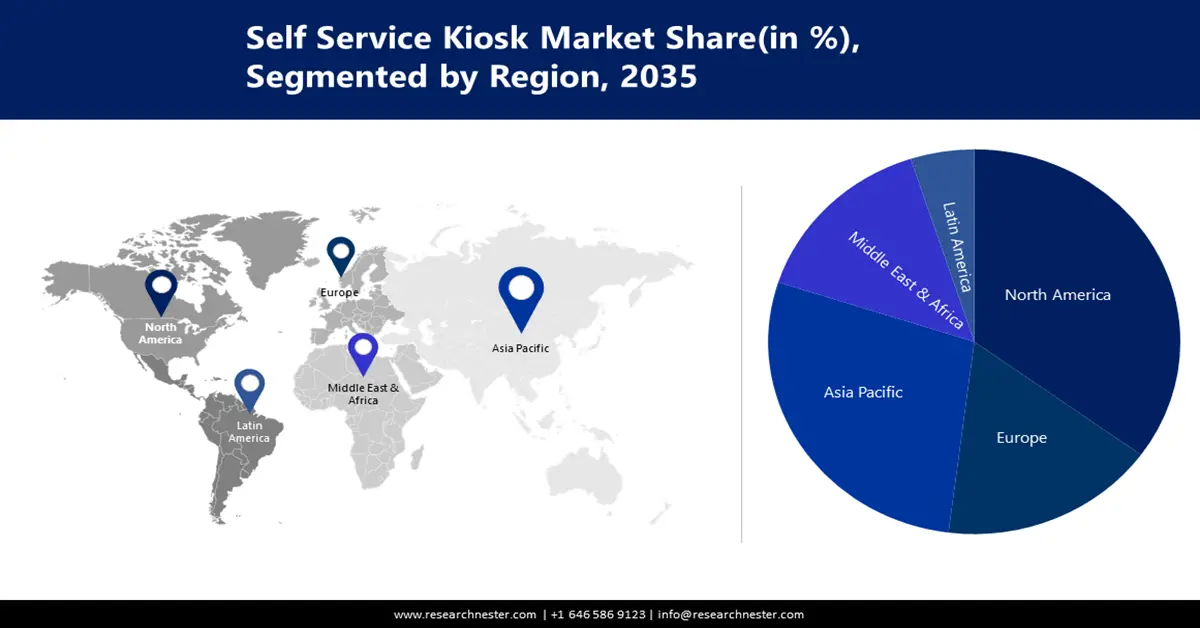

- North America self-service kiosk market will hold around 36% share by 2035, driven by rapid adoption of self-service kiosks and investments in retail stores, along with rising demand for faster, personalized, and contactless transactions.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rising installations of self-service kiosks in metro cities and the surge in penetration of digital solutions in healthcare infrastructure.

Segment Insights:

- The hardware (component type) segment in the self-service kiosk market is anticipated to achieve the largest share by 2035, propelled by the critical role of hardware in enabling reliable and interactive kiosk operations.

- The retail kiosk segment is anticipated to maintain a dominant share by 2035, propelled by self-checkout demand and the ability to advertise without entering the store.

Key Growth Trends:

- Innovations and technological advancements

- Improved connectivity

Major Challenges:

- High initial investment

- Maintenance issues

Key Players: KIOSK Information Systems, NCR Corporation, Touchscreen Solutions, Source Technologies, ADVANCED KIOSKS, Embross, Olea Kiosks, Aila Technologies, Inc., REDYREF, DynaTouch.

Global Self Service Kiosk Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.63 billion

- 2026 Market Size: USD 16.01 billion

- Projected Market Size: USD 39.71 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 October, 2025

Self-service Kiosk Market Growth Drivers and Challenges:

Growth Drivers

- Innovations and technological advancements: Integration of AI, IoT, and biometrics have significantly enhanced the functionality and user experience of self-service kiosks. In July 2024, Diebold Nixdorf equipped Dorfladen Freckenfeld– Powered by EDEKA Paul with two DN Series EASY eXpress self-service checkouts for cashless payment, with AI-powered automatic age verification. These factors along with the development in Near-Field Communication (NFC) and Radio-Frequency Identification (RFID) in security applications are estimated to generate healthy market growth.

- Improved connectivity will boost the self-service kiosk market revenue: Enhanced internet infrastructure, widespread availability of high-speed networks, and reliable WiFi have boosted the functionality of self-service kiosks. Faster and more stable connectivity allows kiosks to process transactions quickly, provide real-time updates, and integrate seamlessly with cloud-based systems for data storage and management. This improved connectivity also supports advanced features such as remote monitoring, software updates, and troubleshooting, reducing downtime and operational costs. As a result, businesses can offer smoother and more efficient services to users.

Challenges

-

High initial investment: The deployment of self-service kiosks involves substantial upfront expenses, including the cost of sophisticated hardware. Additionally, installation requires skilled labor to ensure proper integration. For businesses, especially small to medium enterprises, this significant investment can pose a barrier to adoption despite the potential long-term benefits.

- Maintenance issues: Constant interaction with users leads to wear and tear of critical components such as screens, printers, and card readers. Regular maintenance is essential to prevent downtime and ensure optimal functionality, but it adds to operational costs. Moreover, unforeseen technical glitches or environmental factors, such as dust and temperature variations, can accelerate degradation, making consistent upkeep a challenge for businesses.

Self-service Kiosk Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 14.63 billion |

|

Forecast Year Market Size (2035) |

USD 39.71 billion |

|

Regional Scope |

|

Self-service Kiosk Market Segmentation:

Product Type

The retail kiosk is estimated to dominate the self-service kiosk market share by 2035, owing to focus on self-checkout along with the offering of advertisements without actually entering the retail stores. Further, the retail kiosk provides product information and services in order to capture the attention of customers. The retail kiosk terminates long queues at the payment desk. Moreover, rising smart retail stores deploying retail kiosks are boosting the market growth. For instance, in April 2024, Fiserv, Inc. which is a global provider of payments and financial technology solutions, launched Clover Kiosk, to help restaurants streamline operations and enhance the customer experience. This solution allows end-to-end order management with up to a 40% lower total cost of ownership in comparison to the competitive offerings.

Component Type

The hardware segment is estimated to account for the largest market share during the forecast period. Equipment such as printers, displays, and others are the main part of the hardware sector. Mechanisms to control and integrate hardware components are made by independent software developers and system integrators of kiosk apps. These components enable seamless interaction, reliable performance, and integration of advanced technologies including biometrics, and NFC, making hardware a critical and high-demand aspect of self-service kiosks. In order to enhance the utilization of interactive kiosks, manufacturers are collaborating hardware elements with software platforms.

Our in-depth analysis of the global self-service kiosk market includes the following segments:

|

Product Type |

|

|

Component Type |

|

|

Payment Method Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Self-service Kiosk Market Regional Analysis:

North American Market Insights

North America self-service kiosk market is poised to dominate the majority revenue share with 36% by 2035. This can be attributed to the rapid adoption of self-service kiosks along with the rising investments in the establishment of retail stores. Additionally, the well-developed banking sector infrastructure and the presence of quick-service restaurants are driving the growth of the market. For instance, as per 2022 statistics, Mcdonald's, with nearly 14,000 stores operates as many as 700 self-service kiosks, in the U.S. Developed infrastructure, and a tech-obsessed customer base has boosted the extensive acceptance and distribution of self-service kiosks in the region.

The self-service kiosks market in the U.S. is majorly driven by increasing labor costs and the need to optimize operational efficiency. Furthermore, government initiatives encouraging digital transformation and the integration of secure payment systems are catalyzing the adoption of these kiosks across various industries in the country. Consumer demand for faster, personalized, and contactless transactions has significantly influenced market growth. For instance, in September 2024, Raydiant launched its self-service Order & Pay Kiosk, for restaurant and quick-service restaurant (QSR) businesses of all sizes.

APAC Market Insights

The Asia Pacific self-service kiosk market is estimated to be the fastest-growing through 2035. This can be ascribed to rising installations of self-service kiosks in metro cities along with the surge in penetration of digital solutions in healthcare infrastructure. The growth of organized retail, BFSI, and the tourism sector in the region is propelling the market size. Rising GDP, increasing disposable income, and consumer spending power are a few more of the region’s market drivers. In June 2021, Samsung Electronics announced the expanded availability of Samsung Kiosk, an all-in-one solution that offers contactless ordering and payment capabilities in several countries around the world, including Australia, and Singapore.

India market is experiencing robust growth, fueled by rising demand for efficient, self-service options in sectors such as retail, healthcare, and banking. Businesses are increasingly implementing these kiosks to enhance customer experience, reduce operational costs, and improve service delivery. For instance, in May 2024, Adani Total Gas Ltd. (ATGL) launched its first-ever self-service kiosk to empower the City Gas Distribution (CGD) customers. Integration of touchscreen and secure payment systems is further fueling the market revenue.

Self-service Kiosk Market Players:

- KIOSK Information Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NCR Corporation

- Touchscreen Solutions

- Source Technologies

- ADVANCED KIOSKS

- Embross

- Olea Kiosks

- Aila Technologies, Inc.

- REDYREF

- DynaTouch

Recent Developments

- In November 2024, IDEMIA Public Security North America partnered with Tennessee Department of Safety and Homeland Security (TDOSHS) to launch their SMART-E Kiosksat Tennessee Driver Service Centers to reduce customer wait times.

- In March 2023, SumUp unveiled its sector-leading SumUp Kiosk solution designed to transform how businesses process orders and enables customers to seamlessly order, pay, and collect their orders via self-order kiosks.

- Report ID: 2772

- Published Date: Oct 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Self Service Kiosk Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.