Inorganic Flame Retardants Market Outlook:

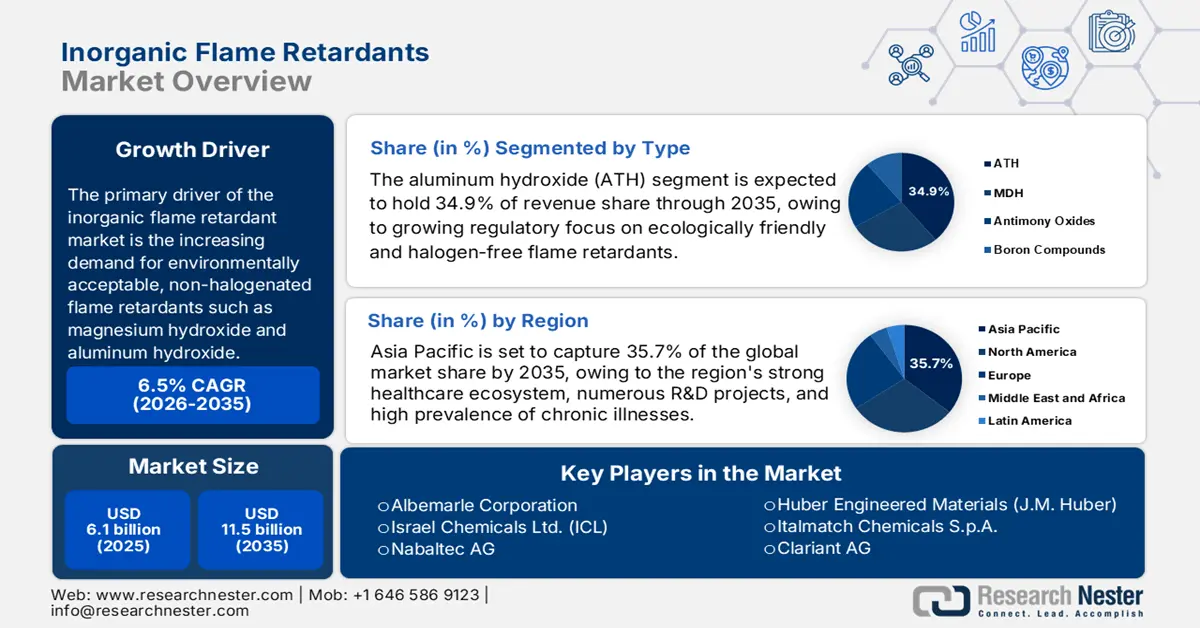

Inorganic Flame Retardants Market size was valued at USD 6.1 billion in 2025 and is projected to reach USD 11.5 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of inorganic flame retardants is estimated at USD 6.5 billion.

The primary driver of the inorganic flame retardants market is the increasing demand for environmentally acceptable, non-halogenated flame retardants such as magnesium hydroxide and aluminium hydroxide. Stricter environmental sustainability regulations and increased consumer awareness of fire safety, especially in the Asia-Pacific, North American, and European countries, are driving this trend. The use of inorganic flame retardants has significantly increased as a result of the shift away from halogenated ones because of health and environmental concerns.

The availability of raw materials like magnesium compounds and aluminium has a direct impact on the supply chain for inorganic flame retardants. About 4.3 million metric tons of aluminium were produced in the US in 2021, with substantial imports helping to meet industrial demand. In a similar vein, imports and production of magnesium are essential to guaranteeing a consistent supply for the creation of flame retardants. To fulfill the growing demand, the industry has witnessed investments aimed at increasing manufacturing facilities.

Key Inorganic Flame Retardants Market Insights Summary:

Regional Highlights:

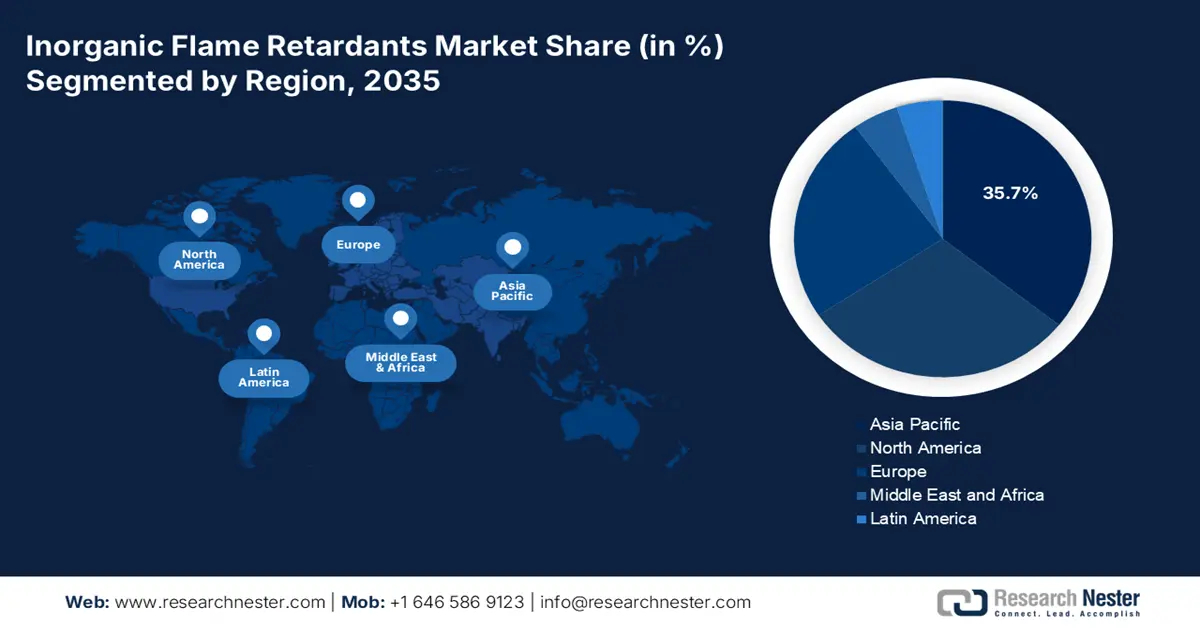

- The Asia-Pacific region is expected to command about 35.7% share of the inorganic flame retardants market by 2035, owing to expanding electrification, industrial growth, and stringent sustainability regulations across emerging economies.

- North America is projected to secure a 27.7% share of the market by 2035, encouraged by strict fire safety norms and the expanding application of eco-friendly retardants in the automotive and electronics sectors.

Segment Insights:

- The aluminium hydroxide (ATH) segment in the inorganic flame retardants market is projected to account for around 34.9% share by 2035, propelled by the growing demand for non-toxic, halogen-free materials aligned with stringent fire safety regulations.

- The polyolefins segment is anticipated to capture a 28.1% share by 2035, supported by rising adoption in automotive and construction applications emphasizing lightweight and fire-resistant materials.

Key Growth Trends:

- Regulatory phase-out of halogenated flame retardants

- Enhanced fire safety building codes and construction standards

Major Challenges:

- Volatility in raw material prices

- Challenges in recycling and circular economy integration

Key Players: Albemarle Corporation, Israel Chemicals Ltd. (ICL), Nabaltec AG, Huber Engineered Materials (J.M. Huber), Italmatch Chemicals S.p.A., Clariant AG, Kyowa Chemical Industry Co., Ltd., Kisuma Chemicals, Posco Chemical Co., Ltd., Tata Chemicals Ltd., Redox Pty Ltd, Chemical Company of Malaysia Berhad (CCM), Lanxess AG, ADEKA Corporation, DIC Corporation.

Global Inorganic Flame Retardants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.1 billion

- 2026 Market Size: USD 6.5 billion

- Projected Market Size: USD 11.5 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (35.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: South Korea, Indonesia, Vietnam, Mexico, Brazil

Last updated on : 3 October, 2025

Inorganic Flame Retardants Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory phase-out of halogenated flame retardants: The European Chemicals Agency (ECHA) has officially recognized aromatic brominated flame retardants, including polybrominated diphenyl ethers, as candidates for EU-wide restrictions under REACH, owing to their persistent, bioaccumulative, or toxic nature. This regulatory pressure compels manufacturers to explore non-halogenated and inorganic flame retardants as substitutes. For instance, companies that previously relied on decaBDE are now required to consider inorganic hydrates, such as aluminium trihydrate or magnesium hydroxide, to ensure compliance with regulations.

- Enhanced fire safety building codes and construction standards: China's updated GB 8624-2022 flammability standard for construction materials, which took effect in March 2023, requires improved fire resistance in high-rise and public buildings. This has resulted in approximately a 12% year-on-year increase in the consumption of magnesium hydroxide and aluminium trihydrate for wiring, cables, and insulation in 2023 within the country. Such regulations compel building material manufacturers to integrate inorganic flame retardants to satisfy the heightened standards; for example, insulation product lines are transitioning from organohalogen-based to mineral-based additives.

- Government-led assessments of alternatives and partnerships: The U.S. EPA, through its Safer Choice / Design for the Environment initiatives, has engaged in partnerships to evaluate alternatives to hazardous flame retardants like DecaBDE and HBCD, reviewing numerous potential replacements. Since many of these candidates are inorganic or non-halogenated, this fosters the industry's utilization of these safer chemistries. For instance, several of the alternatives being assessed include metal hydroxides, mineral-based compounds, or other low-toxicity materials, which manufacturers are adopting to remain proactive in compliance and secure Safer Choice certification.

1. Raw Aluminium Trade

The trade of raw aluminum drives the market by supporting industries where aluminum is a primary material, such as automotive, construction, and electrical applications. Many of these sectors require flame-retardant coatings, additives, or composites to enhance aluminum’s fire resistance and meet strict safety regulations. Inorganic flame retardants like aluminum hydroxide and magnesium hydroxide are often integrated with aluminum-based materials to improve thermal stability and reduce flammability. As international trade expands, the availability of raw aluminum and demand for complementary flame-retardant solutions also rise, creating growth opportunities for suppliers of inorganic flame-retardant chemicals.

Production of Raw Aluminium (2024)

|

Region |

Trade Volume (USD) |

|

Mexico |

832M |

|

Malaysia |

432M |

|

Canada |

328M |

|

France |

32M |

|

Thailand |

16.4M |

Source: OEC

2. EV Trade Dynamics

Electric vehicles, such as EV trucks, rely on large lithium-ion battery packs that pose higher fire and thermal runaway risks, creating a strong need for efficient flame retardants. Inorganic flame retardants, such as aluminum hydroxide, magnesium hydroxide, and phosphorus-based compounds, are widely used in cables, casings, and battery housings to meet stringent safety standards. As international trade expands and the adoption of electric trucks across regions increases, manufacturers are increasing procurement of inorganic flame retardants to ensure regulatory compliance, safety, and reliability.

Export/ Import of Electric Trucks (2023)

|

Leading Exporters |

Value (USD Million) |

Leading Importers |

Value (USD Million) |

|

China |

869 |

Canada |

666 |

|

U.S. |

839 |

UK |

639 |

|

Germany |

649 |

Belgium |

515 |

|

Turkey |

628 |

Norway |

443 |

|

Canada |

165 |

Germany |

437 |

Source: OEC

Challenges

- Volatility in raw material prices: The price of raw materials significantly affects the inorganic flame-retardant industry. In 2021, China's antimony production decreased by 12.2%, resulting in a 28.1% increase in pricing. The price of tetrabromobisphenol A rose by USD 1,201 per ton as a result of companies having to adjust their pricing strategies due to a 58.1% increase in crude oil prices between 2020 and 2022.

- Challenges in recycling and circular economy integration: Recycling efforts are severely hampered by waste that contains flame retardants. As they can contaminate other recyclables or inhibit material recycling, toxic contaminants can hinder the circular economy. The EU's Waste Electrical and Electronic Equipment Directive, for instance, imposes severe limits on the quantity of BFR in recovered plastics, which has led to corporations investing in material recovery equipment.

Inorganic Flame Retardants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 6.1 billion |

|

Forecast Year Market Size (2035) |

USD 11.5 billion |

|

Regional Scope |

|

Inorganic Flame Retardants Market Segmentation:

Type Segment Analysis

The aluminium hydroxide (ATH) segment, based on component, is projected to gain about 34.9% share through 2035. Its supremacy is explained by the fact that it is non-toxic and good at suppressing smoke and flames. When ATH breaks down endothermically, water vapor is released, cooling the substance and reducing the strength of flammable gases. Applications like electrical wires and construction materials that need to meet strict fire safety regulations benefit greatly from this technique. The need for ATH is further fueled by the growing regulatory focus on ecologically friendly and halogen-free flame retardants. For example, the Restriction of Hazardous Compounds (RoHS) directive of the European Union promotes the use of safer substitutes, such as ATH, by restricting the use of specific hazardous compounds in electrical and electronic equipment.

Application Segment Analysis

The polyolefins segment is likely to hold a 28.1% share by the end of 2035. This expansion is fueled by their extensive use in a variety of industries, including packaging, construction, and the automobile sector. Polyolefins' fire resistance is increased by the addition of flame retardants, which qualifies them for uses where fire safety is crucial. The use of flame-retardant polyolefins has expanded as a result of the automobile industry's move towards lightweight materials without sacrificing safety regulations. The need for flame-retardant polyolefins is further increased by building laws and regulations that require the use of fire-resistant materials in construction, such as the National Fire Protection Association (NFPA) standards and the International Building Code (IBC).

End use Segment Analysis

The construction sector is anticipated to retain a significant portion of the global inorganic flame retardants market by 2035, propelled by rigorous fire safety regulations and an increasing demand for non-combustible materials in both residential and commercial structures. The rise in urbanization, along with the emphasis on green building certifications, further enhances the adoption of halogen-free, mineral-based retardants such as aluminum hydroxide in insulation, wiring, and panels. For instance, Clariant AG provides non-halogenated flame-retardant additives specifically designed for construction materials, in accordance with the changing safety codes and environmental standards in regions like Europe and Asia.

Our in-depth analysis of the global inorganic flame retardants market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Inorganic Flame Retardants Market - Regional Analysis

Asia Pacific Market Insights

Asia-Pacific is expected to hold 35.7% of the market for inorganic flame retardants in 2035 due to factors like electrification, industrial growth, and sustainability regulations. Increased EV manufacturing, regulatory pressure for halogen-free retardants, and building safety regulations in China, India, Japan, and Southeast Asia are important motivators. In electronics and semiconductors, South Korea and Japan place a higher priority on non-toxic materials like magnesium hydroxide and aluminium. With the widespread adoption of building regulations and battery-grade fire safety measures, China leads the world in industrial consumption.

By the year 2035, it is anticipated that China will hold the largest share of revenue, approximately 41.2% in the APAC inorganic flame retardants market. This growth is attributed to its extensive industrial base and rigorous fire safety regulations. The swift expansion of electric vehicle manufacturing and significant infrastructure initiatives in the country requires a broad application of flame retardants in batteries, cables, and insulation materials. Albemarle Corporation, a prominent supplier of aluminum hydroxide-based flame retardants, has enhanced its presence in China through strategic alliances that cater to the increasing demand for halogen-free fire protection solutions.

India is expected to take the lead in the APAC inorganic flame retardants market, with a projected CAGR of 7.4% from 2026 to 2035. This growth is fueled by rapid urbanization, the development of an electric vehicle ecosystem, and the introduction of progressive green building and fire safety regulations. These elements are driving the demand for halogen-free, mineral-based flame retardants across the construction, automotive, and electronics industries. ICL Group, a worldwide leader in sustainable flame retardants, is actively broadening its operations in India by providing eco-friendly magnesium and phosphorus-based additives to support these industries.

North America Market Insights

The North America inorganic flame retardants market, which includes the U.S. and Canada, is expected to generate 27.7% of worldwide revenue by 2035, growing at a CAGR of 5.1% between 2026 and 2035. Growing uses in the electronics, automotive, and construction industries, together with strict fire safety laws enforced by organizations like OSHA and EPA, are driving the region's growth. Particularly, the increased production of electric vehicles and smart building retrofits has increased demand for ecologically friendly, non-halogenated retardants such as magnesium hydroxide and aluminium hydroxide.

In the U.S., regulations such as the Toxic Substances Control Act (TSCA) are accelerating the transition away from halogenated flame retardants due to concerns regarding environmental and health impacts. These regulatory pressures are contributing to a steady increase in the demand for inorganic flame retardants, which are regarded as safer and more sustainable alternatives. Industries including electronics, construction, and automotive are progressively embracing non-halogenated options. Huber Engineered Materials stands out as a prominent U.S.-based manufacturer of aluminum hydroxide flame retardants, actively providing eco-friendly solutions that adhere to TSCA standards.

By the year 2035, Canada is anticipated to capture the largest revenue share in the North American inorganic flame retardants market, propelled by rigorous building codes, sustainable construction methodologies, and a growing adoption of electric vehicles. Canada's commitment to non-toxic, halogen-free fire safety solutions in public infrastructure and green-certified buildings is enhancing the demand for mineral-based flame retardants. Rio Tinto, a leading producer of industrial minerals in Canada, plays a vital role by supplying aluminum compounds utilized in flame-retardant formulations across the construction and transportation industries.

Europe Market Insights

Europe's market is anticipated to witness consistent growth, propelled by rigorous fire safety regulations and a transition towards sustainable, non-halogenated alternatives. By 2025, the market size is projected to be around €2.16 billion, with a compound annual growth rate (CAGR) of 4.53% expected through 2030. Germany and the United Kingdom are predicted to capture the largest revenue shares in Europe by 2035, due to their strong industrial foundations and strict regulatory environments.

Germany is expected to dominate the European market by 2035, supported by its robust industrial sector, especially in automotive, electronics, and construction industries. In 2025, Germany's market size is forecasted to reach €124.079 million, representing about 1.34% of the global market. The nation's dedication to sustainability and adherence to stringent fire safety regulations further enhances the demand for non-halogenated flame retardants. Companies such as LANXESS AG are leading the way, providing magnesium hydroxide-based solutions under the Magtech brand, which are widely utilized in wire and cable applications.

The UK is also projected to maintain a substantial revenue share in the European market by 2035. In 2025, the market size in the UK is estimated to be €148.864 million. The country's strict fire safety regulations and focus on sustainable construction practices are driving the demand for inorganic flame retardants. Firms like BASF SE are playing a significant role in this expansion by offering eco-friendly flame retardant solutions that comply with the UK's regulatory requirements and sustainability objectives.

Key Inorganic Flame Retardants Market Players:

- Albemarle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Israel Chemicals Ltd. (ICL)

- Nabaltec AG

- Huber Engineered Materials (J.M. Huber)

- Italmatch Chemicals S.p.A.

- Clariant AG

- Kyowa Chemical Industry Co., Ltd.

- Kisuma Chemicals

- Posco Chemical Co., Ltd.

- Tata Chemicals Ltd.

- Redox Pty Ltd

- Chemical Company of Malaysia Berhad (CCM)

- Lanxess AG

- ADEKA Corporation

- DIC Corporation

Multinational behemoths like Albemarle, ICL, and Nabaltec dominate the fiercely competitive market due to their diverse product lines and extensive global supply chains. Businesses, especially in Europe and the Asia-Pacific, are shifting to halogen-free and environmentally friendly formulations to comply with changing regulatory and environmental standards. Regional development (particularly in APAC), collaborative partnerships, and R&D expenditure are examples of strategic efforts. India and South Korea grow EV-friendly applications, while Japanese companies like ADEKA and Kyowa concentrate on electronics. Sustainability and compliance are essential to long-term positioning in this fragmented industry, which rewards innovation and regional manufacture.

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In December 2024, ICL unveiled VeriQuel R100, a flame retardant with a reactive phosphorus base designed specifically for rigid polyurethane insulation. This product complies with international environmental standards and provides a sustainable substitute for conventional additives.

- In November 2024, Clariant introduced Exolit AP 422 A, a flame retardant that is free of melamine and has exceptional fire resistance. This invention responds to companies seeking safer, more environmentally friendly solutions while addressing worries about melamine's designation as a Substance of Very High Concern (SVHC).

- Report ID: 3965

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Inorganic Flame Retardants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.