Global Magnesium Hydroxide Flame Retardant Market TOC

- Market Definition

- Market Definition

- Market Segmentation

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Executive Summary – Global Magnesium Hydroxide Flame Retardant Market

- Market Dynamics

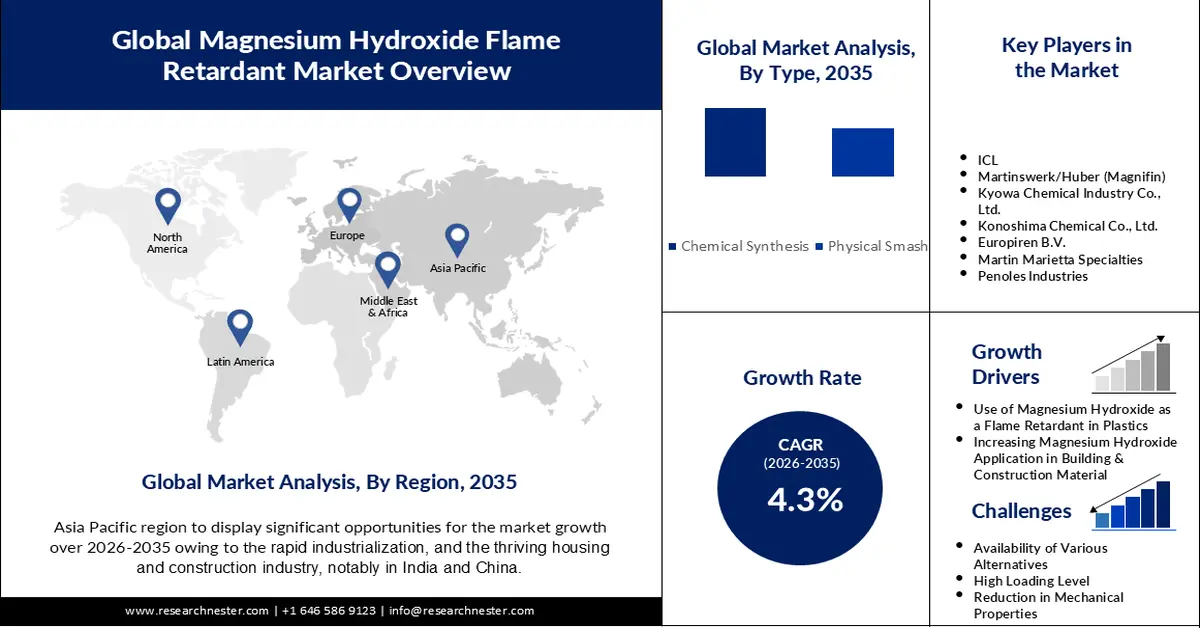

- Market Drivers

- Restraints

- Opportunities

- Trends

- Regulatory and Standards Landscape

- Economic Outlook: US, Europe, China

- Technological Shift and Implementation Analysis

- Industry Risk Analysis

- Impact of COVID-19 on the Magnesium Hydroxide Flame Retardant Market

- Impact on the Manufacturers

- Impact on the supply chain

- Impact on the market strategy

- Impact on the new entrants in the market

- Value Chain Analysis

- Manufacturers

- Distributers/Suppliers

- End users

- Industry Growth Outlook

- Analysis on market demand

- Analysis on growth forecast

- EXIM Analysis of the Magnesium Hydroxide Flame Retardant Market

- Application Analysis of MDH (FR) for Roofing in USA and Europe

- Pricing Analysis

- Competitive Positioning

- Competitive Landscape

- Market Share Analysis, 2022

- Competitive Benchmarking

- ICL

- Martinswerk/Huber (Magnifin)

- Kyowa Chemical Industry Co., Ltd.

- Konoshima Chemical Co., Ltd.

- Europiren B.V.

- Martin Marietta Specialties

- Penoles Industries

- Niknam Chemicals Private Limited

- Xinyang Minerals Group

- Tateho Chemical Industries Co., Ltd.

- NikoMag

- KMT Industrial (HK) Limited

- Nuova Sima

- Global Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Region

- North America, 2023-2036F (USD Million & Thousand Tons)

- Latin America, 2023-2036F (USD Million & Thousand Tons)

- Europe, 2023-2036F (USD Million & Thousand Tons)

- Asia-Pacific, 2023-2036F (USD Million & Thousand Tons)

- Middle East & Africa, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Cross Survey Analysis of Product Type w.r.t Application, 2022

- North America Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Country

- U.S., 2023-2036F (USD Million & Thousand Tons)

- Canada, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Europe Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Country

- U.K., 2023-2036F (USD Million & Thousand Tons)

- Germany, 2023-2036F (USD Million & Thousand Tons)

- Italy, 2023-2036F (USD Million & Thousand Tons)

- France, 2023-2036F (USD Million & Thousand Tons)

- Spain, 2023-2036F (USD Million & Thousand Tons)

- Russia, 2023-2036F (USD Million & Thousand Tons)

- Netherland, 2023-2036F (USD Million & Thousand Tons)

- Rest of Europe, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Asia Pacific Excluded Japan Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Country

- Australia, 2023-2036F (USD Million & Thousand Tons)

- Singapore, 2023-2036F (USD Million & Thousand Tons)

- South Korea 2023-2036F (USD Million & Thousand Tons)

- India, 2023-2036F (USD Million & Thousand Tons)

- China, 2023-2036F (USD Million & Thousand Tons)

- Rest of Asia Pacific, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Japan Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Latin America Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Country

- Brazil, 2023-2036F (USD Million & Thousand Tons)

- Argentina, 2023-2036F (USD Million & Thousand Tons)

- Mexico, 2023-2036F (USD Million & Thousand Tons)

- Rest of Latin America, 2023-2036F (USD Million & Thousand Tons)

- By Type

- Middle East and Africa Magnesium Hydroxide Flame Retardant Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (In Tons)

- Market Segmentation Analysis 2023-2036

- By Type

- Chemical Synthesis, 2023-2036F (USD Million & Thousand Tons)

- Physical Smash, 2023-2036F (USD Million & Thousand Tons)

- By Application

- Rubber & Plastic, 2023-2036F (USD Million & Thousand Tons)

- Construction, 2023-2036F (USD Million & Thousand Tons)

- Wire & Cables, 2023-2036F (USD Million & Thousand Tons)

- Coating, 2023-2036F (USD Million & Thousand Tons)

- Others, 2023-2036F (USD Million & Thousand Tons)

- By End User

- Industrial, 2023-2036F (USD Million & Thousand Tons)

- Commercial, 2023-2036F (USD Million & Thousand Tons)

- By Country

- GCC, 2023-2036F (USD Million & Thousand Tons)

- Israel, 2023-2036F (USD Million & Thousand Tons)

- South Africa, 2023-2036F (USD Million & Thousand Tons)

- Rest of Middle East & Africa, 2023-2036F (USD Million & Thousand Tons)

- By Type

Magnesium Hydroxide Flame Retardant Market Outlook:

Magnesium Hydroxide Flame Retardant Market size was over USD 250.6 million in 2025 and is projected to reach USD 381.79 million by 2035, growing at around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of magnesium hydroxide flame retardant is evaluated at USD 260.3 million.

The demand for magnesium hydroxide flame retardant is growing owing to the stringent government fire safety regulations worldwide. Magnesium hydroxide is recognized as a safe and effective flame retardant, and it meets the regulatory requirements for many industries. As a result, it is widely used in various applications, such as in building materials, electrical cables, and consumer electronics.

Moreover, with the growing population and industrialization, the discharge of wastewater and sewage is rapidly increasing. Owing to this, the growth of magnesium hydroxide flame retardant market is increasing, since adding magnesium hydroxide to wastewater, it can be utilized in various industries to prevent potential fires.

Key Magnesium Hydroxide Flame Retardant Market Insights Summary:

Regional Highlights:

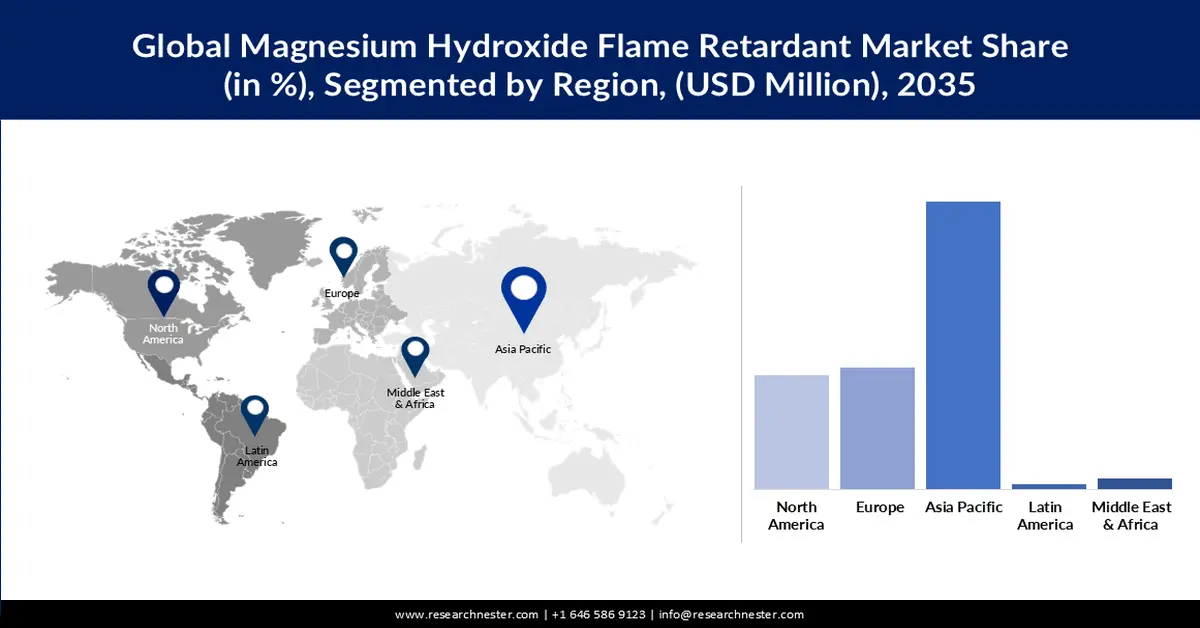

- Asia Pacific is anticipated to capture a 53% revenue share by 2035, fueled by rapid population growth, urbanization, expanding infrastructure needs, and strong electronics manufacturing activity across the region.

- North America is poised for robust growth through 2035, driven by stringent regulatory requirements that restrict hazardous flame retardants and promote the use of environmentally safe and high-performance alternatives such as magnesium hydroxide.

Segment Insights:

- Chemical synthesis segment is projected to grow at a 4.5% CAGR through 2035, driven by its superior control over purity, particle size, and surface modification—factors that significantly enhance flame-retardant performance.

- The construction segment is expected to expand at a 4.6% CAGR by 2035, supported by the rising use of magnesium hydroxide coatings in building materials to improve fire resistance by limiting oxygen exposure and slowing flame spread.

Key Growth Trends:

- Growing Construction Activities across the Globe

- Increasing Demand from the Electrical & Electronics Industry

Major Challenges:

- Low Effectiveness of Magnesium Hydroxide

- Cost of Raw Materials

Key Players: ICL, Martinswerk/Huber (Magnifin), Kyowa Chemical Industry Co., Ltd., Konoshima Chemical Co., Ltd, Europiren B.V., Martin Marietta Specialties, Penoles Industries, Niknam Chemicals Private Limited, Xinyang Minerals Group, Tateho Chemical Industries Co., Ltd., NikoMag, KMT Industrial (HK) Limited, Nuova Sima.

Global Magnesium Hydroxide Flame Retardant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 250.6 million

- 2026 Market Size: USD 260.3 million

- Projected Market Size: USD 381.79 million by 2035

- Growth Forecasts: 4.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (53% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 25 November, 2025

Magnesium Hydroxide Flame Retardant Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Construction Activities across the Globe – The construction industry is one of the largest consumers of magnesium hydroxide flame retardant. With the increasing urbanization and infrastructure development, the demand for flame retardant in construction materials, such as insulation, roofing, flooring, insulation, cables, and coatings to prevent fires. is expected to rise. For instance, according to the World Bank, value added by industry (including construction) was 26.63 trillion in 2021 which experienced an increase of 19.6% over 2020. Besides, according to the International Trade Administration, U.S. Department of Commerce, the construction industry value in Mexico was 72.89 USD Billions in 2020, 88.14 USD Billions in 2021, and 96.77 USD Billions in 2022.

-

Increasing Demand from the Electrical & Electronics Industry– Magnesium hydroxide is a popular flame retardant in electronic devices, such as computers, televisions, and smartphones. It can be integrated into circuit boards to avoid fires caused by overheating or electrical malfunction. With the increasing demand for such products, the demand for flame retardants is also expected to increase. In 2021, 533.6 million units of shipments were recorded across the globe which included watches, hearables, and other aides, which experienced an increase of 20% over 2020. Besides, according to the Invest India, domestic production of electronics is expected to reach USD 300 Bn by 2026. In India, in the Union Budget 2022-23, the government allocated USD 315 million for the promotion of Electronics and IT Hardware manufacturing.

- Rising Production of Automobiles – The automotive industry is among the largest consumers of magnesium hydroxide flame retardant. It is used as a flame retardant in automotive parts such as dashboard components, seat cushions, and steering wheels. It is preferred over traditional flame retardants owing to its properties such as it does not emit harmful fumes when burned. For instance, according to the Society of Indian Automobile Manufacturers, the total automobile production was 22.6 million in 2020-21 and 22.9 million in 2021-22.

Challenges

-

Low Effectiveness of Magnesium Hydroxide– One of the major challenges in using magnesium hydroxide flame retardant is its low effectiveness compared to other flame retardants. Magnesium hydroxide is a physical flame retardant that works by releasing water vapor when exposed to heat, which cools the surrounding material and suppresses the combustion process. However, the mechanism is less effective than the chemical reactions that occur with other flame retardants, such as halogenated compounds. As a result, higher loading levels of magnesium hydroxide are required to achieve the same level of flame retardancy as other flame retardants. This can result in increased material costs, as well as potential performance and processing issues, such as reduced mechanical properties, increased viscosity, and reduced processing speeds.

-

Cost of Raw Materials

- Availability of Alternatives

Magnesium Hydroxide Flame Retardant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 250.6 million |

|

Forecast Year Market Size (2035) |

USD 381.79 million |

|

Regional Scope |

|

Magnesium Hydroxide Flame Retardant Market Segmentation:

Type Segment Analysis

The chemical synthesis segment in the magnesium hydroxide flame retardant market is estimated to gain a significant revenue share over the projected timeframe as it offers several advantages over physical methods. By the end of 2035, the chemical synthesis segment is expected to grow at a CAGR of 4.5% during the forecast period. Chemical synthesis allows for better control over the purity and particle size of the magnesium hydroxide, which is critical for achieving optimal performance as a flame retardant. Additionally, it also allows for the production of surface-modified magnesium hydroxide, which can further enhance its flame-retardant properties. Surface modification can improve the compatibility between the magnesium hydroxide and the polymer matrix, reduce its impact on the physical and mechanical properties of the material, and improve its performance in harsh environments.

Application Segment Analysis

Magnesium hydroxide flame retardant market from the construction segment is estimated to gain a significant revenue share over the projected time frame due to its high efficiency, low cost, and non-toxicity. The segment is expected to grow at a CAGR of 4.6% during the forecast period. Magnesium hydroxide is used as a coating on building materials, such as wood, textiles, and paper to make them more fire-resistant. The coating prevents oxygen from reaching the material and limiting the speed of flames, thereby acting as a barrier. For instance, investment in total residential & nonresidential building construction, in Canada (in USD Billion) was 221 billion which experienced an increase of 19.5% over 2020. Besides, government investments in a plethora of public infrastructure projects such as Housing Projects, Smart Cities, and Connectivity Projects are likely to augment the growth of the construction industry, thereby will increase the demand for magnesium hydroxide flame retardant.

Our in-depth analysis of the global magnesium hydroxide flame retardant market includes the following segments:

|

Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Magnesium Hydroxide Flame Retardant Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 53% by 2035. The growth is due to the increasing population and urbanization across Asian countries. This has led to a surge in demand for housing, commercial buildings, and public infrastructure, all of which require fire-resistant materials. For instance, according to the World Bank, value added by industry (including construction) in East Asia & Pacific was 11.37 trillion in 2022 which experienced an increase of 3.1% over 2021. Moreover, increasing production of electronics in the region will propel the demand of magnesium hydroxide flame retardant. For instance, according to the Association of Southeast Asian Nations, among the total value of exports in the most countries of Asia, the electronics sector accounts for 20% to 50%.

North American Market Insights

The North America magnesium hydroxide flame market shows promising CAGR during the forecast period. The North America market for magnesium hydroxide flame retardant is growing faster due to regional regulatory requirements. North America has some of the most stringent regulations governing the use of flame retardants in building materials. According to the United States Environmental Protection Agency, the Toxic Substances Control Act (TSCA) restricts the use of some halogenated flame retardants in children's products in the United States and many other regulatory bodies namely the National Fire Protection Association (NFPA) has framed regulations for fire safety. Such regulations require manufacturers to use flame retardants that are environmentally friendly, safe, and effective.

Magnesium Hydroxide Flame Retardant Market Players:

- ICL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Martinswerk/Huber (Magnifin)

- Kyowa Chemical Industry Co., Ltd.

- Konoshima Chemical Co., Ltd

- Europiren B.V.

- Martin Marietta Specialties

- Penoles Industries

- Niknam Chemicals Private Limited

- Xinyang Minerals Group

- Tateho Chemical Industries Co., Ltd.

- NikoMag

- KMT Industrial (HK) Limited

- Nuova Sima

Recent Developments

- The Huber Engineered Materials (HEM) completed the acquisition of MAGNIFIN Magnesiaprodukte GmbH & Co. KG, 50% ownership stake a joint venture. This acquisition will support to grow their halogen-free fire retardant and specialty material business globally.

- CIJC NikoMag, a subsidiary of Nikohim Group Company, recently announced a boost in the production capacity of its magnesium hydroxide plant from 25,000 to 40,000 tonnes per year.

- Report ID: 5181

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Magnesium Hydroxide Flame Retardant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.