Drug Delivery Systems Market Outlook:

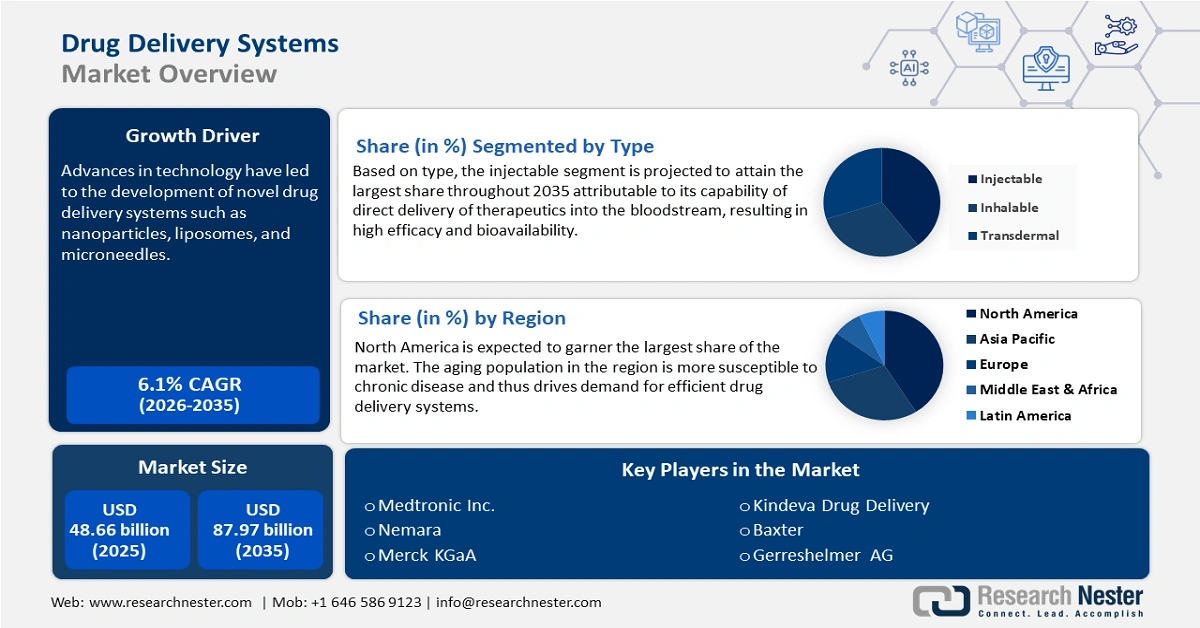

Drug Delivery Systems Market size was over USD 48.66 billion in 2025 and is projected to reach USD 87.97 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drug delivery systems is evaluated at USD 51.33 billion.

The growth of this market can be attributed to the increased availability of vaccines for different types of diseases such as typhoid, tuberculosis, influenza, hepatitis, and others. According to a report, in 2021 the global coverage of hepatitis B is around 80% for Haemophilus influenza type B vaccine nearly 71% and nearly 80% of infants all over the world received polio vaccination.

The cases of chronic disease are constantly rising owing to lifestyle disorders, unhealthy eating habits, and sleeping disorders. According to the World Health Organization, about 17.9 million people die of cardiovascular disease every year, and cardiovascular is the primary reason for most of the deaths in the world.

Key Drug Delivery Systems Market Insights Summary:

Regional Highlights:

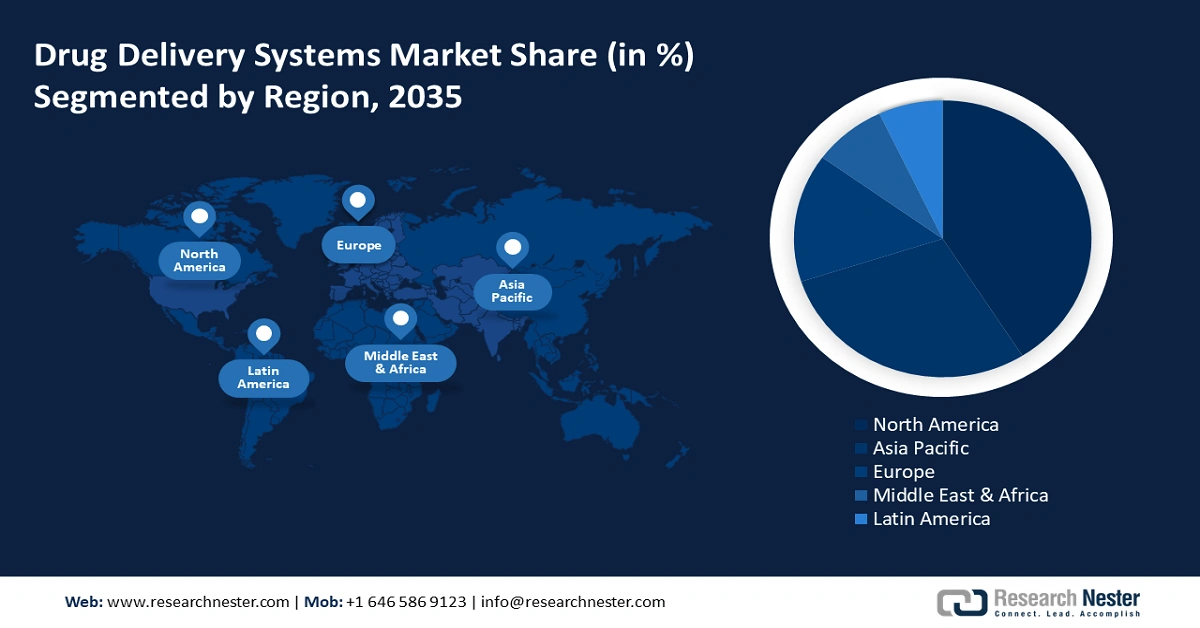

- By 2035, North America is expected to secure a 35% revenue share in the Drug Delivery Systems Market, supported by prolonged hospital stays in the region.

- Europe is projected to hold a notable share by 2035, bolstered by the region’s increasing recognition and adoption of advanced drug delivery technologies.

Segment Insights:

- By 2035, the diabetes segment in the Drug Delivery Systems Market is anticipated to account for a 33% share, sustained by the increasing number of diabetes patients worldwide.

- The injectable segment is forecast to expand significantly through 2035, underpinned by rising awareness of wearable injectable drug delivery solutions.

Key Growth Trends:

- Technological Advancement and Innovations in Drug Delivery Systems

- Rapid COVID-19 Vaccination Drive all over the World

Major Challenges:

- Strict Rules and Regulations Set by the Government

- Negative Impact and Data Security Risk Associated with Drug Delivery System

Key Players: BD (Becton, Dickinson, and Company), Gerreshelmer AG, Baxter, Nemara, Kindeva Drug Delivery, West Pharmaceutical Services Inc., Ypsomed, Medtronic Inc., E3D Elcam Drug Delivery Devices, Astra Zeneca, Merck KGaA.

Global Drug Delivery Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.66 billion

- 2026 Market Size: USD 51.33 billion

- Projected Market Size: USD 87.97 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 9 September, 2025

Drug Delivery Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Technological Advancement and Innovations in Drug Delivery Systems- The rising development in technology has always favored market growth such as microneedle arrays are a new technology for delivering medications through the skin. In these arrays, several microscopic needles, each thinner than a strand of hair, are coated or filled with medicine. Therefore, technological advancement in drug delivery systems is anticipated to boost the market's growth in the upcoming years. Such as, Medtronic announced the release of Efficio, an advanced cloud-based data management technology application for use with SynchroMed II intramedullary drug delivery system in January 2020.

-

Rapid COVID-19 Vaccination Drive all over the World- There has been a rising demand for syringes owing to increasing COVID-19 vaccinations across the globe. Moreover, it has boosted the production of injectable drug delivery, and it is projected to drive the market's growth. According to the reported data, globally, 3.87 million vaccinations are done every day, and 12.69 billion doses have been given worldwide.

- Growth of Digital Drug Delivery- The rising popularity and importance of digital drug delivery among companies is expected to increase the growth of the global drug delivery systems market. Nearly 60% of people working at a company size of 5000 believe that digital drug delivery technology is crucial.

Challenges

-

Strict Rules and Regulations Set by the Government - The government has imposed strict mandates to be followed while checking the product in order to ensure the efficacy and safety of the product. These stringent rules and regulations might limit the production of a new product or any other development of an old product. Therefore, the factor is likely to hamper the market growth.

-

Negative Impact and Data Security Risk Associated with Drug Delivery System

- Customer Trust is Compromised Owing to the Invasive Nature of Drug Delivery

Drug Delivery Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 48.66 billion |

|

Forecast Year Market Size (2035) |

USD 87.97 billion |

|

Regional Scope |

|

Drug Delivery Systems Market Segmentation:

Indication Segment Analysis

Drug delivery systems market from the diabetes market is anticipated to account for 33% share over the coming years. The increasing number of diabetes patients worldwide may be attributed to the segment's expansion. According to the World Health Organisation, there are 422 million diabetics worldwide. Moreover, the high utilization of insulin injections by diabetes patients is also expected to boost the growth of this segment in the projected period.

Type Segment Analysis

The injectable sector is anticipated to see the most market growth over the next years. This is attributable to individuals becoming more aware of wearable injectable medicine delivery methods. Furthermore, it is anticipated that segmental expansion will be aided in the coming years by the expanding immunization campaign that is increasing syringe usage globally. Also it is anticipated that until vaccines are completed, the growing need for needles and syringes will fuel segmental expansion.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Device Type |

|

|

Indication |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drug Delivery Systems Market Regional Analysis:

North America Market Insights

By the end of 2035, the North American drug delivery systems market is anticipated to have the greatest revenue share of 35% worldwide. Longer hospital stays in the area are likely to fuel the market expansion for drug delivery systems in North America during the anticipated time frame. According to a paper published in April 2021, Canada experienced approximately 3 million acute inpatient hospitalizations in the years 2019–2020. The region's delivery systems are expected to improve as a result of these hospitalizations.

Europe Market Insights

On the other side, Europe is anticipated to maintain a sizable market share during the projection period. This is explained by the region's growing recognition of cutting-edge medication delivery methods and acceptance of cutting-edge technology. The launch of novel medication delivery systems by important stakeholders is also projected to fuel regional market expansion, as are clinical studies for crucial governance permissions for innovative medicines.

Drug Delivery Systems Market Players:

- BD (Becton, Dickinson, and Company)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gerreshelmer AG

- Baxter

- Nemara

- Kindeva Drug Delivery

- West Pharmaceutical Services Inc.

- Ypsomed

- Medtronic Inc.

- E3D Elcam Drug Delivery Devices

- Astra Zeneca

- Merck KGaA

Recent Developments

- Nemara announced the sponsorship of Celie Gross for their latest launch Wearable Injectors of On Drug Delivery. The product is designed to suffice the unmet drug delivery needs in chronic diseases. The lack of simultaneous response to the challenges related to biologics, self-administration, connectivity, and sustainability in one device is a driving force behind the thought that it would be good for patients who suffer from chronic disease to have an intelligent, sustainable on-body injector.

- Merck KGaA announces a collaboration with InnoCore Pharmaceuticals to provide Innocare with the proprietary SynBiosys biodegradable polymer platform. It is a drug delivery platform developed to reduce the hurdles in injectable formulation. This collaboration will enable new and potentially life-changing drugs to be made available, by creating a prolonged release of protein therapeutic products into the market. By reducing dosing frequency and maintaining medicines at therapeutic levels for longer, it will also improve patient compliance.

- Report ID: 4460

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drug Delivery Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.