Novel Drug Delivery Systems Market Outlook:

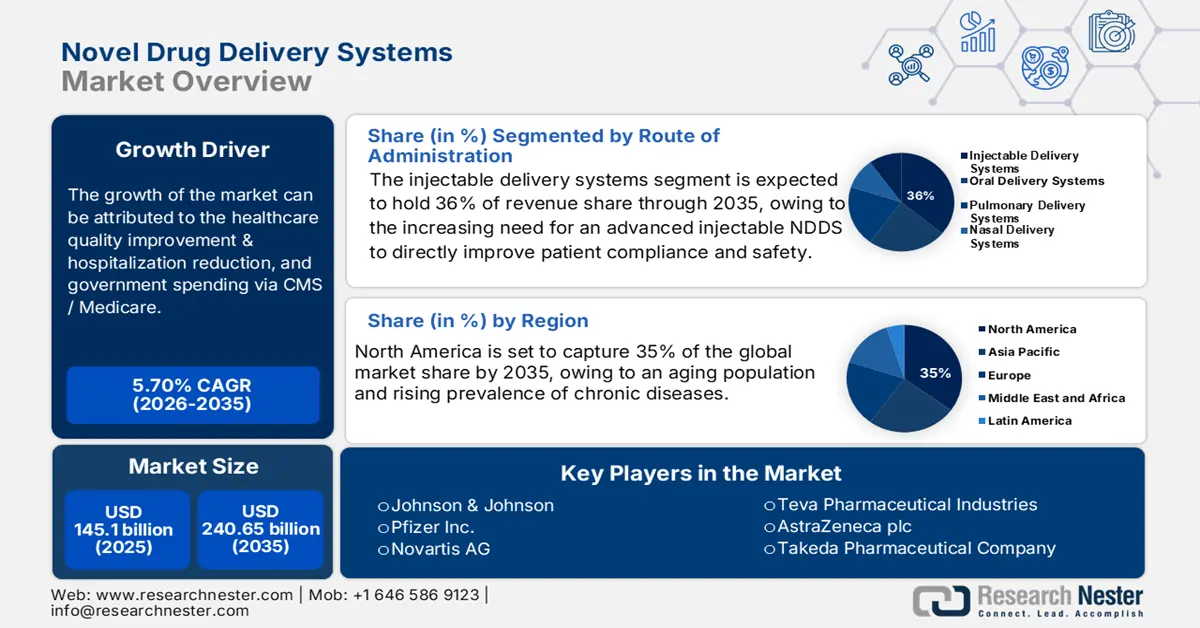

Novel Drug Delivery Systems Market size was valued at USD 145.1 billion in 2025 and is projected to reach USD 240.65 billion by the end of 2035, rising at a CAGR of 5.70% during the forecast period, i.e., 2026–2035. In 2026, the industry size of novel drug delivery systems is estimated at USD 152.91 billion.

In world pharmaceutical markets, the patient pool for products assisted by novel drug delivery systems primarily includes patients with chronic and high-prevalence diseases such as cancer, diabetes, cardiovascular diseases, and respiratory diseases. The Doctoral research and clinical or research trial information published in the National Institute of Health shows a large increase in trials involving drug delivery. Demand is further supported by patient populations needing better efficacy, compliance, and controlled release formulations. Import/export flows are crucial. The vast majority of APIs for the U.S. market are produced outside the U.S., and finished dosage forms depend on intermediates and assembly components that are imported.

The novel drug delivery systems (NDDS) market is rapidly evolving, driven by advances in technology, greater patient demand for targeted and effective therapies, and shifting healthcare needs. Nanotechnology is increasingly used to create nanoparticles, nanocarriers, and liposomes for the purpose of drug delivery. This technology often improves drug selection through the enhancement of bioavailability and targeting of drugs. This advancing technology aligns with the increasing demand for biologics and biopharmaceuticals, particularly in the NDDS market development of delivery systems that are able to accommodate the complexity of large and fragile biologic molecules. The NDDS market appears to be promoting biopharmaceutical development in hospitals, academia, and business, particularly in the realm of oncology and immunotherapy.

Key Novel Drug Delivery Systems Market Insights Summary:

Regional Highlights:

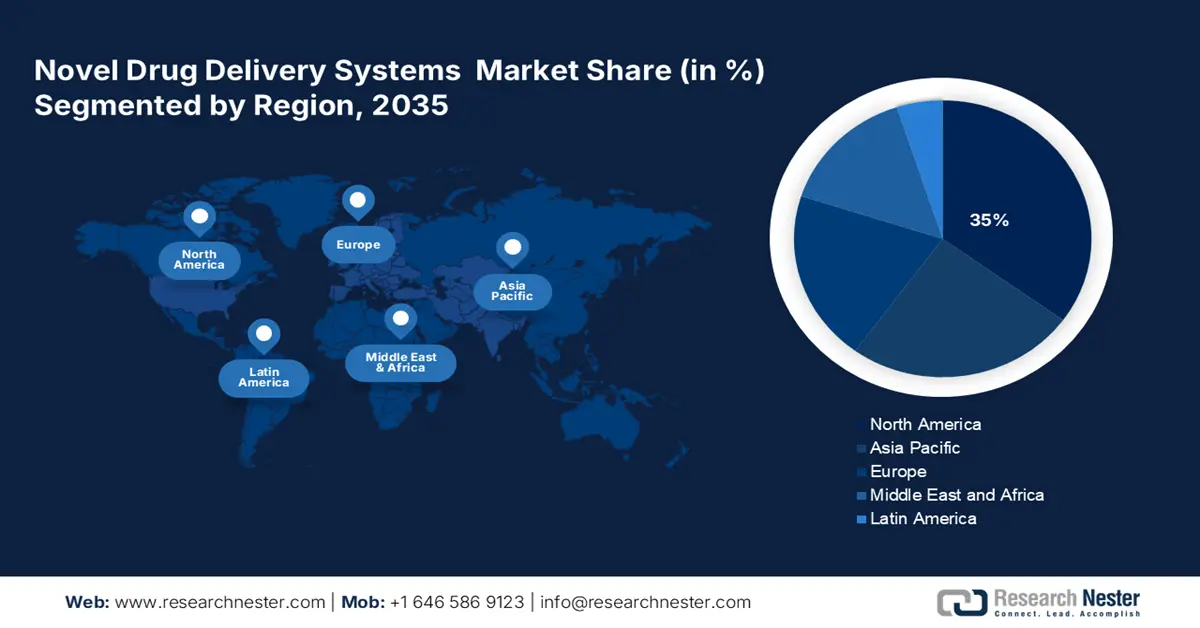

- North America is projected to hold a 35% share of the novel drug delivery systems market by 2035, attributed to the growing aging population, rising chronic disease prevalence, and extensive federal and organizational support for NDDS innovation.

- Asia Pacific is expected to register the fastest growth through 2035, bolstered by the expanding patient base, increasing healthcare expenditure, and accelerated R&D investments in advanced drug delivery technologies.

Segment Insights:

- The injectable delivery systems segment is projected to hold a 36% share of the novel drug delivery systems market by 2035, driven by the rising global vaccination initiatives and growing reliance on injectable biologics for precise dosage, improved safety, and controlled release performance.

- The controlled release systems segment is anticipated to capture a 29% market share by 2035, owing to its pivotal role in chronic disease management through sustained drug efficacy, improved patient adherence, and reduced dosing frequency.

Key Growth Trends:

- Health Care quality improvement & hospitalization reduction

- Government spending via CMS / Medicare

Major Challenges:

- Pricing restraints and government-imposed price caps

- Regulatory approval delays

Key Players: Johnson & Johnson, Pfizer Inc., Novartis AG, Teva Pharmaceutical Industries, AstraZeneca plc, Takeda Pharmaceutical Company, Samsung Biologics, Dr. Reddy's Laboratories, GlaxoSmithKline plc, Baxter International Inc., CSL Limited, Sun Pharmaceutical Industries, Biocon Limited, Sandoz International GmbH, F. Hoffmann-La Roche AG, Boehringer Ingelheim GmbH, Mitsubishi Tanabe Pharma, Cipla Limited, UCB Pharma, Hovid Berhad

Global Novel Drug Delivery Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 145.1 billion

- 2026 Market Size: USD 152.91 billion

- Projected Market Size: USD 240.65 billion by 2035

- Growth Forecasts: 5.70% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, Canada

- Emerging Countries: China, India, South Korea, Brazil, Singapore

Last updated on : 3 September, 2025

Novel Drug Delivery Systems Market - Growth Drivers and Challenges

Growth Drivers

-

Health Care quality improvement & hospitalization reduction: Improve treatment efficacy, minimize complications, and boost patient outcomes. NDDS formulations, such as sustained-release formulations/transdermal patches/targeted drug delivery, result in more accurate dosing, fewer hospital visits, and fewer hospital admissions. This benefits the patient and results in increased compliance and decreased pressure on healthcare facilities. NDDS solutions could reduce hospital acute care admissions, reduce the length of treatment, and improve care quality relative to traditional methods of management at a reasonable cost, which contributes to NDDS.

- Government spending via CMS / Medicare: Broader ticked Medicare Innovation awards guarantee that care delivery models reduce avoidable admissions in clinically complex populations. NDDS platforms that fit within these models. Systematic reviews show that quality improvement interventions that engage patients and clinics reduce readmission and general patient populations. While not NDDS specific, these findings support industry demand for delivery systems that support reliable outpatient therapy, and greater regimen adherence for which NDDS technologies can provide quantifiable returns.

- Patient pool & disease prevalence: The chronic disease counts reported by government bodies in North America and Europe indicate that there is a larger eligible population desirable of NDDS interventions. Targeted pain delivery in advanced cancer intervention is consistent with expanding the patient population, requiring a better framework for chronic care. Adoption continues to be particularly high in oncology and neurological disciplines. By creating access gaps for potential NDDS beneficiaries, generated by cost barriers and lagging coverage. Manufacturers delivering more affordable and coverage-friendly NDDS solutions can meet that unmet demand especially with smaller practices and self-pay patients.

Challenges

-

Pricing restraints and government-imposed price caps: The high prices of NDDS products frequently result in price caps set by the government. This leads to costly development programs with larger R&D expenses, as well as longer clinical programs. Ultimately, when a government limits the price of a new DDT or gives explicit constraints on any ingenious pricing strategy, pharmaceutical companies are limited in the price that they can sell at for these new NDDS. Therefore, if the products are sold at lower prices than expected, the profitability of that product decreases. This lack of profit will result in reduced investment in NDDS innovation and perhaps reduce overall market growth.

-

Regulatory approval delays: The authorization of NDDS technologies could involve a prolonged approval process due to their complexity and unfamiliarity. Regulatory governing bodies (e.g., the FDA), require extensive clinical trial data to assess safety and effectiveness of new delivery systems. Additionally, Global Supply disruption is impacting the availability of the active pharmaceutical ingredient (API). We have witnessed the vulnerabilities and challenges within the pandemic when there was a 4-month backlog and counting of worldwide availability of NDDS products.

Novel Drug Delivery Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.70% |

|

Base Year Market Size (2025) |

USD 145.1 billion |

|

Forecast Year Market Size (2035) |

USD 240.65 billion |

|

Regional Scope |

|

Novel Drug Delivery Systems Market Segmentation:

Route of Administration Segment Analysis

The injectable delivery systems segment is estimated to account for the largest share of 36% in the novel drug delivery systems market over the discussed timeframe. Injectable delivery systems are the primary route of delivery for biologics, vaccines, and other complex molecules that need to be delivered with an exact dosage. The CDC states that vaccination campaigns globally have skyrocketed, increasing the need for an advanced injectable NDDS to directly improve patient compliance and safety. The significant uses of injectable systems also include controlled release and targeted delivery, which offer reduced side effects and ultimately improve therapeutic effect. Also, injectable systems continue to draw heightened regulatory scrutiny, particularly for injectable product safety.

Type Segment Analysis

The controlled release systems segment is poised to dominate the novel drug delivery systems market with a share of 29% during the analyzed period. Controlled release technologies are central to the management of chronic diseases due to their ability to provide the same drug level over a longer time course, resulting in a higher level of efficacy and adherence to the drug regimen. As mentioned by the World Health Organization (WHO), this approach facilitates a reduction in the number of times a patient has to take a dose, therefore improving the outcome of the treatment, and reducing the burden on the healthcare system. This segment continues to expand with the rising incidence of diabetes, cardiovascular diseases, and other chronic conditions that require drugs to be continuously delivered.

Application Segment Analysis

The oncology segment is poised to dominate the novel drug delivery systems market with a share of 31% during the analyzed period. The oncology segment generates excessive revenue driven by a growing global incidence of cancer. The WHO shows a steadily increasing incidence of cancer, which drives demand for targeted NDDS that confine drug delivery to tumors to avoid systemic toxicity. The therapeutic index is improved, and quality of life is enhanced for patients with novel delivery systems, which continues to drive innovation and implementation of new protocols for oncology treatment.

Our in-depth analysis of the global novel drug delivery systems market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Route of Administration |

|

|

Technology |

|

|

Application |

|

|

Carrier Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Novel Drug Delivery Systems Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 35% in the global novel drug delivery systems market by the end of 2035. The market for novel drug delivery systems (NDDS) is booming in the U.S. as offering new opportunities for NDDS companies through an aging population and rising prevalence of chronic diseases. Many organizations, including the American Medical Association and PhRMA, are also working with innovators in NDDS to help in defining the NDDS products and processes within their systems and champion more policy and regulatory support. These initiatives cover patient engagement whilst delivering appropriate drug dosages. Additional funding and grants from the federal government and its agencies for innovative delivery materials and carriers continue to support R&D.

The evolution of Novel Drug Delivery Systems (NDDS) in Canada has benefited from a strong and fiscally supported healthcare model at the provincial level. The government of Canada and its provincial counterparts have pushed toward innovation for NDDS by working with industry associations that would represent this area of pre-clinical and clinical development of sustained-release and implantable delivery systems of potential intervention. Public health agencies, which had been historically narrow in their focus on the delivery of health services toward chronic disease health interventions, would at least explore, to the lowest entry point of cost, introducing technologies of NDDS into healthcare, to improve patient compliance, and avoid further hospitalization costs, over time.

The novel drug delivery systems market in the U.S. will expand, due in part to its large and growing aging population, increasing prevalence of chronic diseases, and ongoing advances in biotechnology and pharmaceuticals. The shift to biopharmaceuticals and biosimilars also supports NDDS; more targeted forms of drug therapies often need innovative delivery mechanisms. The US pharmaceutical industry is committed to developing novel drug delivery technologies. Similarly, regulatory bodies such as the FDA are looking to approve novel NDDS drugs or combinations of drugs, highlighting innovation and the intended patient effect. Patient input is an important aspect, and those NDDS incorporating high levels of patient-centered research are likely to find greater overall product adoption. NDDS, which improves on the previous treatments available to patients, reduces patient burden, provides convenience & compliance should thrive in US commerce.

APAC Market Insights

Asia Pacific is poised to exhibit a notable CAGR in the global novel drug delivery systems market throughout the discussed period. The growth is led by the increased patient populations, a growing prevalence of chronic diseases, and rising government healthcare expenditure. Rapid urbanization, improved healthcare infrastructure, and raising awareness of advanced drug delivery modalities are the drivers. Countries in the region, such as Japan and China, are committing large amounts of money to R&D growth and regulatory streamlining to promote pharmaceutical innovation and product development. There is future growth from an array of new technology developments in ways to use nanoparticles for delivery. Overall, the recent median increases in government spending on healthcare in APAC fuel the NDDS market.

The NDDS products market is gaining traction in China due to rapid urbanization, an aging population, and an increase in healthcare demands from the rise of chronic diseases. China's growing biotechnology and pharmaceutical industries are helping to drive national and local demand for NDDS products. China is acquiring a large share and making rapid advancements in biologics, which sometimes require new delivery methods. The Healthy China 2030 initiative, which the ruling government particularly prioritizes, will enhance innovative drug technologies and is expected to also improve market growth and avert the existing market risk from allowing imports of finished dosage products made by foreign manufacturers, both domestically and abroad.

The market for novel drug delivery systems in India will continue to grow based on its rapid increase in population, rapid rise of chronic disease burden, and improving health-seeking behavior. The push for medical technologies and biotechnology is rising steadily in India. Increasingly, these create conditions for NDDS to be adopted and innovated. India's burden of chronic diseases increases the need to alleviate this burden with better, targeted, and compliant medicine to manage these diseases. According to the National Institutes of Health, in 2022, there were an expected 14,61,427 incident cases of cancer in India. In conjunction with the Indian Government’s recent policy shifts to support healthcare reform initiatives and commitment to supporting research, education, and development policies, the conditions for further growth of this market.

Europe Market Insights

The novel drug delivery systems (NDDS) market in Europe is expected to grow as healthcare spending, an aging population, and the prevalence of chronic diseases increase. Furthermore, emerging treatment paradigms using new technologies to deliver drugs via controlled release, transdermal patches, and injectables will help improve therapeutic effectiveness and patient adherence in Europe. Supportive policies with funding and lessening regulatory complexities through the European Medicines Agency (EMA) and the European Health Data Space initiative continue to prioritize innovation for a number of European governments. Also, new reimbursement frameworks and public-private partnership initiatives have further enabled market penetration in Western Europe, too. The continued integration and augmentation of digital health with, for example, remote monitoring of drug delivery devices, is also an emerging trend in the NDDS market.

Currently, Germany is still the largest NDDS market in Europe. Germany's increasing demand for NDDS can be attributed in part to the Federal Ministry of Health's support for drug delivery innovation and reimbursement mechanisms. Its aging population, along with Germany's tradition of manufacturing pharma products, plus new programs to support integrating new carriers in oncology and diabetes treatment, have all supported increasing NDDS uptake. The increasing shift towards personalized and precision medicine is a key motivator. NDDS technologies provide targeted drug delivery that can be individualized for each patient via genetic or biomarker information. As one of the most sophisticated healthcare systems with some of the largest investments in pharmaceuticals, healthcare, and healthcare infrastructure across the government and private sector, the German healthcare system may lead to more accessibility of NDDS.

There are a variety of factors that will be contributing to growth in the novel drug delivery systems (NDDS) market in France. The increase of chronic diseases, an aging population result in a demand for better, more efficient systems of treatment. In addition, the French government has previously also encouraged innovation in the healthcare sector. Further, demand driven by interest in personalized medicine continues to drive demand for NDDS, as they allow for more personalized and effective systems that have fewer side effects. In addition, the presence of a successful pharmaceutical industry in France, as represented by companies like Sanofi, provides an ecosystem and opportunities for NDDS research and development. Furthermore, the regulatory authorities, namely, the French National Agency for Medicines and Health Products Safety (ANSM), have continued to improve the approval processes through the novel dosage forms process, which has helped facilitate market growth.

Key Novel Drug Delivery Systems Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Novartis AG

- Teva Pharmaceutical Industries

- AstraZeneca plc

- Takeda Pharmaceutical Company

- Samsung Biologics

- Dr. Reddy's Laboratories

- GlaxoSmithKline plc

- Baxter International Inc.

- CSL Limited

- Sun Pharmaceutical Industries

- Biocon Limited

- Sandoz International GmbH

- F. Hoffmann-La Roche AG

- Boehringer Ingelheim GmbH

- Mitsubishi Tanabe Pharma

- Cipla Limited

- UCB Pharma

- Hovid Berhad

The market for novel drug delivery systems (NDDS) contains fierce competition between multinational pharmaceutical and biotech companies. Johnson & Johnson and Pfizer are two key players that capitalize on a robust R&D pipeline with advanced delivery technologies. Companies emerging from India and Malaysia have offered an NDDS amid the burgeoning demand for affordable generic NDDS. Strategic efforts such as collaboration with health care providers and using contract manufacturing while targeting a biologics expansion have contributed to their position in the market. Ongoing regulatory approvals are expanding the market, and government support has catalyzed innovation.

Here is a list of key players operating in the global novel drug delivery systems market:

Recent Developments

- In April 2025, Satio, Inc. announced the successful conclusion of an Advanced Research Projects Agency for Health (ARPA-H) Small Business Innovation Research contract. The company's revolutionary SatioRx drug delivery system utilizes a hollow microneedle (HMN) array to administer liquid medications in a stable and controlled manner. The innovative method from SatioRx blends a low-cost disposable with a reusable motor-driven applicator.

- In October 2024, Researchers at the Institute of Nano Science and Technology (INST), Mohali, have created a unique drug delivery method to treat Central Nervous System Tuberculosis (CNS-TB), marking a significant advancement in medicine. This innovative technique bypasses the blood-brain barrier (BBB) and delivers anti-tuberculosis (TB) medications straight to the brain via the nasal route.

- Report ID: 3930

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Novel Drug Delivery Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.