Infection Surveillance Solutions Market Outlook:

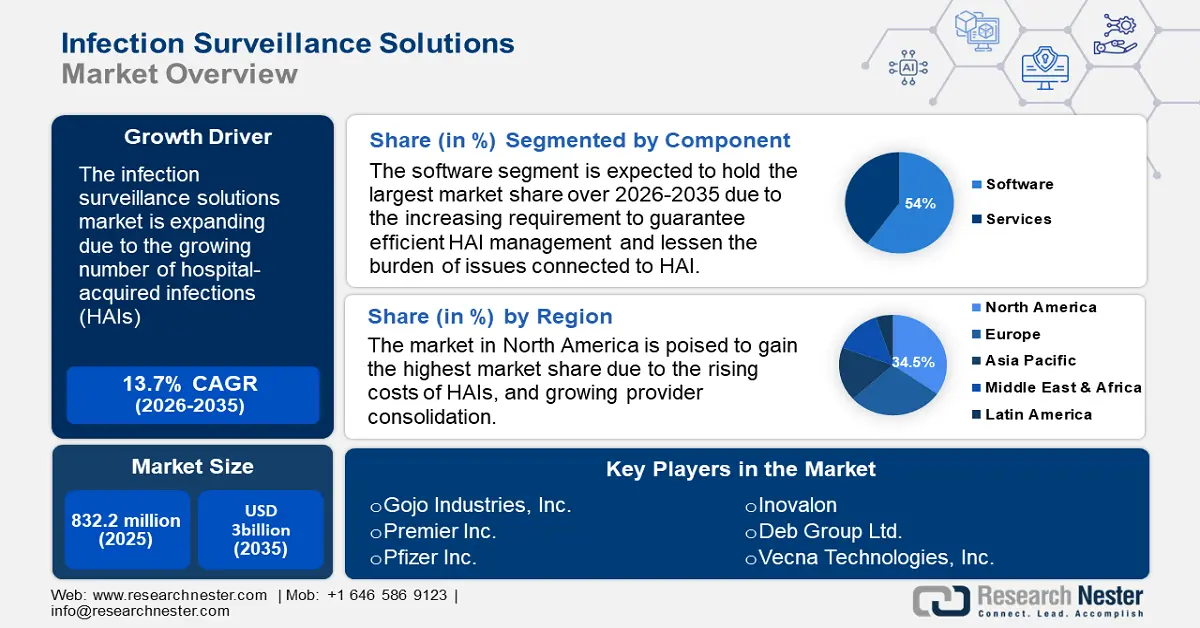

Infection Surveillance Solutions Market size was over USD 832.2 million in 2025 and is poised to exceed USD 3 billion by 2035, growing at over 13.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of infection surveillance solutions is estimated at USD 934.81 million.

The primary growth driver for the infection surveillance solutions market is the increasing prevalence of infectious diseases and the rising awareness of infection control in healthcare settings. This includes the need for effective monitoring and tracking of infections to improve patient outcomes, prevent outbreaks, and enhance overall healthcare quality. According to the Department of Biotechnology, Ministry of Science and Technology, Government of India, infectious diseases are among the top ten causes of death in the country, led by diarrheal diseases, neonatal disorders, lower respiratory infections, and tuberculosis.

The infection surveillance solutions market is also expanding due to an increase in hospital-acquired infections (HAIs). According to the World Health Organization (WHO), HAIs impact one out of every ten patients on average. However, in low- and middle-income nations, as well as among high-risk patients in intensive care units, the frequency may be much higher.

Key Infection Surveillance Solutions Market Insights Summary:

Regional Highlights:

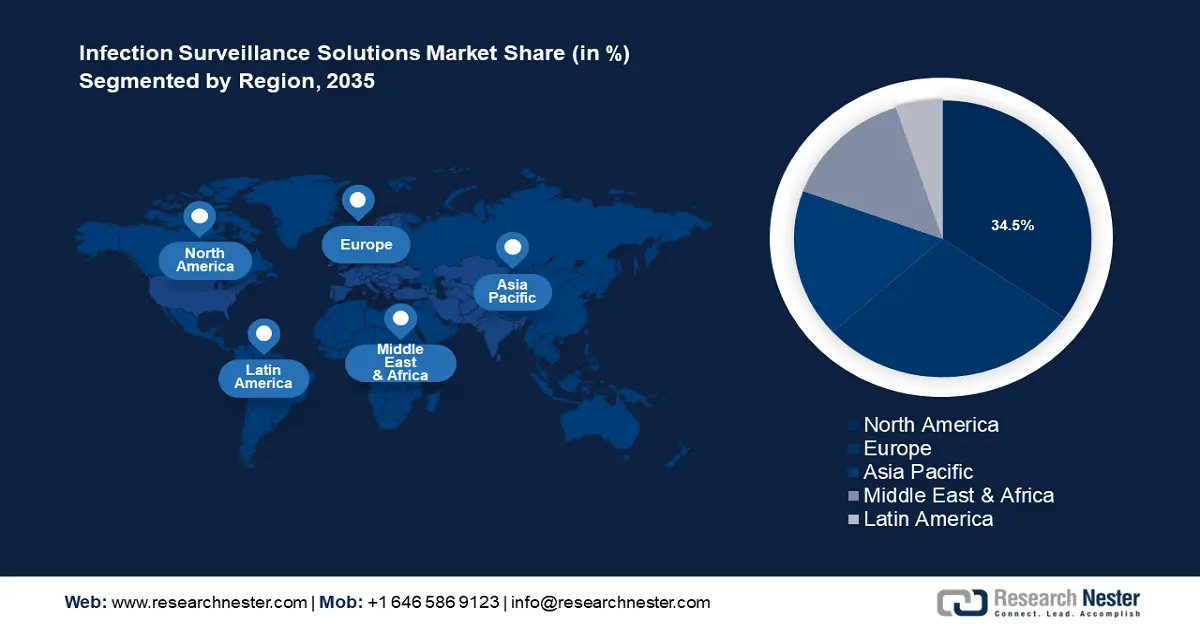

- North America infection surveillance solutions market will account for 34.50% share by 2035, driven by rising costs of HAIs and increased use of healthcare IT solutions.

Segment Insights:

- Software segment in the infection surveillance solutions market is expected to achieve 54% growth by the forecast year 2035, driven by the increasing importance of infection surveillance in the healthcare sector.

- The hospitals segment in the infection surveillance solutions market is projected to hold a significant share by 2035, attributed to hospitals’ ability to monitor more patients and the need for rapid disease analysis.

Key Growth Trends:

- Growing adoption of antimicrobial stewardship programs

- Increased incorporation of electronic hand hygiene monitoring systems

Major Challenges:

- Inadequate data management

- High costs for small healthcare organizations

Key Players: Gojo Industries, Inc., Premier, Inc., Wolters Kluwer N.V., Deb Group Ltd., BioVigil Healthcare Systems, Vecna Technologies, Inc., Pfizer Inc., Inovalon, Baxter International Inc., Cerner Corporation.

Global Infection Surveillance Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 832.2 million

- 2026 Market Size: USD 934.81 million

- Projected Market Size: USD 3 billion by 2035

- Growth Forecasts: 13.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Infection Surveillance Solutions Market Growth Drivers and Challenges:

Growth Drivers

-

Growing adoption of antimicrobial stewardship programs: The goal of the Association for Professionals in Infection Control and Epidemiology (APIC), is to reduce the rising number of HAIs. The threat to world health and development is antimicrobial resistance (AMR). According to the World Health Organization, AMR is one of the top ten worldwide public health hazards to humanity and it has a substantial financial impact on the world economy.

Prolonged disease not only causes death and disability but also lengthens hospital stays, necessitates more expensive medications, and puts those affected financially at a disadvantage. As per a report by the Organization for Economic Co-operation and Development (OECD), the adoption of AMS programs in conjunction with other policies aimed at curbing antibiotic overuse and enhancing hospital hygiene could potentially avert 1.6 million deaths and save USD 4.8 billion annually for the 33-member countries of the OECD. - Increased incorporation of electronic hand hygiene monitoring systems: Hospitals can access extensive data sets about hand hygiene (HH) compliance among healthcare workers who wear badges due to electronic hand hygiene monitoring systems (EHHMSs). Even though direct observation of hand hygiene habits is still the gold standard recommended by the World Health Organization, it is labor-intensive, subject to bias from the Hawthorne effect, and produces a much smaller denominator than EHHMSs.

All HH monitoring solutions have limitations, but many IP programs can benefit from the abundance of data that EHHMs provide. Studies indicate that EHHMSs have a high accuracy rate of over 87.2% and can improve HH compliance and IP programs with greater data sets of HH compliance. - Technological advancements in IT infrastructure: Technological developments in IT systems combined with an increased capacity for analytical processing are making it easier to design analytical and infection surveillance solutions for use in the healthcare sector. These methods include fully automated HAI surveillance by utilizing clinical support-based knowledge that aids in the identification of specific clinical terms, specialized data mining tools, and the use of algorithms with electronic medical records. Staff members in clinical and health settings can now more easily comprehend surveillance software and how to use it due to several advancements in surveillance solutions. This leads to the creation of a competent workforce in the healthcare sector.

Challenges

- Inadequate data management: Inadequate data management produces inaccurate and insufficient information about a patient's medical history and treatment, which makes surveillance systems draw the wrong conclusions. This could make it more difficult to process patient data and surgery histories on time. Therefore, an inadequate data management system may impede the growth of the infection surveillance solutions market.

- High costs for small healthcare organizations: Healthcare IT software implementation is expensive as interoperability and deployment are expensive. Furthermore, software for monitoring infections is costly, and support and maintenance services, which comprise modifying and updating software to evolving user needs, serve as a recurrent expense that makes up a significant portion of the overall cost of ownership. Therefore, this factor will hamper the infection surveillance solutions market in the coming years.

Infection Surveillance Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.7% |

|

Base Year Market Size (2025) |

USD 832.2 million |

|

Forecast Year Market Size (2035) |

USD 3 billion |

|

Regional Scope |

|

Infection Surveillance Solutions Market Segmentation:

Component (Software, Services)

Software segment is set to capture around 54% infection surveillance solutions market share by the end of 2035, due to the growing importance of infection surveillance in the healthcare industry. Furthermore, throughout the forecast period, the market for infection surveillance services is anticipated to rise significantly due to the increasing requirement to guarantee efficient HAI management and lessen the burden of issues connected to HAI.

Deployment Mode (On-premise, Web-based)

The on-premise segment in infection surveillance solutions market is poised to garner a notable share in the forecast period. The necessity to reduce the risk of data breaches and outside attacks, as well as the requirement for safe access to healthcare IT systems are driving the segment growth. According to the World Economic Forum, in 2023, the healthcare business recorded the most expensive data breaches, with an average cost of USD 10.93 million. Thus, many healthcare businesses choose on-premise software solutions to guarantee the security of their private data. Another advantage is the potential to reuse current servers and storage gear, especially for companies upgrading or migrating from one system to another.

End use (Hospitals, Clinics, Ambulatory Service Centers, Specialty Centers)

The hospitals segment in infection surveillance solutions market is estimated to gain a significant share by 2035 due to their capacity to effectively oversee the treatment of HAIs since more procedures allow for the monitoring of more patients within the allotted period. Electronic surveillance systems are used in about 45.0% of hospitals, and this percentage is likely to rise as more rapid software tools for illness pattern analysis become necessary. To contain disease outbreaks, automated methods use simulation approaches to assess historical infection trends.

Our in-depth analysis of the infection surveillance solutions market includes the following segments:

|

Component |

|

|

Deployment Mode |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Infection Surveillance Solutions Market Regional Analysis:

North America Market Statistics

North America industry is estimated to hold largest revenue share of 34.5% by 2035. The market is expanding due to the rising costs of HAIs, growing provider consolidation, and the increased use of healthcare IT solutions to reduce rising healthcare costs. Office of the National Coordinator for Health IT stated that nearly all non-federal acute care hospitals (96%) and 4 out of 5 office-based physicians (78%) had implemented certified electronic health records by 2021.

Federal rules for the adoption of clinical surveillance systems have led to an increasing number of hospitals and healthcare facilities in the U.S. implementing infection monitoring systems. According to the Office of Disease Prevention and Health Promotion, every year, over 680,000 illnesses and billions of dollars in additional healthcare expenses are incurred nationwide due to healthcare-associated infections (HAIs). In hospitals alone, one in every thirty-one hospitalized patients has at least one HAI at any given moment. Therefore, with infection surveillance software healthcare facilities can quickly detect infections.

In Canada, the growing prevalence of surgical site infections due to the increased number of surgeries is escalating the infection surveillance solutions market growth. Surgical site infections (SSIs) are thought to impact between 26,000 and 65,000 individuals in Canada each year.

Europe Market Analysis

The infection surveillance solutions market in Europe is expected to witness significant growth during the forecast period. The infection surveillance solutions market growth can be credited to the increasing prevalence of chronic diseases which has increased the number of surgical procedures in the region. EFPIA reported that 37% of Europeans 65 years of age and older suffer from several chronic illnesses; nevertheless, the percentage varies nearly threefold within EU member states.

In the UK, the adoption of infection surveillance solutions in healthcare settings is driven primarily by increased awareness of infection control sparked by events such as the COVID-19 pandemic. Tight regulatory mandates and technological advancements like artificial intelligence and big data analytics are also contributing factors.

Germany is implementing cutting-edge technologies, such as artificial intelligence (AI), to identify patterns in the virus's dissemination and prevent it from spreading. Researchers in this country are concentrating on creating a novel approach to infection surveillance so that it may be completed more quickly and effectively.

Infection Surveillance Solutions Market Players:

- GOJO Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Premier, Inc.

- Wolters Kluwer N.V.

- Deb Group Ltd.

- BioVigil Healthcare Systems

- Vecna Technologies, Inc.

- Pfizer Inc.

- Inovalon

- Baxter International Inc.

- Cerner Corporation

The leading companies in the infection surveillance solutions market are collaborating to extend their service and product offerings, as well as providing innovative treatment approaches to the industry.

Recent Developments

- In June 2020, Pfizer Inc. and Wellcome announced the formation of the Surveillance Partnership to Improve Data for Action on Antimicrobial Resistance (SPIDAAR), a new multi-year public-private research collaboration with the governments of Ghana, Kenya, Malawi, and Uganda to track resistance patterns and better understand the impact of antimicrobial resistance (AMR) on patients in low- and middle-income countries.

- In May 2020, Inovalon, a leading provider of cloud-based platforms that enable data-driven healthcare, released an infection surveillance and reporting solution that provides healthcare facilities with data-driven insights to enable real-time detection of antibiotic-resistant infections and virus outbreaks such as COVID-19.

- Report ID: 6444

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.