Disinfection Robots Market Outlook:

Disinfection Robots Market size was valued at USD 3.5 billion in 2025 and is projected to reach USD 15.6 billion by the end of 2035, rising at a CAGR of 18.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disinfection robots is assessed at USD 4.1 billion.

The global demand for automated hygiene technologies continues to expand across healthcare, transportation, hospitality, and commercial environments, which is efficiently driving growth in the disinfection robots market. The Department of Science & Technology in February 2024 revealed that India’s first septic tank and manhole-cleaning robot, Homosep Atom, which was developed by Solinas and incubated at the DST-TBI of IIT Madras, is advancing the Swachh Bharat mission by eliminating manual scavenging and enabling safe, robotic sewer cleaning across 16 cities. It also mentioned that the system integrates AI to inspect, desilt, suction, and store waste, reducing the need for multiple devices by improving municipal efficiency in cities. Solinas’ broader suite of robotic and AI tools, including Endobot and Swasth AI, also supports water-pipeline diagnostics, contamination prevention, and sewer-overflow management.

Furthermore, the proven efficacy of these robots in the healthcare sector is efficiently enhancing the uptake of the disinfection robots market, attracting both consumers and investors worldwide. In this regard, a May 2025 study published in the American Journal of Infection Control compared robotic and manual disinfection across two COVID-19–dedicated hospitals, evaluating their effectiveness against WHO-listed global priority pathogens. Using sodium hypochlorite (0.5%), both methods significantly reduced microbial loads, whereas the robotic disinfection achieved a much higher reduction (log 5.8) when compared to manual cleaning (log 3.95), with no pathogens detected after robotic application. The article also noted that this remotely operated spraying robot enabled consistent, contactless coverage, thereby minimizing human error and exposure risks. Hence, these findings support increasing the adoption of robotic disinfection systems in clinical settings to diminish secondary infections and enhance infection-control outcomes.

Key Disinfection Robots Market Insights Summary:

Regional Insights:

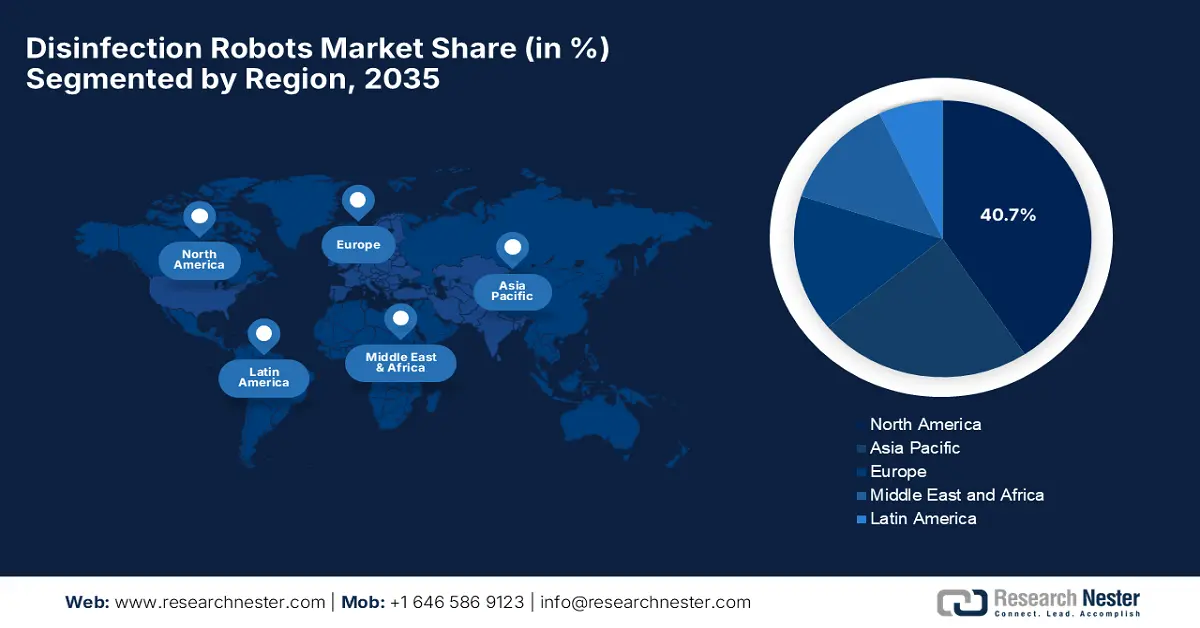

- By 2035, North America is projected to command a 40.7% share of the disinfection robots market owing to stringent hygiene and infection-control regulations across critical facilities.

- Asia Pacific is set to register the highest CAGR through 2026–2035 as escalating labor costs and strong government-backed manufacturing expansion stimulate rapid adoption of automated disinfection solutions.

Segment Insights:

- By 2035, the ultraviolet light robots segment in the disinfection robots market is anticipated to secure a 54.8% share, propelled by its superior efficacy in healthcare surface sterilization.

- The fully automated robots segment is expected to capture a significant share by 2035 as automation enhances consistency and operational precision, impelled by rising demand for error-free disinfection.

Key Growth Trends:

- Post-pandemic hygiene awareness

- Labour shortages

Major Challenges:

- Burgeoning upfront & maintenance expenses

- Regulatory & safety concerns

Key Players: UVD Robots (Denmark), Xenex Disinfection Services (U.S.), Tru‑D SmartUVC (U.S.), Finsen Technologies (U.K.), Skytron (U.S.), OTSAW Digital Pte Ltd (Singapore), Nevoa Inc. (U.S.), Bioquell (now part of Ecolab) (U.K./ U.S.), Taimi Robotics Technology (China), Mediland Enterprise Corporation (Taiwan), Akara Robotics Ltd (Ireland), Avidbots Corp. (Canada / U.S.), SESTO Robotics (Singapore).

Global Disinfection Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 15.6 billion by 2035

- Growth Forecasts: 18.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, UAE

Last updated on : 11 December, 2025

Disinfection Robots Market - Growth Drivers and Challenges

Growth Drivers

- Post-pandemic hygiene awareness: The worldwide experience of the COVID-19 pandemic has rearranged the growth dynamics in the disinfection robots market since it has shifted perceptions around hygiene, cleanliness. Most of the sectors, such as hospitals, airports, hotels, schools, and office buildings, are prioritizing standardized, frequent sanitization. In this context, Xenex LightStrike Germ-Zapping Robots reported that as of October 2022, they have completed 35 million disinfection cycles in healthcare facilities worldwide. Also, these UV-C robots help eliminate harmful pathogens on high-touch surfaces that manual cleaning may not address. Furthermore, their widespread adoption highlights hospitals’ commitment to consistent, automated disinfection and enhanced infection control, hence reflecting the growing emphasis on advanced hygiene technologies in the post-pandemic healthcare landscape.

- Labour shortages: This, coupled with the rising costs of manual cleaning, resulted in the higher turnover, wherein the dependency on manual cleaning is considered to be a costly option, which is prompting a profitable business ecosystem for the disinfection robots market. In this regard Computing Community Consortium in June 2024 stated that industries across manufacturing, healthcare, and agriculture are facing skilled labor shortages, influenced by factors such as demographic shifts, skill gaps, and economic fluctuations. It also underscores that robotics and automation are presented as solutions to address this, in which human workers are scarce, performing repetitive and physically demanding tasks. In addition, the integration of robotics and upskilling employees to operate these systems, organizations across the world can address workforce gaps while maintaining productivity, hence denoting a positive disinfection robots market outlook.

- Rising concern over infections: This aspect, especially healthcare-associated infections, which are often due to antibiotic resistance, overcrowded hospitals, and inconsistent manual cleaning, has heightened the demand for the disinfection robots market. As per an article published by the National Institute of Health in November 2022, Healthcare-associated infections pose a significant risk to patients and healthcare workers, wherein the prevalence rates range from 3.6% to 12% in high-income countries and up to 25% in underdeveloped regions. It also mentioned that radiology departments are particularly at high risk due to their pivotal role in patient care, high patient throughput, and invasive interventional procedures. Therefore, effective infection prevention depends on rigorous surveillance and strict compliance with hygiene and disinfection protocols to minimize transmission.

Challenges

- Burgeoning upfront & maintenance expenses: One of the primary challenges in the disinfection robots market is the expensive purchase costs, along with maintenance costs. The costs of UV-C or hydrogen peroxide vapour robots are extremely high, which puts them out of reach for smaller hospitals, clinics, and budget-constrained facilities, especially in developing countries. In addition, maintenance, software updates, and replacement of UV lamps or other consumables add recurring expenses for the players in this field. Therefore, the existence of these financial barriers often results in organizations relying on manual cleaning or cheaper alternatives, thereby slowing disinfection robots market penetration.

- Regulatory & safety concerns: The disinfection robots market is facing considerable obstacles from regulatory and safety concerns. These robots must comply with stringent regulatory standards, which include safety guidelines for UV-C exposure and chemical disinfectants. Also, any sort of improper use can pose health risks to humans, such as skin or eye damage, or incomplete disinfection, leading to infection spread. In this context, regulatory approvals across regions vary, which in turn complicates international expansion for manufacturers. Furthermore, facilities must implement strict operational protocols to ensure robots function safely, which also includes room vacancy during UV-C cycles or controlled chemical exposure.

Disinfection Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.1% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 15.6 billion |

|

Regional Scope |

|

Disinfection Robots Market Segmentation:

Type Segment Analysis

In the disinfection robots market, the ultraviolet light robots’ segment is expected to lead with the largest revenue share of 54.8% over the discussed timeframe. The subtype emerges as the most effective method for surface sterilization in healthcare settings. In September 2023, Xenex Disinfection Services announced that the U.S. FDA had granted the De Novo authorization for its LightStrike+ UV robot, making it the first and only UV disinfection robot formally recognized for microbial reduction in healthcare settings. The firm also notes that this device uses high-intensity, broad-spectrum ultraviolet light to disinfect non-porous, high-touch surfaces, setting a regulatory precedent for UV robots in infection control. Hence, this authorization underscores the growing role of automated UV disinfection technology in preventing healthcare-associated infections, hence denoting a wider segment scope.

Technology Segment Analysis

By the conclusion of 2035, fully automated robots are expected to account for a significant share of the disinfection robots market. The growth of the segment is highly subject to factors such as manual cleaning is labor-intensive, inconsistent, and often fails to meet stringent disinfection standards, especially in high-risk zones. Also, automation helps ensure consistency, repeatability, and minimizes human error or variability, continuously propelling growth in the segment. Also, the integration of software and algorithms is enabling better decision-making making positioning them at the forefront to generate revenue in this sector. Furthermore, advancements in robotics, pathogen detection are enhancing both operational efficiency and safety. The increasing demand for scalable solutions to handle larger facilities and public spaces also supports adoption, hence strengthening the segment’s market dominance.

End user Segment Analysis

In terms of the end user, the hospitals segment is expected to grow with a lucrative revenue share in the disinfection robots market over the forecasted years. The high-risk for HAIs has a very complex layout, many high-touch surfaces, and a need for frequent and thorough disinfection are making them natural early and primary adopters of disinfection robots. Since the hospital infrastructure is significantly expanding, the regulatory infection control standards are tightening, due to which the hospitals will likely remain the largest end-user segment. In addition, the growing adoption of advanced technologies in healthcare facilities, such as AI-based and autonomous disinfection systems, is also fueling the demand. Also, the existence of government incentives and accreditation requirements for maintaining high standards of infection prevention also supports this growth. Furthermore, hospitals are making strong investments in automation to reduce manual labor and minimize infection transmission among patients and healthcare staff.

Our in-depth analysis of the disinfection robots market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disinfection Robots Market - Regional Analysis

North America Market Insights

North America in the disinfection robots market is predicted to lead, capturing the largest revenue share of 40.7% over the forecast duration. The region’s leadership in this field is highly attributable to stringent regulations on hygiene and infection control, which are allowing different sectors to opt for improved disinfection technologies. The Texas A&M Veterinary Medical Teaching Hospital in October 2023 reported that it deployed the Tru-D Trud UVC disinfection robot with a prime focus on enhancing sanitation, targeting the resistant bacteria on surfaces such as walls, floors, and tables. The hospital also notes that this robot utilizes 28 bulbs and 360-degree sensors and customizes disinfection cycles for a room size, thereby reducing manual cleaning time. Furthermore, from the time of its introduction, this robot has been used over 800 times across operating rooms and ICUs, boosting safety for patients, staff, and the community, hence making it suitable for overall disinfection robots market growth.

The U.S. is augmenting its leadership over the disinfection robots market on account of technological improvements in automation and the rising demand for labor-saving disinfection solutions in various sectors. The country’s market also benefits from commercial spaces, educational institutions, and logistics centers that are deploying disinfection robots to ensure safer environments and reduce human dependency for routine sanitation. Simultaneously, the existence of government incentives and funding for innovative robotics technologies is also supporting market growth. The presence of major domestic players and continuous R&D investments is enabling the U.S. to maintain a strong position in the global disinfection robotics landscape. Furthermore, increasing awareness about antimicrobial resistance is also encouraging organizations to implement automated, high-efficiency disinfection solutions.

Key Deployments and Market Opportunities for Disinfection Robots in U.S. Hospitals

|

Year |

Hospital |

Details |

Market Opportunity |

|

2025 |

Parrish Healthcare, Titusville, FL |

Solaris Lytbot UV-C robots used in ICU, OR, isolation rooms; operated by EVS staff; kill bacteria and viruses |

Highlights the demand for disinfection robots in hospitals to enhance patient safety and infection control |

|

2024 |

San Gorgonio Memorial Hospital, Banning, CA |

RAY™ by HygenX.AI; AI-driven UV-C disinfection; fully autonomous with digital verification of cleaned areas |

Shows potential for AI-enabled autonomous disinfection robots to improve efficiency and infection prevention in healthcare |

Source: Official Press Releases

Canada is also efficiently growing in the disinfection robots market, backed by an increased focus on public health and workplace safety across healthcare, commercial, and industrial sectors. The country’s market also benefits from the adoption of automated disinfection systems, government-backed programs, and grants supporting innovation in robotics. Simultaneously, the partnerships between tech startups and research institutions are fostering localized development of advanced robotic solutions. In August 2022, Fraser Health in British Columbia reported that it had deployed 16 Xenex LightStrike UVGI robots, supported by two new moveable disinfection pods, across its hospitals to kill harmful pathogens such as SARS-CoV-2, C. difficile, and MRSA. It also stated that from the time of their introduction, the robots have disinfected nearly 62,000 rooms in 21 months, with data tracking to optimize usage, hence indicating a positive market outlook.

APAC Market Insights

Asia Pacific has higher potential to record the highest CAGR in the disinfection robots market, propelled by the presence of a large number of manufacturers and government initiatives. Countries across the region are witnessing huge demand for these robots since there has been an increase in labor costs. In April 2024, LionsBot International announced that it had inaugurated Southeast Asia’s largest cleaning robots factory, which spans around 4,908 square metres with a production capacity of up to 4,000 robots annually. The firm also noted that this is supported by Enterprise Singapore; the facility integrates advanced manufacturing, R&D, calibration, and quality testing, boosting innovation across sectors such as healthcare, education, retail, and logistics. Hence, the expansion positions the company to meet growing demand for automated cleaning solutions by fostering sustainable technological innovation.

China represents continued growth in the regional disinfection robots market owing to the higher rate of installations and the larger consumer base for technological adoption. As per the article published by NGS in May 2022, its study observed that during the Shanghai lockdown from March to April 2022, disinfection robots played a crucial role in pandemic control by using UV rays to eliminate germs in hospital rooms. In this context, the Deputy Dean of Shenzhen University General Hospital highlighted that these robots alleviated the burden on nursing staff who otherwise had to don time-consuming protective gear for routine tasks. Private sector companies, such as Shanghai-based Keenon Robotics, responded by ramping up production and expanding their offerings from food-serving robots to medical disinfection robots, helping hospitals mitigate virus spread and manage logistics even more efficiently.

India is growing in the regional disinfection robots market, wherein the progress is strongly facilitated by the adoption in hospitals, commercial spaces, and public facilities. The domestic innovations in terms of Far-UVC technology and collaborations with research institutions are readily enhancing the adoption of disinfection solutions. In this regard, the innovation from PES College of Engineering, in June 2023, is focused on a UV-C disinfection robot utilizing Far‑UVC light at 222nm, which has the potential to sterilize viruses and bacteria without harming human skin or eyes, not as traditional 254nm UV systems. In addition, the robot was patented in the country and published internationally, and it is designed for various applications across healthcare, agriculture, food processing, and commercial sectors, and supports initiatives such as Swachh Bharat and Make in India with a prime focus on hospitals, schools, conference halls, and public spaces.

Europe Market Insights

The disinfection robots market in Europe holds a prominent position due to the growing emphasis on automated solutions in commercial, industrial, and public sectors. The regional hospitals, transportation hubs, and educational institutions are deploying robotic systems that combine UV-C light, hydrogen peroxide vapor, or hybrid cleaning technologies to ensure consistent surface sterilization. In September 2021, Loop Robots announced that it had raised substantial USD 2 million in seed funding to scale its automated disinfection co-bot, SAM, across hospitals. The firm notes that this robot uses UVC light to deactivate up to 99.9999% of pathogens, providing safer and chemically-free cleaning. Furthermore, with strong validation in regional hospitals, SAM is positioned for large-scale deployment to improve operational efficiency.

In Germany, the disinfection robots market has benefited extremely from its deployments across industrial and public environments. The country is reflecting a strong focus on technological innovation and workplace safety, wherein the domestic manufacturers and research institutions are collaborating to develop autonomous cleaning robots. In May 2024, Nilfisk and LionsBot announced that they had jointly unveiled the SC25 at Interclean Amsterdam 2024, which is a new robotic cleaning machine combining Danish cleaning expertise with Singapore-based robotics innovation. The robot is designed for retail spaces, offices, kindergartens, and clinics, and it targets small to medium-sized environments. Furthermore, the SC25 aims to enhance cleaning efficiency while supporting staff by reducing labor-intensive tasks, hence contributing to overall disinfection robots market expansion.

The U.K. is solidifying its position in the regional disinfection robots market, highly backed by an emphasis on automation to maintain high hygiene standards. The market is also bolstered by partnerships between technology providers and NHS initiatives, promoting innovation and the deployment of data-enabled robotic cleaning systems that improve sanitation outcomes. In the U.K., Heathrow Airport has included Gausium autonomous cleaning robots in collaboration with Mitie and ICE, with a prime focus on improving the cleaning efficiency across its terminals. In this regard, Gausium in February 2025 revealed that these robots can handle high-traffic areas such as check-in zones and airside locations by automating repetitive tasks such as water management. Furthermore, this deployment enhances sustainability through water and energy savings, also freeing staff for higher-value work.

Key Disinfection Robots Market Players:

- Blue Ocean Robotics (Denmark)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- UVD Robots (Denmark)

- Xenex Disinfection Services (U.S.)

- Tru‑D SmartUVC (U.S.)

- Finsen Technologies (U.K.)

- Skytron (U.S.)

- OTSAW Digital Pte Ltd (Singapore)

- Nevoa Inc. (U.S.)

- Bioquell (now part of Ecolab) (U.K./ U.S.)

- Taimi Robotics Technology (China)

- Mediland Enterprise Corporation (Taiwan)

- Akara Robotics Ltd (Ireland)

- Avidbots Corp. (Canada / U.S.)

- SESTO Robotics (Singapore)

- UVD Robots under Blue Ocean Robotics is leading the global dynamics with the UV-C disinfection robots, which were deployed across many hospitals, airports, transport hubs, and commercial spaces. The company’s strength comes from advanced navigation, safety systems, and cloud-based monitoring are making these robots versatile beyond just healthcare. Furthermore, UBD is emphasizing international expansion and has built a wide distribution and service network that spans Europe, Asia, and North America.

- Xenex Disinfection Services is yet another dominant force in this field, which has LightStrike robots widely adopted in hospitals across both North America and Europe. The firm is strongly focused on high-intensity, rapid disinfection cycles and integration with hospital workflows. In addition, Xenex supports its commercial strength through long-term service contracts, recurring and expansion into non-healthcare facilities, thereby reinforcing leadership through proven efficacy.

- Tru‑D SmartUVC is mostly targeting consumers in healthcare and institutions who are seeking extremely safe and data-driven solutions. The company’s robots combine UV-C disinfection with dosage monitoring, analytics, and remote reporting, which allows facilities to track and optimize disinfection workflows. Furthermore, Tru‑D’s business model includes direct sales, leasing options, and service contracts, which readily help broaden adoption, especially among cost-conscious clinics and long-term care institutions.

- Finsen Technologies competes in this sector by offering a diverse portfolio consisting of both UV-C and hydrogen peroxide vapor-based disinfection robots that are highly suitable for healthcare, hospitality, transport, and public spaces. The company’s approach is attracting both regions and facilities that require flexibility across environments. Finsen is also making heavy investments in modular design and cost-effectiveness, making their solutions more accessible.

- OTSAW Digital represents a growing class of robotics firms based in Asia by targeting non-hospital spaces such as airports, public transportation hubs, commercial buildings, and other high-traffic public venues. The firm is deeply emphasizing autonomous navigation, obstacle avoidance, and 3D mapping to deliver efficient, scalable disinfection. Alsop, OTSAW’s strategy leverages regional demand for more affordable, robust robots suited for public spaces and commercial facilities.

Below is the list of some prominent players operating in the global market:

The global disinfection robots market is fragmented yet dominated by a few major pioneers such as Blue Ocean Robotics, Xenex Disinfection Services, and Tru‑D SmartUVC, leveraging proven UV-C technology and large-scale hospital deployments. Simultaneously, companies such as OTSAW Digital, Finsen Technologies, and Taimi Robotics are readily expanding by offering cost-effective, modular robots. In December 2024, Symbotic Inc. announced that it had acquired OhmniLabs, which is best known for autonomous disinfection and telepresence robots, strengthening its presence in healthcare automation. Hence, the acquisition combines Symbotic’s expertise in large-scale supply chain automation with OhmniLabs’ advanced mobile robotics, AI, and vision technologies, thereby enabling faster innovation and expanded applications. Furthermore, Symbotic aims to leverage OhmniLabs’ in-house development capabilities and skilled robotics team to deliver solutions across healthcare, logistics, and other industries.

Corporate Landscape of the Disinfection Robots Market:

Recent Developments

- In May 2025, Pudu Robotics announced that it had launched the AI-powered CC1 Pro, which is an autonomous cleaning robot designed for large commercial spaces such as retail centers, airports, and industrial warehouses. The robot uses advanced AI for cleaning detection, adaptive strategies, and component self-monitoring.

- In July 2024, Sodexo announced that it had partnered with UVD Robots, the global leader in autonomous UV disinfection robots improve environmental hygiene by reducing room turnover time by over 50%, to enhance its Protecta program across healthcare facilities.

- In June 2023, Blue Ocean Robotics notified that secured an additional EUR 10 million investment from existing shareholders to accelerate its growth strategy, focusing on product maturity, direct sales in the U.S., in which the Nordic Eye Venture Capital highlighted the strong market potential for UVD Robots and GoBe Robots, citing the continued double-digit growth.

- Report ID: 8305

- Published Date: Dec 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disinfection Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.