Rehabilitation Robots Market Outlook:

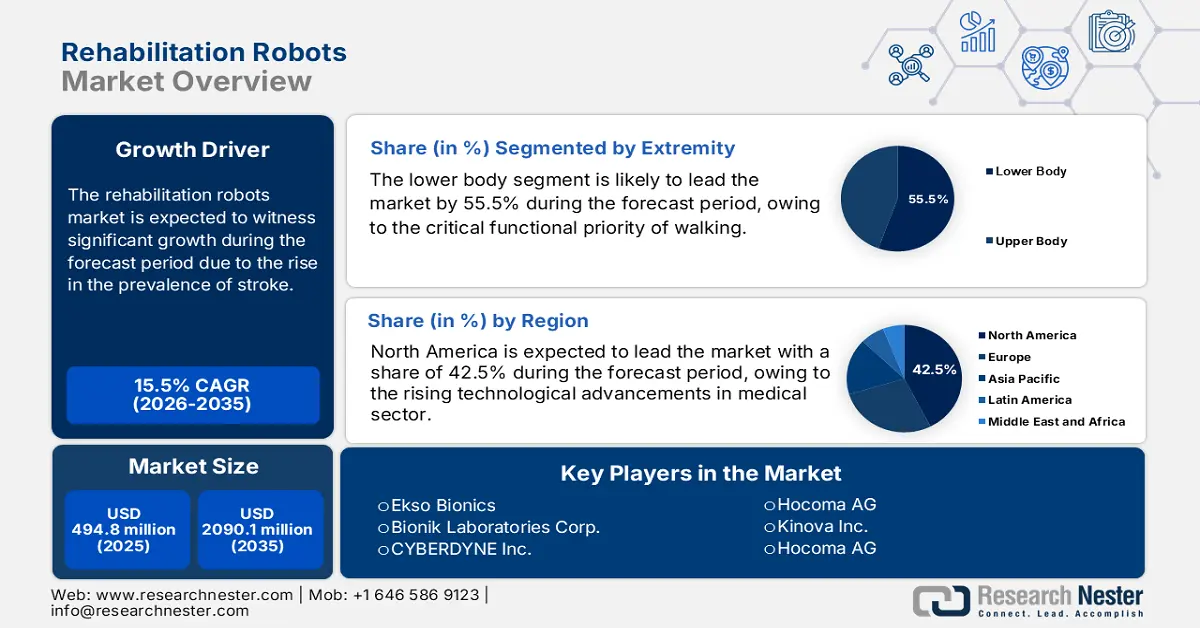

Rehabilitation Robots Market size was valued at USD 494.8 million in 2025 and is projected to reach USD 2090.1 million by the end of 2035, rising at a CAGR of 15.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of rehabilitation robots is assessed at USD 571.4 million.

The global patient pool requiring advanced rehabilitation is growing and is driven by the rising prevalence of neurological events. As per the WHO March 2024 report, more than 3 billion people in the world are living with neurological conditions. Further, the increasing incidence of stroke drives the market for rehabilitation robots. This creates a persistent demand, and the market expands based on the technology-related rehabilitation solutions. The clinical demand is surging further due to a shortage of physical and occupational therapists. This creates a clear need for an automated system that can increase and extend the capability of clinical staff.

Investment in research and development is supported by significant funding, which is aimed at proving efficacy and incorporating these modern technologies into care pathways. In the U.S., the NIH and NSF allocate a considerable amount to academic and commercial entities for enhancing and validating robotic systems in healthcare. The American Investment Council in 2025 reported that private equity supports life sciences and medical device companies by investing USD 36 billion and USD 55 billion, which indirectly drives the market by supporting innovation and commercialization of advanced robotic rehabilitation systems.

Key Rehabilitation Robots Market Insights Summary:

Regional Insights:

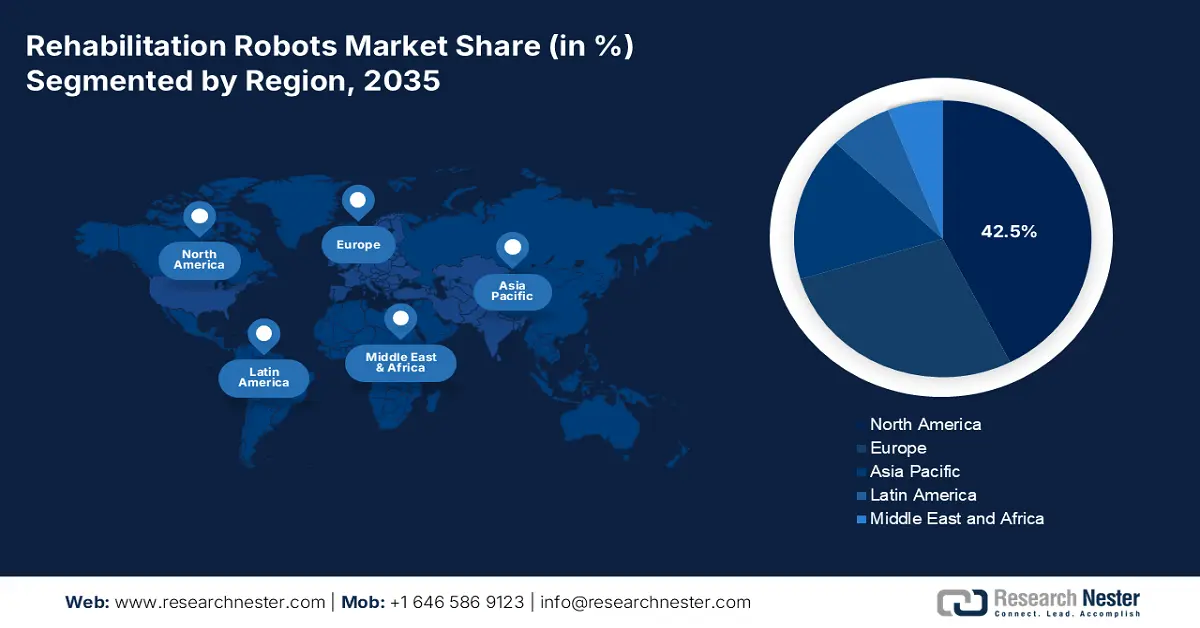

- North America is projected to secure a 42.5% share by 2035 in the rehabilitation robots market, underpinned by strong technological maturity and high clinical adoption of robotic systems in healthcare.

- Europe is anticipated to command a substantial share by 2035, supported by its advanced medical technology environment, structured reimbursement pathways, and rising neurological disease burden.

Segment Insights:

- The lower body segment is expected to hold a 55.5% share by 2035 in the rehabilitation robots market, propelled by its alignment with the critical functional priority of restoring gait and mobility.

- Stroke rehabilitation is forecast to lead the application segment by 2035, sustained by its large long-term disability burden and clinical preference for high-dose, task-oriented robotic therapy.

Key Growth Trends:

- Rising geriatric population and associated disabilities

- Increasing neurological conditions

Major Challenges:

- High development cost and extended R&D timelines

- Limited clinical adoption and therapist training

Key Players: Bionik Laboratories Corp. (USA/Canada), CYBERDYNE Inc. (USA/Japan), Hocoma AG (Switzerland), Kinova Inc. (Canada), Hocoma AG (Switzerland), Tyromotion GmbH (Austria), ReWalk Robotics Ltd. (Israel), GOGOA Mobility Robots (Spain), B-Temia Inc. (Canada/Germany), CYBERDYNE Inc. (Japan), Toyota Motor Corporation (Japan), Panasonic Corporation (Japan), RE2 Robotics (USA), Wandercraft (France), Coppelia Robotics (Australia), Coppelia Robotics (Australia), UNAM Robotics (Malaysia).

Global Rehabilitation Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 494.8 million

- 2026 Market Size: USD 571.4 million

- Projected Market Size: USD 2090.1 million by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Singapore, UAE, Mexico

Last updated on : 23 October, 2025

Rehabilitation Robots Market - Growth Drivers and Challenges

Growth Drivers

- Rising geriatric population and associated disabilities: The rising elderly population is the key driver of the market. Elderly people are the key factor for conditions such as stroke and osteoarthritis, which require rehabilitation. This demographic shift creates a sustained and long-term patient base. As per the WHO October 2025 report, 1 in 6 people will be aged 60 or over. This rising population is forcing the healthcare systems to seek technologically efficient solutions such as robotics to manage the higher volume of patients effectively, and also reduces therapy consistency and reduces the physical strain on human therapists, thereby improving care capacity.

- Increasing neurological conditions: The surging incidence of neurological disorders, such as stroke, is one of the major demands for the advancement in neurorehabilitation. Robots in healthcare are uniquely developed to deliver repetitive movement therapy that is required for neuroplasticity. The NLM study in January 2025 depicts that 12 million strokes are registered every year. This large patient pool, coupled with clinical guidelines advocating for intensive therapy, makes robotic systems a critical tool for improving outcomes and addressing therapist shortages in neurology departments worldwide.

- Advancements in technology with AI and sensors: Innovations with AI, machine learning, and sensor technology, are making robots more effective and innovative. Modern systems support patient performance and fatigue in real time. Companies such as Hocoma incorporate sensors and adaptive algorithms into modern devices to provide personalized gait training. This evolution from rigid, pre-programmed movements to responsive, patient-cooperative therapy enhances the engagement and outcomes, hence making robots a more compelling clinical tool and driving adoption beyond early adopters to mainstream therapy centers.

Incidence of Stroke by Age in 2021

|

Age |

Number |

|

15-49 years |

1,762,000 |

|

<70 years |

6,307,000 |

|

Men (all ages) |

6,284,000 |

|

Women (all ages) |

5,662,000 |

Source: NLM January 2025

Challenges

- High development cost and extended R&D timelines: The path to creating a viable rehabilitation robot is constrained due to the high development costs and extended research and development cycles. These projects demand multidisciplinary, specialized expertise and require a certain time for testing and validation to ensure efficacy and safety. The immense investment is the main challenge for the market entry of new startups and significantly delays profitability. This time period for product launch is often misaligned with the ROI expectation of many investors, which can stifle innovation and limit the participation of small startups in the field.

- Limited clinical adoption and therapist training: Technology itself is the main challenge for adoption in real-time clinical practice. A big part of this is that therapists don’t have required training to make sure they are competent and comfortable utilizing the advanced technology. Without this dedicated support and education, there is a high risk that the expensive robotic systems will be underutilized or abandoned. This not only represents a financial loss but also damages the manufacturer's reputation and hinders the broader acceptance of robotic-assisted therapy within the healthcare community.

Rehabilitation Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 494.8 million |

|

Forecast Year Market Size (2035) |

USD 2090.1 million |

|

Regional Scope |

|

Rehabilitation Robots Market Segmentation:

Extremity Segment Analysis

In the extremity segment, the lower body is dominating the segment in the rehabilitation robots market and is poised to hold a share of 55.5% by 2035. The segment is driven by the positivity of the robots as it is directly linked to the critical functional priority of walking. Based on the NLM study in published in March 2025, 60% to 70% of the people affected with stroke have dysfunction in their lower limbs. This high prevalence of lower limb impairment highlights the growing adoption of robotic rehabilitation systems focusing on restoring gait and mobility functions.

Application Segment Analysis

Under the application segment, stroke rehabilitation leads the segment in the rehabilitation robots market. Stroke is the leading cause for disability for the long term globally, which creates a massive sustained patient base. According to the CDC report in October 2024, 9.5 per 100,000 in 2022 to 39.0 per 100,000 in 2023 died due to stroke in the U.S., with many survivors facing motor impairments. Robotic therapy is uniquely positioned to deliver the high-dose, repetitive task-oriented training recommended in clinical guidelines. Further, various associations advocate for advanced rehabilitation technologies to enhance the outcomes, providing a robotic system a standard care in modern neurorehabilitation and the primary driver of demand in the application segment.

Type Segment Analysis

The exoskeleton robots are dominating the type segment in the rehabilitation robots market and are strongly driven by their capability to restore mobility and enhance health outcomes for spinal cord injury patients. The NIH highlights research showing exoskeletons can provide cardiovascular and metabolic benefits by reducing sedentary-related complications. Further, the U.S. launches various devices such as the ReWalk exoskeleton for qualified veterans with SCI, establishing an important adoption route and proving their therapeutic benefits, thus supporting market growth and reimbursement models.

Our in-depth analysis of the rehabilitation robots market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Extremity |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rehabilitation Robots Market - Regional Analysis

North America Market Insights

North America is dominating the rehabilitation robots market and is projected to hold the market share of 42.5% by 2035. The region is defined by technological maturity and high adoption rates of robots in the healthcare sector. According to the NLM study in April 2025, the study evaluated the ROBERT device's effectiveness in improving hip flexor strength after SCI. The device was launched by Life Science Robotics. The result has provided positive feedback with 92% training adherence with no adverse events. This finding has highlighted that cobot-assisted training is effective in enhancing hip flexor strength.

The U.S. is dominating the North America region and is characterized by a high burden of stroke and spinal cord injuries. The NICHD data in March 2025 reports that approximately 795,000 people suffer a stroke annually, creating a substantial patient base for rehabilitation robotics. The key trend is the expansion of telehealth services, thereby supporting remote robotic therapy. Further, the utilization of systems like the ReWalk exoskeleton for spinal cord-injured veterans demonstrates federal endorsement. The market is also experiencing larger medical device companies acquiring innovative startups to expand their technological portfolios and surge commercial scaling.

Canada's rehabilitation robots market is characterized by an emphasis on fair access and integration in its publicly funded health system. The Canadian Institute for Health Information underlines that strokes are one of the primary causes of disability, with demand for effective rehabilitation technology being driven. According to the Natural Sciences and Engineering Research Council of Canada report in November 2022, emerging motion control robotics and rehabilitation tools garnered an overall award of USD 46,000 under NSERC's Discovery Grants Program (Individual). This fund aims to create algorithms that allow robots to perform complex and stable motions with applications in rehabilitation and medical devices.

Latest Rehabilitation Robots in 2025

|

Product Name |

Company / Origin |

Key Features |

Rehabilitation Focus |

Additional Notes |

|

ArmMotus EMU |

Fourier Rehab (US) |

Immersive gamified therapy, 3D cable-driven upper limb exoskeleton with de-weighting |

Upper limb motor rehabilitation |

Award-winning product, demonstrated at RehabWeek 2025 |

|

ExoMotus M4 |

Fourier Rehab (US) |

Ergonomic body frame, gait training exoskeleton, fall risk reduction |

Gait and mobility recovery |

Clinically focused on stroke, TBI, spinal cord injury patients |

|

GR-1 Humanoid Robot |

Fourier Rehab (US) |

Embodied AI, human-like movement, interactive AI-driven rehab partner |

Advanced neurorehabilitation |

Demonstrated cutting-edge embodied AI robotics for rehab |

Source: Fourier Rehab May 2025

APAC Market Insights

Asia Pacific is the fastest-growing region in the rehabilitation robots market and is expected to grow at a CAGR of 11.5% by 2035. The region is driven by the rising aging population, growing healthcare spending, and enhanced government emphasis on advanced medical technology. Japan and South Korea are leading due to their technological expertise in robotics to support elder care requirements. Strategic joint ventures between global leaders and domestic producers are the norm to meet varied regulatory environments and price sensitivities.

Japan has the biggest market share in APAC, driven by the world's most aged society with 36.23 million aged 65 or above, according to the September 2023 World Economic Forum report. The government actively encourages robotic solutions to balance labor shortages in healthcare, and the Ministry of Economy, Trade, and Industry offers subsidies for the establishment and introduction of nursing care robots. A foremost real-world instance is the Hybrid Assistive Limb from CYBERDYNE, which has received regulatory approval and is being used in most medical centers around the world, with widespread adoption within Japan itself.

India is leading the rehabilitation robots market with high growth potential defined by a large population and growing awareness of rehabilitation care. The government focuses in making healthcare more affordable and accessible, as seen in the Ayushman Bharat scheme. As per the NLM study in February 2022, the incidence of strokes in India ranges from 105 and 152 per 100,000 people per year. This number highlights a significant addressable patient base. Further companies, such as GenRobotics, are emerging, aiming to develop cost-effective exoskeleton solutions for the domestic market.

Europe Market Insights

Europe is the second largest market for rehabilitation robots and is led by the technologically advanced environment, with robust healthcare infrastructure, favorable government policies, and an increasing number of elderly populations. As per the MedTech Europe report in 2025, the medical technology sector in Europe reached €170 billion in 2024. The major drivers are the high incidence of neurological diseases, such as stroke and a heightened emphasis on enhancing post-treatment quality of life with advanced rehabilitation. A significant trend is the integration of robotics into standard clinical pathways, supported by favorable reimbursement frameworks in countries like Germany and France.

Germany is the largest rehabilitation robotics market in Europe and is fueled by its strong economy and comprehensive healthcare reimbursement system. The Federal Ministry of Health and the German statutory health insurance funds facilitate the adoption of new diagnostic and therapeutic methods, including advanced robotic aids. The Destatis report in April 2023 depicts that the healthcare expenditure in Germany reached 474 billion euros in 2021, which ensures a substantial market. Further, the country’s rising elderly population and increasing investments in robotic-assisted rehabilitation centers are surging the market expansion.

The UK market demand is high and is driven by a rising aging population and an increasing focus in improving efficiency in long-term care. In order to decrease hospital stays, the NHS Long Term Plan places a high priority on innovation in community services and rehabilitation. Investment in medical technology, such as robotics, is also a main driver leading the market. For example, the NHS's Accelerated Access Collaborative facilitates the adoption of transformative technologies, through which robotic devices can be fast-tracked. The UK Association of British Healthcare Industries points out that the wider medical technology industry is contributing more than a billion pounds to the UK economy, and this underlines the strategic value of such innovations.

Key Rehabilitation Robots Market Players:

- Ekso Bionics (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bionik Laboratories Corp. (USA/Canada)

- CYBERDYNE Inc. (USA/Japan)

- Hocoma AG (Switzerland)

- Kinova Inc. (Canada)

- Hocoma AG (Switzerland)

- Tyromotion GmbH (Austria)

- ReWalk Robotics Ltd. (Israel)

- GOGOA Mobility Robots (Spain)

- B-Temia Inc. (Canada/Germany)

- CYBERDYNE Inc. (Japan)

- Toyota Motor Corporation (Japan)

- Panasonic Corporation (Japan)

- RE2 Robotics (USA)

- Wandercraft (France)

- Coppelia Robotics (Australia)

- Coppelia Robotics (Australia)

- UNAM Robotics (Malaysia)

- Ekso Bionics is a leading player in robotic exoskeletons for medical rehabilitation and human performance. The company is advancing by developing lower and upper extremity exoskeletons that integrate adaptive gait algorithms and real-time data analytics. This technology allows the devices to provide customized and data-driven assistance for patients with neurological conditions, providing neurorecovery and enabling clinics to quantify patient progress objectively outside traditional therapy settings.

- Bionik Laboratories is innovating in the field of rehabilitation robotics by incorporating gamified therapy and AI-driven adaptive assistance into its systems, like InMotion ARM/HAND robots. This enhancement transforms repetitive task practice into an engaging experience for stroke survivors, using performance data to adjust the level of robotic support. The therapy aims to improve motor function recovery and improve patient motivation and adherence.

- Cyberdyne is also leading with its Hybrid Assistive Limb (HAL) exoskeleton that utilizes a unique bio-cybernic system. The total revenue for the year 2024 reached 4,352 million yen. The latest technology reads bioelectric signals from the patient's skin to initiate and aid voluntary limb movement. Further, it enables patient-driven and real-time robotic therapy for individuals with spinal cord injuries and other mobility disorders, enabling neuromotor recovery by reinforcing the brain’s intention to move and ensuring the therapy is controlled by user's nervous system.

- Hocoma is at the forefront of high-intensity, functional rehabilitation robotics with products such as the Lokomat and Armeo. The firm has pushed the market forward with integrated feedback systems that integrate robotic actuation with fully immersive virtual reality environments. This provides a comprehensive and engaging therapy session in which patients do functional tasks with the robot, supporting body weight and providing guidance.

- Kinova is a company that develops light, agile robotic arms, and it applies this technology to use in the rehabilitation sector to help those with upper-body mobility impairments. The company’s total operational cost reached £ 6,483,000 in 2024. The firm has done a lot to innovate by emphasizing user-friendly design and easy control interfaces like joysticks, sip-and-puff, and myoelectric control.

Here is a list of key players operating in the global market:

The rehabilitation robot market is fragmented and is driven by leading players from various regions, such as Europe and the U.S. These players dominate via technological prowess and well-established clinical partnerships. This competitive landscape is defined by R&D focused on creating innovative, adaptive, and data-driven robotic systems. Further, strategic alliances, mergers, and acquisitions also lead the market. For instance, in October 2025, Zimmer Biomet Holdings, Inc. completed its acquisition of Monogram Technologies Inc. The acquisition focus on utilizing the capability of robotic technology and expanding its market reach beyond clinical settings.

Corporate Landscape of the Rehabilitation Robots Market:

Recent Developments

- In July 2025, Hermina Kemayoran Hospital in Jakarta launched its new Robotic Rehabilitation Centre, marking the first facility within the Hermina Hospitals Group, which has a network of 52 hospitals across Indonesia.

- In November 2024, Hyundai Motor and Kia’s Robotics LAB announced plans to introduce the X-ble Shoulder at Wearable Robot Tech Day. The robot is used to enhance the industrial efficiency and minimize musculoskeletal injuries.

- In November 2024, Syrebo has introduced several rehabilitation robots at MEDICA 2024 in Düsseldorf, targeting remote therapy and advanced motion assistance for stroke and neuro patients.

- Report ID: 4049

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rehabilitation Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.