Industrial Safety Market Outlook:

Industrial Safety Market size was valued at USD 5.8 billion in 2025 and is projected to reach USD 11.9 billion by the end of 2035, rising at a CAGR of 8.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial safety is estimated at USD 6.2 billion.

The industrial safety market is set for extensive growth owing to rising preference for workplace safety, process hazard management, and compliance with evolving regulations. In this regard, the government of Canada in January 2026 launched calls for project proposals to support innovative initiatives that promote safer, more diverse, and equitable workplaces in federally regulated private sectors. It is led jointly by Employment and Social Development Canada and Impact Canada, whereas the funding will be delivered through the WORBE program and the workplace harassment and violence prevention fund. Based on the government data, up to USD 16.5 million will be available, and selected projects can receive up to USD 500,000 per year for up to three years starting in June 2026. Therefore, such funded projects will focus on improving workplace culture and making practical tools publicly available for workplaces across Canada.

Furthermore, the government-backed training programs and continuous advancements in automation, robotics, and digital technologies are stimulating growth in the industrial safety market. In September 2024, the U.S. Department of Labor announced the award of USD 12.7 million in Susan Harwood Training Grants to 102 nonprofit organizations across the U.S. to advance workplace safety and health education. It is administered by OSHA, and the grants support training on hazard awareness, prevention, and workers’ rights under the Occupational Safety and Health Act. In addition, the funding covers targeted topic training, training and educational materials development, and capacity-building initiatives, with a prime focus on high-hazard industries and vulnerable worker populations, hence contributing to wider industrial safety market expansion.

2024 Susan Harwood Training Grant - Selected Government-Reported Safety Training Awards

|

Organization |

City |

State |

Award Amount (USD) |

|

South Arkansas College |

El Dorado |

AR |

104,054 |

|

Arizona State University |

Tempe |

AZ |

160,000 |

|

National Day Laborer Organizing Network |

Pasadena |

CA |

160,000 |

|

Community Services & Employment Training, Inc. |

Visalia |

CA |

160,000 |

|

Construction Education Foundation of Colorado |

Denver |

CO |

159,860 |

|

Colorado State University |

Fort Collins |

CO |

145,893 |

|

Connecticosh Health Technical Committee, Inc. |

Newington |

CT |

159,814 |

|

LiUNA Training & Education Fund |

Pomfret Center |

CT |

158,677 |

|

American Road & Transportation Builders Association |

Washington |

DC |

160,000 |

|

Association of Farmworker Opportunity Programs |

Washington |

DC |

160,000 |

|

Farmworker Justice Fund Inc |

Washington |

DC |

160,000 |

|

Institute of Scrap Recycling Industries Inc |

Washington |

DC |

160,000 |

|

Florida International University |

Miami |

FL |

160,000 |

|

United Safety Council, Inc. (Florida Safety Council) |

Orlando |

FL |

94,409 |

|

OSAP Foundation Inc. |

Atlanta |

GA |

143,789 |

|

Iowa State University of Science & Technology |

Ames |

IA |

160,000 |

|

University of Iowa |

Iowa City |

IA |

159,736 |

|

Latino Worker Safety Center |

Joliet |

IL |

160,000 |

|

William Rainey Harper College |

Palatine |

IL |

151,720 |

Source: OSHA

Key Industrial Safety Market Insights Summary:

Regional Highlights:

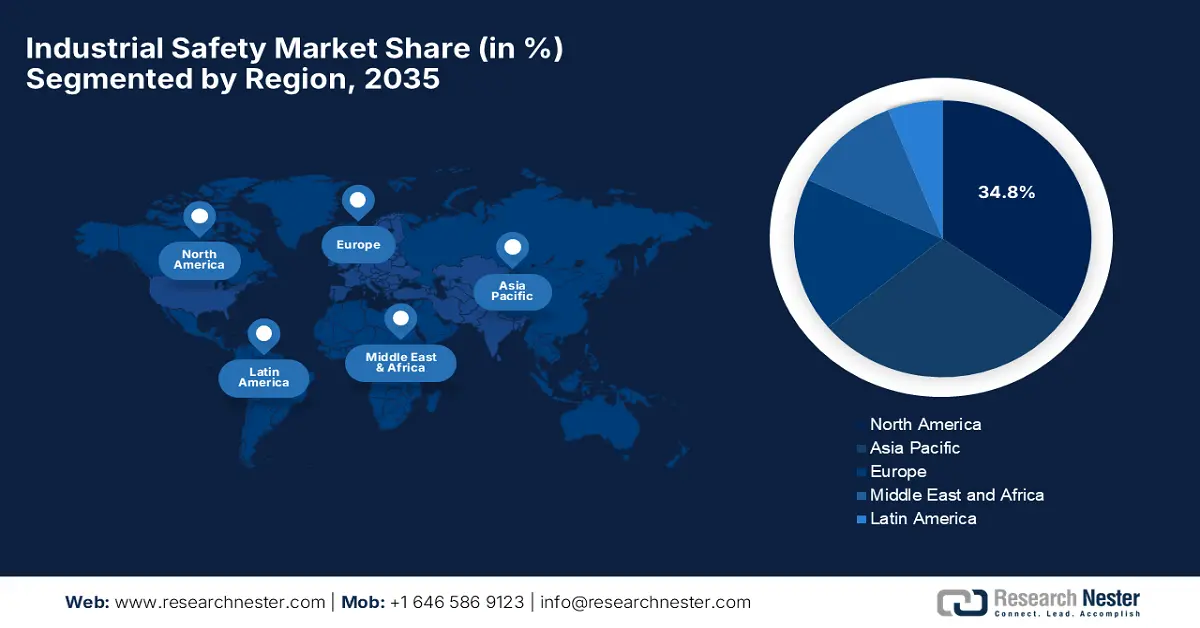

- North America is projected to dominate the industrial safety market with an estimated 34.8% share by 2035, supported by robust regulatory enforcement and high penetration of advanced safety technologies across industrial facilities.

- Asia-Pacific is expected to register rapid expansion through 2035, stimulated by accelerated industrialization, the rise of manufacturing hubs, and growing deployment of AI- and robotics-integrated safety systems in high-risk industries.

Segment Insights:

- Oil & Gas is projected to secure a dominant 49.4% revenue share by 2035 in the industrial safety market, underpinned by the hazardous nature of operations, stringent safety regulations, and rising integration of automated monitoring, gas detection, and AI-enabled hazard prevention technologies.

- Emergency shutdown systems are expected to command a significant share by 2035, supported by their critical role in automatically halting operations during unsafe conditions across high-risk industries, reinforcing demand through their accident-prevention capabilities.

Key Growth Trends:

- Stringent regulatory compliance

- Industrial automation & industry 4.0 integration

Major Challenges:

- High implementation and equipment costs

- Regulatory compliance complexity

Key Players: Honeywell International Inc. (U.S.), 3M Company (U.S.), MSA Safety Incorporated (U.S.), Ansell Limited (Australia), DuPont de Nemours, Inc. (U.S.), Drägerwerk AG & Co. KGaA (Germany), Rockwell Automation, Inc. (U.S.), Schmersal Group (Germany), Kimberly-Clark Corporation (U.S.), Lakeland Industries, Inc. (U.S.), Uvex Safety Group GmbH & Co. KG (Germany), Terra Universal, Inc. (U.S.), Gerson Company, Inc. (U.S.), Global Industrial Company (U.S.), MSA Safety (Singapore).

Global Industrial Safety Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.8 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 11.9 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Vietnam, Indonesia, Brazil

Last updated on : 13 January, 2026

Industrial Safety Market - Growth Drivers and Challenges

Growth Drivers

- Stringent regulatory compliance: This, coupled with the safety standards imposed by the administrative bodies, is encouraging companies to make investments in safety systems and training to avoid penalties and protect workers. Regulatory filings show that in December 2024, OSHA finalized a revision to its personal protective equipment (PPE) standard for construction (29 CFR 1926.95) to require that PPE must properly fit each employee. This, in turn, aligns the construction standard with existing general industry and shipyard requirements and also reports that properly fitting PPE is highly essential to protect workers from hazards, prevent additional risks, and ensure compliance with safety programs. Also, OSHA’s action followed extensive stakeholder input, which includes comments highlighting injuries from ill-fitting PPE, particularly among women and smaller workers, demonstrating the practical safety impact of this regulatory update, increasing uptake of the industrial safety market.

- Industrial automation & industry 4.0 integration: Growth in automation, robotics, and smart manufacturing increases the need for safety systems that can manage human–machine interaction risks. In June 2025, Fraunhofer IFF unveiled cognitive robots that are capable of handling complex manufacturing tasks, along with PARU, a patented safety system projecting dynamic light curtains around robots at Automatica 2025. In addition, they also showcased computer-aided safety software, which supports planning, risk assessment, and compliance for human-robot collaboration, adapting robot speeds and distances based on real-time conditions. These innovations demonstrate how AI-based automation and Industry 4.0 technologies are being paired with advanced safety systems to manage human–robot interaction risks in modern manufacturing, driving business in the industrial safety market.

- Rise in industrial accidents & hazardous conditions: This is yet another important growth driver for the industrial safety market since the surge in accidents in various industrial areas fuels the demand for safety systems that reduce accident frequency. In this context, IndustriALL in December 2024 reported that in the same year, India witnessed more than 400 worker mortalities and over 850 serious injuries across the sectors of manufacturing, mining, and energy, majorly influenced by systemic safety lapses and regulatory weaknesses. It also highlighted that major incidents are explosions and fires at chemical and pharmaceutical factories, as well as accidents in mining and automotive supply chains, sometimes involving untrained or precarious workers, thereby highlighting the urgent need for stronger enforcement and higher potential for the industrial safety market over the forecasted years.

U.S. Private Industry Workplace Injuries & Illnesses: Official Statistics & Trends 2023

|

Category |

2023 Cases |

|

Total nonfatal workplace injuries & illnesses |

2,600,000 |

|

Total illnesses |

200,100 |

|

Respiratory illnesses |

100,200 |

|

Injury cases |

2,399,900 |

Source: BLS

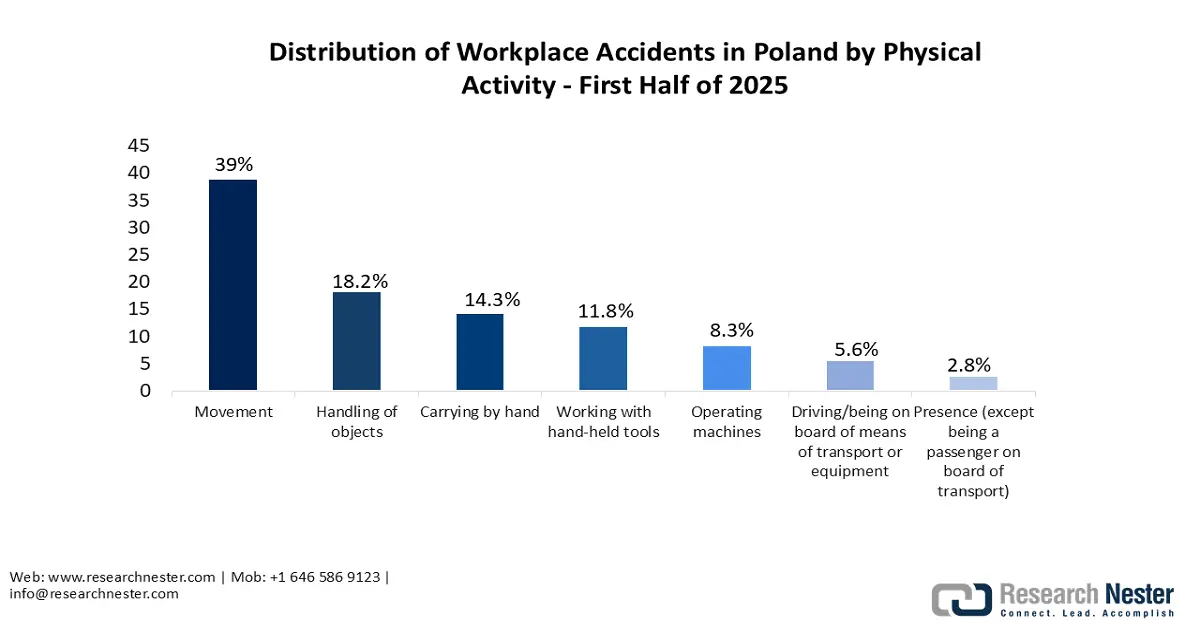

Source: Statistics Poland

Challenges

- High implementation and equipment costs: This is one of the main obstacles that is limiting adoption in the industrial safety market. Industrial safety solutions, such as gas detection devices, emergency shutdown systems, and smart PPE, require considerable capital investment, wherein small and medium sized enterprises might find it restrictive. Even large corporations in this field face constraints during the implementation of safety programs across multiple sites in terms of budget. In addition, the factor of ongoing maintenance, calibration, and training costs adds to the financial burden. This high cost can slow down industrial safety market penetration, especially in emerging economies where industries are rapidly expanding but lack sufficient safety budgets.

- Regulatory compliance complexity: Industrial safety companies operate under a very complex web of national and international regulations, which vary by country and industry. Organizations must comply with standards and other occupational safety frameworks, thereby creating hesitation among players to make investments in this field. This complexity can pose a major drawback in ensuring that products, equipment, and workplace safety programs meet regulatory requirements. In this regard, non-compliance can cause penalties and even operational shutdowns. In addition, regulations are being frequently updated, requiring continuous monitoring and adaptation. In this context, manufacturers and service providers find it complex to navigate these requirements, increasing operational complexity and negatively impacting the industrial safety market.

Industrial Safety Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 11.9 billion |

|

Regional Scope |

|

Industrial Safety Market Segmentation:

Industry Segment Analysis

In the industry segment, oil & gas is anticipated to garner the largest revenue share of 49.4% in the industrial safety market during the forecast duration. The subtype’s growth is mainly propelled by the high-risk operations, safety regulations, and increasing adoption of safety technologies such as automated monitoring systems, gas detection, and AI-enabled hazard prevention solutions. In 2025, NOPSEMA announced that it had implemented the Offshore Petroleum and Greenhouse Gas Storage (Safety) Regulations 2024 in Australia by updating the 2006 Act to strengthen safety requirements for offshore oil and gas operations. It also notes that the revisions include enhanced risk management, mandatory safety case reviews, and improved workforce health provisions, ensuring that operators integrate safety systems before commencing activities. Furthermore, NOPSEMA updated guidance materials, consulted industry stakeholders, and continues to refine the regulations to maintain compliance and clarity for the offshore sector.

Product Type Segment Analysis

By the end of 2035, emergency shutdown systems are expected to hold a significant share of the industrial safety market. Critical in high-hazard industries such as oil, gas, and chemicals, ESD systems automatically shut down operations during unsafe conditions, thereby preventing accidents, driving continued revenue in the segment. In May 2022, Emerson announced that it had launched the TopWorx DX PST with HART 7, which is a discrete valve controller that efficiently enhances industrial safety by enabling partial stroke testing and predictive maintenance without shutting down operations. It also mentioned that the system can automatically perform an emergency shutdown if unsafe conditions are detected by ensuring valve integrity in hazardous applications such as oil, gas, chemical, and mining facilities. In addition, the system is certified for SIL 3 and is compatible with redundant control systems; it integrates valve diagnostics into digital and IIoT platforms, hence denoting a wider segment scope.

Application Segment Analysis

Based on the application, machine safety is expected to grow at a considerable share of the industrial safety market during the discussed timeframe. The segment’s progress in this field is attributable to the rise of robotics and automation; machine safety systems, such as interlocks, light curtains, and guarding devices, are essential to protect operators. On the other hand, machine safety has become even more critical as factories adopt collaborative robots (cobots) and automated machinery that operate along with human workers. Technologies such as safety interlocks, light curtains, and presence-sensing devices help prevent accidents by stopping machines when a human enters a hazardous zone. Regulatory standards are driving adoption, ensuring that safety systems meet rigorous functional safety requirements, attracting more players to make investments in this field.

Our in-depth analysis of the industrial safety market includes the following segments:

|

Segment |

Subsegments |

|

Industry |

|

|

Product Type |

|

|

Application |

|

|

Component |

|

|

PPE |

|

|

Sensors & Detectors |

|

|

Offering |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Safety Market - Regional Analysis

North America Market Insights

The North America industrial safety market is forecast to emerge as the largest regional market, representing an estimated 34.8% share by the end of 2035. The stronger regulatory frameworks and higher adoption of safety technologies are the key factors catalyzing the region’s pace of progress in this field. In August 2025, a fatal explosion at U.S. Steel’s Clairton Coke Works in Pennsylvania killed two employees, seriously injured four others, and damaged nearby structures. In this context, the U.S. Chemical Safety Board issued interim safety recommendations urging U.S. Steel to conduct a thorough facility siting evaluation to identify hazards near occupied buildings and ensure safe worker relocation. The recommendations also call for mitigating any risks identified in line with industry safety principles. In addition, the CSB also emphasized that these measures are critical to preventing future explosions, fires, or toxic releases at the facility, hence contributing to overall industrial safety market growth.

The U.S. industrial safety market is strongly backed by ever-increasing adoption of industrial automation, stringent safety regulations, and extensive use of emergency shutdown systems, fire and gas monitoring, and pressure protection systems across various sectors. The presence of key industrial safety market players and strategic growth approaches is also fostering a profitable business environment. Testifying to this in August 2025, MSA Safety released its latest impact report, which represents the company’s mission-driven approach to protecting workers and infrastructure through innovative safety products and solutions. The report outlines progress across three focus areas being products and solutions, people, and planet, by also including advancements in head protection, connected leak detection, and fire helmets, along with initiatives supporting employee wellbeing and sustainability. In addition, MSA also mentioned its global impact, estimating that its products helped protect around 40 million workers worldwide in 2024, thereby reinforcing its long-standing commitment to workplace safety.

Canada industrial safety market benefits from a combination of government-led safety initiatives and industry-driven innovation. The country’s market is also positively influenced by regional climate conditions, which efficiently prompt solutions that address extreme temperature operations and environmental hazards while also ensuring worker protection. Based on the government data published in March 2025, Canada updated the Canada Occupational Health and Safety Regulations (SOR/2025‑79) under the Canada Labour Code to strengthen workplace safety across multiple sectors, including oil and gas, aviation, maritime, and rail. It also notes that amendments introduced stricter limits on chemical exposure, clarified first aid and injury reporting requirements, and ensured critical safety documents are readily accessible at worksites. The presence of these government-led changes reflects the country’s priority to enhance industrial safety and protect employees from occupational hazards.

APAC Market Insights

The Asia-Pacific industrial safety market is exponentially growing on account of accelerated industrialization, growth in manufacturing hubs, and increased awareness of workplace safety standards. The high-risk industries are the main revenue drivers for the market since countries across this region are integrating automated safety systems with robotics and AI-based monitoring tools in the high-risk industries. In this context, Hitachi, Ltd. and Hitachi Plant Construction in October 2025, together reported that they developed a risk and hazard prediction support system using their AI agent Naivy with a prime focus on enhancing worksite safety across industrial sectors, which includes construction, power, railways, and manufacturing. The system efficiently recreates worksites in a metaverse environment, allowing Naivy to analyze past accidents, knowledge bases, and site photos to visualize hazards and recommend site-specific safety measures, allowing a steady industrial safety market growth.

Factories implementing automation and robotics solutions to meet production targets are the key factor propelling growth in China industrial safety market. The country’s market also benefits from safety technologies as machine guarding, emergency shutdown systems, and real-time monitoring, which are being deployed to reduce industrial accidents in various sectors. In April 2025, Hanwei Technology Group announced that it is participating in the 49th IPA Convex 2025 at the Indonesia Convention Exhibition, by showcasing its gas detection solutions for oil, gas, and urban gas industries. During the same time, the company displayed portable personal gas detectors, fixed toxic, combustible gas detectors, and open-path detection systems, which are designed to enhance both workplace and industrial safety. Hence, such instances position China at a leading position in the regional industrial safety industry, encouraging more players to establish their footprint in the country.

India industrial safety market is gradually evolving at a notable pace on account of increasing awareness of workplace hazards and regulatory reforms. Despite challenges in enforcement, there has been a rising focus on training and safety audits to minimize industrial fatalities and injuries in the country. In December 2025, the country’s government reported that it strengthened safety for the workers in hazardous industries under the new labour codes by consolidating 29 laws into a combined framework. These reforms mandate risk assessments, emergency response systems, PPE, health check-ups, and training, while also providing social security benefits such as ESI, PF, gratuity, and maternity protection. In addition, these measures create a safer, accountable, and future-ready work environment for employees in high-risk industries as mining, chemicals, petroleum, and heavy manufacturing, hence contributing to overall industrial safety market growth.

Europe Market Insights

Europe’s industrial safety market is growing on account of stringent compliance with EU directives, such as the Machinery Directive and ATEX regulations. The focus on sustainability and worker well-being is readily encouraging the adoption of smart and energy-efficient safety devices across factories and plants throughout the region’s vast geography. In this context, MSA Safety, Inc. in November 2025 announced that it had launched the ALTAIR io 6 multigas detector in Europe at the A+A International Trade Fair in Düsseldorf, consisting of an integrated pump and cellular connectivity for real-time hazard monitoring. The detector is a part of the MSA connected work platform, and it allows construction, manufacturing, oil & gas, and utility workers to monitor confined spaces safely, whereas MSA grid software provides location and alert data across fleets of devices. Therefore, this innovation highlights MSA’s focus on enhancing industrial safety through advanced detection technologies, wearable devices, and connected safety solutions.

Europe Workplace Accidents & Fatalities: Official Eurostat Data (2022-2023)

|

Statistic |

2023 |

2022 |

|

Non-fatal accidents at work |

2,830,000 |

2,978,935 |

|

Fatal accidents at work |

3,298 |

3,286 |

|

Incidence rate of fatal accidents (per 100,000 workers) |

1.63 |

1.66 |

|

The percentage of fatal accidents out of all accidents |

0.1% |

- |

Source: Eurostat

Germany industrial safety market is maintaining a strong position in the regional landscape owing to its progressing manufacturing sector in terms of automotive, chemicals, and machinery. Research and innovation in Industry 4.0 also drive the adoption of connected and automated safety solutions in the country. In July 2025, U‑TECH GmbH announced the launch of its U‑TECH FLEX, which is an innovative radio-based personal protection system especially designed for industrial plants in Germany. The company also notes that this system detects hazards on machines such as conveyors, shredders, and cutting equipment, automatically triggering emergency stops to prevent accidents, and can be retrofitted to both new and existing machines. In addition, it is certified to international safety standards, whereas U‑TECH FLEX enhances worker safety and supports the company’s commitment to vision zero, aiming to eliminate serious workplace accidents.

The U.K. industrial safety market is primarily shaped by strict HSE regulations and a strong industrial compliance culture. Safety systems such as gas detection, machine interlocks, and emergency shutdown solutions are being consistently deployed across energy, chemical, and food processing industries. In November 2025, Discovering Safety and Safetytech Accelerator announced that they had received government funding from the £12 million (USD 15 million) regulators’ pioneer fund, which was launched by the country’s Department for Business, Energy and Industrial Strategy (BEIS), to generate evidence-based assessments of industrial safetytech against construction regulatory frameworks. The project, ‘enabling innovation in industrial safetytech,’ will use a regulatory sandbox approach to help regulators, innovators, and industry collaborate on safely deploying emerging safety technologies.

Key Industrial Safety Market Players:

- Honeywell International Inc. (U.S.)

- 3M Company (U.S.)

- MSA Safety Incorporated (U.S.)

- Ansell Limited (Australia)

- DuPont de Nemours, Inc. (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Rockwell Automation, Inc. (U.S.)

- Schmersal Group (Germany)

- Kimberly-Clark Corporation (U.S.)

- Lakeland Industries, Inc. (U.S.)

- Uvex Safety Group GmbH & Co. KG (Germany)

- Terra Universal, Inc. (U.S.)

- Gerson Company, Inc. (U.S.)

- Global Industrial Company (U.S.)

- MSA Safety (Singapore)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc. leading firm in industrial safety solutions, is offering a product portfolio that includes personal protective equipment, gas detection systems, safety sensors, and automation safety controls. The company leverages advanced IoT and connected safety technologies to provide real-time monitoring and predictive hazard detection, enabling highly efficacious, safer industrial operations.

- 3M Company is based in the U.S. and is based for its PPE, respiratory protection, hearing protection, and fall protection solutions. Its focus on research and innovation has positioned it as a front-runner in high-performance protective gear and industrial safety products. In addition, 3M makes continued investments in new material technologies, digital safety solutions, and smart PPE, by efficiently progressing into emerging markets.

- MSA Safety Incorporated is yet another frontrunner in this field that specializes in equipment and solutions for worker protection in hazardous environments, which includes gas detection, head, eye, and respiratory protection, and industrial fire safety. Meanwhile, the company deliberately emphasizes innovation through smart PPE, wearable sensors, and connected safety systems that provide actionable safety insights. Further, MSA pursues distinct strategic activities with a prime focus on enhancing its service portfolio, aiming to reduce workplace incidents and deliver safety solutions across the energy, manufacturing, and construction industries.

- Ansell Limited is focused mainly on chemical, medical, and industrial protective solutions, offering gloves, clothing, and safety equipment that is designed to protect workers from chemical, biological, and mechanical hazards. The company incorporates advanced material technologies such as MICROCHEM and ergonomic designs for improved comfort and performance. Sustainable product development, distribution expansion, and targeted acquisitions are a few strategies opted for by the firm to secure its market position.

- DuPont de Nemours, Inc. is a pioneer in protective fabrics, chemical-resistant PPE, and industrial safety materials. The company’s product portfolio encompasses Nomex fire-resistant clothing, Kevlar cut-resistant gloves, and Tyvek protective suits. DuPont makes continued investments in R&D to develop next-generation safety materials and collaborates with industrial partners to create even more integrated safety solutions. Strategic priorities are focused primarily on expanding global market penetration and compliance with safety regulations across oil & gas, chemicals, manufacturing, and energy sectors.

Below is the list of some prominent players operating in the global industrial safety market:

The industrial safety market is extremely competitive and is driven by technological innovation, regulatory compliance, and growing workplace safety awareness. Key players in this field are focused mainly on expanding their product portfolios, integrating smart PPE, and adopting IoT- and AI-enabled safety solutions to enhance worker protection. In December 2025, Jensen Hughes announced that it had acquired Safety Management Services, Inc., which is an engineering firm specializing in process safety hazard analysis, energetic materials testing, and risk management services for commercial and government clients. The acquisition strengthens Jensen Hughes’ capabilities in process safety, testing, and hazard mitigation by also expanding its global reach across high-risk environments in the U.S., Europe, the Middle East, and Asia. In addition, by integrating SMS’s technical expertise with its own consulting and engineering platform, Jensen Hughes aims to deliver enhanced, risk-informed safety solutions worldwide.

Corporate Landscape of the Industrial Safety Market:

Recent Developments

- In December 2025, Ansell announced the launch of its TouchNTuff 93-800, which is the first disposable glove offering at least 15 minutes of acetone resistance, fifteen times longer than standard nitrile gloves, especially designed for workers handling aggressive solvents in aerospace, automotive, chemical, and maintenance settings.

- In October 2025, MES Life Safety announced that it had acquired Safety Inc., expanding its industrial safety, PPE, and gas detection offerings. The move strengthens MES’s nationwide safety solutions by integrating Safety Inc.’s expertise in instrumentation, calibration, and service.

- Report ID: 8334

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Safety Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.