Industrial Fasteners Market Outlook:

Industrial Fasteners Market size was over USD 109.6 billion in 2025 and is estimated to reach USD 189.9 billion by the end of 2035, expanding at a CAGR of 6.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of industrial fasteners is evaluated at USD 116.5 billion.

The international market is steadily expanding, with growth fueled by sustainability initiatives, infrastructure investments, aerospace modernization, and automotive electrification. According to an article published by the World Bank Organization in 2024, the aspect of private participation in infrastructure (PPI) investment reached USD 100.7 billion as of 2024. This has marked a suitable surge of 16% from USD 87.1 billion in 2023, along with 20% from the past 5-year average of USD 83.7 billion. This readily represents an increase in PPI investment, amounting to USD 100 billion, which positively impacts the market’s growth across different nations. Besides, infrastructure investment offers social and economic benefits to both emerging and advanced economies, thus creating an optimistic outlook for the market’s growth in different countries.

Global Infrastructure Investment in Different Countries (2023)

|

Country |

Investment Amount (EURO) |

|

Greece |

111,742,978 |

|

Latvia |

161,000,000 |

|

Ireland |

175,000,000 |

|

Lithuania |

314,000,000 |

|

New Zealand |

394,145,072 |

|

Sweden |

2,313,733,352 |

|

Australia |

9,241,323,121 |

|

Japan |

11,414,900,910 |

|

France |

12,439,679,308 |

Source: OECD

Furthermore, the presence of digitalized and smart fastening solutions, high-strength and lightweight materials, green manufacturing and sustainability, supply chain localization, along with vendor-managed and e-commerce inventory, are other factors driving the market internationally. As per an article published by Alexandria Engineering Journal in April 2025, advanced materials usually comprise a matrix, which is reinforced with particles or fibers, denoting an opportunity to gain weight reductions of almost 50% in comparison to conventional metallic components. Besides, Europe has successfully set a standard target to diminish carbon dioxide emission from newest cars by 37.5% by the end of 2030. Likewise, Corporate Average Fuel Economy (CAFE) standards in the U.S. has also mandated a wide average of 54.5 miles per gallon, thereby making it suitable for boosting the market internationally.

Key Industrial Fasteners Market Insights Summary:

Regional Highlights:

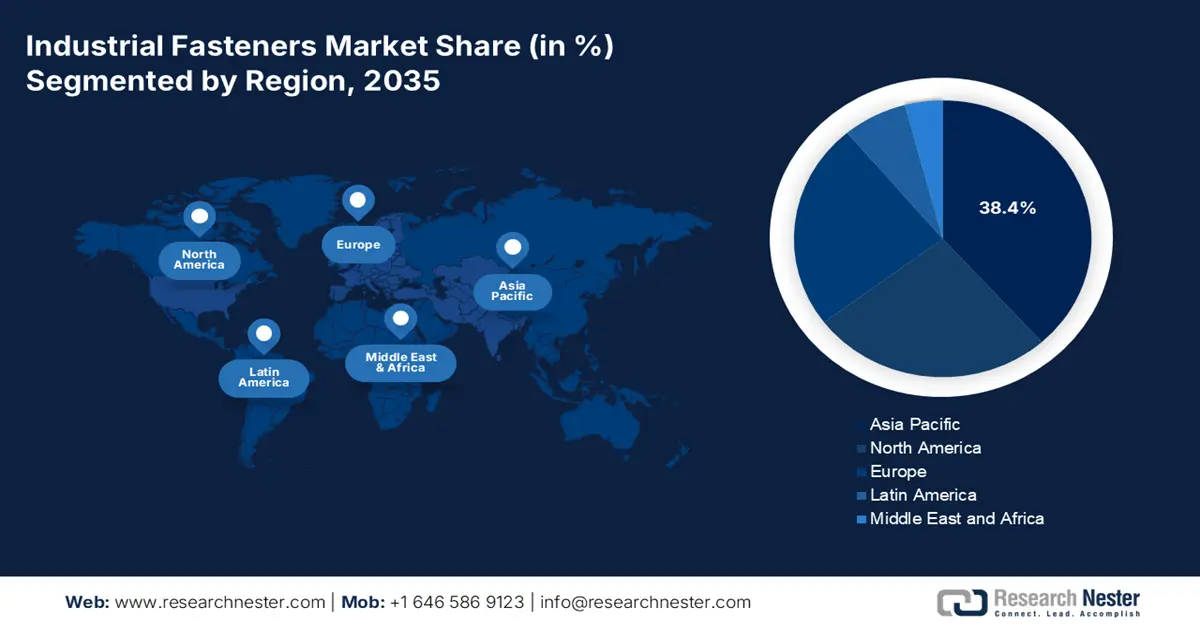

- Asia Pacific is projected to capture a commanding 38.4% share by 2035 in the industrial fasteners market, supported by robust aerospace and automotive expansion, large-scale manufacturing bases, and accelerated infrastructure development.

- Europe is expected to advance as the fastest-growing region through 2035, reinforced by innovation-led manufacturing, aerospace initiatives, stringent quality regulations, and rising automotive electrification.

Segment Insights:

- Metal sub-segment (Material segment) is forecast to dominate with a 72.4% share by 2035 in the industrial fasteners market, anchored by its superior strength, versatility, and durability enabling critical load-bearing and secure connections.

- Steel segment (Raw material segment) is projected to represent the second-largest share by 2035, sustained by its high tensile strength, durability, cost efficiency, and broad applicability across industrial end-use sectors.

Key Growth Trends:

- Increase in automotive electrification

- Focus on aerospace modernization

Major Challenges:

- Disruptions in supply chain

- Extreme competition from substitutes

Key Players: Illinois Tool Works Inc., Stanley Black & Decker, Bossard Group, Hilti Group, SFS Group, LISI Group, Bulten AB, KAMAX, EJOT, PennEngineering, MacLean-Fogg, Fastenal Company, Nucor Fastener, Nitto Seiko Co., Ltd., Meidoh Co., Ltd.

Global Industrial Fasteners Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 109.6 billion

- 2026 Market Size: USD 116.5 billion

- Projected Market Size: USD 189.9 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Poland, Thailand

Last updated on : 5 January, 2026

Industrial Fasteners Market - Growth Drivers and Challenges

Growth Drivers

- Increase in automotive electrification: The aspect of electric vehicle battery enclosure, lightweight chassis, as well as safety-critical assemblies, needs innovative threaded fasteners, which positively impacts the industrial fasteners market. According to an article published by the IEA Organization in 2025, the battery demand in the energy industry for storage applications and electric batteries has effectively reached the historical milestone of 1 TWh as of 2024. In addition, the demand has largely been driven by growth in electric vehicle sales, since electric vehicle batteries significantly grew to more than 950 GWh, denoting a 25% rise in comparison to 2023. Moreover, electric cars continue to remain the principal factor behind the electric battery demand, accounting for more than 85%, thus positively impacting the market’s growth.

- Focus on aerospace modernization: The presence of defense investments and fleet renewal programs readily demands aerospace-based fasteners with traceability and certification, which is also fueling the market. As stated in an article published by the NASA Government in November 2023, over 873,000 Unmanned Aircraft Systems (UAS), which are also regarded as drones, have been registered to fly in the U.S. Besides, the National Airspace System (NAS) has been made up of over 29 million square miles, including landing areas, airports, air navigation facilities, and airspace. Besides, NASA has offered USD 7,000 to develop new designs for a wind tunnel facility, thereby denoting an increase in the demand for the market.

- Surge in chemical and industrial sector upgradation: The aspect of compliance with safety and environmental standards uplifts the adoption of corrosion-resistant fasteners in industrial machinery and chemical plants, which significantly boosts the market. As per an article published by the Arabian Journal of Chemistry in March 2024, the Organization of Petroleum Exporting Countries (OPEC) has aimed at demonstrating prices within the range of USD 20 to USD 22, which is considered the maximum price difference per barrel between the least expensive and most expensive crude oil. Besides, non-traditional heavy crude oils are a suitable energy source that represents a standard opportunity for fossil fuel organizations to offer an alternative option for depleting light oil resources.

Challenges

- Disruptions in supply chain: Global supply chains in the industrial fasteners market are complex, spanning raw material extraction, manufacturing, and distribution across multiple regions. Events such as the COVID-19 pandemic, port congestion, and geopolitical conflicts have exposed vulnerabilities. For instance, semiconductor shortages disrupted automotive production, indirectly reducing fastener demand. Similarly, shipping delays and rising freight costs increased lead times and inventory risks. Fasteners, though small components, are critical for assembly; any delay halts production lines. Companies are now localizing production and building regional hubs to reduce dependency on global logistics. Yet, fragmented supplier bases and reliance on Asia-Pacific manufacturing remain challenges.

- Extreme competition from substitutes: The market faces competition from adhesives, welding, and advanced bonding technologies. Automotive and aerospace industries increasingly adopt adhesives for lightweight assemblies, reducing reliance on traditional bolts and screws. Adhesives offer benefits such as weight reduction, corrosion resistance, and streamlined design. For instance, electric vehicle manufacturers use structural adhesives in battery enclosures to improve safety and efficiency. While fasteners remain indispensable for load-bearing and serviceable joints, substitutes erode market share in specific applications. This trend forces fastener manufacturers to innovate, thus developing hybrid fastening systems, coatings, and smart fasteners with embedded sensors.

Industrial Fasteners Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 109.6 billion |

|

Forecast Year Market Size (2035) |

USD 189.9 billion |

|

Regional Scope |

|

Industrial Fasteners Market Segmentation:

Material Segment Analysis

The metal sub-segment, which is part of the material segment, is projected to hold the largest share of 72.4% in the industrial fasteners market by the end of 2035. The sub-segment’s upliftment is highly attributed to its importance in its unmatched strength, versatility, and durability, along with enabling load-bearing and secured connections for critical structures, devices, and machinery. According to an article published by the PIB Government in October 2024, there has been an expansion in the steel output at an outstanding 6% compound yearly growth rate, which has successfully outpaced China’s 1% steel production. Besides, globally, there has been an increase in steel capacity by almost 62 million tons, with India effectively accounting for 6% of the growth. In addition, India and ASEAN are predicted to cater to nearly 89% of steelmaking additions in Asia, thereby proliferating the sub-segment’s growth.

Raw Material Segment Analysis

By the end of the forecast period, the steel segment, part of raw material, is expected to account for the second-largest share in the industrial fasteners market. The segment’s growth is highly driven by the aspect of remaining as the backbone of the market, accounting for the largest share of raw materials used globally. Its dominance stems from high tensile strength, durability, and cost-effectiveness, making it indispensable across automotive, construction, aerospace, and heavy machinery applications. Stainless steel fasteners, in particular, are favored for their corrosion resistance in chemical plants, marine environments, and infrastructure projects. The versatility of steel allows manufacturers to produce a wide range of externally threaded fasteners, such as bolts and screws, and internally threaded fasteners, including nuts that meet strict ISO and ASTM standards.

Sales Channel Segment Analysis

Based on the sales channel, the OEM/direct to manufacturers segment in the market is predicted to cater to the third-largest share during the stipulated timeline. The segment’s development is extremely propelled by the critical role fasteners play in assembly lines across automotive, aerospace, construction, and industrial machinery sectors. OEMs demand high volumes of standardized and customized fasteners, ensuring consistent quality, traceability, and compliance with safety regulations. Direct sales relationships allow manufacturers to integrate deeply into OEM supply chains, offering vendor-managed inventory, just-in-time delivery, and co-development of fastening solutions tailored to specific platforms, thereby making it suitable for the segment’s upliftment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Raw Material |

|

|

Sales Channel |

|

|

Product |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Fasteners Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the industrial fasteners market is projected to garner the highest share of 38.4% by the end of 2035. The market’s upliftment in the region is highly attributed to expansion in aerospace and automotive, infrastructure build-out, and is underpinned by large-scale manufacturing. According to an article published by the TNI Organization in August 2025, Singapore’s Green Plan 2030 is considered a wide-ranging strategy to gain net-zero emissions by the end of 2050, with 60% sourcing of electricity sourced from low-carbon sources by the end of 2035. Besides, the government’s Manufacturing 2030 plan has aimed to bolster sectoral valuation by 50%. In addition, the distinct resource model in China is effectively characterized by the downstream and midstream stages of the supply chain, especially in fabrication and refining, accounting for 50% of the market share, thereby proliferating the market’s growth.

China in the market is growing significantly due to policy-related industrial upgradation, upscaling of chemicals, construction, machinery, and automotive. As stated in an article published by the ITA in July 2024, the country’s State Council introduced an action plan for promoting large-scale equipment replacement and trading in customer goods, accounting for a 25% increase in capital investments across notable areas. These areas comprise healthcare, culture and tourism, education, transportation, construction, and industry, thereby representing an additional RMB 270 billion in capital investment in equipment in comparison to baseline growth expectations. Besides, the People’s Bank of China declared a RMB 500 billion (USD 69.1 billion) for supporting small and medium-sized technological organizations, thereby denoting an optimistic approach for the market’s growth.

India, in the industrial fasteners market, is also growing due to modernization in the chemical industry, industrial corridors, and acceleration in infrastructure. As stated in an article published by the Invest India Government in March 2025, the petrochemical and chemical industry caters to more than 9% of manufacturing gross value addition, along with 7% to overall exports. In addition, manufacturing more than 80,000 different options of chemical products, this particular sector is one of the most diversified industries in the country. Moreover, the chemical manufacturing center has estimated that the domestic chemical industry is poised to grow by 7% to 10% by the end of 2040. The country is projected to cater to 20% of the incremental international consumption of chemicals for the upcoming two decades, with domestic demand predicted to increase to USD 850 billion to USD 1,000 billion by the end of 2040.

Europe Market Insights

Europe in the industrial fasteners market is expected to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is highly propelled by the support provision from innovative manufacturing, aerospace programs, strict quality standards, and automotive electrification that highly favor corrosion-resistant and high-performance fasteners. According to an article published by Results in Engineering in September 2023, 60% of the advanced technology patent share lies within discrete manufacturing in the region, along with 30% of its share within machinery, and the regional electronics industry caters to almost 15% share. Based on this, Germany is poised to account for the highest share of patents with an investment of over €2,250 million in terms of advanced technology, and all of these factors are suitable for increasing the market’s demand in the overall region.

Germany in the market is gaining increased exposure due to its leadership in advanced manufacturing, extended chemical processing infrastructure, and dominating machinery and automotive sectors. As stated in an article published by the ITA in August 2025, the advanced manufacturing valuation was USD 955 billion as of 2022, which increased to more than USD 1 trillion in 2023, followed by USD 991 billion in 2024. Besides, the 2024 U.S. Advanced Manufacturing exports to the country amounted to USD 37 billion, and meanwhile, the valuation of U.S. exports to the country was estimated to be USD 43 billion. Furthermore, the country’s overall imports are lower than exports, amounting to USD 722 billion as of 2024. Therefore, with an increase in the ongoing export and import facilities, there is a huge growth opportunity for the market in the country.

Advanced Manufacturing sector in Germany (2022-2024)

|

Components |

2022 (USD Million) |

2023 (USD Million) |

2024 (USD Million) |

|

Import |

955,316 |

1,026,836 |

991,050 |

|

Export |

753,557 |

764,300 |

721,621 |

|

Import from the U.S. |

35,978 |

38,998 |

36,753 |

|

Trade Deficit/Surplus |

201,759 |

262,536 |

269,429 |

|

EUR-USD Exchange Rate |

1.05 |

1.08 |

1.08 |

Source: ITA

France in the market is also developing, owing to the presence of robust policy support for circular economy and sustainability, automotive electrification, and aerospace modernization. As per a report published by the ETUI Organization in 2022, the plug-in and electric hybrid vehicles readily exceeded 10% of the market share, with the presence of 333 electrified models as of 2025. Besides, regional standards on carbon dioxide emissions have been the ultimate driving force behind the transition to electrified models. For instance, by significantly setting an average emissions ceiling of 95g CO2/km, there has been the aspect of enabling a 40% reduction in emissions. Additionally, from the regional viewpoint, there has been a rise in the overall 2030 objective of diminishing greenhouse gas emissions for cars to an estimated 55%, thus enhancing the market’s exposure.

North America Market Insights

North America in the industrial fasteners market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly driven by the resilient demand from industrial machinery, construction, aerospace, and automotive, along with MRO standardization and PEM consolidation. Besides, according to an article published by the EIA Government in August 2024, there has been an increase in battery electric vehicles, hybrid vehicles, and plug-in electric vehicles in the U.S. by 17.8% to 18.7% as of 2024. Additionally, a slight surge in hybrid and electric market share has been fueled by hybrid electric vehicle sales, increasing by 30.7% year-over-year (YoY). Moreover, luxury electric vehicles also continued to sell, accounting for 32.8% as of 2024, thereby denoting a huge growth opportunity for the market in the overall region.

The industrial fasteners market in the U.S. is gaining increased traction due to the existence of chemical process and plants industries, an increase in governmental spending, and the presence of EPA regulatory oversight, along with policy frameworks. As per an article published by the USA Facts Organization in 2025, the Chemical Safety and Hazard Investigation Board (CSB) provided USD 13.1 million in 2024, denoting 0.1% of the overall federal spending. In addition, this also catered to 0.00019% of the USD 6.7 trillion in total federal expenditure, which is also positively impacting the market’s growth in the country. Moreover, the Board’s spending has surged by 70.9%, with the overall spending increased by 111.6%. Therefore, this particular federal budget caters to maintaining self-sufficiency and sustainability, as well as natural and environmental resources, thus suitable for bolstering the market in the country.

The market in Canada is also growing, owing to infrastructure investment, clean and energy technology, aerospace and automotive supply chains, along with safety and sustainability regulations. As stated in an article published by the Government of Canada in September 2025, the country’s government committed more than USD 180 billion over 12 years through the Investing in Canada Plan. This funding opportunity is readily suitable for community services to natural spaces, broadband networks to energy systems, and public transit to trading ports. Additionally, this particular plan has also invested more than USD 168 billion across over 100,000 projects, and 93% are either underway or completed. Therefore, with the participation of the domestic government by offering generous funds, the market is poised to grow increasingly in the overall nation.

Key Industrial Fasteners Market Players:

- Würth Group (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Illinois Tool Works Inc. – ITW (U.S.)

- Stanley Black & Decker (U.S.)

- Bossard Group (Switzerland)

- Hilti Group (Liechtenstein)

- SFS Group (Switzerland)

- LISI Group (France)

- Bulten AB (Sweden)

- KAMAX (Germany)

- EJOT (Germany)

- PennEngineering (U.S.)

- MacLean‑Fogg (U.S.)

- Fastenal Company (U.S.)

- Nucor Fastener (U.S.)

- Nitto Seiko Co., Ltd. (Japan)

- Meidoh Co., Ltd. (Japan)

- Sundram Fasteners Limited (India)

- Chin Well Holdings Berhad (Malaysia)

- KPF (South Korea)

- Hobson Engineering (Australia)

- Würth Group is one of the world’s largest suppliers of fastening and assembly materials, with a strong presence across automotive, construction, and industrial sectors. Its extensive distribution network and focus on digital platforms make it a dominant player in Europe and globally.

- Illinois Tool Works Inc. readily leverages a diversified portfolio of engineered fasteners and components, serving automotive, aerospace, and industrial machinery. Its decentralized business model and innovation in specialty fasteners help it maintain a leading global market share.

- Stanley Black & Decker is effectively known for its broad hardware and tools portfolio. The company integrates industrial fasteners into its construction and manufacturing solutions. The company’s global reach and brand strength position it as a key competitor in both OEM and retail channels.

- Bossard Group specializes in fastening technology and logistics solutions, focusing on smart fastening systems and vendor‑managed inventory. Its emphasis on innovation and supply chain efficiency makes it a preferred partner for advanced manufacturing industries.

- Hilti Group is recognized for premium fastening and anchoring systems tailored to construction and infrastructure projects. Its direct sales model and investment in research and development ensure strong customer loyalty and a competitive edge in high‑performance fasteners.

Here is a list of key players operating in the global market:

The global industrial fasteners market’s competition is concentrated among diversified leaders and specialized mid‑caps. Top players scale through OEM partnerships, distribution depth, and engineered solutions, emphasizing high‑strength alloys, surface treatments, and application‑specific designs. Strategic initiatives include smart fastening, automation‑ready products, and sustainability, including low‑VOC coatings and recyclability. Merger and acquisitions consolidate niche capabilities, such as aerospace‑grade and micro‑fasteners, while regional localization strengthens supply resilience. Besides, in March 2025, Fontana Gruppo successfully completed acquiring the majority of its ownership stake in Right Tight Fasteners Pvt. Ltd. This significantly aligns with Fontana’s long-standing localized strategies, along with developing local infrastructure and organizations, thus suitable for bolstering the market internationally.

Corporate Landscape of the Industrial Fasteners Market:

Recent Developments

- In November 2025, Truelink Capital declared the acquisition of SouthernCarlson, Inc. from Kyocera Corporation, with the objective of achieving strong growth and expansion into the newest consumer segments.

- In February 2025, TriMas notified that its Aerospace’s Monogram Aerospace Fasteners, Allfast Fastening Systems, and Mac Fasteners brands have gained a multi-year international contract to expand the organization’s contract scope and strengthen aerospace’s position.

- Report ID: 4430

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Fasteners Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.