Industrial Gensets Market Outlook:

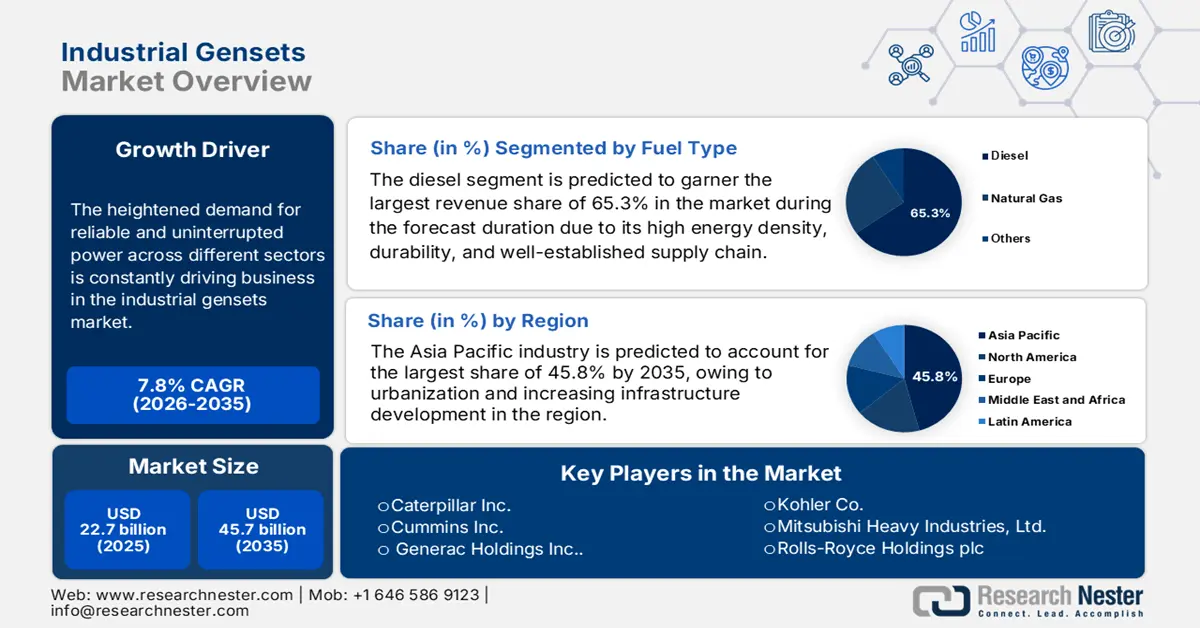

Industrial Gensets Market size was valued at USD 22.7 billion in 2025 and is projected to reach USD 45.7 billion by the end of 2035, rising at a CAGR of 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial gensets is estimated at USD 24.5 billion.

The heightened demand for reliable and uninterrupted power across different sectors is constantly driving business in the market. Also, the demand is particularly witnessed in regions where there are unreliable grid infrastructures and rapid industrialization. As per an article published by the Ministry of Power in July 2024, India’s power generation capacity has grown from 248,554 MW in March 2014 to 446,190 MW in June 2024, wherein the coal-based capacity rose to 210,969 MW and renewables to 195,013 MW. It also stated that the unified national grid now transfers up to 118,740 MW across regions, thereby supporting 100% village electrification and increasing rural power availability to 21.9 hours in 2024.

Furthermore, the industries are heavily prioritizing sustainability and continuity, providing an encouraging opportunity for the market, thereby adapting to meet the evolving energy demand. In this regard, the U.S. Department of Energy in July 2025 stated that if current power plant retirements totaling 104 GW by the end of 2030 are not adequately replaced with firm generation, blackout risks could increase by 100 times, wherein outage hours would rise to over 800 on a yearly basis. Hence, this reflects the urgent need for modernized grid management and capacity additions to ensure energy security and support economic development.

Key Industrial Gensets Market Insights Summary:

Regional Highlights:

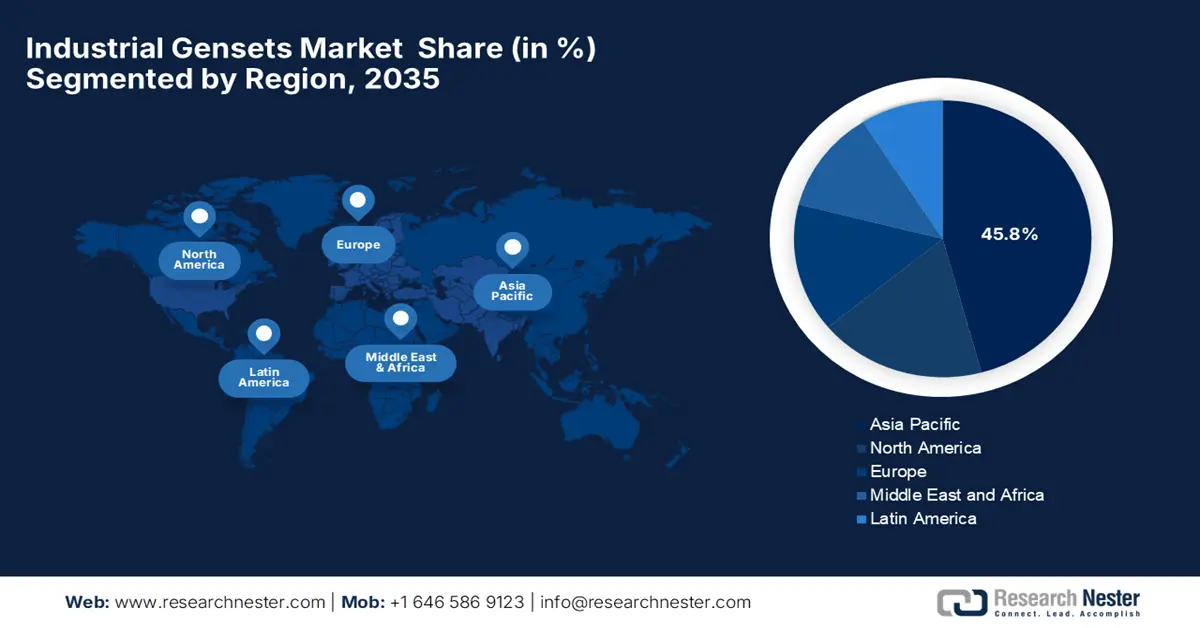

- Asia Pacific is projected to hold a 45.8% share by 2035 in the industrial gensets market, impelled by rapid industrialization, urbanization, and increasing infrastructure development.

- North America is expected to maintain a strong market presence, owing to rising industrial activities and growing emphasis on reliable power backup solutions.

Segment Insights:

- Diesel segment is projected to account for 65.3% share by 2035 in the industrial gensets market, driven by its high energy density, durability, and well-established supply chain.

- Power generation segment is expected to hold a 35.8% share by 2035, owing to the rising global demand for electricity and the need for reliable backup power.

Key Growth Trends:

- Technological advancements

- Integration of hybrid and renewable energy

Major Challenges:

- Stringent emission regulations

- Rising fuel costs

Key Players: Caterpillar Inc. (U.S.), Cummins Inc. (U.S.), Generac Holdings Inc. (U.S.), Kohler Co. (U.S.), Mitsubishi Heavy Industries, Ltd. (Japan), Rolls-Royce Holdings plc / MTU Onsite Energy (Europe), Wärtsilä Corporation (Europe – Finland), Atlas Copco AB (Europe – Sweden), Siemens AG (Europe – Germany), Yanmar Co., Ltd. (Japan), Kirloskar Oil Engines Ltd. (India), Mahindra Powerol (India), Doosan Enerbility Co., Ltd. (South Korea), Hyosung Heavy Industries Corporation (South Korea), Aksa Power Generation (Turkey — Europe/Asia), FG Wilson (Engineering) Ltd. (UK / Europe), Himoinsa S.L. (Spain / Europe), Perkins Engines Company Limited (UK / Europe), Ashok Leyland (India), SDMO Industries (France / Europe).

Global Industrial Gensets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.7 billion

- 2026 Market Size: USD 24.5 billion

- Projected Market Size: USD 45.7 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Mexico, South Korea, Indonesia, Saudi Arabia

Last updated on : 29 October, 2025

Industrial Gensets Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements: The integration of digital technologies, such as IoT sensors, remote monitoring systems, is recognized as one of the important drivers for the expansion of the market. In June 2023, Cummins India Limited reported that it had launched a new range of genset engines that are compliant with the latest CPCB IV+ emission norms, enabling power solutions up to 800 kWh that appreciably reduce harmful emissions by approximately 90%.

- Integration of hybrid and renewable energy: The growing adoption of hybrid power solutions that combine industrial gensets with renewable energy sources such as solar or wind power is readily driving business in the market. For instance, in December 2024, Panasonic announced that it had launched a hydrogen-based renewable energy system at its UK factory, which integrates pure hydrogen fuel cell generators, photovoltaic panels, and storage batteries to power the microwave oven assembly line with 100% renewable energy, hence positively impacting market development.

- Industrial expansion: The rapid industrialization and urbanization in terms of emerging economies are increasing the demand for reliable power sources. Testifying to this, the article published by the World Bank in July 2025 stated that it supported India’s industrial expansion and infrastructure development by financing major electricity projects such as the north eastern region power system improvement project, which increased electricity access by 51% from 2015 to 2024, thereby benefiting over 45 million people and powering domestic businesses, hence enhancing grid reliability.

Statistical Data on India’s Electricity Distribution Improvement Projects and Energy Sector (2015-2024)

|

Project |

Details |

|

Jharkhand Power System Improvement Project |

- Improved services for nearly 5 million users |

|

West Bengal Electricity Distribution Grid Modernization Project |

- Covers approximately 90 million people in 14 districts |

|

Coal Electricity Generation |

- Coal and lignite generation increased by 5% in 2024 |

|

Transmission Network Investment Needed by 2030 |

- Estimated investment: USD 30 billion |

Source: World Bank

Key Developments in Diesel, Gas, and Hydrogen Generator Technologies

|

Year |

Company |

Product |

Key Features |

|

2025 |

Caterpillar Inc. |

Cat D1500 Diesel Generator Set |

1.5 MW standby power, 13% smaller footprint, 32% lighter, ISO & EPA compliant, remote monitoring |

|

2024 |

Rolls-Royce |

MTU Series 4000 Gas Generator Sets |

Natural gas gensets for Alberta grid peak demand, low emissions, 84,000 hrs lifespan, H2 ready |

|

2024 |

DEUTZ |

Hydrogen-Powered Generator Sets |

First H2 gensets in China, hydrogen combustion engines, reduce CO2 emissions using grey/green H2 |

|

2024 |

HIMOINSA/Yanmar |

HGY Series Generators |

1250-3500 kVA, supports alternative fuels (HVO, gas, H2), meets European & EPA standards, low emissions |

Source: Company Official Press Releases

Challenges

- Stringent emission regulations: The tightening environmental regulations across almost all nations, especially in terms of nitrogen oxides, particulate matter, and greenhouse gases, are posing a major challenge to market expansion. Also, governments are enforcing stricter standards to mitigate pollution, thereby compelling manufacturers in this field to make heavy investments in cleaner and more efficient engines. Therefore, this remains a critical hurdle for industry players restricting increasing investments.

- Rising fuel costs: This, along with fuel availability, is yet another factor negatively impacting upliftment of the market. The fuel expenses represent considerable operating costs and fluctuating prices of diesel, natural gas, wherein alternative fuels pose economic challenges. In addition, the availability and infrastructure for cleaner fuels such as hydrogen or biodiesel remain extremely limited in most regions, hence hindering adoption.

Industrial Gensets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 22.7 billion |

|

Forecast Year Market Size (2035) |

USD 45.7 billion |

|

Regional Scope |

|

Industrial Gensets Market Segmentation:

Fuel Type Segment Analysis

Based on fuel type diesel segment is predicted to garner the largest revenue share of 65.3% during the forecast duration. Its high energy density, durability, and well-established supply chain make it highly essential for heavy-duty industrial applications and reliable backup power. On the other hand, the subtype’s use is often mandated for emergency systems in critical facilities such as hospitals and data centers, thus denoting a wider segment scope. In addition, the ongoing advancements in fuel efficiency and emission reduction technologies are expected to further drive the adoption of industrial gensets across various sectors.

Application Segment Analysis

In terms of application power generation segment is projected to grow at a considerable rate, with a share of 35.8% by the end of 2035. The growth in the segment is highly subject to the rising worldwide demand for electricity and the need for reliable backup power to mitigate financial losses from grid outages. As per an article published by EIA in 2023, the U.S. generated approximately 4.18 trillion kWh of electricity from utility-scale sources, wherein natural gas led at 43.1%, followed by renewables at 21.4%, nuclear at 18.6%, and coal at 16.2%, reflecting growing adoption of distributed energy systems in this field.

End user Segment Analysis

Based on end user manufacturing segment is expected to attain a lucrative share of 28.5% over the analyzed timeframe. The critical need for an uninterrupted power supply to avoid costly production halts, equipment damage, and data loss is the key factor behind this leadership. Besides the push for industrial automation and resilient supply chains, this further solidifies the demand for backup power in this sector, thus allowing a steady cash influx in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Fuel Type |

|

|

Application |

|

|

End user |

|

|

Power Rating |

|

|

Distribution Channel |

|

|

Design |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Gensets Market - Regional Analysis

APAC Market Insights

The Asia Pacific region is predicted to showcase its dominance in the industrial gensets market by capturing the largest revenue share of 45.8% by the end of the forecast duration. The dominance of the region is effectively attributable to rapid industrialization, urbanization, and increasing infrastructure development. For instance, in September 2023, Kirloskar Oil Engines reported that it had launched its largest range of CPCB IV+ compliant gensets, which comprises fuel-flexible options such as diesel, natural gas, and biogas, aimed at delivering cleaner, efficient, and sustainable power solutions, hence contributing to a strong global presence.

China is representing a strong leadership over the regional market owing to a huge focus on modernization and technological advancements. The expansion of heavy industries and increasing investments in infrastructure projects are also propelling a profitable business environment. ABB Motors & Generators in April 2025 reported that it celebrated its 20th and 30th anniversaries by showcasing advancements in high-efficiency motors and generators, which include the new AMZ 1400 permanent magnet shaft generators and IE5 ultra-premium efficiency motors. Therefore, these enabling industries to reduce energy costs and emissions, thereby boosting demand for sustainable power solutions.

India is readily blistering growth in the global market, owing to the country’s industrial facilities, and is also shaped by government initiatives to improve energy infrastructure and promote clean energy technologies. As per an article published by Energy & Environment in June 2025, the country’s energy landscape has rapidly evolved, reaching a total installed power capacity of 476 GW, wherein nearly half is sourced from non-fossil fuels such as renewables and nuclear. It also stated that the consistent progress in electrification has boosted per capita electricity consumption by over 45% underscoring the efficient demand for industrial gensets.

Power Supply Position in India: Energy and Peak Demand Comparison for 2022-23 and 2023-24 (up to November 2023)

|

Year |

Energy Requirement (MU) |

Energy Supplied (MU) |

Peak Demand (MW) |

Peak Met (MW) |

|

2022-2023 |

15,11,847 |

15,04,264 |

2,15,888 |

2,07,231 |

|

2023-2024 (up to Nov 2023) |

11,02,887 |

10,99,907 |

2,43,271 |

2,39,931 |

Source: Ministry of Power

North America Market Insights

The industrial gensets market in North America is likely to maintain a strong position in the upcoming years. The increasing industrial activities and a growing emphasis on reliable power backup solutions are the key factors behind this leadership. In October 2025, Rolls-Royce announced that it is enhancing its energy portfolio with fast-start MTU gas gensets, which include the new 20V4000 model that powers up in just 45 seconds and is ideal for data centers and grid stabilization in North America, thereby supporting the growing energy demands of AI data centers.

The U.S. remains one of the most powerful players in the industrial gensets market, which is influenced by a combination of factors such as disaster preparedness and growing interest in hybrid and fuel-efficient genset options. Besides the region’s huge focus on sustainability and energy efficiency, businesses across different sectors are prompting greater adoption of advanced genset technologies. Furthermore, the ongoing infrastructure developments and the need for uninterrupted power in critical situations are fueling the heightened demand for industrial gensets.

Canada is continuously growing in the regional industrial gensets market on account of the necessity to power remote and harsh environments reliably. Also, the huge emphasis on reducing carbon footprints and adopting cleaner technologies has led to increased interest in gensets. In January 2025, T&T Power Group reported that it acquired All Generator Solutions Inc., thereby enhancing its expertise in generator maintenance, diesel fire pump servicing, and fuel system care. Therefore, this enhances its presence in Western Canada, thereby expanding T&T’s capabilities in power generation, equipment rentals, and industrial power solutions.

Europe Market Insights

Europe in the industrial gensets market is shaped by numerous energy policies across its countries, which are fostering continued innovation in hybrid and alternative fuel technologies. Besides, industries are increasingly adopting gensets that integrate with smart energy systems to enhance grid stability. In February 2023, Volvo Penta reported that it had expanded its industrial genset lineup with the new 200 kVA D8 Stage II engine, which offers up to 8% better fuel efficiency and low noise levels compared to its predecessor, hence encouraging more players to operate in this field.

Germany holds a strong position in the industrial gensets market owing to its strong industrial base and precision engineering standards. Also, there is a growing preference for extremely reliable gensets that can integrate with the country’s extensive renewable energy infrastructure. Testifying, this NED srl reported that it represented its latest gensets and launched the new Hypersilent brand at Bauma 2025 in Munich, which highlights its innovative, ultra-quiet, and eco-friendly power solutions. Besides, in partnership with the country’s distributor Lehmann Notstromaggregate Service GMBH, NED will present high-performance generators for construction, rental, and event industries.

The U.K. is considered to be one of the central players in the regional industrial gensets market since it is readily prioritizing rapid response and operational flexibility owing to the frequent fluctuations in energy demand. Besides, the market also favors compact and modular genset solutions that cater to urban industrial developments with space constraints. Furthermore, the ongoing transition to low-carbon fuels in the country is also accelerating the adoption of biofuel-compatible and hybrid genset models, which are especially designed to meet evolving regulatory requirements.

Key Industrial Gensets Market Players:

- Caterpillar Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cummins Inc. (U.S.)

- Generac Holdings Inc. (U.S.)

- Kohler Co. (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Rolls-Royce Holdings plc / MTU Onsite Energy (Europe)

- Wärtsilä Corporation (Europe – Finland)

- Atlas Copco AB (Europe – Sweden)

- Siemens AG (Europe – Germany)

- Yanmar Co., Ltd. (Japan)

- Kirloskar Oil Engines Ltd. (India)

- Mahindra Powerol (India)

- Doosan Enerbility Co., Ltd. (South Korea)

- Hyosung Heavy Industries Corporation (South Korea)

- Aksa Power Generation (Turkey — Europe/Asia)

- FG Wilson (Engineering) Ltd. (UK / Europe)

- Himoinsa S.L. (Spain / Europe)

- Perkins Engines Company Limited (UK / Europe)

- Ashok Leyland (India)

- SDMO Industries (France / Europe)

- Caterpillar Inc. is one of the most dominating players in this field, which is recognized for its extensive portfolio of products, such as diesel and gas generator sets. The firm also has a Cat Power Solutions division that emphasizes product reliability, emissions compliance, and integration with digital control systems such as the Cat Energy Control System.

- Cummins Inc., the firm is based in the U.S. and is a global leader in power generation systems, which is known for its broad product range and innovative technologies in terms of diesel, gas, and hybrid gensets. The organization’s strategy revolves around the vision called destination zero, which is a transition towards decarbonized power solutions through hydrogen-ready and battery-integrated systems.

- Rolls-Royce Holdings plc, through the MTU Onsite Energy brand the company is heavily focusing on industrial gensets that deliver high power density, fuel flexibility, and low emissions. The company has an established name in major regions such as Europe, North America, and Asia, supplying generator sets for data centers, hospitals, and infrastructure projects.

- Mitsubishi Heavy Industries Ltd. is based in Japan and consists of a diversified energy systems portfolio with its MHI Engine & Turbocharger division, which is supplying large-scale industrial generator sets for continuous and standby power. Besides, the firm is extensively focusing on reliability, high-output performance, and integration into hybrid power systems, especially in industrial and marine sectors.

- Wärtsilä Corporation is a prominent player from Europe specializing in large-capacity power generation solutions and hybrid energy systems. The company is traditionally focused on marine and utility applications, but its gensets are increasingly utilized for decentralized power generation and microgrids.

Below is the list of some prominent players operating in the global market:

The global industrial gensets market presents a combination of large established OEMs and regional specialists who are competing on scale, fuel-flexibility, digital capability, along emissions compliance. Pioneers such as Caterpillar, Cummins, and Generac are leading in terms of global reach and broader product portfolios. DEUTZ in June 2024 declared that it has acquired 100% of Blue Star Power Systems, which is one of the leading manufacturers of generator sets, marking a strategic move to become a strong provider in decentralized energy supply. The company also stated that this will support growth in the fast-expanding US market, expected to add over USD 100 million in annual revenue, thereby broadening its product portfolio.

Corporate Landscape of the Industrial Gensets Market:

Recent Developments

- In June 2025, Cummins Power Generation reported that it had launched a 17-liter S17 Centum generator set, which delivers up to 1 megawatt of power in a compact footprint ideal for urban environments.

- In May 2025, Mahindra Powerol declared that it was named India’s No.1 diesel genset manufacturer in 2025 by Frost & Sullivan, capturing a 23.8% market share and surpassing the previous leader. The company stated that this achievement is driven by strong sales of CPCB4+ compliant gensets and dominance in the telecom sector, wherein it holds over 55% market share.

- Report ID: 8197

- Published Date: Oct 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Gensets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.