Industrial Boiler Market Outlook:

Industrial Boiler Market size was valued at USD 17.4 billion in 2025 and is projected to reach USD 24.3 billion by the end of 2035, rising at a CAGR of 3.7% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of size of industrial boiler is assessed at USD 18.1 billion.

The market is poised for extensive growth owing to the increasing demand for efficient and reliable steam and hot water solutions across various sectors, such as manufacturing, power generation, and chemicals. As per an article published by the Ministry of New and Renewable Energy in July 2024, it has revised the central financial assistance rates for biomass pellet manufacturing under the National Bioenergy Programme to boost production and promote cleaner fuel use. Therefore, this enhances the biomass utilization, driving the adoption and growth of biomass-based industrial boilers.

In addition, the market also benefits from a major shift towards cleaner fuel options, which include natural gas and biomass, to stringent environmental regulations and a focus on sustainability. The November 2024 study by the government of India found that the country is making a major shift from fossil fuels to clean energy, thereby cutting fossil fuel subsidies by 85% in a span of 4 years through its remove, target, and shift strategy, which has been highlighted in the Asian Development Bank’s Asia-Pacific Climate Report.

Key Industrial Boiler Market Insights Summary:

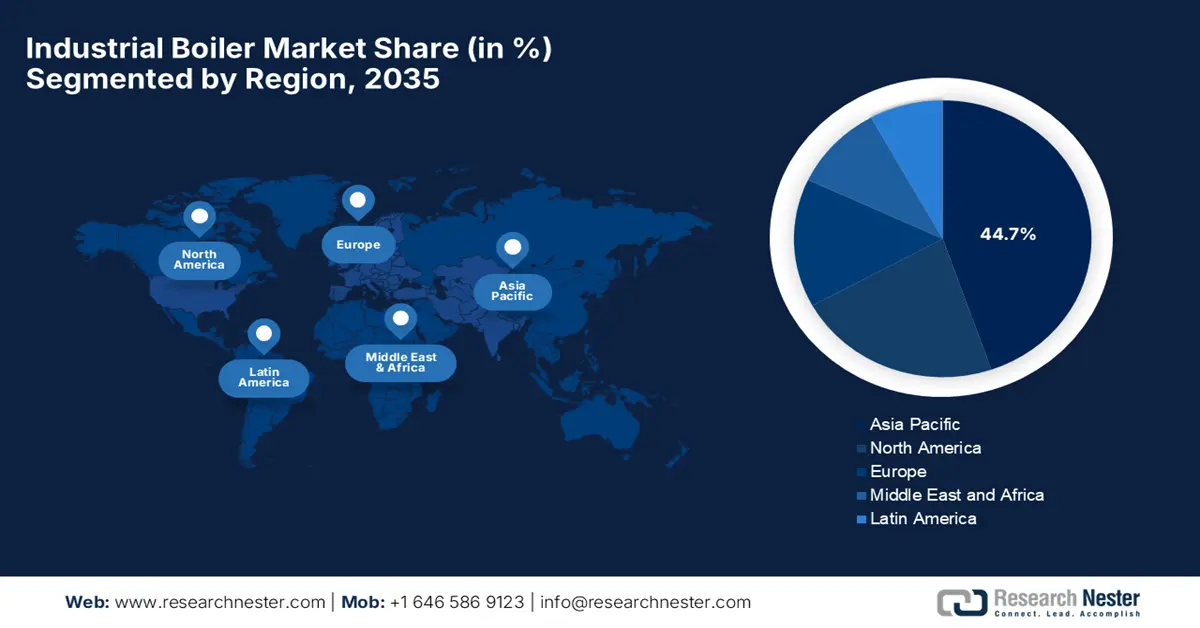

Regional Highlights:

- Asia Pacific is projected to secure a 44.7% share by 2035 in the industrial boiler market, sustained by rapid industrialization and expanding energy demand.

- North America is expected to maintain a notable revenue share through 2035, underpinned by its emphasis on modernization and energy-efficient boiler technologies.

Segment Insights:

- Water tube boiler segment is projected to hold a 48.6% share by 2035 in the industrial boiler market, bolstered by its capability to support high-pressure industrial applications.

- Natural gas segment is set to achieve a 42.8% share by 2035, facilitated by its favorable cost profile and lower emission footprint.

Key Growth Trends:

- Rising demand for energy-efficient solutions

- Expansion of industrial & manufacturing sectors

Major Challenges:

- Stringent environmental regulations

- High initial investment

Key Players: Abcock & Wilcox Enterprises, Inc. (U.S.), General Electric (GE) Power (U.S.), Siemens AG (Germany), Mitsubishi Heavy Industries Ltd. (Japan), Hitachi Ltd. (Japan), IHI Corporation (Japan), Bharat Heavy Electricals Limited (BHEL) (India), Thermax Limited (India), Forbes Marshall (India), Miura Co., Ltd. (Japan), Daikin Industries, Ltd. (Japan), O. Smith Corporation (U.S.), Weil-McLain (U.S.), Vaillant Group (Germany), Ariston Thermo SpA (Italy), BDR Thermea Group (Netherlands), Giacomini S.p.A. (Italy), KSB SE & Co. KGaA (Germany), Franco Tosi Meccanica (Italy), Dongfang Electric Corporation Ltd. (China)

Global Industrial Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.4 billion

- 2026 Market Size: USD 18.1 billion

- Projected Market Size: USD 24.3 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries:India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 29 October, 2025

Industrial Boiler Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for energy-efficient solutions: The increasing focus on reducing carbon emissions and improving energy efficiency is the primary driving factor in this market. As of the October 2025 report from EEA, Europe witnessed strong progress in climate change mitigation, appreciably reducing greenhouse gas emissions by more than 37% over the past two decades due to the increased use of renewable energy and decreased reliance on fossil fuels. It also stated that the target is for a 55% reduction by the end of 2030 and climate neutrality by 2050, requiring further cuts to balance emissions with natural carbon sinks.

- Expansion of industrial & manufacturing sectors: This growth across areas such as chemicals, food processing, textiles, and power generation is providing an optimistic opportunity for the pioneers in the industrial boiler market. According to a report published by Research Nester, the food processing equipment market is expected to grow at a notable pace in the upcoming years, which also positively increases the demand for industrial boilers in food processing applications.

- Preceding technological advancements: The innovations, such as automated controls, improved combustion technology, and integration with renewable energy sources, are significantly boosting the uptake of industrial boilers. For instance, in October 2024, Sitong Boiler notified that it had showcased its advanced biomass boiler equipment at the HEATECH INDONESIA 2024, wherein it also highlighted how its equipment, which uses sustainable fuel sources like wood pellets and rice husks, supports the global push for net-zero emissions.

Exports of Nuclear Reactors, Industrial Boilers, and Parts from India (FY 2018-19 to 2021-22)

|

Financial Year |

Exports (in USD Million) |

|

2018-19 |

824.42 |

|

2019-20 |

816.07 |

|

2020-21 |

562.20 |

|

2021-22 |

585.30 |

Source: Ministry of Commerce & Industry

Challenges

- Stringent environmental regulations: This is a major challenge negatively influencing growth in the market. Governments across the world are implementing strict emission standards to reduce carbon footprints and impure air quality. Besides industrial boilers, those are run on fossil fuels are under pressure to meet these regulations, which demand advanced emission control technologies. Further, these often necessitate expensive upgrades, making it challenging for small-scale manufacturers.

- High initial investment: This, coupled with maintenance costs, is hindering adoption in the industrial boilers market. Also, setting up industrial boiler systems necessitates high amounts of substantial capital expenditure owing to the increasing costs of equipment, installation, and compliance. Besides the ongoing maintenance and occasional inspections, further exacerbating these costs, thereby deterring adoption among small & medium-sized industries.

Industrial Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 17.4 billion |

|

Forecast Year Market Size (2035) |

USD 24.3 billion |

|

Regional Scope |

|

Industrial Boiler Market Segmentation:

Product Type Segment Analysis

Based on product type water tube boiler segment is expected to garner the largest revenue share of 48.6% in the market during the forecast duration. The high-pressure and safety features in this subtype position it as ideal for large-scale power generation and industrial processes. In January 2023, Babcock Wanson UK Ltd announced the launch of its FM pack range of steam water tube boilers, which offers steam outputs from 4.5 to 80 tonnes per hour and pressures up to 95 barg, thereby supporting industrial process heating with reliable, energy-efficient solutions.

Fuel Type Segment Analysis

In terms of fuel type, the natural gas segment is predicted to attain a share of 42.8% in the industrial boiler market by the end of 2035. The growth in the segment is highly attributable to its cost-effectiveness and lower carbon emissions when compared to coal and oil. In December 2024, ClearSign Technologies reported that it had received a new purchase order from California Boiler for an ultra-low NOx boiler burner to be used in their rental fleet, hence making it suitable for standard market growth.

Application Segment Analysis

Based on the application food & beverage segment is expected to capture a significant share of 28.3% in the market over the analyzed timeframe. This upliftment is readily propelled by the necessity of precise steam for sterilization, cooking, and cleaning, creating a consistent demand for boilers. In February 2025, Arla Foods Ingredients announced the installation of a 16 MW electric boiler at its Danmark Protein site in Videbæk, which marks a pivotal step in its CO₂ reduction strategy. It also stated that the e-boiler is expected to cut annual emissions by 3,500 tonnes and will support the facility's high-temperature spray-drying processes.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Fuel Type |

|

|

Application |

|

|

Boiler Horsepower |

|

|

Technology |

|

|

Function |

|

|

Pressure |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Boiler Market - Regional Analysis

APAC Market Insights

Asia Pacific industrial boilers market is likely to emerge as the dominating region, capturing the largest revenue share of 44.7% by the end of 2035. The region benefits from rapid growth in industrialization, manufacturing sectors, and increasing energy demand across countries such as China, India, Japan, and South Korea. In this regard, the government of India reported that the Biomass Programme from the tenure 2021-22 to 2025-26 enables it to support setting up biomass briquette/pellet manufacturing plants and biomass (non-bagasse) based cogeneration projects in industries across India. It also offers central financial assistance of up to ₹45 lakhs (~USD 54,000) for pellet/briquette plants and up to ₹5 crores (~USD 600,000) for cogeneration projects, with mandatory use of new machinery and SCADA systems.

China is readily augmenting its leadership in the industrial boiler market owing to the presence of its large manufacturing base and industrialization. The country also benefits from energy efficiency upgrades, wherein sectors such as chemicals, food processing, and paper rely heavily on steam and heat, increasing the demand for industrial boilers. Cubic in April 2024 reported that it made an investment in LOPE and Jingding Electric to build an integrated supply chain for full premixed condensing wall-mounted gas boilers in the country, hence accelerating industrial upgrades.

India remains an extremely strong landscape for the market, strongly influenced by the growing industrial activities in sectors such as textiles, pharmaceuticals, food processing, and power generation. Testifying this, the Bureau of Energy Efficiency in March 2024 launched new Standards & Labeling Programs for packaged boilers and visi coolers, and released the maiden India EV Digest and the State Energy Efficiency Index 2023, wherein Karnataka topped the list. The report also underscored that BEE played a pivotal role in reducing energy use by 3.5% and carbon emissions by 306 million tonnes on a yearly basis.

North America Market Insights

North America market is predicted to hold a significant revenue share throughout the discussed tenure. The leadership is primarily driven by the strong focus on modernization and energy efficiency, along with stringent environmental regulations and a shift toward cleaner fuel sources. Besides, industries in the region are proactively adopting boiler technologies to reduce emissions and improve operational efficiency, receiving constant support from government incentives, hence denoting a positive market outlook.

The U.S. is a strong player in the regional industrial boiler market owing to the widespread adoption of advanced technologies such as condensing boilers and integrated control systems. In June 2025, AtmosZero reported that it installed the world’s first fully drop-in zero-emission electric steam heat-pump boiler, Boiler 2.0, at New Belgium Brewing’s Fort Collins facility without any operational downtime. It also stated that this is supported by a USD 24.3 million federal clean energy tax credit, wherein the firm plans to scale production, marking a major step in industrial steam electrification.

Canada is gaining traction in North America’s market on account of its commitment to reducing greenhouse gas emissions and substantial funding grants. Besides, industries are adopting boilers that utilize low-carbon fuels and advanced emissions control technologies. As per an article published by BoilMakers in September 2025, the Ontario government has committed a total of USD 5.7 million to Local 128 Boilermakers to expand training capacity, including new equipment and a new facility in Sudbury. This investment also supports the growing demand for skilled Boilermakers in Northern Ontario’s industrial and energy sectors.

Canadian Government and Industry Grants Supporting Industrial Boiler Efficiency and Decarbonization

|

Grant Source |

Project |

Location |

Funding |

Details |

|

Natural Resources Canada (NRCan) |

Industrial Facility Track (Open Call) |

Canada-wide |

Up to USD 5 million |

Supports zero-emission heating systems, including boilers |

|

Environment & Climate Change Canada |

Sherritt International – Boiler Economizer |

Fort Saskatchewan, AB |

USD 1.6 million |

Waste heat recovery for gas-fired industrial steam boilers |

|

Environment & Climate Change Canada |

Cavendish Farms – Fryer Heat Recovery |

Lethbridge, AB |

USD 1.375 million |

Industrial heat recovery that can complement boiler systems |

|

NGIF Industry Grants |

SMTI – Thermally-Driven Heat Pumps (Boiler Alternative) |

Alberta (field testing) |

USD 600K |

High-efficiency natural gas-driven heat pump (boiler replacement) |

Source: Official Press Releases

Europe Market Insights

Europe in the industrial boiler market is likely to retain its position as one of the strongest landscapes in the upcoming years. The region’s market is effectively backed by increasing demand for advanced boiler technologies that incorporate renewable energy integration and digital monitoring systems. In February 2024, Babcock Wanson Group reported that it acquired VKK Group, which is a leading specialist in industrial boiler design, manufacturing, and services with expertise in high-power boilers, hence denoting a positive market outlook.

Germany is one of the largest and most influential markets in the industrial boilers market, backed by its strong focus on innovation, energy efficiency, and environmental compliance. The country is one of the largest industrial economies in the region, where it is making heavy investments in upgrading boiler infrastructure to meet stringent emission standards. On the other hand, the demand for biomass and electric boilers is at a surge, underscoring the country’s commitment to energy transition and decarbonization goals.

The U.K. is evolving in the market due to huge pressure from the governing bodies to reduce carbon emissions and enhance operational efficiency. The government policies in the region are also promoting clean energy and the adoption of low-carbon technologies. In 2023, ACV UK announced that it had launched EVO S, which is a new range of high-efficiency wall-hung boilers comprising stainless steel plate heat exchangers and low NOx Class 6 emissions. It also stated that these are available in outputs from 40 to 150kW, the compact units offer flexible installation options, a 5:1 turndown ratio, and cascade capability up to 900kW.

Key Industrial Boilers Market Players:

- Abcock & Wilcox Enterprises, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric (GE) Power (U.S.)

- Siemens AG (Germany)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Hitachi Ltd. (Japan)

- IHI Corporation (Japan)

- Bharat Heavy Electricals Limited (BHEL) (India)

- Thermax Limited (India)

- Forbes Marshall (India)

- Miura Co., Ltd. (Japan)

- Daikin Industries, Ltd. (Japan)

- O. Smith Corporation (U.S.)

- Weil-McLain (U.S.)

- Vaillant Group (Germany)

- Ariston Thermo SpA (Italy)

- BDR Thermea Group (Netherlands)

- Giacomini S.p.A. (Italy)

- KSB SE & Co. KGaA (Germany)

- Franco Tosi Meccanica (Italy)

- Dongfang Electric Corporation Ltd. (China)

- Babcock & Wilcox Enterprises, Inc. is based in the U.S. and is one of the leading providers of energy and environmental technologies and services for the power and industrial markets. Also, the company operates through three major segments called B&W Renewable, B&W Environmental, and B&W Thermal. The company also leads in terms of revenue generation by leveraging advanced steam generation systems and is actively involved in the development of small modular reactor technologies.

- General Electric Vernova will remain as one of the prominent players in this field and is the energy division of General Electric, which focuses on providing advanced technologies and services to the energy sector. On the other hand, the firm has captured an extensive consumer base driven by strong demand across its product portfolio. It is also expanding its manufacturing capabilities and enhancing energy production technologies, including industrial boilers.

- Mitsubishi Heavy Industries, Ltd., a firm based in Japan and is one of the most noteworthy leaders in the heavy industries, which includes the manufacturing of industrial boilers. The company is also hosting heavy order intakes and year-over-year increases in revenue, underscoring its potential in this field. Further, the extensive product portfolio is also fostering a profitable business environment for the company.

- Siemens AG is the global leader in terms of technology, which also boasts a strong presence in the market. The firm is readily making investments in domestic manufacturing capabilities and advancing AI technologies. Besides, this investment is a part of its strategy to expand its presence in the industrial sector and improve energy efficiency through advanced boiler technologies.

- IHI Corporation is a well-known Japan firm that specializes in industrial machinery, including the manufacturing of industrial boilers. The company is quite popular for its high-efficiency boiler systems and has a strong presence in the international market as well. The firm continues to innovate in boiler technology, with a prime focus on enhancing energy efficiency and reducing emissions.

Below is the list of some prominent players operating in the global market:

The companies involved in the industrial boilers are implementing numerous strategies to secure their positions in the global landscape. The pioneers are increasingly focusing on technological advancement, mergers & acquisitions to expand their service networks, providing a critical competitive edge. For instance, in September 2024, Boccard declared that it had acquired Leroux & Lotz Technologies, which combines Boccard’s industrial contracting expertise with LLT’s legacy in biomass and waste-fired boiler systems, enabling integrated turnkey solutions for decarbonization and waste recovery. Also, this alliance is expected to enhance their capabilities in combustion, flue gas treatment, energy recovery, and carbon.

Corporate Landscape of the Industrial Boiler Market:

Recent Developments

- In August 2025, Nationwide Boiler Inc. reported that it had expanded its exclusive representation of Babcock & Wilcox package watertube boilers to cover Oregon and Washington, enhancing its existing territory in California and parts of Nevada, hence providing in-stock and custom-built B&W boilers to industrial clients.

- In January 2025, Babcock & Wilcox announced that it had secured a USD 13 million contract to retrofit boiler cleaning equipment for a coal power plant in Southeast Asia, aiming to enhance operational efficiency and reduce emissions.

- Report ID: 8198

- Published Date: Oct 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.