Industrial Boiler Maintenance Market Outlook:

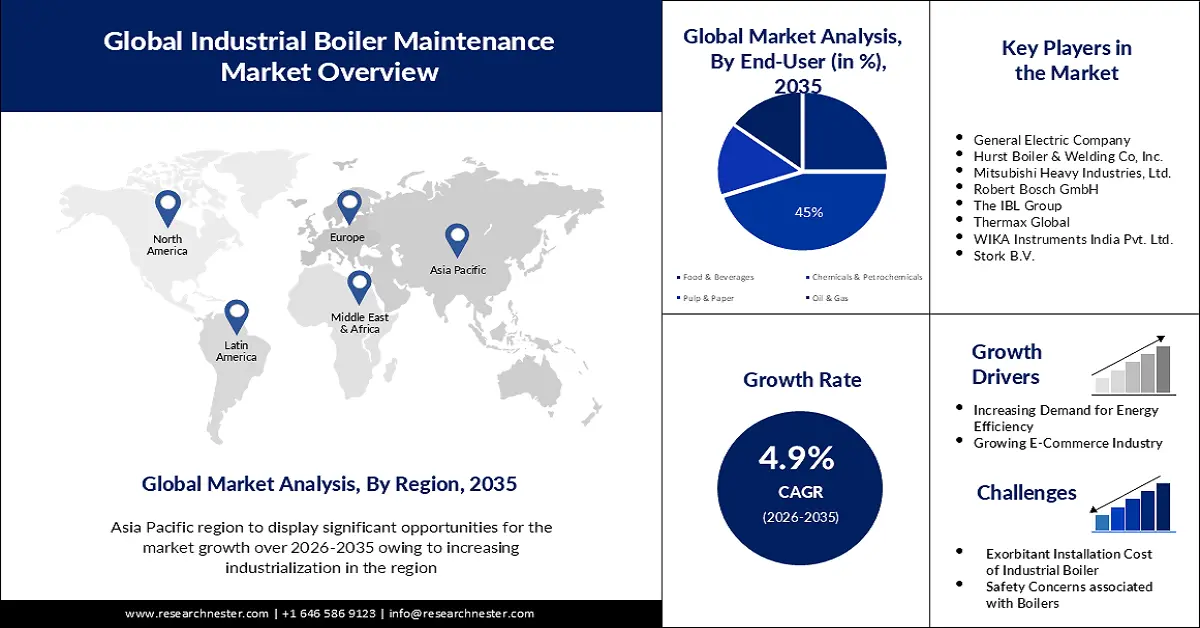

Industrial Boiler Maintenance Market size was valued at USD 22.52 billion in 2025 and is expected to reach USD 36.33 billion by 2035, expanding at around 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial boiler maintenance is assessed at USD 23.51 billion.

The reason behind the growth is impelled by the increasing power generation. This may result in increasing use of industrial boilers as they are used in power plants to generate electricity, which may lead to higher maintenance requirements. For instance, over 2% more energy was produced globally in 2022.

The growing personal disposable income across the globe is believed to fuel the market growth. For instance, people are spending more on products owing to an increase in disposable income which has resulted in the rise in industrial activities. According to estimates, global disposable income and household expenditure are expected to rise by over 2% in 2022.

Key Industrial Boiler Maintenance Market Insights Summary:

Regional Insights:

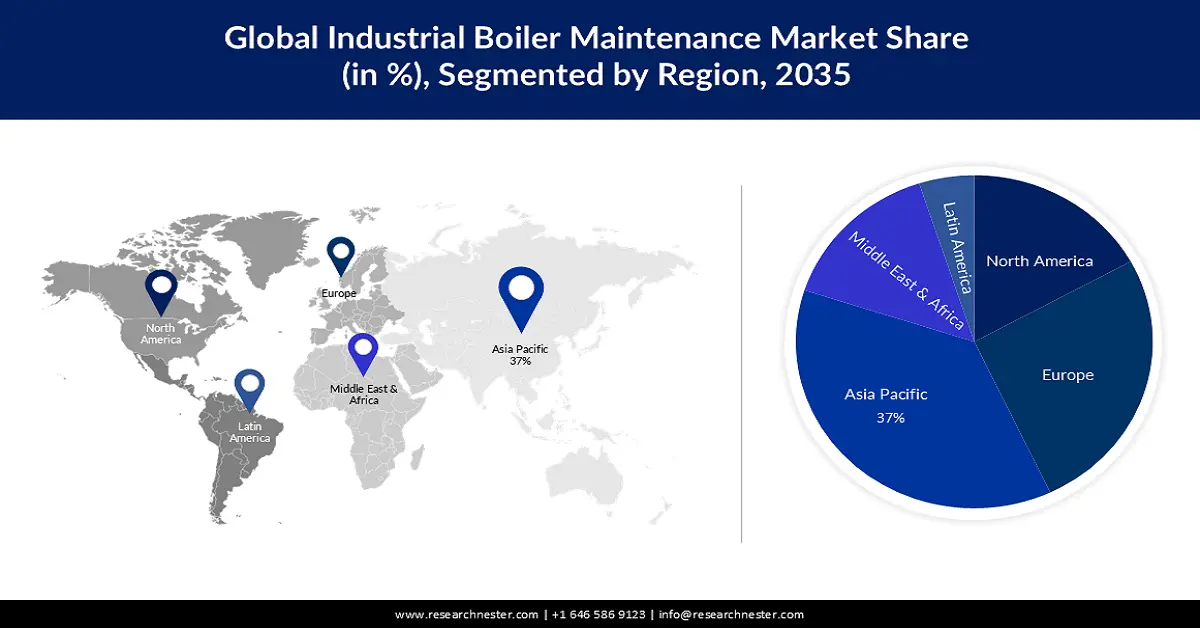

- Asia Pacific is expected to account for a 37% revenue share by 2035 in the industrial boiler maintenance market, driven by accelerated industrialization fueled by rapid population growth and urbanization in countries such as China and India.

- Europe is projected to hold the second-largest share by 2035, supported by the widespread use of steam boilers in the food & beverages sector for processing, cooking, sanitizing, and packaging applications.

Segment Insights:

- The chemicals & petrochemicals segment is anticipated to secure a 45% share by 2035, driven by the expanding chemical sector that requires frequent boiler maintenance for operations involving complex reactions under controlled conditions.

- The water-tube segment is set to achieve a 60% market share, supported by rising adoption of high-pressure water tube boilers in power generation systems requiring substantial steam output.

Key Growth Trends:

- Increasing Demand for Energy Efficiency

- Growing E Commerce Industry

Major Challenges:

- Exorbitant Installation Cost of Industrial Boiler

- Safety Concerns associated with Boilers

Key Players: General Electric Company, Hurst Boiler & Welding Co, Inc., Mitsubishi Heavy Industries, Ltd., Robert Bosch GmbH, The IBL Group, Thermax Global, WIKA Instruments India Pvt. Ltd., Stork B.V., Jera Power Taketoyo G.K.

Global Industrial Boiler Maintenance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.52 billion

- 2026 Market Size: USD 23.51 billion

- Projected Market Size: USD 36.33 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, India, Germany, Japan, United States

- Emerging Countries: South Korea, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 20 November, 2025

Industrial Boiler Maintenance Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand for Energy Efficiency – It is expected that owing to rising environmental concerns industries are putting more emphasis on enhancing energy efficiency in their operations, which as a result increased the demand for industrial boiler maintenance. For instance, owing to outdated technology, the energy efficiency of steam boiler systems can be relatively poor since it is considered a crucial factor in industrial boiler and heating solutions in order to maintain top performance and guarantee long tube life. Therefore, a boiler should be scheduled for routine maintenance to ensure its smooth working and minimize the chance of accidents. According to recent data, the world's economy used energy over 1% more efficiently in 2022 than it did in 2021.

- Growing E-Commerce Industry – As a result, the need for warehouses is also rising which frequently requires industrial boilers for various purposes. Moreover, boilers are crucial for a variety of reasons as they supply warehouses with electricity and heating since the energy economy is important for many warehouses. Retail e-commerce sales in 2021 were over USD 5 5 trillion worldwide. Further, this value is expected to rise by more than 55% over the, reaching around USD 8 trillion by 2026.

Challenges

- Exorbitant Installation Cost of Industrial Boiler - The high installation cost is one of the major factors predicted to slow down the market growth. For instance, as site preparation, engineering, and labor expenditures are involved, the capital costs of constructing a boiler to burn waste fuel may be more than those of a straightforward gas-burning boiler. In addition, qualified personnel are needed for the installation, which is more expensive. This as a result can increase the overall cost of installation.

- Safety Concerns associated with Boilers

- Supply Chain Disruptions Leading to Delay in Maintenance and Repairs

Industrial Boiler Maintenance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 22.52 billion |

|

Forecast Year Market Size (2035) |

USD 36.33 billion |

|

Regional Scope |

|

Industrial Boiler Maintenance Market Segmentation:

End-User Segment Analysis

The chemicals & petrochemicals segment is estimated to hold 45% share of the global industrial boiler maintenance market in the coming years owing to the increasing chemical sector. For instance, the expanding chemical industry may lead to growing demand for industrial boilers which demand more frequent maintenance since they perform some complex reactions at a specific temperature and pressure.

Industrial boiler maintenance helps to ensure proper functioning, enhance the efficiency of the boilers, and also helps in preventing corrosion produced by chemical processes. According to estimates, by 2025, it is projected that the Indian chemical sector will reach over USD 300 billion.

Boiler Type Segment Analysis

Industrial boiler maintenance market from the water-tube segment is set to garner a notable share of 60% shortly driven by rising demand for water tube boilers in power generation. In the energy sector, electricity is generated using steam boilers as generators, which needs up to 500 kg/s of steam output. Water tube boilers are widely used for power generation since they can handle high-pressure steam.

Power plants where larger capacity is required often utilize water tube boilers since they are more efficient, and can produce more steam, which results in rising demand for industrial boiler maintenance. For instance, water tube boilers installed in power generation require frequent maintenance to mitigate the risks of boiler failures which can lead to severe accidents.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Boiler Maintenance Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 37% by 2035, impelled by the increasing industrialization. For instance, industrial activities are increasing owing to the rapid population expansion and increased urbanization in nations such as China and India.

This as a result is expected to increase the demand for industrial boilers in the region. As more and more industrial boilers are utilized the need for maintenance may also rise since boilers represent a significant investment, and they require regular maintenance and inspection, to maintain their condition and guarantee the workers' security at the processing facility. In 2023, India's industrial production increased by an average of over 6% as compared to around 133% in 2021 and approximately 57% in 2020.

European Market Insights

The Europe industrial boiler maintenance market is estimated to be the second largest, during the forecast timeframe led by growing popularity of boilers in food & beverages industry. The European food processing industry extensively uses steam boilers owing to their adaptability to various applications, and they are also an integral part of the food processing industry since they generate steam that aids in the cooking, sanitizing, processing, and packaging in the food industry.

In addition, few sectors in the region extensively use boilers in the beverage industry for manufacturing and processing breweries, distilleries, and canning these boilers may face risk of corrosion, overheating, and boiler failures which increases the need for frequent maintenance.

Industrial Boiler Maintenance Market Players:

- Babcock & Wilcox Enterprises, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric Company

- Hurst Boiler & Welding Co, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Robert Bosch GmbH

- The IBL Group

- Thermax Global

- WIKA Instruments India Pvt. Ltd.

- Stork B.V.

- Jera Power Taketoyo G.K.

Recent Developments

- Thermax Global launched a multi-waste solution, FlexiSource for industrial users to offer flexibility in energy input, and get around the problem of fuel availability brought on by geopolitical developments, other prices, and environmental issues.

- Mitsubishi Heavy Industries, Ltd. introduced the cylindrical type 25 t/h to 35 t/h oil-fired boilers, and also became more proactive in the boiler industry by expanding the line of dual fuel-fired boilers for offshore applications. Furthermore, one of the company’s key products, marine boilers, surpassed a cumulative delivery total of 6,000 units on August 24.

- Report ID: 3905

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.