Hydrophobic Interaction Chromatography Market Outlook:

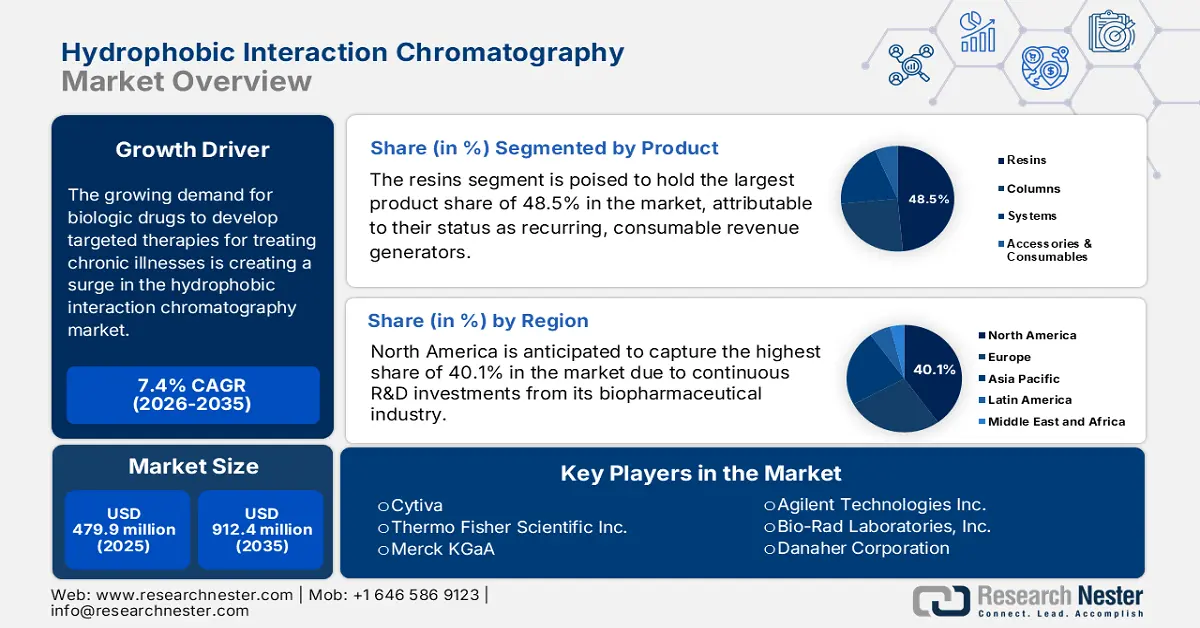

Hydrophobic Interaction Chromatography Market size was over USD 479.9 million in 2025 and is estimated to reach USD 912.4 million by the end of 2035, expanding at a CAGR of 7.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hydrophobic interaction chromatography is assessed at USD 515.4 million by the end of 2026.

The growing demand for biologic drugs to develop targeted therapies for treating chronic illnesses, including cancer, autoimmune disorders, and rare genetic conditions, is creating a surge in the market. This demography can be testified by the NLM’s conclusion on worldwide chronic disease expenses, which is predicted to total $47 trillion by 2030. Besides, the number of new cancer cases is expected to surpass 35 million by 2050, underscoring a 77% increase from 2022, as per the WHO report. Another study from February 2025 calculated the prevalence of rare diseases around the globe to range between 263 million and 446 million.

The growing economic burden on patients and healthcare systems from the elongated and expensive treatments of these ailments is pushing respective governments to cultivate cost-effective solutions from biomedical processing. Hence, the volume of both the consumer base and capital influx is amplifying in the market. However, the lack of an adequate supply chain for the required raw materials and inflation in the cost of equipment are collectively prohibiting companies from offering comprehensive payers’ pricing in this sector. Testifying to the same, a 2022 NLM study revealed that downstream purification accounts for 50-80% of the entire production cost of biopharmaceuticals.

Key Hydrophobic Interaction Chromatography Market Insights Summary:

Regional Highlights:

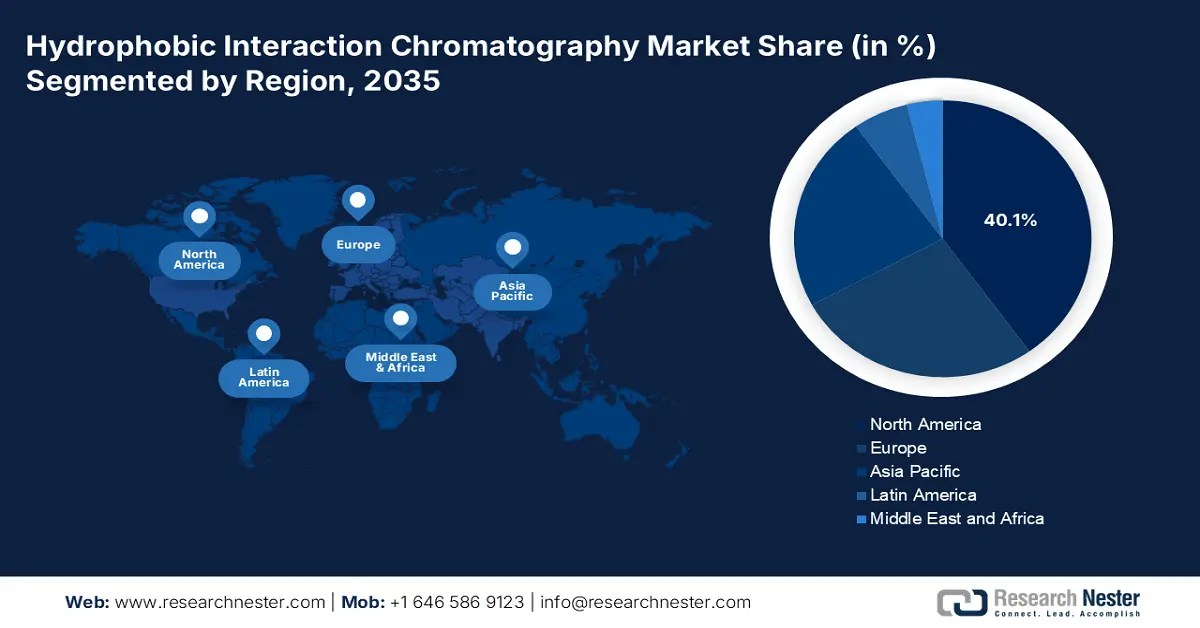

- North America is anticipated to command a 40.1% share by 2035 in the hydrophobic interaction chromatography market, underpinned by sustained biopharmaceutical R&D spending and stringent regulatory oversight of medicinal quality and purity.

- Asia Pacific is set to emerge as the fastest-growing region during 2026–2035, supported by the rapid scale-up of biopharmaceutical and biotechnology industries across major economies.

Segment Insights:

- The resins segment is projected to secure a 48.5% share by 2035 in the hydrophobic interaction chromatography market, supported by their recurring consumable nature essential to each purification cycle and amplified by the ongoing development of novel ligands offering higher binding capacity and stability.

- The protein & antibody purification segment is anticipated to command a 65.4% share by 2035, strengthened by the continuous expansion in biologics pipelines, particularly monoclonal antibodies (mAbs).

Key Growth Trends:

- Increasing demand for biopharmaceuticals

- Strict regulatory standards for product purity

Major Challenges:

- Protracted and fragmented process of compliance

- High R&D and manufacturing costs

Key Players: Cytiva, Thermo Fisher Scientific Inc., Merck KGaA, Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Sartorius AG, Waters Corporation, Repligen Corporation, GE Healthcare, Purolite Life Sciences, Novasep Holding S.A.S, Sunresin New Materials Co. Ltd., Sartorius Stedim India Pvt. Ltd., Samsung Biologics, CS Chromatography

Global Hydrophobic Interaction Chromatography Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 479.9 million

- 2026 Market Size: USD 515.4 million

- Projected Market Size: USD 912.4 million by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 27 August, 2025

Hydrophobic Interaction Chromatography Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing demand for biopharmaceuticals: The rising global demand for biopharmaceutical products, such as monoclonal antibodies (mAbs), therapeutic proteins, and vaccines, is driving the need for efficient purification techniques. The market offers a gentle yet effective method to separate proteins without denaturing them. Thus, with the continuous expansion and R&D activities in biopharma pipelines, the surge in this sector continues to grow. This can also be testified by the enlarging territory of the GMP biologics industry, where the market value of therapeutic mAbs crossed $300 billion in 2025, as per the NLM.

-

Strict regulatory standards for product purity: The tightening of regulations regarding biologic safety and purity is pushing biomanufacturers to invest in the hydrophobic interaction chromatography market. In this regard, the 2023 Journal of Biomaterials unveiled that more than 90% of biologics are delivered through invasive methods, which require >99% purity in order to acquire compliance for production. Moreover, the compliance-friendly offerings and precise separation capabilities are making this technology highly preferred among biopharma producers and institutional researchers.

-

Growing deployment of automation: Modernization of systems is increasingly enhancing the efficiency and outcomes gained from the hydrophobic interaction chromatography (HIC) procedures. Particularly, the incorporation of automation with advanced sensors and software improves process control and optimization, hence securing a greater future for this sector. Additionally, the trend of next-generation biomanufacturing is deepening the penetration of automated HIC technologies, allowing real-time monitoring and scalable operations in the hydrophobic interaction chromatography market.

Historic Shifts in the Patient Pool of the Hydrophobic Interaction Chromatography Market

Trends in U.S. Chronic Disease Volume

|

Year / Period |

Chronic Disease Prevalence / Number of Patients |

Key Details |

|

2013 vs 2023 |

Young adults (18-34 years): increased from 52.5% to 59.5% |

Increase in at least 1 chronic condition; multiple chronic conditions (MCC) rose from 21.8% to 27.1% |

|

2023 |

76.4% of U.S. adults (~194 million) have at least 1 chronic condition |

By age group: 59.5% young adults, 78.4% midlife adults, 93.0% older adults report ≥1 condition |

|

2023 |

51.4% U.S. adults (~130 million) have multiple chronic conditions (MCC) |

MCC prevalence is 27.1% young adults, 52.7% midlife adults, and 78.8% older adults |

|

2022 |

Chronic diseases cause 90% of US healthcare costs ($4.5 trillion in 2022) |

Chronic diseases affect ~60% of Americans; many have multiple diseases |

Source: CDC and NIHCM

Current/Recent Activity Overview of the Field of Application in the Hydrophobic Interaction Chromatography Market

Biologics Under Clinical Trials (2022-2025)

|

Year |

Total Biologics Approved by FDA |

Key Therapeutic Areas |

Number of Bispecific Biologics Approved |

Notes |

|

2022 |

15 |

Cancer (6), Autoimmune (4), Rare Diseases |

4 |

Highest number of bispecific biologics approved in recent years; 7 orphan drugs among approvals |

|

2025 |

Approx. 40% of new FDA approvals are biologics |

Expanding indications, including neurodegenerative diseases |

Growing clinical trial volume continues |

The total registered studies is increasing annually |

Source: NLM and Clinicaltrials.gov

Challenges

-

Protracted and fragmented process of compliance: The regulatory pathway for a new medical device or consumable is distinct from the drug itself but equally critical. This creates dual pressures on both suppliers and consumers in the hydrophobic interaction chromatography market. The requirement for extensive data on quality, consistency, and leachables further escalates the budget of therapy development and commercialization, which imposes severe economic disparity in this sector, while restricting the cash inflow.

-

High R&D and manufacturing costs: Alongside the expensive regulatory process, the development of novel, high-capacity, and more efficient HIC ligands is also capital-intensive. These additional expenditures are ultimately passed down the chain to biopharma companies and then to healthcare systems and patients. Such limitations in comprehensive pricing further restrict access to biologics for both uninsured and underinsured populations, hindering profitability and consumer engagement in the hydrophobic interaction chromatography market.

Hydrophobic Interaction Chromatography Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 479.9 million |

|

Forecast Year Market Size (2035) |

USD 912.4 million |

|

Regional Scope |

|

Hydrophobic Interaction Chromatography Market Segmentation:

Product Segment Analysis

The resins segment is poised to hold the largest product share of 48.5% in the hydrophobic interaction chromatography market by the end of 2035. This dominance is attributable to their status as recurring, consumable revenue generators that are essential for every purification cycle, which is further fueled by the ongoing development of novel ligands offering higher binding capacity and stability. Exemplifying the same, in January 2025, Bio-Rad Laboratories introduced a scalable weak anion exchange and hydrophobic interaction (AEX-HIC) mixed-mode chromatography resin, Nuvia wPrime 2A Media, which can support both pilot and manufacturing-scale downstream purification processes.

Application Segment Analysis

The protein & antibody purification is predicted to dominate the field of application in the hydrophobic interaction chromatography market with a 65.4% share over the discussed period. The explosive growth in this segment is primarily fueled by the continuous expansion in biologics pipelines, particularly monoclonal antibodies (mAbs). Evidencing the same, a report from the American Chemical Society unveiled that sales of biologics are expected to outperform innovative small molecules by USD 120 billion from 2021 to 2027, while accounting for 55% of all innovative drug sales. Thus, HIC being a critical polishing step in mAb production to remove aggregates and fragments, revenue generation from this application is higher than in other categories in the sector.

End user Segment Analysis

Pharmaceutical & biotechnology companies are poised to represent the dominant end-user segment in the hydrophobic interaction chromatography market throughout the assessed timeframe, with a 55.7% of overall share. This leadership is pledged to the growing need for high-purity biologics, such as mAbs, therapeutic proteins, and vaccines. Besides, the increasing R&D activities in the biopharmaceutical industry are also creating a strong emphasis for HIC on product quality and safety. Thus, the cash inflow in advanced chromatography technologies from pharma and biotech firms continues to rise evidently, solidifying their leading role in this sector as the largest investors.

Our in-depth analysis of the hydrophobic interaction chromatography market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Technology |

|

|

Sample Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrophobic Interaction Chromatography Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 40.1% in the global hydrophobic interaction chromatography market by the end of 2035. The continuous R&D investments from its biopharmaceutical industry and strict regulatory control over medicinal quality and purity are the foundational pillars of the region’s proprietorship in this sector. The high concentration of leading pharma and biotech companies, advanced research infrastructure, and large-scale GMP biologics manufacturing facilities are also benefiting the landscape with greater capital influx. Exemplifying the same, Novartis allocated USD 1.1 billion to establish a biomedical research center in San Diego in April 2025, according to its 5-year U.S.-based production expansion plan.

The U.S. augments the hydrophobic interaction chromatography market with regional dominance, which is backed by its growing capacity in biopharmaceutical innovation and production. Being a home to globally leading pharma giants, research institutions, and contract manufacturing organizations (CMOs), the country has garnered a lucrative demand base for this sector. Testifying to the same, a 2024 report from the Pharmaceutical Research and Manufacturers of America unveiled that the companies based in the U.S. contributed to 55% of the worldwide investment in biopharmaceutical R&D.

Canada is emerging steadily in the hydrophobic interaction chromatography market in support of a growing capital influx in life sciences research. The country’s emphasis on innovation is increasingly improving, which is further complemented by government-backed initiatives to expand biomanufacturing capabilities. This is ultimately driving the adoption of HIC across the nation. As evidence, in July 2025, the Ministries of Industry, Health, and Economic Development in Canada collectively sanctioned a $1.3 billion grant to more than 9,700 researchers and research projects across the nation.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the hydrophobic interaction chromatography market during the analyzed tenure. Rapid expansion in the biopharmaceutical and biotechnology industries across emerging economies, such as China, India, Japan, and South Korea, is the major propeller behind the region’s progress in this sector. Moreover, increasing investments in biologics manufacturing and R&D, coupled with the rising healthcare expenditure and government-backed funding, are driving demand for HIC commodities. Additionally, the region’s leveraging capacity in contractual research and manufacturing services for the pharmaceutical industry is consolidating a favorable landscape for this business category.

China is a leading manufacturer in the Asia Pacific hydrophobic interaction chromatography market, owing to its strong emphasis on clinical trials and massive government support. Further, the country’s focus is highly concentrated on advancing biologics production and increasing adoption of cutting-edge purification technologies boosted demand for HIC resins and systems. Additionally, the amplifying network of contract manufacturing organizations (CMOs) and research institutions is accelerating the integration of HIC in the maximum volume of downstream processing.

India, with an ambitious goal to become the global hub of biomanufacturing, is emerging as a prominent contributor to the Asia Pacific hydrophobic interaction chromatography market. The country’s augmentation in this sector is primarily driven by its expanding biotechnology and pharmaceutical industries. According to a 2023 PIB report, India ranked 3rd in the APAC biotechnology industry. It also highlighted the collaborative call from the country and the U.S. administrations to extend the existing partnerships to advanced biotechnology and biomanufacturing, and enhance biosafety and biosecurity innovation, practices, and norms.

Country-wise Trade of Vaccines, Blood, Antisera, Toxins, and Cultures (2023)

|

Country |

Export Value (Million) |

Import Value (Million) |

|

China |

$1,030 |

$17,700 |

|

Japan |

$2,522 |

$13,921 |

|

Chinese Taipei |

$52.7 |

$311 |

Source: OEC

Europe Market Insights

Europe is predicted to maintain a strong position in the global hydrophobic interaction chromatography market over the timeline between 2026 and 2035. The region’s steady progress in this field is fueled by its advanced biopharma and academic research ecosystem. Besides, the stringent regulatory standards for biologics production are also propelling demand in this landscape. Developed countries, including Germany, the UK, and Switzerland, are home to several globally leading pharma companies and contract development and manufacturing organizations (CDMOs) that rely on high-performance HIC technology. This portrays the presence of a sustainable consumer base for this sector in Europe.

The UK contributes remarkably to the regional propagation of the hydrophobic interaction chromatography market. It is empowered by a strong life sciences industry and commitment to extensive biopharmaceutical innovation. Besides, with a high concentration of biotech firms, academic research institutions, and CDMOs, the UK is fostering a lucrative ecosystem for both domestic and foreign pioneers in this sector. The country's emphasis on advanced purification methods, including HIC, is further supported by ongoing investments in R&D and a regulatory framework that promotes high standards in drug manufacturing.

Germany leads the European hydrophobic interaction chromatography market, owing to its robust pharma and biotech industries. Evidencing the same, in June 2023, WuXi Biologics extended its manufacturing capacity from 12,000L to 24,000L on a 30,000 square metre facility situated in Germany. The sterile filling and freeze-drying plant at Chempark Leverkusen, with an annual capacity of approximately ten million doses, now consists of a second variable filling line. The country also has a strong emphasis on precision manufacturing, which makes it an attractive landscape for pioneers who are seeking to conduct profitable business in this category.

Country-wise Trade of Biologics (Vaccine for Human Use) (2023)

|

Country |

Export Value (Million) |

Import Value (Million) |

|

Belgium |

$15,300 |

$13,200 |

|

Switzerland |

$276 |

$343 |

|

Ireland |

$12,300 |

$943 |

Source: OEC

Key Hydrophobic Interaction Chromatography Market Players:

- Cytiva

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Sartorius AG

- Waters Corporation

- Repligen Corporation

- GE Healthcare

- Purolite Life Sciences

- Novasep Holding S.A.S

- Sunresin New Materials Co. Ltd.

- Sartorius Stedim India Pvt. Ltd.

- Samsung Biologics

- CS Chromatography

The commercial dynamics of the hydrophobic interaction chromatography market are remarkably controlled by innovations from key players such as Agilent, Thermo Fisher, and Bio-Rad Laboratories. They are highly focused on developing advanced HIC systems that enhance performance and user experience. The 2024 launch of the next-generation InfinityLab LC Series, including the 1290 Infinity III LC and 1260 Infinity III LC systems with biocompatible versions, by Agilent demonstrated the same characteristics. Moreover, such advancements underscore the presence of a healthy competition among market leaders to provide cutting-edge, user-friendly chromatography solutions that maintain the sector's relevance with the evolving needs of consumers.

Such key players are:

Recent Developments

- In June 2025, Sartorius expanded its manufacturing and R&D capacities for innovative bioprocess solutions in France. The facility is now equipped with doubled cleanroom space, along with automated production lines, logistics, and warehouse platform. This marked a milestone for the company in innovative fluid management technologies.

- In February 2025, Thermo Fisher Scientific entered into a definitive agreement with Solventum to acquire its purification & filtration business in a transaction of $4.1 billion in cash. This was a strategic move by Thermo Fisher that created the scope of expansion across America, Europe, the Middle East, Africa, and APAC.

- Report ID: 5000

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrophobic Interaction Chromatography Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.