Hydrogenated Dimer Acid Market Outlook:

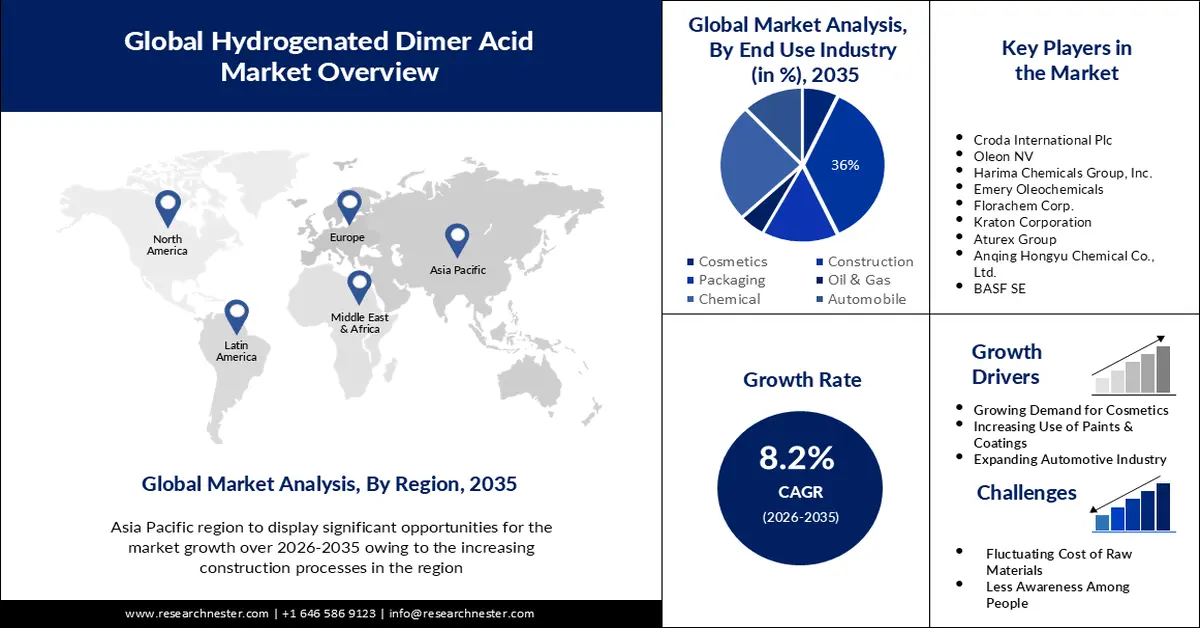

Hydrogenated Dimer Acid Market size was over USD 1.33 billion in 2025 and is anticipated to cross USD 2.92 billion by 2035, growing at more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogenated dimer acid is assessed at USD 1.43 billion.

Hot melt adhesives are becoming more and more popular, and this is one of the key drivers anticipated to propel the market for hydrogenated dimer acids. An excellent material for the manufacture of polyamide hot melt adhesives is hydrogenated dimer acid.

Hydrogenated dimer acid is being used to synthesize polyamide resins. As reactive polyamide is used as a curing agent for molded resin, marine coating, thermosetting surface coating, adhesives, potting materials & lining, heavy-duty coating, and others. Moreover, non-reactive polyamide is also used for printing inks and producing hot melt adhesives. Thus, the high demand for these products is projected to increase the need for hydrogenated dimer acid in the next few years.

Key Hydrogenated Dimer Acid Market Insights Summary:

Regional Highlights:

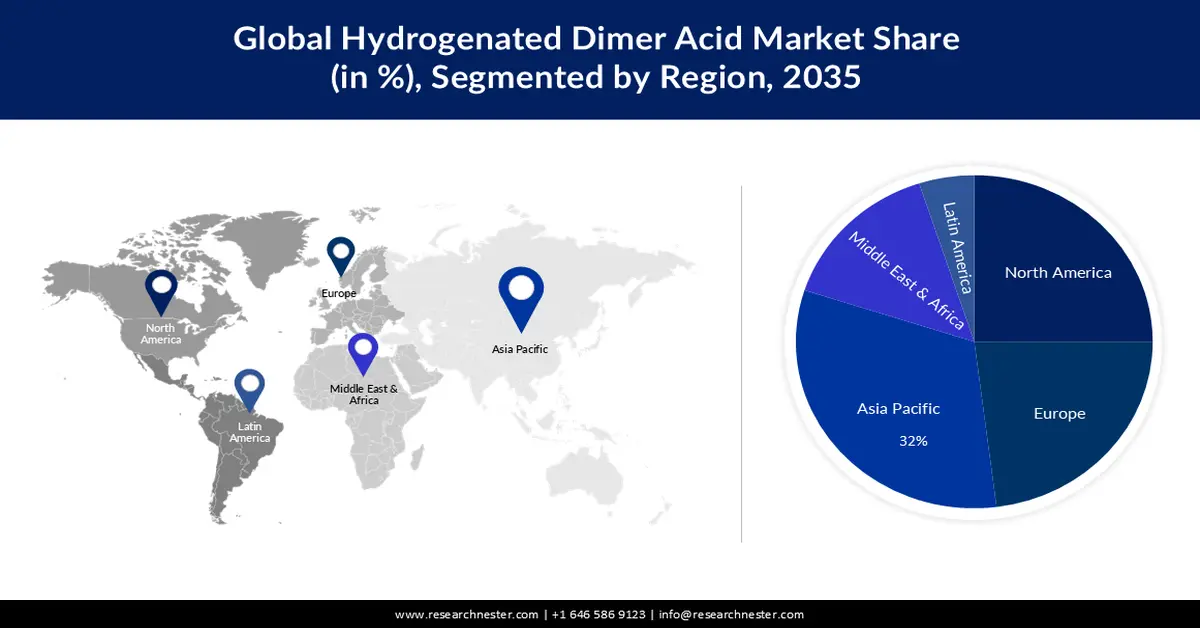

- The Asia Pacific industry is projected to command a 32% share by 2035 in the hydrogenated dimer acid market, owing to escalating demand for food packaging fueled by the surge in ready-to-eat meals and widespread growth of online food ordering across the region.

- North America is expected to capture a 25% share by 2035, supported by rising vehicle production that drives the need for hydrogenated dimer acid in coatings, adhesives, and related automotive applications.

Segment Insights:

- The construction segment is forecasted to account for a 36% share by 2035 in the hydrogenated dimer acid market, driven by increasing demand for polymers used in coatings, paints, adhesives, and sealants across expanding construction and real-estate developments.

- The paints & coatings segment is anticipated to lead the market by 2035, bolstered by the extensive use of hydrogenated dimer acid–based polyamide resins in protective coatings across construction, automotive, and diverse industrial sectors.

Key Growth Trends:

- Rising Demand and Consumption of Paints and Coatings

- Growing Construction Sector

Major Challenges:

- Fluctuation in Raw Material Prices

- Crude Oil Supply and Requirement Imbalance

Key Players: BASF SECroda International PlcOleon NVHarima Chemicals Group, Inc.Emery OleochemicalsFlorachem Corp.Kraton CorporationAturex GroupAnqing Hongyu Chemical Co., Ltd.Shandong Hujin Chemical Co., Ltd.

Global Hydrogenated Dimer Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.33 billion

- 2026 Market Size: USD 1.43 billion

- Projected Market Size: USD 2.92 billion by 2035

- Growth Forecasts: 8.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 24 November, 2025

Hydrogenated Dimer Acid Market - Growth Drivers and Challenges

Growth Drivers

- Rising Demand and Consumption of Paints and Coatings– Future sales opportunities for the hydrogenated dimer acid market are projected to result from the increasing need for lubricants, paints, and coatings globally. To make paints and coatings resistant to changes in the outside environment, manufacturers frequently use hydrogenated dimer acid during production. It was found that nearly 860 million gallons of paint were consumed in the United States in total in 2020 and more than 350 million gallons of architectural paint were devoured by the DIY (do it yourself) segment in the U.S.

- Growing Construction Sector– Hydrogenated dimer acid has various advantages in producing products such as sealants, resins, and others. Thus, the rapid expansion of the construction industry is anticipated to generate sales for hydrogenated dimer acid in the assessment period. It was noticed that the economy in the USA is greatly influenced by the construction sector, the sector employs more than 745,000 people and produces structures valued at close to USD 1.4 trillion annually.

- Increasing Import-Export of Chemical– It was noted that exports of chemicals from the EU outpaced imports by a sizeable margin from USD 242.03 billion in 2010 to USD 411.05 billion in 2020 and over this time, exports grew by 5% a year on average.

Challenges

- Fluctuation in Raw Material Prices - The constant ups and downs in the prices of raw materials of hydrogenated dimer acid can hamper the growth of the market. It might cause significant losses to the producers by affecting the supply chain and decrement in the export/import volume. Hence, this factor is estimated to be one of the major restraints to the market over the forecast period.

- Crude Oil Supply and Requirement Imbalance

- Less Consumer Awareness

Hydrogenated Dimer Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 1.33 billion |

|

Forecast Year Market Size (2035) |

USD 2.92 billion |

|

Regional Scope |

|

Hydrogenated Dimer Acid Market Segmentation:

End Use Segment Analysis

The construction segment in the hydrogenated dimer acid market is estimated to hold the largest revenue share of 36 % by the end of 2035. The growth of the segment can be accounted to the rising demand for hydrogenated dimer acid in the construction sector since it comprises all the necessary polymers. It was noticed that in 2021, the market size of the American construction industry was estimated to be over 2 trillion dollars, and in the following year, it is anticipated to grow even more. The rapid growth of the real estate sector, along with massive investments to construct buildings and infrastructures generates the need for hydrogenated dimer acid as it is used for surface coating, paint & inks, adhesives, and sealants in construction processes.

Application Segment Analysis

Hydrogenated dimer acid market from the paints & coatings segment is attributed to holding the most significant share by the end of the forecast period. Hydrogenated dimer acid is used to synthesize polyamide resins that are further used in paints & coatings, especially in protective coating. The rapidly expanding demand for paints and coatings from various end-use industries such as construction, automotive, and others is anticipated to bring lucrative growth opportunities for segment growth

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogenated Dimer Acid Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 32% by 2035. The growth of the market can be ascribed to the rising demand for packaging, mainly food packaging, supported by increasing demand for ready-to-eat meals and online food ordering across the region. As per one of the surveys, by the end of 2033, approximately more than 519 million users in India are estimated to be dependent on the online food ordering system.

North American Market Insights

The North America hydrogenated dimer acid market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the surging production of vehicles. The auto industry of the United States manufactured around 10 million vehicles in 2022, which included buses, coaches, commercial vehicles, heavy trucks as well as passenger vehicles.

Hydrogenated Dimer Acid Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Croda International Plc

- Oleon NV

- Harima Chemicals Group, Inc.

- Emery Oleochemicals

- Florachem Corp.

- Kraton Corporation

- Aturex Group

- Anqing Hongyu Chemical Co., Ltd.

- Shandong Hujin Chemical Co., Ltd.

Recent Developments

- BASF SE and Hannong Chemicals of Asia-Pacific together has planned to launch a cooperative venture for the commercial manufacturing of non-ionic surfactants.

- Oleon NV is a premium on eco-friendly packaging as it can lower the product’s carbon footprint for both the consumer and the manufacturer. Olean uses packaging for its finished products that are 100% recyclable and contains 30% recycled materials.

- Report ID: 4594

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogenated Dimer Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.