Hot Melt Adhesives Market Outlook:

Hot Melt Adhesives Market size was over USD 8.7 billion in 2025 and is estimated to reach USD 14.3 billion by the end of 2035, expanding at a CAGR of 5.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hot melt adhesives is estimated at USD 9.2 billion.

The worldwide hot melt adhesives market is rapidly evolving, readily shaped by sustainability, and ensuring technological advancement and the increasing demand from the packaging, automotive, and hygiene industries. According to an article published by the America Coatings Association in 2025, the global hygiene industry is continuously growing at 7% to 8% with suitable growth rates across emerging nations. This is one of the biggest end use applications of adhesives, which has significantly evolved and is comprehensively utilized in car interiors. Besides, as per an article published by NLM in December 2022, approximately 7 to 10 billion tons of waste are readily produced every year globally. Therefore, based on this, the circular economy needs to be effectively adopted to ensure zero waste while manufacturing different types of adhesives.

Furthermore, the availability of bio-based and sustainability adhesives, a boom in e-commerce packaging, automation and smart manufacturing, along with advancements in EVA systems and polyolefin, are other factors that are driving the market globally. As per an article published by NLM in June 2024, traditional adhesives tend to release volatile organic compounds (VOCs), accounting for 12,351 tons as of 2023, particularly in the U.S., through the production processes, including curing and application stages. Besides, a bioadhesive comprising outstanding bio-based materials has a 22% lower life cycle effect in comparison to a petrochemical adhesive. Meanwhile, polyurethane adhesives (PUAs) with an RNCO:OH of 1.5/1.0 constitute a strength of 5.7 MPa, along with a glass transition temperature (Tg) of 101 degrees Celsius. Besides, the continuous self-adhesive plastic supply from and to various nations is also bolstering the market’s exposure.

Self-Adhesive Plastic 2023 Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

China |

3.6 billion |

- |

|

U.S. |

2.3 billion |

1.0 billion |

|

Japan |

2.2 billion |

- |

|

Mexico |

- |

853 million |

|

Global Trade Valuation |

17.5 billion |

|

|

Global Trade Share |

0.077% |

|

|

Product Complexity |

1.13 |

|

Source: OEC

Key Hot Melt Adhesives Market Insights Summary:

Regional Highlights:

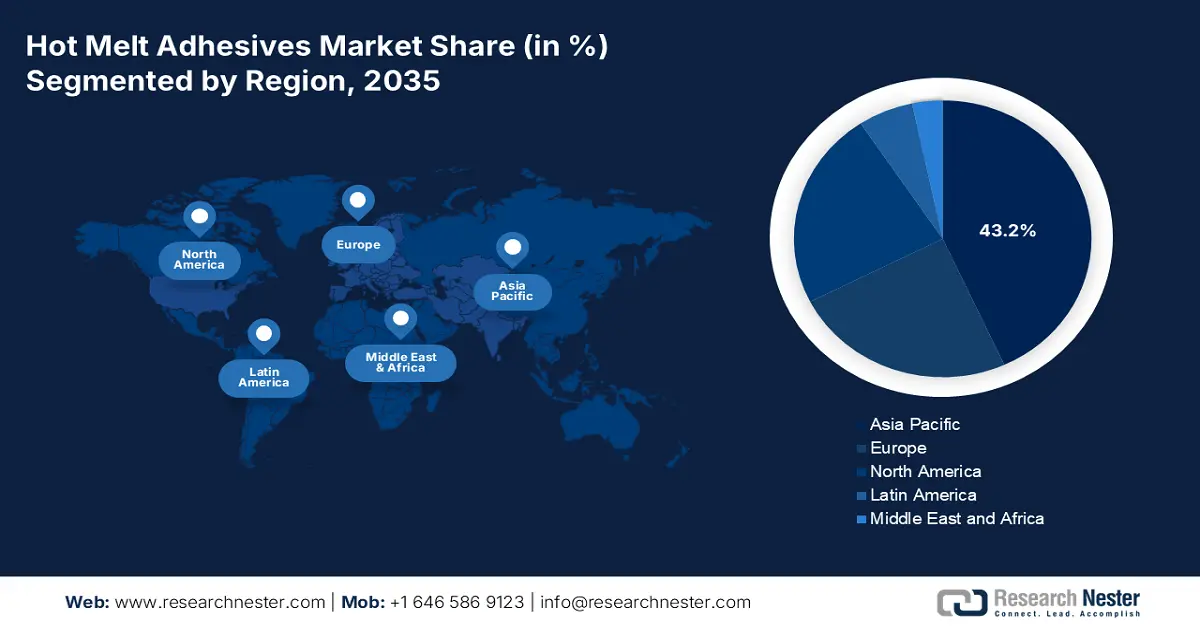

- Asia Pacific in the hot melt adhesives market is forecast to command the highest 43.2% share by 2035, supported by strong demand from packaging, hygiene nonwovens, woodworking, automotive assembly, and accelerating e-commerce activities across major economies.

- North America is expected to register the fastest growth during the forecast period, reinforced by expanding usage in automotive manufacturing, woodworking, hygiene nonwovens, and e-commerce-driven packaging solutions.

Segment Insights:

- The packaging segment under the application category in the hot melt adhesives market is estimated to account for a dominant 34.7% share by 2035, benefiting from fast-setting performance, product security, freshness retention, and growing adoption of sustainable adhesive formats.

- The ethylene vinyl acetate (EVA) sub-segment within raw materials is projected to hold the second-highest share by 2035, bolstered by its versatility, cost efficiency, ease of processing, and reliable adhesion across high-volume industrial applications.

Key Growth Trends:

- Expansion in disposable hygiene products

- Increased focus on automotive light weighting

Major Challenges:

- Increased raw material price volatility

- Environmental regulations and sustainability pressure

Key Players: Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (U.S.), 3M Company (U.S.), Bostik (France), Avery Dennison Corporation (U.S.), Sika AG (Switzerland), Jowat SE (Germany), Beardow Adams (United Kingdom), Paramelt B.V. (Netherlands), Kleiberit (Germany), Tex Year Industries Inc. (Taiwan), Nan Pao Resins Chemical Co., Ltd. (Taiwan), Mitsui Chemicals, Inc. (Japan), Konishi Co., Ltd. (Japan), KCC Corporation (South Korea), Pidilite Industries Limited (India), Aica Malaysia Sdn. Bhd. (Malaysia), RLA Polymers Pty Ltd (Australia), Tesa SE (Germany), Huntsman Corporation (U.S.).

Global Hot Melt Adhesives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.7 billion

- 2026 Market Size: USD 9.2 billion

- Projected Market Size: USD 14.3 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Mexico

Last updated on : 24 December, 2025

Hot Melt Adhesives Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in disposable hygiene products: There is a huge growth in medical disposables, sanitary napkins, and diapers, which is readily driving the hot melt adhesives market growth internationally. According to an article published by NLM in November 2024, the international market for effectively manufactured menstrual hygiene products was worth USD 22 billion as of 2022, and in Europe, 49 billion single-use products are readily consumed every year. Besides, people are expected to utilize an estimated 10,000 menstrual products in their lifetime. Meanwhile, since the initial commercial launch, sanitary napkins and tampons have been evolving constantly, since the latest synthetic materials have been invented and are currently made of more than 90% plastic, thus denoting an optimistic outlook for the market.

- Increased focus on automotive light weighting: Hot melt adhesives can significantly replace mechanical fasteners in interior assemblies and trims. This eventually supports fuel efficiency and weight reduction in electric vehicles and conventional vehicles, thereby suitable for fueling the hot melt adhesives market internationally. Besides, as per an article published by the DOE in 2025, a 10% reduction in vehicle weight tends to result in a 6% to 8% fuel economy optimization. Therefore, replacing traditional steel and cast-iron components with lightweight materials, including polymer composites, carbon fiber, aluminum alloys, magnesium, and high-strength steel, reduces a vehicle’s body weight by nearly 50%. Additionally, replacing heavy steel components with these materials can also decrease component weight by 10% to 60%, thereby creating a positive impact on the market globally.

- Growth in construction and infrastructure: The aspect of woodworking, insulation, and flooring applications is gradually expanding across emerging economies. This has resulted in the market providing flexible and durable bonding solutions for diversified substrates. As stated in the 2025 National Action Plans on Business and Human Rights article, the international construction industry is projected to expand from USD 4.5 trillion to USD 15.2 trillion within the upcoming 10 years. Meanwhile, the U.S., India, China, and Indonesia readily account for 58.3% of the forecast growth, which is suitable for the overall market’s upliftment. Moreover, as per Sustainable Development Goal 9, there will be 2 billion additional city dwellers, based on which the demand for construction industries is poised to increase, thus suitable for the market’s upliftment.

Challenges

- Increased raw material price volatility: The hot melt adhesives market relies heavily on petrochemical-derived raw materials such as ethylene vinyl acetate (EVA), polyolefins, and tackifiers. Price fluctuations in crude oil and derivatives directly impact production costs, squeezing margins for manufacturers and converters. For instance, global oil price volatility in recent years has led to unpredictable adhesive input costs, making long-term contracts difficult to manage. This volatility also affects downstream industries, such as packaging and hygiene, where cost-sensitive buyers demand stable pricing. Companies must hedge against raw material risks through diversified sourcing, long-term supplier agreements, and investments in alternative feedstocks such as bio-based polymers, thereby limiting the market’s expansion.

- Environmental regulations and sustainability pressure: Governments worldwide are tightening regulations on volatile organic compounds (VOCs), emissions, and waste disposal. While hot melt adhesives are inherently low-VOC compared to solvent-based alternatives, sustainability pressures are pushing manufacturers to develop bio-based and recyclable formulations. The Europe Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have introduced stricter compliance frameworks, requiring companies to invest in greener technologies. This transition is costly, as R&D for bio-based HMAs involves significant capital expenditure and long development cycles. Moreover, customers increasingly demand adhesives compatible with circular packaging initiatives, adding pressure to innovate, thus causing a hindrance to the market’s growth.

Hot Melt Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 8.7 billion |

|

Forecast Year Market Size (2035) |

USD 14.3 billion |

|

Regional Scope |

|

Hot Melt Adhesives Market Segmentation:

Application Segment Analysis

The packaging segment, which is part of the application, is anticipated to garner the highest share of 34.7% in the hot melt adhesives market by the end of 2035. The segment’s upliftment is highly attributed to its ability to secure products, enhance efficiency through fast settling, enabling diversified applications, such as labels, flexible packaging, and cartons, preserve freshness, and ensure sustainability with a specialized format, including biodegradable. According to an article published by the Our World in Data Organization in November 2024, 40% of the international plastic waste originates from packaging. This is worth 142 million tons per year globally, along with 84 million tons combinedly in the U.S., Europe, and China. Therefore, with an increase in waste generation, the packaging industry is continuously flourishing, which is positively impacting the market globally.

Raw Material Segment Analysis

Based on the raw material segment, the ethylene vinyl acetate (EVA) sub-segment in the market is expected to account for the second-highest share. The sub-segment’s growth is highly propelled by its versatility, cost-effectiveness, and ease of processing. EVA-based HMAs are particularly dominant in packaging, bookbinding, and woodworking applications, where fast setting times and reliable adhesion are critical. The material’s flexibility allows it to bond effectively with a wide range of substrates, including paper, cardboard, and certain plastics, making it indispensable in high-volume packaging operations. EVA adhesives also offer good thermal stability and resistance to cracking, which enhances their performance in demanding industrial environments. However, EVA’s reliance on petrochemical feedstocks exposes manufacturers to raw material price volatility, creating challenges in cost management.

Substrate Segment Analysis

By the end of the stipulated timeline, the paper and board sub-segment, part of the substrate segment, is projected to cater to the third-highest share in the hot melt adhesives. The sub-segment’s growth is highly uplifted by the packaging industry’s rapid expansion. HMAs are extensively used in case and carton sealing, labeling, and flexible packaging, where their fast-setting times and strong adhesion provide efficiency in high-speed production lines. The rise of e-commerce has further accelerated demand, as durable packaging solutions are essential for logistics and shipping. HMAs offer advantages over water-based adhesives by providing immediate bond strength, reducing downtime, and ensuring package integrity under varying environmental conditions. Additionally, their compatibility with recyclable paper and board aligns with global sustainability initiatives, particularly in Europe and North America, where regulations encourage eco-friendly packaging solutions.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Raw Material |

|

|

Substrate |

|

|

End use Industry |

|

|

Technology |

|

|

Product Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hot Melt Adhesives Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the hot melt adhesives market is anticipated to hold the highest share of 43.2% by the end of 2035. The market’s upliftment in the region is primarily attributed to packaging, hygiene nonwovens, woodworking, consumer electronics, and automotive assembly. According to an article published by the ITA in 2025, business-to-business e-commerce for the massive region has been continuously increasing at 15% on a yearly basis. This is deliberately higher than the international average of 14.5% gross merchandise value growth every year. Besides, China accounts for the highest point of 71.4 for cross-border ecommerce development, which is followed by 66.7 in South Korea, 65.5 in Singapore, 61.1 in Japan, 58.8 in Thailand, 57.7 in Malaysia, and 54.3 in Indonesia. Therefore, the continuous growth in the e-commerce sector has readily driven the opportunity for the market’s upliftment annually.

B2B E-commerce Growth in the Asia Pacific (2017-2025)

|

Year |

Growth (USD Billion) |

|

2017 |

7,667.2 |

|

2018 |

8,834.1 |

|

2019 |

10,369.5 |

|

2020 |

11,618.7 |

|

2021 |

13,998.4 |

|

2022 |

16,518.1 |

|

2023 |

19,293.1 |

|

2024 |

22,264.2 |

|

2025 |

25,603.9 |

Source: ITA

China in the hot melt adhesives market is growing significantly due to ensuring upscaling in packaging, electronics, and automotive assembly, plus extensive converting capacity and integrated chemical feedstocks. As per an article published by the Adhesives Organization in February 2025, the construction market in the country is projected to be worth CHF 4.3 million as of 2025, and is further forecasted to surge at a 3.9% growth rate by the end of 2028. Besides, based on a 5-year plan, the country’s government has successfully embarked on more than half a trillion for infrastructure projects as well as enhanced construction quality objectives. Additionally, the nation has made an investment of CHF 12 trillion in green transition to gain net-zero emissions by the end of 2060, resulting in an increased need for sustainable solutions, thus boosting the market’s exposure.

India in the market is also growing, owing to expansion in e-commerce and food packaging, along with hygiene nonwovens, furniture/woodworking, and automotive assembly. As per an article published by IBEF Organization in October 2025, the chemical industry in the country covers over 80,000 commercial products. In addition, the country contributes 7% to the GDP, and meanwhile, the chemical industry has been estimated to be worth Rs. 21,50,750 crore (USD 250 billion) in 2024, which is further estimated to grow to USD 300 billion by the end of 2028, along with Rs. 86,03,000 (USD 1 trillion) by the end of 2040. Moreover, the country accounts for 16% to 18% of the world’s production of dye intermediaries and dye stuffs, which is catering to the market’s upliftment.

North America Market Insights

North America in the hot melt adhesives market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by automotive applications, woodworking, hygiene nonwovens, and resilient packaging. Besides, according to the September 2025 U.S. Bureau of Labor Statistics data report, the producer price index for final demand has readily increased by 0.3%. Meanwhile, based on an unadjusted basis, the index for final demand surged by 2.7% for the year. Moreover, a 60% increase in the index for finalized demand goods can be readily traced to gasoline prices, with an additional 11.8%. Besides, the market’s structural demand in the region is effectively underpinned by case sealing, pressure-sensitive labeling, and e-commerce packaging, thereby making it suitable for bolstering the overall market.

The U.S. in the hot melt adhesives market is gaining increased traction, owing to industrial price signals, along with government programs and spending for safety, sustainability, and chemicals. As per an article published by the U.S. Department of Energy (DOE) in September 2025, there has been an announcement of the Industrial Efficiency and Decarbonization FOA, which is a funding opportunity, allocated USD 104 million to readily decarbonize the country’s industrial sector and uplift it towards the net-zero economy by the end of 2050. Besides, as stated in an article published by the Industrial Innovation Initiative Organization in March 2024, the DOE declared USD 6 billion in funding for industrial decarbonization projects. Therefore, with all these generous investments, the market is poised to experience growth.

Canada in the market is also developing due to expansion in the packaging sector, green building and construction initiatives, automotive manufacturing, as well as environmental and sustainability regulations. As stated in an article published by the Government of Canada in January 2025, the country has significantly generated an estimated 1.4 million tons of plastic film, of which less than 4% has been recycled, owing to issues within its sorting and collection. Besides, as stated in the October 2025 Canada Newswire article, the plastic waste aspect in the country represents an effective economic opportunity, which is approximately USD 8 billion. In addition, the Minister of Environment and Climate Change notified over USD 3.4 million for supporting regional solutions to diminish plastic pollution and waste, and develop a robust and resilient circular economy for the benefit of the overall population.

Europe Market Insights

Europe in the hot melt adhesives market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by packaging, hygiene nonwovens, woodworking, and automotive assembly, with continued mix upgrades toward metallocene polyolefin and EVA systems due to better thermal stability and faster line speeds. According to an article published by the Cefic Organization in 2024, the Europe27 capital expenditure has been 35% as of 2024, which is above the pre-crisis levels. Besides, in the same year, the regional chemical sector reported €28.4 billion as a generous capital spending. Moreover, the region caters to 10% of the global chemical investment, and meanwhile, the research and investment spending was 22% above the pre-crisis levels, thereby proliferating the market’s growth.

Europe’s Yearly Capital Spending Analysis (2014-2024)

|

Year |

Capital Expenditure (EUR Billion) |

|

2014 |

17.9 |

|

2015 |

19.9 |

|

2016 |

19.0 |

|

2017 |

21.8 |

|

2018 |

23.6 |

|

2019 |

24.4 |

|

2020 |

23.8 |

|

2021 |

26.2 |

|

2022 |

27.7 |

|

2023 |

29.3 |

|

2024 |

28.4 |

Source: Cefic Organization

The hot met adhesives market in Germany is gaining increased exposure, owing to its scale in automotive, packaging, engineered wood, and industrial assembly. As stated in an article published by the ITA in August 2025, the country’s advanced manufacturing industry amounts to USD 991,050 million in overall exports. This is followed by 721,621 million in imports, USD 36,753 million in imports from the U.S., USD 269,429 million in trade surplus, along with 1.0% in the EUR-USD exchange rate. Therefore, with this continuous advancement in the manufacturing industry, there is a huge demand for packaging, which is readily proliferating the market’s growth in the country. Besides, macroeconomic projections deliberately indicate macroeconomic projections indicate moderate growth, which stabilizes end‑market volumes and maintains demand for HMAs in automotive and packaging.

The market in Poland is also growing due to a rise in the packaging capacity, growth in consumer goods manufacturing, and ongoing investment in industrial modernization. As stated in an article published by the ITA in January 2024, the overall e-commerce industry has reached a USD 22 billion valuation. In addition, despite its maturity, this particular industry in the country is projected to grow in the upcoming years and is poised to reach USD 31 billion. Besides, 77% of internet users in the nation purchase online products, based on which the e-commerce industry is expected to account for 20% of overall retail sales. Meanwhile, the business-to-business (B2B) e-commerce segment has witnessed dynamic growth and successfully reached USD 90 billion as of 2022, thus creating an optimistic opportunity for uplifting the market in the country.

Key Hot Melt Adhesives Market Players:

- Henkel AG & Co. KGaA (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- H.B. Fuller Company (U.S.)

- 3M Company (U.S.)

- Bostik (France)

- Avery Dennison Corporation (U.S.)

- Sika AG (Switzerland)

- Jowat SE (Germany)

- Beardow Adams (United Kingdom)

- Paramelt B.V. (Netherlands)

- Kleiberit (Germany)

- Tex Year Industries Inc. (Taiwan)

- Nan Pao Resins Chemical Co., Ltd. (Taiwan)

- Mitsui Chemicals, Inc. (Japan)

- Konishi Co., Ltd. (Japan)

- KCC Corporation (South Korea)

- Pidilite Industries Limited (India)

- Aica Malaysia Sdn. Bhd. (Malaysia)

- RLA Polymers Pty Ltd (Australia)

- Tesa SE (Germany)

- Huntsman Corporation (U.S.)

- Henkel AG & Co. KGaA is one of the largest global players in hot melt adhesives, with strong penetration in packaging, hygiene, and automotive applications. Its focus on sustainability and innovation in bio-based adhesives positions it as a leader in meeting regulatory and customer demands.

- H.B. Fuller Company has a significant presence in hygiene, packaging, and construction adhesives, with a global footprint in hot melt technologies. The company invests heavily in R&D to develop high-performance, low-VOC formulations that align with environmental standards.

- 3M Company readily leverages its diversified portfolio to supply hot melt adhesives across industrial and consumer applications. Its strength lies in innovation and advanced bonding solutions that enhance efficiency in packaging and assembly lines.

- Bostik is a subsidiary of Arkema, Bostik is a major supplier of hot melt adhesives for packaging, hygiene, and industrial markets. The company emphasizes sustainable solutions and has expanded its product range to meet the growing demand for recyclable and eco-friendly adhesives.

- Avery Dennison Corporation integrates hot melt adhesives into its labeling and packaging solutions, serving global FMCG and logistics industries. Its expertise in pressure-sensitive technologies and sustainability initiatives strengthens its competitive edge in the adhesives market.

Here is a list of key players operating in the global market:

The international hot melt adhesives market is consolidated among diversified chemical and specialty adhesive leaders, while regional champions compete on cost, formulations, and service. Strategies include mergers and acquisitions to expand product breadth and channels, research and development in metallocene polyolefin and PUR systems for higher line speeds and heat stability, and sustainability initiatives, such as low-VOC, bio-based inputs, and recyclability, to meet regulatory demands. Players invest in application labs, technical service, and digital tools for spec-in wins, and scale manufacturing near end-markets to reduce lead times. Besides, in March 2025, Henkel Adhesives Technology introduced Technomelt Supra PRO 301 Plus, which is a new hot melt solution, particularly designed for high-speed machines in the pharma industry, thereby boosting the market globally.

Corporate Landscape of the Hot Melt Adhesives Market:

Recent Developments

- In July 2025, BioBond Adhesives, Inc. declared its official entry into the packaging hot melt industry by introducing BioMelt SPKG250, as well as BioMelt SPKG500 product offerings, which are readily available for sampling.

- In December 2024, Bostik collaborated with Nordson and Dow, and unveiled Kizen LIME, which is an advanced and high-performance hot melt adhesive, by utilizing 80% renewable ingredients as well as with bio-circular and bio-based materials.

- Report ID: 4998

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hot Melt Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.