Global Hydrogen Internal Combustion Engines Market

- An Outline of the Global Hydrogen Internal Combustion Engines Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Hydrogen Internal Combustion Engines Market

- Recent News

- Regional Demand

- Ultra-High Molecular Polyethylene Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Hydrogen Internal Combustion Engines Landscape

- Ultra-High Molecular Polyethylene Demand Trends (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Hydrogen Internal Combustion Engines Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Hydrogen Internal Combustion Engines Market – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- JCB

- Toyota

- Daimler Truck

- DEUTZ

- Cummins

- MAN

- Weichai Power

- KEYOU

- Westport Fuel Systems

- Business Profile of Key Enterprise

- Global Hydrogen Internal Combustion Engines Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Hydrogen Internal Combustion Engines Market Segmentation Analysis (2026-2036)

- By Vehicle

- ~Trucks & Buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition (PFI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection, Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition, Market Value (USD Million), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Power Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Vehicle

- ~Trucks & buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractor, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition (PFI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection (HPDI), Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition (RCDI-SI), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Power Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Vehicle

- ~Trucks & buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractor, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition (PFI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection (HPDI), Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition, Market Value (USD Million), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036,

- By Vehicle

- ~Trucks & buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractors, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition, Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection (HPDI), Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition (ECDI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Power Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Vehicle

- ~Trucks & buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractor, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition (PFI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection (HPDI), Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition (RCDI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Power Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Vehicle

- ~Trucks & buses, Market Value (USD Million), and CAGR, 2026-2036F

- ~Construction equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Mining equipment, Market Value (USD Million), and CAGR, 2026-2036F

- ~Crawler excavator, Market Value (USD Million), and CAGR, 2026-2036F

- Tractor, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Combustion

- Port fuel injection with spark ignition (PFI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- High-pressure direct injection (HPDI), Market Value (USD Million), and CAGR, 2026-2036F

- Early cycle direct injection with spark ignition (ECDI-SI), Market Value (USD Million), and CAGR, 2026-2036F

- By Driving Range

- Up to 250 km, Market Value (USD Million), and CAGR, 2026-2036F

- 251-500 km, Market Value (USD Million), and CAGR, 2026-2036F

- 501-800 km, Market Value (USD Million), and CAGR, 2026-2036F

- Above 800 km, Market Value (USD Million), and CAGR, 2026-2036F

- By Power Output

- Below 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Above 300 HP, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Vehicle

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

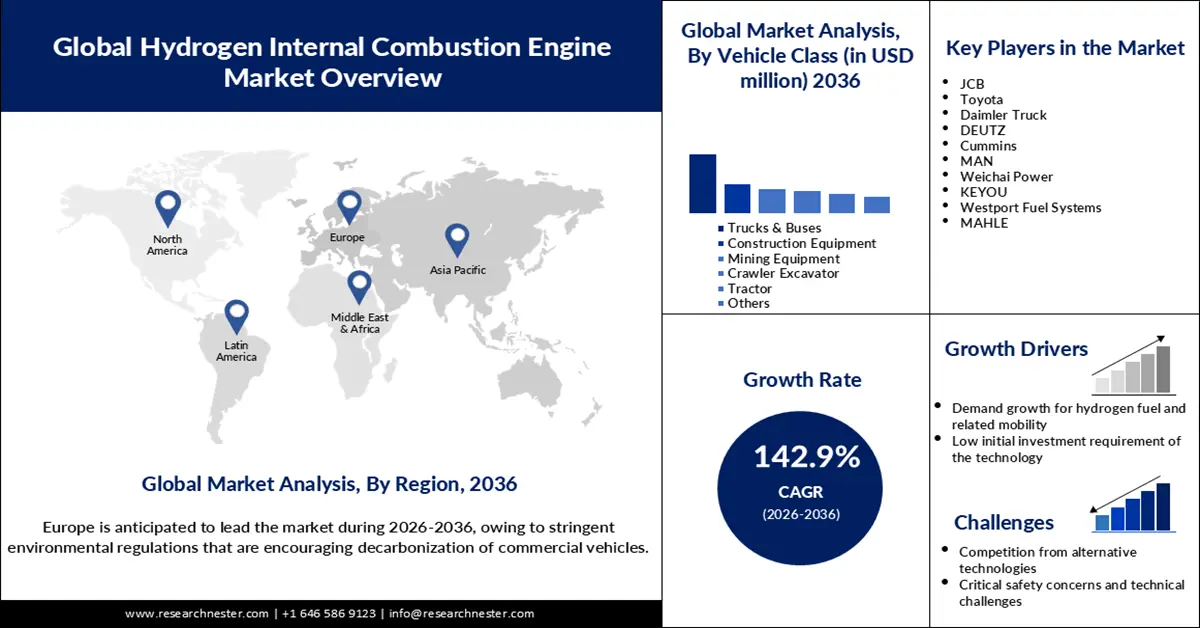

Hydrogen Internal Combustion Engines Market Outlook:

Hydrogen Internal Combustion Engines Market size was valued at USD 3.6 million in 2025 and is forecasted to reach a valuation of USD 62.54 billion by the end of 2036, rising at a CAGR of 142.9% during the forecast period, i.e., 2026-2036. In 2026, the industry size of hydrogen internal combustion engines is assessed at USD 8.7 million.

The growth of the hydrogen internal combustion engines market is fueled by the rising demand for environmentally friendly and low-carbon transportation solutions, influenced by regulatory pressures. As reported by the European Union in March 2023, the council adopted the Fit for 55, a legislative package that set stringent carbon emissions performance standards for new vehicles. Through the implementation of the regulation, the Council aims to achieve carbon emission reductions of 55% for new cars and 50% for vans between 2030 and 2034, compared to 2021 levels, culminating in a 100% reduction in emissions from all new vehicles by 2035. Similarly, in January 2025, the Pennsylvania Petroleum Association (PPA) reported that California had submitted its Advanced Clean Fleets (ACF) waiver request to the Environmental Protection Agency (EPA) in November 2023. The request aimed to enforce regulations mandating trucking fleets to begin transitioning to zero-emission vehicles in 2024, with all other fleets required to achieve full zero-emission compliance between 2035 and 2042. As a result, the demand for H2-ICEs could increase in the automotive sector, enabling vehicles powered by hydrogen fuel while eliminating the utilization of fossil fuels.

Additionally, strategic industry alliances are expected to play a crucial role in the expansion of the hydrogen internal combustion engines market. A report by the Department of Energy, published in February 2023, revealed that programs related to H2-ICE development and demonstration were gaining momentum, as more than 130 original equipment manufacturers had shown interest in planning or operating H2 engine research and development projects. This can accelerate innovation in the development of H2-ICEs, and as a result, the performance of the component can improve. Earlier, in April 2021, the CMB and TSUNEISHI unveiled their collaborative intention of developing the hydrogen internal combustion engine technology, dedicated to the industrial and maritime market of Japan. Through the establishment, the organizations aimed to bolster the deployment of the revolutionary technology.

Key Hydrogen Internal Combustion Engines Market Insights Summary:

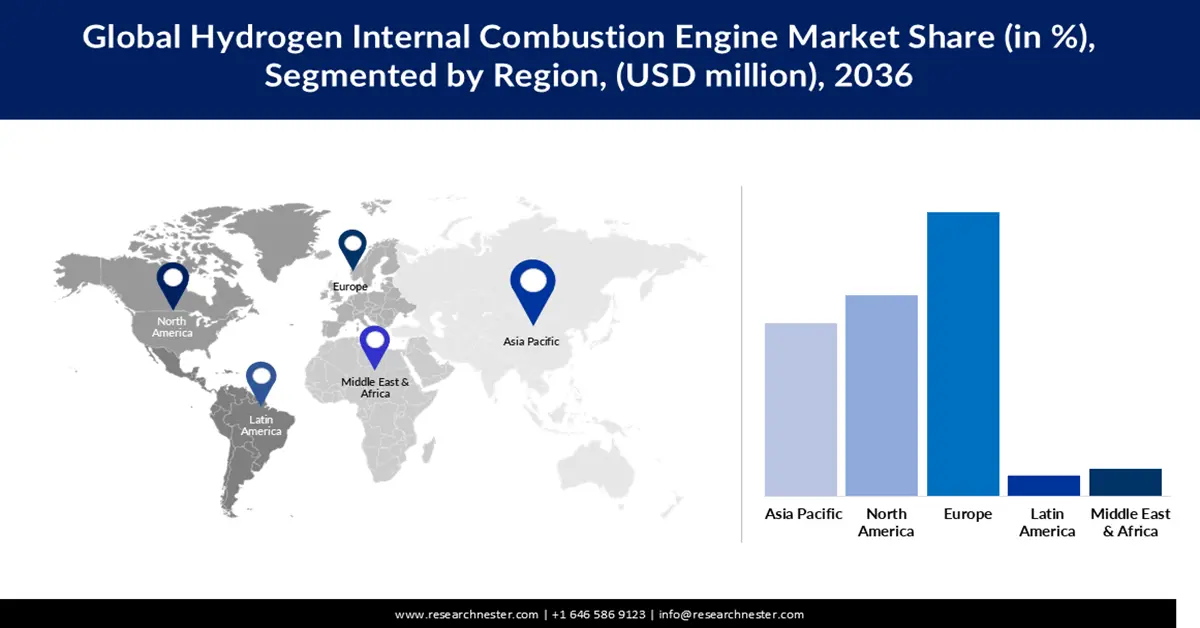

Regional Insights:

- Europe hydrogen internal combustion engines market is projected to hold a 40.5% share by 2036, impelled by stringent environmental regulations encouraging decarbonization of commercial vehicles.

- North America market is expected to acquire a remarkable share by 2036, driven by government support and well-established hydrogen infrastructure.

Segment Insights:

- Trucks & buses segment in the hydrogen internal combustion engines market is projected to account for 55.3% share by 2036, driven by abiding by stringent regulations and promoting environmental sustainability.

- Above 800 km segment is expected to hold a significant share by 2036, propelled by increasing adoption of H2-ICE vehicles for commercial and industrial purposes.

Key Growth Trends:

- Rapid refueling and minimal downtime

- Demand growth for hydrogen fuel and related mobility

Major Challenges:

- Competition from alternative technologies

- Critical safety concerns and technical challenges

Key Players:JCB (UK), Toyota (Japan), Daimler Truck (Germany), DEUTZ (Germany), Cummins (U.S.), MAN (Germany), Weichai Power (China), KEYOU (Germany), Westport Fuel Systems (Canada), MAHLE (Germany)

Global Hydrogen Internal Combustion Engines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 million

- 2026 Market Size: USD 8.7 million

- Projected Market Size: USD 62.54 billion by 2036

- Growth Forecasts: 142.9% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Europe (40.5% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, Japan, United States, France, South Korea

- Emerging Countries: India, China, Brazil, Australia, Mexico

Last updated on : 5 November, 2025

Hydrogen Internal Combustion Engines Market - Growth Drivers and Challenges

Growth Drivers

- Rapid refueling and minimal downtime: Hydrogen internal combustion engines can be refueled within minutes, significantly reducing downtime and enhancing operational efficiency, particularly in freight applications. Consequently, the heavy-duty and long-haul trucking sectors are likely to show a growing inclination toward adopting hydrogen internal combustion engine technology. Industries that depend on the timely delivery of goods can also benefit from its use, as it ensures that trucks return to operation quickly after refueling, helping to meet strict delivery schedules and minimize disruptions.

- Demand growth for hydrogen fuel and related mobility: The demand for hydrogen fuel and related mobility is growing rapidly worldwide, driven by relevant technological advancements and the regulatory pressure for green energy initiatives in different industries. As disclosed by the International Energy Agency, the demand for hydrogen across refining, industrial applications, heavy-duty vehicles, long-distance transport, and energy storage sectors increased to over 97 Mt in 2023 and surpassed 100 Mt in 2024. With the expansion of the hydrogen economy, the consumption of H2-ICE can increase in the mentioned industries for decarbonization.

- Low initial investment requirement of the technology: In established internal combustion engines, the design of H2-ICE is possible to be grounded. This leads to a low initial investment required for the deployment of the technology. In the production of the H2-ICEs, the same components used in traditional ICEs are supposed to be used. Therefore, the manufacturers of hydrogen internal combustion engines can leverage the manufacturing ecosystem they already have in the production of H2-ICEs. This can automatically result in a reduction in research and development costs.

Challenges

- Competition from alternative technologies: The availability of alternative technologies, such as battery electric vehicles (BEVs), fuel cell electric vehicles (FCEVs), and other fuel (methanol and ammonia) powered vehicles, can hinder the hydrogen internal combustion engines market growth significantly. Especially, FCEVs that generate electricity using hydrogen in the fuel cell, making the technology more efficient compared to H2-ICE. which burns hydrogen on internal combustion engines to generate power.

- Critical safety concerns and technical challenges: Technical challenges such as limited power density, reduced efficiency, and abnormal combustion continue to hinder the large-scale deployment of hydrogen internal combustion engine technology. These issues contribute to both economic and operational constraints in production and adoption. As noted by the Department of Energy in February 2023, these factors represent key areas requiring further research and innovation. Additionally, hydrogen’s highly flammable nature poses safety risks during storage and handling. The Occupational Safety and Health Administration (OSHA) in January 2025 reported that hydrogen gas can easily ignite fires and explosions if not managed carefully, which can raise concerns among potential consumers and slow the adoption rate of H2-ICE systems.

Hydrogen Internal Combustion Engines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

142.9% |

|

Base Year Market Size (2025) |

USD 3.6 million |

|

Forecast Year Market Size (2036) |

USD 62.54 billion |

|

Regional Scope |

|

Hydrogen Internal Combustion Engines Market Segmentation:

Vehicle Class Segment Analysis

The trucks & buses segment is poised to acquire a hydrogen internal combustion engines market share of 55.3% by the end of 2036. Abiding by the stringent regulations, the manufacturers of trucks and buses are increasingly focusing on the adoption of H2-ICE to promote environmental sustainability. This revolution in transportation is also occurring in developing economies. For instance, in February 2023, Ashoke Leyland and Reliance Industries collaboratively first H2-ICE integrated a heavy-duty truck in India. The gross weight rate of the vehicle ranges from 19 to 35 tons. The focus of governments on sustainable transportation in different countries is influencing the dominance of H2-ICE powered trucks and buses segment. As reported by the India Brand Equity Foundation in June 2025, the government has a target of bringing more than 1,000 hydrogen-powered buses and buses on roads for commercial purposes by 2030, following the deployment of around 50 vehicles before the start of 2026.

Driving Range Segment Analysis

The above 800 km segment is anticipated to hold a significant share of the hydrogen internal combustion engines market during the projection period. H2-ICE-powered vehicles are likely to be adopted increasingly for commercial and industrial purposes. The vehicles need to have a driving range of more than 800km to serve various industries in their logistics. Therefore, with a surge in logistics operations, the consumption of the H2-ICEs can increase over time, as, according to the Government of India in June 2021, 90% of the expenses in logistics were caused by transportation and inventory management. Companies are also active in researching ways to enable vehicles to be used for commercial and industrial purposes with a higher driving range.

Power Output Segment Analysis

The below 300 HP segment in the hydrogen internal combustion engines market is projected to dominate between 2026 and 2036, driven by its widespread application across medium- and heavy-duty trucks, buses, compact off-highway equipment, construction machinery, and on-highway vehicles. Automotive companies are increasingly manufacturing H2-ICE-powered vehicles within this horsepower range to balance performance and efficiency. In November 2024, Toyota announced a breakthrough in H2-ICE integration with its liquid hydrogen GR Corolla, featuring an output below 300 HP. Similarly, smaller mobility engines often operate below 30 HP; for instance, in May 2023, Yamaha collaborated in forming a Ministry of Economy, Trade and Industry-approved R&D association to develop hydrogen-powered engines for small mobility vehicles.

Our in-depth analysis of the hydrogen internal combustion engines market includes the following segments:

|

Segments |

Subsegments |

|

Vehicle |

|

|

Combustion |

|

|

Driving Range |

|

|

Power Output |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Internal Combustion Engines Market - Regional Analysis

Europe Market Insights

The Europe hydrogen internal combustion engines (H2-ICE) market is expected to account for a revenue share of 40.5% by the end of 2036, owing to stringent environmental regulations that are encouraging decarbonization of commercial vehicles. As reported by the International Council on Clean Transportation (ICCT) in February 2023, the European Commission proposed revisions to the EU’s CO₂ standards for commercial vehicles, including trailers, trucks, and buses. The updated regulation mandates carbon emission reductions of 45% by 2030, 65% by 2035, and 90% by 2040 for new trucks. It also broadens the scope of regulated vehicles from 60% to 90% of all heavy-duty vehicles across the region and supports the phase-out of combustion bus sales by 2030. Such regulatory measures are expected to accelerate the adoption and integration of H2-ICE technology in newly manufactured commercial vehicles.

Aggressive investment in hydrogen infrastructure can also foster hydrogen internal combustion engines market expansion within the region remarkably. As disclosed by the European Commission's Directorate-General for Energy, by initiating the implementation of the REPowerEU Strategy of 2022, the commission set out a new target of producing 100 million tons of hydrogen, following a 10 million tons of import by 2030. This indicates a widespread availability of hydrogen across the region, which can foster the adoption of hydrogen internal combustion engines in the upcoming financial years.

Germany is anticipated to emerge as the fastest-growing hydrogen internal combustion engines market in Europe, owing to the growing demand for the technology in the automotive sector, driven by the EU regulatory pressures. According to the disclosure by the Verband der Automobilindustrie e.V. (VDA) in May 2023, the Regulation (EU) 2019/1242 introduced novel CO2 aims for lorries, trailers, buses, or coaches. As a result, the suppliers of heavy-duty vehicles within the country have been committed to decreasing carbon and exhaust emissions in public and road freight transport and enabling registration of all new vehicles to be fossil-free by 2040. This indicates the likelihood of an accelerating integration of H2-ICEs in heavy-duty vehicles. As reported by the European Hydrogen Observatory in November 2024, Germany had the largest revenue share of 46% in Europe hydrogen internal combustion engines market in terms of the total number of hydrogen refueling stations (HRS), with 86 operational stations. The presence of effective refueling infrastructure makes the use of vehicles powered by hydrogen internal combustion engines convenient, which can lead to an accelerated adoption.

The UK is emerging as a key growth market for H2-ICE technology throughout the forecast period, driven by the rising demand for hydrogen-powered vehicles across heavy-duty sectors such as agriculture and construction. These industries rely heavily on non-road mobile machinery (NRMM) to support their operations. According to a Hydrogen Energy Association report (November 2024), H2-ICEs are increasingly being adopted as an effective technological solution for decarbonization within these sectors. Additionally, the government’s transport emission reduction targets are encouraging consumers to shift toward environmentally sustainable, hydrogen-based vehicles. As highlighted by the UK Government, users of zero-emission cars and electric vans are exempt from paying vehicle excise duty and related taxes, further promoting adoption.

North America Market Insights

A combination of government support is expected to make the hydrogen internal combustion engines market in North America acquire a remarkable revenue share by the end of 2036. For example, in February 2024, the U.S. Department of Energy announced an investment of USD 10.5 million to fund 3 projects, focused on research, development, and demonstration of hydrogen combustion engines. Effective hydrogen infrastructure of the region also influences a booming adoption of hydrogen internal combustion engines, when hydrogen is a comparatively cost-effective fuel option for vehicles. As reported by the Hydrogen Council in May 2023, low-carbon hydrogen accounted for over 70% of the total hydrogen capacity of North America.

The U.S. is expected to retain its dominance as an expanding hydrogen internal combustion engines market during the stipulated timeframe, due to the government incentives for relevant research and development. As informed by the U.S. Department of Energy (DOE), the Department of Energy is offering financial aid of up to USD 200,000 for potential applicants, including domestic small enterprises that are involved in research and development, focused on fostering commercial innovations of hydrogen-powered vehicle technologies. Therefore, key players operating within the country have access to adequate financial support to fund the advancement of H2-ICEs. The presence of a wide range of manufacturers that are ensuring an adequate supply of technology in the hydrogen internal combustion engines market is fueling the industry's growth.

The hydrogen internal combustion engines market in Canada is poised to witness a robust CAGR throughout the projection period, as a continuous push by the government to expand the use of hydrogen as an eco-friendly alternative to fossil fuels. According to the report by the Government of Canada, published in February 2025, its Clean Hydrogen Investment Tax Credit (ITC) provides financial returns in the form of a tax credit against properties acquired between March 2023 and December 2034 with the motive of enabling clean hydrogen production. This type of government support can lead to more widespread availability of hydrogen, which can increase the convenience of using H2-ICE-powered vehicles for the population. The adoption of hydrogen internal combustion engines integrated public transportation options can also increase in the country, owing to its compatibility with the population distribution. As disclosed by the International Institute for Sustainable Development (IISD) in March 2025, with 82% residing in urban areas, the population distribution of the country is well-suited to green transportation options, including metropolitan public transport, intercity rail connections, and others.

Asia Pacific Market Insights

The Asia Pacific hydrogen internal combustion engines market is anticipated to hold a significant revenue share between 2026 and 2036, attributed to the rapid expansion of hydrogen refueling infrastructure within the region. The APAC hydrogen internal combustion engines market is gaining momentum as governments and OEMs pursue hydrogen strategies to decarbonize transport while leveraging existing internal-combustion platforms. Japan’s Basic Hydrogen Strategy, for example, targets a major scale-up of hydrogen supply, aiming for roughly 3 million tons of hydrogen consumption annually by 2030, which underpins industrial and transport use cases, including H2-ICE development.

National programs across the region, from India’s National Green Hydrogen Mission to Australia’s national hydrogen strategy, are accelerating electrolyser deployment, pilot projects, and R&D that improve hydrogen availability and lower costs, enabling downstream applications such as H2-ICE.

Although low-emission hydrogen currently represents only a small fraction of global hydrogen use, international reviews note growing project pipelines and policy momentum that make transport applications more viable over the next decade. Technically, hydrogen internal combustion engines activity is already concentrated in Asia and Europe, with government and industry demonstrations focused on heavy-duty, maritime, and off-road applications where rapid refueling and existing engine architectures are advantageous. Research syntheses emphasize that scaling H2-ICE commercially will depend on lowering hydrogen production costs, improving fuel handling and safety standards, and continuing collaboration between OEMs, utilities, and testing bodies across the Asia-Pacific.

Key Hydrogen Internal Combustion Engines Market Players:

- JCB (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Toyota (Japan)

- Daimler Truck (Germany)

- DEUTZ (Germany)

- Cummins (U.S.)

- MAN (Germany)

- Weichai Power (China)

- KEYOU (Germany)

- Westport Fuel Systems (Canada)

- MAHLE (Germany)

- Cummins is a leading global engine manufacturer actively exploring hydrogen internal combustion technology to reduce emissions. The company focuses on developing H2-ICE engines for heavy-duty trucks, buses, and industrial applications, leveraging its expertise in powertrain systems and emission control technologies.

- MAN, a subsidiary of Traton Group, is advancing hydrogen combustion technology for commercial vehicles. It is investing in R&D to integrate hydrogen engines into trucks and buses, aiming to provide zero-emission alternatives while maintaining high performance and efficiency.

- Weichai Power is a major Chinese engine manufacturer diversifying into hydrogen-powered solutions. The company is developing H2-ICE engines for heavy-duty transport and industrial machinery, combining its strong domestic manufacturing base with strategic partnerships for green mobility solutions.

- KEYOU specializes in hydrogen combustion technology, aiming to retrofit existing diesel engines to run on hydrogen. The company focuses on commercial vehicles and industrial applications, positioning itself as a pioneer in sustainable hydrogen internal combustion engine solutions in Europe.

- Westport develops advanced clean-fuel technologies, including hydrogen combustion engines. The company focuses on providing high-efficiency, low-emission power solutions for commercial vehicles, leveraging its global expertise in alternative fuels and engine conversion systems.

Below are the areas covered for each company in the global hydrogen internal combustion engines market:

Key industry players are accelerating the growth of the hydrogen internal combustion engine market through strategic collaborations, technology innovation, and pilot deployments across transportation and industrial sectors. Companies such as Toyota, Cummins, and Kawasaki Heavy Industries are investing in engine redesigns to enable hydrogen compatibility within existing combustion platforms, reducing transition costs. Yamaha and DENSO are jointly developing small and mid-sized H₂ engines suitable for motorcycles and compact mobility vehicles, expanding hydrogen use beyond heavy-duty transport. Additionally, partnerships like CMB.TECH and Tsuneishi Shipbuilding are demonstrating hydrogen-powered maritime engines in Japan, showcasing cross-industry integration. Collectively, these efforts are enhancing fuel efficiency, addressing combustion challenges, and driving global recognition of hydrogen internal combustion engine as a practical bridge toward full hydrogen mobility.

Corporate Landscape of the global hydrogen internal combustion engine market:

Recent Developments

- In April 2025, Cummins Inc., a global leader in power and technology solutions, announced the launch of its new turbocharger specifically designed for Hydrogen Internal Combustion Engines (H₂-ICEs). This innovation represents a major milestone in advancing turbocharging technology for heavy-duty commercial on-highway applications across Europe. The development, led by Cummins Components and Software (CCS)—a division of the company’s Components business segment, highlights Cummins’ growing leadership in hydrogen-based innovation. Notably, CCS has also secured a supply contract with a major European OEM for H₂-ICE turbochargers, underscoring the company’s pivotal role in the decarbonization of commercial transport.

- In December 2024, HORIBA India Private Limited (HORIBA India) announced its entry into the rapidly expanding hydrogen technology sector with the inauguration of its first Hydrogen Internal Combustion Engine (H₂-ICE) Test Bed Facility at the HORIBA India Technical Center (HITC) in Chakan, Pune. This advanced facility marks a major step in HORIBA India’s strategic expansion, enabling innovation and testing in hydrogen-powered engine technologies. The initiative is designed not only to open new business opportunities but also to align with the global vision of carbon neutrality, decarbonization, and sustainable energy transition.

- Report ID: 8223

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Internal Combustion Engines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.