Hydrogen Combustion Engine Market Outlook:

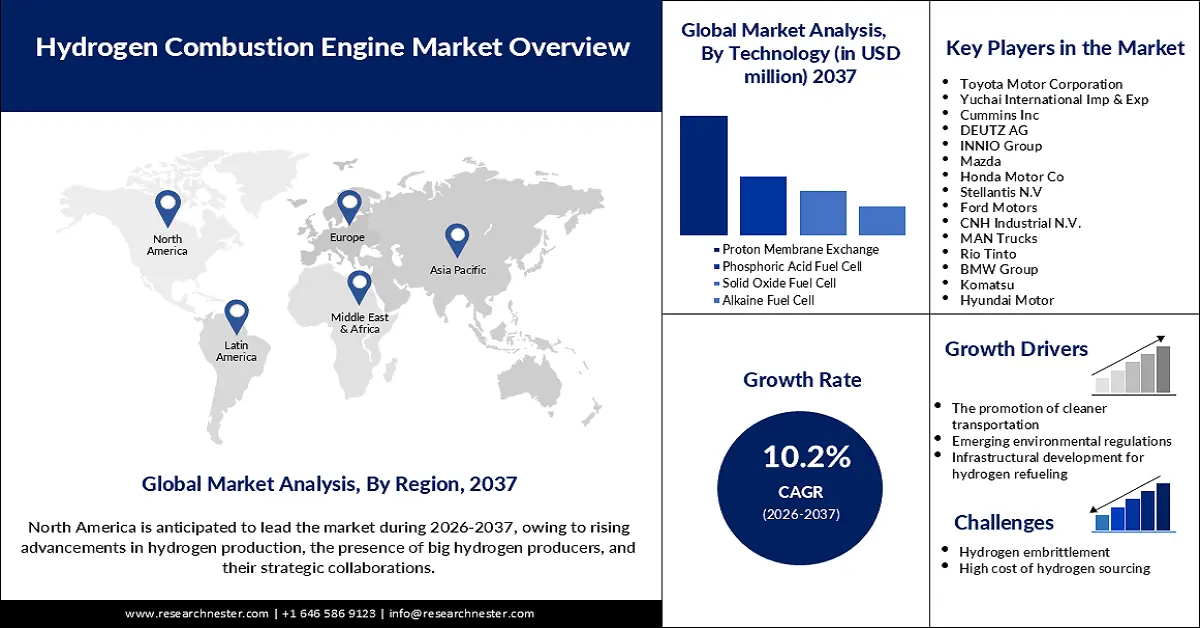

Hydrogen Combustion Engine Market size was valued at USD 48.6 billion in 2025 and is forecasted to reach a valuation of USD 155.8 billion by the end of 2037, rising at a CAGR of 10.2% during the forecast period, i.e., 2026-2037. In 2026, the industry size of hydrogen combustion engine is assessed at USD 53.5 billion.

Rising global environmental concerns is a primary factor fueling the growth of the hydrogen combustion engine market. Societal stakeholders, including government, companies, and others, are taking measures to mitigate environmental challenges. For example, the government of India, along with the national leaders of countries such as Brazil, the U.S, Italy, Argentina, Bangladesh, Singapore, UAE, and Mauritius, launched the Global Biofuels Alliance in September 2023 to promote the sustainable production and use of the same. The promotion of biofuels is likely to create a preferred environment for the adoption of hydrogen combustion engines.

Increasing production and storage of hydrogen also boosts the hydrogen combustion engine market growth. As per the Global Hydrogen Review, in 2023, the production of hydrogen globally reached 97 Mt. By the same business year, the capacity of installed water electrolyzers reached 1.4 GW. By 2030, the production of low-emissions hydrogen is expected to reach 49 Mtpa. By ensuring adequate availability of hydrogen fuel to run vehicles, increasing production and storage of hydrogen is likely to incline towards hydrogen combustion engines.

Global Hydrogen Policy & Capacity Developments 2024

|

Region / Country |

Key Highlights |

|

China |

Leads electrolyzers capacity additions with 780 MW cumulative capacity (2023) and >9 GW at advanced development stages |

|

European Union |

Adopted two delegated acts (Feb 2023) defining renewable hydrogen; funding approved for four waves of IPCEI; launched two Hydrogen Bank auctions (EUR 1.9 bn / USD 2 bn) in 2024 |

|

India |

Launched National Green Hydrogen Mission (Jan 2023) targeting 5 Mt of renewable hydrogen by 2030. Includes SIGHT Programme to support electrolyser manufacturing & renewable H₂ production |

|

United Kingdom |

Issued Low-Carbon Hydrogen Standard (Jul 2022); opened consultation (Feb 2023) for hydrogen certification scheme; launched Electrolytic Allocation Rounds to support 1 GW cumulative capacity |

|

United States |

Approved USD 1.7 bn for six projects (Industrial Demonstration Programme); released final rules for IRA hydrogen tax credit |

|

Mauritania (Sub-Saharan Africa) |

Published Hydrogen Strategy (2023), joining South Africa, Kenya, Namibia, and ECOWAS as early movers in the region |

Source: IEA

Key Hydrogen Combustion Engine Market Insights Summary:

Regional Insights:

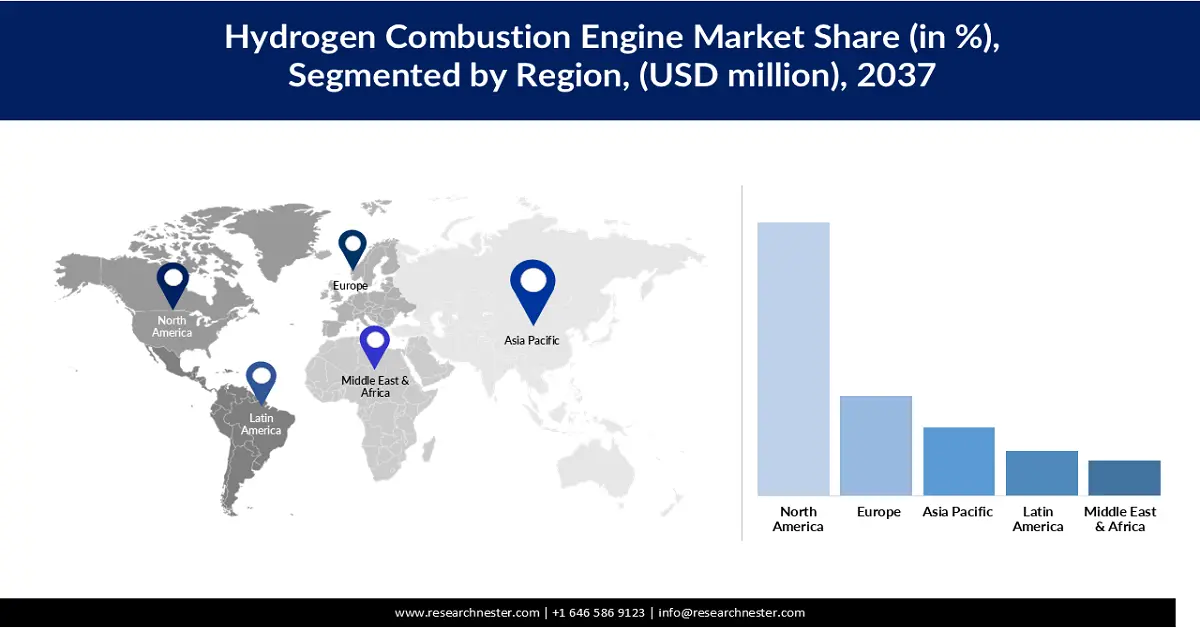

- North America is projected to hold a 48.7% share by 2037, owing to increasing hydrogen production advancements and strategic investments by leading companies.

- Europe is expected to expand at a CAGR of 14.2% by 2037, driven by continuous development in hydrogen production, storage, and automotive R&D.

Segment Insights:

- The Proton Membrane Exchange (PEM) segment is projected to account for 60.2% share by 2037, propelled by the emergence of proton membrane exchange fuel cells as a suitable technology for transportation applications.

- The hydrogen fuel cell engine segment is anticipated to hold a significant share by 2037, impelled by the advancement and rising adoption of fuel cell technology in the automotive industry.

Key Growth Trends:

- The promotion of cleaner transportation solutions

- Emerging environmental regulations

Major Challenges:

- Hydrogen embrittlement

- High cost of hydrogen sourcing

Key Players:Toyota Motor Corporation Yuchai International Imp & Exp Cummins Inc DEUTZ AG INNIO Group Mazda Honda Motor Co Stellantis N.V Ford Motors CNH Industrial N.V. MAN Trucks Rio Tinto BMW Group Komatsu Hyundai Motor.

Global Hydrogen Combustion Engine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.6 billion

- 2026 Market Size: USD 53.5 billion

- Projected Market Size: USD 155.8 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.7% Share by 2037)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Australia, Canada, France, Brazil

Last updated on : 5 September, 2025

Hydrogen Combustion Engine Market - Growth Drivers and Challenges

Growth Drivers

- The promotion of cleaner transportation solutions: Global intention to eliminate pollution caused by transportation so that climate pollution can be reduced and public health can be improved, is a key driver that fuels the growth of the hydrogen combustion engine market. The International Council on Clean Transportation organized a two-day conference in August 2024 in India, empowering governments and policymakers globally in the improvement of the environmental performance of marine, road, and air transportation to benefit public health. In the conference, the focus of discussion was on the imperative journey of countries towards decarbonization of businesses associated with the road transportation sector. The promotion of cleaner transportation boosts the demand for vehicles incorporated with hydrogen combustion engines.

- Emerging environmental regulations: Emerging environmental regulations that are focused on the reduction of carbon emissions and promotion of carbon-neutral transportation fuel the hydrogen combustion engine market growth significantly. In May 2024, the agreement on the revision of heavy-duty vehicles CO2 standards was supported by the European Union. The revision of the standards obligated trucks to reduce carbon emissions by 15% and 30% by the years 2025 and 2030, respectively. The push to be increasingly carbon-neutral is influencing truck owners to adopt hydrogen fuel as the latest alternative to fossil fuel. As a result, the demand for hydrogen combustion engines is expected to increase.

- The development of infrastructure for hydrogen refueling: The growth of the hydrogen combustion engine market is significantly boosted by the infrastructural development for hydrogen refueling, including the development of production systems for transportation, storage facilities, and stations for hydrogen refueling. One such example is the funding opportunity up to USD 1.2 billion as an award at GFO-23-307 Pre-Application Workshop, organized by the California Energy Commission, which was obtained by Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES) for the deployment of a hydrogen hub in California in November 2023. The development of the hydrogen refueling infrastructure increases the convenience of hydrogen combustion engines to be used in vehicles, which is likely to lead to increased adoption.

Challenges

- Hydrogen embrittlement: Hydrogen embrittlement emerges as a key area of challenge that the hydrogen combustion engine market must overcome to remain viable. The occurrence of hydrogen embrittlement weakens metal elements in the hydrogen-powered engines, which can lead to engine failures. Ductility and load-bearing capacity of hydrogen combustion engines deteriorate as soon as there is hydrogen embrittlement. This often leads to cracking and failure of the brittle. This raises concerns among potential consumers and reduces the adoption of hydrogen combustion engine-integrated vehicles.

- High cost of hydrogen sourcing: The high cost of hydrogen is a significant area of challenge to the growth of the hydrogen combustion engine market. The cost of hydrogen varies from country to country, depending on the extent to which the production plants are expanded and developed within the country. The demand for hydrogen also influences the production of the same. For example, in developing countries, with comparatively lower adoption of hydrogen vehicles, the demand for hydrogen is relatively low. This is likely to reduce the production and heighten the prices of hydrogen. The lack of affordability of hydrogen as an alternative to fossil fuels hinders the adoption of hydrogen combustion engines in vehicles.

Hydrogen Combustion Engine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2037 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 48.6 billion |

|

Forecast Year Market Size (2037) |

USD 155.8 billion |

|

Regional Scope |

|

Hydrogen Combustion Engine Market Segmentation:

Technology Segment Analysis

The Proton Membrane Exchange (PEM) segment is expected to account for the largest market share of 60.2% by the end of 2037, owing to the emergence of proton membrane exchange fuel cells as a suitable technology for transportation applications. The technology has high power density, better efficiency, fast start-up time, a user-friendly nature, and the ability to operate in low temperatures. Organizations are also investing in the development of the technology. One such example is the National Power Corporation’s (NTPC) announcement in June 2023, regarding the acquisition of Ohmium International, for the production of the PEM electrolyzer. The production of PEM electrolyzers increases the scope of increased green hydrogen production, which makes hydrogen combustion engines more convenient.

Type Segment Analysis

The hydrogen fuel cell engine segment is anticipated to acquire a significant market share by the end of 2037 due to the advancement of fuel cell technology. The rising adoption of hydrogen fuel cell engines in the automotive industry also boosts the growth of the hydrogen combustion engine. In February 2025, Toyota Motor Corporation announced the development of its new third-generation fuel cell system. The new fuel cell engine is more durable, cost-effective in terms of production, fuel-efficient, compatible with various commercial and general-purpose applications, including rail, generators, and ships, and passenger cars. The features of the innovation are effective enough to drive consumer demand for hydrogen combustion engine-enabled vehicles.

Application Segment Analysis

The passenger cars segment is expected to account for a remarkable share by the end of 2037, owing to the familiarity of hydrogen-powered vehicles among passengers. The availability of hydrogen-powered transportation facilities can influence passengers to adopt the same. Companies are also involved in the development of hydrogen-powered passenger cars. For instance, in April 2024, at the ChangeNow Summit organized in Paris, Renault unveiled Renault Emblème. It was the demo of the next-generation hydrogen-powered passenger car that reached a new decarbonization level. With the expansion of hydrogen-powered passenger cars, the demand for hydrogen combustion engines surges.

Our in-depth analysis of the hydrogen combustion engine market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Type |

|

|

Power Output |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Combustion Engine Market - Regional Analysis

North America Market Insights

The North America hydrogen combustion engine market is expected to acquire a market share of 48.7% by the end of 2037 due to increasing hydrogen production advancements. Companies in North America are involved in strategic investments for the production of hydrogen. For instance, in March 2025, ABB, a leading supplier of standard electrical and modular substances, announced its collaboration with Charbone Hydrogen for the establishment of up to 15 scalable and modular production plants of green hydrogen across North America.

The U.S. hydrogen combustion engine market is expected to expand at a CAGR of 14.0% during the forecast period, owing to stringent environmental regulations related to emissions. Regulators are also raising funds for the advancement of the hydrogen combustion engine. For instance, in February 2024, an investment of USD 10.5 million was announced by the U.S Department of Energy for the advancement of innovation in hydrogen combustion engines. Thus, regulations and investment in hydrogen combustion engines promote the use of hydrogen as a byproduct instead of fossil fuel in vehicles for environmental sustainability.

|

Name |

Location (City, State) |

Project Description |

|

PACCAR Inc. |

Mount Vernon, WA |

Development and demonstration of a heavy-duty hydrogen internal combustion engine |

|

Cummins Inc. |

Columbus, IN |

Development of a high-efficiency, low-emissions, heavy-duty hydrogen internal combustion engine |

|

Powertrain |

Plymouth, MI |

Development of a high-power, ultra-low emissions, heavy-duty hydrogen engine |

Source: U.S. DoE

The hydrogen combustion engine market in Canada is likely to acquire a CAGR of 16.4% during the forecast period, on account of government support and funding for the adoption of hydrogen-powered vehicles. The production of hydrogen fuel in Canada has also been on the rise for several years. As of October 2023, the government selected 10 projects related to hydrogen products to be funded with USD 300 million. The rising adoption of hydrogen-powered vehicles is expected to fuel the demand for hydrogen combustion engines.

Europe Market Insights

By 2037, Europe is expected to emerge as a consistently expanding hydrogen combustion engine market, expanding at a CAGR of 14.2% during the forecast period. Constant development of hydrogen production and storage fuels the market growth. Investment by the automotive industry in R&D on hydrogen combustion engine-enabled vehicles is also fueling the advancements of engine types. For instance, in May 2023, Ligier Automotive revealed its strategic partnership with Bosch for the development of Ligier JS2 RH2, a high-performance vehicle powered by a hydrogen engine. Overall, hydrogen combustion engines are becoming increasingly attractive as an alternative to fuel combustion engines among the population.

Germany hydrogen combustion engine market is anticipated to experience an expansion at a CAGR of 14.2% during the forecast period as a consequence of the adoption of climate change goals by the government. The Federal Ministry for Economic Affairs and Climate Action adopted the 2023 Climate Action Programme. Through such an initiative, measures for the reduction of GHG emissions across all sectors were prioritized. The demand for sustainable transportation is also rising constantly in Germany. This particular factor, along with climate change goals, increases the attractiveness of hydrogen combustion engines across the nation.

Following Germany, the UK is expected to emerge as an expanding hydrogen combustion engine market with a CAGR of 15.2% throughout the forecast period, owing to support from automotive engineering service providers in the development of hydrogen-powered vehicles. Automotive manufacturers are also involved in developing hydrogen vehicles. For example, in February 2023, First Hydrogen Corp unveiled the collaboration with EDAG Group in designing the second generation of light commercial vehicles. The development of hydrogen vehicles is evidence of the constant demand for hydrogen combustion engines.

Asia Pacific Market Insights

The Asia Pacific hydrogen combustion engine market is anticipated to grow rapidly by 2037, due to rapid advancements in hydrogen-powered vehicles. Companies are also consistently launching hydrogen-powered vehicles. In November 2023, Toyota Motor Corporation announced the launch of its newly developed Crown Sedan, an FCEV version of hydrogen-powered vehicles that emits zero carbon while in operation. In addition, government investments in expanding hydrogen plants and rising focus on developing advanced hydrogen combustion engines are expected to fuel market growth in the coming years.

China hydrogen combustion engine market is expected to expand exponentially during the forecast period as a consequence of China’s global position as the largest producer of hydrogen. The launch of novel combustion engines also boosts market growth. Automotive companies in China are also involved in the development of supporting infrastructure for vehicles integrated with the hydrogen combustion engine. For instance, in December 2021, China Yuchai International announced the launch of YCK05, China’s very first hydrogen engine and the potential candidate to be adopted widely in the commercial vehicle market.

India is anticipated to emerge as a growing market for hydrogen combustion engines, expanding at a remarkable CAGR, owing to rising pollution across the nation. As reported by the Society for Environmental Communications in March 2024, India ranked third among the most polluted countries globally in 2023. The use of hydrogen combustion engines as an alternative to petrol and diesel engines in vehicles is increasing due to rising pollution. Similarly, government initiative like the approval for the National Green Hydrogen Mission by the Union Cabinet in January 2023 is expected to fuel the adoption of hydrogen combustion engines.

Key Hydrogen Combustion Engine Market Players:

- Toyota Motor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Yuchai International Imp & Exp

- Cummins Inc

- DEUTZ AG

- INNIO Group

- Mazda

- Honda Motor Co

- Stellantis N.V

- Ford Motors

- CNH Industrial N.V.

- MAN Trucks

- Rio Tinto

- BMW Group

- Komatsu

- Hyundai Motor

The global hydrogen combustion engine market is highly competitive, comprising key players operating at global and regional levels. The majority of the key players are investing in research and development to make hydrogen combustion engines more advanced. Some of the competitors in the market are also putting efforts to contribute to increasing the production of hydrogen. The majority of the revenue share is acquired by large businesses, keeping the market fragmented, while the emergence of a vast number of relatively smaller players makes the market concentrated at the same time.

Below are some of the companies listed in the hydrogen combustion engine market:

Recent Developments

- In March 2025, Tata Motors started driving the green future of India by enhancing trials of the first hydrogen truck in the nation. The company has planned to drive 16 trucks across the key freight corridors of India.

- In March 2025, Cummins celebrated the completion of a project to deliver a 6.7-litre capacity enabled hydrogen internal combustion engine modelled as H2-ICE. The company carried out the project in collaboration with PHINIA, Johnson Matthey, and Zircotec.

- In February 2025, Komatsu started the world’s first proof-of-concept tests of the dump truck modeled as HD785, which is incorporated with a hydrogen combustion engine.

- In April 2024, MAN Trucks expanded its portfolio of zero-emission vehicles by announcing the launch of MAN hTGX, a small truck incorporated with a hydrogen combustion engine. The company planned to launch 200 vehicles for selected markets.

- Report ID: 7425

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Combustion Engine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.