Hydraulic Recloser Market Outlook:

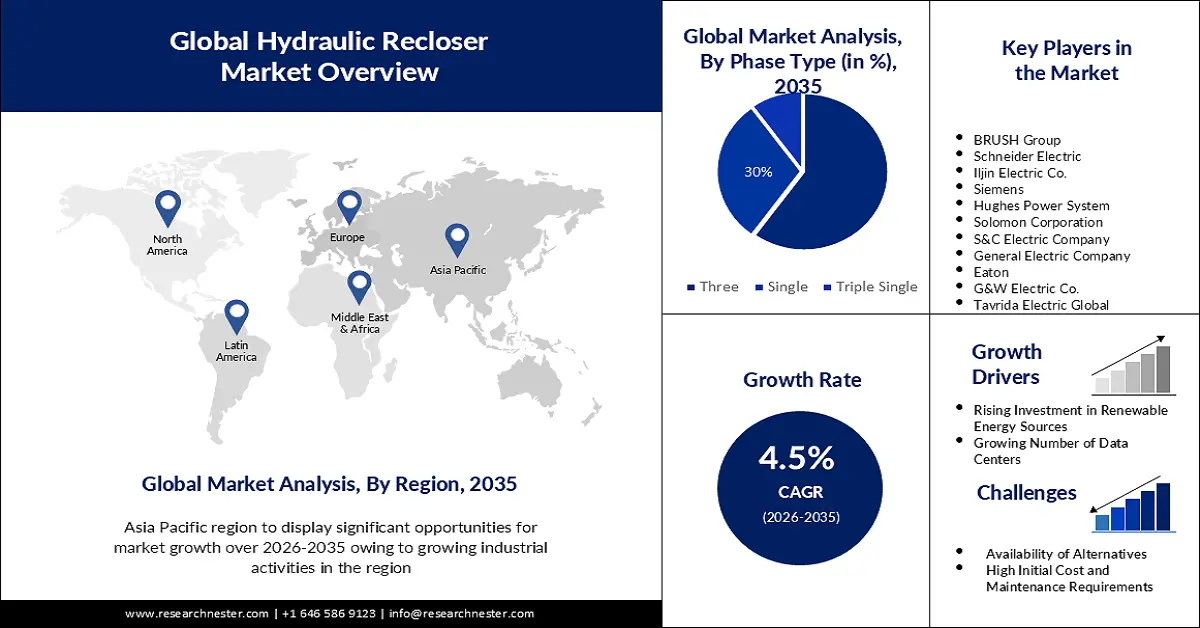

Hydraulic Recloser Market size was valued at USD 808.08 million in 2025 and is expected to reach USD 1.25 billion by 2035, expanding at around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulic recloser is evaluated at USD 840.81 million.

The reason behind the growth is due to the growing production of electricity across the globe. Over the past three decades, there has been a huge increase in the world's energy generation owing to factors such as increasing urbanization, and growth in the world's population and economy. For instance, in 2022, the world's power generation increased by more than 2%.

The growing need for smart grid technologies is believed to fuel the hydraulic recloser market growth. The smart grid relies heavily on hydraulic recloser controllers that provide sophisticated monitoring, and control features, of power distribution systems, and can control and observe the reclosers from a distance.

Key Hydraulic Recloser Market Insights Summary:

Regional Highlights:

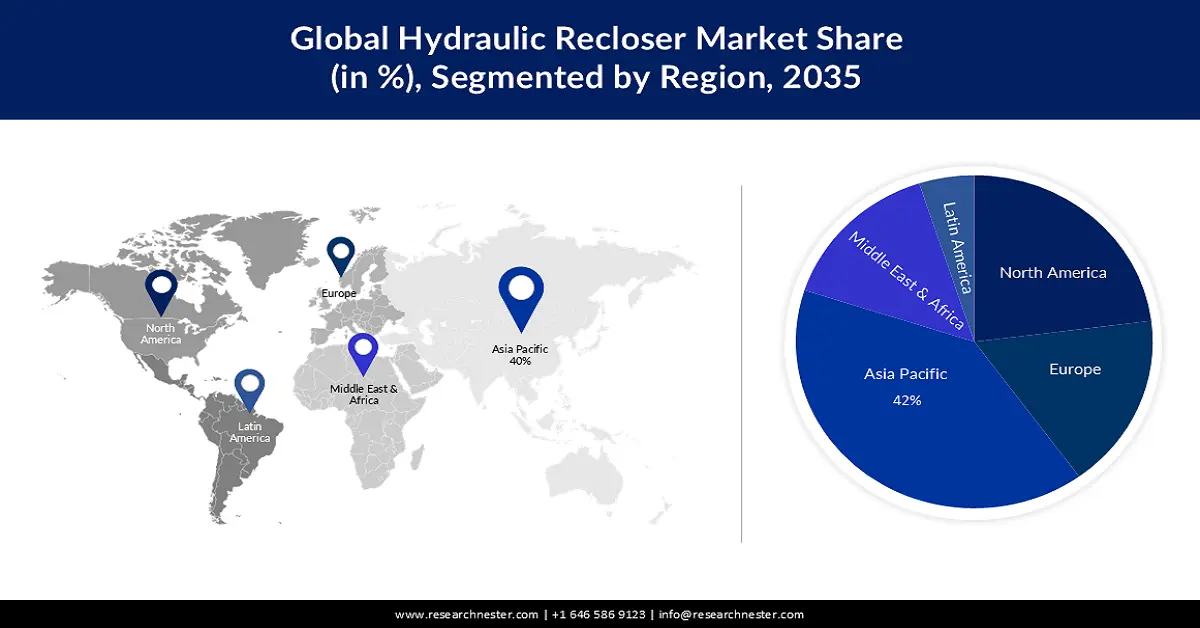

- Asia Pacific hydraulic recloser market is expected to capture 42% share, driven by growing industrial activities and infrastructure expansion in countries like India and China, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by the rising frequency of blackouts and investment in modernizing the U.S. power grid, forecast period 2026–2035.

Segment Insights:

- The three-phase segment in the hydraulic recloser market is projected to hold a 60% share by 2035, driven by its large power-carrying capacity, reliability, and cost-effectiveness in power distribution.

- The 16 kv–25 kv segment in the hydraulic recloser market is projected to hold a notable revenue share by 2035, influenced by enhanced fault detection, cost-effective medium-voltage solutions, and smart grid support.

Key Growth Trends:

- High initial cost and maintenance requirements which may limit its adoption

- Variation in raw material prices is expected to increase the overall cost of production

Major Challenges:

- Rising Investment in Renewable Energy Sources

- Growing Number of Data Centers

Key Players: BRUSH Group, Schneider Electric, Iljin Electric, Siemens, Hughes Power System, Solomon Corporation, S&C Electric Company, General Electric Company, Eaton, G&W Electric Co., Tavrida Electric Global, ABB Ltd..

Global Hydraulic Recloser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 808.08 million

- 2026 Market Size: USD 840.81 million

- Projected Market Size: USD 1.25 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Hydraulic Recloser Market Growth Drivers and Challenges:

Growth Drivers

- Rising Investment in Renewable Energy Sources - The process of integrating renewable energy sources into the electrical grid is known as renewable integration and maintains the safe and dependable functioning of distribution infrastructure under a variety of operating conditions, hydraulic reclosers offer crucial protection and control functions.

- Growing Number of Data Centers- The growth of big data is driving up the size and energy requirements of data centers, which necessitates the use of automatic circuit reclosers with hydraulic control to offer dependable and cost-effective overcurrent protection.

- Increasing Natural Disasters- Natural calamities have brought attention to how crucial grid resilience is therefore, recloser control devices let utilities detect and address electrical grid issues promptly, which enhances energy efficiency.

Challenges

- Availability of Alternatives- The presence of solid-state and vacuum reclosers may impact the adoption of hydraulic reclosers. A basic single-phase distribution system is used to deploy the recloser models, and have solid-state vacuum interrupters, which offer better dependability and performance. Customers may favor alternative recloser technologies owing to their benefits in terms of performance, dependability, and maintenance needs, and are frequently more compatible with smart grid infrastructures.

- High initial cost and maintenance requirements which may limit its adoption

- Variation in raw material prices is expected to increase the overall cost of production

Hydraulic Recloser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 808.08 million |

|

Forecast Year Market Size (2035) |

USD 1.25 billion |

|

Regional Scope |

|

Hydraulic Recloser Market Segmentation:

Phase Type Segment Analysis

The three-phase segment in the hydraulic recloser market is estimated to gain a robust revenue share of 60% in the coming years. To increase system reliability, three-phase circuits employ three-phase reclosers as they offer dependable, independent protection against overcurrents in distribution circuits, and as they also require little maintenance and are inexpensively available. One mechanism controls all three-phase reclosers which is a high-voltage automatic switch that is commonly used in household electric lines owing to its large power-carrying capacity and is also suitable for use in the transmission and distribution sectors of the power industry.

Owing to advantages including a higher power-to-weight ratio, three-phase reclosers are becoming more popular than single-phase ones, and are mostly being utilized by utilities to achieve single-pole tripping. Moreover, an essential part of electrical distribution networks, the three-phase hydraulic recloser guards power lines against malfunctions and interruptions to guarantee dependable energy distribution, and power monitoring, providing thorough protection and synchronization.

In addition, the single-phase hydraulic recloser is a type of phase-sensing device that is used in power plants, transmission lines, substations, and distribution lines and helps network operators by lowering operational expenses.

Voltage Segment Analysis

The 16 kV–25 KV segment in the hydraulic recloser market is set to garner a notable share shortly. The rising need for 16kV to 25kV hydraulic reclosers can be ascribed to their capacity to boost fault detection and localization, enable cost-effective solutions for medium-voltage distribution applications, support smart grid initiatives, and improve the safety, efficiency, and dependability of power distribution networks.

Our in-depth analysis of the global hydraulic recloser market includes the following segments:

|

Phase Type |

|

|

Voltage |

|

|

Interruption |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Recloser Market Regional Analysis:

APAC Market Insights

The hydraulic recloser market in the Asia Pacific is predicted to account for the largest share of 42% by 2035 impelled by the growing industrial activities. The manufacturing industry in India plays a significant role in the economic expansion of the nation and is one of the key factors influencing India's GDP (gross domestic product). For instance, in November 2023, India's industrial production grew by more than 2% compared to the same month the previous year.

In addition, China has expanded both localized and cross-regional infrastructure to a substantial degree during the past 30 years, making it the largest infrastructure market in the world, with a five-year strategy in place, the nation intends to keep spending heavily on transportation infrastructure. All these factors are expected to drive the market growth in the region.

North American Market Insights

The North America hydraulic recloser market is estimated to be the second largest, during the forecast timeframe led by the frequent blackouts. In the US, the frequency of blackouts is rising a result of which The U.S. Department of Energy (DOE) is working to develop the contemporary grid of the future which can deliver a massive boost to the U.S. economy, especially in rural areas. For instance, by 2030, the United States may need to invest over USD 1 trillion in grid upgrading.

Hydraulic Recloser Market Players:

- NOJA Power

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BRUSH Group

- Schneider Electric

- Iljin Electric Co.

- Siemens

- Hughes Power System

- Solomon Corporation

- S&C Electric Company

- General Electric Company

- Eaton

- G&W Electric Co.

- Tavrida Electric Global

- ABB Ltd.

- ENTEC Electric & Electronic

Recent Developments

- NOJA Power announced the introduction of a new controller for their OSM Recloser products, the RC-03 that aids in achieving cost optimizations by updating specifications several times, and enhances ease of use for operators while maintaining the strength and adaptability of the solution for SCADA and protection engineers.

- Iljin Electric Co. announced to provide high-voltage transformers to a prominent US energy company, and significantly increase production capacity, to produce transformers valued over 433 million by 2026. In addition to securing its crucial position in the changing US energy environment, Iljin Electric's winning proposal also fits with the larger industry trend of updating and improving power infrastructure.

- Report ID: 5677

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Recloser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.