Household Generators Market Outlook:

Household Generators Market size was over USD 4.1 billion in 2025 and is estimated to reach USD 7.4 billion by the end of 2035, expanding at a CAGR of 6.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of household generators is estimated at USD 4.3 billion.

The worldwide household generators market is presently witnessing an effective transformation, readily evolving from a niche product for emergency preparedness to a mainstream residential energy strategy component. The integration with renewable energy systems and the servitization and connectivity trend are increasingly uplifting the overall market globally. According to a data report published by the IEA Organization in 2025, the international renewable electricity generation is projected to increase to more than 17,000 terawatt-hours (TWh), denoting an increase by 90% from 2023. This is suitable enough to cater to the power demand of the U.S. and China by the end of 2030 through the adoption of different renewable types.

Renewable Electricity Generation by Technology (2025-2030)

|

Years/ Technology |

All Renewables |

Variable Renewables |

Hydropower |

Wind |

Solar PV |

Other Renewables |

|

2025 |

34.5% |

17.5% |

14.2% |

9.2% |

8.3% |

2.8% |

|

2026 |

36.7% |

19.8% |

14.1% |

9.9% |

9.8% |

2.9% |

|

2027 |

38.8% |

22.1% |

13.8% |

10.7% |

11.4% |

2.9% |

|

2028 |

41.0% |

24.5% |

13.6% |

11.6% |

12.9% |

2.9% |

|

2029 |

43.2% |

27.0% |

13.3% |

12.5% |

14.5% |

3.0% |

|

2030 |

45.6% |

29.5% |

13.1% |

13.4% |

16.1% |

3.0% |

Source: IEA Organization

Furthermore, the aspect of fuel diversification and flexibility, along with acoustic and aesthetic design as a differentiator, is also bolstering the household generators market demand globally. For instance, as per an article published by the PIB Government in November 2024, the Asia Development Bank (ADB) has highlighted that there has been an 85% reduction in fossil fuel subsidies in India, and with a strong net-zero target set to be achieved by 2070, the country has reimagined its strategy for energy. As a result, this approach effectively adjusted tax rates and retail prices to USD 3.5 billion as of 2023, a reduction from a peak of USD 25 billion in 2013. Therefore, such a strategy is extremely suitable for fueling the market’s demand in different nations.

Key Household Generators Market Insights Summary:

Regional Highlights:

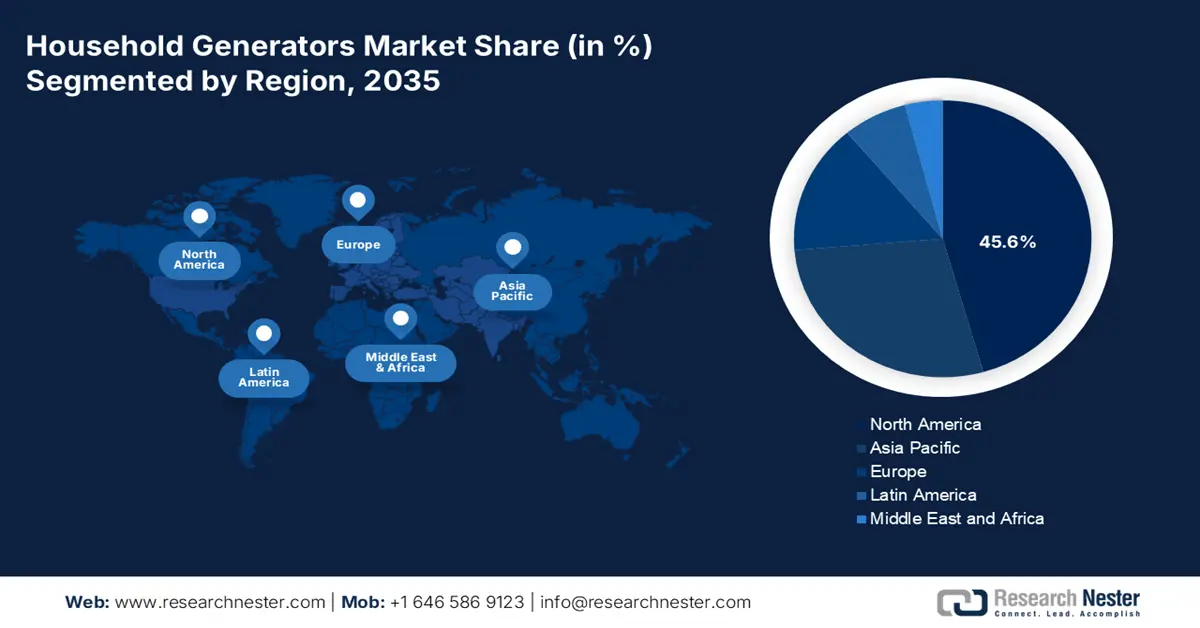

- North America in the Household generators market is anticipated to command a 45.6% share by 2035, owing to escalating climate-driven outage severity, an aging grid, and rising household dependence on continuous power for telecommuting.

- Europe is projected to be the fastest-growing region by 2035, stimulated by heightened energy-security priorities following geopolitical tensions and increasing grid instability from renewable intermittency.

Segment Insights:

- The backup power (essential loads) segment in the household generators market is projected to secure a 60.8% share by 2035, supported by households’ inclination toward economical, essential-only backup solutions that safeguard critical systems.

- The automatic generators segment is expected to hold the second-largest share by 2035, underpinned by growing demand for seamless outage protection that maintains operational continuity and household comfort.

Key Growth Trends:

- Rise in telecommuting economy

- Increase in home-based medical equipment

Major Challenges:

- Increased ownership expense and consumer financing obstacle

- Intense competition from alternative technologies

Key Players: Generac Power Systems, Inc. (U.S.), Honda Motor Co., Ltd. (Japan), Briggs & Stratton LLC (U.S.), Kohler Co. (U.S.), Cummins Inc. (U.S.), Champion Power Equipment (U.S.), Yamaha Motor Co., Ltd. (Japan), Eaton Corporation plc (Ireland), Siemens AG (Germany), Techtronic Industries Co. Ltd. (TTI) (Hong Kong), Generac Holdings Inc. (U.S.), Mitsubishi Heavy Industries, Ltd. (Japan), Winco (Wincor Nixdorf) (U.S.), Powermate (U.S.), Pramac (Italy), A-iPower (U.S.), Firman Power Equipment (U.S.), DuroMax Power Equipment (U.S.), Hyundai Power Products (South Korea), Mahindra Powerol (India)

Global Household Generators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 7.4 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Turkey, Mexico

Last updated on : 4 November, 2025

Household Generators Market - Growth Drivers and Challenges

Growth Drivers

- Rise in telecommuting economy: The permanent transition to hybrid and remote work models has deliberately altered the cost-benefit analysis of power outages, which is driving the household generators market globally. According to a data report published by the U.S. Bureau of Labor Statistics in October 2024, 6.5% of workers in the private business field operated from home during the COVID-19 pandemic. Besides, waste management and administrative services comprised 16.8% of its workers operating remotely, 12.4% workers in durable manufacturing, 15.7% in wholesale trade, and 8.8% in warehousing and transportation.

- Increase in home-based medical equipment: There has been an upsurge in the number of households relying on electrically powered medical devices, owing to the aspect of decentralized healthcare. As per an article published by Results in Engineering in September 2025, the population proportion aged more than 60 years has almost reached 18.7%, increasing the rare diseases incidence globally. In this regard, China’s population accounts for 17.95 of the overall population, and deaths caused by chronic disorders account for 25.9%. Therefore, this denotes a huge demand for remote and electrical medical devices for continuous monitoring, which is positively impacting the market’s development.

- Professionalization and supply chain consolidation: The installation and sales channel for generators, especially standby units, is rapidly maturing, based on which the household generators market is continuously growing internationally. The majority of manufacturers are also strengthening their partnerships with electrical contractors and HVAC, with the intention of embedding generator sales into the natural cycle of system upgrades and home improvement. Therefore, this professional channel has developed customer trust and has simplified the purchase procedure, thus denoting market acceleration.

Challenges

- Increased ownership expense and consumer financing obstacle: The gap to purchase expands beyond the increased upfront expense of the unit itself, which is negatively impacting the household generators market. For standby generators, the aspect of professional installation can require increased cost, while continuous expenses include potential major repairs, routine maintenance, and fuel. Besides, in an environment of economic uncertainty and high interest rates, securing financing for such a discretionary and significant purchase has become challenging for the majority of customers.

- Intense competition from alternative technologies: The household generators market is experiencing a long-lasting threat from the cost reduction and rapid advancement of competing technologies. In this regard, residential energy storage systems are frequently paired with solar, which provides zero-emission and silent backup power. Their appeal is boosted by falling battery expenses as well as governmental incentives. However, the microgrid development, along with community-based resilient solutions, can diminish the demand for individual household generators in specific areas.

Household Generators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.4 billion |

|

Regional Scope |

|

Household Generators Market Segmentation:

Application Segment Analysis

Based on the application, the backup power (essential loads) segment in the household generators market is anticipated to garner the largest share of 60.8% by the end of 2035. The segment’s upliftment is highly propelled by the aspect of a cost-conscious and strategic approach to home backup power. Besides, majority of consumers readily prioritize powering a severe system to ensure safety, maintain basic comfort, and overcome property damage, rather than making any investments for a whole-house system. This comprises charging for communication devices, selecting lighting, furnace blowers, well pumps, and refrigerators, which is readily fueling the segment’s exposure.

Technology Segment Analysis

Based on the technology, the automatic generators segment in the household generators market is expected to account for the second-largest share during the projected period. The segment’s growth is highly driven by the provision of crucial backup power during outages, business continuity, and ensuring suitable comfort and safety. According to an article published by the NPR Organization in January 2022, Generic Power Systems witnessed a 50% jump in its revenue, with USD 3.7 billion in revenue sales. Therefore, this denotes an increase in the sales of home-based generators, which is positively impacting the overall segment.

Sales Channel Segment Analysis

Based on the sales channel, the professional dealers and installers segment in the household generators market is predicted to account for the third-largest share by the end of the forecast timeline. The segment’s development is effectively fueled by the critical importance of safety, expertise, and trust in the overall purchasing process, especially for standby generators. This is not considered a simple DIY product, but constitutes a severe electrical work, compliance with stringent local building and safety codes, as well as fuel line connections. Besides, consumers depend on certified professionals to successfully ensure the appropriate size, safe integration, and long-lasting reliability.

Our in-depth analysis of the household generators market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Technology |

|

|

Sales Channel |

|

|

Price Category |

|

|

Fuel Type |

|

|

Power Rating |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Household Generators Market - Regional Analysis

North America Market Insights

North America in the household generators market is anticipated to garner the highest share of 45.6% by the end of 2035. The market’s growth in the market is highly attributed to an increase in the frequency, climate-based power outage severity, the aging grid infrastructure, and dependence of modernized households on ongoing power for telecommuting. According to an article published by the U.S. Department of Energy in July 2025, the power outage risk has been projected to increase by 100 times by 2030. In addition, yearly outage hours can grow from single digits to over 800 hours annually. Besides, the aspect of federal funding programs to create a suitable electricity system is also uplifting the market’s demand in the region.

Federal Funding Programs in North America Boosting the Household Generators Market (2025)

|

Program Name |

Purpose |

Federal Agency/Grant Type |

Amount Allocated |

|

Powering Affordable Clean Energy Program |

To make energy clean, cost-effective, and dependable to the rural population of the region. |

USDA, Loan |

USD 1 billion (Maximum USD 100 million loan and minimum USD 1 million loan) |

|

Empowering Rural America Program |

To invest in projects to assist the rural population in shifting to clean energy |

USDA, Grant, Loan |

USD 9.7 billion |

|

Zero-Emission Nuclear Power Production Credit (45U) |

To credit the produced electricity at a qualified nuclear power infrastructure |

Treasury, Production Tax Credit |

0.3 cents per kWh bonus |

|

The Advanced Nuclear Production Tax Credit (45J) |

To credit the produced electricity at a qualified nuclear power infrastructure |

Treasury, Production Tax Credit |

1.8 cents per kWh |

|

Clean Electricity Investment Tax Credit (48E) |

To offer a technology-neutral tax credit for investment in infrastructure that generates clean electricity |

Treasury, Investment, Tax Credit |

6% of qualified investment bonus |

|

Long Duration Energy Storage Demonstration Initiative and Joint Program |

To develop an approach for demonstration projects, focused on creating long-lasting energy storage technologies |

DOE, Grant, Cooperative Agreement |

USD 150,000,000 |

Source: U.S. CATF

The household generators market in the U.S. is growing significantly, owing to the government’s influence on the chemical sector by focusing on advanced manufacturing, environmental sustainability, and research and development. As per an article published by the EPA Government in February 2025, the Climate Pollution Reduction Grants (CPRG) program has successfully provided almost USD 5.0 billion in grants to territories, tribes, local governments, and states to implement robust plants for diminishing harmful air pollution and greenhouse gas emissions. This program is authorized under Section 60114 of the Inflation Reduction Act, offering USD 250 million for noncompetitive planning grants and USD 4.6 billion for competitive implementation grants.

The household generators market in Canada is also growing due to an escalation in frequency and extreme weather incidents, governmental incentives for adopting green technology and ensuring energy resilience, and the expansion of electrification pressures and natural gas infrastructure. As stated in the October 2025 Government of Canada article, the Oil to Heat Pump Affordability Program provides USD 10,000 to cover expenses for shifting from an oil heating system to a suitable heat pump. It also grants almost USD 25,000 for eligible homeowners to be a part of territories and provinces, where the program is being initiated. Finally, an additional USD 250 as a one-time incentive is readily eligible for homeowners, thereby making it suitable for the market’s growth.

Europe Market Insights

Europe in the household generators market is projected to emerge as the fastest-growing region during the predicted period. The market’s exposure in the region is highly driven by a rise in the energy security emphasis post-Ukraine invasion, as well as extreme weather and energy transition. In addition, the region’s grid is currently undergoing effective stress due to the intermittent renewables integration, resulting in supply-demand imbalances and local frequency fluctuations. Besides, as per an article published by the EIB Organization in December 2024, the Europe Investment Bank has provided €22.5 million non-dilutive financing to Chromafora to contribute to the region’s fight against harmful pollutants.

The household generators market in Germany is gaining increased traction, owing to the aspect of coal-based plants and the phase-out of nuclear power facilities, developing intermittent strain on the regional grid, an increase in the demand for quality engineering, government-based investments, and a surge in frequency for critical weather possibilities. For instance, as per a data report published by the Europe Commission in May 2023, there has been an increase in gross wages, resulting in EUR 12 per hour as of October 2022. Moreover, there has also been a surge in unit labor expenses by 5.9%, which is positively impacting the market’s upliftment in the country.

The household generators market in France is also uplifting due to the presence of the Electricity Sobriety mandate and nuclear fleet reliability issues, acute vulnerability to climate modifications, the provision of support through energy sovereignty focus, and increased demand for generators by the agriculture and rural sector. According to the October 2025 World Nuclear Association article, the country derives almost 70% of its electricity from nuclear energy, owing to a long-term policy for energy security. In addition, governmental reforms have aimed to diminish nuclear electricity generation's share to 50% by the end of 2025, thus bolstering the market’s demand.

APAC Market Insights

Asia Pacific in the household generators market is predicted to grow steadily by the end of the forecast duration. The market’s development in the region is highly driven by rare electricity deficits, a rise in disposable income, and rapid urbanization. Additionally, the aspect of the low-cost and high-volume portable diesel and gasoline generator segment is readily dominating the region, based on which the market is continuously growing. Moreover, there has been a surge in the inverter generator across different countries in the region, which is effectively fueled by suitable backup for high-value electronics and the demand for comfort and convenience by the middle-class population.

The household generators market in China is gaining increased exposure, owing to the presence of its huge population, largest manufacturing base for generators, and an increase in the internal demand from both urban and rural locations. According to an article published by the IEA Organization in 2025, the country accounts for 40% of international renewable capacity extension, which is propelled by enhanced competitiveness of both onshore wind and solar PV, low curtailment rates, and optimized system integration. Besides, the country caters to 60.9% of coal and coal-based products, 18.3% of oil-based products, and 3.2% of biofuels and waste, thereby suitable for the increased market demand.

The household generators market in India is also developing due to the critical combination of a huge population, rise in climate vulnerability, and persistent electricity deficits. In addition, the India Meteorological Department (IMD) has reported a significant rise in the intensity and frequency of cyclones and heatwaves, causing long-lasting and prolonged grid damage. For instance, as stated in the August 2025 India Waterportal Organization article, the country’s 7,500-kilometer coastline appears to be an ongoing stretch of brown and blue, resulting in increased climatic changes, rising sea levels, and an increase in cyclonic storms, all of which are readily driving the market’s need in the country.

Key Household Generators Market Players:

- Generac Power Systems, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honda Motor Co., Ltd. (Japan)

- Briggs & Stratton LLC (U.S.)

- Kohler Co. (U.S.)

- Cummins Inc. (U.S.)

- Champion Power Equipment (U.S.)

- Yamaha Motor Co., Ltd. (Japan)

- Eaton Corporation plc (Ireland)

- Siemens AG (Germany)

- Techtronic Industries Co. Ltd. (TTI) (Hong Kong)

- Generac Holdings Inc. (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Winco (Wincor Nixdorf) (U.S.)

- Powermate (U.S.)

- Pramac (Italy)

- A-iPower (U.S.)

- Firman Power Equipment (U.S.)

- DuroMax Power Equipment (U.S.)

- Hyundai Power Products (South Korea)

- Mahindra Powerol (India)

- Generac Power Systems, Inc. is regarded as the undisputed market leader, particularly in the North America-based standby generator segment, which is credited with developing a mass economy for residential automatic backup power. As per its 2024 annual report, the company’s net sales increased to USD 4.3 billion as of 2024, denoting a 7.0% increase in comparison to USD 4.0 billion in 2023.

- Honda Motor Co., Ltd. is regarded as the global firm for setting the industrial benchmark for reliable, quiet, and fuel-efficient portable inverter generators. Its ultimate engineering technology and unwavering focus on quality have made it a premium and trusted brand among consumers.

- Briggs & Stratton LLC is regarded as the historic powerhouse in small-engine manufacturing, offering the actual power source for a massive portion of the value-specific portable generator market. The organization’s significant contribution remains in its extended distribution and its crucial role as a notable engine supplier to other equipment manufacturers.

- Kohler Co. readily competes at the high-end of the standby generator sector, deliberately emphasizing premium engineering, strong performance for whole-home backup, and exceptional reliability. The organization has leveraged its robust brand reputation in power and plumbing to cater to loyal customers. According to its 2024 annual report, the organization has generated USD 1.6 billion in sales, denoting a 2.0% increase from 2023.

- Cummins Inc. has brought its international expertise in heavy-duty diesel as well as natural gas power systems to the residential economy, providing powerful and highly durable standby generators. The firm is considered a notable player in offering robust solutions for critical applications and large homes, frequently implementing innovative transfer switch technology.

Here is a list of key players operating in the global market:

The international household generators market is highly fragmented and characterized by the dominance of Japan and U.S.-based organizations, with severe competition across different product tiers. Generac is leading the standby segment in North America, while Honda is well-known worldwide for its portable inverter generators. Meanwhile, notable approaches, such as diversification in technology, with leaders, including Cummins and Kohler, have integrated IoT and smart-enabled features for remote monitoring. For instance, in April 2024, Cummins Power Generation unveiled two newest generator models, including C2750D6E and C3000D6EB, which are powered by Cummins Inc.’s robust QSK78 engine, which is contributing to the market’s growth.

Corporate Landscape of the Household Generators Market:

Recent Developments

- In January 2025, Generac Holdings, Inc. declared its latest home-based standby generator design, which comprises the latest 28kW model, regarded as the most powerful air-cooled home standby, readily available in the market.

- In April 2024, Panasonic Corporation notified its Electric Works Company will launch the newest pure hydrogen fuel cell generator that will effectively generate power through a chemical reaction between oxygen and high-purity hydrogen in the air.

- In November 2023, Hitachi Energy introduced the HyFlex demonstration unit at its Hydrogen Power Generator in Gothenburg, Sweden, which is an emission-free alternative to diesel-based generators.

- Report ID: 8207

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Household Generators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.