Histoplasmosis Treatment Market Outlook:

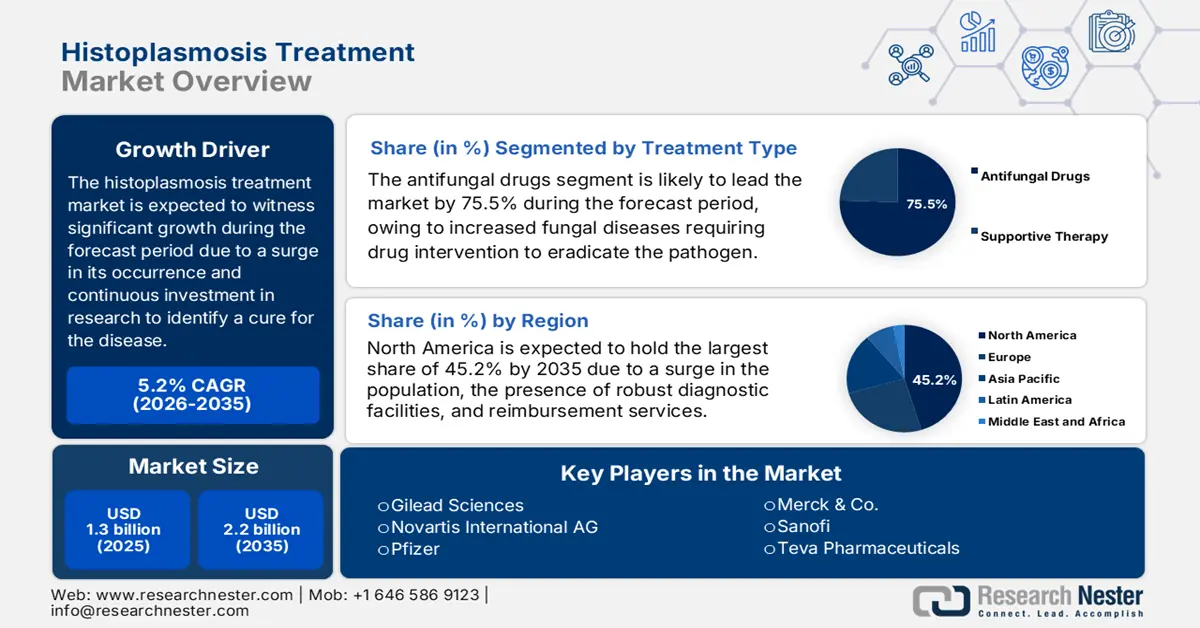

Histoplasmosis Treatment Market size was valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by the end of 2035, increasing at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of histoplasmosis treatment is estimated at USD 1.4 billion.

The international patient pool in the market is recorded between 1 to 2 cases per 100,000 yearly population, the death cases are registered at around 5%, and higher rates are seen in the adult population, based on the CDC report in April 2024. According to the NLM report in April 2023, 90% proportion of critical disseminated histoplasmosis cases occur mainly among immunocompromised patients, which includes people with AIDS and post-transplant conditions, often representing the vast majority. Besides, the supply chain facility in the market heavily depends on active pharmaceutical ingredients (APIs), which are sourced from India, catering to international antifungal API manufacturing, thus suitable for uplifting the market globally.

Investments in research, development, and deployment of new therapeutics are mainly driven by public and non-profit organizations due to the orphan disease nature of disseminated histoplasmosis. The NIH has funded clinical research in fungal infections, while the Global Action Fund for Fungal Infections has enhanced diagnostic and treatment availability in low-resource environments. According to the NLM article in June 2025, the U.S. government continues to face substantial costs from fungal diseases estimated at more than USD 13.4 billion in direct medical expenditure and USD 6 billion in indirect expenses, suggesting an ongoing necessity for investment in prevention, diagnosis, and treatment.

Key Histoplasmosis Treatment Market Insights Summary:

Regional Highlights:

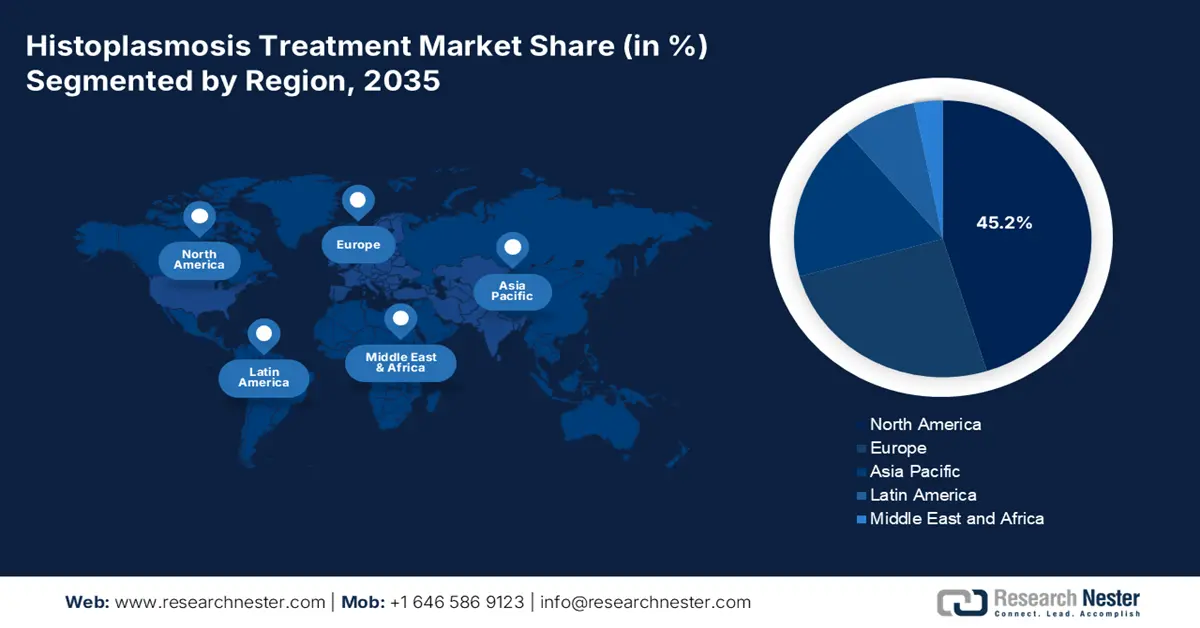

- North America is projected to lead the histoplasmosis treatment market with a 45.2% share by 2035, owing to a growing immunocompromised population and well-established diagnostic infrastructure.

- Europe is expected to maintain a substantial share by 2035, driven by increasing HIV prevalence and robust healthcare procurement and reimbursement systems.

Segment Insights:

- The antifungal drugs segment is projected to hold 75.5% share by 2035 in the histoplasmosis treatment market, propelled by clinical guideline recommendations and the necessity for systemic drug intervention.

- The itraconazole segment is expected to dominate the drug class category by 2035, driven by its broad-spectrum efficacy, safety profile, and convenience as an oral therapy.

Key Growth Trends:

- Cost-effective developments and health enhancement

- Current trends in government and personal expenditure

Major Challenges:

- Diagnostic underusage among endemic nations

- Vulnerabilities in API-based supply chain

Key Players: Pfizer, Merck & Co. (MSD), Johnson & Johnson (Janssen), Gilead Sciences, Viatris (ex-Mylan), Novartis / Sandoz, GlaxoSmithKline (GSK), Sanofi, Bayer, Fresenius Kabi, Teva Pharmaceuticals, Cipla, Sun Pharmaceutical, Aurobindo Pharma, Mayne Pharma

Global Histoplasmosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 2.2 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Canada, Japan

- Emerging Countries: India, China, South Korea, Malaysia, Thailand

Last updated on : 17 September, 2025

Histoplasmosis Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Cost-effective developments and health enhancement: The increased demand for improvement in healthcare quality is effectively impacting the histoplasmosis treatment market adoption. According to a 2022 economic burden analysis by the CDC (published by NLM in March), fungal diseases, including histoplasmosis, cause significant hospitalizations and outpatient visits, with an average loss of 13.4 workdays per histoplasmosis hospitalization, highlighting the impact of timely diagnosis and treatment on reducing morbidity and costs. This is evidently relevant for immunocompromised populations, wherein a delay in diagnosis results in poor outcomes. Besides, hospitals are integrating rapid antigen testing and have successfully achieved a reduction in misdiagnosis rates, thus suitable for the market’s growth.

- Current trends in government and personal expenditure: Antifungal treatment expenditure under Medicaid has grown consistently, with total spending on superficial fungal infections (SFIs) medications rising from USD 121.9 million in 2009 to approximately USD 155 million in 2023. Invasive fungal infection (IFI) medication spending peaked at USD 156.8 million in 2022 before moderating to USD 80.7 million in 2023, reflecting shifts in usage and drug prices. On the other hand, government spending is increasing due to rising fungal disease cases and immunocompromised populations. These trends highlight the expanding opportunity in the histoplasmosis treatment market’s growth.

- Increased immunocompromised patient populations: The leading driver behind the demand for histoplasmosis treatment is the increasing size of immunocompromised populations at risk for disseminated disease. This encompasses patients with advanced HIV/AIDS, organ transplant recipients taking immunosuppressants, and those taking biologic treatments for autoimmune diseases. For instance, the NLM June 2025 study stated that 78% of the symptomatic histoplasmosis cases had affected immunocompromised individuals, mostly those with HIV, indicating higher susceptibility and severity among them. This trend necessitates broader drug availability and diagnostic capabilities in both developed and emerging healthcare systems.

Total Direct and Indirect Costs in Histoplasmosis Treatment

|

Direct medical costs of hospitalizations |

||||

|

Medicaid (USD) |

Medicare (USD) |

Private insurance (USD) |

Other (USD) |

Total (USD) |

|

21,721,750 |

63,591,040 |

170,905,688 |

15,214,156 |

271,432,634 |

|

Direct medical costs of outpatient visits |

||||

|

4,509,114 |

3,821,820 |

17,641,149 |

2,589,526 |

28,561,608 |

|

Indirect costs due to productivity loss |

||||

|

Total direct medical costs (USD) |

From workdays lost due to hospitalizations (USD) |

From workdays lost due to outpatient visits (USD) |

From premature deaths (USD) |

Total economic burden (USD) |

|

299,994,242 |

22,080,742 |

49,253,393 |

132,505,839 |

503,834,216 |

Source: NLM, June 2025

Challenges

- Diagnostic underusage among endemic nations: Despite suggestions from the WHO, primary care facilities across histoplasmosis-based areas have access to antigen evaluation, which has caused a hindrance in the histoplasmosis treatment market. Besides, the 2023 CDC Morbidity Report has demonstrated that the registered cases in the U.S. are frequently misdiagnosed, which tends to delay the treatment procedure by nearly a month. Besides, the disease prevalence has increased to in Brazil, and only public hospitals are able to perform confirmatory testing, thereby creating a gap in the market’s upliftment.

- Vulnerabilities in API-based supply chain: The histoplasmosis treatment market is experiencing supply constraints for API, with international antifungal APIs stemming from only manufacturers in India. As per an article published by the FDA in 2023, import alerts on major suppliers have resulted in a half-year shortage of amphotericin B, especially in the U.S., which has pressured rationing in hospitals. This issue effectively compounds in developing nations, based on which the PAHO reported that Latin America has witnessed stockouts of itraconazole as of 2023, owing to delays in India’s export compliance, thus negatively impacting the overall market.

Histoplasmosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 2.2 billion |

|

Regional Scope |

|

Histoplasmosis Treatment Market Segmentation:

Treatment Type Segment Analysis

Under the treatment type category, the antifungal drugs category is dominating the segment and is expected to hold 75.5% of the share value by 2035. This dominance is because invasive fungal diseases necessitate drug intervention that the body to eradicate the pathogen. Clinical practice guidelines from leading organizations exclusively prescribe systemic antifungals, e.g., azoles and amphotericin B, for all types of progressive histoplasmosis, highlighting this segment's key role in treatment regimens and its resultant market dominance.

Drug Class Segment Analysis

In the drug class segment, itraconazole has the highest share based on its wide spectrum, safety profile, and clinical guideline recommendations for mild to moderate histoplasmosis. Oral itraconazole's convenience over intravenous drugs is the driving force behind its extensive use for both treatment and maintenance phases of therapy. The NLM report in June 2024 indicates that 75% of the respondents are treated with itraconazole according to both IDSA and European Confederation of Medical Mycology guidelines. Continuous formula developments that improve bioavailability and tolerability further strengthen growth.

Mode of Administration Segment Analysis

Based on the route of administration, the oral segment in the histoplasmosis treatment market is expected to garner the highest share during the forecast period, which is attributed to efficiencies in the healthcare system, along with clinical benefits. Oral azoles are regarded as first-line therapy, with the treatment duration of 6 to 12 weeks for treatment success rates in mild-to-moderate incidences, while diminishing hospitalization demands in comparison to IV alternative options, based on the IDSA article released in March 2025. This administrative method has benefited from low treatment expenses in generic markets, as well as coordination in simplified care provision.

Our in-depth analysis of the histoplasmosis treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Drug Class |

|

|

Mode of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Histoplasmosis Treatment Market - Regional Analysis

North America Market Insights

North America in the histoplasmosis treatment market is projected to be the dominating region, with an expected share of 45.2% by the end of 2035. The U.S. is readily driving the majority of the regional demand, which is attributed to an increase in the immunocompromised population and the existence of strong diagnostic infrastructure. The NLM report in March 2022 states that the fungal infection burden in the U.S. was estimated to be USD 11.5 billion. Meanwhile, Canada is deliberately contributing to the market’s upliftment in the region through universal healthcare, with funding programs available in Ontario.

The histoplasmosis treatment market in the U.S. is significantly growing, owing to an upsurge in immunocompromised populations, accounting for almost 1.2 million HIV patients, based on the HIV government report in February 2025. Besides, the CDC article in April 2024 has successfully stated that people around 60% to 90% are exposed to Histoplasma in their lifetime. Meanwhile, Gilead and Pfizer are the leading companies in the antifungal and histoplasmosis markets, and have leveraged orphan drug exclusivity for innovative therapies, thus suitable for the market development in the country.

The histoplasmosis treatment market in Canada is also growing, and is driven by a rise in endemic cases, along with the presence of universal healthcare coverage. The existence of the Fungal Disease Program in Ontario has effectively allocated funding for generic itraconazole subsidies and rapid testing. Besides, the private and public partnership between Janssen and Alberta Health has augmented diagnostic turnaround, which is another driver for boosting the market’s exposure in the country. Further, climate modifications are also increasing across endemic zones, which is expected to contribute to the growth in cases.

APAC Market Insights

Asia Pacific in the histoplasmosis treatment market is predicted to be the fastest-growing region, with an expected to hold a considerable share during the forecast timeline. The market’s upliftment in the country is propelled by an extension in administrative healthcare, enhanced diagnostics, and a rise in immunocompromised populations. This is further fueled by the generic drug dominance, as well as the HIV burden, catering to 6.7 million patients in APAC, according the UNAIDS in 2024. India is effectively dominating the region, owing to funding provision through government programs, while China is close behind, with an increase in expenditure for antifungals. South Korea and Malaysia are also displaying rapid growth, which is backed by travel-based cases and universal health and medical reforms.

The histoplasmosis treatment market in India is gaining increased traction and is predicted to capture a significant regional revenue by the end of 2035. The segment’s growth in the country is highly uplifted by a surge in the disease burden, accounting for 2.5 million cases every year, along with low-cost generic dominance, based on the PIC report in September 2024. Besides, the 2024 the total healthcare budget allocated is Rs. 90,659 with significant allocations to health research, disease control, and essential drug accessibility, as per the PRS Legislative Research report in August 2024. Meanwhile, Cipla and Mylan are collectively controlling the market through the provision of price-competitive generics, which is boosting the market demand.

The histoplasmosis treatment market in China is also growing, and will hold a considerable share by the end of the forecast period, which is highly driven by the rising yearly cases and hospital procurement reforms. In addition, nearly 225 cases are registered till 2022 with a median age of 39.2 years. Besides, urban hospitals in the country and presently deploying PCR evaluation, which has diminished misdiagnosis rates, thus suitable for uplifting and enhancing the market demand.

Europe Market Insights

Europe in the histoplasmosis treatment market is expected to emerge, with a considerable share during the projected timeline. The market in the region is highly propelled by an increase in HIV patients, and centralized health and medical procurement systems. Germany is dominating the market in the region, which is followed by France, and collectively constitutes the largest region’s revenue, owing to a high diagnostic rate and suitable reimbursement policies. Besides, the region’s 2023 Health Emergency Framework has generously allocated funding for stockpiling and conducting antifungal R&D.

The histoplasmosis treatment market in Germany is rising actively and is expected to dominate the region by the end of 2035. Germany is the largest market for pharmaceuticals in Europe, with €59.8 billion in revenue in 2023, as per GTAI report in 2025. Its market size for antifungals is substantial due to its strong healthcare infrastructure and rapid adoption of innovative medicines. Spending on antifungal medications is integrated into the diagnosis-related group system for hospital care and statutory health insurance (SHI) reimbursements for outpatient care. The Federal Joint Committee is the central body determining which treatments are reimbursed by the SHI system.

The histoplasmosis treatment market in France is also steadily increasing. According to the Frontiers report in June 2024, France has registered 19.3% histoplasmosis cases. Additionally, the market is supported by its system of universal coverage. The French National Authority for Health (HAS) assesses the medical benefit and improvement in medical benefit of new drugs, which directly influences pricing and reimbursement decisions. Growth is also associated with the launch of innovative antifungal treatments, guaranteeing patient access under public financing.

Key Histoplasmosis Treatment Market Players:

- Pfizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co. (MSD)

- Johnson & Johnson (Janssen)

- Gilead Sciences

- Viatris (ex-Mylan)

- Novartis / Sandoz

- GlaxoSmithKline (GSK)

- Sanofi

- Bayer

- Fresenius Kabi

- Teva Pharmaceuticals

- Cipla

- Sun Pharmaceutical

- Aurobindo Pharma

- Mayne Pharma

The histoplasmosis treatment market is effectively oligopolistic and united, with the presence of notable key players, including Gilead, Novartis, and Pfizer, collectively dominating the overall market with the international revenue through supported therapies. Besides, generic players, such as Teva, Cipla, and Mulan, are also dominating emerging nations with low-cost itraconazole. Meanwhile, accessibility programs, administrative approvals, along with suitable partnerships and collaborations, are a few strategic approaches that these organizations have implemented to uplift the market internationally. For instance, in 2023, Astella achieved the PDMA clearance for its isavuconazole, particularly in Japan, and captured most of the local share, thus suitable for the histoplasmosis treatment market.

Here is a list of key players operating in the global market:

Recent Developments

· In June 2024, Biocon received FDA approval for Micafungin, which is used as an antifungal medication to treat fungal or yeast infections. Micafungin is available in 50mg and 100mg.

- Report ID: 3651

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Histoplasmosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.