High Voltage Battery Market Outlook:

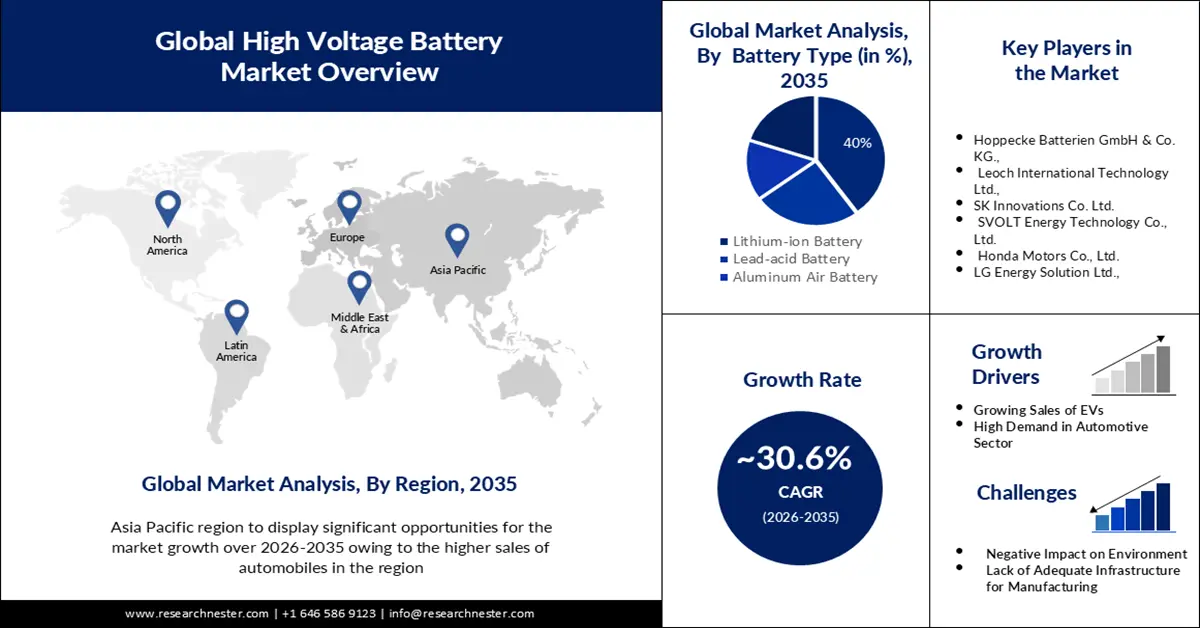

High Voltage Battery Market size was valued at USD 74.69 billion in 2025 and is expected to reach USD 1.08 trillion by 2035, registering around 30.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high voltage battery is evaluated at USD 95.26 billion.

Market growth is believed to be due to the growing need to reduce pollution and CO2 emissions. Electric vehicles emit almost no exhaust gas from the exhaust pipe, making a significant contribution to reducing greenhouse gas emissions. Road transport accounts for about 75% of global CO2 emissions, and in recent years Asian economies have contributed to the emissions. Approximately 795 million tons of CO2 are emitted by Asian countries, out of which India produces approximately 291 million tons.

Other factors that are expected to boost the growth of the high voltage battery market include aggressive government initiatives for smart city development. Clean energy sources such as batteries play an important role in this regard. During the COVID-19 pandemic, approximately 45% of government agencies worldwide were unprepared for the unprecedented challenges they encountered during the pandemic. This has prompted governments to upgrade their traditional infrastructure and launch and further develop smart city plans. Smart cities enable facilities that can efficiently address these challenges.

Key High Voltage Battery Market Insights Summary:

Regional Highlights:

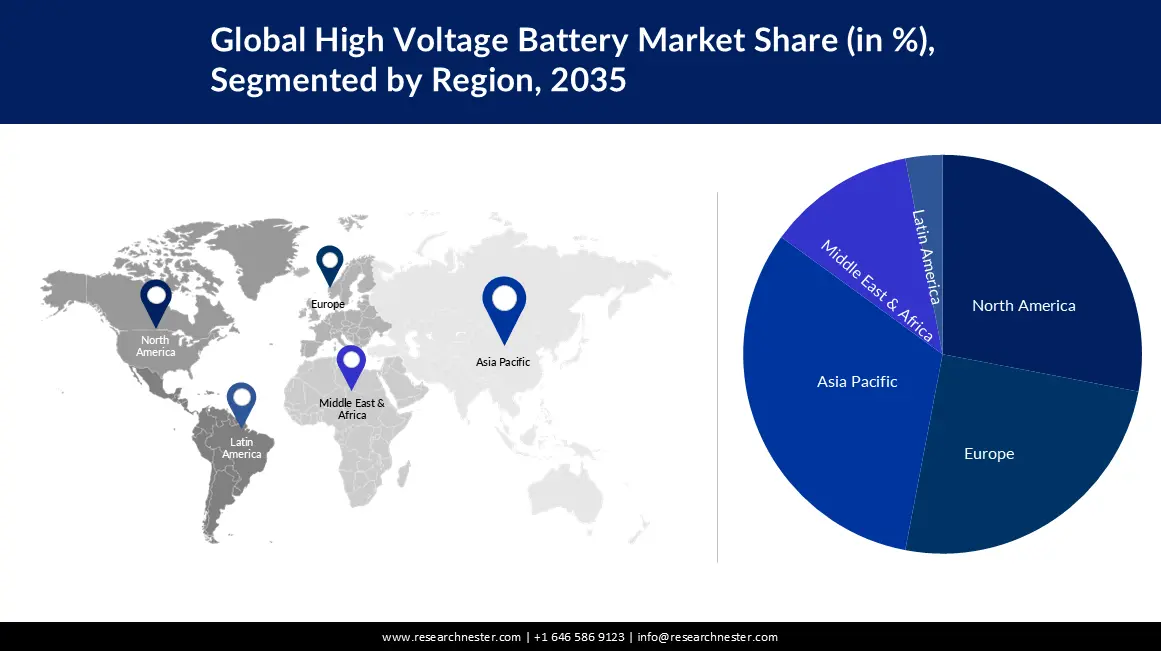

- Asia Pacific high voltage battery market will dominate more than 50% share by 2035, driven mainly due to the increase in automobile sales and high investments in renewable energy projects.

- North America market will achieve a substantial CAGR during 2026-2035, driven by increased investment in battery manufacturing and expansion plans for electric vehicle battery plants.

Segment Insights:

- The lithium-ion battery segment in the high voltage battery market is anticipated to secure a 40% share by 2035, attributed to increased investments in battery production and rising global demand.

- The passenger cars segment in the high voltage battery market is expected to capture the largest share by 2035, fueled by the growing popularity of electric vehicles and rising car demand.

Key Growth Trends:

- Growing Demand in the Automotive Industry

- Increased Sales of Electric Vehicles Battery

Major Challenges:

- Negative Impact on Environment

- Lack of adequate facilities for the manufacturing

Key Players: The Lion Electric Company, Celgard, LLC, Exide Industries Ltd., Hoppecke Batterien GmbH & Co. KG., Leoch International Technology Ltd., SK Innovations Co. Ltd., SVOLT Energy Technology Co., Ltd., Honda Motors Co., Ltd., LG Energy Solution Ltd., Contemporary Amperex Technology Co. Limited.

Global High Voltage Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.69 billion

- 2026 Market Size: USD 95.26 billion

- Projected Market Size: USD 1.08 trillion by 2035

- Growth Forecasts: 30.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

High Voltage Battery Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand in the Automotive Industry – Batteries are an important part of the automotive industry. It is a power supply device that assists in starting the vehicle. Despite supply chain issues and rising prices, global SUV sales also increased, growing by about 3% from 2021 to 2022. By 2022, SUVs will account for about 46% of new car sales worldwide.

- Increased Sales of Electric Vehicles Battery – All-electric vehicles, plug-in hybrid electric vehicles (PHEW), and hybrid electric vehicles require an energy storage device (usually a battery). Batteries serve as an alternative to diesel and gasoline and are responsible for the entire purpose of the car. New model launches, rising oil prices, and targeted regulatory support drove electric vehicle sales up in all high voltage battery market. Global sales of electric vehicles will increase by nearly 60% in 2022 from 6.6 million in 2021, surpassing 10 million for the first time.

- Reducing Battery Cost – In the past few times, there has been a decline in the price of batteries primarily driven by advancements in technology, economies of scale, and increased manufacturing efficiency. These declining costs have made electric vehicles more affordable for consumers and have boosted the demand for high-voltage batteries worldwide.

Challenges

-

Negative Impact on Environment – The raw material which is required for the production of batteries, such as lead, cobalt, and others are rare earth minerals. These are extracted through the process of mining which adversely impacts the surrounding the area of mine. However, the production of batteries requires huge amounts of water, as the production of 1 ton of lithium requires nearly 2 million tons of water. Furthermore, even the aftermath of using batteries is not environmentally sustainable. Battery corrosion releases chemicals that contaminate groundwater and surface water as well as soil. When contaminated by battery chemicals, our ecosystem which supports thousands of aquatic plants and animals is put at risk.

- Lack of adequate facilities for the manufacturing

- Shortage of charging stations for battery-operated vehicles.

High Voltage Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

30.6% |

|

Base Year Market Size (2025) |

USD 74.69 billion |

|

Forecast Year Market Size (2035) |

USD 1.08 trillion |

|

Regional Scope |

|

High Voltage Battery Market Segmentation:

Battery Type Segment Analysis

The lithium-ion battery is poised to dominate the global high voltage battery market by reaching a share of 40% by the end of 2035. Growth in this sector is due to the increased investment in the production of lithium-ion batteries. The expanding lithium-ion battery capacity globally is expected to be financed by various investments, which he expects to exceed USD 620 billion over the next 21 years. The funding is intended to cover different areas of battery production including supply chain, material extraction, and refining. Additionally, the increasing demand for lithium-ion batteries contributed significantly to the segment growth in the market. Global demand for this battery is expected to increase by about 11-fold between 2020 and 2030, and its capacity is expected to reach more than 2 terawatt hours.

Application Segment Analysis

The passenger car segment in the high voltage battery market is expected to observe the largest share till 2035. Growing demand for passenger cars is expected to drive the growth of this segment. Indian passenger car sales increased by more than 8% in December 2022. About 280,000 passenger cars were shipped from factories to dealers during the same period, up from nearly 25,000 last year. In addition, the growing popularity of electric vehicles has increased the demand for electric passenger vehicles. As per the analysis, the global sales of electric passenger vehicles will increase by 13% in 2023.

Our in-depth analysis of the global high voltage battery market includes the following segments:

|

Voltage Capacity |

|

|

Battery Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Voltage Battery Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 50% by 2035. The growth of the market is driven mainly due to the increase in automobile sales in the region. Total vehicle sales in China, including passenger cars, trucks, and buses, were approximately 27 million units. Sales of sedans and minivans will increase, reaching 24 million units in 2022. Furthermore, the Asia Pacific region is experiencing high investments in renewable energy projects such as solar and wind power. Thus, high-voltage batteries play a vital role in storing excess energy generated from these renewable sources and offer a stable power supply as well.

North American Market Insights

The North America high voltage battery market is estimated to gain a substantial market share in the projection timeframe. The market growth is mainly due to increased investment in battery manufacturing. The U.S. battery-manufacturing investment plans have skyrocketed since President Biden signed a bill that would give a big boost to electric vehicles and renewable energy. For instance, in order to meet growing demand from automakers looking to ramp up production of electric cars and trucks, a South Korean battery maker said it would triple its investment plans for a new plant in Arizona. In addition, LG Energy announced that it will invest nearly USD 5 billion to build a new plant in the United States to start producing batteries for electric vehicles in 2025.

High Voltage Battery Market Players:

- The Lion Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Celgard, LLC

- Exide Industries Ltd.

- Hoppecke Batterien GmbH & Co. KG.

- Leoch International Technology Ltd.

- SK Innovations Co. Ltd.

- SVOLT Energy Technology Co., Ltd.

- Honda Motors Co., Ltd.

- LG Energy Solution Ltd.

- Contemporary Amperex Technology Co. Limited

Recent Developments

- The Lion Electric & Company announced the completion of its first pack of lithium-Ion batteries at the facility located in Mirabel, Quebec. The Lion5 truck and the LionAmbulance, which are anticipated to enter commercial production in the first half of 2023, will be powered by the first batteries made in Mirabel.

- Celgard LLC announced the strategic collaboration with C4V to progress the creation of high-performance, high voltage battery cells of the next generation. The company also aims at development of separator solution for the lithium-ion battery market

- Report ID: 4779

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Voltage Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.