High Dynamic Range Market Outlook:

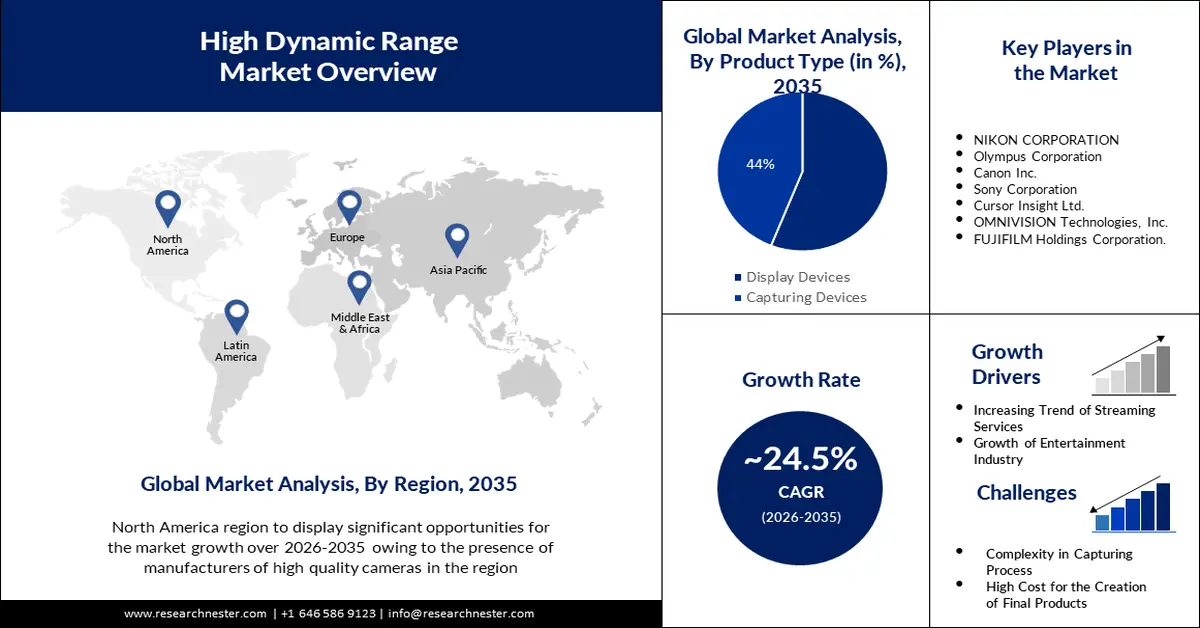

High Dynamic Range Market size was over USD 43.06 billion in 2025 and is poised to exceed USD 385.27 billion by 2035, witnessing over 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high dynamic range is estimated at USD 52.55 billion.

The growth of the market can be attributed to the increase in the number of smartphone users across the globe. Furthermore, the high dynamic range in smartphones helps to capture the pictures without causing the image sensors to suffer from any kind of overexposure. Therefore, it is anticipated to surge the growth of the market in the upcoming years. As per the reported data, there will be more than 7.5 billion smartphone users across the globe by the end of 2027.

High dynamic range is used in photography, videography, and any display system to represent the same range of luminance experienced by the human visual system. This method combines images of the same subject taken at various exposures. Furthermore, HDR makes bright parts of the image appear much brighter, giving the image more depth. High dynamic range photos capture multiple images with varying exposures at the same time in a rapid sequence using varying exposure values. The final image is made by combining the photos into a single image. High dynamic range videos are captured in the same way that high dynamic range photos are, with the exception that each scene is recorded with different exposures or international organizations.

Key High Dynamic Range Market Insights Summary:

Regional Highlights:

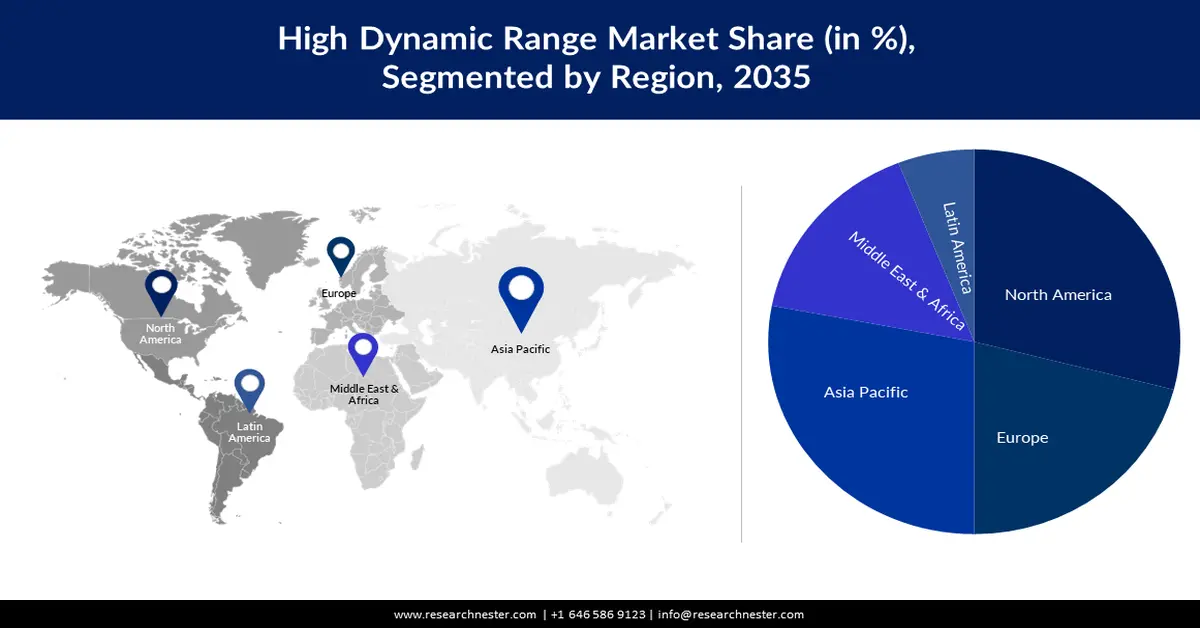

- The North America high dynamic range market is forecasted to hold a 29% share by 2035, attributed to the presence of high-quality camera manufacturers and rising adoption of advanced technologies.

- The Asia Pacific market is anticipated to experience the fastest growth from 2026 to 2035, driven by increasing demand for smart TVs, gaming, entertainment, and HDR-capable devices.

Segment Insights:

- The display devices segment in the high dynamic range market is projected to capture a 56% share by 2035, driven by rising adoption of HDR solutions for laptops, projectors, and smart televisions.

- The entertainment segment in the high dynamic range market is expected to hold a 29% share by 2035, driven by increasing use of HDR in movies, games, and home entertainment with smart homes surge.

Key Growth Trends:

- Growing Potential for Digital Photography

- Rising Demand for Television

Major Challenges:

- Complexity in Capturing Process

- High Cost for the Creation of Final Products

Key Players: OMNIVISION Technologies, Inc., Canon Inc., Cursor Insight Ltd., Apple Inc., Sony Corporation, LG Display, Samsung Electronics, FUJIFILM Holdings Corporation, Olympus Corporation, NIKON CORPORATION.

Global High Dynamic Range Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.06 billion

- 2026 Market Size: USD 52.55 billion

- Projected Market Size: USD 385.27 billion by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

High Dynamic Range Market Growth Drivers and Challenges:

Growth Drivers

- Growing Potential for Digital Photography– A large number of people are moving towards a professional photography career. The traditional photographer’s technologies have been replaced by digital technologies owing to the rising competitors in this particular sector. Moreover, career courses related to the same have been taken by many people, which is giving a boost to the digital photography industry. In addition to the career option the digital photography is used as a part time job in the form of fashion, wildlife, and wedding photography. Thus, it is projected to increase the growth of the market. There are more than 20,000 digital photographers employed in the United States currently, according to the recent reports.

- Rising Demand for Television – There has been a surge in the demand for television across the globe, which increases the demand for content delivery services. Moreover, different movies, shows, and games are displayed to the people through television with high quality Hence, this factor is expected to surge the growth of the global high dynamic range market over the forecast period. More than 650 million homes across the globe owned a smart TV by the end of 2020, as per the estimated.

- Increasing Trend of Streaming Services– As per the reported data, more than one billion people subscribed to streaming services in the year 2021. Streaming services let people watch movies, TV shows, and listen to podcast without the need to download them. Therefore, the growing trend of streaming services is increasing the demand for high dynamic range TVs and it is estimated to drive the market’s growth.

- Growing Use of High Dynamic Range Video Camera– HDR makes the pictures look better, and films very high contrast scenes. It is about recreating image realism from the camera through post production to display. Owing to these factors, manufacturers are launching new video cameras with high dynamic range, and it is projected to rise the growth of the market. Moreover, CCTV cameras with HDR are ideal for surveillance systems, they help in making deep investigations, and it is further anticipated to drive the market’s growth. According to the reports, as of 2021, more than 50 percent of the world’s cameras are located in China, accounting to nearly 500 million CCTV cameras.

- Growth of the Entertainment Industry – Generally, the HDR is a future of digital entertainment, as it flows from the start to the finish. Furthermore, the production house in the entertainment industry is opting for high dynamic range, leaving behind SDR devices, as it provided for brighter highlights, and deeper details. Moreover, the HRD helps to expand the contrast and range in a game that makes it more ideal for games by making experience more immersive for players. Therefore, it is projected to surge the growth of the global high dynamic range industry by the end of 2035. The number of gamers is expected to reach more than 3 Billion by the end of 2024 around the world.

Challenges

- Complexity in Capturing Process

- Requirement for Lot of Storage Space and Instruments- There is a requirement of lot of storage space in devices for the high dynamic range photographs. Moreover, the extra instruments are also needed to capture images such as bracketing provisions, and tripod. Therefore, it is expected to restrain the growth of the market in the upcoming years.

- High Cost for the Creation of Final Products

High Dynamic Range Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 43.06 billion |

|

Forecast Year Market Size (2035) |

USD 385.27 billion |

|

Regional Scope |

|

High Dynamic Range Market Segmentation:

Application Segment Analysis

The global industry is segmented and analyzed for demand and supply by application into gaming, video streaming, entertainment, and others. Out of the three types of application, the entertainment segment is estimated to gain the largest market share of about 29% in the year 2035. The growth of the segment can be attributed to the increasing use of high dynamic range for movies, games, web series, and others. Furthermore, it improves the overall quality of the movies as compared to the older movies that are in SDR. In addition, the HDR is widely used in home entertainment, as people watch movies at home, along with the surge in smart homes. As per the data provided, nearly 54 percent of the adults in the United States preferred to watch movies at home in the year 2022.

Product Type Segment Analysis

The global high dynamic range market is also segmented and analyzed for demand and supply by product type into display, and capturing devices. Amongst these three segments, the display devices segment is expected to garner a significant share of around 56% in the year 2035. This can be attributed to the rising adoption of high dynamic range solutions for various applications such as laptops, devices, projectors, and others. Moreover, the sale of smart televisions is also increasing the demand for high dynamic range This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Type |

|

|

By Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Dynamic Range Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 29% by 2035. The growth of the market can be attributed majorly to the presence of manufacturers of high-quality cameras in the region. Moreover, there has been a surge in demand for advanced products, and technologies in countries such as the United States, that is further expected to boost the growth of the market in the region. In addition, the increasing research and development initiatives in the region, are also projected to contribute to the growth of the market in the region. More than 55 percent of the United States consumers are estimated to adopt smart home technology by the end of 2025.

APAC Market Insights

The Asia Pacific market is estimated to register the fastest growth by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for smart TVs by the end users in the emerging countries such as Japan and China. Furthermore, the upsurge demand for high dynamic range products from entertainment, gaming, and media industries. In addition, the smartphones, and cameras increasing demand and production are another factor that are increasing the demand for HDR. Thus, all these factors are predicted to rise the market’s growth in the region.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035. The growth of the market can be attributed majorly to the presence of high dynamic range solution providers in the region. Moreover, the increasing tourism in the countries such as Italy, France, and others are also contributing to the demand for photographers with professional cameras. Therefore, it is anticipated to drive the growth of the high dynamic range market in the region.

High Dynamic Range Market Players:

- OMNIVISION Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Inc.

- Cursor Insight Ltd.

- Apple Inc.

- Sony Corporation

- LG Display

- Samsung Electronics

- FUJIFILM Holdings Corporation

- Olympus Corporation

- NIKON CORPORATION

Recent Developments

- FUJIFILM Holdings Corporation announced the launch of FUJIFILM SX1600 in order to join a lineup of SX series of lens-integrated long-range cameras.

- Apple Inc., announced the launch of next generation of Apple TV 4K with a high frame rate HDR, connecting the customers to their content with the highest quality.

- Report ID: 4894

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Dynamic Range Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.