High-density Polyethylene Market Outlook:

High-density Polyethylene Market size was over USD 60.1 billion in 2025 and is estimated to reach USD 96.4 billion by the end of 2035, expanding at a CAGR of 5.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of high-density polyethylene is evaluated at USD 63.3 billion.

The worldwide high-density polyethylene (HDPE) market is presently growing, with current trends emphasizing advanced manufacturing, recycling, and sustainability. Meanwhile, the aspect of regulatory support for circular economy strategies, infrastructure expansion, and packaging demand is also fueling the market’s exposure. According to official statistics published by the Department of Energy in January 2025, emerging energy technologies demonstrate approximately USD 130 trillion economic opportunity. Therefore, to realize this potential advantage, the U.S. needs to create robust and more secure domestic supply chain systems for manufacturing processes and materials. Besides, as per the October 2022 NLM article, just 2% of plastic packaging materials are deliberately recycled as packaging materials internationally. Besides, 30% of plastic -based packaging items are either too small or too complex for recycling, but despite this, packaging materials continue to be in huge demand.

Furthermore, the increased focus on recycling and sustainability, a shift toward advanced manufacturing, packaging dominance, along with the growth of construction and infrastructure are other factors driving the high-density polyethylene (HDPE) market globally. As per an article published by the Journal of Environmental Management in December 2023, 8.6% of the municipal solid waste plastic is recycled, and 75.9% are landfilled. Besides, the overall plastic production has been 311 million tons, which is projected to triple by the end of 2050. Moreover, as of 2023, the landfill disposal of collected household waste, especially in the U.S., was worth USD 177, and meanwhile adopting a recycling system has increased the handling expense to USD 218, thereby making it suitable for bolstering the market globally.

Key High-density Polyethylene (HDPE) Market Insights Summary:

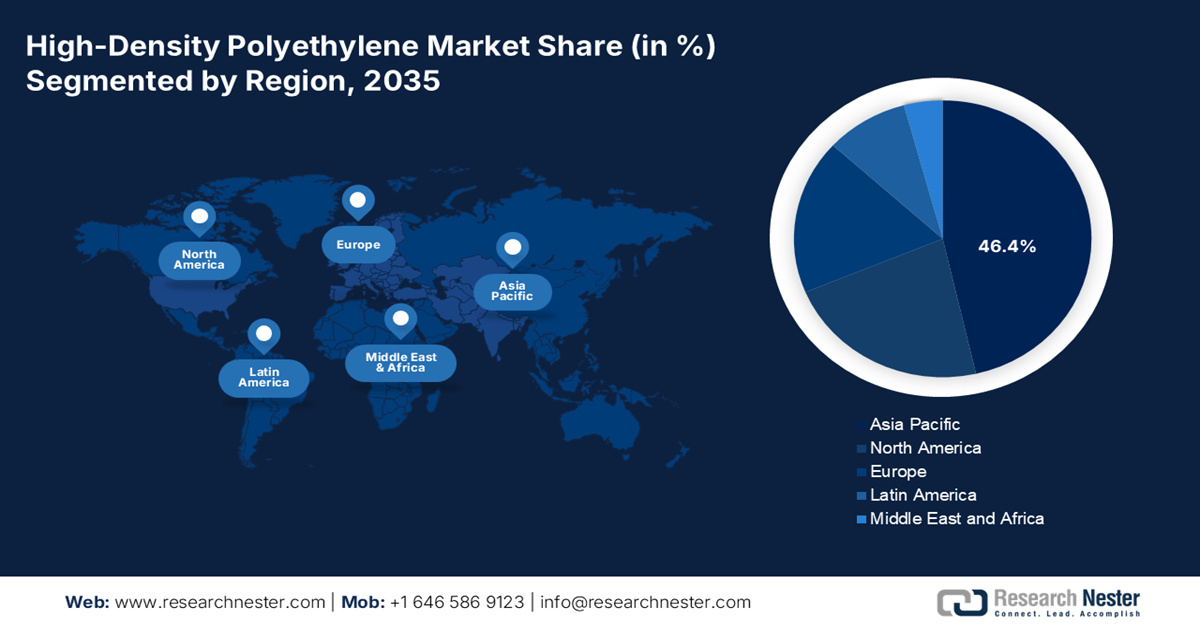

Regional Insights:

- Asia Pacific is forecast to capture a leading 46.4% share by 2035 in the high-density polyethylene market, underpinned by expanding infrastructure investments, government-backed chemical industry initiatives, and rising adoption of recyclable plastics.

- Europe is projected to register the fastest growth by 2035, stimulated by stringent chemical safety norms, automotive lightweighting demand, public spending, and advancements in sustainable chemical technologies.

Segment Insights:

- Film and Sheet Sub-segment is projected to command a dominant 38.8% share by 2035 in the high-density polyethylene market, supported by accelerating demand for lightweight, durable, and recyclable packaging formats across e-commerce, retail, and agriculture.

- Slurry Process Segment is expected to secure the second-largest share by 2035, strengthened by its cost-efficient scalability and ability to produce high–molecular weight HDPE with superior mechanical performance for pipes, films, and containers.

Key Growth Trends:

- Increase in automotive light weighting

- Surge in infrastructure expansion

Major Challenges:

- Environmental regulations and recycling mandates

- Feedstock price volatility

Key Players:ExxonMobil Chemical Company, Dow Inc., Chevron Phillips Chemical Company LLC, LyondellBasell Industries N.V., SABIC – Saudi Basic Industries Corporation, Borealis AG, INEOS Group Holdings S.A., Reliance Industries Limited, Formosa Plastics Corporation, China Petroleum & Chemical Corporation – Sinopec, PetroChina Company Limited, TotalEnergies SE, Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd., Hanwha Solutions Corporation, LG Chem Ltd., PTT Global Chemical Public Company Limited, Westlake Chemical Corporation, Qenos Pty Ltd., Petronas Chemicals Group Berhad.

Global High-density Polyethylene (HDPE) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.1 billion

- 2026 Market Size: USD 63.3 billion

- Projected Market Size: USD 96.4 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Mexico

Last updated on : 20 January, 2026

High-density Polyethylene Market - Growth Drivers and Challenges

Growth Drivers

- Increase in automotive light weighting: The high-density polyethylene (HDPE) market is increasingly focused on utilizing components and fuel tanks to diminish vehicle weight and optimize efficiency. According to official statistics published by Alexandria Engineering Journal in April 2025, Europe has set a target to diminish carbon dioxide emissions from new cars by 37.5% by the end of 2030. Likewise, the U.S. Corporate Average Fuel Economy (CAFÉ) standards have mandated a fleet-wide average of 54.5 miles per gallon. Besides, the weight of battery packs in electric vehicles tends to account for almost 30% of the overall vehicle weight. This has readily necessitated strong lightweight in other components, thus making it suitable for boosting the market’s exposure globally.

- Surge in infrastructure expansion: The presence of large-scale sewage and water projects in North America and the Asia Pacific is readily driving the high-density polyethylene market’s demand. As per an article published by Invest India Government in February 2024, the government in India initiated a commitment through its generous allocation of 3.3% of gross domestic product (GDP) to the infrastructure industry as of 2024, with special focus on logistics and transport industries. Additionally, the government has also set targets for the transport sector by developing a 2 lakh-km national highway network in 2025, and successfully expanding airports to 220 in number. Moreover, governmental plans also include operating waterways by the end of 2030 and creating 35 multi-modal logistics parks. Therefore, the overall budget outlay for infrastructure-based ministries boosted from nearly INR 3.7 Lakh Crore in 2023 to INR 5 Lakh Crore in 2024.

- Rise in packaged food consumption: The rise in packaged food, beverage, and consumer goods is readily uplifting the high-density polyethylene (HDPE) market internationally. As stated in an article published by the India Council for Research on International Economic Relations in August 2023, the ultra-processed food sector in India grew by 13.3% in terms of retail sales valuation. In addition, the sector is expected to be 39% by the end of 2032, which is rapidly proliferating the market’s exposure. Besides, nearly 80% of the production, along with more than 70% of sales, are initiated through independent small grocers or the unorganized industry. Therefore, with a continuous upsurge in processed food, there is a huge demand in the market.

Challenges

- Environmental regulations and recycling mandates: The high-density polyethylene (HDPE) market faces mounting pressure from stringent environmental regulations across the U.S., Europe, and the Asia Pacific. Governments are enforcing bans on single-use plastics and mandating higher recycling rates, which directly impacts HDPE demand in packaging. For instance, the European Chemicals Agency (ECHA) requires compliance with strict chemical safety and recycling standards, while the U.S. Environmental Protection Agency (EPA) promotes sustainable materials management programs. These policies increase compliance costs for manufacturers, who must invest in advanced recycling technologies such as chemical depolymerization and mechanical reprocessing, thus causing a hindrance in the market’s expansion.

- Feedstock price volatility: The high-density polyethylene market’s production is heavily dependent on petrochemical feedstocks such as naphtha and natural gas, making the industry vulnerable to fluctuations in global oil and gas prices. Volatility in crude oil markets, driven by geopolitical tensions, OPEC-based production decisions, and supply chain disruptions, directly impacts HDPE manufacturing costs. For instance, during the 2022 energy crisis, Europe-based petrochemical producers faced soaring feedstock prices, reducing competitiveness against Middle Eastern and U.S. producers with cheaper shale gas. The U.S. Department of Energy (DOE) highlights that feedstock volatility can erode margins and discourage long-term investment in HDPE capacity. Additionally, the transition toward renewable energy sources creates uncertainty in fossil fuel availability, further complicating cost structures.

High-density Polyethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 60.1 billion |

|

Forecast Year Market Size (2035) |

USD 96.4 billion |

|

Regional Scope |

|

High-density Polyethylene Market Segmentation:

Application Segment Analysis

The film and sheet sub-segment, which is part of the application segment, is anticipated to garner the largest share of 38.8% in the high-density polyethylene (HDPE) market by the end of 2035. The sub-segment’s upliftment is highly driven by its wide utilization in food packaging, industrial wraps, shopping bags, and agricultural films due to their durability, moisture resistance, and cost-effectiveness. The growth of e-commerce and retail sectors has significantly boosted demand for lightweight, flexible packaging solutions. Additionally, HDPE’s recyclability aligns with global sustainability mandates, making it a preferred choice for companies seeking compliance with EPA (U.S.) and Europe Chemicals Agency (ECHA) recycling regulations. Governments are pushing for circular economy initiatives, which encourage the use of recyclable HDPE films over single-use plastics.

Manufacturing Process Segment Analysis

By the end of the forecast duration, the slurry process segment, part of the manufacturing process, is projected to hold the second-largest share in the high-density polyethylene market. The segment’s growth is highly fueled by the aspect of polymerization that occurs in a hydrocarbon diluent, producing HDPE with high molecular weight and excellent mechanical properties. The slurry process is particularly suited for applications requiring pipes, films, and blow-molded containers, where strength and durability are critical. Its popularity stems from cost efficiency, scalability, and versatility, allowing producers to manufacture a wide range of HDPE grades. The process also enables better control over polymer morphology, resulting in consistent product quality. Major producers such as Chevron Phillips, Dow, and SABIC rely on slurry technology for large-scale HDPE production.

Feedstock Segment Analysis

Based on the feedstock segment, the naphtha sub-segment in the high-density polyethylene (HDPE) market is expected to account for the third-largest share by the end of the stipulated timeline. The sub-segment’s development is highly propelled by its importance in the petrochemical sector for creating HDPE, along with acting as a primary source for ethylene monomer through steam cracking. Besides, organizational contribution across different countries is also uplifting this sub-segment. For instance, in July 2025, Mittal Energy Limited successfully granted 3 patents in India, which include 2 that have unveiled the world’s first-ever design for pipeline pigs, thus enabling the simultaneous transportation of naphtha in crude pipelines. Moreover, the third patent constitutes an apparatus for generating green oxy-hydrogen gas, thereby making it suitable for bolstering the sub-segment internationally.

Our in-depth analysis of the high-density polyethylene (HDPE) market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Manufacturing Process |

|

|

Feedstock |

|

|

End use Industry |

|

|

Product Form |

|

|

Wire & Cable |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-density Polyethylene Market - Regional Analysis

APAC Market Insights

The Asia Pacific HDPE market is anticipated to garner the largest share of 46.4% by the end of 2035. The market’s upliftment in the region is highly fueled by government-based chemical industrial programs, an expansion in infrastructure, and a rise in the need for recyclable plastics. According to official statistics published by the OECD in July 2025, plastic utilization in Southeast and East Asia has increased recently from 17 million tons to 152 million tons in 2022. Additionally, the ASEAN Plus Three (APT) nations' average plastics utilization per capita is 67 kg, and this usually ranges from only 29 kg in Indonesia to more than 100 kg in Korea and Japan. Besides, in the APT region, for every thousand dollars of value addition, nearly 3.5 kg of plastic products have been embedded, thus denoting an optimistic outlook for the market’s upliftment.

The high-density polyethylene market in China is growing significantly due to generous investments in petrochemical capacity, an increased focus on prioritizing sustainable plastics, along with mandates for recycling. Based on government estimates published by the State Council Information Office in November 2024, the country has significantly allocated 150 billion yuan (USD 21 billion) in special bonds, particularly for supporting equipment upgradation in notable areas, along with energy-saving and carbon reduction projects in prioritized sectors. It has been estimated that these projects are poised to fuel the renewal of more than 2 million units of equipment, leading to a yearly reduction of approximately 25 million metric tons of carbon dioxide emissions. Besides, the country has intensified its energy transition, advancing both the consumption and supply of clean energy, which is suitable for the market’s growth.

The high-density polyethylene (HDPE) market in India is also growing, owing to prioritizing sustainable chemical technologies and an increase in highlighting the role of HDPE in automotive light-weighting, agriculture irrigation pipes, and water infrastructure. As per an article published by the ITA in January 2024, the chemical industry in the country is valued at USD 220 billion and is further expected to grow at 9% to 12% every year to reach USD 300 billion by the end of 2026. In addition, the specialty chemicals industry is projected to contribute significantly to the overall industry development and is anticipated to reach USD 40 billion by the end of the same timeline. An estimated 70% of the nation’s chemical production is consumed domestically, and meanwhile, commodity chemicals constitute 25% of the total market, thereby denoting a positive outlook for the market’s growth.

Europe Market Insights

Europe HDPE market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by stringent chemical safety regulations, automotive applications, government expenditure, and sustainable chemical advancements. Besides, according to official statistics published by Europe Parliament in July 2024, the regional Member States has pledged to diminish net greenhouse gas emissions by almost 55% by the end of 2030, which is readily suitable for fueling the market in the overall region. As per the May 2023 DOE data report, gallium arsenide wafers in varying applications are expected to grow by 6.5%, and meanwhile, Horizon Europe’s investment programs are also readily bolstering the market’s growth in the region.

Horizon Europe’s Green Deal Projects (2024)

|

Project Type |

Number of Projects |

Funding Amount (Million) |

Funding per Project (Million) |

|

Horizon Missions |

111 |

€881.4 |

€7.9 |

|

Horizon Clusters |

1,681 |

€9,750 |

5.8 |

|

Europe Innovation Council |

202 |

€522.5 |

€2.6 |

|

Europe Innovation Ecosystems |

14 |

€2.7 |

€0.2 |

Source: Europe Parliament

The HDPE market in Germany is gaining increased traction due to government-backed sustainability programs, innovative recycling infrastructure, and leadership stemming from robust industrial demand. As per official statistics published by Clean Energy Wire Organization in March 2024, 12 massive chemical production facilities in the country have caused 23 million tons of carbon emissions as of 2022, which is roughly 3% of the nation’s overall yearly greenhouse gas output. Besides, combined power and heat installations that are usually gas-based are readily responsible for the largest emissions share with almost 40%, which is followed by steam cracker facilities for chemical production with 24%, as well as ammonia production hubs with 14%. Therefore, owing to these emissions, the country is effectively focused on high-density polyethylene, thus enhancing the market’s demand.

The high-density polyethylene (HDPE) market in Poland is also developing, owing to modernization in infrastructure, a rise in packaging demand, and an increase in government-specific chemical sector initiatives. According to official statistics published by the ITA in January 2024, under the present regional funding scheme, the country’s government has planned to generously invest USD 17.5 billion in railway infrastructure, along with USD 36.6 billion in road infrastructure. Besides, the country comprises a huge road network of almost 1,300 miles of highways, as well as 3,807 express roads. In this regard, the Ministry of Infrastructure has successfully developed a draft of a new road program, representing a list of investments on domestic roads as planned by the government. The overall amount is worth an estimated USD 65.5 billion, including the latest tasks amounting to USD 42 billion, along with continued tasks worth USD 23.5 billion, there denoting a huge growth opportunity for the market.

North America Market Insights

North America high-density polyethylene market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by automotive light weighting, construction, and packaging. In addition, the U.S. Environmental Protection Agency has readily mandated stringent recycling goals, pushing the need for recyclable HDPE packaging films. Based on government data estimated by the Department of Energy (DOE) in 2025, a suitable 10% reduction in vehicle weight tends to result in a 6% to 8% fuel economy optimization. Therefore, replacing cast iron and conventional steel components with lightweight materials, including high-strength magnesium alloys, steel, polymer composites, carbon fiber, and aluminum alloys, directly lowers the weight of a vehicle’s chassis and body by almost 50%. Therefore, utilizing lightweight components, along with high-efficiency engines ensured by innovative materials, is suitable for boosting the market in the region.

The high-density polyethylene (HDPE) market in the U.S. is gaining increased exposure due to infrastructure investment, the presence of recycling and sustainability mandates, feedstock and energy benefits, as well as compliance and safety considerations. According to official statistics published by the Government Finance Officers Association in 2026, the Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), has readily authorized USD 1.2 trillion for infrastructure and transportation expenditure. In addition, USD 550 billion has been allocated towards new programs and investments, specifically addressing power and energy infrastructure, as well as accessibility to broadband internet and water infrastructure. Therefore, with such investment programs, there is a huge growth opportunity for the market in the country.

The HDPE market in Canada is also growing, owing to the aspect of government funding for clean energy chemicals, circular economy policies, infrastructure and construction growth, and industrial collaboration. As per an article published by the Government of Canada in January 2026, the Critical Minerals Infrastructure Fund (CMIF) provides nearly USD 1.5 billion in federal funding by the end of 2030 for clean transportation and energy infrastructure projects to expand critical minerals in the country. This particular fund caters to representing 15 critical minerals, 33 transportation and energy infrastructure projects, 6 shovel-based projects, 27 pre-construction projects, 12 transportation infrastructure, 17 energy infrastructure, and 4 energy and transportation projects. Additionally, an amount of nearly USD 306 million has been declared by CMIF funding contributions, thus suitable for uplifting the market.

Key High-density Polyethylene Market Players:

- ExxonMobil Chemical Company (U.S.)

- Dow Inc. (U.S.)

- Chevron Phillips Chemical Company LLC (U.S.)

- LyondellBasell Industries N.V. (Netherlands)

- SABIC – Saudi Basic Industries Corporation (Saudi Arabia)

- Borealis AG (Austria)

- INEOS Group Holdings S.A. (UK)

- Reliance Industries Limited (India)

- Formosa Plastics Corporation (Taiwan)

- China Petroleum & Chemical Corporation – Sinopec (China)

- PetroChina Company Limited (China)

- TotalEnergies SE (France)

- Mitsui Chemicals, Inc. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Hanwha Solutions Corporation (South Korea)

- LG Chem Ltd. (South Korea)

- PTT Global Chemical Public Company Limited (Thailand)

- Westlake Chemical Corporation (U.S.)

- Qenos Pty Ltd. (Australia)

- Petronas Chemicals Group Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- ExxonMobil Chemical Company is one of the largest global producers of HDPE, leveraging its integrated petrochemical operations and access to low-cost shale gas feedstock. The company focuses on high-performance HDPE grades for packaging and films, with sustainability initiatives targeting advanced recycling technologies.

- Dow Inc. holds a significant share of the HDPE market, with revenues exceeding, its strategy emphasizes innovation in packaging solutions, particularly recyclable HDPE films, supported by partnerships under the U.S. EPA’s sustainability programs.

- Chevron Phillips Chemical Company LLC is a major HDPE supplier, known for its strong presence in pipe and blow molding applications. The company invests heavily in expanding petrochemical capacity in the U.S. Gulf Coast, aligning with DOE-backed initiatives for cleaner chemical production.

- LyondellBasell Industries N.V. commands a huge portion of the HDPE market share. It is a leader in circular economy initiatives, pioneering mechanical and chemical recycling technologies to meet Europe-based Green Deal mandates.

- SABIC – Saudi Basic Industries Corporation is a global HDPE powerhouse, producing huge tons of chemicals in 2024. Its HDPE portfolio benefits from cost-advantaged feedstock in the Middle East, while sustainability programs focus on bio-based polymers and advanced recycling aligned with Saudi Arabia’s Vision 2030.

Here is a list of key players operating in the global HDPE market:

The international high-density polyethylene (HDPE) market is highly competitive, with ExxonMobil, Dow, SABIC, and LyondellBasell leading in market share through large-scale production and global distribution networks. Asia-based players such as Sinopec, PetroChina, Reliance Industries, and LG Chem are rapidly expanding capacity to meet rising regional demand. Strategic initiatives include investments in bio-based HDPE, recycling technologies, and circular economy programs to align with sustainability mandates. Besides, in August 2025, Lummus Technology declared that Vioneo has significantly selected its Novolen polyethylene technology for the latest grassroots facility in Belgium. This particular facility is poised to be the world’s first-ever industrial-scale fossil-free plastics production complex, thereby making it suitable for bolstering the high-density polyethylene industry globally.

Corporate Landscape of the High-density Polyethylene (HDPE) Market:

Recent Developments

- In January 2026, Technip Energies achieved two massive contracts by Bharat Petroleum Corporation Limited for notable projects at its Mumbai refinery in Maharashtra and Bina refinery in Madhya Pradesh, significantly covering Engineering, Procurement, Construction and Commissioning (EPCC) for new polyethylene and Butene-1 units.

- In May 2025, Borealis generously invested more than EUR 100 million in the latest High Melt Strength polyethylene (HMS PP) line in Germany, thereby ensuring sustainable solutions that are evolving the overall polymer industry.

- In January 2025, LyondellBasell notified that Indian Oil Corporation Ltd. has chosen its Hostalen Advanced Cascade Process (Hostalen ACP) technology for the newest 500 kiloton per year high-density polyethylene infrastructure in India.

- Report ID: 8353

- Published Date: Jan 20, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.