Hemostasis Products Market Outlook:

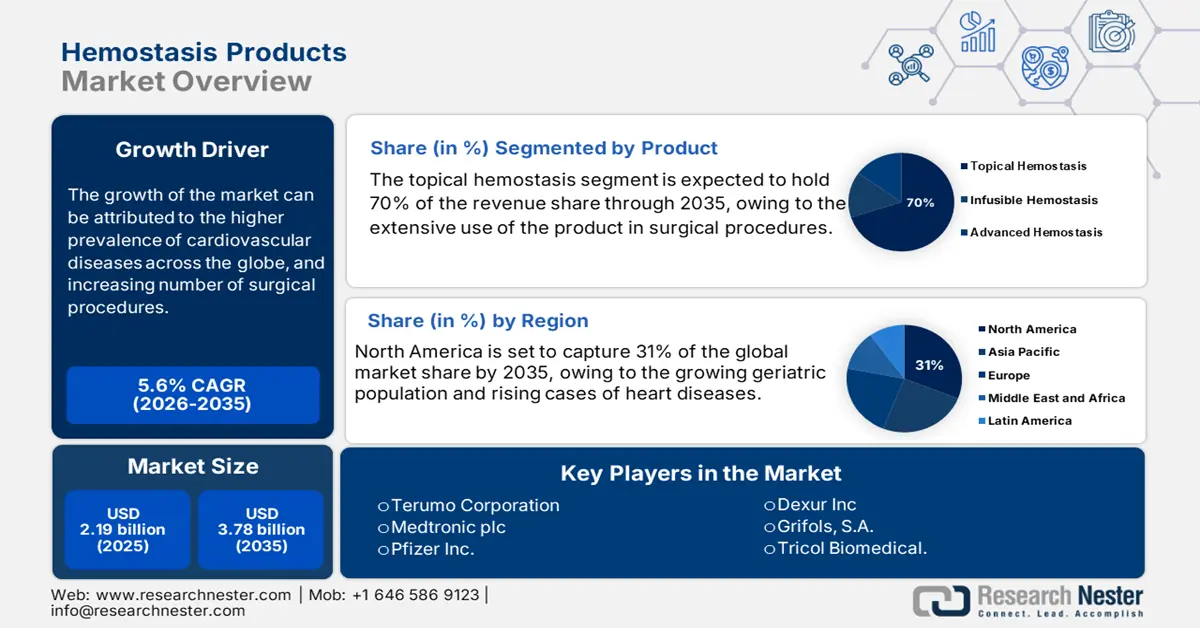

Hemostasis Products Market size was valued at USD 2.19 billion in 2025 and is likely to cross USD 3.78 billion by 2035, expanding at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hemostasis products is assessed at USD 2.3 billion.

The growth of the market can be attributed primarily to the rising prevalence of cardiovascular diseases worldwide, owing to adoption of unhealthy lifestyle, consumption of unhealthy food products and rising illnesses among the population. According to the World Health Organization, in 2019, 17.9 million people died from cardiovascular diseases, representing 32% of all deaths worldwide. Heart attacks and strokes accounted for 85% of these deaths.

To promote wound healing, hemostasis prevents or slows down blood flow or clotting following injury. Hemostatic products that are based on tissue are widely used to pack wounds after a severe injury. Furthermore, the rising medical tourism, higher investments by government in development of hemostasis products, huge base of geriatric population coupled with large number of blood disorders patient population are expected to drive global hemostasis products market growth during the forecast period.

Key Hemostasis Products Market Insights Summary:

Regional Highlights:

- The North America hemostasis products market will secure around 31% share by 2035, driven by the rising incidence of heart diseases, the aging population, and favorable healthcare policies.

Segment Insights:

- The topical hemostasis products segment in the hemostasis products market is anticipated to capture a 70% share by 2035, driven by the extensive use in surgical procedures, cost effectiveness, and ease of use.

Key Growth Trends:

- Globally Increasing Number of Surgical Procedures

- Rise in Expenditures for Research and Development

Major Challenges:

- Inadequacy of Surgical Professionals

- Disruption in Demand and Supply Due to COVID-19

Key Players: Terumo Corporation, Baxter International, Inc., Sysmex Asia Pacific Pte Ltd, Abbott Healthcare Private Limited, csl behring llc, Grifols, S.A., Dexur Inc, Pfizer Inc., Tricol Biomedical., Medtronic plc.

Global Hemostasis Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.19 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 3.78 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Hemostasis Products Market Growth Drivers and Challenges:

Growth Drivers

-

Globally Increasing Number of Surgical Procedures- The use of hemostats has increased in recent years owing to the high prevalence of chronic diseases requiring surgery. The outcome of any surgical procedure can be disastrous if severe complications develop and uncontrollable bleeding occurs. Thus, the rising number of surgical procedures undertaken in hospitals is anticipated to drive global hemostasis products market growth over the forecast period. It is estimated that around 300 million complex surgeries are performed globally each year, with approximately 45 million conducted in the United States and 22 million undertaken in Europe.

-

Rise in Expenditures for Research and Development -Approximately 2.63% of the global Gross Domestic Product (GDP) was spent on research and development in 2020, according to the World Bank. Compared to 2018, this was a notable increase of 2.2%.

- Surge in Cases of Hemophilia Worldwide- As per the Centers for Disease Control and Prevention, a prevalence estimate for hemophilia A in the United States is 12 cases per 100,000 males, whereas, for hemophilia B, it is 3.7 cases per 100,000 males.

- Technologically Advanced Product Development- For instance, in February 2020 Terumo Corporation has released AQUABRID, a new surgical sealant for the EMEA market. Designed to stop bleeding during surgery, the product prevents blood loss

- Growing Incidence of Accidents and Trauma Around the World- It has been estimated by the World Health Organization (WHO) that violence-related trauma and unintentional injuries are responsible for about 4.4 million deaths worldwide each year.

Challenges

-

Inadequacy of Surgical Professionals

-

High Prices Associated with Hemostasis Products - Even if illnesses are increasing at an alarming rate, the cost of hemostasis products is also increasing. As a result, the population with middle income is expected to slower the adoption rate of hemostasis products in the forecast period.

- Disruption in Demand and Supply Due to COVID-19

Hemostasis Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 2.19 billion |

|

Forecast Year Market Size (2035) |

USD 3.78 billion |

|

Regional Scope |

|

Hemostasis Products Market Segmentation:

Product Segment Analysis

The topical hemostasis products segment is poised to capture the highest hemostasis products market share of 70% by 2035, owing to the extensive use of the product in surgical procedures. There are numerous benefits of topical hemostasis products, including their cost effectiveness, efficiency, ease of use, and biodegradability, which are expected to augment segment growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemostasis Products Market Regional Analysis:

North American Market Insights

North America industry is likely to account for largest revenue share of 31% by 2035, owing to rising incidence of heart diseases such as heart attacks and heart strokes along with rising geriatric population in the region.According to the Centers for Disease Control and Prevention, heart disease is a major cause of death in United States, and nearly 697,000 Americans died of heart disease in 2020. Moreover, the higher healthcare spending, increasing government initiatives, favorable reimbursement policies along with presence of major market players in the market are expected to drive regional market during the forecast period.

Hemostasis Products Market Players:

- Terumo Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International, Inc.

- Sysmex Asia Pacific Pte Ltd

- Abbott Healthcare Private Limited

- csl behring llc

- Grifols, S.A.

- Dexur Inc

- Pfizer Inc.

- Tricol Biomedical.

- Medtronic plc

Recent Developments

-

In order to accelerate and expand its product portfolio, Grifols, S.A. has completed the acquisition of 100% of the stock capital of Tiancheng Pharmaceutical Holdings AG.

-

A new product line for advanced surgery has been added to the Baxter International, Inc. portfolio with the acquisition of the PerClot Polysaccharide Hemostatic System.

- Report ID: 4447

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemostasis Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.