Hemostats Market Outlook:

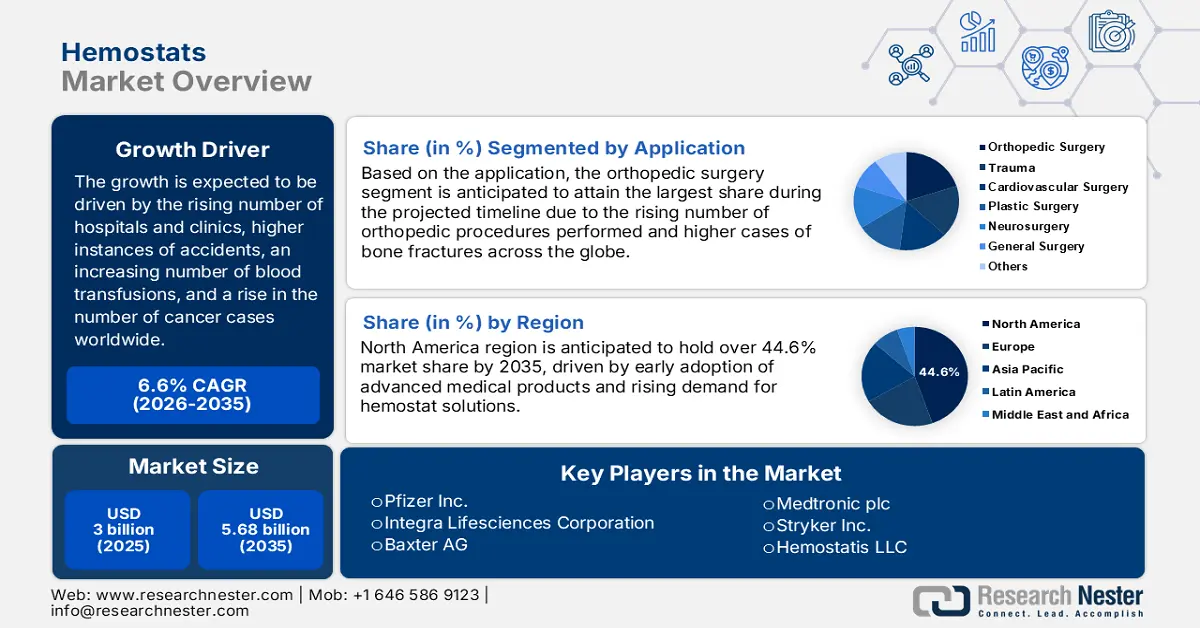

Hemostats Market size was valued at USD 3 Billion in 2025 and is expected to reach USD 5.68 Billion by 2035, expanding at around 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hemostats is evaluated at USD 3.18 Billion.

The major growth factor of the hemostats market is the increasing prevalence of chronic diseases and the increasing number of surgeries are fueling the demand for hemostats in the medical industry. By the statistics of the World Health Organization, in 2018, around 2 million surgeries were carried out, worldwide. In addition, the need for surgical care is to rise by 30% in the next few years.

Increased prevalence of cancer among people is expected to boost the growth of the global hemostats market. It is expected that by 2040, the count of new cases of cancer is to reach around 28 million and about 16 million deaths due to cancer. Furthermore, the growing number of hospitals across the world induced-blood donation drives, and rising instances of chronic issues are propelling the market growth.

Key Hemostats Market Insights Summary:

Regional Highlights:

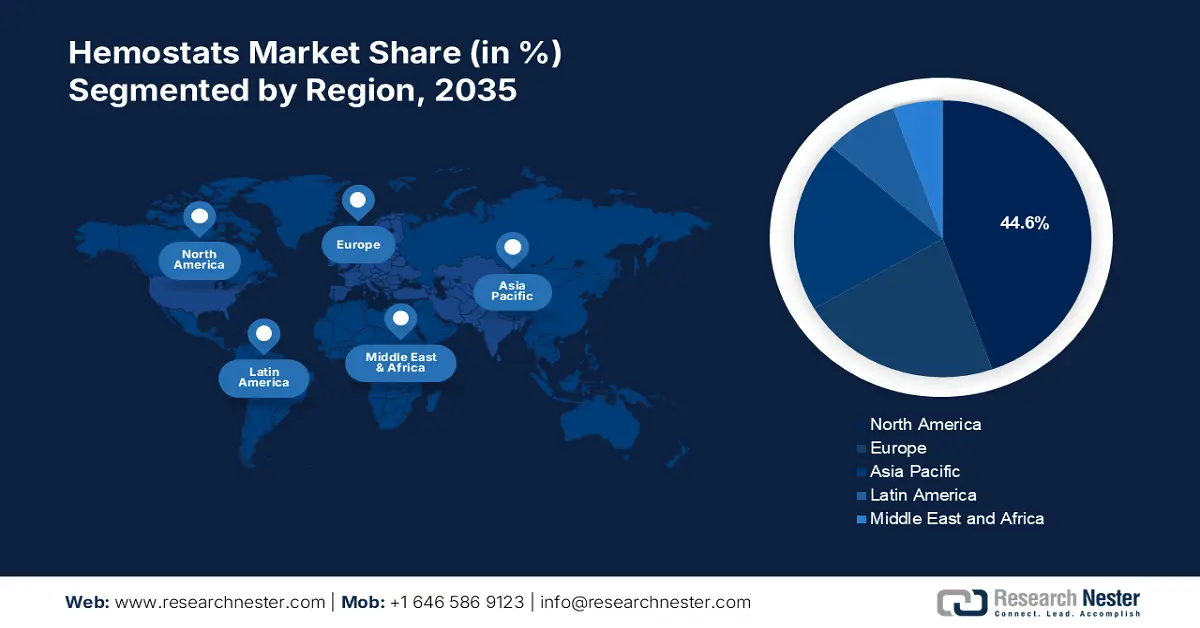

- The North America Hemostats Market is expected to command the largest market share by 2035, attributable to the region’s early adoption of technologically advanced medical solutions and increasing demand for dependable hemostat products.

Segment Insights:

- The orthopedic surgery segment in the Hemostats Market is projected to hold the largest share by 2035, spurred by rising orthopedic procedures performed and higher cases of bone fractures across the globe.

Key Growth Trends:

- Rise in the Number of Hospitals and Clinics

- Higher Instances of Accidents

Major Challenges:

- Higher Cost of the Product

- Shortage of Trained Expertise and Skilled Professionals

Key Players: Pfizer Inc., Integra LifeSciences Corporation, Baxter, Medtronic, Stryker, BD (Becton, Dickinson and Company), Biom'up Innovative Surgery, Johnson & Johnson Services, Inc., CryoLife, Inc., Hemostatis LLC.

Global Hemostats Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 Billion

- 2026 Market Size: USD 3.18 Billion

- Projected Market Size: USD 5.68 Billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (Largest Market Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 10 September, 2025

Hemostats Market Growth Drivers and Challenges:

Growth Drivers

- Rise in the Number of Hospitals and Clinics- The hospitals and clinics are rising at a remarkable pace owing to their reinforced coverage, services, and additional expenditure by the public as well as private investors. There are nearly 11,000 hospitals in China, around 2000 in the United Kingdom, and approximately 6000 hospitals in the United States

- Higher Instances of Accidents- According to the World Health Organization, every year nearly 1.3 million people die due to road accidents and road accidents are the primary cause of death among people of age between 5 to 29 years

- Increasing Requirement for Blood Transfusion- The global burden of blood transfusion is reported around 76% among adults of age 60 and above and nearly 54% in children by the World Health Organization.

- Rise in the Number of People Suffering from Cancer- As per the data of the World Health Organization, in 2020, there were nearly 10 million deaths as a result of cancer. Moreover, there were around 2.26 million new cases of breast cancer and over 2 million of lung cancer.

Challenges

- Higher Cost of the Product - Clinical procedures require different types of hemostats for different operations, the cost of these products is a little higher, therefore, which imposes restrictions on clinics to have every kind of hemostat, moreover it also hinders the growth of the market. Compared to other adjunctive hemostats (OAHs), the average cost of a topical adjunctive hemostat was 47% lower using ORCs (oxidized regenerated celluloses), or a savings of USD 88 per treatment.

- Cases of Unlimited Bleeding to Limit the Demand for the Hemostats

- Shortage of Trained Expertise and Skilled Professionals

Hemostats Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 3 Billion |

|

Forecast Year Market Size (2035) |

USD 5.68 Billion |

|

Regional Scope |

|

Hemostats Market Segmentation:

Application Segment Analysis

The hemostats market is segmented and analyzed for demand and supply by application into trauma, cardiovascular surgery, orthopedic surgery, plastic surgery, neurosurgery, general surgery, and others. Amongst all, the orthopedic surgery segment is anticipated to hold the largest market size by the end of 2035. The growth of the segment is attributed to rising in orthopedic procedures performed and higher cases of bone fractures across the globe. In 2019, there were about 178 million cases emerged of new fractures and around 455 million cases of long-term symptoms of fractures. Moreover, globally there were over 6 million orthopedic surgeons in 2020.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemostats Market Regional Analysis:

North American Market Insights

The North America hemostats market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, owing to the region's early adoption of a variety of technologically cutting-edge medical products and solutions as well as the rise in demand for dependable hemostat solutions. Additionally, the prevalence of chronic diseases is increasing in the area, which is fueling market expansion in North America. As per the data of the Centers for Disease Control and Prevention, in the United States, every 4 in 10 persons is suffering from more than 1 chronic problem and around 6 in 10 adults have at least 1 in one chronic issue. Furthermore, the rising need for blood donation and blood transfusion is expected to boost the market growth in the region. In America, more than 4 million people are expected to require blood transfusion every year and in the combined region of the United States and Canada, around 43,000 pints of blood are donated each day.

Hemostats Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Integra LifeSciences Corporation

- Baxter AG

- Medtronic plc

- Stryker Inc.

- BD (Becton, Dickinson, and Company)

- Biom’up Innovative Surgery

- Johnson & Johnson Services, Inc.

- CryoLife, Inc.

- Hemostatis LLC

Recent Developments

-

Pfizer Inc. announced the acquisition of Global Blood Therapeutics to amplify the rare hematology and to brace the treatment for sickle cell disease. This agreement was finalized at the worth of USD 5.4 billion.

-

Biom’up announced the approval of Hemosnow by U.S. Food and Drug Administration . Hemosnow is a hemostatic dry powder for control the mild levels of bleeding during surgical procedures.

- Report ID: 4484

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemostats Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.