Healthcare Integration Market Outlook:

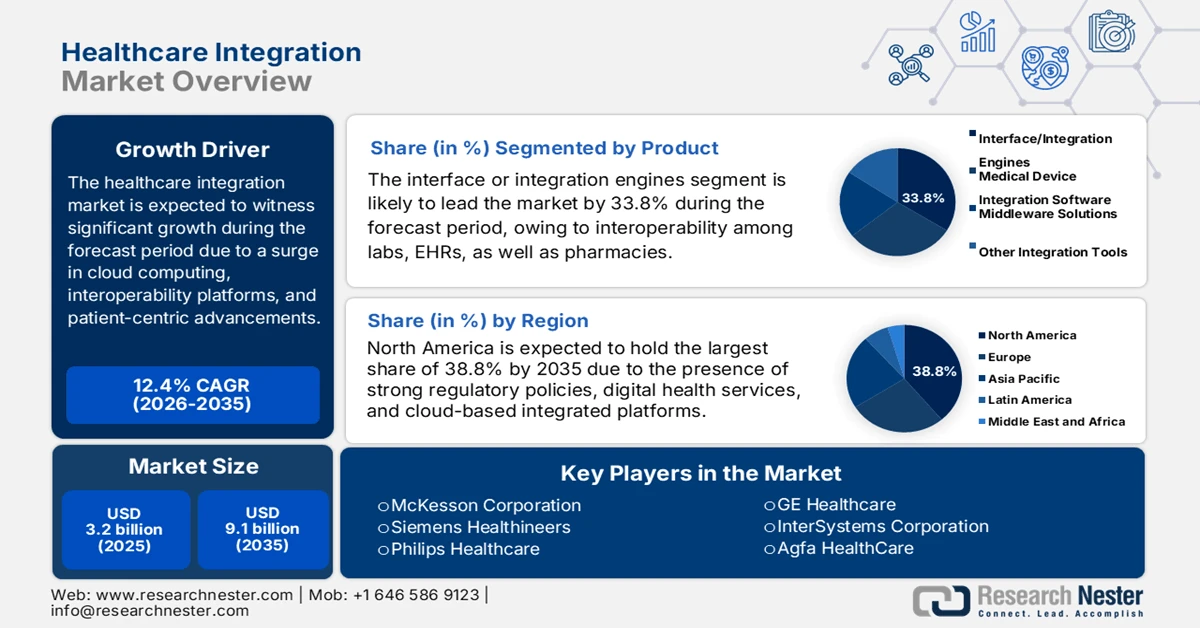

Healthcare Integration Market size was over USD 3.2 billion in 2025 and is estimated to reach USD 9.1 billion by the end of 2035, expanding at a CAGR of 12.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of healthcare integration is assessed at USD 3.6 billion.

The worldwide healthcare integration market is gradually entering a transformative phase, highly driven by cloud adoption and interoperability mandates. In addition to these, new forces such as sustainability, cybersecurity, and patient-centric innovation are also redefining healthcare systems to secure, exchange, and connect data globally. According to official statistics published by The Lancet Digital Health in January 2026, in 2023, the global healthcare industry experienced the highest breach expense, amounting to USD 10.9 million, which is almost double the international average. However, as of November 2025, the government in the UK unveiled the Cyber Security and Resilience Bill to the parliament, aimed at protecting critical infrastructure and strengthening national cyber defenses, including healthcare, thereby creating growth opportunities for the market across different locations.

Furthermore, the presence of secure integration platforms, along with patient-centric integration models, green IT and sustainability adoption, AI-specific predictive integration, and cross-sector collaboration platforms are also responsible for driving the healthcare integration market internationally. As stated in an article published by the World Health Organization (WHO) in 2026, there are an estimated 2 million different kinds of medical devices in the global market, readily categorized into over 7,000 generic device groups. Besides, in June 2024, WHO joined as a partner at the ASEAN regional meeting to bolster the accessibility to quality diagnostic testing. This particular testing is utilized regularly across all healthcare services for managing, monitoring, diagnosing, and preventing comprehensive diseases. Moreover, the ongoing supply of medical instruments is also proliferating the market’s expansion across different countries.

2023 Medical Instruments Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

U.S. |

36.1 billion |

37.8 billion |

|

Germany |

18.6 billion |

12.4 billion |

|

Mexico |

17.9 billion |

- |

|

Netherlands |

- |

14.5 billion |

|

Global Trade Valuation |

170 billion |

|

|

Global Trade Share |

0.75% |

|

|

Product Complexity |

0.74 |

|

|

Export Growth |

7.9% |

|

Source: OEC

Key Healthcare Integration Market Insights Summary:

Regional Highlights:

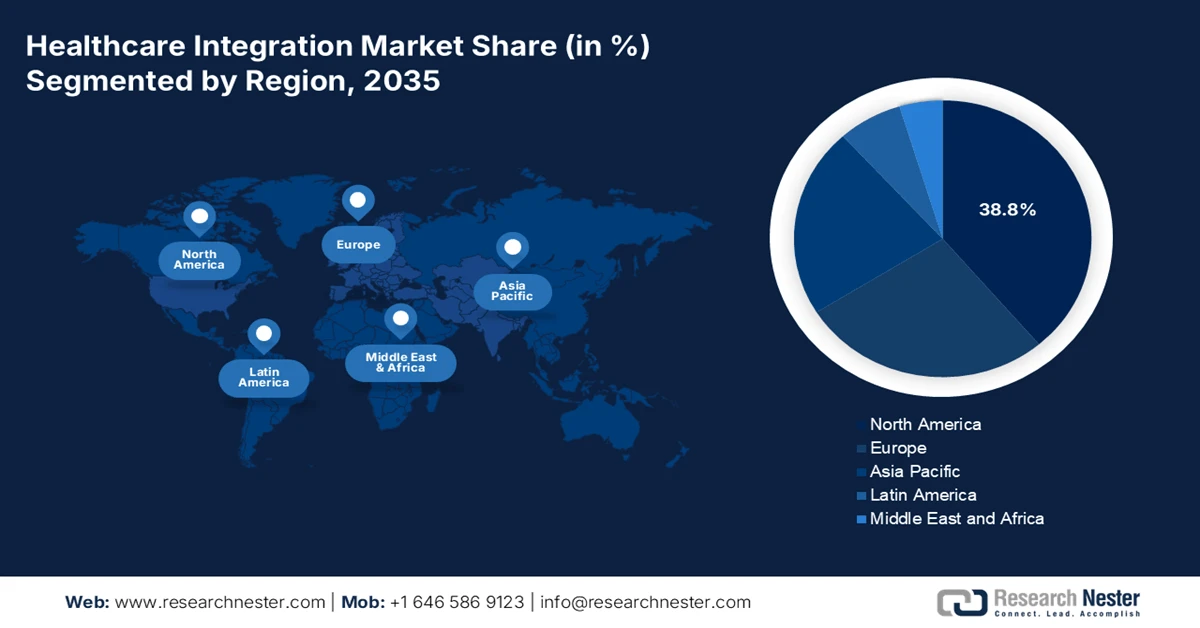

- North America is projected to command a leading 38.8% share by 2035 in the healthcare integration market, underpinned by strong government-backed interoperability initiatives, mature regulatory frameworks, and widespread adoption of cloud-based digital health solutions.

- Asia Pacific is expected to register the fastest growth over the 2026–2035 period, stimulated by surging patient volumes, expanding government-funded digital health programs, and accelerated deployment of cloud-centric interoperability platforms.

Segment Insights:

- The interface or integration engines segment is anticipated to secure a dominant 33.8% share by 2035 in the healthcare integration market, bolstered by its essential role in enabling seamless interoperability across pharmacies, laboratories, and electronic health record systems.

- The healthcare providers sub-segment is forecast to capture the second-largest share by 2035, reinforced by the growing reliance of hospitals and clinics on integration platforms to streamline workflows, enhance patient outcomes, and comply with regulatory requirements.

Key Growth Trends:

- Government funding for digital health facility

- Rise in the demand for value-based care

Major Challenges:

- Data privacy and security concerns

- High implementation expenses and resource constraints

Key Players: Oracle Cerner, Epic Systems Corporation, Allscripts Healthcare Solutions, IBM Watson Health, McKesson Corporation, Siemens Healthineers, Philips Healthcare, GE Healthcare, InterSystems Corporation, Agfa HealthCare, Dedalus Group, TietoEVRY, Fujitsu Limited, NEC Corporation, Samsung SDS, Kakao Healthcare, Infosys Limited.

Global Healthcare Integration Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 9.1 billion by 2035

- Growth Forecasts: 12.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, South Korea, Australia, Singapore

Last updated on : 29 January, 2026

Healthcare Integration Market - Growth Drivers and Challenges

Growth Drivers

- Government funding for digital health facility: Governments across different countries are generously allocating budgets to healthcare IT modernization, which is positively driving the healthcare integration market globally. According to official statistics published by The Global Fund Organization in August 2025, large-scale investors provide an estimated USD 150 million a year in digital health, especially across low-and middle-income nations for digitalized tools in more than 90 nations. Moreover, the USD 25 million Data Science Catalytic Fund (DSCF), based on a collaboration between The Rockefeller Foundation and the Global Fund, readily drove data-based solutions for international health by optimizing the digital collection and the utilization of community health data, thereby making it suitable for the healthcare integration market’s growth.

- Rise in the demand for value-based care: The presence of healthcare systems is significantly moving from volume to valuation, demanding integrated platforms that deliberately track patient reimbursement, expenses, and outcomes. As per an article published by Health Policy in December 2023, collectively, inefficiencies are estimated to account for 20% to 40% of healthcare expenditure. Therefore, it is essential to ensure primary and secondary care in an efficient manner, which creates an optimistic outlook for the healthcare integration market globally. Besides, there has also been a rise in expectation for huge accountability by international citizens to provide financial protection while optimizing accessibility to health services, thus denoting a huge demand for the market’s expansion.

- Integration of genomics: The availability of genomic data is increasingly being associated with EHRs, ensuring personalized treatment plans, particularly in the U.S. and Japan, which in turn, is uplifting the healthcare integration market’s upliftment. As stated in an article published by NLM in March 2025, several international and national strategies, including the All of Us Research Program in the U.S., along with the 1+ Million Genomes Initiative in Europe, and the Precision Medicine Initiative in China, are deliberately aiming to sequence genomes of 1,000,000 individuals to effectively guide evidence-specific precision medicine approaches. Therefore, with the presence of such strategies across different regions, there is a huge growth opportunity as well as expansion of the healthcare integration market.

Challenges

- Data privacy and security concerns: The healthcare integration market requires seamless exchange of sensitive patient data across multiple platforms, but this creates significant cybersecurity risks. Hospitals and providers are increasingly targeted by ransomware and phishing attacks, with breaches leading to financial losses and reputational damage. Regulations such as HIPAA in the U.S. and GDPR in Europe mandate strict compliance, yet many organizations struggle to implement robust safeguards while maintaining interoperability. The challenge lies in balancing accessibility with security, ensuring that authorized providers can access patient records without exposing systems to vulnerabilities. Moreover, the rise of telemedicine and mobile health apps expands the attack surface, making integration platforms more complex to secure.

- High implementation expenses and resource constraints: Deploying healthcare integration solutions involves substantial upfront investment in IT infrastructure, software licensing, and skilled workforce training. Smaller hospitals and clinics, especially in developing economies, often lack the financial resources to adopt advanced integration platforms. Even in developed markets, budget constraints force providers to prioritize immediate patient care needs over long-term IT modernization. Additionally, integration requires continuous upgrades to remain compatible with evolving standards such as HL7 and FHIR, further increasing costs. Skilled IT professionals are essential for managing these systems, yet shortages in healthcare IT talent exacerbate the challenge, which is negatively impacting the healthcare integration market’s growth.

Healthcare Integration Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.4% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 9.1 billion |

|

Regional Scope |

|

Healthcare Integration Market Segmentation:

Product Segment Analysis

The interface or integration engines segment is anticipated to garner the largest share of 33.8% in the healthcare integration market by the end of 2035. The segment’s upliftment is highly driven by its importance for gaining seamless interoperability between disparate systems, including pharmacies, laboratories, and EHRs. Besides, according to official statistics published by NLM in May 2023, many patients and their families have readily migrated towards urban locations, and it has been predicted that by the end of 2030, 60% of the international population is poised to reside in urban settings. Therefore, there is a huge demand for smart medical applications that are projected to be unveiled for ensuring suitable healthcare services, thus significantly contributing to smart cities development, which is positively bolstering the segment’s growth.

End users Segment Analysis

By the end of the forecast period, the healthcare providers sub-segment, which is part of the end users segment, is projected to hold the second-largest share in the healthcare integration market. The sub-segment’s growth is highly fueled by the aspect that hospitals, clinics, and specialty care centers rely heavily on integration platforms to streamline workflows, improve patient outcomes, and comply with regulatory mandates. The growing complexity of healthcare delivery, driven by aging populations, chronic disease prevalence, and rising patient volumes, has made seamless data exchange across departments and systems essential. Providers are increasingly adopting integration engines, APIs, and cloud-based solutions to connect electronic health records (EHRs), laboratory systems, imaging platforms, and telemedicine applications.

Deployment Models Segment Analysis

The cloud-based sub-segment, part of the deployment models segment, is expected to account for the third-largest share in the healthcare integration market by the end of the stipulated timeline. The sub-segment’s development is highly attributed to the aspect of enabling real-time accessibility to EHRs, centralizing data, as well as optimizing collaboration across different platforms. As per an article published by NLM in February 2024, the medical cloud computing industry increased from USD 95.2 billion to USD 491 billion, along with a 16% growth rate as of 2022. Additionally, the industry also reached USD 39.4 billion, with the Asia Pacific rapidly exhibiting the fastest-growth rate of 22% every year, with India and China as suitable contributors to the expansion. Moreover, the industrial size in China has upsurged from USD 270 million to USD 66.9 billion, thus proliferating the sub-segment’s demand for the market.

Our in-depth analysis of the healthcare integration market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End users |

|

|

Deployment Models |

|

|

Technology |

|

|

Services |

|

|

Integration Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Integration Market - Regional Analysis

North America Market Insights

North America healthcare integration market is anticipated to garner the highest share of 38.8% by the end of 2035. The market’s upliftment in the region is highly driven by the presence of government-backed interoperability initiatives, robust regulatory frameworks, digitalized health approaches, and cloud-based integration platforms. According to official statistics published by NLM in September 2025, remote patient monitoring systems have the ability to diminish first heart failure re-admissions by almost 22%, along with cardiovascular mortality by 3.4%. Besides, as per the September 2025 U.S. Department of State article, there has been the introduction of the America First Global Health Strategy, based on which less than 40% of domestic health foreign assistance goes to frontline supporters as well as healthcare professionals, thereby making it suitable for boosting the market’s exposure.

The healthcare integration market in the U.S. is growing significantly due to the provision of federal budget allocations, reimbursement policies, healthcare IT modernization, and an increase in care delivery services. As per an article published by the AMA Organization in April 2025, healthcare expenditure in the country surged by 7.5% as of 2023, amounting to USD 4.9 trillion or USD 14,570 per capita. In addition, this particular growth is significantly more than the 4.6% as of 2022. Besides, the escalation in 2023 is highly fueled by increased utilization of healthcare products and services, along with a highly 92.5% insured share. Moreover, the total healthcare spending accounted for 17.6% of the gross domestic product (GDP) in 2023, and meanwhile, the country overall spent USD 4,866.5 billion on various aspects of healthcare, which is boosting the market’s growth.

Healthcare Expenditure Analysis in the U.S. (2023)

|

Components |

Amount (USD) |

Rate (%) |

|

Hospital Care |

1,519.7 billion |

31.2 |

|

Other Personal Healthcare |

800.8 billion |

16.5 |

|

Physician Services |

721.7 billion |

14.8 |

|

Prescription Drugs |

449.7 billion |

9.2 |

|

Net Cost of Health Insurance |

302.9 billion |

6.2 |

|

Clinical Services |

256.3 billion |

5.3 |

|

Investment |

238.8 billion |

4.9 |

|

Nursing Care Facilities and Continuing Care Retirement Communities |

211.3 billion |

4.3 |

|

Government Public Health Activities |

160.2 billion |

3.3 |

|

Home Healthcare |

147.8 billion |

3.0 |

|

Government Administration |

57.4 billion |

1.2 |

Source: AMA Organization

The provision of provincial and federal investments, along with the presence of digitalized health modernization, prioritizing standardized digital tools and health data, and cloud-based deployment are rapidly uplifting the healthcare integration market in Canada. Based on government estimates published by the Government of Canada in July 2024, there has been a domestic investment of nearly USD 200 billion for more than 10 years to optimize healthcare services in the country. Additionally, with this funding, USD 25 billion has been provided through tailored bilateral deals that can address the advanced health system demands of the population. Moreover, in July 2024, the Government of Canada declared USD 47 million in federal funding for advanced projects to assist in supporting the country’s health professionals, thereby denoting an optimistic outlook for the market.

APAC Market Insights

The Asia Pacific healthcare integration market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by a rise in massive patient volumes, government-funded digital health approaches, and the integration of cloud-specific interoperability platforms. According to official statistics published by the ADB Organization in November 2023, there has been an increase in the expansion of universal health coverage (UHC) in Southeast Asia from an index score of 46% to 61%. Besides, Japan is considered a super-aged society, wherein 29.1% of the population are aged more than 65 years, and 15% are over 75 years. In addition, the proportion of 65-year-olds is expected to rise to 1/3rd of the population by the end of 2036, leading to an increase in the market’s demand in the overall region.

The healthcare integration market in China is gaining increased traction due to the existence of government digital health policies, an increase in population scale and chronic disease burden, smart hospital approaches, and public investment in IoT and AI. As per an article published by The Lancet Public Health in December 2024, the country has the largest diabetes population, with over 118 million people residing with the disease and further accounting for an estimated 22% of diabetes globally. In addition, the approximate prevalence rates for East China are 13.2%, which is followed by 11.2% for Central China, and 9.7% for West China. Besides, for 482,589 adults recorded without diabetes across 10 localities, the incidence rate has been 314 per 100,000 persons after maintaining 9.2 years follow-up, thus denoting a huge growth opportunity for the market in the country.

Growth in government spending, digitalized health mission, expansion in telemedicine, a rise in patient demand, and private sector participation are significantly responsible for fueling the healthcare integration market in India. As stated in an article published by the IBEF Organization in September 2025, the country comprises an estimated 820 million internet users with the world’s lowest data expenses, which has successfully set the stage for a digitalized health revolution. Besides, the COVID-19 pandemic has effectively escalated telehealth in the nation since in-person doctor visits accounted for 32%, along with online consultations continuously surged by 300%. Moreover, there exists the flagship public telemedicine platform in the country, known as eSanjeevani, operating on a hub-and-spoke model that comprises more than 1,50,000 village-based clinics and wellness centers, thus denoting an optimistic outlook for the market’s welfare.

Europe Market Insights

Europe healthcare integration market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by investments under the Europe Health Data Space (EHDS), the adoption of digital health technologies, and regional interoperability mandates. According to official statistics published by OECD in November 2024, electronic health records (EHRs) ensure reliable domestic accessibility, with digitalized health services rising by 8% points from 2022 to an average 79%. Additionally, there have been noteworthy advancements in Ireland, with its score surging from 0% to 11% by implementing EHR accessibility throughout the nation. Moreover, Sweden, Denmark, Finland, and Czechia utilize an outstanding patient identifier for associating more than 90% national health databases, thus proliferating the market’s growth.

The healthcare integration market in Germany is gaining increased exposure due to the existence of BMG-based digitalized health approaches, along with robust investments in interoperability platforms. Based on government estimates published by the ITA in August 2025, the healthcare industry in the country constitutes the highest share of GDP and employs an estimated 6.1 million people. In this regard, the medical devices sector in the country is one of the largest globally, accounting for approximately EUR 38 billion (USD 44 billion) in yearly revenue, which makes up almost 26.5% of the regional market. In addition, 1 out of 6 employment opportunities is associated with the domestic healthcare sector, significantly generating a yearly economic footprint of EUR 775 billion (USD 838 billion) or an estimated 12.8% of the country’s GDP, which is positively impacting the healthcare integration market in the country.

The aspects of ABPI advocacy, NHS digitalized transformation programs, along with an increase in prioritizing AI-based platforms, telemedicine, and interoperability, are readily driving the healthcare integration market in the UK. As stated in an article published by the Health Foundation Organization in December 2025, the Department of Health and Social Care (DHSC) noted a rise in the overall health spending from £217.0 billion to £246.0 billion. Besides, adjusted for transfers and pensions, this effectively works out to be a real-term increase by 2.7% every year. Additionally, the planned day-to-day DHSC expenditure is further projected to increase from £203.4 billion as of 2026 to £231.2 billion by the end of 2028 and 2029, denoting a 2.8% surge per year. Moreover, the DHSC capital budget is also expected to increase from £13.6 billion to £14.8 billion, thereby making it suitable for the market’s upliftment in the country.

Key Healthcare Integration Market Players:

- Oracle Cerner (U.S.)

- Epic Systems Corporation (U.S.)

- Allscripts Healthcare Solutions (U.S.)

- IBM Watson Health (U.S.)

- McKesson Corporation (U.S.)

- Siemens Healthineers (Germany)

- Philips Healthcare (Netherlands)

- GE Healthcare (U.S.)

- InterSystems Corporation (U.S.)

- Agfa HealthCare (Belgium)

- Dedalus Group (Italy)

- TietoEVRY (Finland)

- Fujitsu Limited (Japan)

- NEC Corporation (Japan)

- Samsung SDS (South Korea)

- Kakao Healthcare (South Korea)

- Infosys Limited (India)

- Tata Consultancy Services (India)

- Telstra Health (Australia)

- Malaysian HealthTech Solutions (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Oracle Cerner is a leading provider of electronic health records (EHR) and integration platforms, widely adopted across hospitals and health systems. Its focus on interoperability and cloud-based solutions positions it as a dominant player in global healthcare integration.

- Epic Systems Corporation is known for its comprehensive EHR solutions and strong emphasis on patient data exchange. Its interoperability initiatives, particularly through HL7 and FHIR standards, make it a key driver of integrated healthcare ecosystems.

- Allscripts Healthcare Solutions delivers healthcare IT solutions with a focus on open, connected systems. Its integration tools support providers and payors in achieving seamless data exchange, enhancing patient engagement and care coordination.

- IBM Watson Health leverages AI and cloud technologies to advance healthcare integration. Its platforms enable predictive analytics and interoperability, supporting providers in managing large-scale patient data efficiently.

- McKesson Corporation plays a critical role in the healthcare supply chain and integration services, linking providers, payors, and pharmacies. Its technology-driven solutions enhance connectivity across the healthcare ecosystem, improving efficiency and patient outcomes.

Here is a list of key players operating in the global healthcare integration market:

The global healthcare integration market is highly competitive, with U.S. firms such as Oracle Cerner, Epic Systems, and IBM Watson Health leading through advanced interoperability platforms and cloud-native solutions. Europe-based players, including Siemens Healthineers, Philips, and Dedalus, focus on cross-border integration aligned with regional regulations. Japan and South Korea emphasize AI-driven healthcare IT, while India and Malaysia are emerging with cost-effective integration services. Besides, in December 2025, DarioHealth Corp. declared the introduction of the Dario Health application readily enhanced with DarioIQ. This is the organization’s newest AI-driven layer that tends to deliver as a direct-to-consumer first version for hypertension members, significantly enrolled to ensure accessibility to a new experience, thereby making it suitable for boosting the healthcare integration industry internationally.

Corporate Landscape of the Healthcare Integration Market:

Recent Developments

- In September 2025, Medtronic plc notified two FDA regulatory milestones that has broadened the MiniMed 780G system portfolio clearance of the SmartGuard algorithm as an interoperable automated glycemic controller.

- In July 2025, Samsung Electronics declared that it has effectively signed a deal to acquire Xealth to assist in making advancements in the company’s transformation into a connected care platform that tends to bride wellness as well as medical care by ensuring a holistic and seamless holistic strategy to provide preventive care.

- In July 2025, dacadoo, along with Abi Global Health has successfully formed a partnership to deliver a completely integrated multilingual digitalized health experience by offering solutions in over 27 languages and operate across 40 countries globally.

- Report ID: 8370

- Published Date: Jan 29, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Integration Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.