Healthcare Video Conferencing Solutions Market Outlook:

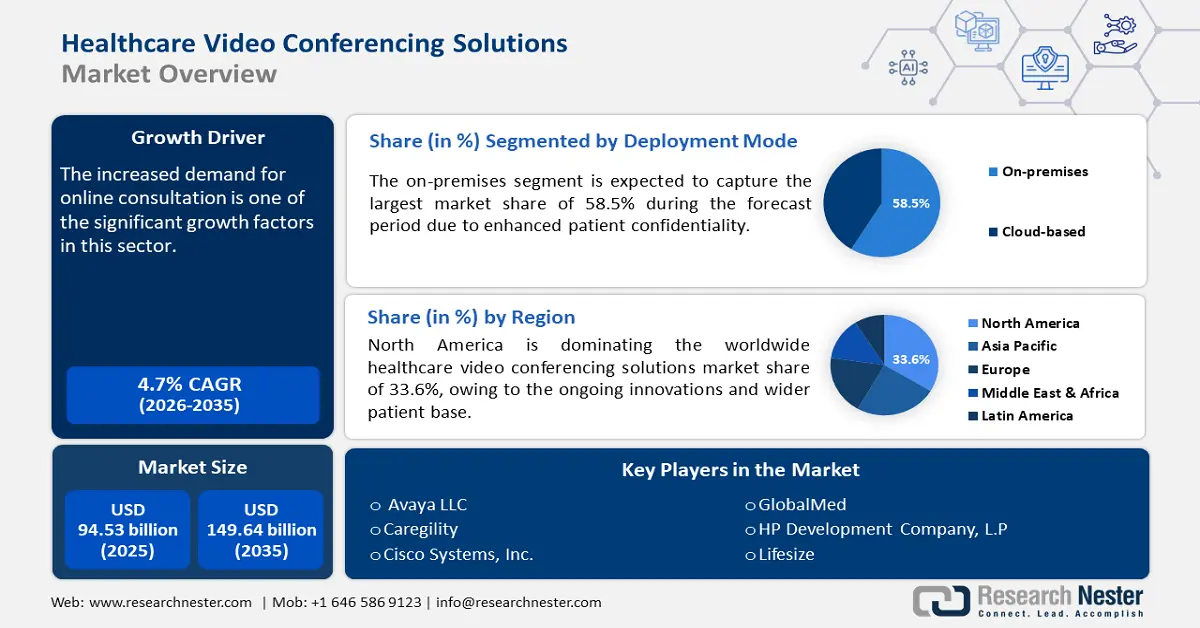

Healthcare Video Conferencing Solutions Market size was over USD 94.53 billion in 2025 and is anticipated to cross USD 149.64 billion by 2035, growing at more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare video conferencing solutions is assessed at USD 98.53 billion.

The increased demand for online consultation is one of the significant growth factors in this sector. The integration of video conferencing services has enhanced the workflow of healthcare organizations cost-effectively. Solutions with EHR (Electronic Health Records) and data management software are encouraging healthcare facilities to implement them. Further emphasizing the healthcare video conferencing solutions market.

Key Healthcare Video Conferencing Solutions Market Insights Summary:

Regional Highlights:

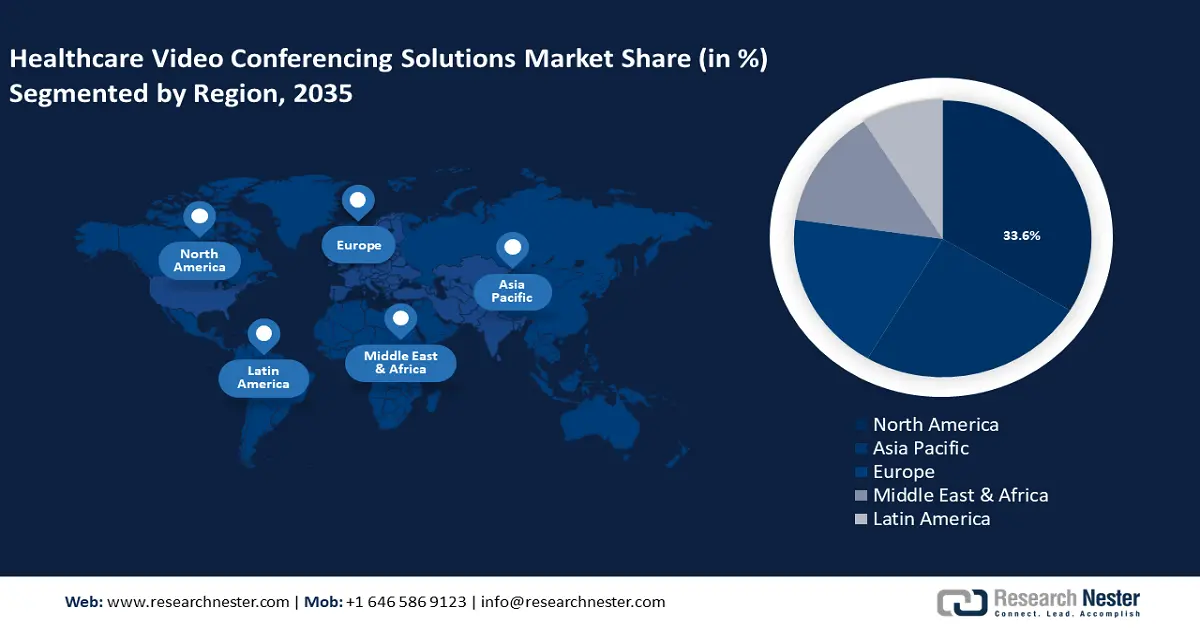

- North America commands a 33.6% share of the Healthcare Video Conferencing Solutions Market, fueled by innovations in video conferencing technology, enhancing telehealth adoption and growth through 2026–2035.

- APAC’s healthcare video conferencing solutions market is set for robust growth from 2026–2035, driven by the surge in at-home healthcare solutions, aging population, and increased mental health awareness.

Segment Insights:

- The On-premises segment of the Healthcare Video Conferencing Solutions Market is set for substantial growth through 2026-2035, attributed to rising demand for secure and customizable video conferencing in healthcare.

- The On-premises segment is expected to achieve over 58.5% market share by 2035, driven by enhanced patient confidentiality and seamless integration with existing healthcare systems.

Key Growth Trends:

- Increased demand for telemedicine

- Technological advancement and regulatory support

Major Challenges:

- Lack of digital education

- Data security and insufficient technological infrastructure

- Key Players: Avaya LLC, Caregility, Cisco Systems, Inc., GlobalMed, HP Development Company, L.P, Lifesize, Logitech, Microsoft, Mitel, Networks Corp., Pexip, Teladoc Health, Inc., TrueConf LLC, Vidyo, Inc., VSee, Zoom Video Communications.

Global Healthcare Video Conferencing Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.53 billion

- 2026 Market Size: USD 98.53 billion

- Projected Market Size: USD 149.64 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 14 August, 2025

Healthcare Video Conferencing Solutions Market Growth Drivers and Challenges:

Growth Drivers

- Increased demand for telemedicine: Booking consultations with doctors, especially in rural areas is time-consuming and costly. Video conferencing has concluded both appointment booking and direct interaction with experts in a single system, creating an instant budget-friendly option. Remote healthcare support has now become more favorable after the COVID-19 pandemic, accelerating the adoption of telehealth solutions. According to a survey report published by ASPE, in April 2023, the utilization of telehealth services increased rapidly during the pandemic episode. According to the same database, the video-based services were higher in proportion than the audio-based services. In-person visits for elderly patients are challenging, and these seamless healthcare services can avail of the real-time virtual presence of medical professionals at home. Video conferencing can also effectively provide medical assistance in emergencies, reshaping the landscape of the global healthcare industry.

- Technological advancement and regulatory support: The global trend of digitalization in healthcare has influenced technological developments. The advanced features can establish high-resolution audio-visual representation between service providers and patients. The systems increase consumer engagement with healthcare facilities, helping them build a better business portfolio. Moreover, attracting clinical institutions for greater investment in the video conferencing solutions market. Government policies such as reimbursement for virtual visits are also encouraging further development in this sector. According to a report published by CCHP, in July 2024, the State Telehealth Laws and Medicaid Program Policies are offering reimbursement for live video conferencing in rural areas.

Challenges

- Lack of digital education: Less literacy in operating digital devices is restricting the adoption of advanced video conference solutions for elder citizens and doctors. The majority of the healthcare facilities in rural areas are not equipped or trained in utilizing such advanced technologies. Patients often struggle to operate through unfamiliar platforms, leading to a decrease in engagement and satisfaction. Pre-hand educational programs in facilitating such systems are crucial for optimum accessibility and outcomes.

- Data security and insufficient technological infrastructure: Legal concerns regarding patient data privacy are a major setback in establishing a healthcare video conferencing solutions market. Regulations such as HIPPA require precise alignment with robust healthcare technologies to be approved for launch. Medical facilities often fail to offer sufficient security features to safeguard sensitive patient information due to outdated systems. Further inadequate technological infrastructure can obstruct the complete adoption of telehealth services.

Healthcare Video Conferencing Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 94.53 billion |

|

Forecast Year Market Size (2035) |

USD 149.64 billion |

|

Regional Scope |

|

Healthcare Video Conferencing Solutions Market Segmentation:

Deployment mode (On-premises, Cloud-based)

The on-premises segment is poised to hold over 58.5% healthcare video conferencing solutions market share by the end of 2035, due to enhanced patient confidentiality. The technology can efficiently comply with the existing healthcare systems such as EMR and HER. With a customizable feature, the video conferencing solutions can be reconstructed as per organizational needs. These devices are further optimized with upgraded software, making them able to process large-scale patient data formats. Their reliable infrastructure can efficiently serve even in the absence of external internet access. The conferencing solutions are now in high demand for their essentiality in organizations, prioritizing data security. Innovations in this segment can offer both the functionality of on-premises and cloud-based video conferencing solutions.

Component (Hardware, Software, Services)

Based on components, the hardware segment in healthcare video conferencing solutions market is poised to generate the highest revenue by the end of 2035. These systems are perfect for secured medical communication settings due to high-definition video quality and diverse connectiveness. The hardware video conferencing solutions easily integrate with various applications. These systems are equipped with premium-quality cameras and microphones, allowing accurate diagnoses and fruitful consultations. Applicability in various operations with accuracy makes them mostly preferred by surgeons, especially for consulting with seniors during surgery. Recently developed hybrid solutions can offer seamless collaboration with tools and can support multiple video services. Large healthcare facilities such as super-specialty hospitals and multidisciplinary nursing homes are increasing the demand for such communication systems.

Our in-depth analysis of the healthcare video conference solutions market includes the following segments

|

Deployment Mode |

|

|

Component |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Video Conferencing Solutions Market Regional Analysis:

North America Market Statistics

North America industry is set to hold largest revenue share of 33.6% by 2035. The improved success rate of research-based evolutions in video conferencing technology has emphasized the industry. Advanced features of these telehealth services have greatly contributed to revamping the region’s healthcare configuration. Regional governing bodies are partnering with research associations to build new HIPPA-compliant software, indicating the scope of development. Telehealth policies are now being modified after the COVID-19 public health emergency, promoting a structured regulatory framework for better compliance. Moreover, expanding the healthcare video conferencing solutions market for more secure communicative solutions, including video conferencing.

The U.S. healthcare video conferencing solutions market is booming to capture a significant share of this region. The increasing need for telehealth communication in rural areas has inspired companies to invest in technologies, that are cost-effective and user-friendly. According to an NOSI issued by U.S. Government, in May 2023, about 20% population lives in rural areas and an estimated 22.2 million rural residents face a shortage of healthcare providers. This report indicates the large consumer base for the telehealth industry. Further, it concludes the increasing demand for advanced yet affordable communication technologies. A report published by GAO (U.S. Government Accountability Office) in September 2022 that investment in telehealth services has increased from USD 306 million to about USD 3700 billion during 2019-2020.

Canada is also estimated to witness the biggest revolution in the healthcare video conferencing market. The government of this country is issuing policies for equal distribution of convenient healthcare facilities. According to a report published by NIH in October 2021, Canada has issued a telemedicine program, OTN (The Ontario Telemedicine Network). This program will ensure telehealth services to patients with minimum technological capabilities. Such initiatives are encouraging the market participants to invest in larger production of quality video conferencing solutions.

Asia Pacific Market Analysis

Asia Pacific healthcare video conferencing solutions market is also expected to witness rapid growth due to the surge of at-home healthcare solutions. The increasing number of elderly populations in this region is increasing the demand for remote consultation methods. Increased awareness about mental health in educational and corporate sectors is also putting a requirement for a system of on-call doctors. Accelerated digitalization has grown an accepting consumer base, further developing the potential market space for innovative product launches.

India emerging to be one of the fastest-growing countries for the healthcare video conferencing solutions market in upcoming years. The government is proceeding towards creating a digital spectrum of healthcare to connect patients with their required healthcare facilities. Schemes such as eSanjeevani and Ayushman Bharat are showcasing future investment opportunities supported by the government. In August 2023, Zenzo launched a 5G ambulance service, which will be able to collect and share real-time health data, advanced patient monitoring, and faster treatment responses.

China is also leading its path toward building a digitalized healthcare infrastructure, enlarging the healthcare video conferencing solutions market. With a large population and developing technology, the country created a sustainable patient base to invest in. Video conferencing can provide patients with a safe and convenient platform to get effective counseling and therapies. In China, there has been a significant push towards mental health services, which have the potential to boost the healthcare video conferencing solutions market.

Key Healthcare Video Conferencing Solutions Market Players:

- Avaya LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Caregility

- Cisco Systems, Inc.

- GlobalMed

- HP Development Company, L.P

- Lifesize

- Logitech

- Microsoft

- Mitel Networks Corp.

- Pexip

- Teladoc Health, Inc.

- TrueConf LLC

- Vidyo, Inc.

- VSee

- Zoom Video Communications

Market leaders are focusing on developing more user-friendly software such as Parta, HIPAA Telmed, Events10x, and PractiCall to manage the data while video conferencing. The incorporation of AI and machine learning in video conferencing applications has also increased for enhanced interactions. In March 2024, Healthray Technologies Private Limited launched Healthary, an AI-powered hospital management system, which can simplify the operations for every user. Recent innovations are portraying the scope for future development in the healthcare video conferencing solutions market. Some of the prominent players in the healthcare video conferencing solutions market include:

Recent Developments

- In February 2024, Virtua partnered with care.ai to implement an AI-enabled virtual patient-care facility, a platform to deliver smart healthcare services.

- In September 2023, Apollo Hospital launched India’s first Comprehensive Connected Care program. It is dedicated to providing emergency & ambulance, In-patient, post-surgery, and home care services at the patient's touchpoint.

- Report ID: 6530

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Video Conferencing Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.