Healthcare Cloud Infrastructure Market Outlook:

Healthcare Cloud Infrastructure Market size was over USD 83.14 billion in 2025 and is poised to exceed USD 379.61 billion by 2035, witnessing over 16.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare cloud infrastructure is evaluated at USD 95.41 billion.

The growth is driven by the surge in collecting data volume for healthcare facilities. The collected data is further utilized to improve the spectrum of medical services. Many pharmaceutical companies also choose cloud services to collect patient feedback in drug development. In March 2024, Microsoft collaborated with NVIDIA to elevate the research and innovation in health and life sciences through cloud computing technology.

The rise in EHRs and telehealth services is also growing the demand in the healthcare cloud infrastructure market. Health organizations are adopting cloud solutions for efficient data management and storage. Hospitals and other large healthcare institutions are seeking secure cloud services to comply with regulatory laws. Leading tech companies are developing technologies to supply as per HIPPA-compliance conditions. In April 2021, IBM introduced Trestle to help highly regulated industries, including healthcare. The open-source tool can accommodate auto-compliance with regulations during development. Such innovative cloud solutions are helping developers save time while minimizing the risk of noncompliance.

Key Healthcare Cloud Infrastructure Market Insights Summary:

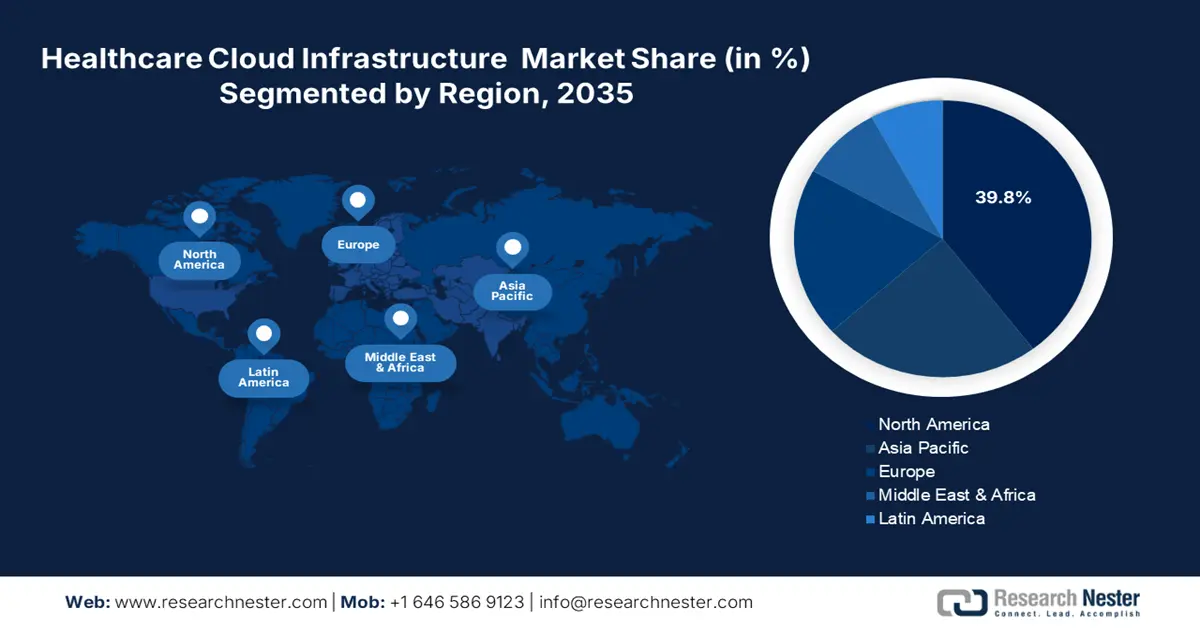

Regional Highlights:

- North America commands a 39.8% share of the Healthcare Cloud Infrastructure Market, driven by global healthcare leaders based in the region and increasing adoption of cloud solutions, ensuring market leadership through 2026–2035.

- Asia Pacific’s healthcare cloud infrastructure market is projected for significant growth through 2026–2035, fueled by increasing demand for telehealth services and cost-effective healthcare access.

Segment Insights:

- The Service segment is projected to achieve a 76.7% market share by 2035, propelled by diverse applications and scalability driving rapid cloud services adoption.

Key Growth Trends:

- Minimized cost of data management in healthcare

- Technological advancements

Major Challenges:

- Resistance to healthcare transformation

- Limited vendor switches

- Key Players: Allscripts Healthcare Solutions Inc., Alphabet Inc., Amazon Web Services, Inc., Cisco Systems, Inc, Dell Inc., Hewlett Packard Enterprise Development LP, IBM, Microsoft Corporation, Oracle Corporation, Salesforce, Inc..

Global Healthcare Cloud Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.14 billion

- 2026 Market Size: USD 95.41 billion

- Projected Market Size: USD 379.61 billion by 2035

- Growth Forecasts: 16.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Healthcare Cloud Infrastructure Market Growth Drivers and Challenges:

Growth Drivers

- Minimized cost of data management in healthcare: The healthcare cloud infrastructure market offers cost-effective data storage, management, and analytic solutions. Flexible scalability of the cloud infrastructure can efficiently reduce the need for expensive IT hardware and maintenance. Further, it lowers operational costs while providing scalable and easily adjustable resources. For instance, in June 2024, Oracle launched the Health Insurance Data Exchange Cloud Service. The service helps healthcare insurers to partner with CMS, offering a cost-effective and secure data exchange. Auto-compliant features also help to introduce innovations in serving according to changing consumer preferences, preventing extensive investment.

- Technological advancements: Innovation in delivering medical services has influenced the healthcare cloud infrastructure market. Collaboration between healthcare providers and tech companies encourages the integration of advanced technologies in this industry. For instance, in September 2024, Oracle partnered with AWS to launch Oracle Database@AWS for cloud users. The partnership will provide consumers with a unified experience through autonomous resources and administration. Additionally, the integration of AI and Machine learning in data management is accelerating the adoption of new cloud technologies. In March 2024, Google Cloud announced the general availability of Vertex AI Search to revolutionize healthcare.

Challenges

- Resistance to healthcare transformation: Lack of knowledge in advanced technologies may restrain professionals from investing in the healthcare cloud infrastructure market. Organizations often prefer to stick with traditional systems instead of adopting innovative solutions. This may further shrink the consumer base, limiting maximum utilization. Small-scale healthcare providers can be prohibited from implementing cloud infrastructure due to high initial investment. A shortage of skilled operators can also hinder the effective usage of cloud solutions.

- Limited vendor switches: Organizations may resist switching vendors due to their reliance upon specific cloud service providers. Building trust in upgraded data management systems may become a hurdle for the healthcare cloud infrastructure market. Migrating allied data from previous operators for transitions can also become challenging. Further, this makes it difficult to convince consumers to invest in integrating multiple solutions. Concern about compliance with the regulatory framework can force healthcare institutions to rethink before changing their vendor. Moreover, refraining new companies from participation.

Healthcare Cloud Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.4% |

|

Base Year Market Size (2025) |

USD 83.14 billion |

|

Forecast Year Market Size (2035) |

USD 379.61 billion |

|

Regional Scope |

|

Healthcare Cloud Infrastructure Market Segmentation:

Component (Service, Hardware)

In terms of components, the service segment is projected to dominate healthcare cloud infrastructure market share of over 76.7% by 2035. Diverse applications and scalability are some of the major reasons behind the rapid adoption of cloud services. The effectiveness of these offerings including IaaS, PaaS, and SaaS is propelling the demand. The secure and efficient solutions enable medical organizations to improve patient care and streamline operations. In November 2023, ServiceNow collaborated with AWS with a five-year SCA to develop a conjugated Software‑as‑a‑Service (SaaS). The service is dedicated to developing AI-driven custom applications for industries such as healthcare.

End Use (Healthcare Providers, Healthcare Payers)

Based on end use, the healthcare providers segment is garnering greater growth opportunities in the healthcare cloud infrastructure market. Enlarging demand for the HER, patient management, and data storage solutions is emphasizing the industry. The increased range of medical facilities inspires providers to develop more convenient and affordable cloud tools. Enhanced patient care and improved operational efficiency are driving the focus of organizations to implement cloud technologies. Many tech companies are combining industry expertise to upgrade their existing data management solutions. For instance, in April 2021, Microsoft acquired Nuance in a transaction of USD 19.7 billion to extend cloud and AI capabilities for EHRs.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Cloud Infrastructure Market Regional Analysis:

North America Market Analysis

North America in healthcare cloud infrastructure market is likely to hold more than 39.8% revenue share by 2035. The massive growth is propelled by the efforts of global leaders, originated in this region. The well-established medical facilities demand continuous advancement in data management. Cloud services offer an efficient solution to introduce new technologies to improve healthcare outcomes. For instance, in June 2024, Cognizant partnered with Google Cloud to launch the first set of Healthcare Large Language Models (LLM). The solution is based on the genAI including the Vertex AI platform and Gemini, aiming to improve administrative experience.

The U.S. is leading to dominate the landscape of the healthcare cloud infrastructure market by the end of 2035. Being home to the industry leaders such as Microsoft, Google, IBM, and others, the country shows great investment opportunities. Companies are also focusing on R&D to enhance cybersecurity. In April 2024, IBM acquired HashiCorp, Inc. to create an end-to-end encrypted cloud platform for healthcare providers. Through this acquisition worth USD 6.4 billion, IBM aims to deliver hybrid and multi-cloud offerings, creating future cloud opportunities. Leaders are also partnering to stand out in the global cost competitiveness of this sector. In July 2024, Humana and Google Cloud expanded their partnership to a multi-year agreement to develop a cost-effective healthcare platform for the members.

Canada is also augmenting with regulatory support to participate in the regional growth of the healthcare cloud infrastructure market. Regulations such as PHIPA and PIPEDA are shaping the standards to produce solutions with data security. The cloud service providers are partnering with research facilities to support R&D for life sciences. In September 2024, CanPath collaborated with AWS to supply regional data for the researchers of OICR. The research facility will utilize a grant worth USD 6.2 million from Genome Canada. CanPath, Lifebit, and AWS will build a secure cloud-based platform, the Trusted Research Environment. Such applications in data sharing, hosting, and analyzing inflate the demand for cloud computing tools.

APAC Market Statistics

Asia Pacific healthcare cloud infrastructure market is estimated to witness significant growth in upcoming years due to increasing demand for telehealth services. The cost reduction benefit of cloud services breaks the economic barriers. Further, making world-class healthcare accessible to every patient. In July 2024, Australia government announced an investment of USD 20 million to commercialize digital health research projects. Such initiatives inspire future developments in cloud services. According to the Australia economic strategy for Southeast Asia by 2040, 75% of the value of healthcare in Asia will be attributed to digitalization. The share will consist of investment opportunities for the EHRs, cloud services, AI, and others.

India is predicted to obtain lucrative growth in the healthcare cloud infrastructure market by 2035. Government programs such as the National Digital Health Mission are promoting digitalization in the medical industry. The integration of digital solutions is further boosting cloud adoption. In September 2023, Apollo Hospital collaborated with Google Cloud to build an AI-powered clinical decision support system for doctors. The developed Clinical Intelligence Engine offers assistance through collective data from Apollo and LLM from Google.

China is expected to generate record-high revenue in the healthcare cloud infrastructure market. The post-pandemic landscape of this country has fostered a zero-visit culture in medical services, surging the need for cloud computing services. According to a report published by NIH, in February 2024, the market size of the medical cloud computing industry reached USD 66.9 billion in 2022. It is estimated to hold USD 150 billion by the end of 2025 due to the impact of the COVID-19 pandemic. The survey further revealed that around 63% of hospitals in China were using cloud services till 2022.

Key Healthcare Cloud Infrastructure Market Players:

- Allscripts Healthcare Solutions Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alphabet Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

The focus is shifting towards the development of a secure network for the transition in medical data management. Leaders are now enhancing data security in the healthcare cloud infrastructure market through end-to-end encryption and multi-factor authentication. In April 2024, Google Cloud launched Next Gen Firewall Enterprise to offer robust network security. The seamless security controls help operators to save sensitive health-related data from cyber threats. They are also upgrading cloud services to comply with safety regulations such as HIPPA and NIST. These innovations are helping companies gain consumer trust, leveraging future investment opportunities in this sector. Such key players include:

Recent Developments

- In October 2024, Accenture acquired consus.health to help healthcare providers and hospitals with enhanced management strategies. The acquisition will consolidate Accenture’s footprint across Germany, Australia, and Switzerland.

- In September 2024, Oracle signed an agreement with Evidium, where it will supply its OCI AI infrastructure to empower Evidium’s healthcare platform. With this collaboration, Oracle can extend its cloud portfolio to the medical industry.

- Report ID: 6602

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.